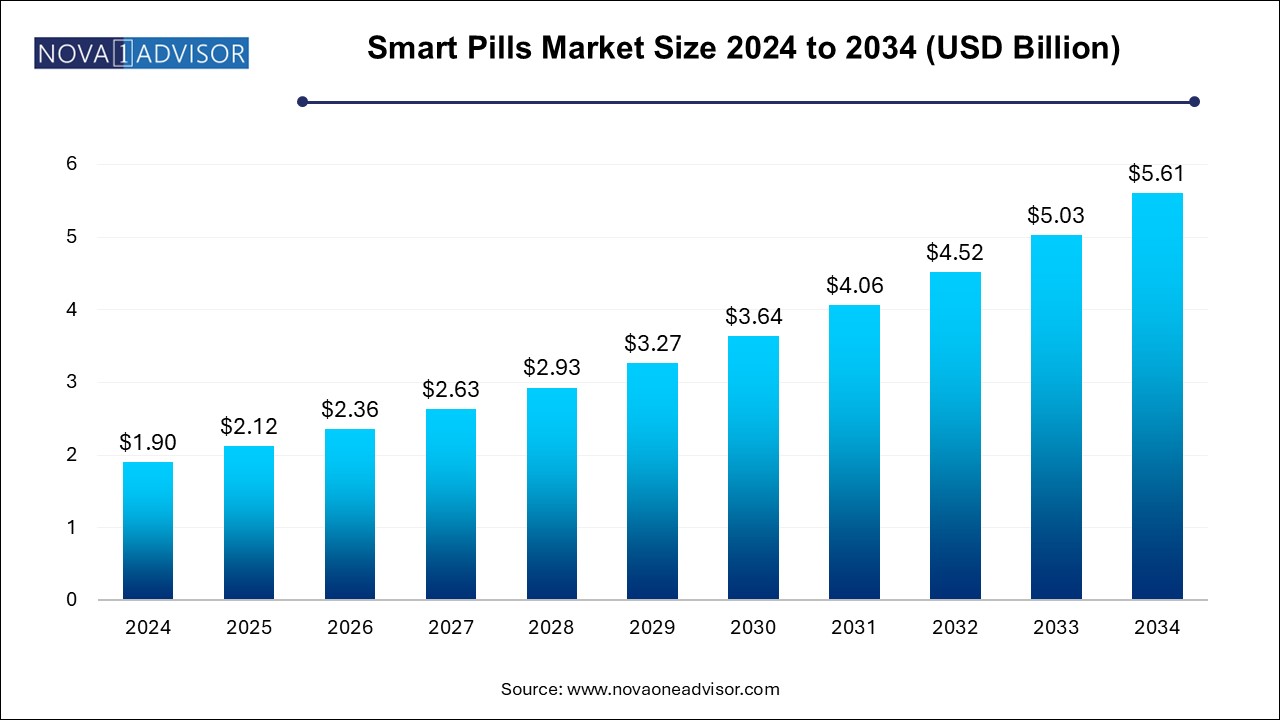

Smart Pills Market Size and Growth

The smart pills market size was exhibited at USD 1.9 billion in 2024 and is projected to hit around USD 5.61 billion by 2034, growing at a CAGR of 11.4% during the forecast period 2025 to 2034.

Smart Pills Market Key Takeaways:

- Capsule endoscopy dominated the market and accounted for the largest revenue share of 54.1%.

- Drug delivery is expected to grow at a CAGR of 11.1% over the forecast period.

- Celiac disease led the market and accounted for the largest revenue share 2024

- Small bowel tumors are expected to grow significantly over the forecast period.

- Small intestine dominated the market and held the largest revenue share in 2024.

- The stomach is expected to witness substantial growth over the forecast period.

- Outpatient facilities dominated the market with a share of 54.0% in 2024.

- Hospitals are expected to grow at a CAGR of 10.4% over the forecast period.

- The North America smart pills market dominated the global market and accounted for the largest revenue share of 37.5% in 2024.

