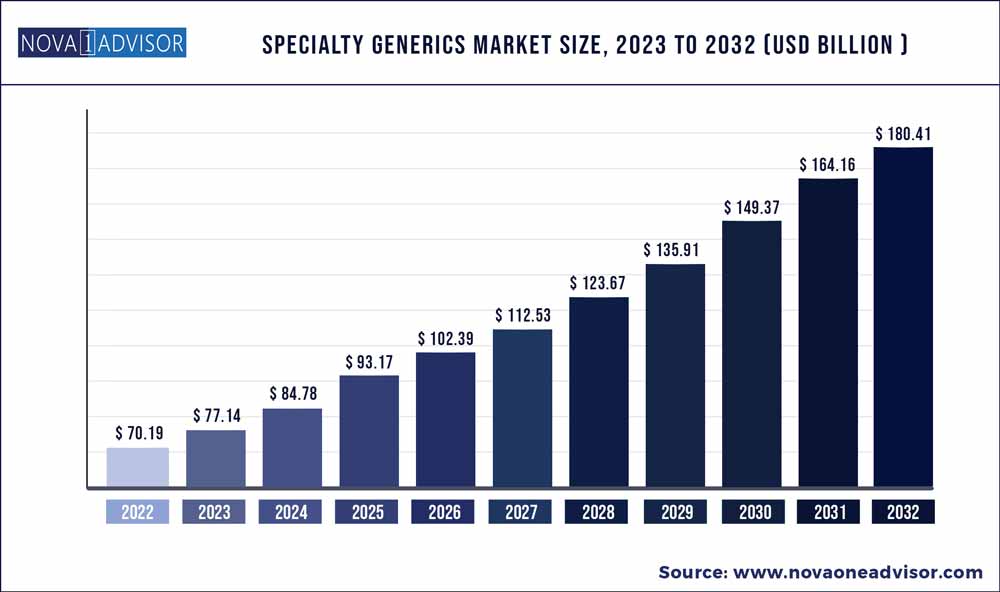

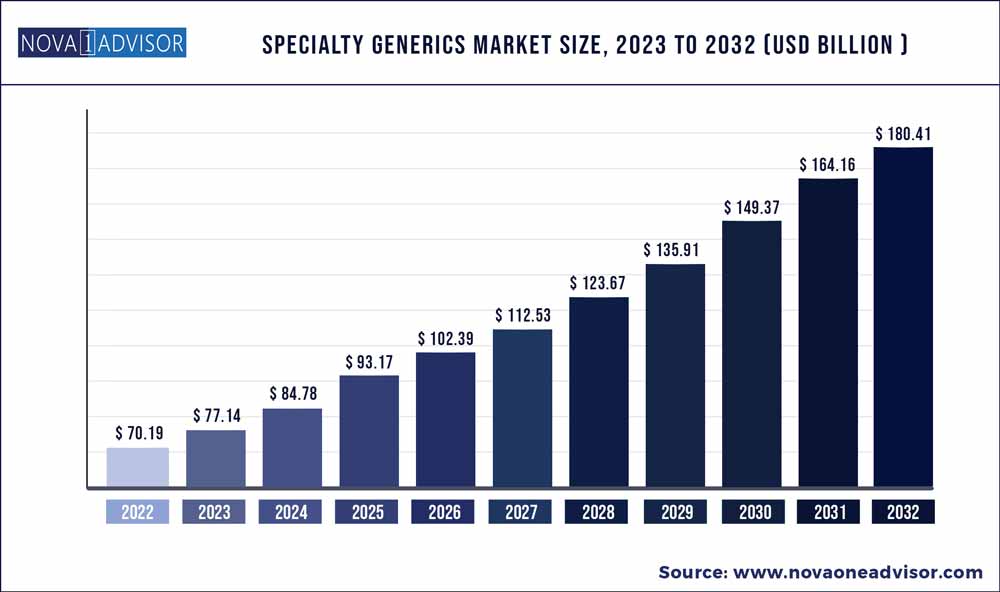

The global specialty generics market size was estimated at USD 70.19 billion in 2022 and is expected to surpass around USD 180.41billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 9.9% during the forecast period 2023 to 2032.

