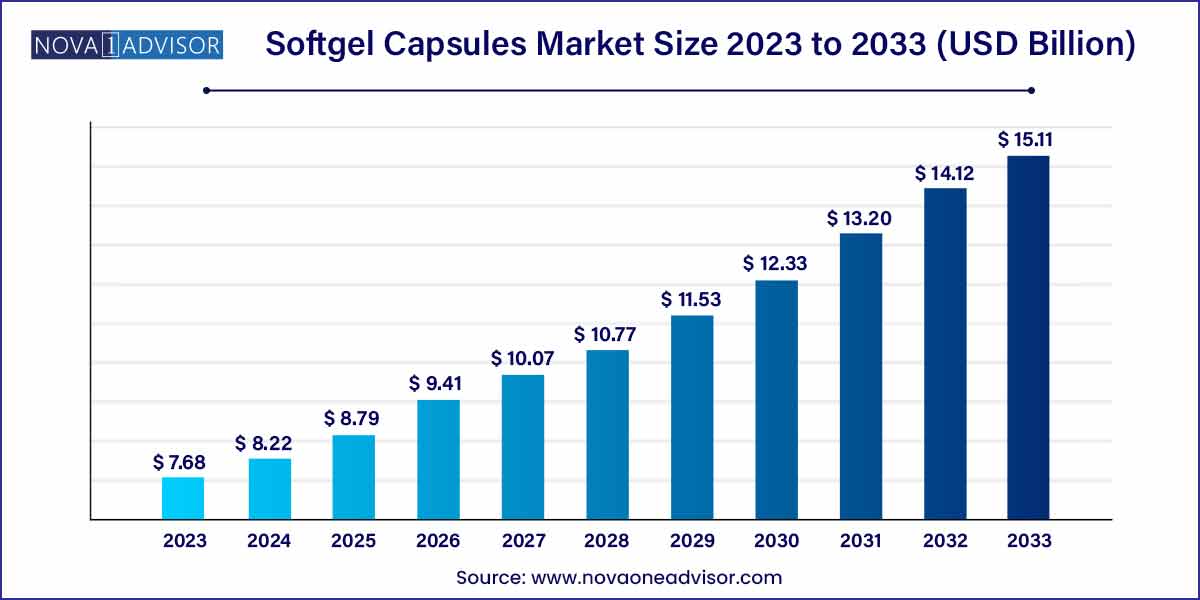

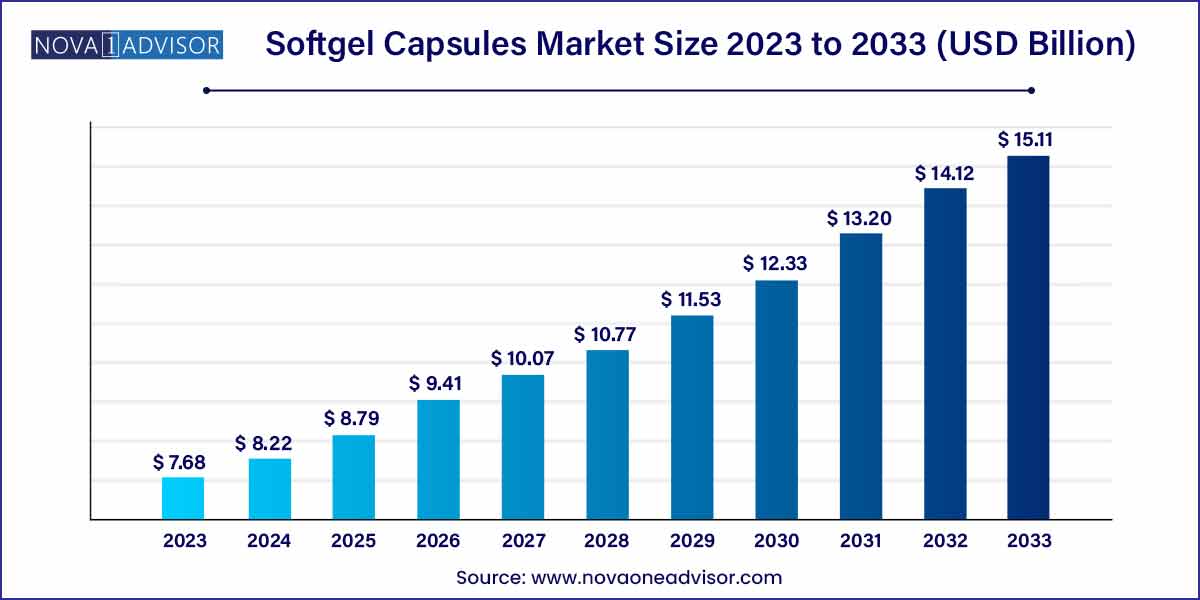

The global softgel capsules market size was exhibited at USD 7.68 billion in 2023 and is projected to hit around USD 15.11 billion by 2033, growing at a CAGR of 7.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- The gelatin-based/animal-based segment dominated the market with the largest revenue share in 2023.

