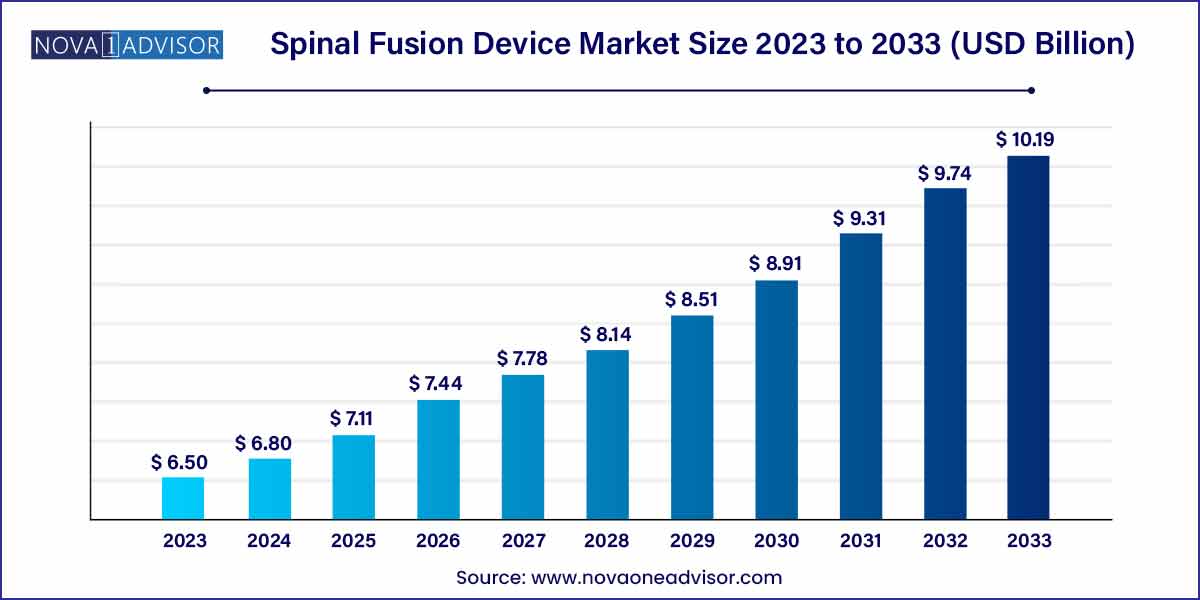

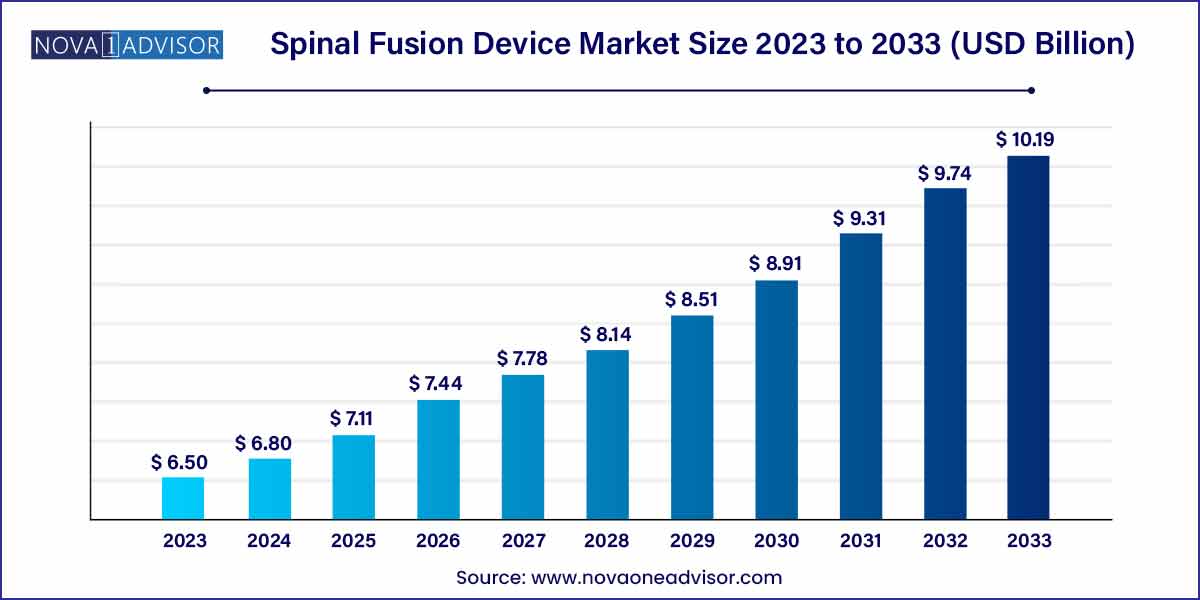

The global spinal fusion device size was exhibited at USD 6.50 billion in 2023 and is projected to hit around USD 10.19 billion by 2033, growing at a CAGR of 4.6% during the forecast period 2024 to 2033.

