Sterile Tubing Welder Market Size and Trends

The sterile tubing welder market size was exhibited at USD 2.65 billion in 2024 and is projected to hit around USD 4.44 billion by 2034, growing at a CAGR of 5.3% during the forecast period 2024 to 2034.

Sterile Tubing Welder Market Key Takeaways:

- The blood processing segment held the largest revenue share of over 60% in 2024. The segment is expected to grow at the fastest CAGR of 5.4% over the forecast period.

- The automatic segment held the largest market share of over 80% in 2024.

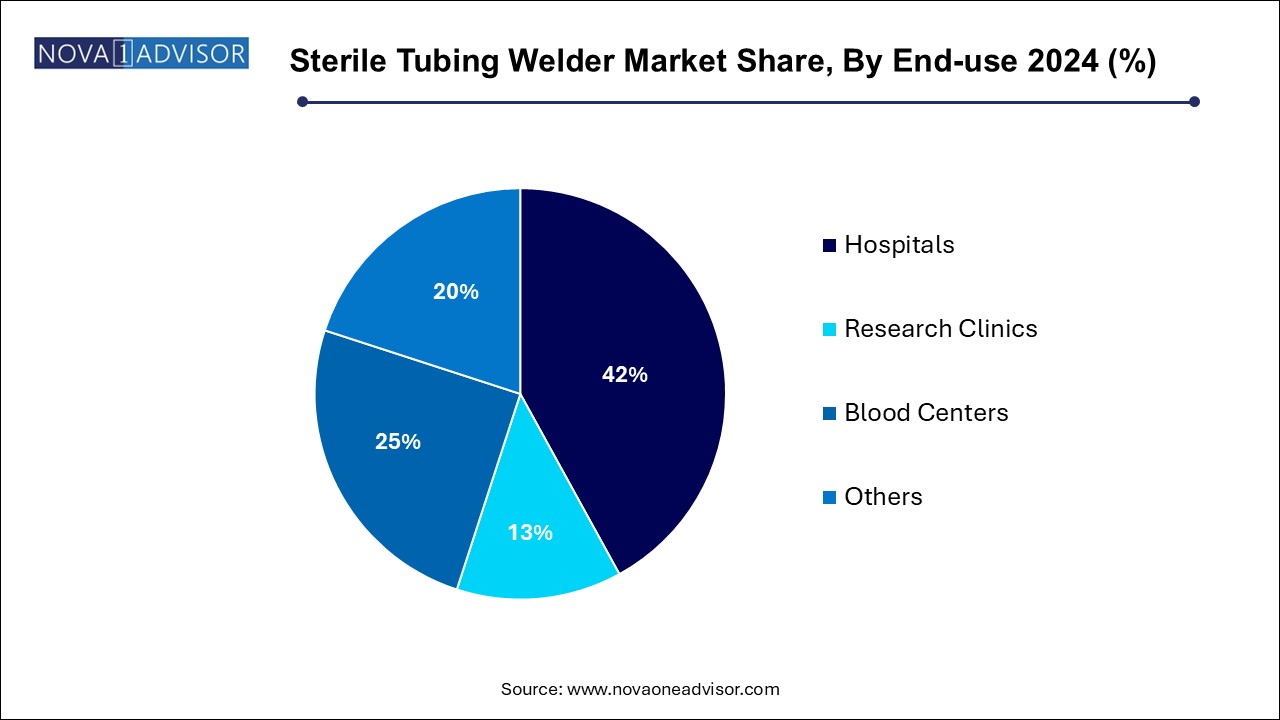

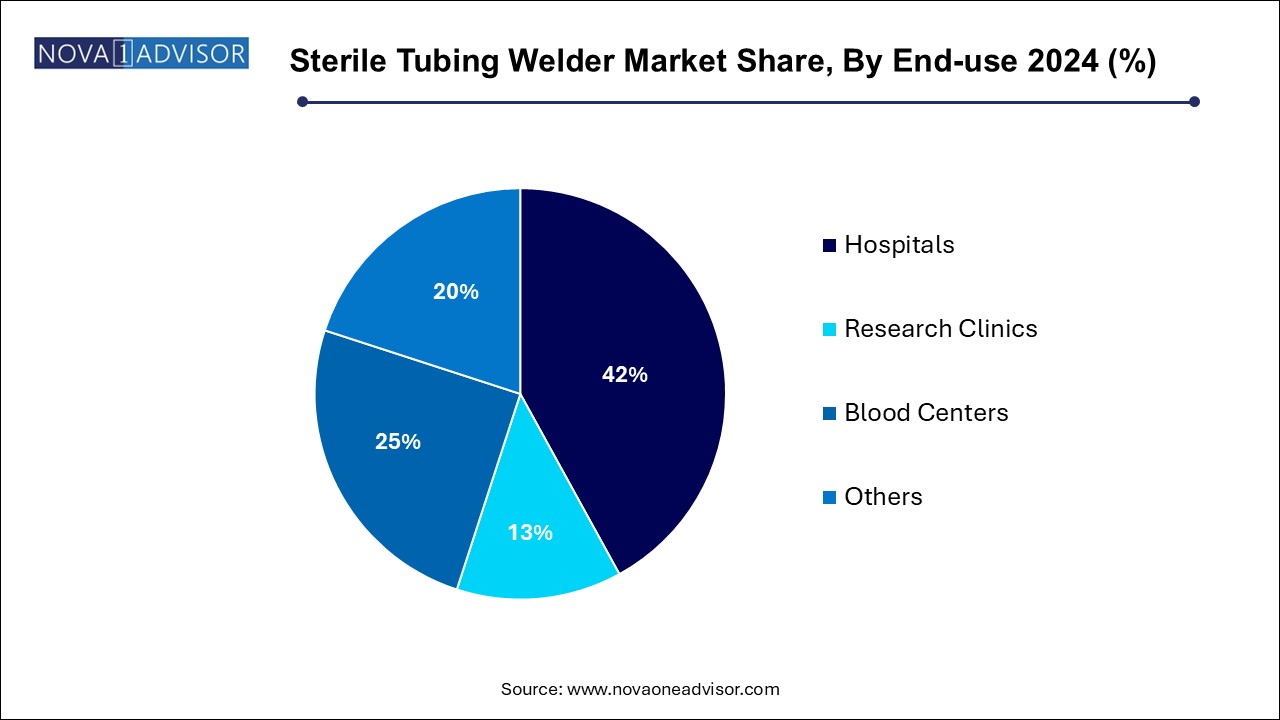

- The hospitals segment accounted for the largest revenue share of over 41% in 2024.

- Blood centers are also expected to grow at the fastest CAGR rate during the forecast period.

- North America dominated the market and accounted for the largest revenue share of over 35% in 2024.

- The Asia Pacific region is expected to grow at the fastest CAGR of 5.8% during the forecast period.

Market Overview

The Sterile Tubing Welder Market plays a critical role in ensuring aseptic fluid transfer across industries where sterility is paramount especially in biopharmaceutical production, blood banking, and diagnostic laboratories. Sterile tubing welders are specialized devices designed to connect two pieces of thermoplastic tubing while maintaining a sterile barrier, a process vital to preventing contamination in fluid handling workflows.

