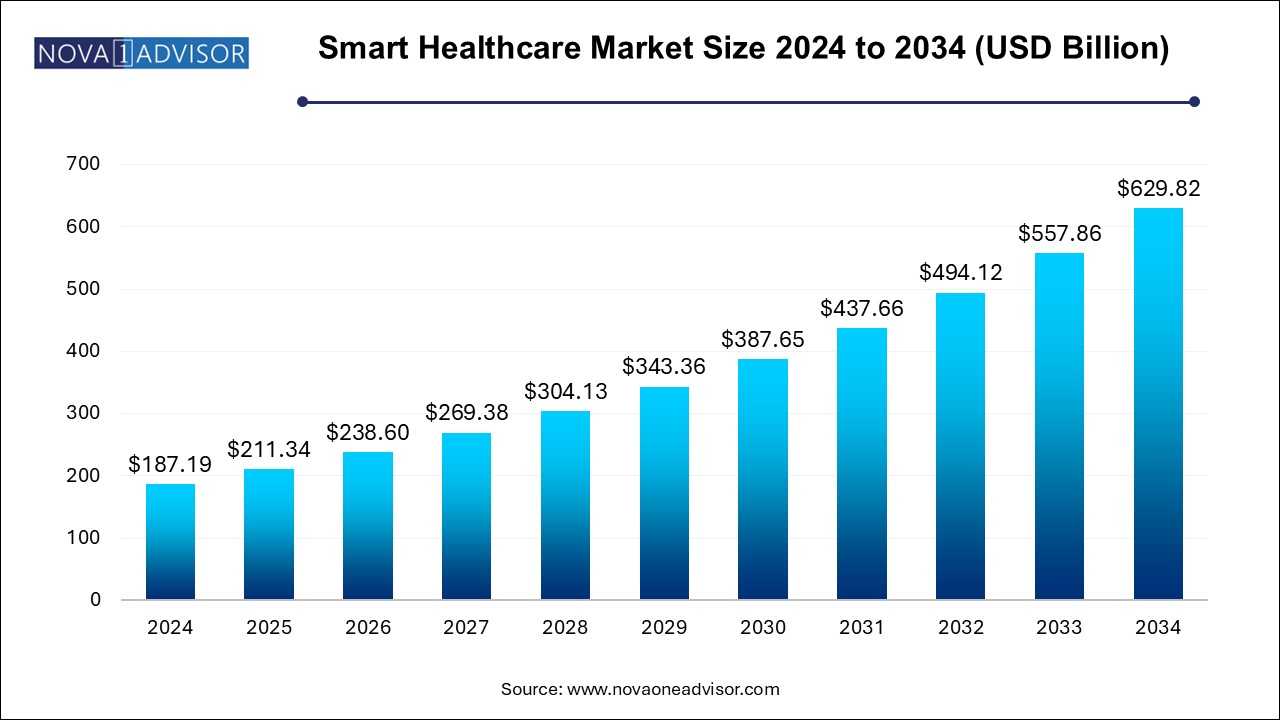

Smart Healthcare Market Size and Growth

The smart healthcare market size was exhibited at USD 187.19 billion in 2024 and is projected to hit around USD 629.82 billion by 2034, growing at a CAGR of 12.9% during the forecast period 2025 to 2034.