- The vitamins and dietary supplements segment dominated the market with the largest revenue share in 2023.

- The nutraceutical companies segment dominated the market with the largest revenue share of 38.0% in 2023

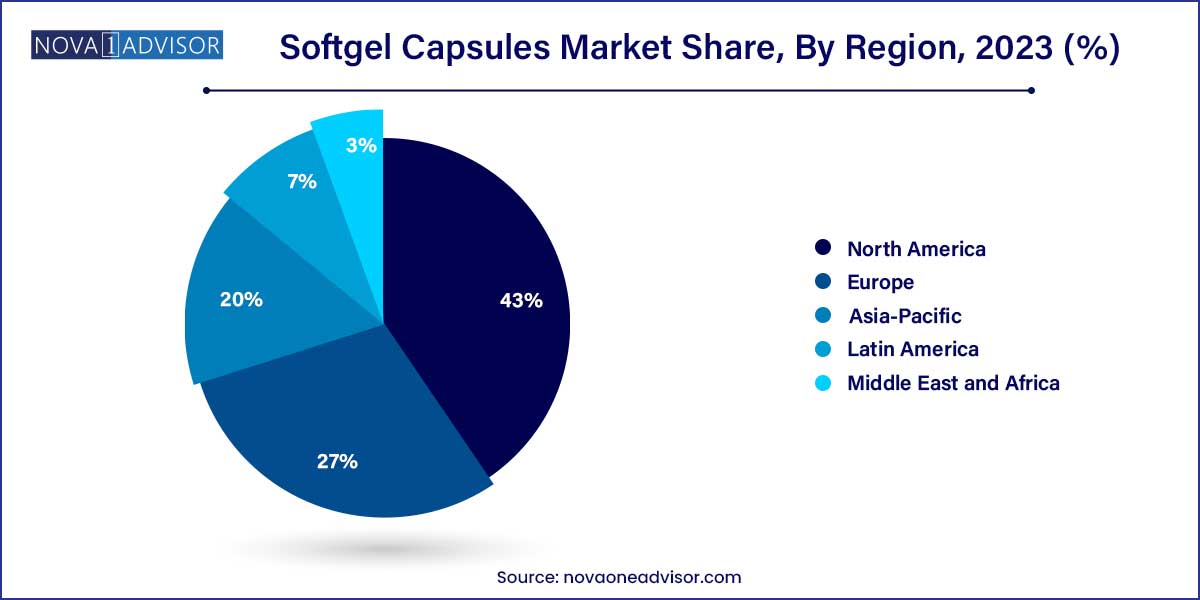

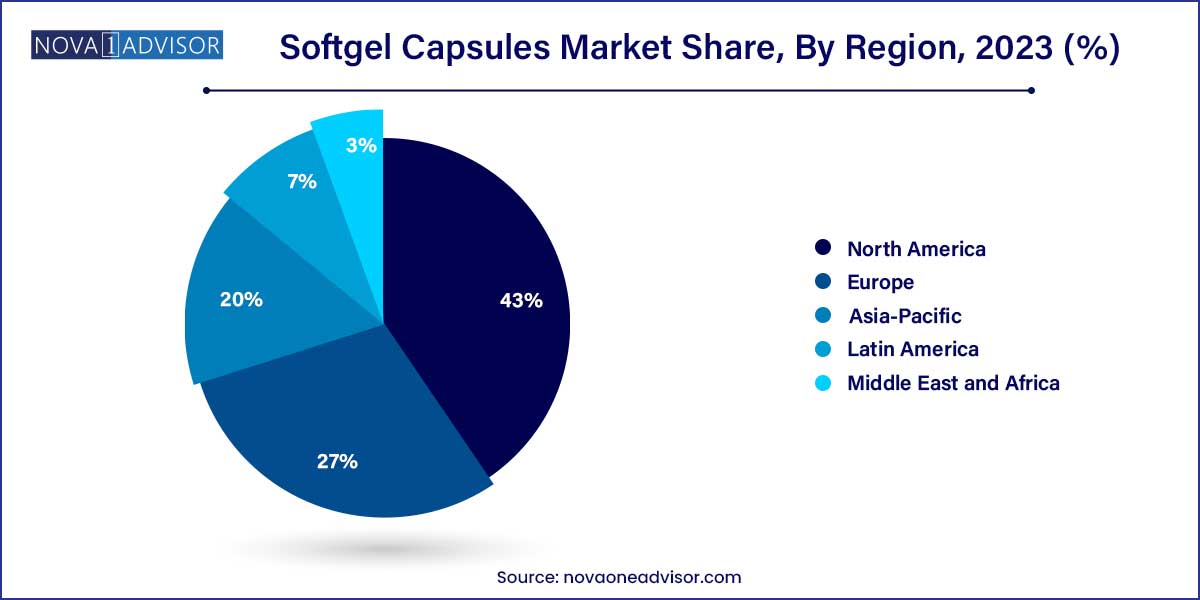

- North America dominated the market, with the largest revenue share of 43.0% in 2023.