With increasing demands for sterility in manufacturing environments, the sterile tubing welder has become indispensable. It allows seamless, closed-system fluid transfers without exposure to the external environment, drastically minimizing contamination risks. The rising adoption of single-use technologies in bioprocessing and the critical importance of sterile blood processing in healthcare facilities are among the key forces driving market expansion.

As industries such as biologics, cell and gene therapy, and blood banking continue to grow and become more complex, the need for reliable, high-throughput, and user-friendly sterile welding solutions is stronger than ever. Innovations in automation, welding precision, and material compatibility are transforming the sterile welding landscape, positioning the market for substantial growth in the coming decade.

Major Trends in the Market

-

Integration of Fully Automated Sterile Welders: Reducing human error and boosting efficiency in biomanufacturing processes.

-

Rising Use of Single-use Systems in Biopharma: Driving the demand for tubing welders that support disposable workflows.

-

Expansion into Cell and Gene Therapy Applications: Customized sterile welding solutions are emerging for advanced therapies.

-

Focus on Portable and Compact Welder Designs: Meeting the demand for space-efficient equipment in labs and mobile blood centers.

-

Enhancement in Welding Speed and Cycle Time: Faster welding cycles are becoming essential for high-throughput operations.

-

Wider Compatibility with Diverse Tubing Materials: Welders now accommodate various thermoplastics like C-Flex, TPE, and silicone.

