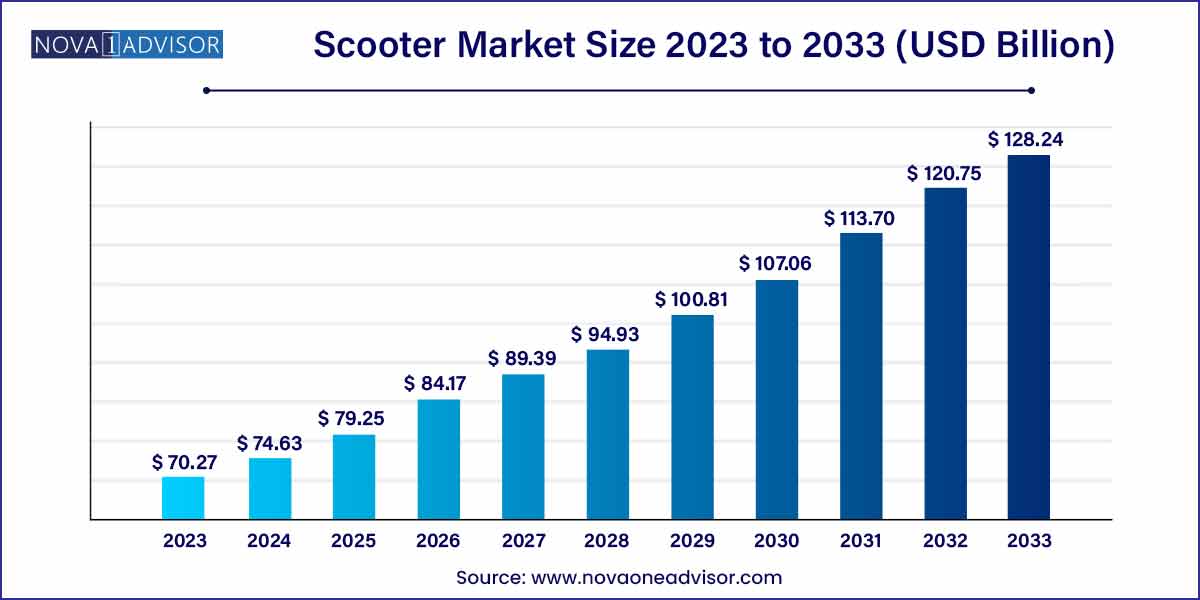

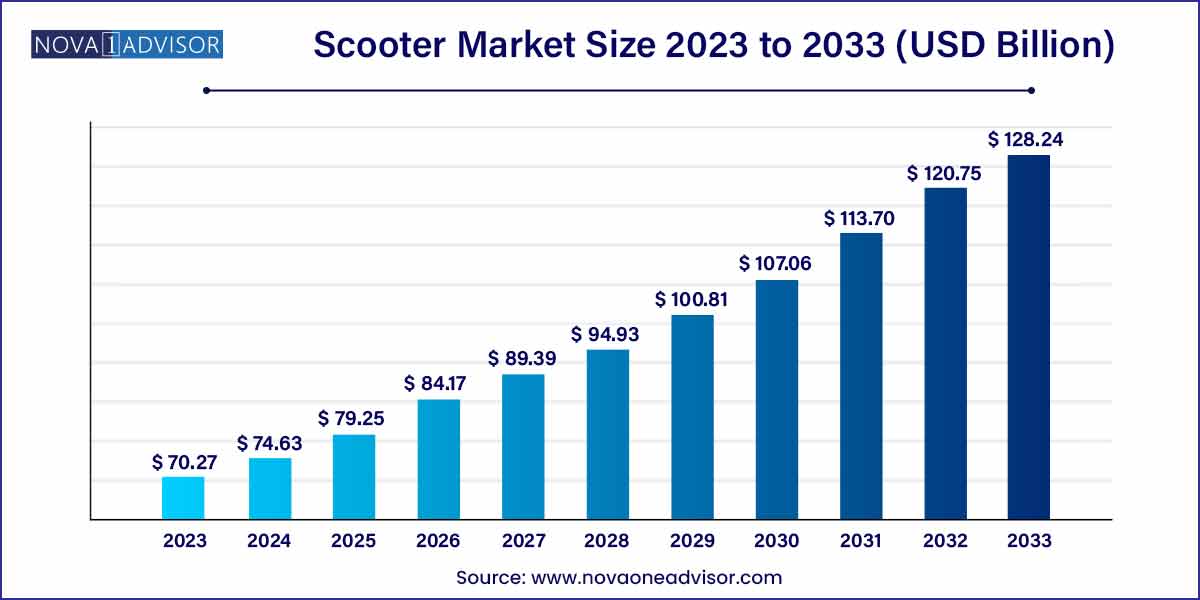

The global scooter market size was estimated at USD 70.27 billion in 2023, is expected to surpass around USD 128.24 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 6.2% during the forecast period of 2024–2033.

Key Takeaways:

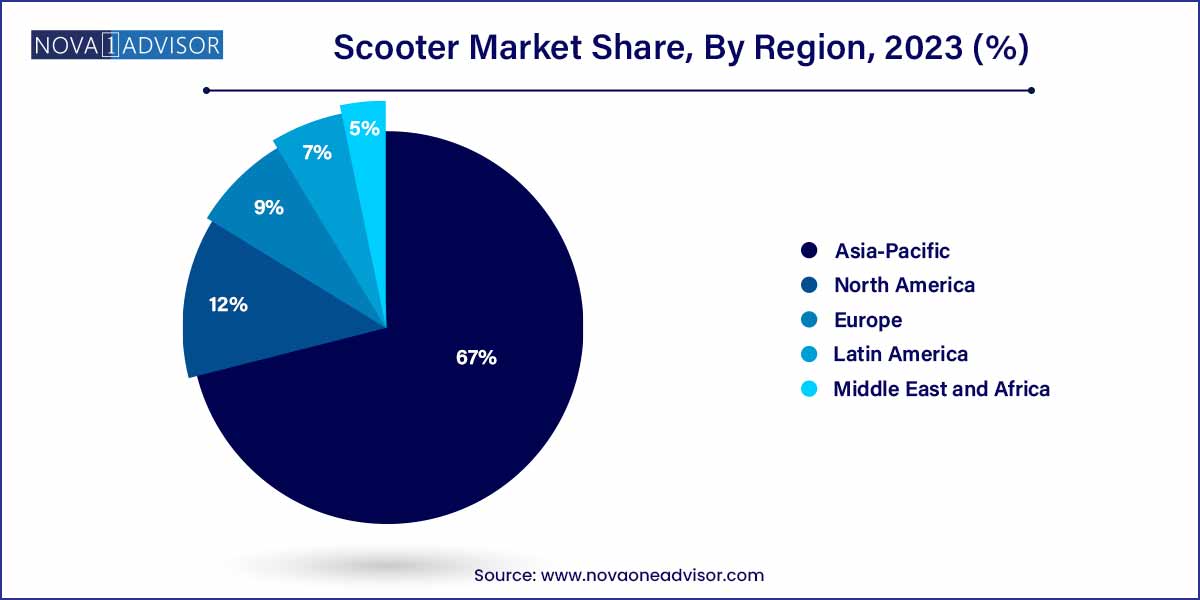

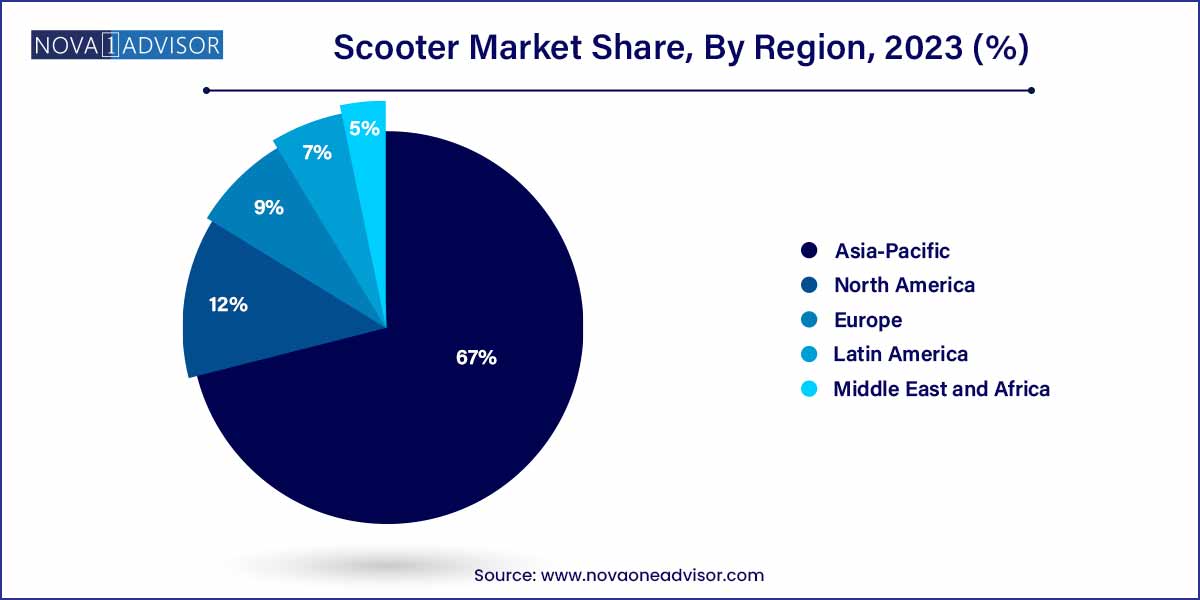

- Asia Pacific dominated the market and accounted for the largest revenue share of 67% in 2023.