Market Overview

The Softgel Capsules Market has established itself as a vital component of the pharmaceutical, nutraceutical, and cosmeceutical industries, offering a versatile and effective oral dosage form. Softgel capsules consist of a gelatin or non-animal-based shell filled with active ingredients in liquid or semi-solid form, providing superior bioavailability, dosage accuracy, and patient compliance compared to traditional tablets or powders.

Key drivers of the softgel market include the increasing consumer preference for easy-to-swallow formulations, the demand for enhanced absorption drugs, growing trends in health and wellness supplementation, and the booming personalized nutrition market. Additionally, advancements in encapsulation technology, such as enteric coatings and sustained-release systems, have expanded the application of softgels across pharmaceutical and non-pharmaceutical sectors.

Leading players such as Catalent, Inc., Capsugel (Lonza Group), Aenova Group, and Sirio Pharma Co., Ltd. are continuously innovating with new formulation capabilities, sustainable materials, and customized offerings tailored to client needs. As healthcare shifts toward preventive care and convenience, the global softgel capsules market is poised for sustained growth.

Major Trends in the Market

-

Rising Adoption of Non-Animal-Based (Vegan) Softgels: Addressing the needs of vegetarian, vegan, and religiously restricted (e.g., Halal, Kosher) consumers.

-

Growth in Customized and Targeted Nutraceuticals: Personalized supplementation driving demand for tailor-made softgel formulations.

-

Advances in Controlled and Sustained Release Technologies: Improving therapeutic effectiveness and patient adherence.

-

Expansion into Beauty-from-Within Products: Softgels containing collagen, hyaluronic acid, and other cosmeceutical ingredients gaining popularity.

-

Increasing Outsourcing to Contract Manufacturing Organizations (CMOs): Rising demand for specialized softgel production expertise.

-

Focus on Clean Label and Plant-Based Ingredients: Transparency trends pushing natural colorants, flavorings, and minimal excipient use.

-

Emergence of Nano-Encapsulation and Lipid-Based Delivery Systems: Enhancing bioavailability of poorly soluble compounds.

Softgel Capsules Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.68 Billion |

| Market Size by 2033 |

USD 15.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Fuji Capsule; Sirio Pharma Co., Ltd.; CAPTEK Softgel International Inc.; Thermo Fisher Scientific Inc.; EyePoint Pharmaceuticals, Inc.; Catalent, Inc.; EuroCaps; Aenova Group; Lonza Capsules & Health Ingredients; ProCaps Laboratories, LLC; Soft Gel Technologies, Inc. |

Key Market Driver

Growing Preference for Easy-to-Swallow and Enhanced Bioavailability Dosage Forms

One of the primary drivers for the softgel capsules market is the increasing consumer and patient preference for convenient, easy-to-swallow, and effective dosage forms. Particularly among pediatric, geriatric, and dysphagic populations, softgels offer a smooth texture, odorless nature, and minimal aftertaste, improving compliance. Furthermore, their ability to encapsulate lipophilic or poorly soluble drugs enhances bioavailability and therapeutic efficacy. According to a March 2024 survey by PharmaTimes, over 62% of healthcare practitioners indicated a preference for prescribing softgel formulations for lipid-soluble drugs to optimize patient outcomes.

Key Market Restraint

High Production Costs and Complex Manufacturing Processes

Despite their advantages, softgel capsules involve complex and expensive manufacturing processes, including specialized encapsulation equipment, precise humidity and temperature controls, and stringent regulatory compliance. Additionally, sourcing high-quality gelatin or developing plant-based alternatives adds to production costs. These factors result in higher end-product prices compared to conventional tablets or hard capsules, potentially limiting adoption in price-sensitive markets and restricting product affordability for consumers.

Key Market Opportunity

Expanding Applications in the Nutraceutical and Functional Foods Sector

The surging popularity of health and wellness trends presents a significant opportunity for softgel manufacturers. Consumers are increasingly seeking supplements for immune support, weight management, anti-aging, cognitive health, and athletic performance. Softgels, with their capacity to deliver complex, oily ingredients like omega-3s, curcumin, CBD, and fat-soluble vitamins, are ideally suited for nutraceutical applications. In February 2024, a leading nutrition brand launched a new range of "beauty softgels" combining marine collagen, antioxidants, and hyaluronic acid, targeting the rapidly growing beauty-from-within market.