Key Takeaways:

- The thoracolumbar devices segment dominated the market for spinal fusion devices and accounted for the largest revenue share of more than 55.0% in 2023.

- The degenerative disc segment dominated the market for spinal fusion devices and accounted for the largest revenue share of over 42.0% in 2023.

- The minimally invasive surgery segment dominated the market for spinal fusion devices and accounted for the largest revenue share of 64.0% in 2023 as it’s the first preference for spinal fusion surgeries.

- The hospitals dominated the market for spinal fusion devices and accounted for the largest revenue share of over 60.0% in 2023.

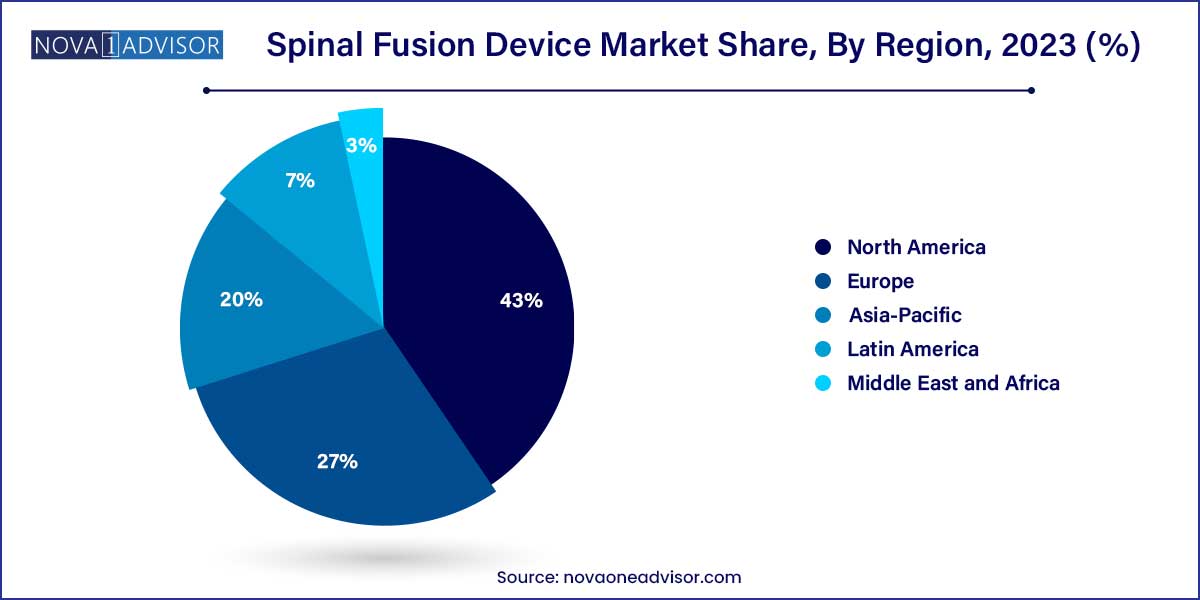

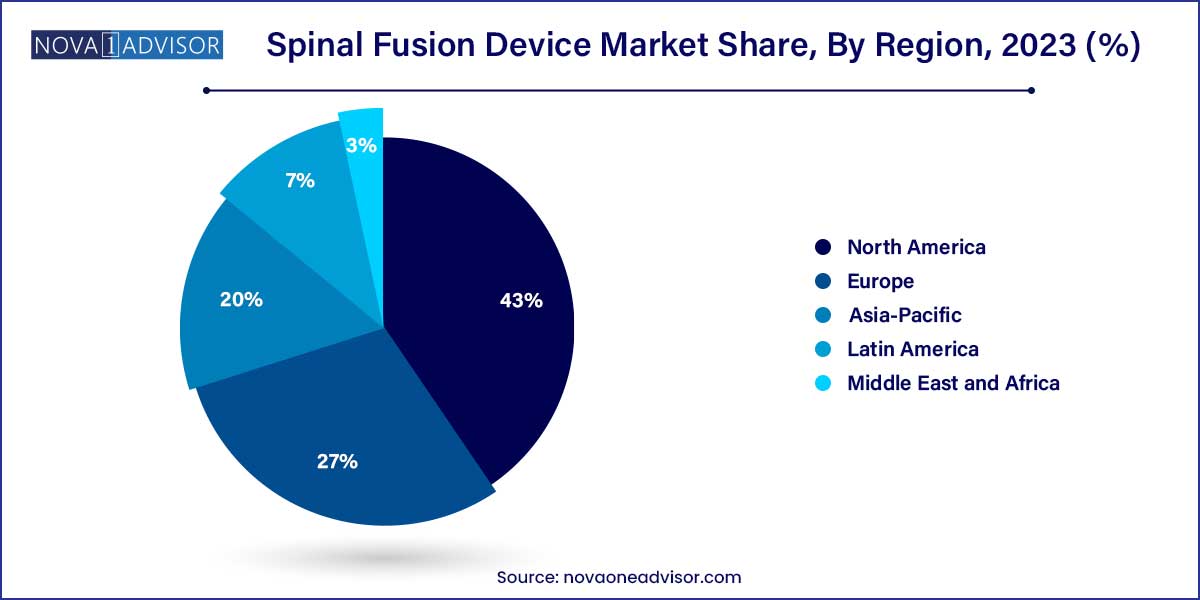

- North America dominated the spinal fusion devices market and accounted for the largest revenue share of over 43.0% in 2023.

Market Overview

The spinal fusion device market has emerged as a vital component within the global orthopedic and neurosurgical sectors. Spinal fusion surgeries aim to correct deformities, treat degenerative disc diseases, fractures, and spinal instability by permanently connecting two or more vertebrae. These procedures rely heavily on medical devices such as rods, screws, cages, and plates to stabilize and support the spine during the healing process.

Advancements in biomaterials, minimally invasive surgical techniques, and image-guided navigation have significantly expanded the range of spinal fusion solutions available. Increasing incidence rates of spinal disorders due to aging populations, sedentary lifestyles, and the rising prevalence of obesity-related spinal degeneration are key factors propelling market growth.

Moreover, the market has seen notable technological innovations such as 3D-printed interbody fusion devices, biologic fusion enhancers, and patient-specific implants. As healthcare systems prioritize outcomes and value-based care, demand for durable, efficient, and less invasive spinal fusion solutions continues to intensify.

