Silver Wound Dressing Market Size and Growth

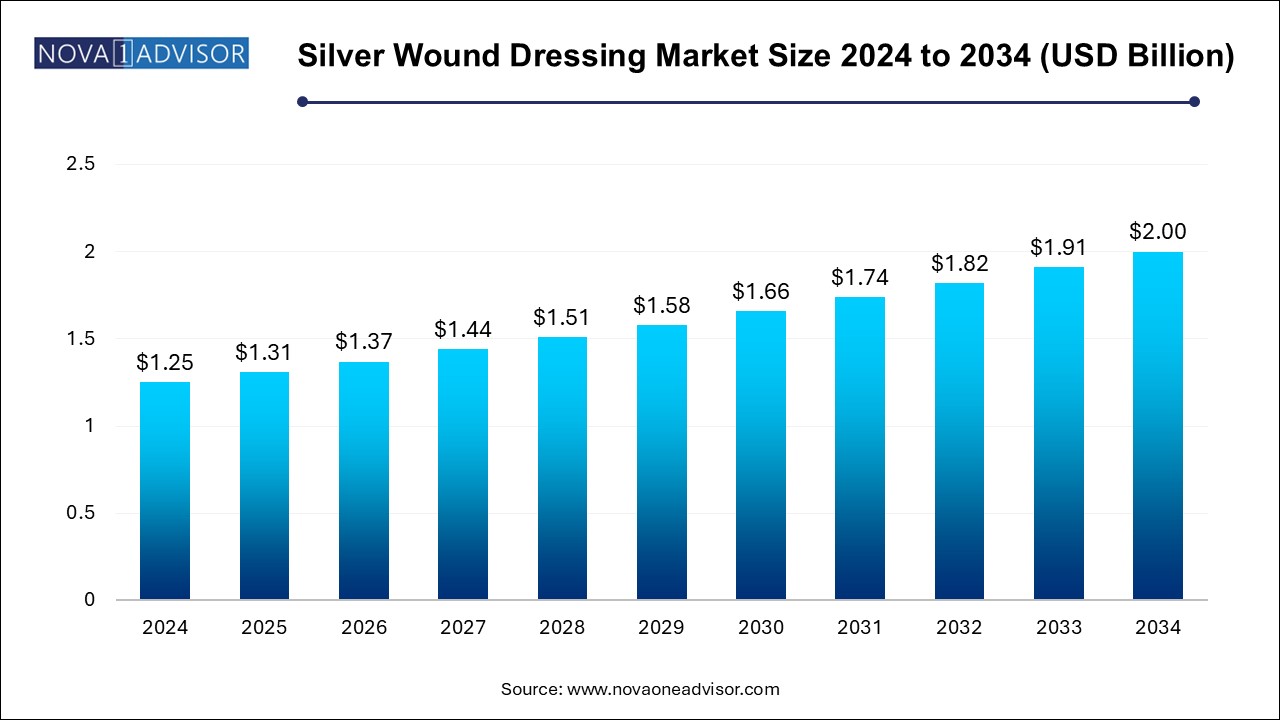

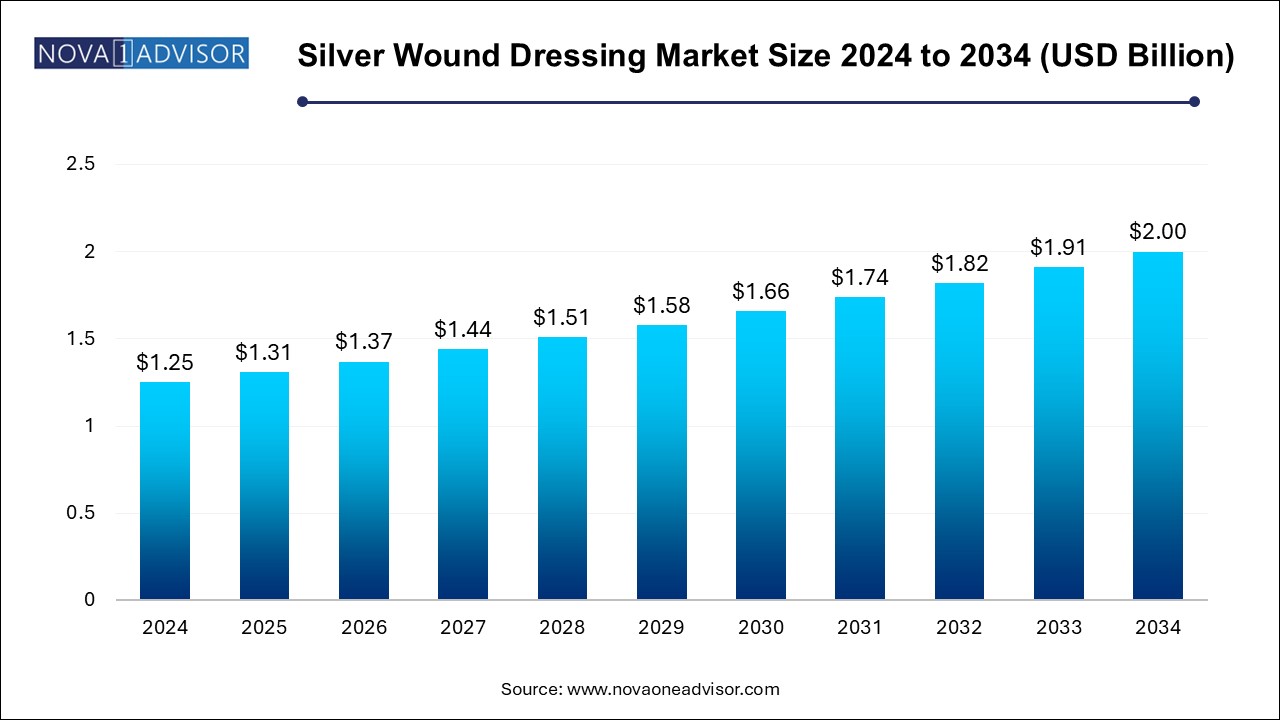

The silver wound dressing market size was exhibited at USD 1.25 billion in 2024 and is projected to hit around USD 2.0 billion by 2034, growing at a CAGR of 4.8% during the forecast period 2024 to 2034. The rising incidences of chronic wounds, ongoing clinical trials and progress in innovative wound dressings are the factors driving the growth of the silver wound dressing market.

Silver Wound Dressing Market Key Takeaways:

- Advanced silver wound dressing led the market with a revenue share of 60.3% in 2024.

