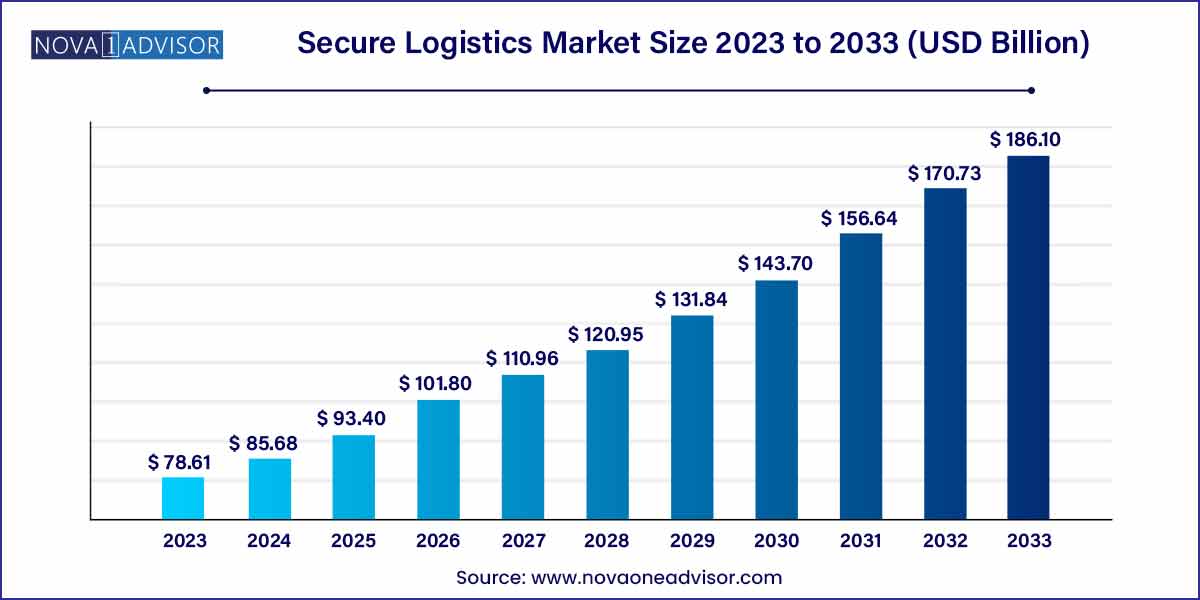

The global secure logistics market size was exhibited at USD 78.61 billion in 2023 and is projected to hit around USD 186.10 billion by 2033, growing at a CAGR of 9.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- The cash management segment led the industry in 2023 and accounted for the largest revenue share of more than 55.6%.

