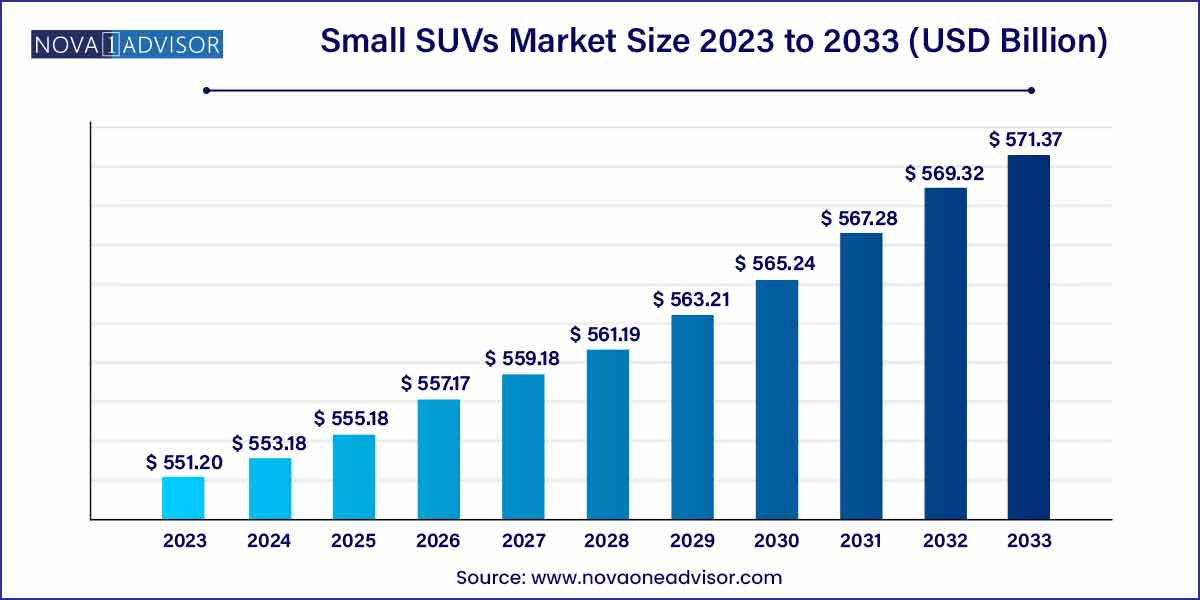

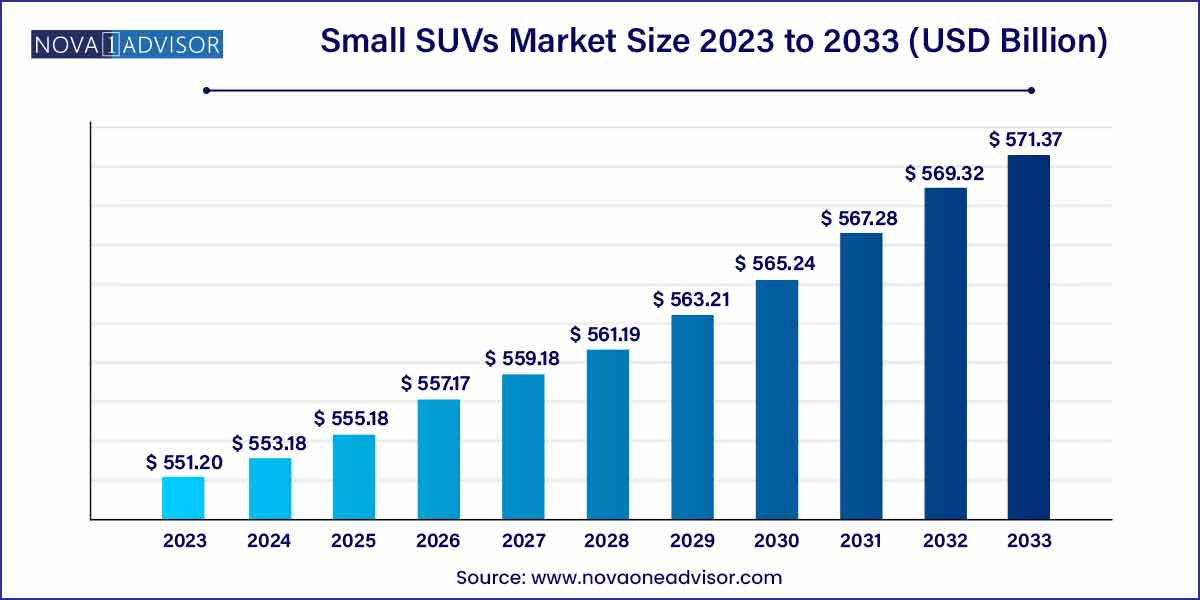

The global small SUVs market size was exhibited at USD 551.20 billion in 2023 and is projected to hit around USD 571.37 billion by 2033, growing at a CAGR of 0.36% during the forecast period of 2024 to 2033.

Key Takeaways:

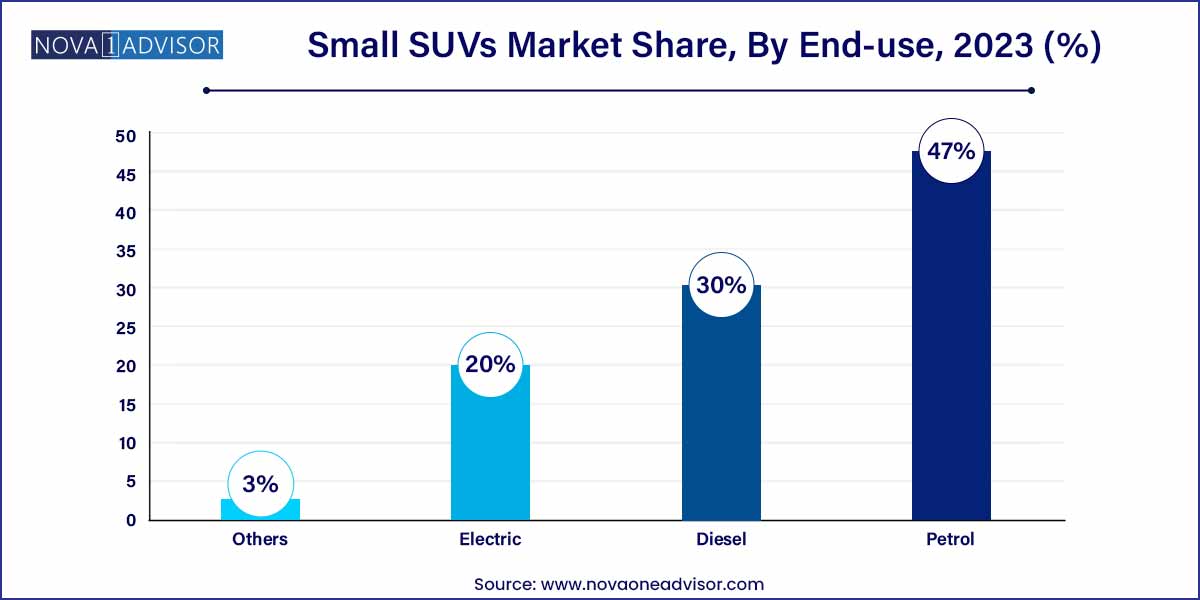

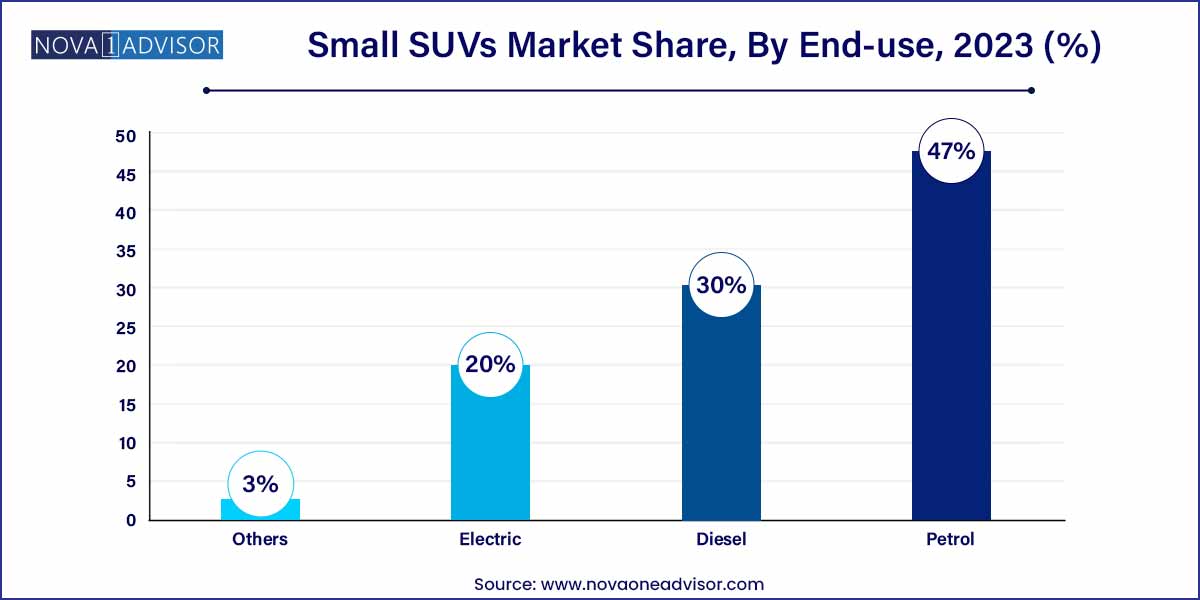

- Petrol segment recorded over 47% market share in 2023 in the global small SUV market.