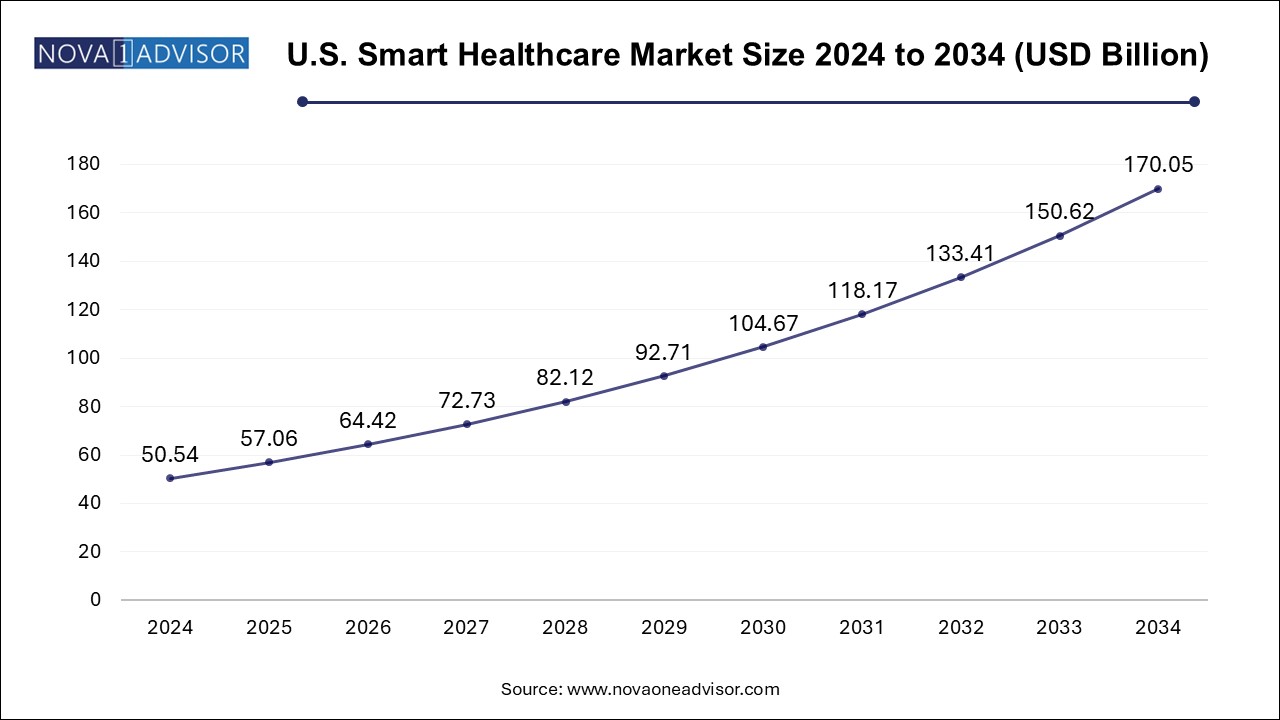

U.S. smart healthcare market Size and Growth 2025 to 2034

The U.S. smart healthcare market size is evaluated at USD 50.54 billion in 2024 and is projected to be worth around USD 170.05 billion by 2034, growing at a CAGR of 11.66% from 2025 to 2034.

North America dominates the global smart healthcare market, supported by a highly digitized healthcare ecosystem, favorable reimbursement policies, and early adoption of cutting-edge technologies. The United States leads the region, with widespread integration of EHRs, wearables, and AI-based care models. Federal incentives, such as the HITECH Act and ongoing CMS support for remote patient monitoring, have fueled innovation and deployment of smart healthcare solutions across urban and rural landscapes.

Moreover, the presence of tech giants like Google, Apple, and Amazon entering healthcare with smart devices and data platforms has accelerated growth. The rise of value-based care in the U.S. aligns perfectly with smart healthcare technologies, which promote outcomes, efficiency, and transparency. Canada's unified EHR infrastructure and growing investment in telehealth further consolidate North America's position as the market leader.

Asia Pacific is the fastest-growing region, driven by rising healthcare expenditure, rapid digitalization, and increasing demand for accessible and affordable healthcare. Countries such as China, India, Japan, and South Korea are leading this growth, each investing heavily in health IT infrastructure, mobile health platforms, and smart hospitals. The region’s vast population, diverse health needs, and mobile-first approach provide a fertile ground for mHealth, telemedicine, and AI-based diagnostics.

Governments are introducing digital health roadmaps, such as India's Ayushman Bharat Digital Mission and China's "Healthy China 2030," to support smart healthcare initiatives. With a growing middle class demanding quality care, and local startups innovating cost-effective solutions, Asia Pacific is set to become a key driver of global smart healthcare transformation.