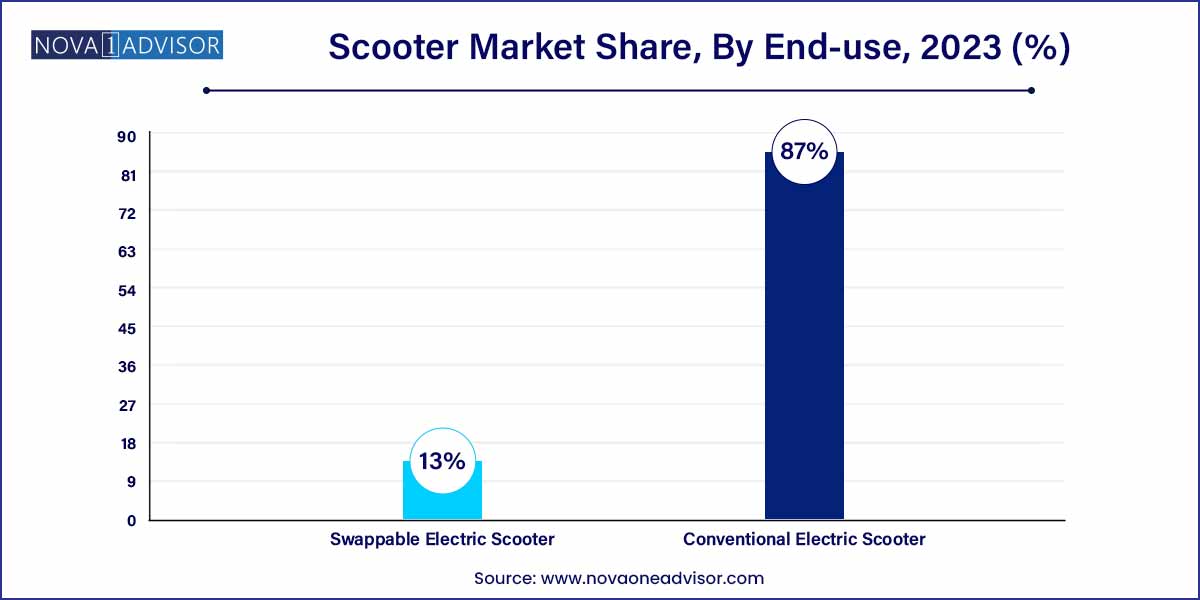

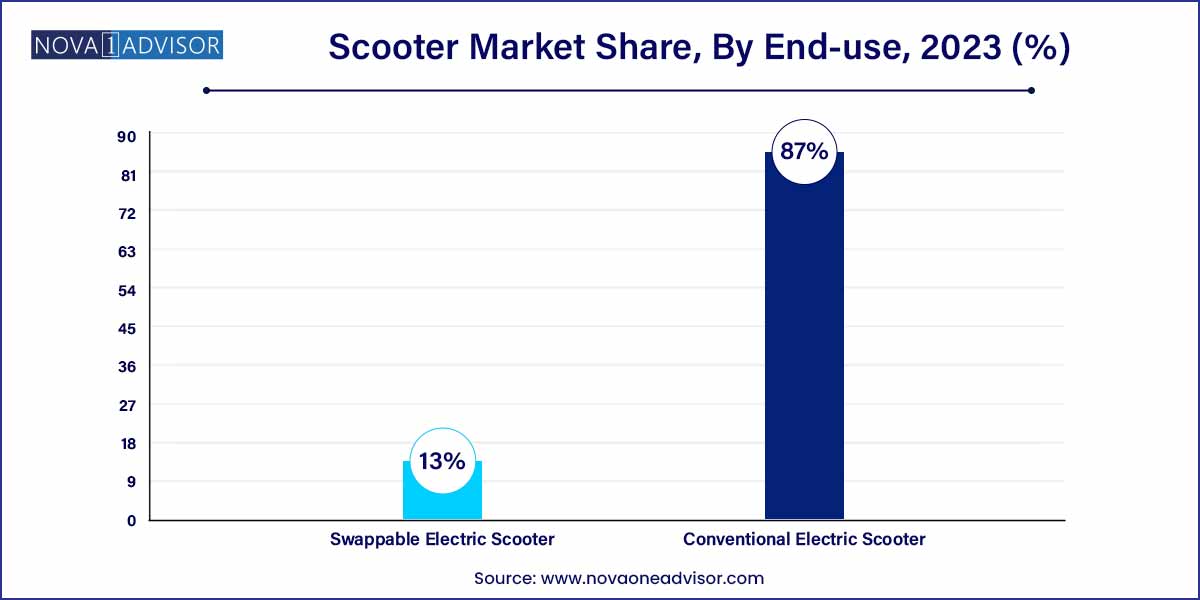

- The conventional scooter segment accounted for the largest revenue share of around 87% in 2023.

- The normal scooter segment accounted for the largest revenue share of 68.3% in 2023.

Scooter Market Overview

In recent years, the global scooter market has witnessed a significant surge in popularity, driven by factors such as urbanization, rising fuel prices, and a growing emphasis on eco-friendly transportation solutions. This comprehensive overview explores the current landscape of the scooter market, shedding light on key trends, growth drivers, and the anticipated future trajectory.

Scooter Market Growth

In recent years, the scooter market has experienced robust growth, propelled by a convergence of key factors. Urbanization, a prominent catalyst, has led to an increased demand for compact and agile transportation solutions, with scooters emerging as a favored choice among urban commuters. Furthermore, a heightened awareness of environmental sustainability has driven a shift towards eco-friendly alternatives, positioning electric scooters as integral contributors to green mobility. Technological advancements, including smart connectivity features and improved battery efficiency, have augmented the appeal of scooters, transforming them into high-tech and convenient modes of transportation. This amalgamation of urbanization, environmental consciousness, and technological innovation underscores the vibrant growth witnessed in the scooter market, promising continued expansion in the foreseeable future.

Scooter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 70.27 Billion |

| Market Size by 2033 |

USD 128.24 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Electric Scooter Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Yadea Technology Group Co., Ltd.; Ninebot Ltd; NEUTRON HOLDINGS, INC.; Bird Rides, Inc.; Spin; GOTRAX; SEGWAY INC.; Razor USA LLC.; Uber Technologies Inc.; OKAI Inc. |

Scooter Market Dynamics

- Urbanization Driving Demand

The dynamics of the scooter market are significantly influenced by the global trend of urbanization. As more individuals migrate to urban areas, the need for efficient and agile modes of transportation has surged. Scooters have emerged as a practical solution for urban commuters, offering maneuverability through congested city streets and addressing the challenges of last-mile connectivity. This urbanization-driven demand has become a pivotal factor shaping the scooter market dynamics, leading to increased sales and market penetration in densely populated metropolitan regions.