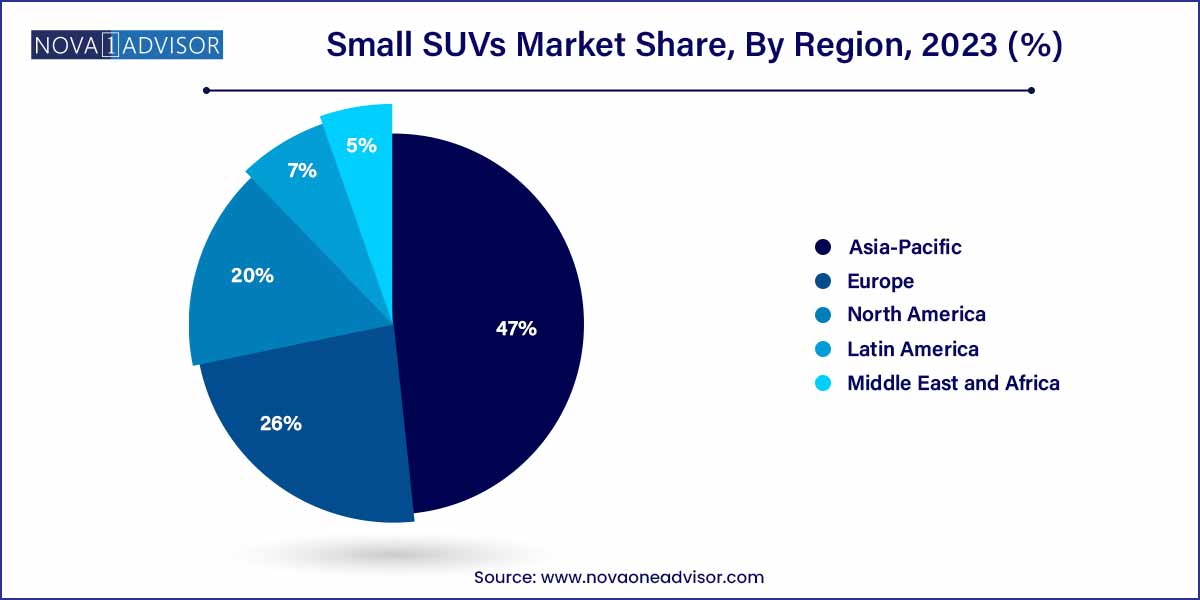

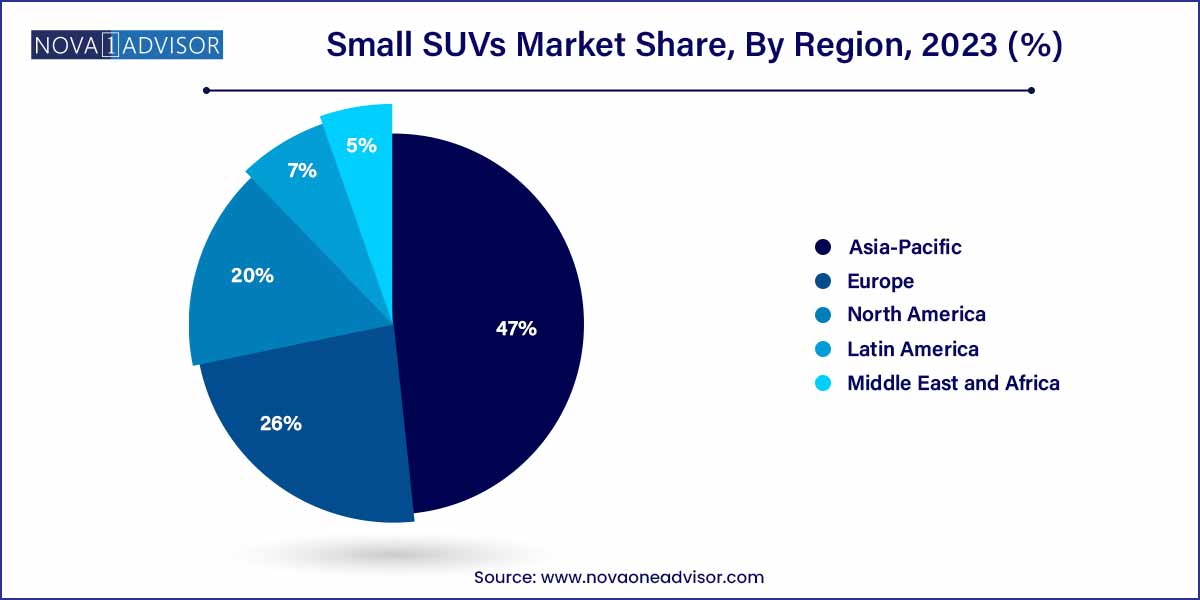

- Geographically speaking, Asia Pacific held 47% of the global market share in 2023.

Small SUVs Market: Overview

The Small SUVs market has emerged as a dominant force in the global automotive landscape, bridging the gap between traditional sedans and full-sized sport utility vehicles. Characterized by compact design, enhanced fuel efficiency, versatile performance, and affordability, small SUVs have appealed to a broad consumer base ranging from urban commuters to young families. Their popularity continues to rise amid shifting consumer preferences towards more practical and adaptable mobility solutions. As lifestyles change globally, buyers are increasingly gravitating toward vehicles that offer utility without the bulkiness or high costs associated with larger SUVs.

The segment witnessed significant traction during the post-2010 decade, bolstered by urbanization, increased disposable incomes in emerging economies, and evolving buyer expectations. In developed markets like North America and Europe, small SUVs have steadily cannibalized the market shares of sedans, becoming the default choice for middle-class households. Technological advancements such as all-wheel drive integration, infotainment systems, and safety innovations have also contributed to their appeal.