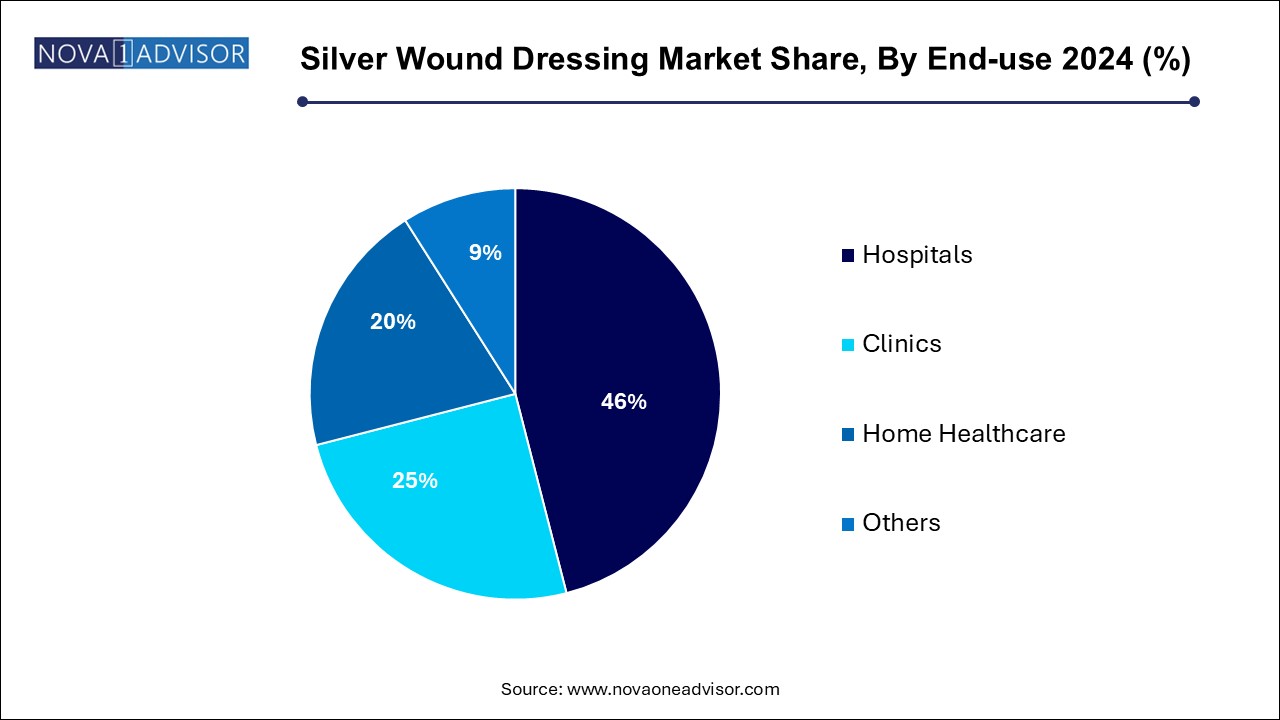

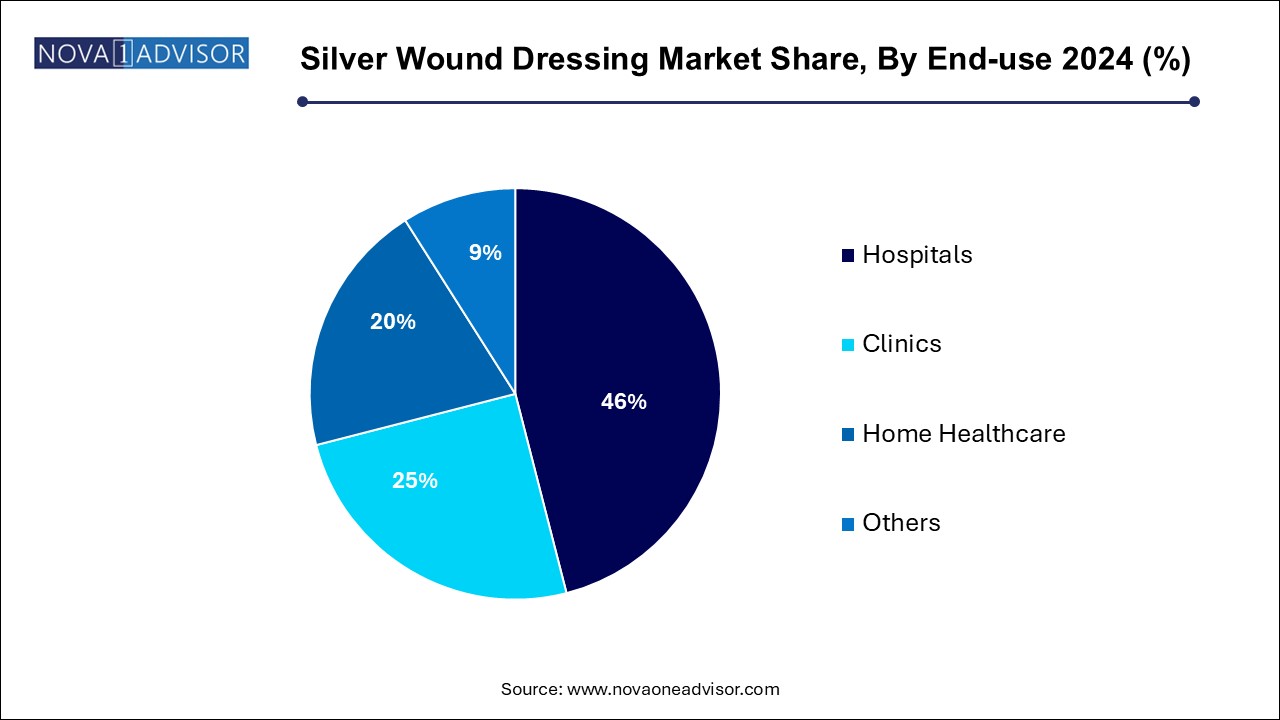

- Hospitals dominated the market and accounted for a share of 46.0% in 2024.

