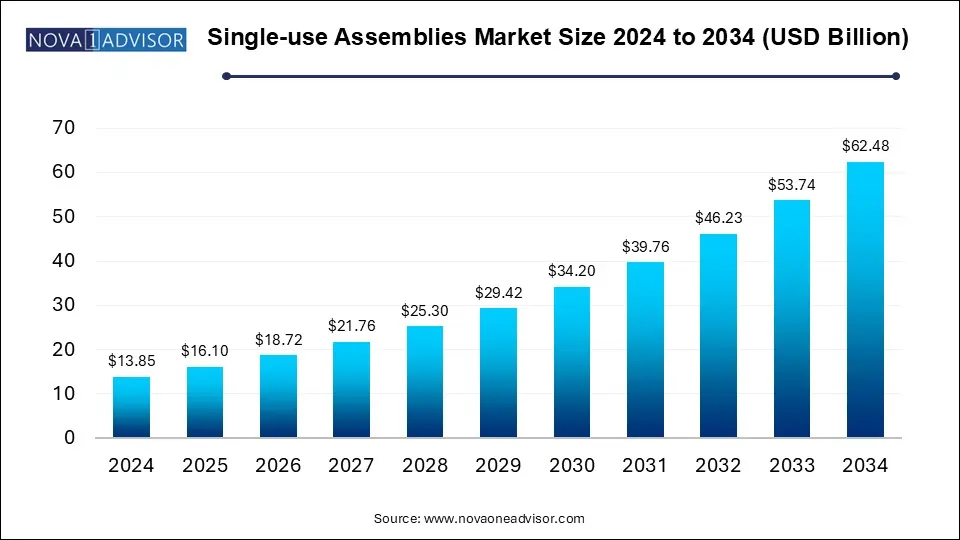

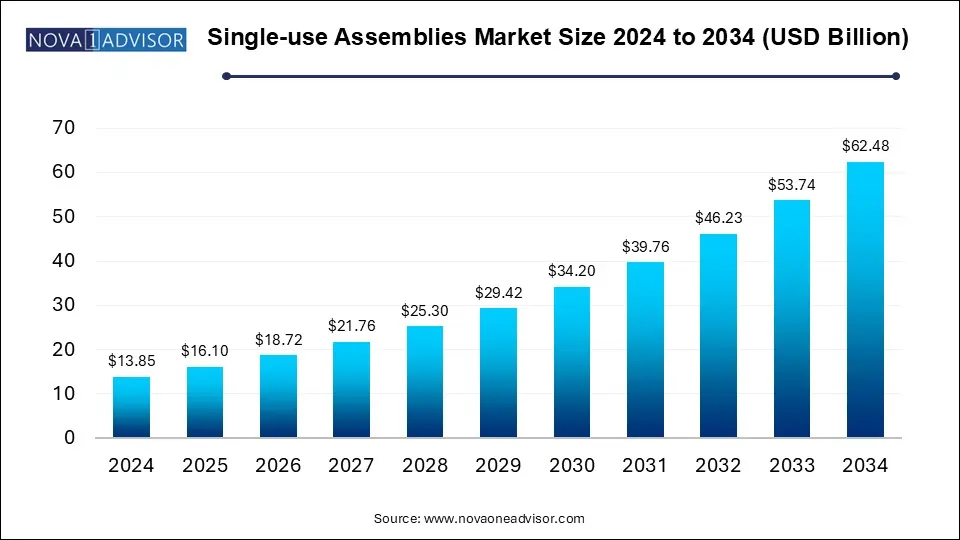

The global single-use assemblies market size was exhibited at USD 13.85 billion in 2024 and is projected to hit around USD 62.48 billion by 2034, growing at a CAGR of 16.26% during the forecast period 2025 to 2034.

Key Takeaways:

- North America dominated the market with a share of 36.33% in 2024.

- Filtration assemblies held the highest market share of around 29.22% in 2024.

- The bag assemblies segmentis expected to grow at the fastest CAGR of 20.02% from 2025 to 2034.

- The filtration segment dominated the industry in 2023 andaccounted for a revenue share of 28.75%.

- Customized solutions dominated the market in 2023 and accounted for the largest share of 71.58%

- Biopharmaceutical & pharmaceutical companies dominated the industry in 2024 and accounted for the highest share of 45.79%.

- CROs & CMOs are expected to grow at the fastest CAGR of 19.74% during the forecast period.

Market Overview

The single-use assemblies market has emerged as a transformative segment within the bioprocessing and pharmaceutical manufacturing landscape. These assemblies refer to pre-assembled, pre-sterilized fluid path systems that are used once and then discarded, offering streamlined workflows, contamination control, and operational flexibility. They include components such as bags, tubing, filters, connectors, and sensors, and are widely used in upstream and downstream bioprocessing, fill-finish operations, and media/buffer preparation.

Driven by the global demand for biopharmaceuticals, single-use assemblies have become the backbone of modern facilities aiming for modularity, scalability, and fast turnaround times. They minimize cleaning requirements, reduce cross-contamination risks, and support rapid product changeovers critical features in environments that demand speed and compliance, such as vaccine manufacturing, cell and gene therapies, and monoclonal antibody production.