Moreover, governments around the world are incentivizing cleaner, more fuel-efficient vehicles through tax rebates and policy shifts, which has encouraged automakers to introduce hybrid and electric small SUVs. As a result, the market continues to evolve, aligning with broader trends of sustainability, smart connectivity, and autonomous readiness. The competitive landscape is fierce, with traditional players like Toyota, Ford, and Hyundai vying with newer EV-centric brands such as Tesla and NIO to capitalize on this high-demand segment.

Small SUVs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 551.20 Billion |

| Market Size by 2033 |

USD 571.37 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 0.36% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Stellantis NV; Toyota Motor; Renault; Volkswagen; Hyundai Motor Company; Volvo Car Corporation; Suzuki Motor Corporation; General Motors; Ford Motor Company; BMW Group; Peugeot S.A.; Geely. |

Small SUVs Market Dynamics

- Shifting Consumer Preferences:

The dynamics of the small SUVs market are significantly influenced by the evolving preferences of consumers. There is a noticeable shift towards compact SUVs due to their versatile nature and adaptability to various lifestyles. Consumers appreciate the combination of a smaller footprint with ample interior space, making these vehicles suitable for urban commuting as well as weekend adventures. The demand is further propelled by the desire for elevated driving positions and a sense of security on the road. As consumer expectations continue to evolve, manufacturers must stay attuned to these preferences, driving innovation in design, technology, and sustainability to maintain a competitive edge in this dynamic market.

- Technological Advancements:

Rapid technological advancements play a pivotal role in shaping the dynamics of the small SUVs market. Manufacturers are integrating cutting-edge technologies into these vehicles to enhance the overall driving experience. This includes the adoption of electric and hybrid powertrains, providing eco-friendly alternatives in response to increasing environmental awareness. Moreover, the incorporation of advanced safety features, autonomous driving capabilities, and sophisticated infotainment systems contribute to the appeal of small SUVs. As technology continues to evolve, market players must stay at the forefront of innovation, meeting consumer expectations for connectivity, efficiency, and sustainability to sustain and expand their market share in this competitive landscape.

Small SUVs Market Restraint

One significant restraint impacting the small SUVs market revolves around regulatory challenges. Stringent emission standards and fuel efficiency requirements, imposed by various governmental bodies globally, pose a considerable challenge for manufacturers. Compliance with these regulations often demands substantial investments in research and development for the integration of alternative powertrains and emission-reducing technologies. Navigating the complex landscape of regulatory requirements becomes a critical aspect for market participants, impacting both production costs and the ability to swiftly adapt to changing environmental standards.

- Supply Chain Disruptions:

The small SUVs market faces the restraint of supply chain disruptions, which have become increasingly prevalent in today's globalized manufacturing landscape. Factors such as geopolitical tensions, natural disasters, and the ongoing challenges presented by the COVID-19 pandemic can disrupt the supply chain, leading to shortages of critical components. This, in turn, hampers production schedules and can result in increased costs. Manufacturers need to implement robust risk mitigation strategies and agile supply chain management to counteract the potential negative impacts of these disruptions and maintain a steady flow of production in the small SUVs market.

Small SUVs Market Opportunity

- Expansion into Emerging Markets:

A significant opportunity within the small SUVs market lies in the exploration and expansion into emerging markets. As economic prosperity increases in various regions, consumer purchasing power is on the rise. Small SUVs, with their blend of practicality and versatility, present an attractive option for individuals and families in these emerging markets. Manufacturers can capitalize on this opportunity by tailoring their offerings to suit the preferences and needs of consumers in these regions, creating a foothold in untapped markets, and fostering long-term brand loyalty.

- Embracing Sustainability Initiatives:

The growing emphasis on sustainability presents a compelling opportunity for the small SUVs market. With an increasing awareness of environmental concerns, consumers are seeking eco-friendly transportation options. Manufacturers can capitalize on this trend by incorporating electric and hybrid powertrains into their small SUV models, providing environmentally conscious choices for consumers. By investing in sustainable technologies and promoting eco-friendly practices throughout the production process, companies can not only align with global environmental goals but also cater to a growing market segment of environmentally conscious consumers, thereby enhancing their market presence and reputation.