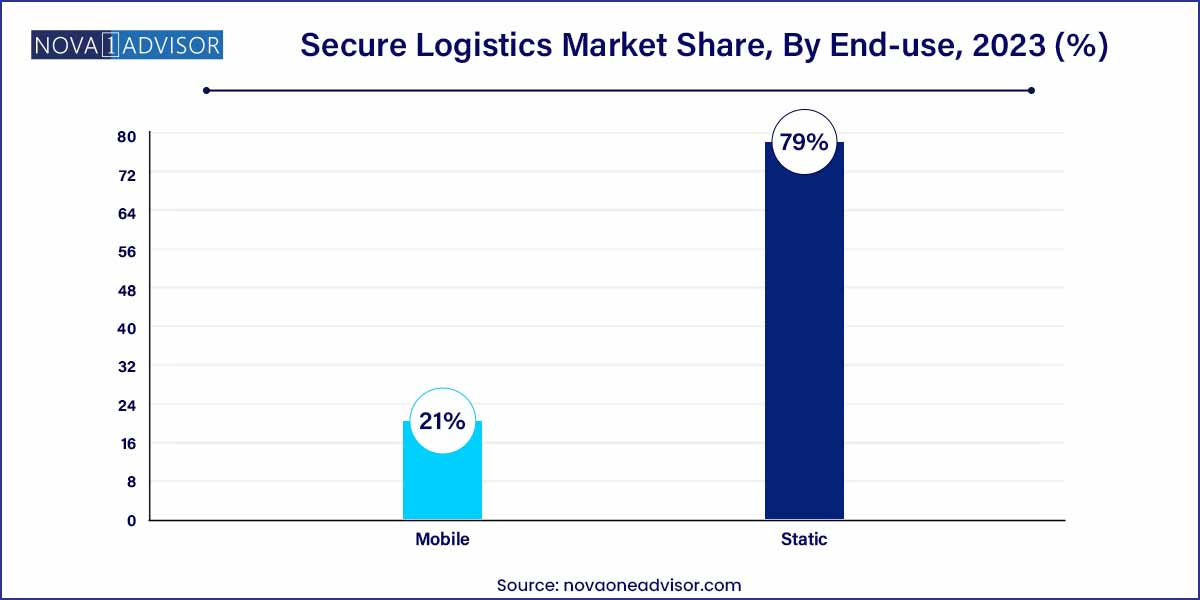

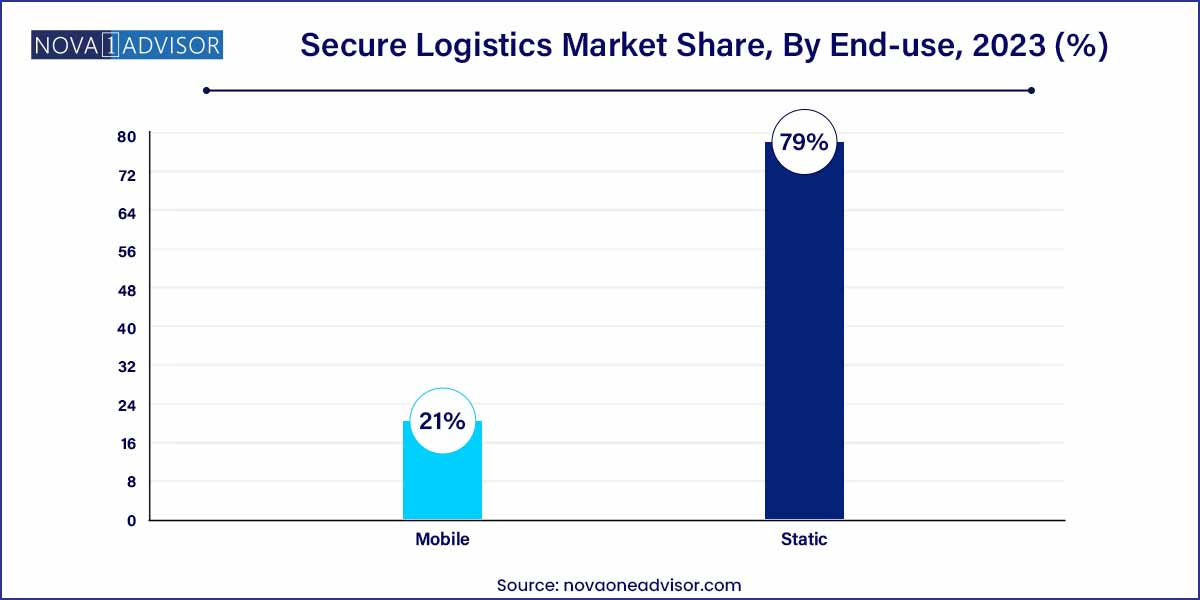

- The static type segment registered the highest market share in 2023 and is expected to dominate over the forecast period.