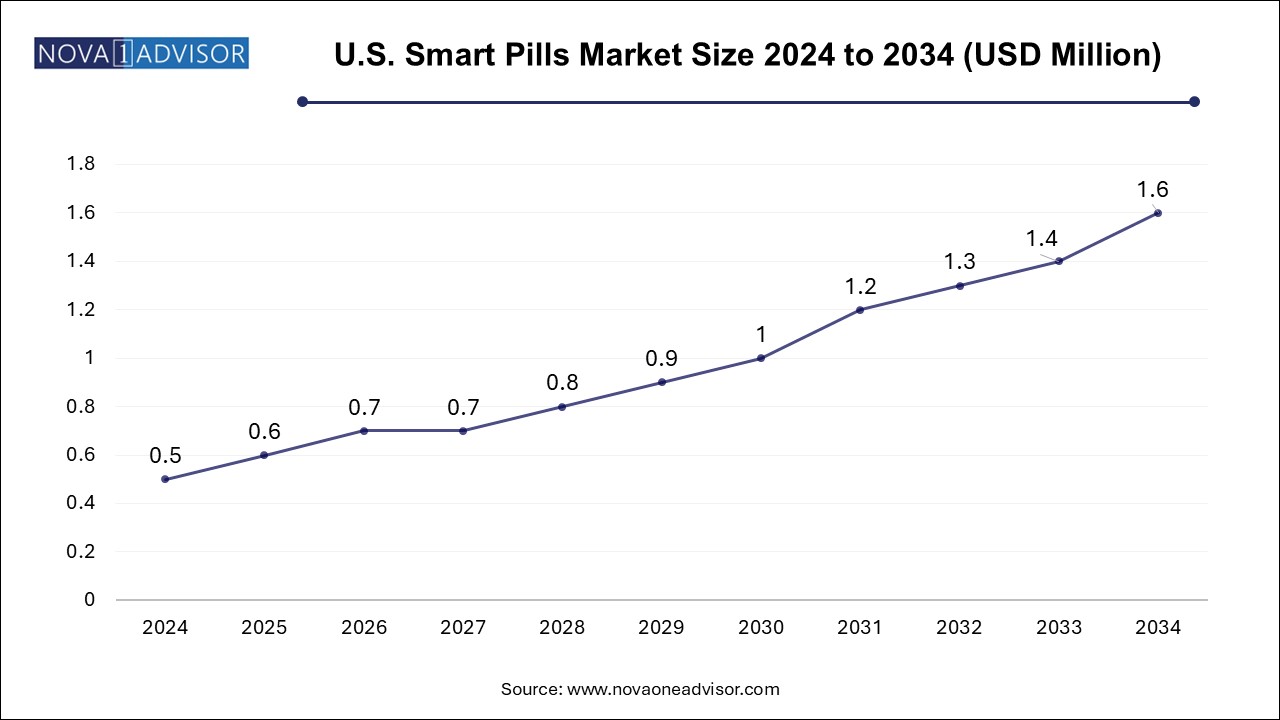

U.S. Smart Pills Market Size and Growth 2025 to 2034

The U.S. smart pills market size is evaluated at USD 0.50 Million in 2024 and is projected to be worth around USD 1.6 million by 2034, growing at a CAGR of 11.15% from 2025 to 2034.

The North America, led by the United States, is the largest market for smart pills. The region benefits from advanced healthcare infrastructure, high adoption of non-invasive technologies, and significant investment in medical innovation. The U.S. FDA’s progressive stance on ingestible devices and its approval of several smart pill products have given confidence to both clinicians and patients. Moreover, widespread awareness of colorectal and small bowel diseases has driven demand for capsule endoscopy.

Asia Pacific is emerging as the fastest-growing region, owing to the rising prevalence of gastrointestinal diseases, increasing healthcare access, and expanding medical tourism. Countries like Japan, China, India, and South Korea are leading in smart pill adoption, especially for endoscopic applications. Japan’s aging population and its leadership in miniaturized medical technologies make it an important market for innovation.

In China and India, awareness of non-invasive diagnostics is growing, driven by urbanization and lifestyle-related gastrointestinal disorders. Public and private hospital investments in endoscopy suites and partnerships with Western device manufacturers are further propelling regional growth. As the cost of smart pill technology declines and local production capabilities improve, Asia Pacific is expected to play a major role in the global market landscape.

Market Overview

The smart pills market represents a convergence of digital health, diagnostic innovation, and pharmaceutical delivery systems. These miniature electronic devices—designed in the form of ingestible capsules—combine sensing, imaging, and sometimes therapeutic functions to monitor physiological parameters, detect gastrointestinal abnormalities, and deliver drugs in a controlled and targeted manner. Smart pills are a product of continuous advancements in wireless communication, micro-electronics, and non-invasive diagnostics, aiming to revolutionize gastrointestinal diagnostics, patient monitoring, and compliance.

Initially introduced for capsule endoscopy to explore the small intestine, the technology has evolved to support broader applications such as drug delivery, vital sign monitoring, and targeted disease diagnostics for conditions like Crohn’s disease, celiac disease, occult GI bleeding, and small bowel tumors. These pills often contain sensors, transmitters, and imaging devices that provide real-time data to external receivers, eliminating the need for invasive procedures such as colonoscopies and traditional endoscopy.