Small SUVs Market Challenges

One of the primary challenges facing the small SUVs market is the intense competition among manufacturers. As the demand for compact SUVs continues to rise, numerous automotive companies are entering the market, leading to saturation and fierce rivalry. To stand out, companies must invest heavily in innovation, design, and marketing strategies. The competitive landscape necessitates continuous improvement in features, technological advancements, and overall product differentiation to capture and retain market share in an environment where consumer choices are abundant.

- Evolving Consumer Expectations:

The dynamic nature of consumer preferences poses a significant challenge for the small SUVs market. As consumer expectations evolve, manufacturers must keep pace with changing trends in design, technology, and sustainability. Meeting these expectations requires agility and a proactive approach to research and development. The challenge lies in accurately anticipating and responding to consumer demands, which may vary across demographics and regions. Failure to align with evolving expectations can result in a loss of market relevance and competitiveness within the small SUVs segment.

Segments Insights:

Fuel Type Insights

Petrol-powered small SUVs dominated the global market in terms of sales volume, driven by their affordability, widespread fueling infrastructure, and consumer familiarity. Vehicles such as the Toyota RAV4 and Honda HR-V have consistently performed well in this category. Petrol variants typically feature lower upfront costs and maintenance expenses compared to diesel or electric options, making them particularly attractive in price-sensitive markets across Asia and Latin America. Additionally, technological enhancements in petrol engines, such as turbocharging and fuel injection systems, have improved efficiency and reduced emissions. This has prolonged their relevance, even as electrification grows.

On the other hand, electric small SUVs are projected to be the fastest-growing fuel type segment during the forecast period. This rapid growth is fueled by increasing environmental awareness, improved battery technology, and aggressive emission regulations globally. Governments are subsidizing EV purchases, and OEMs are launching new EV models frequently. For instance, in 2024, Kia announced a fully electric version of its Seltos model, aiming to tap into the growing demand in Europe and Asia-Pacific. Advancements in fast-charging technologies and extended driving ranges are also alleviating consumer range anxiety, accelerating adoption in both developed and emerging markets.

Regional Insights

North America dominated the small SUVs market, accounting for the highest market share in recent years. The region benefits from a mature automotive infrastructure, high disposable incomes, and a strong consumer preference for SUVs over sedans. U.S. automakers like Ford and General Motors have heavily invested in this segment, with models such as the Ford Escape and Chevrolet Trax seeing widespread adoption. Consumer interest in safety, comfort, and in-car entertainment systems further aligns with the tech-integrated nature of modern small SUVs. Additionally, North American buyers appreciate the balance between affordability and utility, especially in suburban and semi-urban areas where small SUVs are replacing sedans as the preferred family car.

Conversely, Asia-Pacific is the fastest-growing regional market, buoyed by economic growth, expanding middle-class populations, and urbanization. Countries like China, India, and Indonesia are witnessing a surge in demand for compact yet versatile vehicles. Global and local automakers are responding by launching region-specific models tailored to local road conditions and consumer preferences. For example, in early 2025, Tata Motors announced plans to expand its Nexon EV line to Southeast Asian markets, emphasizing affordability and local manufacturing. With infrastructural development, rising environmental consciousness, and the rise of first-time buyers, Asia-Pacific is expected to outpace other regions in CAGR terms over the next decade.

Some of the prominent players in the small SUVs market include:

- Stellantis NV

- Toyota Motor

- Renault

- Volkswagen

- Hyundai Motor Company

- Volvo Car Corporation

- Suzuki Motor Corporation

- General Motors

- Ford Motor Company

- BMW Group

- Peugeot S.A.

- Geely

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global small SUVs market.

Fuel Type

- Petrol

- Diesel

- Electric

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)