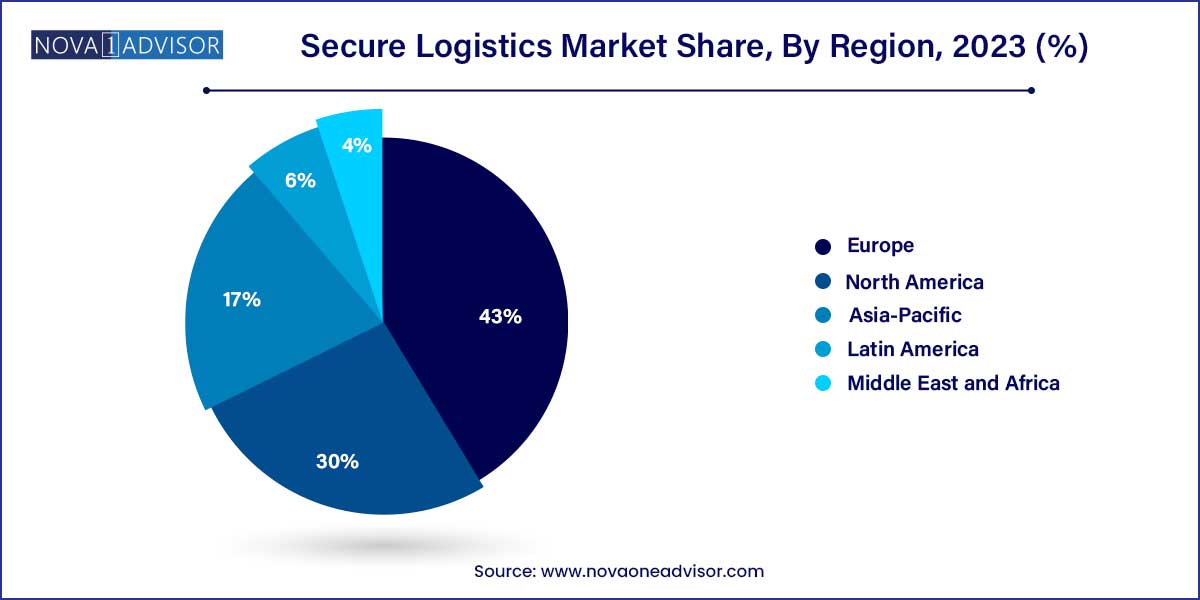

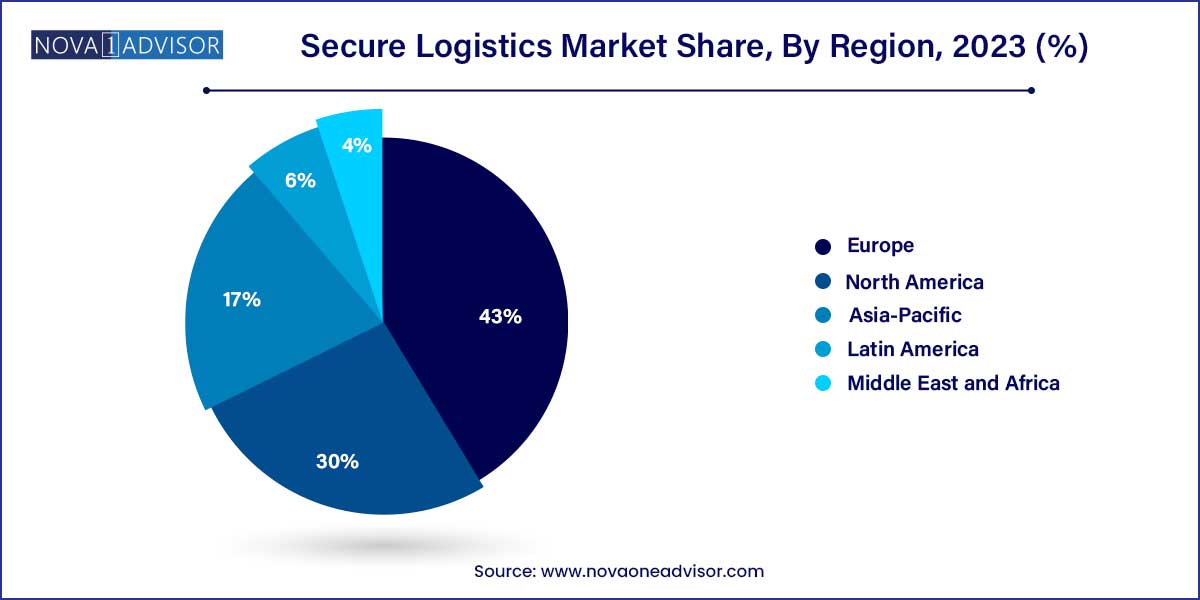

- Europe held the largest share of more than 43.0% of the global market in 2023 and has become one of the most influential markets.

Market Overview

The secure logistics market is a critical backbone of modern-day supply chain operations, ensuring the safe transportation and storage of high-value, confidential, or hazardous materials. Unlike traditional logistics, secure logistics encompasses advanced risk mitigation strategies, real-time surveillance, specialized security personnel, armored transport, and digital encryption mechanisms. It plays an indispensable role in industries where safety, traceability, and regulatory compliance are paramount.

The global growth of e-commerce, digital transactions, high-value asset movement, and increasing security threats has propelled the demand for robust secure logistics solutions. Industries such as banking and financial services, mining, pharmaceuticals, precious metals, luxury goods, confidential documents, and electronics all rely on secure logistics to safeguard the integrity of physical and digital assets during transit and storage. As cyber-physical convergence increases, the scope of secure logistics has expanded beyond armored trucks and vaults to encompass digital tracking, blockchain auditing, and biometric access control.

The post-pandemic landscape has accelerated the adoption of secure logistics, particularly in the cashless economy management, secure vaccine and pharma transport, and movement of high-value electronics. In parallel, geopolitical tensions, rising crime rates, and regulatory scrutiny over cross-border shipments have increased the complexity of secure logistics operations. Companies are now investing heavily in technology such as GPS-enabled vehicles, IoT sensors, AI-driven route optimization, and predictive risk analytics, transforming secure logistics into a high-tech, highly regulated global industry.