The rise of contract manufacturing organizations (CMOs) and contract research organizations (CROs) has further expanded the adoption of single-use technologies, enabling them to offer flexible services across diverse client pipelines. Additionally, the increasing shift toward personalized therapies and small-batch biologics demands equipment that accommodates variability and speed needs that single-use assemblies are uniquely positioned to fulfill.

Major Trends in the Market

-

Shift Toward Fully Disposable Manufacturing Facilities

Emerging biopharma firms and modular facilities are adopting all-disposable workflows to reduce capital expenditure and shorten development cycles.

-

Surge in Cell & Gene Therapy Manufacturing

Single-use technologies are increasingly deployed in CAR-T, stem cell, and gene therapy processes due to their closed systems and sterility assurance.

-

Rising Demand for Customizable Assemblies

Manufacturers prefer tailored assemblies that integrate process-specific requirements and reduce manual intervention during scale-up.

-

Integration of Sensors and Process Analytical Technologies (PAT)

Smart assemblies equipped with pressure, flow, and temperature sensors enable real-time process monitoring and quality control.

-

Sustainability and Waste Management Innovations

Manufacturers are exploring recyclable materials and waste minimization strategies as environmental concerns become more pressing.

Report Scope of The Single-use Assemblies Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.1 Billion |

| Market Size by 2034 |

USD 62.48 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.26% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Solution, End-use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA; Sartorius AG; Danaher Corporation; Avantor; Lonza; Saint-Gobain; Corning Incorporated; Entegris; KUHNER AG |

Market Driver: Rapid Growth of Biopharmaceutical Production

A primary driver for the single-use assemblies market is the booming biopharmaceutical sector, which encompasses monoclonal antibodies, recombinant proteins, cell and gene therapies, and vaccines. These therapeutics require highly sterile, adaptable, and scalable manufacturing processes, making single-use technologies a natural fit.

Unlike traditional stainless-steel equipment, single-use assemblies eliminate the need for cleaning, cleaning validation, and costly downtime between production runs. This is especially important in multi-product facilities where rapid changeover is required. For example, during the COVID-19 pandemic, vaccine production facilities leveraged single-use systems to meet the surge in global demand while maintaining high throughput and sterility.

Single-use assemblies also align with regulatory expectations for risk mitigation, contamination control, and Good Manufacturing Practice (GMP) compliance. As biologics continue to outpace small-molecule drugs in terms of market growth and R&D investment, the reliance on flexible, ready-to-use assemblies is expected to deepen across both early-stage and commercial production facilities.

Market Restraint: Concerns Regarding Supply Chain Reliability and Standardization

One of the key restraints in the market is the complexity and fragility of supply chains for single-use components. These assemblies often require specialized materials, custom configurations, and sterility assurance, making them highly dependent on a select group of manufacturers.

During the COVID-19 pandemic, many facilities experienced critical shortages and delays in tubing, bag assemblies, and filtration devices, highlighting the risk of overreliance on limited vendors. Furthermore, the lack of standardized connectors and material compatibility across different suppliers adds to integration challenges, especially when building hybrid systems with multiple third-party components.

Such supply chain vulnerabilities increase lead times and may force facilities to stockpile inventories, impacting working capital and flexibility. The market’s reliance on just-in-time logistics needs to be balanced with better contingency planning and increased investments in local sourcing and component standardization to reduce long-term risk.

Market Opportunity: Expansion of Personalized Medicine and Small-batch Bioprocessing

An emerging opportunity in the single-use assemblies market is the growth of personalized medicine and small-batch biologic production. Therapies such as CAR-T cell treatments, autologous stem cell therapies, and gene-edited interventions are often produced in small, patient-specific batches, requiring highly modular, disposable systems.

Traditional stainless-steel systems are ill-suited for these applications due to their size, cleanroom requirements, and turnaround time. In contrast, single-use assemblies offer a closed, sterile, and flexible platform that reduces cross-contamination risk and allows for parallel manufacturing.

Many biotech startups and decentralized facilities are designing their platforms around prefabricated single-use bioreactors, mixing systems, and fill-finish setups, where assemblies are preconfigured for rapid deployment. This modularity also supports regional production centers or mobile units that can adapt to epidemiological needs opening new use cases beyond traditional pharma environments.

Segments:

Single-use Assemblies Market By Product Insights

Bag assemblies are the most dominant product segment due to their widespread application in media and buffer storage, harvesting, and fill-finish operations. These include both 2D bag assemblies, which are commonly used in small-scale applications and fluid transfers, and 3D bag assemblies designed for larger volume mixing and bioreactor integration.

Their dominance stems from advantages such as gamma sterilization compatibility, high flexibility, leak resistance, and easy scalability. These assemblies are available in preconfigured and customized formats, reducing assembly errors and improving process consistency. Many leading biologics manufacturers rely heavily on bag-based systems to optimize footprint, mobility, and sterility.