- Environmental Shift towards Green Mobility:

A pivotal shift towards environmental consciousness is reshaping the scooter market dynamics, with a growing emphasis on green mobility solutions. Electric scooters, in particular, have gained prominence as eco-friendly alternatives to traditional gas-powered counterparts. This shift is fueled by an increasing awareness of environmental issues and a desire for sustainable transportation options. Governments and regulatory bodies worldwide are also providing incentives for the adoption of electric scooters, contributing to a dynamic market landscape where environmental considerations play a crucial role in shaping consumer preferences and industry trends.

Scooter Market Restraint

- Regulatory Challenges and Safety Concerns:

The scooter market faces significant restraints in the form of regulatory challenges and safety concerns. As scooters become increasingly integrated into urban transportation systems, governments are grappling with the need to establish clear regulatory frameworks. Issues such as licensing requirements, traffic regulations, and safety standards for scooter riders pose challenges to market growth. Additionally, safety concerns, including accidents and injuries associated with scooter use, have prompted regulatory scrutiny and public apprehension. Addressing these regulatory and safety challenges is imperative for the sustainable growth of the scooter market, requiring collaboration between industry stakeholders and policymakers to establish comprehensive guidelines and safety measures.

- Infrastructure Limitations for Electric Scooters:

One notable restraint in the scooter market pertains to infrastructure limitations, particularly concerning electric scooters. While electric scooters offer an eco-friendly alternative, the widespread adoption is hindered by inadequate charging infrastructure in many regions. Insufficient charging stations and limited battery range pose challenges for electric scooter users, impacting the convenience and practicality of these vehicles. Overcoming these infrastructure limitations requires concerted efforts from governments, businesses, and communities to invest in the development of robust charging networks, thereby facilitating the seamless integration of electric scooters into the broader transportation ecosystem.

Scooter Market Opportunity

- Advancements in Battery Technology:

A notable opportunity in the scooter market lies in the continuous advancements in battery technology. As electric scooters gain traction as eco-friendly alternatives, improvements in battery efficiency and energy storage capacity present a significant growth avenue. Innovations such as fast-charging capabilities and extended battery life not only enhance the overall appeal of electric scooters but also address concerns related to range anxiety. Industry players investing in research and development to bolster battery technology stand to capitalize on this opportunity, paving the way for a more widespread adoption of electric scooters and contributing to the overall sustainability of urban transportation.

- Collaborations with Ride-Sharing Platforms:

Another promising opportunity in the scooter market revolves around strategic collaborations with ride-sharing platforms. The integration of scooters into existing ride-sharing services presents a mutually beneficial arrangement. For urban commuters, scooters offer a convenient and cost-effective last-mile transportation option, seamlessly complementing larger transit systems. Simultaneously, ride-sharing platforms can diversify their offerings by incorporating scooters into their fleets, expanding their reach and providing users with versatile mobility solutions. By forging partnerships with ride-sharing companies, scooter manufacturers can tap into a broader customer base and capitalize on the growing demand for flexible and interconnected transportation options in urban environments.

Scooter Market Challenges

- Regulatory Hurdles and Safety Concerns:

The scooter market grapples with significant challenges related to regulatory frameworks and safety concerns. The rapid integration of scooters into urban landscapes has outpaced the development of comprehensive regulations, leading to ambiguity in areas such as licensing, parking, and traffic rules. Governments worldwide are working to establish clear guidelines, but the evolving nature of the scooter market poses challenges for effective and uniform regulation. Additionally, safety concerns regarding scooter usage, including accidents and injuries, have raised public apprehension and prompted a closer examination of safety standards. Addressing these regulatory and safety challenges is crucial for fostering a secure and sustainable environment for scooter use, requiring collaboration between industry stakeholders and policymakers to ensure responsible and standardized practices.

- Infrastructure Limitations for Electric Scooters:

One prominent challenge in the scooter market revolves around infrastructure limitations, particularly concerning electric scooters. While electric scooters offer a cleaner and more sustainable mode of transportation, the widespread adoption is hindered by insufficient charging infrastructure. The availability of charging stations and the limited range of electric scooter batteries pose practical challenges for users, impacting the overall convenience and feasibility of electric scooters.