Major Trends in the Market

-

Integration of IoT and Telematics for Real-Time Monitoring

Secure logistics fleets are increasingly equipped with IoT devices that transmit location, cargo condition, and route deviations in real time.

-

Rising Demand for Cash Management Services in Emerging Economies

Despite digitalization, cash circulation remains high in Asia, Africa, and Latin America, driving armored transport and cash-in-transit services.

-

Adoption of Blockchain for Asset Verification and Tracking

Blockchain is emerging as a trusted tool for tracking precious metals and high-value goods across supply chains.

-

Growth in High-Value E-Commerce and Luxury Goods Transport

With more luxury transactions taking place online, secure last-mile delivery solutions are in demand for jewelry, watches, and electronics.

-

Customized Security Solutions for Pharmaceuticals and Vaccines

Cold-chain secure logistics for temperature-sensitive pharmaceuticals, especially in the post-COVID-19 era, is a fast-expanding segment.

-

Rise of Mobile Secure Logistics Units

Mobile secure containers equipped with GPS, biometric locks, and environmental controls are being used for short-term deployment in conflict zones or mobile banking.

-

Outsourcing of Secure Logistics by Banks and Retail Chains

Financial institutions and big-box retailers are outsourcing their secure logistics operations to third-party service providers to reduce operational risks and liabilities.

