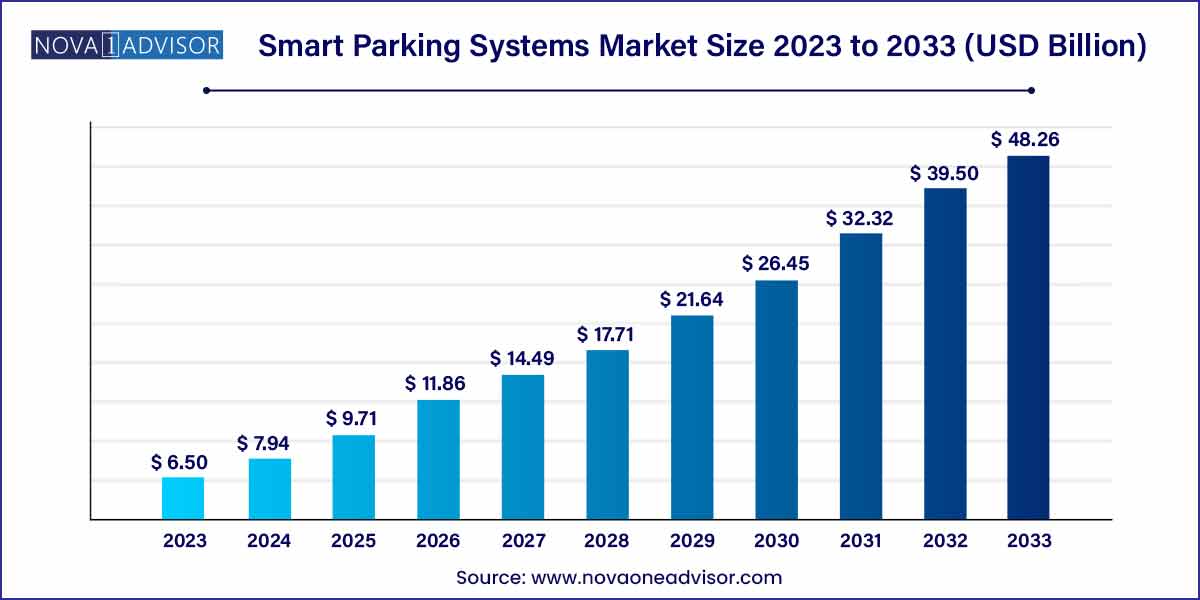

The global smart parking systems market size was exhibited at USD 6.50 billion in 2023 and is projected to hit around USD 48.26 billion by 2033, growing at a CAGR of 22.2% during the forecast period of 2024 to 2033.

Key Takeaways:

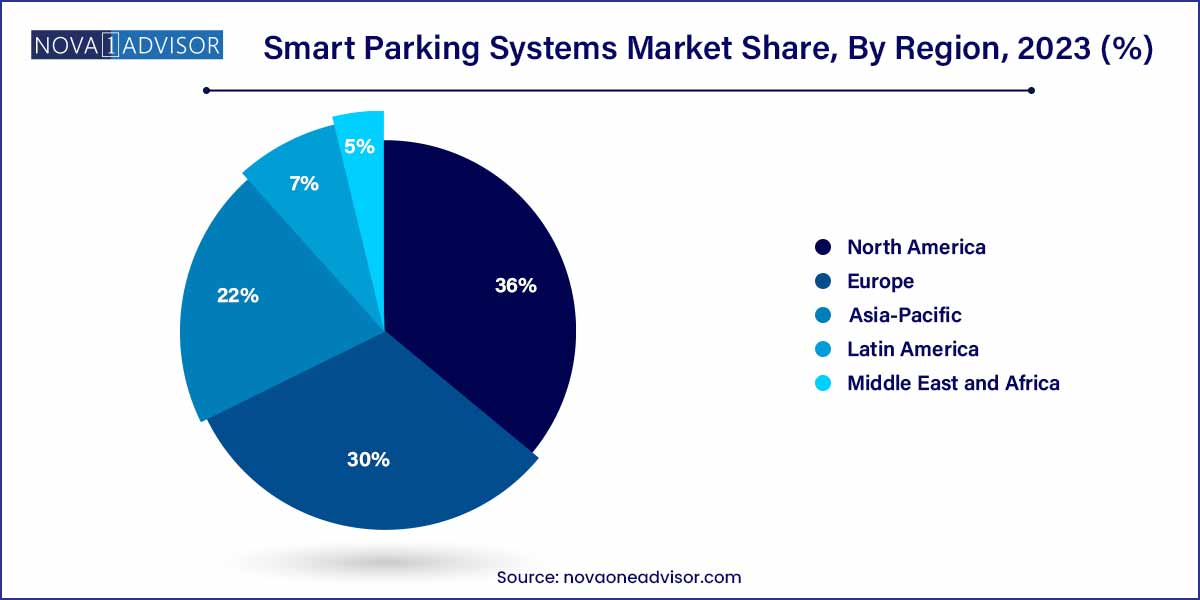

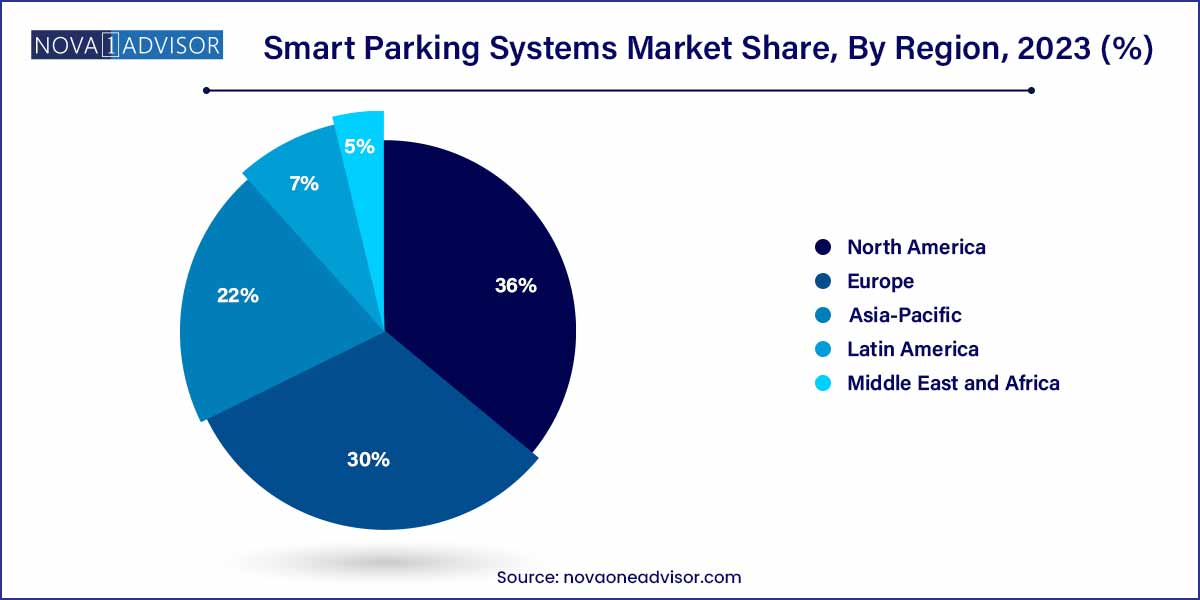

- North America held the major share of over 36% of the global smart parking systems market in 2023.

- The smart meters segment held the majority of over 40%, in 2023.

- The parking guidance systems segment accounted for a revenue share of over 75% in 2023.

- The engineering service segment acquired a share of over 60% in 2023.

