Deprecated: mb_convert_encoding(): Handling HTML entities via mbstring is deprecated; use htmlspecialchars, htmlentities, or mb_encode_numericentity/mb_decode_numericentity instead in

/home/novaoneadvisor/public_html/report-details.php on line

323

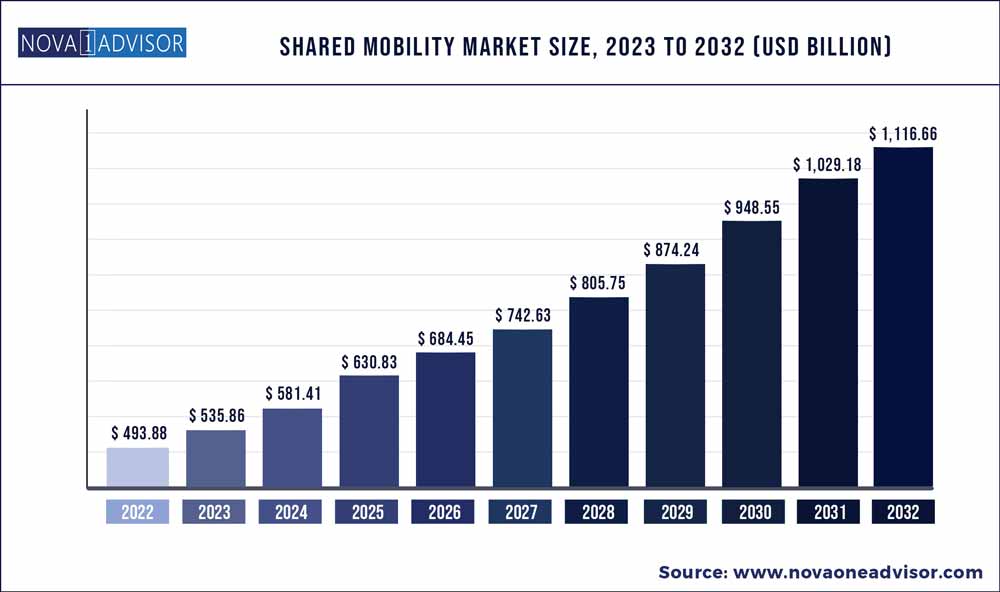

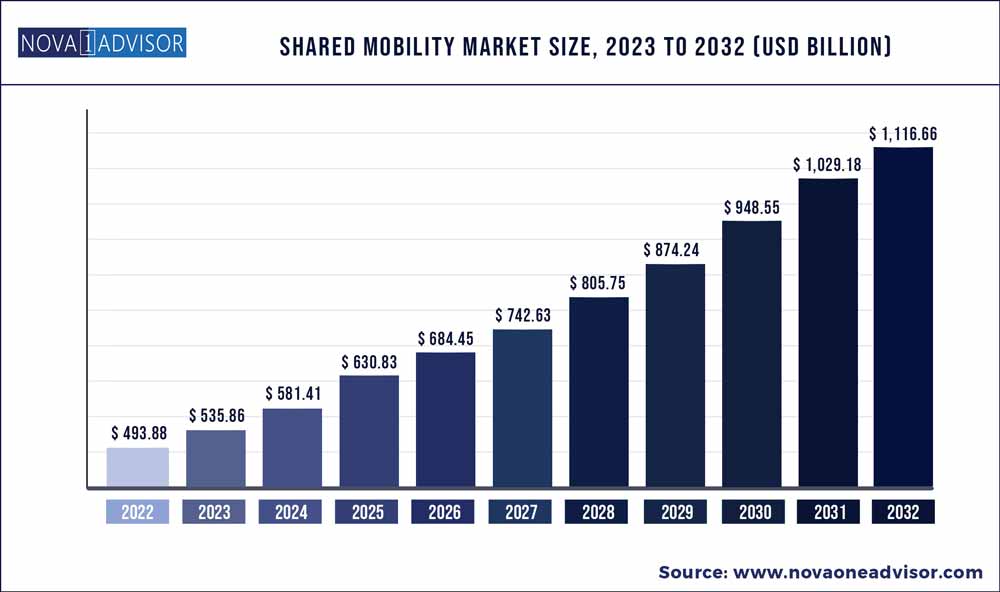

The global shared mobility market size was estimated at USD 493.88 billion in 2022 and is expected to surpass around USD 1,116.66 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 8.5% during the forecast period 2023 to 2032.

