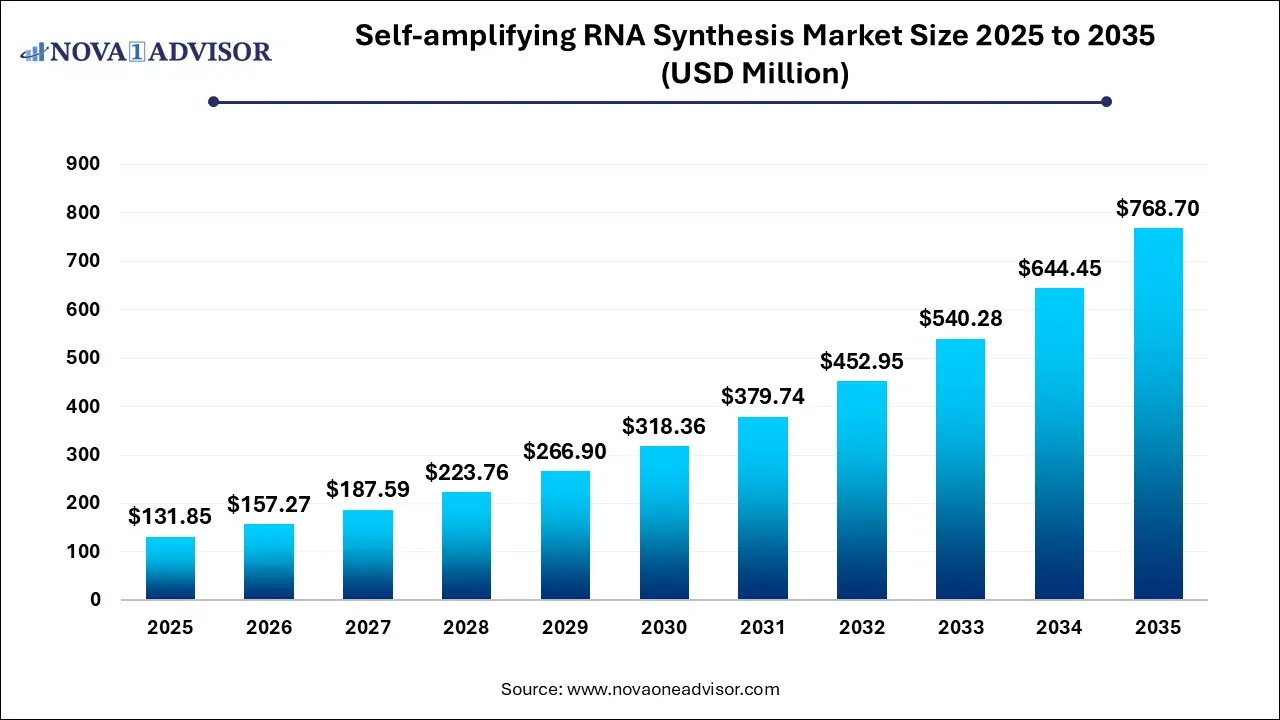

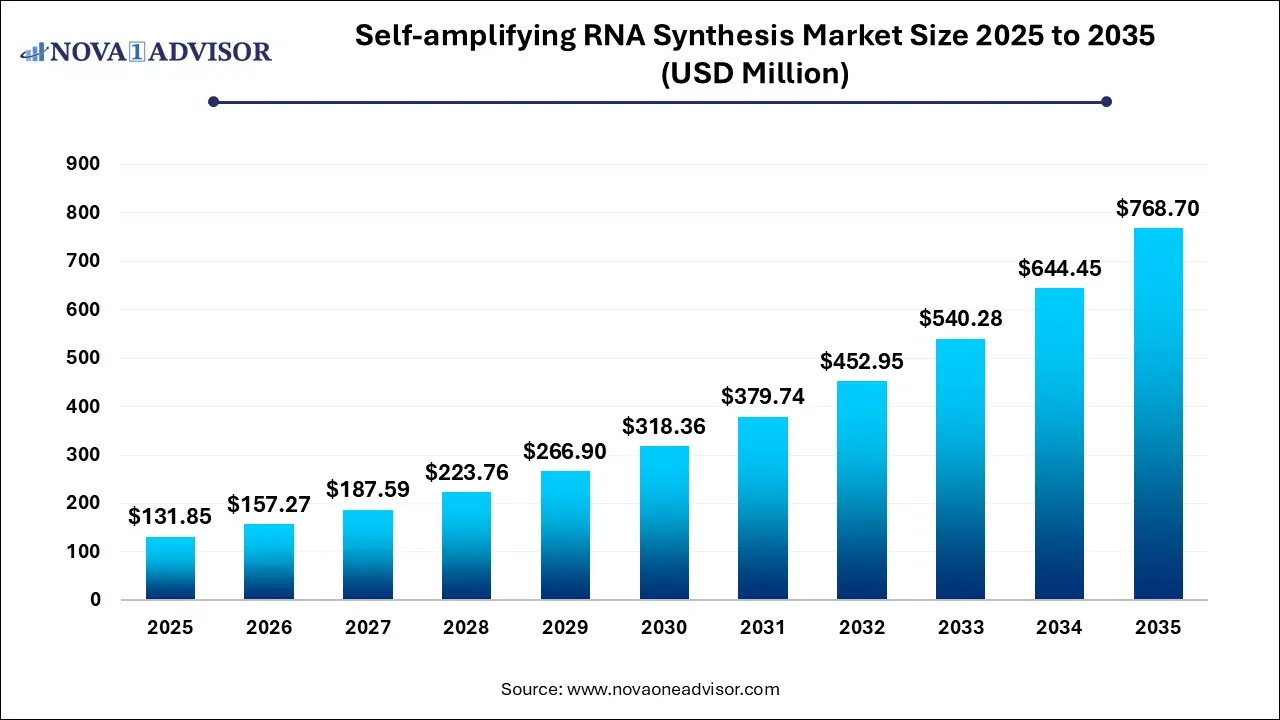

Self-amplifying RNA Synthesis Market Size and Growth

The Self-amplifying RNA synthesis market size was exhibited at USD 131.85 million in 2025 and is projected to hit around USD 768.70 million by 2035, growing at a CAGR of 19.28% during the forecast period 2026 to 2035.

Key Takeaways:

- The products segment dominated the self-amplifying RNA synthesis industry with the largest revenue share of 63% in 2025

- The therapeutics development segment dominated the self-amplifying RNA synthesis market with the largest revenue share of 75% in 2025

- The pharmaceutical and biotechnology companies segment dominated the market with the largest revenue share of 56% in 2025

Market Overview

The self-amplifying RNA (saRNA) synthesis market is emerging as a transformative sector within biotechnology, driven by its potential to revolutionize vaccine development, therapeutics, and gene editing. Unlike traditional messenger RNA (mRNA), saRNA technology leverages an added replicon sequence that enables the amplification of RNA within the host cell, resulting in higher protein expression from a smaller dose. This approach significantly reduces production costs, enhances immunogenicity, and offers rapid scalability critical in pandemic response and personalized medicine.

The COVID-19 pandemic highlighted the global demand for rapid, scalable RNA technologies. While mRNA vaccines like those from Pfizer-BioNTech and Moderna gained prominence, saRNA is being recognized for its superior efficiency. Research institutions, biotech firms, and pharmaceutical giants are heavily investing in R&D, pilot production facilities, and clinical trials targeting saRNA-based vaccines and therapeutics. Additionally, the modular nature of saRNA platforms allows for quick redesigns, especially important for combating emerging infectious diseases and variants.

From infectious diseases to oncology and rare genetic disorders, saRNA’s flexible application spectrum ensures it is not just a pandemic-response tool but a broader platform for the future of therapeutics. The saRNA synthesis market is poised for exponential growth over the coming decade, underpinned by technological innovation, strategic collaborations, and a shifting focus toward next-generation gene therapies.

Major Trends in the Market

-

Miniaturization of RNA doses: With saRNA’s self-replicating ability, smaller doses are achieving higher efficacy, reducing costs and improving safety profiles.

-

Rise of contract development and manufacturing organizations (CDMOs): Pharma companies are outsourcing saRNA synthesis to specialized CDMOs to scale production and reduce capital investment.