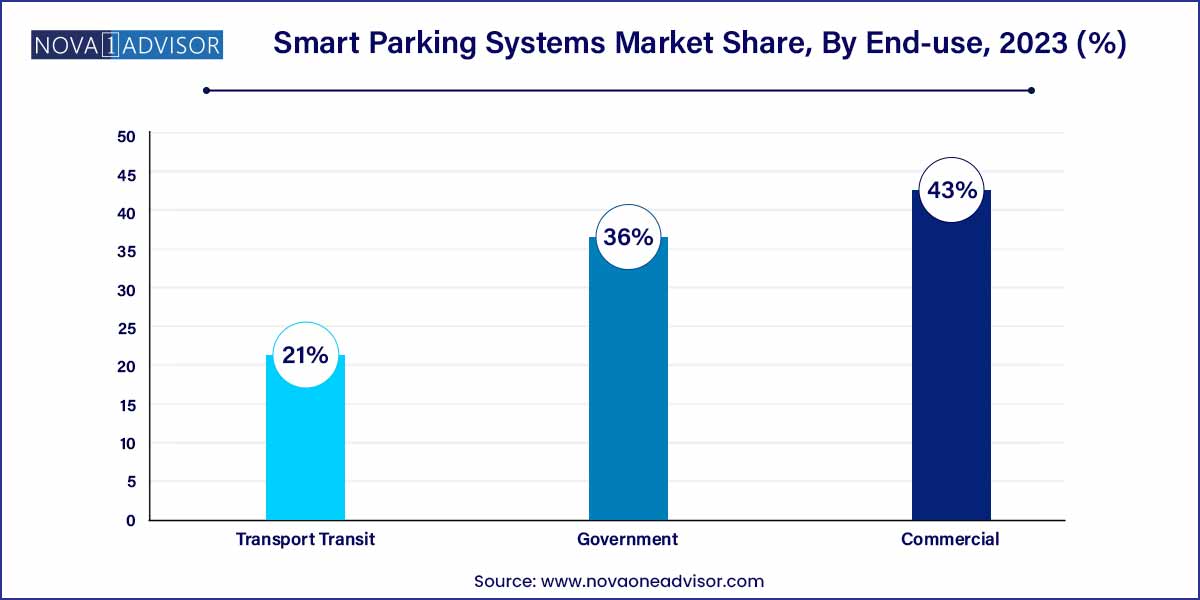

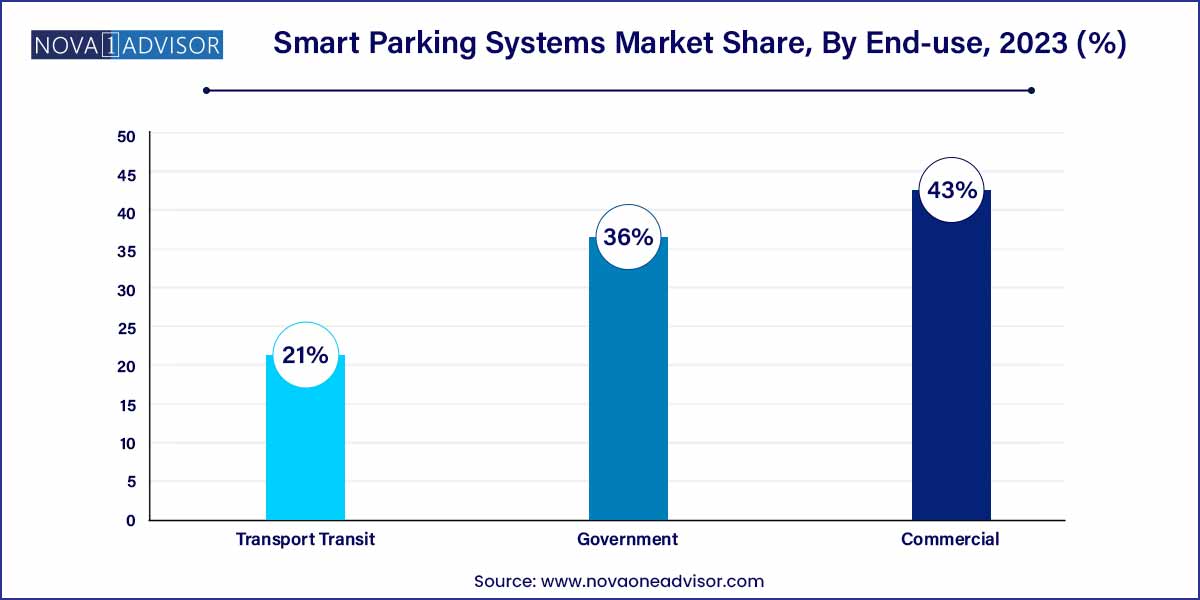

- The commercial segment dominated in 2023 and accounted for a revenue share of over 43%.

- The off-street segment dominated the market in 2023 and accounted for a revenue share of over 70%.

Smart Parking Systems Market: Overview

The Smart Parking Systems Market is undergoing a transformative boom globally, as cities increasingly adopt technology-driven solutions to manage space scarcity, reduce traffic congestion, and enhance urban mobility. Smart parking refers to the use of advanced technologies such as sensors, IoT, artificial intelligence, and data analytics to streamline the process of locating, managing, and utilizing parking spaces.