- Home healthcare is projected to grow at the fastest CAGR of 5.6% over the forecast period

- North America silver wound dressing market dominated the global market with a revenue share of 48.4% in 2024.

Market Overview

The Silver Wound Dressing Market is witnessing steady and significant growth, driven by an increasing global burden of chronic wounds, a rise in surgical procedures, and a growing demand for advanced wound care solutions. Silver has long been recognized for its potent antimicrobial properties, making it an essential component in the management of wounds susceptible to infection. In modern medicine, silver-infused dressings have gained popularity across healthcare settings due to their ability to prevent microbial contamination, accelerate healing, and reduce the risk of sepsis especially in immunocompromised patients.

These dressings are particularly effective in treating burns, ulcers, post-surgical wounds, diabetic foot injuries, and pressure sores. The rising geriatric population, coupled with the growing prevalence of diabetes and vascular diseases, has resulted in a heightened need for effective wound management strategies. According to the International Diabetes Federation, over 640 million people are expected to live with diabetes by 2030, many of whom will face chronic non-healing wounds, thus elevating the demand for silver-based dressings.

The market is undergoing a technological transformation, with innovations in dressing formats—from traditional silver bandages to advanced products such as silver alginates, hydrofiber dressings, and nanocrystalline silver coatings. These advancements offer enhanced exudate management, increased patient comfort, and longer wear time, which ultimately reduce the frequency of dressing changes and treatment costs.

Moreover, the silver wound dressing market is being fueled by broader healthcare trends, such as the shift toward outpatient care, the rise in home healthcare services, and an emphasis on infection control. Increasing awareness among healthcare providers and patients about the benefits of silver-based products is encouraging adoption across both hospital and home settings.

Major Trends in the Market

-

Rising preference for advanced silver wound dressings over traditional products, due to superior antimicrobial action and better wound healing outcomes.

-

Technological innovation in nanocrystalline silver dressings, enabling controlled silver ion release for extended protection.

-

Increasing adoption in home healthcare and outpatient care, driven by cost savings and patient convenience.

-

Integration of silver with biocompatible polymers and smart dressing materials for moisture regulation and wound monitoring.

-

Growing investment in antimicrobial resistance (AMR) mitigation, with silver dressings gaining attention as an alternative to antibiotic-based wound care.

-

Surge in demand for burn and trauma wound management in conflict zones and natural disaster-hit areas, promoting large-scale deployment of silver dressings.

-

Development of dual-action dressings combining silver with hydrocolloids, foams, or hydrogels for better adherence and flexibility.

-

Entry of nanotechnology-based startups into the market, focusing on customizable, low-toxicity, and highly effective silver formulations.

Report Scope of Silver Wound Dressing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.31 Billion |

| Market Size by 2034 |

USD 2.0 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 4.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

B. Braun Medical Inc.; 3M; Convatec Group PLC; Coloplast Group; Smith+Nephew; Mölnlycke Health Care AB; Ferris Mfg. Corp.; Cardinal Health |

Market Driver: Rising Global Burden of Chronic Wounds

The most compelling driver for the silver wound dressing market is the surge in chronic wound cases worldwide, particularly among the aging and diabetic populations. Chronic wounds such as venous leg ulcers, diabetic foot ulcers, and pressure injuries often become sites of bacterial colonization and biofilm formation, leading to prolonged healing and increased risk of complications. Silver dressings provide a potent antimicrobial barrier, reducing microbial load and enabling optimal wound healing environments.

For instance, in the U.S., chronic wounds affect approximately 6.5 million patients annually, with the majority of these cases requiring long-term wound care strategies. In many of these instances, silver-based dressings have proven to reduce infection rates, minimize hospitalization, and improve overall quality of life. The rise in outpatient care models and government reimbursement schemes further boosts the adoption of these products in both clinical and home settings.