Major Trends in the Market

-

Rising Popularity of Minimally Invasive Spine Surgery (MISS): Techniques that reduce hospital stays, recovery times, and surgical complications are gaining traction.

-

Adoption of Biologics and Bone Grafts: Innovations in osteoinductive materials are enhancing spinal fusion outcomes.

-

3D Printing and Patient-specific Implants: Customized implants designed for patient-specific anatomy are becoming mainstream.

-

Integration of Navigation and Robotics: Robotic-assisted spine surgery is improving precision and outcomes.

-

Growing Demand for Anterior and Lateral Approaches: Alternative surgical access points are reducing tissue trauma and recovery times.

-

Partnerships and Acquisitions: Companies are merging capabilities to accelerate innovation and expand global reach.

-

Focus on Motion Preservation Techniques: Development of dynamic stabilization devices to maintain natural spine movement.

Spinal Fusion Device Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.50 Billion |

| Market Size by 2033 |

USD 10.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Disease Type, Surgery, End-User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Johnson & Johnson Services, Inc. (DePuy Synthes); Stryker; Zimmer Biomet; Orthofix Medical, Inc.; B. Braun Melsungen AG; Medtronic; NuVasive, Inc.; Globus Medical; ATEC Spine, Inc; Captiva Spine, Inc; SeaSpine; Spinal Elements, Inc.; Spine Wave, Inc.; Spineology, Inc.; Xtant Medical Holdings, Inc. |

Product Insights

Thoracolumbar devices dominated the product segment. Thoracolumbar fusion devices, including anterior lumbar plates and pedicle screw and rod systems, are widely utilized to stabilize and correct deformities in the lower thoracic and lumbar spine. Given that lumbar degeneration is the most common cause of chronic lower back pain, demand for these devices remains high. Pedicle screw and rod systems, in particular, provide robust fixation and have become standard of care in posterior spinal fusions, driving this segment's dominance.