Segments Insights

Electric Scooter Type Insights

Conventional electric scooters, featuring fixed batteries, remain the most widely adopted form of electric two-wheelers. They are simpler to design, cost-effective, and offer relatively straightforward ownership experiences. Leading players like Vespa Elettrica and Bajaj Chetak have established strong footholds in this category. Despite the rising interest in innovative battery-swapping models, the trust built around traditional charging models keeps conventional electric scooters in the lead. Additionally, many existing charging stations cater better to these models, contributing to their continued dominance.

Swappable electric scooters are transforming urban commuting by eliminating long charging times. Pioneers like Gogoro and Bounce Infinity have demonstrated the commercial viability of battery swapping, especially for fleet operations and delivery services. Consumers and businesses alike appreciate the time-saving and flexibility benefits, propelling the growth of this segment. Governments are also encouraging battery-swapping infrastructure as a means to accelerate EV adoption without overburdening the electricity grid. As networks expand, swappable electric scooters are poised to claim an increasingly significant share of the market.

Product Type Insights

Electric scooters have surged ahead in terms of demand, especially in urban environments where emissions regulations are tightening. Governments across regions like Europe, North America, and parts of Asia are offering lucrative subsidies for electric vehicle purchases, making electric scooters more accessible to the masses. Additionally, advancements in battery technology have alleviated concerns about limited driving ranges, thus encouraging adoption. Brands like Ather Energy, Ola Electric, and Segway have launched electric scooters with impressive mileage and user-friendly features like app connectivity and battery swapping options.

Internal combustion engine (ICE) scooters are widely preferred in emerging economies like India, Indonesia, and parts of Africa, where electric charging networks are inadequate. The affordability, ease of refueling, and familiarity with ICE technology ensure the sustained demand for conventional scooters. Popular models like Honda Activa and TVS Jupiter continue to dominate sales figures in these markets. Despite the global trend toward electrification, normal scooters will remain a crucial segment, particularly where cost sensitivity is high and infrastructural development is gradual.

Regional Insights

Asia-Pacific remains the heartland of the scooter market, accounting for a lion’s share of both production and consumption. Countries like India and China have a deep-rooted two-wheeler culture, with scooters serving as a primary mode of transportation for millions. Government policies encouraging electric mobility, the rising urban middle class, and the availability of affordable models have fortified the region's dominance. For example, India's "FAME II" scheme incentivizes electric two-wheelers, while Chinese companies like Niu Technologies and Yadea have scaled operations domestically and internationally.

With cities like Paris, Berlin, and Madrid implementing aggressive low-emission zones and green mobility initiatives, electric scooters are becoming the preferred mode of micro-mobility. Companies like Silence, Piaggio, and Seat have introduced advanced e-scooter models tailored for European city commuters. The continent’s emphasis on sustainability, coupled with infrastructural support such as widespread EV charging stations, has accelerated market growth. Moreover, European consumers' strong preference for premium, technologically advanced products provides fertile ground for innovation-led expansion.

Recent Developments

-

January 2025: Ola Electric announced the launch of its new S1 X electric scooter, priced competitively to target mid-income consumers in India.

-

March 2025: Gogoro expanded its battery-swapping network into Singapore, aiming to create a fully electric, citywide scooter-sharing service.

-

February 2025: Piaggio introduced the "Vespa Elettrica 2025 Edition" featuring an enhanced range of 120 km per charge and integrated AI navigation systems.

-

April 2025: Hero MotoCorp entered the European market with its Vida electric scooters, announcing partnerships with local charging providers in Germany and France.

-

January 2025: Yadea unveiled its "Kemper Series," targeting the high-end urban mobility segment with smart app controls and enhanced safety features.

Some of the prominent players in the scooter market include:

- Yadea Technology Group Co., Ltd.

- Ninebot Ltd

- NEUTRON HOLDINGS, INC.

- Bird Rides, Inc.

- Spin

- GOTRAX

- SEGWAY INC.

- Razor USA LLC.

- Uber Technologies Inc.

- OKAI Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global scooter market.

Product Type

- Electric Scooter

- Normal Scooter

Electric Scooter Type

- Conventional Electric Scooter

- Swappable Electric Scooter

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)