-

Implementation of Smart Features: Devices featuring touchscreens, data recording, and error diagnostics are gaining traction.

-

Customization for Blood Center Requirements: Specialized models tailored for blood bag tubing are expanding their market share.

-

Emphasis on Training and User Simplicity: Design innovations to minimize the learning curve and standardize operation.

-

Eco-friendly Sterile Tubing Welders: Focus on energy efficiency and reduced waste generation during welding operations.

Report Scope of Sterile Tubing Welder Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.42 Billion |

| Market Size by 2034 |

USD 4.44 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Application, Mode, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Sartorius AG; Terumo BCT, Inc.; GE Healthcare; MGA Technologies; Vante Biopharm / Sebra.; Genesis BPS; Biomen Biosystems Co., Ltd.; SynGen, Inc.; Sentinel Process Systems, Inc.; Flex Concepts, Inc.; Shanghai Le Pure Biological Technology Co., Ltd. |

Key Market Driver: Growth in the Biopharmaceutical Manufacturing Sector

One of the strongest market drivers for sterile tubing welders is the explosive growth of the biopharmaceutical manufacturing sector. Biologics, which include vaccines, monoclonal antibodies, and recombinant proteins, require extremely stringent sterile conditions during production. Any contamination event can result in millions of dollars in product loss and operational downtime.

Sterile tubing welders are critical in supporting closed-system processing, a central tenet of modern biomanufacturing. In upstream and downstream bioprocessing, sterile connections are needed for media transfers, harvests, and buffer preparations. Welders allow operators to make connections quickly, reliably, and aseptically without the need for laminar flow hoods or manual interventions, thereby boosting manufacturing efficiency while minimizing contamination risk. As the global demand for biologics continues to expand accelerated by vaccine production, oncology therapeutics, and rare disease treatments the sterile tubing welder market is poised to benefit directly.

Key Market Restraint: High Capital Cost and Maintenance Requirements

Despite their necessity, the high initial cost and maintenance complexity associated with sterile tubing welders present significant barriers to widespread adoption, particularly among smaller labs and healthcare facilities. Premium models with automation features and broader tubing material compatibility can cost tens of thousands of dollars, not including training, calibration, and service contracts.

Furthermore, regular validation, calibration, and preventive maintenance are critical to ensuring weld consistency and sterility. Facilities lacking technical expertise may find maintenance challenging, leading to operational disruptions. This cost and complexity factor may deter small-scale blood centers, regional diagnostic laboratories, and research clinics from investing in sterile tubing welders, opting instead for manual connectors or basic sealer systems.

Key Market Opportunity: Expansion into Cell and Gene Therapy Workflows

A promising growth opportunity for the sterile tubing welder market lies in the expanding field of cell and gene therapy. These cutting-edge therapies require closed, sterile fluid handling for processes like cell expansion, washing, harvesting, and cryopreservation. Maintaining product integrity through aseptic processing is crucial, given the high value and sensitivity of cell-based products.

Sterile tubing welders that are compatible with small-bore tubing, flexible manufacturing layouts, and customized bag systems are increasingly in demand. Companies developing next-generation welders designed specifically for these highly specialized, small-volume workflows have a first-mover advantage. As the pipeline of approved cell and gene therapies grows globally, and manufacturing scales up, demand for high-precision, GMP-compliant sterile tubing welders will surge, unlocking significant market opportunities.

Sterile Tubing Welder Market By Application Insights

Biopharmaceutical application dominated the sterile tubing welder market in 2024. The complex, highly regulated environment of biopharma production mandates stringent aseptic processing at every step. Whether during cell culture, fermentation, purification, or fill-finish operations, the need to connect and disconnect fluid lines without exposing contents to the environment makes sterile welders indispensable. Primary drivers include the growing adoption of single-use bioprocessing systems and regulatory emphasis on contamination control. Welders supporting a range of tubing sizes and materials for upstream and downstream processing have found widespread adoption in biologics facilities.

Diagnostic laboratories are projected to be the fastest-growing segment. As molecular diagnostics, infectious disease testing, and personalized medicine continue to expand, diagnostic labs require increasingly sterile and efficient fluid handling systems. Laboratories processing blood, plasma, or reagents in high-throughput environments are incorporating sterile tubing welders to improve sterility assurance and workflow flexibility. Miniaturized and portable welders that meet the needs of clinical labs and research facilities are fueling rapid growth in this segment.