Urban centers across the globe are grappling with the challenge of inadequate parking infrastructure, often leading to traffic bottlenecks, wasted fuel, and increased carbon emissions. According to industry estimates, up to 30% of urban traffic is caused by drivers searching for parking. This scenario is prompting municipal governments, private developers, and tech companies to integrate intelligent parking systems that can optimize parking utilization in real time, provide cashless payment solutions, guide drivers to available spots, and generate data for infrastructure planning.

Smart parking systems are broadly categorized into on-street and off-street formats, with growing adoption across commercial establishments, transport transit facilities, and government-regulated spaces. On the hardware front, devices such as wireless sensor pucks, cameras, license plate recognition systems (LPRs), smart meters, signage, and automated gates form the physical infrastructure. These are complemented by software modules that include guidance systems, analytics, and mobile apps enabling seamless end-user interaction and back-end management.

Globally, smart parking is becoming a key enabler of smart cities, especially in North America, Europe, and Asia-Pacific. Countries like the U.S., Germany, Japan, and South Korea are actively investing in intelligent traffic and parking control systems as part of their digital transformation agendas. The integration of mobile applications, real-time data, and AI-powered analytics is redefining how urban dwellers and businesses interact with parking facilities creating an ecosystem of connected, efficient, and user-friendly mobility infrastructure.

Major Trends in the Market

-

Proliferation of IoT-Enabled Sensors and Wireless Pucks

Cities and parking operators are deploying embedded sensors in parking spots that detect vehicle presence, enabling real-time space monitoring and analytics.

-

Integration of Mobile Applications for User Convenience

Mobile parking apps allow users to find, reserve, and pay for parking spots digitally, while receiving notifications and time extensions remotely.

-

Rise of License Plate Recognition (LPR) and Camera-Based Systems

LPR cameras facilitate touchless entry, auto-payments, and enforcement by automatically scanning vehicle license plates.

-

Data-Driven Decision Making via Analytics Platforms

Parking authorities are leveraging data from smart meters and sensors to analyze usage patterns and improve infrastructure planning.

-

Growing Adoption of Dynamic Pricing Models

Parking rates are adjusted in real-time based on demand, location, and duration to balance usage and increase revenue.

-

Adoption in Transit and Airport Infrastructure

Transport terminals and airports are increasingly integrating smart parking to streamline long-term parking, drop-offs, and fleet management.

-

Expansion of EV Charging Integration

Smart parking spots are being co-developed with electric vehicle (EV) charging stations, enabling green mobility alignment.

Smart Parking Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.50 Billion |

| Market Size by 2033 |

USD 48.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Hardware, Software, Service, Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Altiux Innovations; Amano McGann, Inc.; Amco S.A.; BMW AG (ParkNow GmbH, Parkmobile, LLC); Cisco Systems, Inc.; CivicSmart, Inc.; Deteq Solutions; Flowbird; gtechna; INDECT Electronics & Distribution GmbH; Kapsch TrafficCom; Libelium Comunicaciones Distribuidas S.L.; Meter Feeder, Inc.; Mindteck; Municipal Parking Services, Inc.; Nedap N.V.; Park Assist; Parkeon; ParkHelp; ParkJockey; ParkMe Inc.; Robert Bosch GmbH; Siemens AG; SKIDATA AG; Smart Parking Ltd.; SpotHero, Inc.; Swarco AG; Urbiotica, S.L.; |

Smart Parking Systems Market Dynamics

- Urbanization Trends Driving Demand:

The dynamics of the smart parking systems market are intricately linked to the ongoing global trend of urbanization. As populations gravitate towards urban centers, the resultant surge in vehicles exacerbates parking challenges. Smart Parking Systems emerge as a solution to optimize space utilization, reduce congestion, and enhance overall urban mobility.

- Technological Advancements Fueling Innovation:

At the core of the Smart Parking Systems market dynamics lies the relentless march of technological progress. Continuous advancements in Internet of Things (IoT), artificial intelligence, and data analytics are pivotal in shaping the landscape of parking solutions. The integration of advanced sensors, real-time data analytics, and communication networks not only improves the efficiency of parking management but also enables predictive analysis for optimized usage.

Smart Parking Systems Market Restraint

- Infrastructure Integration Challenges:

A notable restraint in the smart parking systems market pertains to the complexities associated with integrating these intelligent solutions into existing urban infrastructure. Implementing smart parking technologies requires seamless coordination with municipal systems, urban planning, and transportation frameworks. The intricacies involved in retrofitting or adapting these solutions to diverse infrastructural setups can lead to delays and increased implementation costs.