The demand for smart pills is being driven by a growing elderly population, increasing incidence of chronic gastrointestinal disorders, and the global shift toward non-invasive diagnostics. Additionally, the market benefits from rising healthcare digitization, greater emphasis on patient-centric care, and the push for enhanced medication adherence monitoring. As technologies like artificial intelligence (AI), Internet of Things (IoT), and microfabrication continue to evolve, smart pills are expected to become a mainstay in next-generation medical diagnostics and drug administration platforms.

Major Trends in the Market

-

Wider Adoption of Capsule Endoscopy in Gastroenterology Diagnostics

-

Emergence of Ingestible Sensors for Medication Adherence Monitoring

-

Advancements in Microelectronics Enabling Multi-Functional Smart Pills

-

Integration of Smart Pills with IoT Platforms and Wearables

-

Rise in Demand for Non-Invasive Alternatives to Conventional Endoscopy

-

Increasing Application of AI in Interpreting Smart Pill Imaging Data

-

Miniaturization of Components to Expand Utility in Pediatrics and Geriatrics

-

Growth in Smart Pills for Neurological Disorder Monitoring and Treatment

-

Clinical Trials Exploring Smart Pills in Targeted Oncology Drug Delivery

-

Development of Next-Generation Biosensors for Internal Vital Sign Monitoring

Report Scope of Smart Pills Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.12 Billion |

| Market Size by 2034 |

USD 5.61 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Disease Indication, Target Area, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Otsuka Holdings Co., Ltd.; Olympus Corporation; CapsoCam Plus; Pentax Medical; JINSHAN Science & Technology (Group) Co., Ltd.; Check-Cap Ltd.; etectRx; INTROMEDIC; Shenzen Jifu Medical Technology Co., Ltd; BodyCapUSA |

Market Driver: Increasing Demand for Minimally Invasive Diagnostics

A primary driver of the smart pills market is the rising demand for minimally invasive or non-invasive diagnostic procedures, particularly for gastrointestinal (GI) diseases. Conventional techniques like colonoscopy and endoscopy, though effective, are often uncomfortable, expensive, and associated with procedural risks such as bleeding, anesthesia-related complications, or intestinal perforation. In contrast, smart pills offer a patient-friendly alternative by enabling full visualization of the GI tract without the need for sedation or hospital stay.

For instance, capsule endoscopy allows for the detailed examination of the small intestine—an area that is difficult to access through standard endoscopy—making it invaluable in diagnosing Crohn’s disease or small bowel tumors. The ability to record and transmit thousands of high-resolution images has improved early disease detection, which is critical for effective intervention. As patient preference shifts toward non-invasive technologies, and as physicians seek better compliance tools, smart pills are positioned for broad adoption in clinical settings.

Market Restraint: High Cost and Regulatory Complexity

Despite the promise of smart pills, their adoption is constrained by high development and operational costs, alongside regulatory complexities. Designing ingestible electronics that can safely pass through the human body, withstand gastric conditions, and perform multifunctional tasks requires sophisticated R&D, precision engineering, and rigorous validation. These factors increase production costs, which are passed on to healthcare systems and patients, limiting accessibility—especially in developing economies.

Moreover, because smart pills often fall under the purview of both drug and device regulations, obtaining market approvals is time-consuming and resource-intensive. In the U.S., for example, developers must satisfy both FDA’s Center for Devices and Radiological Health (CDRH) and Center for Drug Evaluation and Research (CDER) requirements. The lack of clear regulatory pathways and harmonized global standards hinders fast-track innovation and commercialization. Ensuring safety, efficacy, data privacy, and long-term biocompatibility are ongoing challenges manufacturers must address.

Market Opportunity: Growing Role in Precision Drug Delivery and Neurological Monitoring

A promising opportunity for the smart pills market lies in their potential role in precision drug delivery and neurological monitoring. These applications extend beyond diagnostics into the realm of active intervention. For instance, smart pills are being developed to release medication at targeted sites in the GI tract, such as the colon or stomach, improving bioavailability and reducing systemic side effects. This technology is especially beneficial for treating localized inflammatory conditions, infections, or even tumors.

Furthermore, recent innovations explore the utility of smart pills in monitoring neurological activity via the gut-brain axis. Ingestible sensors capable of measuring neurotransmitter levels or GI motility patterns can offer valuable insights into conditions like Parkinson’s disease, epilepsy, or even psychiatric disorders. As precision medicine continues to gain traction, smart pills with controlled release mechanisms and real-time data transmission will play a crucial role in personalized treatment regimes. The convergence of smart pills with AI and cloud computing will unlock new dimensions in real-time therapeutic monitoring and response assessment.