Sterile Tubing Welder Market By Mode Insights

Manual sterile tubing welders dominated the market in 2024. These devices, often semi-automatic in nature, are easier to operate, lower in cost, and highly reliable for standard sterile welding tasks. Many hospitals, blood banks, and smaller bioprocessing facilities rely on manual welders for their simplicity, durability, and the ability to control welds manually in varied environmental conditions. They continue to be favored where cost sensitivity and moderate throughput are priorities.

Automatic sterile tubing welders are anticipated to experience the fastest growth. Automation in tubing welding addresses the rising need for repeatability, traceability, and process validation in high-throughput environments such as large biologics plants and centralized blood processing centers. Automatic welders reduce operator dependency, minimize errors, and integrate seamlessly with manufacturing execution systems (MES) and electronic batch records (EBR). Touchscreen interfaces, preset recipes, and automatic error alerts are making these systems increasingly attractive for GMP-regulated industries.

Sterile Tubing Welder Market By End-use Insights

Hospitals dominated the end-use segment of the sterile tubing welder market in 2024. Centralized hospital blood banks, apheresis centers, and oncology units use sterile tubing welders for blood component processing, chemotherapy preparation, and parenteral nutrition setups. The critical role of sterility in hospital patient care, particularly among immunocompromised populations, ensures strong demand for sterile welding systems.

Blood centers are projected to grow at the fastest rate over the next decade. Central blood banks and mobile blood collection centers require sterile tubing welders for processing donations into components such as plasma, platelets, and red cells. With initiatives to improve blood safety worldwide and rising blood donation rates in Asia and Latin America, blood centers are rapidly modernizing their infrastructure, including investments in sterile tubing welders to maintain closed system workflows.

Sterile Tubing Welder Market By Regional Insights

North America continues to dominate the sterile tubing welder market, driven by advanced healthcare systems, a strong biopharmaceutical manufacturing base, and strict regulatory standards governing aseptic processing. The presence of leading biotech hubs such as Boston, San Francisco, and Toronto fuels high demand for sterile fluid handling systems. Additionally, major manufacturers like Terumo BCT and GE Healthcare operate significant facilities in the U.S., ensuring early adoption of next-generation sterile welding solutions. Government incentives supporting cell therapy and blood safety initiatives further solidify North America's leadership.

Asia Pacific is poised to witness the fastest growth in the sterile tubing welder market. Rapid expansion of biopharmaceutical production in China, India, Japan, and South Korea, combined with rising healthcare infrastructure investments, is driving demand. Furthermore, the region’s growing interest in regenerative medicine, large blood donation programs, and medical tourism are creating fertile ground for sterile welding technologies. International players are establishing local production units and partnerships to tap into the region's cost-sensitive yet expanding healthcare and life sciences sectors.

Some of the prominent players in the sterile tubing welder market include:

- Sartorius AG

- Terumo BCT, Inc.

- GE Healthcare

- MGA Technologies

- Vante Biopharm / Sebra.

- Genesis BPS

- Biomen Biosystems Co., Ltd.

- SynGen, Inc.

- Sentinel Process Systems, Inc.

- Flex Concepts, Inc.

- Shanghai Le Pure Biological Technology Co., Ltd.

Recent Developments

-

February 2025 – Terumo BCT launched its next-generation automated sterile tubing welder, specifically designed for cell and gene therapy manufacturing applications, with enhanced multi-tubing compatibility.

-

December 2024 – GE Healthcare introduced a compact, smart sterile tubing welder targeting small-scale biologics manufacturing facilities, featuring touchscreen operation and real-time weld verification.

-

October 2024 – Sartorius AG expanded its single-use technology portfolio with the acquisition of a startup specializing in portable sterile welding solutions.

-

August 2024 – Genesis BPS announced FDA 510(k) clearance for its FlexWelder™, a high-speed automated tubing welder for blood processing centers.

-

June 2024 – Biosafe SA (a subsidiary of GE Healthcare) introduced enhancements to its SmartWeld tubing welding system, improving weld consistency in high-volume laboratories.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the sterile tubing welder market

Application

- Biopharmaceutical

- Blood Processing

- Diagnostic Laboratories

- Others

Mode

End-use

- Hospitals

- Research Clinics

- Blood Centers

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)