- Cost Considerations and Initial Investments:

Despite the long-term benefits offered by smart parking systems, the initial setup costs and ongoing maintenance expenses can be perceived as significant barriers to adoption. Municipalities and businesses may face budgetary constraints in implementing these advanced parking solutions, especially in regions where financial resources are limited. Convincing stakeholders of the long-term returns on investment and the overall value proposition of smart parking systems becomes crucial in overcoming the restraint posed by cost considerations.

Smart Parking Systems Market Opportunity

- Rising Demand for Electric Vehicles (EVs):

An immense opportunity for the smart parking systems market lies in the surging popularity of electric vehicles (EVs). As the global automotive landscape undergoes a transformative shift towards sustainable practices, the need for charging infrastructure becomes paramount. Smart parking systems can capitalize on this trend by incorporating features such as EV charging station integration and real-time availability tracking.

- Integration of Artificial Intelligence (AI) and Predictive Analytics:

The incorporation of artificial intelligence (AI) and predictive analytics represents a significant opportunity within the smart parking systems market. By harnessing the power of AI-driven algorithms, these systems can provide motorists with real-time insights into parking availability, predict peak usage times, and optimize parking space allocation.

Smart Parking Systems Market Challenges

- Public awareness and user adoption:

A primary challenge faced by the smart parking systems market is the necessity to enhance public awareness and promote widespread user adoption. Many individuals may not be fully acquainted with the benefits of smart parking technologies, leading to underutilization. Overcoming this challenge requires strategic marketing and educational campaigns to inform the public about the advantages, convenience, and positive environmental impact of these systems.

- Security and Data Privacy Concerns:

The proliferation of connected technologies in smart parking systems raises significant concerns regarding security and data privacy. As these systems collect and process sensitive data, including vehicle information and user behavior, ensuring robust cybersecurity measures is imperative. The potential vulnerability of smart parking infrastructure to cyber-attacks and unauthorized access poses a challenge to market players and regulatory bodies.

Segments Insights:

By Hardware Insights

Cameras and License Plate Recognition (LPRs) dominate the hardware segment, driven by their growing utility in enabling touchless parking, security, and automated billing. These systems capture vehicle data upon entry and exit, ensuring faster vehicle processing and reducing manual labor. Airports, malls, and commercial facilities use LPR to track usage, enforce time limits, and offer auto-payment services. LPR systems are especially popular in premium smart city projects where automation and user convenience are top priorities.

Pucks and wireless sensors are the fastest-growing hardware category, especially for on-street parking applications. These coin-sized sensors are embedded into parking spaces and detect vehicle presence in real-time. Their wireless nature allows for quick deployment and scalability. Cities like Amsterdam and Copenhagen are increasingly using puck sensors across thousands of parking bays, enabling real-time visibility, dynamic pricing, and traffic optimization. As sensor costs decline, adoption is expected to surge across mid-sized cities and developing nations.

By Software Insights

Parking guidance systems are the dominant software solution, as they provide drivers with real-time information about available spaces through LED signage, apps, or in-car displays. These systems reduce search time, cut emissions, and improve user satisfaction. In urban environments, parking guidance software is integrated with roadside sensors and smart meters, enhancing the visibility of on-street availability. Shopping centers and hospitals also use these systems to streamline high-traffic entry points.

Analytics solutions are the fastest-growing software segment, offering municipalities and private operators the tools to visualize patterns in space usage, peak hours, payment compliance, and user behavior. With predictive modeling, cities can forecast demand, optimize pricing strategies, and plan future infrastructure development. For instance, in Singapore, city authorities use data analytics from smart meters to determine when and where to build new parking structures.

By Service Insights

Mobile app parking services dominate the service category, enabling users to reserve spaces, receive time alerts, and make contactless payments. With the surge of smartphone penetration, apps such as Park+ (India), ParkMobile (U.S.), and EasyPark (Europe) have become widely popular. These apps offer a seamless parking experience by integrating payment gateways, location data, and loyalty benefits. Consumers favor these apps for their convenience and transparency.