Key Takeaways:

- North America dominated the market with a share of 37.3% in 2022

- The Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- The market is segmented into oral drugs, injectables, and others. The injectables segment held the highest share of 65.2% of the specialty generics market in 2022.

- injectables segment is also expected to grow at the fastest growth over the forecast period.

- The inflammatory conditions segment dominated the market with a revenue share of 28.7% in 2022

- Oncology segment is expected to witness the significant growth over the forecast period

- The specialty pharmacy segment dominated the market with a revenue share of 77.7% in 2022 and is expected to witness lucrative growth over the forecast period.

Specialty Generics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 77.14 Billion |

| Market Size by 2032 |

USD 180.41 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 9.9% |

| Base Year |

2022 |

| Forecast Period 2023 to 2032 |

2023 to 2032 |

| Segments Covered |

Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Teva Pharmaceuticals Industries Ltd: Novartis AG (Sandoz International GmbH); Mallinckrodt; Bausch Health Companies Inc. (Valeant Pharmaceuticals International, Inc.); Endo Pharmaceuticals Inc.; Viatris Inc.;Fresenius Kabi Brasil Ltda; STADA Arzneimittel AG; Apotex Corp.; Hikma Pharmaceuticals PLC; Dr. Reddy’s Laboratories Ltd; Sun Pharmaceutical Industries Ltd. |

The growth in the market is largely driven by increasing product approvals and the rising prevalence of complex chronic diseases, such as multiple sclerosis.

In April 2022, Dr. Reddy’s Laboratories launched a methylprednisolone sodium succinate injection in the U.S. for the treatment of patients with arthritis, blood disorders, and certain rare cancers. Furthermore, in June 2022, Elixir launched copay solutions enhancement program for the management of specialty generic medication prices. Under this program, an eligible patient receives a generic version of specialty medication at zero cost. Thus, the launch of new low-cost generic injectables and the availability of such programs is projected to fuel market growth.

Increased claim settlements and availability of specialty generic drugs increase their prescription rates due to the high safety, efficacy, and tolerability associated with them. According to the Human Resources Benefits Office University of Michigan annual report (2021), around 1,383 claims were settled for specialty generic drugs such as glatiramer acetate (Copaxone/Glatopa), teriflunomide (Aubagio), and fingolimod (Gilenya) in 2021, compared to 1,360 in 2020, with a rise of 1.7% for the treatment of patients with multiple sclerosis.

However, high costs associated with specialty generics may hamper their uptake. The lack of ability to attract patients toward drugs, marketing rights acquired by companies for off-patent drugs with no generic competition, and small target patient pool, subsequently increases the prices of products. According to the University of Michigan Prescription Drug Plan Formulary report, the average cost of specialty generic is over USD 4,500 monthly per person, compared to USD 17 to 22 for a generic prescription.

Type Insights

Based on type, the market is segmented into oral drugs, injectables, and others. The injectables segment held the highest share of 65.2% of the specialty generics market in 2022. The dominance of the injectables segment can be attributed to the benefits associated with injectables like long term effect, and immediate absorption, thus leading to higher patient compliance and acceptability.

Furthermore, injectables segment is also expected to grow at the fastest growth over the forecast period owing to increasing products approval and higher market penetration. For instance, in September 2021, Dr Reddy's Laboratories in partnership with Natco Pharma launched a generic version of Revlimid; Nat-lenalidomide & Reddy-lenalidomide approved by Health Canada for the treatment of patients with myelodysplastic syndrome and multiple myeloma in Canada. This approval provides easy access to low-cost specialty generic drugs to cancer patients, thereby, increasing prescription rate.

