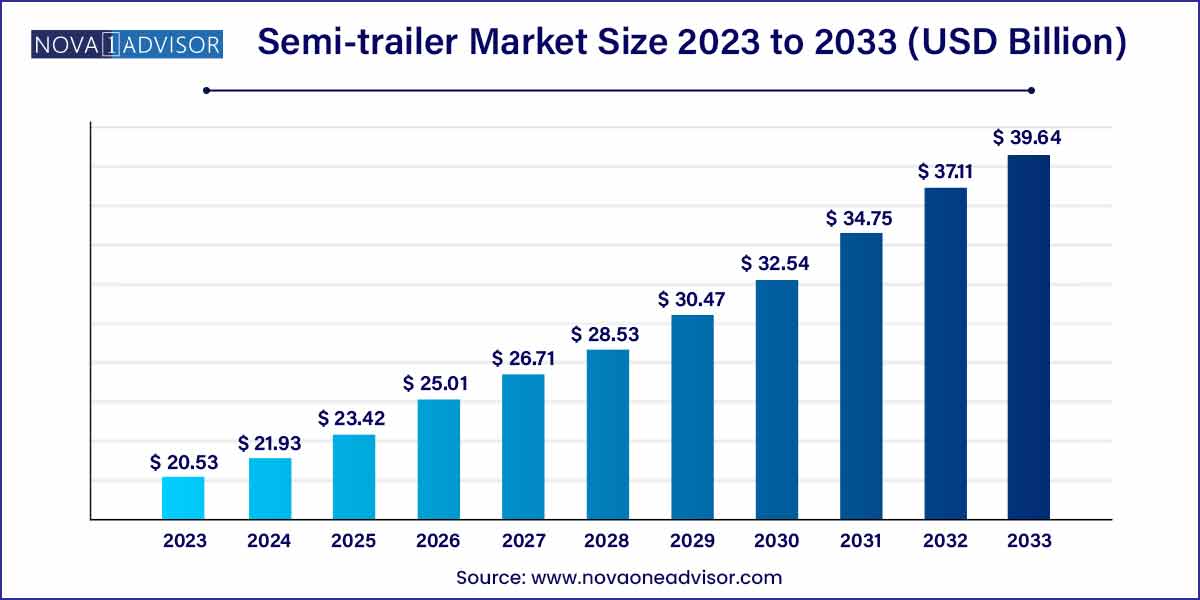

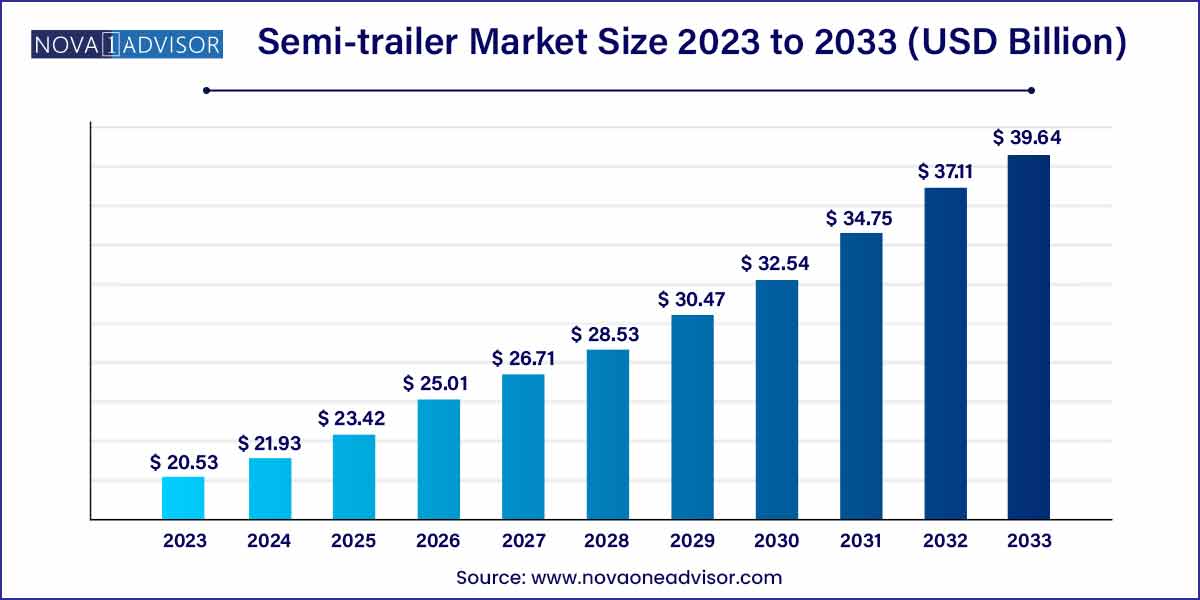

The global semi-trailer market size was exhibited at USD 20.53 billion in 2023 and is projected to hit around USD 39.64 billion by 2033, growing at a CAGR of 6.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific held the largest revenue share of 40% in 2023 and is expected to expand at the fastest CAGR during the forecast period.

- The lowboy trailers segment accounted for the largest share of 27.0% in 2023.