Consulting and engineering services are growing rapidly, as city authorities and private developers seek specialized expertise in designing and implementing smart parking infrastructure. From feasibility assessments to IoT integration and cybersecurity frameworks, engineering consultancies provide end-to-end project management. As smart city initiatives proliferate, the demand for tailored parking design solutions is expected to rise sharply.

By Application Insights

Commercial applications dominate, including shopping malls, office complexes, hospitals, and entertainment venues. These properties invest in smart parking systems to improve customer experience, reduce queuing, and monetize parking assets. High turnover and the need for seamless entry and exit encourage advanced feature implementation, including mobile pay, LPR, and EV support. Real-time availability also helps manage parking demand during peak hours.

Transport transit applications are growing fastest, particularly in rail and metro stations, airports, and bus depots. Transit authorities are investing in smart parking to streamline commuter access, reduce congestion around terminals, and integrate park-and-ride services. For example, Tokyo’s JR East railway network offers smart parking systems at key station hubs, enabling commuters to pre-book spaces and sync their parking with train schedules.

By Type Insights

Off-street parking, especially garage parking, dominates the market, particularly in densely populated urban areas. Parking garages are ideal for integrating full-suite smart systems, including gates, sensors, LPRs, and EV charging points. Malls, airports, and corporate campuses benefit from such enclosed environments, which allow for controlled traffic flow and dynamic space management. Companies like Nedap and SKIDATA provide modular smart garage systems used globally.

On-street parking is the fastest-growing segment, especially in cities with limited real estate. Governments are deploying IoT-enabled meters, wireless sensors, and signage to manage on-street spaces more efficiently. Dynamic pricing based on demand, time-of-day, and location is increasingly being used to improve turnover and reduce congestion. Cities like Los Angeles and Tel Aviv are considered leaders in on-street smart parking deployment.

By Regional Insights

North America is currently the largest market for smart parking systems, fueled by technological innovation, high vehicle ownership, and strong smart city funding. The United States leads in both on-street and off-street smart parking deployments, with cities like San Francisco, Boston, and Chicago at the forefront. The presence of major companies like Streetline, ParkMobile, and Passport Inc., along with active collaboration between city councils and private technology vendors, fosters innovation.

Furthermore, robust infrastructure, high digital adoption, and strong EV growth are encouraging cities and private developers to integrate parking solutions with renewable energy, automation, and data analytics. The U.S. federal and state governments are also allocating grants to modernize transportation infrastructure, making the region a hotbed for smart parking innovation.

Asia-Pacific is witnessing the fastest growth, driven by rapid urbanization, traffic congestion, and digitization in countries such as China, Japan, South Korea, India, and Singapore. Cities are adopting smart parking as a core component of broader smart city initiatives. For instance, Seoul uses AI-powered camera systems to guide drivers to empty spots, while Beijing has integrated mobile parking apps into WeChat and Alipay ecosystems.

In India, start-ups like Park+ and Get My Parking are developing scalable, app-driven parking solutions in metro cities such as Delhi and Mumbai. Singapore, known for its advanced mobility infrastructure, is leveraging IoT and big data to optimize parking space allocation and revenue management. As governments in APAC push for digital public services, smart parking systems are becoming integral to urban planning and public transport strategies.

Some of the prominent players in the smart parking systems market include:

- Altiux Innovations

- Amano McGann, Inc.

- Amco S.A.

- BMW AG (ParkNow GmbH, Parkmobile LLC)

- Cisco Systems, Inc.

- CivicSmart, Inc.

- Deteq Solutions

- Flowbird

- gtechna

- INDECT Electronics & Distribution GmbH

- Kapsch TrafficCom

- Libelium Comunicaciones Distribuidas S.L.

- Meter Feeder, Inc.

- Mindteck

- Municipal Parking Services, Inc.

- Nedap N.V.

- Park Assist

- ParkHelp Technologies

- ParkJockey

- ParkMe Inc.

- Robert Bosch GmbH

- Siemens AG

- SKIDATA AG

- Smart Parking Ltd.

- SpotHero, Inc.

- Swarco AG

- Urbiotica, S.L.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global smart parking systems market.

Hardware

- Pucks (Wireless Sensors)

- Cameras & LPRs

- Smart Meters

- Signage

- Parking Gates

Software

- Parking Guidance System

- Analytics Solutions

Service

- Consulting Service

- Engineering Service

- Mobile App Parking Service

Type

-

- Garage Parking

- Lot Parking

Application

- Commercial

- Government

- Transport Transit

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)