-

Integration with lipid nanoparticle (LNP) delivery systems: LNPs remain the delivery vehicle of choice for saRNA, and advances here are synergistically pushing the saRNA field forward.

-

Focus on personalized cancer vaccines: saRNA is being applied in oncology to develop vaccines tailored to a patient's specific tumor antigens.

-

Increased public and private investment: Governments and VCs are investing in saRNA infrastructure and innovation, especially post-COVID.

-

Partnerships between academia and industry: Collaborations are fostering faster translation of academic discoveries into commercial products.

-

Adoption of synthetic biology tools: Enhanced RNA synthesis technologies, including enzyme engineering and cell-free systems, are improving yield and reducing timelines.

-

Development of thermostable formulations: Reducing cold chain dependency is making saRNA-based therapeutics viable for global distribution, especially in low-resource settings.

Report Scope of Self-Amplifying RNA Synthesis Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 157.27 Million |

| Market Size by 2035 |

USD 768.7 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 19.28% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product & Service; Application; End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

GenScript; Creative Biogene.; OZ Biosciences; BOC Sciences; Croyez Bioscience Co., Ltd.; Creative Biolabs.; Maravai LifeSciences; Areterna LLC; Applied DNA Sciences, Inc. (LineaRx). |

The most significant driver of the saRNA synthesis market is the growing demand for rapid and scalable vaccine platforms. The COVID-19 crisis showcased the limitations of conventional vaccine production, which often takes years. In contrast, RNA-based platforms particularly saRNA enable rapid design and production. A key advantage is the lower RNA dose requirement; for instance, saRNA vaccines in development for COVID-19 showed similar efficacy with 10 to 100 times less RNA than traditional mRNA vaccines.

This scalability reduces production time and costs, allowing manufacturers to respond swiftly to pandemics or emerging infectious diseases. Moreover, governments and global health organizations are pushing for pandemic preparedness, channeling funding into RNA research. saRNA's adaptability makes it a prime candidate in this evolving public health landscape.

Key Market Restraint: Regulatory Complexity

Despite the promising benefits, regulatory uncertainty and complexity remain a key market restraint. saRNA-based therapeutics are relatively new and lack a well-established regulatory framework. Unlike small molecules or even monoclonal antibodies, RNA-based therapies pose unique challenges in characterization, stability, delivery, and immunogenicity.

Regulatory bodies such as the FDA and EMA are still developing comprehensive guidelines for RNA therapeutics, especially concerning quality control, safety assessment, and long-term efficacy. This uncertainty can delay product approvals, increase development costs, and discourage small players from entering the market. Additionally, the lack of harmonized global standards poses challenges for multinational clinical trials and global commercialization.

Key Market Opportunity: Expansion into Oncology

One of the most promising opportunities for the saRNA synthesis market lies in expanding applications in oncology. saRNA-based cancer vaccines are being developed to encode tumor-associated antigens, stimulating the immune system to target cancer cells more effectively. Unlike traditional cancer therapies, which may involve toxic chemotherapy or invasive surgeries, saRNA-based approaches offer a targeted, minimally invasive alternative.

For instance, saRNA can be personalized to encode neoantigens specific to a patient's tumor, enabling highly tailored immunotherapies. Companies like BioNTech and CureVac have announced early-stage development of saRNA cancer vaccines. As oncology remains a major focus in pharmaceutical R&D, with billions invested annually, the saRNA market stands to benefit immensely from breakthroughs in this domain.

Segmental Analysis

By Product & Service

Custom Synthesis Services dominate the market, owing to the specialized nature of saRNA synthesis, which requires tailored protocols, vector designs, and quality controls. Many pharmaceutical and biotech companies, particularly those lacking in-house RNA capabilities, rely on contract manufacturers and service providers. These services offer flexibility, faster turnaround, and access to advanced platforms, making them indispensable in early-stage R&D and clinical trial preparation.

Meanwhile, Premade saRNA products are the fastest growing segment, especially in the research and diagnostic space. As academic institutions and smaller startups seek cost-effective, off-the-shelf RNA solutions, premade saRNA formats are witnessing increased demand. These standardized products reduce lead time, are ideal for screening studies, and serve as platforms for proof-of-concept research in oncology, infectious diseases, and vaccine formulation.