Market Restraint: Cytotoxicity Concerns and Cost Barriers

Despite their efficacy, concerns regarding silver-induced cytotoxicity and higher costs present notable barriers to market growth. While silver is a powerful antimicrobial agent, excessive or prolonged exposure to silver ions can lead to delayed healing or cytotoxic effects on healthy cells, particularly in shallow or less-infected wounds. This limits the universal applicability of silver wound dressings, with clinicians often opting for alternative non-silver dressings in early wound stages or non-infected wounds.

Additionally, the cost of advanced silver dressings is significantly higher than traditional wound care products. In low-income and resource-constrained healthcare settings, budget limitations often preclude the use of silver-based products. This is particularly true in public hospitals in emerging markets, where procurement of wound care supplies is dictated by cost-efficiency rather than clinical superiority.

Market Opportunity: Integration of Nanotechnology in Silver Dressings

A transformative opportunity in the silver wound dressing market lies in the application of nanotechnology to enhance efficacy and reduce cytotoxicity. Nanocrystalline silver dressings offer controlled and sustained release of silver ions, ensuring antimicrobial efficacy while minimizing tissue damage. These dressings also demonstrate improved exudate management and are often more flexible, breathable, and comfortable for patients.

Companies and research institutions are increasingly investing in the development of nanoparticle-infused dressings with enhanced surface area and activity, which not only reduce infection but also promote angiogenesis and tissue regeneration. For example, nanocomposite silver-hydrogel matrices are being tested for burn treatment, post-operative care, and even battlefield wound applications. As the regulatory landscape becomes more favorable and production costs decline, nanotechnology-based silver dressings are poised to revolutionize the market.

Silver Wound Dressing Market By Product Insights

Advanced silver wound dressing led the market with a revenue share of 60.3% in 2024, owing to their superior performance, longer wear time, and ability to manage moderate to highly exudative wounds. These include formats such as silver foam dressings, hydrofiber dressings, and silver alginates, which offer a moist wound environment, excellent absorption, and sustained antimicrobial action. These products are widely used in hospital settings for treating infected surgical wounds, trauma injuries, and pressure ulcers. Their integration with soft foam or fiber materials improves patient comfort and compliance, making them a preferred choice for long-term care and home healthcare alike.

Nano crystalline silver dressings are emerging as the fastest growing product segment, driven by advancements in nanotechnology and growing clinical evidence supporting their efficacy. These dressings release silver ions in a controlled manner, reducing the frequency of dressing changes while enhancing healing rates. Hospitals dealing with severe burn cases, complex ulcers, and surgical infections are increasingly adopting nanocrystalline products for their superior wound-healing properties. Additionally, military medical units and emergency responders are incorporating nanocrystalline dressings in field kits due to their compactness and extended shelf-life.

Silver Wound Dressing Market By End-use Insights

Hospitals dominated the market and accounted for a share of 46.0% in 2024. Accounting for the largest market share due to their handling of complex wound cases, surgical site management, and burn care. Hospitals also have access to trained personnel, enabling the use of advanced dressing protocols, including multi-layered silver dressings and silver-impregnated surgical drapes. These institutions often use a wide range of silver products for post-operative wound prevention, diabetic ulcer management, and trauma care, contributing to high-volume demand and recurring purchases.

Home healthcare is projected to grow at the fastest CAGR of 5.6% over the forecast period, reflecting a global shift toward decentralized care models and aging-in-place initiatives. Patients with chronic conditions such as diabetic foot ulcers or pressure sores are increasingly receiving treatment at home. Silver wound dressings—especially foam-based and hydrogel variants—are easy to apply and require less frequent changes, making them suitable for non-hospital environments. The availability of instructional support via telehealth and home nurse visits has further boosted confidence in home-based wound care, particularly in high-income regions and urban centers.