Semi-trailer Market: Overview

The semi-trailer market stands at the crossroads of innovation and functionality, driven by a myriad of factors ranging from technological advancements to evolving consumer demands and industry regulations.As a pivotal component of the transportation and logistics sector, semi-trailers play an indispensable role in facilitating the movement of goods across vast distances efficiently and safely.

Semi-trailer Market Growth

The growth of the semi-trailer market is propelled by a confluence of factors driving demand and innovation within the transportation and logistics sector. Key growth drivers include the expanding scope of international trade, spurred by globalization and the rise of e-commerce platforms. This surge in trade necessitates efficient and reliable transportation solutions, boosting the demand for semi-trailers as a vital component of the supply chain. Furthermore, infrastructure development initiatives worldwide, coupled with increasing urbanization, contribute to the need for robust transportation networks, driving demand for semi-trailers across various applications. Additionally, stringent regulatory mandates aimed at enhancing safety and reducing emissions incentivize manufacturers to invest in advanced technologies, such as lightweight materials and eco-friendly propulsion systems, further stimulating market growth.As industries continue to adapt to changing market dynamics and consumer preferences, the semi-trailer market is poised to witness sustained expansion driven by these multifaceted growth factors.

Semi-trailer Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 20.53 Billion |

| Market Size by 2033 |

USD 39.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Qingdao CIMC Special Vehicles Co., Ltd; Fontaine Trailer; Great Dane A Division of Great Dane LLC.; Kögel; KRONE Trailer; LAMBERET SAS; Polar Tank Trailer.; Schmitz Cargobull.; Utility Trailer Manufacturing Company; Wabash National Corporation.; HYUNDAI TRANSLEAD. |

Semi-trailer Market Dynamics

- Regulatory Landscape and Sustainability Initiatives:

The semi-trailer market is profoundly influenced by regulatory frameworks aimed at improving safety standards and reducing environmental impact. Stringent regulations pertaining to emissions, weight limits, and vehicle dimensions compel manufacturers to innovate and adopt technologies that enhance fuel efficiency and minimize carbon footprint. Moreover, sustainability initiatives and the growing emphasis on eco-friendly transportation solutions are driving the adoption of alternative fuels, electric propulsion systems, and lightweight materials in semi-trailer manufacturing.

- Technological Advancements and Digitalization:

Rapid advancements in technology are revolutionizing the semi-trailer industry, ushering in an era of digitalization, connectivity, and automation. Telematics systems, IoT (Internet of Things) sensors, and advanced data analytics enable real-time monitoring of vehicle performance, maintenance needs, and cargo conditions, enhancing operational efficiency and fleet management. Moreover, the integration of autonomous driving technologies holds the promise of improving safety, reducing labor costs, and optimizing logistics operations.

Semi-trailer Market Restraint

- Economic Uncertainty and Volatility:

Economic fluctuations and uncertainties, such as currency devaluation, trade tensions, and geopolitical instability, pose significant challenges to the semi-trailer market. In times of economic downturns or recessions, businesses may reduce capital expenditures, defer fleet expansions, or opt for cost-saving measures, leading to decreased demand for semi-trailers. Moreover, fluctuations in fuel prices and raw material costs can adversely affect manufacturing margins and profitability for industry players.

- Supply Chain Disruptions and Component Shortages:

The semi-trailer industry is susceptible to supply chain disruptions and component shortages, which can arise from various factors such as natural disasters, geopolitical conflicts, or disruptions in raw material supply chains. Interruptions in the availability of critical components, such as axles, tires, or electronic components, can lead to production delays, increased lead times, and elevated manufacturing costs. Additionally, the global pandemic highlighted vulnerabilities in supply chains, prompting companies to reevaluate their sourcing strategies and adopt measures to enhance resilience.

Semi-trailer Market Opportunity

- Growing Adoption of Electric and Alternative Fuel Vehicles:

The increasing focus on environmental sustainability and the drive towards decarbonization present a significant opportunity for the adoption of electric and alternative fuel semi-trailers. Governments worldwide are implementing stringent emissions regulations and offering incentives to encourage the transition towards cleaner transportation solutions. As a result, there is a rising demand for electric semi-trailers powered by battery-electric or hydrogen fuel cell technologies. Manufacturers investing in research and development of electric propulsion systems, lightweight materials, and infrastructure for charging or refueling stations stand to capitalize on this burgeoning market opportunity.

- Expansion of E-commerce and Last-Mile Delivery Solutions:

The exponential growth of e-commerce and the proliferation of online retail platforms have reshaped consumer shopping habits and supply chain dynamics. This trend has fueled the demand for efficient last-mile delivery solutions, driving the need for specialized semi-trailers tailored to urban logistics and parcel delivery. Companies operating in the semi-trailer market have an opportunity to develop innovative solutions, such as lightweight trailers with increased cargo capacity, maneuverability, and accessibility features optimized for urban environments. Additionally, the integration of telematics, tracking systems, and route optimization algorithms can enhance the efficiency and reliability of last-mile delivery operations.