Key Takeaways:

- Asia Pacific is gaining market traction by acquiring a market revenue share of around 54.16% in 2022.

- Middle East and Africa is the highest growing market acquiring a CAGR of 17.1% during 2023-2032.

- The vehicle rental/leasing type segment is expected to witness the highest growth accounting for more than 45.6% of revenue share in 2022

- The bike sharing service model segment is predicted to witness a CAGR of 20.3% from 2023 to 2032.

- The passenger cars in this segment is forecasted to contribute the largest revenues share of more than 55.6% in 2022

- Two-wheelers have always been a popular mode of transportation due to their low cost and fuel efficiency. Shared mobility companies have recognized this trend and have started to offer shared two-wheeler services, such as bike-sharing and scooter-sharing to cater to the market growth

Shared Mobility Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 535.86 Billion |

| Market Size by 2032 |

USD 1,116.66 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 8.5% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Type, Vehicle Type, Business Model, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Avis Budget Group, ANI Technologies Pvt. Ltd. (OLA), car2go NA LLC, Beijing Xiaoju Technology Co, Ltd., The Hertz Corporation, WingzInc., Uber Technologies Inc., Curb Mobility, GrabHoldings Inc., Lyft Inc., Careem Inc. |

The market's growth can be attributed to the rise of ride-hailing services such as Uber and Lyft, which have disrupted traditional taxi services. In addition, the increasing popularity of car-sharing services such as Zipcar and Car2Go and the emergence of bike-sharing and scooter-sharing services such as Lime and Bird have also contributed to the market growth.

The widespread adoption of mobile apps enables users to access and book car-pool services quickly and easily. These apps provide real-time information on vehicle availability, pricing, and location, making it easier for users to plan their trips and navigate the city. Electric vehicles also benefit from advancements in battery technology which have increased their range and made them more practical for car-pool services. Electric and hybrid cars are increasingly used in the service as they offer more sustainable and environmentally friendly transportation options.

Electric vehicles have zero emissions and can be charged from renewable energy sources, making them a key solution in transitioning to a low-carbon economy. Hybrid vehicles combine an electric motor with a gasoline engine reducing emissions and increasing fuel efficiency. Companies like Uber and Lyft are increasingly offering electric and hybrid vehicles as a part of their fleets providing riders with a more sustainable option.

Car-sharing companies like Zipcar and Car2Go also introduced electric and hybrid vehicles to their fleet, giving users access to better short-term rental options. The use of electric and hybrid vehicles in the market is expected to grow in the coming years as cities and governments increasingly prioritize sustainable transportation solutions to reduce carbon emissions and improve air quality.

Consumer preferences in the market are rapidly changing, driven by various factors such as the need for convenience, sustainability, and cost-effectiveness. With the shift from car ownership towards shared mobility services, the younger generation is showing less interest in owning a car. Instead, it is opting for a car-pooling option that offers flexibility and cost savings. In addition to a preference for carpooling, consumers increasingly prioritize sustainability in their transportation choices. This has led to a rise in the use of electric and hybrid vehicles in the market and the growth of bike-sharing and scooter-sharing services.

Consumers also demand more convenience and flexibility in the services, which has led to the development of new business models and services. For example, Uber and Lyft have introduced ride-hailing services that offer on-demand transportation. In contrast, car-sharing services like Zipcar and Car2Go provide flexible pick-up and drop-off options for hourly rentals.

Bike-sharing programs typically involve a fleet of bicycles stationed at various locations throughout a city. Users can rent a bike for a short period, typically by scanning a QR code with their smartphone or swiping a membership card, and then return it to another station when finished. Bike sharing is often used for shirt trips such as community to work or running errands. Scooter-sharing programs operate similarly, with users renting electric scooters instead of bicycles. These scooters are often equipped with GPS trackers, allowing users to locate them through a mobile app and unlock them with a code. Like bike sharing, scooter sharing is often used for short trips, although it is generally considered faster than biking.