Type Insights

Gelatin-Based Softgel Capsules dominated the type segment in 2024. Traditional gelatin capsules, derived from bovine, porcine, or fish collagen, continue to be widely used due to their superior mechanical properties, ease of encapsulation, and cost-effectiveness. Pharmaceutical and nutraceutical companies favor gelatin-based softgels for delivering both hydrophilic and lipophilic drugs efficiently.

However, ethical, religious, and dietary restrictions are gradually driving demand for alternatives.

Non-Animal-Based Softgel Capsules are the fastest-growing segment, particularly among vegan, vegetarian, and ethically conscious consumers. These capsules, typically formulated using plant-derived materials like modified starches, carrageenan, and cellulose, are witnessing robust adoption across North America, Europe, and Asia-Pacific. In March 2024, Lonza Group expanded its "Vcaps Plus" plant-based capsule range to include new formulations optimized for high oil load active ingredients.

Application Insights

Vitamin and Dietary Supplement

Vitamin and Dietary Supplement applications dominated the market. The global push toward preventive healthcare and holistic well-being has fueled demand for vitamin D, vitamin E, omega-3 fatty acids, and multivitamin supplements delivered in softgel form. Their ease of ingestion and superior bioavailability make softgels a preferred choice for daily supplementation.

Health Supplement

Health Supplements are witnessing rapid growth, driven by increasing demand for functional ingredients targeting immunity, gut health, joint support, and cognitive enhancement. In February 2024, a major nutraceutical brand launched a new "Brain Health" softgel series featuring nootropics and adaptogens.

Antacid and Anti-Flatulent Preparation

Softgel formulations for antacid and digestive health are also experiencing steady growth. The convenience and rapid action of softgels make them ideal for addressing gastrointestinal discomfort, particularly in aging populations.

Anti-Anemic, Anti-Inflammatory, Antibiotic, and Pregnancy Applications

Niche pharmaceutical applications, including iron supplements for anemia, anti-inflammatory agents, antibiotics, and prenatal vitamins, continue to provide stable demand, particularly within hospital and prescription settings.

End-use Insights

Pharmaceutical Companies

Pharmaceutical Companies dominated the end-use segment. Softgel capsules offer pharma companies advantages in life cycle management, reformulation of existing drugs, and development of new chemical entities (NCEs) with solubility challenges. Numerous generic and branded prescription drugs are increasingly being reformulated into softgel formats.

Nutraceutical Companies

Nutraceutical Companies are the fastest-growing end-user segment, reflecting the surging demand for preventive and wellness solutions globally. Strategic partnerships between softgel manufacturers and wellness brands are driving innovations in this space.

Cosmeceutical Companies

Softgel delivery systems are making inroads into the cosmeceutical industry, delivering beauty supplements promoting skin hydration, hair health, and anti-aging from within.

Contract Manufacturing Organizations

CMOs play a critical role by offering turnkey softgel development and production services, allowing brands to accelerate product launches without significant capital investment.

Regional Insights

North America dominated the global softgel capsules market in 2024. High consumer awareness, advanced healthcare infrastructure, a well-established pharmaceutical and nutraceutical industry, and strong regulatory frameworks contribute to North America's leadership. The U.S., in particular, accounts for a substantial share, supported by the popularity of dietary supplements and the increasing preference for alternative dosage forms.

Asia-Pacific is the fastest-growing region. Rising disposable incomes, expanding middle-class populations, growing health consciousness, and increasing demand for preventive healthcare solutions are key drivers. Countries like China, India, Japan, and South Korea are experiencing a surge in softgel supplement consumption. In March 2024, China's National Health Commission included softgel-based omega-3 products in its national dietary guideline recommendations, providing further impetus to the regional market.

Some of the prominent players in the softgel capsule market include:

- Fuji Capsule

- Sirio Pharma Co., Ltd.

- CAPTEK Softgel International Inc.

- Thermo Fisher Scientific Inc.

- EyePoint Pharmaceuticals, Inc.

- Catalent, Inc.

- EuroCaps

- Aenova Group

- Lonza Capsules & Health Ingredients

- ProCaps Laboratories, LLC

- Soft Gel Technologies, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global softgel capsule market.

Type

- Gelatin-Based/Animal-Based

- Non-Animal-Based

Application

- Antacid and Anti-Flatulent Preparation

- Anti-Anemic Preparations

- Anti-Inflammatory Drugs

- Antibiotic and Antibacterial Drugs

- Cough and Cold Preparations

- Health Supplement

- Vitamin and Dietary Supplement

- Pregnancy

End-use

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)