Interbody fusion devices are the fastest-growing product segment. Interbody fusion devices, which replace degenerated intervertebral discs and restore disc height and spinal alignment, are witnessing rapid growth. Advances such as 3D-printed cages that promote bone ingrowth and radiolucent materials like PEEK (polyetheretherketone) improve fusion success rates and post-surgical imaging clarity. As surgeons increasingly favor anterior and lateral approaches for interbody fusion, this segment's adoption is expected to outpace traditional fixation methods.

Disease Type Insights

Degenerative disc disease dominated the disease type segment. Degenerative disc disease (DDD) is a leading indication for spinal fusion surgery. As intervertebral discs lose hydration and elasticity with age, they can cause pain, instability, and nerve compression. Surgical intervention often involves spinal fusion to stabilize the affected segment and alleviate symptoms. Given the high prevalence of DDD in aging populations, its dominance in driving fusion procedures is unsurprising.

Complex deformities are the fastest-growing disease segment. Conditions like scoliosis, kyphosis, and other spinal deformities necessitate complex, multilevel spinal fusion procedures. Technological advancements enabling 3D planning, custom rods, and improved intraoperative navigation have improved surgical outcomes for deformity corrections. Increasing diagnosis rates, improved awareness, and access to surgical solutions are propelling growth in this specialized segment.

Surgery Insights

Open spine surgery dominated the surgery segment. Traditional open spine surgery has been the gold standard for spinal fusion for decades. It allows direct visualization of the surgical site, facilitating complex reconstructions, deformity corrections, and multilevel fusions. Despite growing interest in MISS, open surgery remains prevalent for extensive and complicated cases.

Minimally invasive spine surgery is the fastest-growing surgery segment. Minimally invasive spine surgery is transforming the field by offering comparable outcomes to open procedures with significantly reduced morbidity. As technological barriers decrease and surgeon training improves, more institutions are adopting MISS techniques for lumbar, thoracic, and cervical fusions. The trend towards value-based care further accelerates this shift, given MISS's shorter hospital stays and faster recoveries.

End-user Insights

Hospitals dominated the end-user segment. Hospitals remain the primary centers for spinal fusion surgeries due to their comprehensive surgical capabilities, specialized personnel, and access to advanced imaging and intensive postoperative care facilities. The majority of complex spine surgeries, including multilevel fusions and deformity corrections, are conducted in hospital settings.

Specialty clinics are the fastest-growing end-user segment. The proliferation of specialized spine clinics and ambulatory surgical centers (ASCs) offering minimally invasive spine surgeries is a significant trend. These centers provide cost-effective, efficient care for single-level fusions and less complex procedures. Patient preference for outpatient settings with reduced waiting times and faster discharges is driving this segment's rapid growth

Regional Insights

North America dominated the spinal fusion device market. North America’s leadership is attributed to a high prevalence of spinal disorders, advanced healthcare infrastructure, and early adoption of innovative technologies. The United States, in particular, accounts for a substantial share due to high surgical volumes, favorable reimbursement policies, and the presence of key industry players such as Medtronic, Zimmer Biomet, and NuVasive. Moreover, a strong focus on R&D activities, clinical trials, and surgeon training programs supports market growth in the region.

Asia-Pacific is the fastest-growing region. Asia-Pacific is experiencing significant market expansion fueled by improving healthcare infrastructure, rising disposable incomes, and growing awareness about spinal health. Countries like China, India, and Japan are investing heavily in expanding their orthopedic and neurosurgical capabilities. Increasing healthcare expenditure, along with the rising burden of spine-related disorders among the aging population, is fostering demand for advanced spinal fusion devices in the region. Additionally, local manufacturing initiatives and government support are boosting the availability and affordability of these devices.

Some of the prominent players in the Spinal fusion device include:

- Johnson & Johnson Services, Inc. (DePuy Synthes)

- Stryker

- Zimmer Biomet

- Orthofix Medical, Inc.

- B. Braun Melsungen AG

- Medtronic

- NuVasive, Inc.

- Globus Medical

- ATEC Spine, Inc

- Captiva Spine, Inc

- SeaSpine

- Spinal Elements, Inc.

- Spine Wave, Inc.

- Spineology, Inc.

- Xtant Medical Holdings, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global spinal fusion device.

Product

-

- Anterior Lumbar Plates

- Pedicle Screw and Rods

- Others

- Cervical Fixation Devices

-

- Anterior Cervical Plates

- Hook Fixation Systems

- Others

Disease Type

- Degenerative Disc

- Complex Deformity

- Trauma & Fractures

- Others

Surgery

- Open spine surgery

- Minimally Invasive Spine Surgery

End-user

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)