Market Overview

The smart healthcare market is at the forefront of the digital transformation in global healthcare, redefining how services are delivered, managed, and experienced. Integrating information technology, artificial intelligence, the Internet of Things (IoT), and connected devices, smart healthcare systems enhance medical outcomes, increase accessibility, and optimize operational efficiency. These technologies are not only improving clinical diagnostics and patient monitoring but also enabling personalized, predictive, and preventive healthcare models.

As the global burden of chronic diseases continues to rise and healthcare systems face pressure to deliver high-quality care to growing populations, smart healthcare solutions are emerging as indispensable. From remote patient monitoring and mHealth applications to RFID smart cabinets that improve medical inventory tracking and smart pills that report medication adherence, the applications are vast and impactful. Governments, payers, and providers are heavily investing in these technologies to address workforce shortages, improve decision-making, and enhance patient experiences.

Smart healthcare is not a futuristic concept—it is a present-day imperative. The COVID-19 pandemic accelerated digital health adoption worldwide, compelling healthcare stakeholders to embrace telemedicine, virtual care, and digital records. Today, the market is poised for exponential growth as advancements in connectivity (e.g., 5G), cloud computing, wearable devices, and data analytics converge to shape the next generation of care delivery. With both emerging economies and established healthcare systems recognizing its value, the smart healthcare market is on a trajectory of sustained global expansion through 2034.

Major Trends in the Market

-

Expansion of AI-Driven Diagnosis and Predictive Analytics in Clinical Decision Support

-

Proliferation of Wearables and mHealth Apps for Chronic Disease Management

-

Rise in Adoption of Telemedicine Platforms, Especially in Rural and Underserved Areas

-

Integration of Smart RFID Cabinets and Inventory Automation in Hospital Supply Chains

-

Development of Smart Pills for Real-Time Medication Adherence and Gastrointestinal Monitoring

-

Increasing Shift Toward Web-Based Electronic Health Records Over Client-Server Systems

-

Growing Role of Blockchain for Health Data Security and Interoperability

-

Demand for Smart Syringes to Prevent Needle-Stick Injuries and Ensure Accurate Dosing

-

Personalized Healthcare Enabled by Remote Monitoring and Mobile Diagnostics

-

Collaborations Between Big Tech and Healthcare Systems to Develop Cloud-Based Smart Solutions

Report Scope of Smart Healthcare Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 211.34 Billion |

| Market Size by 2034 |

USD 629.82 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IBM; Cisco; GE Healthcare; Olympus Corporation; Brooks Automation; Given Imaging, Inc.; Stanley Innerspace; Solstice Medical LLC; Siemens Medical Solutions; Allscripts Healthcare Solutions; Samsung Electronics Corporation; AirStrip Technologies Inc.; Apple Inc.; AT&T Inc.; Logi-Tag; Cerner Corporation; Pepperl+Fuchs; Hurst Green Plastics Ltd.; Bollhoff Group; Wurth Group; McKesson Corporation; Brooks Automation; LogTag |

Market Driver: Rising Burden of Chronic Diseases and Aging Population

The most significant driver of the smart healthcare market is the rising global burden of chronic diseases combined with aging demographics. Non-communicable diseases such as diabetes, cardiovascular conditions, respiratory illnesses, and cancer account for over 70% of global deaths, according to the WHO. These conditions often require continuous monitoring, timely intervention, and long-term management—challenges that smart healthcare technologies are well-equipped to address.

Smart wearable devices that monitor heart rate, blood glucose, and oxygen saturation in real-time empower patients to track their health while allowing providers to receive alerts for abnormal readings. For example, a patient with heart failure can use a wearable that transmits daily data to a care team, reducing the risk of hospitalization. Similarly, elderly individuals at risk of falls can be equipped with sensors that alert caregivers in emergencies. These innovations reduce hospital visits, lower costs, and significantly improve the quality of life for patients, driving widespread adoption.