Smart Pills Market By Application Insights

Capsule endoscopy dominated the market and accounted for the largest revenue share of 54.1% accounting for the largest share. The procedure has become a critical tool in diagnosing disorders of the small intestine, such as obscure gastrointestinal bleeding, Crohn’s disease, and small bowel tumors. The ability to non-invasively visualize the full length of the intestine with high-resolution imaging is a major clinical advantage, reducing the diagnostic gap associated with traditional endoscopic techniques.

Drug delivery is expected to grow at a CAGR of 11.1% over the forecast period, With advancements in micro-dosing mechanisms, pharmaceutical manufacturers and tech companies are developing smart pills that can release drugs in response to physiological triggers or at specific locations within the digestive system. This includes smart pills that monitor pH, temperature, or pressure to determine the optimal drug release site. Drug delivery capsules for colon-specific therapies and timed-release antidepressants are currently under development or in clinical trials.

Smart Pills Market By Disease Indication Insights

Celiac disease led the market and accounted for the largest revenue share 2024 Characterized by patchy inflammation that can affect any part of the GI tract, Crohn’s disease is notoriously difficult to monitor. Smart pills enable deep enteroscopy without the invasiveness of balloon-assisted procedures. Their use helps assess disease severity, monitor treatment response, and detect mucosal healing—important markers in managing this chronic condition.

Small bowel tumors are expected to grow significantly over the forecast period. Smart pills have become the first-line diagnostic tool when traditional endoscopy fails to locate the bleeding source. Capsule endoscopy enables early detection, improves diagnostic accuracy, and guides therapeutic decision-making. Hospitals increasingly deploy smart pills in cases of unexplained anemia, recurrent melena, or iron deficiency—common signs of occult bleeding.

Smart Pills Market By Target Area Insights

The small intestine remains the primary target area for smart pills, mainly because of its inaccessibility via conventional scopes and its high association with elusive GI disorders. Capsule endoscopy has revolutionized how the small bowel is assessed, offering a complete, non-invasive, panoramic view that enables diagnosis of polyps, tumors, strictures, and vascular lesions.

However, stomach-targeted smart pills are emerging rapidly, particularly in drug delivery applications where controlled gastric release is critical. Gastric sensors that monitor pH or motility are also being explored for early detection of functional disorders like gastroparesis. Meanwhile, colon-targeted capsules for bowel prep assessment or colorectal cancer screening are under active investigation.

Smart Pills Market By End-use Insights

Outpatient facilities dominated the market with a share of 54.0% in 2024 The portability, safety, and simplicity of capsule procedures make them ideal for outpatient settings. These facilities are increasingly investing in capsule reader stations and cloud-based data systems to analyze smart pill outputs, reducing dependence on high-cost hospital visits.

Hospitals are expected to grow at a CAGR of 10.4% over the forecast period. attributed to their comprehensive diagnostic facilities, trained gastroenterologists, and infrastructure to support capsule endoscopy procedures. Hospitals are also the primary venues for advanced capsule studies, including obscure GI bleeding investigations and capsule-based motility tests.

Some of the prominent players in the smart pills market include:

Smart Pills Market Recent Developments

-

March 2025: Medtronic launched the next generation of its PillCam™ capsule endoscopy platform with enhanced imaging resolution and AI-powered image analysis for faster review.

-

February 2025: CapsoVision received FDA clearance for its CapsoCam Plus® with 360° panoramic imaging and upgraded telemetry for remote physician review.

-

January 2025: iNexGen Technologies announced a collaboration with a U.S.-based pharma company to co-develop smart drug delivery capsules capable of real-time pH monitoring and delayed release.

-

December 2024: Check-Cap Ltd. began a multicenter clinical trial of its colon imaging capsule as a radiation-free alternative to colonoscopy for colorectal cancer screening.

-

November 2024: Proteus Digital Health, recently acquired by a private equity firm, announced plans to reintroduce its ingestible sensor system for medication adherence in psychiatric and cardiovascular disease patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the smart pills market

By Application

- Capsule Endoscopy

- Drug Delivery

- Vital Sign Monitoring

By Disease Identification

- Occult GI Bleeding

- Crohn’s Disease

- Small Bowel Tumors

- Celiac Disease

- Inherited Polyposis Syndromes

- Neurological Disorders

- Other Disease Indications

By Target Area

- Esophagus

- Small Intestine

- Large Intestine

- Stomach

By End-use

- Hospitals

- Outpatient Facilities

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)