Application Insights

Based on application, the market is segmented into oncology, inflammatory conditions, multiple sclerosis, hepatitis C, and others. The inflammatory conditions segment dominated the market with a revenue share of 28.7% in 2022 due to increased prevalence of inflammatory conditions like rheumatoid arthritis. According to Global RA Network estimate, around 350 million people live with arthritis worldwide. In addition, according to the NHS, more than 10 million people are suffering from arthritis. Hence, the rise in prevalence of inflammatory conditions have paved the way for key players to enhance their market share in this sector.

Oncology segment is expected to witness the significant growth over the forecast period owing to rise in disease burden of cancer and ANDA product approvals such as generic Xtandi (Enzalutamide) for treating castration-resistant prostate cancer in May 2021. According to Globocan, the number of new cancer cases is anticipated to reach 28.4 million within the next two decades, with a rise of 47% from 2020, owing to adoption of western lifestyle, high consumption of alcohol, smoking, poor diet choices, and physical inactivity. Growing number of cancer cases is projected to propel the demand for specialty generics.

End Use Insights

On the basis of end-use, the market has been segmented into specialty pharmacy, retail pharmacy, and hospital pharmacy. The specialty pharmacy segment dominated the market with a revenue share of 77.7% in 2022 and is expected to witness lucrative growth over the forecast period. Major specialty generic manufacturers and insurance providers choose specialty pharmacies for the distribution of products due to negligible distribution costs and easy access to medicines. According to Drug Channels Institute’s report 2021, CVS specialty, Accredo, Optum specialty pharmacy, Walgreens stores, and Humana specialty pharmacy were world’s top five specialty pharmacies.

Furthermore, low cost associated with specialty generic drug inventory offers a great return on investment on medicines compared to branded products. Factors like timely delivery, optimizing patient access, and effective distribution management of specialty pharmacies attract buyers attention to specialty pharmacy and contributes in segment growth.

Regional Insights

North America dominated the market with a share of 37.3% in 2022 owing to the presence of supportive regulatory policies regarding the approval of new products. The U.S. FDA has undertaken several initiatives to smoothen overall approval process. Thus, the U.S. FDA introduced Generic Drug User Free Amendments (GDUFA) under the Hatch-Waxman act to quicken the delivery of safe and effective low cost generic drugs to the public. As a result, the key manufacturers are constantly making efforts for commercialization of specialty generic drugs in the market. For instance, in June 2022, Amneal Pharmaceuticals Inc., launched LYVISPAH (baclofen) a specialty product approved by U.S. FDA for the indication of multiple sclerosis and other spinal cord disorders.

The Asia Pacific is estimated to be the fastest-growing region over the forecast period. The growth of region is mainly driven by high unmet low cost medicine need and launch of new generic drugs in region. In 2021, BDR Pharma launched generic version of Midostaurin with brand name of MSTARIN for the treatment of rare cancer like acute myeloid leukemia (AML).

Specialty Generics Market Share Insights

Regional expansion of product portfolio & service offerings is a key strategy adopted by players in the market. In June 2020, Sun Pharmaceutical Industries Ltd and Hikma Pharmaceuticals PLC signed an exclusive licensing and distribution agreement for Ilumya in the MEA region for the treatment of moderate to severe plaque psoriasis. This agreement offers a low-cost and equally effective specialty generic medicines to people with unmet treatment need. Some of the key players in the global specialty generics market include:

- Teva Pharmaceuticals Industries Ltd

- Viatris Inc.

- Novartis AG (Sandoz International GmbH)

- Hikma Pharmaceuticals PLC

- Mallinckrodt

- Bausch Health Companies Inc. (Valeant Pharmaceuticals International, Inc.)

- Dr. Reddy’s Laboratories Ltd.

- Endo Pharmaceuticals Inc.

- Apotex Corp.

- Sun Pharmaceutical Industries Ltd

- Fresenius Kabi Brasil Ltda

- STADA Arzneimittel AG

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Specialty Generics market.

By Type

- Injectables

- Oral drugs

- Others

By Application

- Oncology

- Inflammatory conditions

- Multiple sclerosis

- Hepatitis C

- Others

By End Use

- Specialty pharmacy

- Retail pharmacy

- Hospital pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)