Secure Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 78.61 Billion |

| Market Size by 2033 |

USD 186.10 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Brink’s Inc.; CargoGuard; CMS Info Systems (CMS); G4S plc; GardaWorld; Lemuir Group; Loomis AB; Maltacourt; PlanITROI, Inc.; Prosegur; Allied Universal; Securitas AB. |

Secure Logistics Market Dynamics

- Technological Innovation and Integration

The secure logistics market is dynamically influenced by continuous technological advancements and their seamless integration into logistics solutions. Technologies such as GPS tracking, RFID systems, and real-time monitoring have become integral to secure logistics operations, providing enhanced visibility, control, and security. The ongoing pursuit of innovation in biometric authentication, blockchain, and artificial intelligence further amplifies the market dynamics, shaping a landscape where the adoption of cutting-edge technologies is not just a competitive advantage but a necessity for staying ahead in the evolving realm of secure logistics.

- Globalization and Cross-Border Trade

The dynamics of the secure logistics market are significantly impacted by the increasing globalization of trade and cross-border transactions. As businesses expand their reach across international markets, the need for secure transportation of high-value goods becomes paramount. The market witnesses fluctuations in demand based on geopolitical factors, trade policies, and the overall economic landscape. Moreover, the proliferation of e-commerce, with its reliance on efficient and secure logistics, fuels the dynamic nature of the market as companies adapt to the evolving demands of a globally interconnected supply chain.

Secure Logistics Market Restraint

- Regulatory Constraints and Compliance Challenges

One significant restraint facing the secure logistics market is the complex web of regulatory constraints and compliance challenges. The stringent regulations governing the secure transportation of high-value goods vary across regions and industries, posing a considerable challenge for logistics providers. Adherence to diverse compliance standards, including customs regulations, security protocols, and international trade laws, requires significant resources and meticulous attention to detail.

- High Operational Costs and Economic Volatility

The secure logistics market is constrained by the burden of high operational costs, encompassing expenses related to advanced security technologies, skilled personnel, and specialized equipment. The necessity for armored vehicles, state-of-the-art surveillance systems, and secure storage facilities contributes significantly to the overall operational expenditure. Economic volatility and fluctuations in fuel prices further exacerbate cost challenges, impacting the profitability of secure logistics providers.

Secure Logistics Market Opportunity

- Emerging Technologies for Enhanced Security

A notable opportunity within the secure logistics market lies in the continued exploration and integration of emerging technologies aimed at enhancing security measures. The adoption of innovations such as blockchain for secure and transparent transactions, advanced data analytics for predictive risk management, and the Internet of Things (IoT) for real-time tracking presents a significant growth avenue.

- Growing Demand for Customized and Specialized Services

The evolving nature of goods requiring secure logistics, coupled with the diversification of industries relying on these services, presents an opportunity for providers to offer customized and specialized solutions. Tailoring services to meet the unique requirements of sectors such as pharmaceuticals, electronics, and high-end retail allows for a more targeted and value-added approach. This customization may involve specialized handling protocols, temperature-controlled transport for sensitive products, or additional layers of security based on the nature of the goods.

Secure Logistics Market Challenges

- Continuous Innovation to Combat Evolving Threats

A paramount challenge confronting the secure logistics market is the need for continuous innovation to counteract the ever-evolving landscape of security threats. Criminal tactics, including cyber-attacks, theft methodologies, and counterfeiting techniques, continually adapt and become more sophisticated. Secure logistics providers must invest substantially in research and development to stay ahead of these threats, developing and implementing advanced security protocols, technologies, and training programs to safeguard shipments effectively.

- Talent Acquisition and Training for Specialized Operations

The recruitment and training of skilled personnel for specialized, secure logistics operations pose a significant challenge for market players. The nature of transporting high-value goods demands a workforce with expertise in security protocols, risk management, and the operation of advanced technologies. Securing and retaining qualified professionals who can handle the intricacies of secure logistics becomes a critical factor in maintaining the integrity and effectiveness of services.

Segments Insights:

Application Insights

Cash management dominated the secure logistics market, driven by the sustained demand for cash circulation across banks, ATMs, and retail outlets. This includes cash pickup, delivery, replenishment of ATMs, and processing services. Major financial institutions in Asia, Latin America, and Africa continue to rely on armored vehicle fleets and vault-based services to manage large volumes of currency securely. Companies like G4S and Brink’s have expanded their cash logistics services with value-added features such as cash forecasting, sorting, and reconciliation, reflecting the critical nature of this segment.