By Application

Therapeutics Development leads the application segment, reflecting the robust investment in developing saRNA-based treatments. Companies are advancing saRNA candidates for influenza, COVID-19 variants, and even rare genetic disorders. This segment also benefits from a growing pipeline of clinical trials and collaborations with academic institutions. The need for versatile, rapidly deployable therapeutics has made this the cornerstone of saRNA application.

Infectious Diseases emerge as the fastest growing application, due to heightened focus on epidemic preparedness. The WHO and CEPI are funding platforms that use saRNA for diseases like Lassa fever and Chikungunya. The success of mRNA vaccines during COVID-19 has instilled confidence in RNA technologies, spurring research into saRNA vaccines for Zika, rabies, and tuberculosis.

By End Use

Pharmaceutical & Biotechnology Companies are the primary end-users, leveraging saRNA synthesis for drug development, clinical trials, and commercialization. These companies drive innovation, secure funding, and form strategic partnerships with CDMOs and research institutions. Their focus on streamlining pipelines and developing platform technologies ensures a steady demand for saRNA synthesis services.

Academic & Research Institutes represent the fastest growing end-user group. With increasing availability of grant funding and public interest, universities and public research centers are delving into saRNA for basic biomedical studies and translational research. The simplicity and modularity of saRNA makes it ideal for academic labs studying gene expression, immune modulation, and personalized vaccines.

Regional Analysis

North America dominates the saRNA synthesis market, accounting for the largest revenue share. The region boasts leading biotechnology hubs in the U.S. and Canada, a high concentration of RNA-focused firms, and strong governmental support. The Biomedical Advanced Research and Development Authority (BARDA) and NIH have heavily invested in RNA platforms post-COVID. Additionally, regulatory agencies like the FDA have begun engaging proactively with companies working on saRNA, which accelerates development.

Major pharmaceutical firms like Moderna and Pfizer are headquartered here, and several startups have emerged with saRNA pipelines, including Arcturus Therapeutics and Strand Therapeutics. The U.S. also leads in clinical trials and collaborations with universities like MIT and Stanford driving academic research forward.

Asia Pacific is the fastest growing region, driven by increasing government investment, rising biotech startups, and expanding healthcare infrastructure. Countries like China, South Korea, and India are prioritizing domestic biomanufacturing capabilities and investing in RNA vaccine development. For example, China’s Suzhou Abogen Biosciences is advancing its saRNA-based COVID-19 vaccine.

Moreover, countries in this region are actively participating in global partnerships and licensing agreements. Japan’s Takeda and India's Bharat Biotech are showing interest in RNA-based platforms. With a growing population, high burden of infectious diseases, and rising healthcare R&D expenditure, Asia Pacific is expected to continue its rapid growth trajectory in the saRNA synthesis space.

Some of The Prominent Players in The Self-amplifying RNA synthesis market Include:

Recent Developments

-

March 2025: U.K.-based VaxEquity announced the successful Phase I results of its saRNA-based COVID-19 booster, developed in partnership with AstraZeneca. The results showed robust immune responses at lower doses, validating saRNA’s potential in next-gen vaccines.

-

February 2025: CureVac partnered with Germany’s CEPI (Coalition for Epidemic Preparedness Innovations) to co-develop saRNA vaccines for Lassa Fever and Marburg Virus, committing to equitable access across low-income nations.

-

December 2024: U.S. firm Strand Therapeutics raised $70 million in a Series B round to advance its pipeline of saRNA immuno-oncology therapies. The funds will support IND submissions for liver and pancreatic cancers.

-

October 2024: Arcturus Therapeutics expanded its manufacturing capacity in San Diego to include commercial-scale saRNA vaccine production, aiming to support global pandemic preparedness initiatives.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Self-amplifying RNA synthesis market

Product & Service

-

- Premade saRNA

- Enzymes & Reagents

- Others

- Custom Synthesis Services

Application

-

- Infectious Diseases

- Oncology

- Others

End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Other End Use

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)