Silver Wound Dressing Market By Regional Insights

North America holds the largest share of the global silver wound dressing market, thanks to its advanced healthcare infrastructure, high chronic disease burden, and early adoption of innovative wound care technologies. The United States leads in the deployment of advanced silver dressings in both hospital and home care settings. Reimbursement coverage for advanced wound care, supported by CMS (Centers for Medicare & Medicaid Services), has made these products accessible to a wider population. Additionally, the presence of leading manufacturers such as 3M, Smith & Nephew, and ConvaTec ensures continual product availability and innovation.

Moreover, the high incidence of diabetes and obesity in the region correlates with rising cases of chronic wounds requiring long-term care. Burn centers and trauma units in North American hospitals rely heavily on silver-based dressings for infection prevention. With consistent R&D funding and a mature regulatory environment, North America is expected to maintain its dominance throughout the forecast period.

Asia Pacific is experiencing the fastest growth in the silver wound dressing market, spurred by increasing healthcare expenditure, growing awareness of advanced wound care, and a rising elderly population. Countries like China, India, Japan, and South Korea are investing heavily in modernizing their healthcare systems. In India and China, the burgeoning diabetic population has increased the need for chronic wound management, creating a favorable environment for silver dressing adoption.

Government initiatives to improve rural healthcare, along with partnerships between local and international manufacturers, are accelerating product availability in underserved regions. Additionally, local startups and academic institutions are developing cost-effective silver-based dressings tailored to regional needs. With supportive policy frameworks and a growing middle-class consumer base, Asia Pacific is poised to become a key growth engine for the global silver wound care market.

China holds the largest market driving the expansion of silver wound dressing market in Asia Pacific region. The country’s large and aging population, rising incidences of trauma cases creating need for infection control and increasing access to advanced products for wound care, especially in the rural areas is driving the market growth. Additionally, the Chinese government’s initiatives like Internet Plus Medical Care for improving telehealth services which includes home-based wound care and regulatory oversight of medical devices managed by the National Medical Products Administration (NMPA) are contributing to the growth of the market.

Clinical Trials Advancing Wound Care with Silver

Various ongoing clinical trials are investigating the safety and efficacy of silver wound dressings for different wound types, including chronic wounds such as diabetic foot and venous leg ulcers, as well as surgical wounds and burns. Enhanced antimicrobial properties of silver nanoparticles are driving their use in clinical research. Comparison studies to conventional dressings approaches or other advanced care products are being explored for additional benefits. Influence of regulatory agencies like the EMA (European Medicines Agency) and FDA (Food and Drug Administration) plays a critical role in commercialization of novel products and technologies driving acceptance among healthcare providers.

Additionally, post-market surveillance (PMS) is an important phase for monitoring the safety, efficacy and performance of medical devices such as silver wound dressings after their market release. Real-world data is analyzed and evaluated through PMS, based on user experiences for identification of rare adverse events or long-term effects which helps in detecting potential risks and taking corrective actions for enhancing patient safety.

Some of the prominent players in the silver wound dressing market include:

- B. Braun Medical Inc.

- 3M

- Convatec Group PLC

- Coloplast Group

- Smith+Nephew

- Mölnlycke Health Care AB

- Ferris Mfg. Corp.

- Cardinal Health

Silver Wound Dressing Market Recent Developments

-

In March 2025, Imbed Biosciences, an innovator developing groundbreaking wound care synthetic matrix technology, was granted the Investigational Device Exemption (IDE) by the U.S. Food and Drug Administration (FDA) to conduct a feasibility clinical trial for enables Imbed’s Silver-Gallium, Ultra-Thin Matrix Technology in human donor site wounds.

-

In October 2024, Imbed Biosciences received the U.S. Food and Drug Administration 510(k) clearance for marketing the first ever antimicrobial wound dressing integrating lidocaine, Microlyte Ag/Lidocaine developed for management of painful skin wounds.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the silver wound dressing market

Product

-

- Silver Foam Dressing

- Silver Plated Nylon Fiber Dressing

- Silver Hydrogel/Hydrofiber

- Silver Alginates

- Nano Crystalline Silver Dressings

- Others

End-use

- Hospitals

- Clinics

- Home Healthcare

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)