Filtration assemblies are the fastest growing segment, driven by their critical role in viral filtration, bioburden reduction, and sterility assurance. Single-use filtration units eliminate the risk of cross-contamination and support in-line integration, reducing handling steps.

As regulatory expectations for viral clearance and endotoxin control intensify, these assemblies are increasingly deployed across upstream and downstream workflows. New developments include pre-sterilized capsules, integrated filter-bag systems, and connectors compatible with aseptic closed systems, all of which support automation and continuous bioprocessing.

Single-use Assemblies Market By Application Insights

Filtration remains the most widely used application of single-use assemblies, central to ensuring product safety and regulatory compliance. From cell harvest and buffer exchange to virus filtration and sterile fill, single-use filters are integrated into assemblies to deliver closed-loop, high-efficiency separation and purification.

The popularity of filtration assemblies is further boosted by their modularity, scalability, and compatibility with predefined quality control protocols. The ability to rapidly scale from benchtop to production scale using similar platforms enhances process consistency.

Fastest Growing Segment: Fill-finish Applications

The fastest growing application segment is fill-finish, driven by rising demand for aseptic processing of biologics and personalized therapies. Single-use assemblies used in this phase include closed sampling devices, sterile bag assemblies, and transfer tubing sets, all of which help maintain product sterility up to the point of packaging.

Fill-finish requires high precision and minimal human intervention, and single-use solutions are ideal for supporting automated, closed systems in Grade A/B cleanroom environments. As gene therapies and niche biologics rise, this segment will continue to grow rapidly.

Single-use Assemblies Market By Solution Insights

Customized solutions dominate due to their ability to fit specific bioprocessing workflows and regulatory needs. Custom assemblies are tailored to integrate with proprietary bioreactors, chromatography systems, or unique facility layouts.

They also support accelerated development timelines, especially in clinical and pre-commercial phases where process configurations are dynamic. Companies often work closely with vendors to design kits that streamline material handling, data traceability, and quality assurance.

Standardized solutions are gaining popularity, particularly among small- and mid-sized biopharma firms and CMOs seeking rapid deployment. These off-the-shelf assemblies reduce lead times and validation complexity, making them ideal for generic biologics, biosimilars, and early-stage trials.

Standardization also supports cost predictability and easier component replacement, which is valuable for sites operating with leaner technical teams.

Single-use Assemblies Market By End-use Insights

Biopharma manufacturers remain the largest end-users of single-use assemblies. Large-scale monoclonal antibody producers, vaccine developers, and advanced therapy manufacturers rely on flexible, GMP-compliant assemblies for commercial-scale production.

These companies benefit from the reduced downtime, higher sterility assurance, and modularity that single-use assemblies offer, especially in multi-product or multi-site production environments.

CROs and CMOs are the fastest growing users, given their focus on agility, process standardization, and cost-efficiency. With the rising trend of outsourcing in drug development and manufacturing, service providers are investing in single-use platforms to manage diverse client requirements.

Single-use assemblies enable these organizations to offer rapid scale-up, customizable processing, and shorter technology transfer timelines, making them highly competitive in the outsourced manufacturing space.

Single-use Assemblies Market By Regional Insights

North America leads the global market, supported by its established biopharmaceutical ecosystem, strong regulatory framework, and significant R&D investments. The U.S., in particular, houses major biologics manufacturers, including Amgen, Genentech, Moderna, and Pfizer, all of which heavily utilize single-use systems in their facilities.

Government support for biotechnology innovation, along with a robust base of CMOs and academic research centers, strengthens regional demand. The emphasis on automation, GMP compliance, and digital traceability further supports innovation in the use of modular assemblies.

Fastest Growing Region: Asia-Pacific

Asia-Pacific is the fastest growing region, fueled by healthcare infrastructure expansion, rising biologics demand, and growing investments in domestic manufacturing capacity. China, South Korea, India, and Singapore are emerging as hubs for biologics development and biosimilar production.

Governments across the region are supporting biotech development through tax incentives, infrastructure grants, and international partnerships, encouraging adoption of single-use systems. As biologics penetration deepens and tech transfers increase, demand for flexible, rapid-deployment manufacturing technologies will surge.

Some of the prominent players in the Single-use assemblies market include:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- Avantor

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG

Recent Developments

-

March 2025 – Sartorius launched a new customizable single-use sampling assembly with integrated sensor technology, targeting fill-finish operations in cell therapy manufacturing.

-

February 2025 – Thermo Fisher Scientific announced the expansion of its Singapore bioproduction facility to scale production of pre-assembled single-use systems for Asia-Pacific clients.

-

January 2025 – Pall Corporation introduced a modular 3D bag system with in-line sterile connectors, designed for upstream media preparation and high-volume filtration.

-

December 2024 – Saint-Gobain Life Sciences formed a strategic partnership with a leading CMO in Europe to develop facility-wide disposable assembly systems.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global single-use assemblies market.

Product

-

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Other Products

Application

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish Applications

- Other Applications

Solution

- Customized Solutions

- Standard Solutions

End-use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)