Semi-trailer Market Challenges

- Infrastructure Limitations and Road Congestion:

One of the primary challenges for the semi-trailer market is the inadequacy of transportation infrastructure and the prevalence of road congestion in many regions. Insufficient road networks, outdated bridges, and narrow passageways limit the movement of semi-trailers, leading to delays, increased transportation costs, and productivity losses. Moreover, urban areas often face congestion due to population growth, commercial activities, and inadequate urban planning, further exacerbating transportation challenges for semi-trailers. Addressing infrastructure limitations requires significant investment in road expansion, bridge maintenance, and the development of intermodal facilities to accommodate the growing volume of freight transported by semi-trailers.

- Safety and Regulatory Compliance:

Ensuring the safety of semi-trailers and compliance with stringent regulatory requirements present ongoing challenges for manufacturers and operators in the market. Semi-trailers are subject to a myriad of regulations governing vehicle design, construction, weight limits, braking systems, and emissions standards aimed at minimizing accidents and environmental impact. Compliance with these regulations necessitates continuous monitoring, testing, and validation of semi-trailer designs and components, adding complexity and costs to the manufacturing process. Moreover, ensuring driver compliance with safety regulations, such as hours-of-service rules and load security standards, requires robust training programs and enforcement measures. Failure to adhere to safety regulations can result in fines, penalties, and reputational damage for companies operating in the semi-trailer market.

Segments Insights:

Type Insights

Flat Bed Trailers dominated the type segment within the semi-trailer market.

Flat bed trailers offer versatility and flexibility unmatched by other trailer types, enabling them to transport a wide variety of cargo, including construction materials, heavy machinery, and oversized goods. Their open design allows for easy loading and unloading, making them the preferred choice for industries such as construction, mining, and manufacturing. Flatbeds are also ideal for non-standardized loads that cannot fit into enclosed trailers, further enhancing their appeal. Given their ability to adapt to multiple cargo types and industries, flat bed trailers continue to capture a significant share of the market.

On the other hand, Refrigerated Trailers are poised to grow at the fastest rate.

The refrigerated trailer, or "reefer" segment, has experienced tremendous growth, especially with the surge in demand for temperature-sensitive goods such as food, pharmaceuticals, and chemicals. The COVID-19 pandemic notably accelerated this trend, emphasizing the critical importance of cold chain logistics. Additionally, the expansion of organized retail, pharmaceutical cold chains, and agricultural exports in emerging economies fuels this segment's growth. Technological innovations like solar-powered refrigeration units and multi-temperature compartments further elevate the adoption of refrigerated trailers worldwi

Regional Insights

North America emerged as the dominant region in the semi-trailer market.

North America, particularly the United States, boasts a highly developed logistics infrastructure and a robust freight trucking industry, making it the leader in the semi-trailer market. The region's heavy reliance on road freight, vast geographical area, and thriving e-commerce sector drive continuous demand for semi-trailers. Government regulations, such as the Federal Motor Carrier Safety Administration's (FMCSA) guidelines, also influence the adoption of technologically advanced trailers emphasizing safety and efficiency. Companies like Great Dane, Utility Trailer Manufacturing Company, and Wabash National Corporation have long established their presence, fueling innovation and competitive dynamics in the market.

Meanwhile, Asia-Pacific is projected to be the fastest-growing region.

Asia-Pacific's rapid economic growth, expanding manufacturing base, and booming e-commerce sectors in countries like China, India, and Southeast Asian nations have significantly boosted the need for efficient goods transportation. Governments are investing heavily in infrastructure development, such as highways, logistics parks, and smart freight corridors, which further support semi-trailer market growth. The Belt and Road Initiative by China and India's Dedicated Freight Corridors exemplify major investments that will stimulate long-term demand for trailers. Additionally, the push toward regional trade agreements and free trade zones across Asia-Pacific accelerates cross-border logistics, further driving semi-trailer adoption.

Recent Developments

-

In March 2025, Wabash National Corporation announced the launch of its EcoNex refrigerated trailers made with environmentally friendly composite materials, enhancing sustainability in cold chain logistics.

-

In January 2025, Utility Trailer Manufacturing Company expanded its Utah plant to boost production capacity for refrigerated trailers in response to surging demand.

-

In December 2024, Schmitz Cargobull introduced a smart semi-trailer with integrated telematics and solar-powered refrigeration, aiming to reduce operational costs for fleet operators.

-

In October 2024, Hyundai Translead partnered with technology firm Platform Science to develop smart trailer systems offering real-time diagnostics and route optimization.

-

In August 2024, Great Dane announced an initiative to incorporate electric axle technologies into its trailer designs, promoting energy regeneration during braking events.

Some of the prominent players in the semi-trailer market include:

- Qingdao CIMC Special Vehicles Co., Ltd

- Fontaine Trailer

- Great Dane A Division of Great Dane LLC.

- Kögel

- KRONE Trailer

- LAMBERET SAS

- Polar Tank Trailer.

- Schmitz Cargobull.

- Utility Trailer Manufacturing Company

- Wabash National Corporation.

- HYUNDAI TRANSLEAD

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global semi-trailer market.

Type

- Flat Bed Trailer

- Dry Vans

- Refrigerated Trailers

- Lowboy Trailers

- Tankers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)