Machine learning and artificial intelligence are already being used in the market to improve efficiency, safety, and user experience. AI can be used to analyze data from the vehicle and predict when maintenance will be needed. This can help companies to schedule maintenance more efficiently, reduce downtime, and extend the lifespan of their vehicles. Machine learning algorithms can analyze data on past usage patterns and weather conditions to forecast demand for the service in the future. This can help companies allocate resources more effectively and avoid a supply shortage.

Type Insights

Based on the type, the shared mobility market is divided into ride-sharing, vehicle rental/leasing, ride sourcing and private. The vehicle rental/leasing type segment is expected to witness the highest growth accounting for more than 45.6% of revenue share in 2022 and The bike sharing service model segment is predicted to witness a CAGR of 20.3% from 2023 to 2032. And also it is anticipated to grow at a decent pace during the forecast period owing to increase in population specially in the developing countries.

Furthermore, ride-sharing type segment is also growing significantly during the forecast period owing to the desire of customers opting for more cost-effective and elegant modes of transportation over personal driving preferences. All these factors are estimated to drive the growth of the market. For instance, On 30th September 2021, Europe's leading free-floating car sharing provider SHARE NOW announced that it will use artificial intelligence in overcoming traffic in cities. With the introducing of AI in the car sharing services, Share Now will efficiently manage and control its vehicle fleet.

Vehicle Type Insights

Based on the Vehicle Type, the shared mobility market is divided into Passenger Cars, LCVs, Busses & Coaches and Micro Mobility. The passenger cars in this segment is forecasted to contribute the largest revenues share of more than 55.6% in 2022 and is estimated to grow remarkably over the forecast period. It is because of the lucrative features provided in the passenger cars and the driving experience it provides. Also, launch of new services by ride-hailing providers is expected to boost the market growth. For instance, On 6th August 2021, Rapido India's largest bike taxi platform announced their expansion of its auto service to Bengaluru, taking the service to a total of 26 cities in India. These services aim to give them access to safer and more affordable commute options and provide other avenues of earning for the auto drivers.

Business Model Insights

Based on the End-user, the Shared Mobility Market is divided into P2P, B2B and B2C. The P2P business model segment is expected to witness a significant revenue share during the forecast period amounting for more than 59% of the global share. It is also anticipated to grow significantly during the forecast period. It is due to the surge in use of automobiles for rental and leasing services.

Region Insights

Asia Pacific is gaining market traction by acquiring a market revenue share of around 54.16% in 2022. The region is home to some of the world’s largest and fastest-growing cities, and as a result, there is a growing demand for convenient and sustainable transportation options. The rapid growth of ride-hailing services in the region due to the presence of companies like Uber and Grab has seen tremendous success, as they offer a convenient and affordable alternative to traditional taxis. In addition, many of these companies have expanded their services to include other forms of transportation, such as bike sharing and car sharing.

Middle East and Africa is the highest growing market acquiring a CAGR of 17.1% during 2023-2032. The region is experiencing rapid urbanization and a growing population, contributing to the demand for more sustainable and efficient modes of transportation. Companies like Dyky and Lime are offering bike-sharing services in some of the larger cities, providing users with a convenient and environmentally friendly mode of transportation.

Some of the prominent players in the Shared Mobility Market include:

- Avis Budget Group

- ANI Technologies Pvt. Ltd. (OLA),

- car2go NA LLC,

- Beijing Xiaoju Technology Co, Ltd.,

- The Hertz Corporation,

- WingzInc.,

- Uber Technologies Inc.,

- Curb Mobility,

- GrabHoldings Inc.,

- Lyft Inc., Careem Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Shared Mobility market.

By Type

- Ride-sharing

- Vehicle Rental/Leasing

- Ride Sourcing

- Private

By Vehicle Type

- Passenger Cars

- LCVs

- Busses & Coaches

- Micro Mobility

By Business Model

By Vehicle Propulsion

- IC Engine Vehicles

- Electric Vehicles

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

By Sales Channel

By Sector Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)