Market Restraint: Data Privacy and Cybersecurity Concerns

While the benefits of smart healthcare are substantial, the market faces a critical restraint in the form of data privacy and cybersecurity concerns. With a surge in interconnected medical devices and cloud-based platforms, the volume and sensitivity of healthcare data have increased dramatically. These include personal health records, biometric data, real-time location tracking, and clinical histories—high-value targets for cybercriminals.

Healthcare systems are already among the most frequently targeted sectors for ransomware attacks. For instance, in 2023, several high-profile data breaches compromised millions of patient records in the U.S. and Europe. Regulatory frameworks such as HIPAA in the U.S. and GDPR in the EU impose stringent requirements on data protection, and non-compliance can result in severe penalties. Many providers, especially in low-resource settings, lack the infrastructure or expertise to safeguard patient data effectively. As a result, cybersecurity remains a major hurdle for the full-scale implementation of smart healthcare technologies.

Market Opportunity: Integration of AI and IoT for Preventive Healthcare Models

A transformative opportunity within the smart healthcare market lies in the integration of AI and IoT to enable predictive and preventive healthcare models. Moving beyond reactive care, AI and IoT empower providers to anticipate health risks and intervene before complications arise. This shift not only enhances outcomes but also reduces healthcare costs and improves patient satisfaction.

For example, AI algorithms embedded within wearable devices can analyze vital signs and detect early signs of deterioration, prompting preventive action. In hospital settings, IoT sensors can predict equipment failures or identify patterns in infection outbreaks. Mobile apps with AI chatbots now offer 24/7 symptom triage and health advice, significantly easing the burden on emergency departments. These solutions are particularly valuable in rural and aging populations, where access to in-person care is limited. As governments worldwide focus on healthcare sustainability, AI and IoT-based preventive strategies present a compelling growth avenue.

Smart Healthcare Market By Product Insights

Based on product, the mHealth segment dominated the market for smart healthcare and accounted for a revenue share of over 36.0% in 2024. EHRs have become central to digital health infrastructure, enabling secure, real-time access to patient data across clinical settings. Their ability to store and share data such as laboratory results, imaging, prescriptions, and clinical notes has improved care coordination and reduced medical errors. Among EHR types, web-based EHR systems dominate due to their cost-effectiveness, scalability, and ease of access across mobile and desktop platforms. These systems are widely adopted by small-to-medium-sized clinics and primary care centers.

In contrast, telemedicine is witnessing the fastest growth, especially in the post-pandemic era. Driven by consumer demand for virtual care and supported by expanding reimbursement frameworks, telemedicine is being integrated into primary, specialty, and mental health services. The market is witnessing innovation across all subcategories—hardware (e.g., digital stethoscopes, connected diagnostic tools), software (teleconsultation platforms), and auxiliary services such as AI-based virtual triage. Countries across Asia Pacific and Latin America are rapidly rolling out telemedicine as a response to healthcare access disparities, pushing this segment to the forefront.

Some of the prominent players in the smart healthcare market include:

Recent Developments

-

March 2025: Apple Inc. launched an advanced health monitoring suite in its new Apple Watch Series 10, including non-invasive blood glucose monitoring and AI-based atrial fibrillation prediction.

-

February 2025: Philips Healthcare introduced a cloud-native smart imaging and diagnostics platform that integrates EHR data for more accurate radiology workflows.

-

January 2025: Siemens Healthineers acquired an Indian digital health startup to scale remote diagnostics and mobile imaging solutions in Asia and Africa.

-

December 2024: GE HealthCare launched a smart syringe with embedded sensors for vaccine traceability and accurate dosage administration in mass immunization programs.

-

November 2024: Teladoc Health integrated generative AI into its telehealth platform to support personalized care recommendations and automate post-consultation documentation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the smart healthcare market

By Product

- RFID Kanban Systems

- RFID Smart Cabinets

- Electronic Health Records (EHR)

-

- Web-based EHR

- Client-server Based EHR

-

- Monitoring Services

- Diagnosis Services

- Healthcare Systems Strengthening

- Others

- Smart Pills

- Smart Syringes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)