Pharmaceutical and high-value goods are among the fastest-growing applications, particularly with the rise in e-commerce and the increasing complexity of global supply chains. Diamonds, jewelry, precious metals, and luxury goods require ultra-secure, often international transport and warehousing. Events like global jewelry exhibitions, auctions, and high-net-worth individual (HNI) transactions necessitate real-time tracking and armed escorts. Similarly, high-value electronics such as chipsets, semiconductors, and data servers are now being transported in tamper-evident secure pods under 24/7 surveillance. This evolving mix of goods necessitates customized logistics, stimulating growth in this segment.

Type Insights

Static secure logistics services dominate the market, encompassing fixed operations such as cash vaults, secure warehousing for valuables, document archiving facilities, and secure pharmaceutical storage. These services are used by banks, jewellers, and manufacturers to store and manage high-value inventory under 24/7 monitoring with biometric access and environmental controls. Static services often include value-added operations such as counting, grading, sorting, authentication, and regulatory compliance documentation.

Mobile secure logistics is the fastest-growing type, enabled by advancements in fleet monitoring, route optimization, and mobile surveillance. These include armored transport vehicles, portable vaults, and mobile banking vans that serve rural and underbanked populations. Innovations in mobile secure containers fitted with satellite tracking, temperature control, and AI-powered anomaly detection are enhancing the scope of secure logistics. These are now used in field hospitals, cross-border transfer hubs, and diplomatic missions, where high-mobility secure services are critical.

Regional Insights

North America holds the largest share of the secure logistics market, driven by a mature financial services industry, high volume of luxury goods transactions, and stringent regulatory requirements for security and transport. The United States and Canada have a widespread network of ATMs, data centers, pharma facilities, and high-value retail operations, all of which rely on secure logistics for risk mitigation. Companies like Brink’s and GardaWorld have well-established networks offering cash management, secure storage, and armored vehicle services. Moreover, the region’s investment in smart city infrastructure and digital banking continues to demand secure, hybrid logistics solutions combining physical and digital asset protection.

Advanced technologies such as blockchain for transaction traceability, AI-driven fleet optimization, and drone surveillance for warehouse perimeters are increasingly being deployed in the U.S. secure logistics ecosystem. This region also leads in compliance and certification standards, with strong emphasis on Homeland Security, FinCEN regulations, and pharmaceutical logistics validation protocols.

Asia-Pacific is the fastest-growing secure logistics market, powered by economic growth, rising urbanization, increasing ATM penetration, and heightened demand for luxury and electronic goods. In countries like India, China, and Indonesia, the combination of digital inclusion programs and sustained cash dependence has created a hybrid market for secure logistics. India alone has over 250,000 ATMs, and secure cash replenishment is a daily requirement across banks and microfinance institutions.

In parallel, Southeast Asia’s thriving e-commerce ecosystem, involving high-value electronics and luxury goods, is generating demand for secure last-mile logistics. Companies are also investing in cross-border secure logistics, especially between ASEAN nations, to support trade in diamonds, precious metals, and pharma goods. With increasing government mandates for traceable pharma distribution and secure document handling in digital governance programs, Asia-Pacific is poised to become a hub for next-gen secure logistics services.

Some of the prominent players in the secure logistics market include:

- Brink’s Incorporated

- CargoGuard

- CMS Info Systems (CMS)

- G4S Limited

- GardaWorld

- Lemuir Group

- Loomis AB

- Maltacourt

- PlanITROI, Inc.

- Prosegur

- Allied Universal

- Securitas AB

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global secure logistics market.

Application

- Cash Management

- Diamonds, Jewelry & Precious Metals

- Manufacturing

- Others

Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)