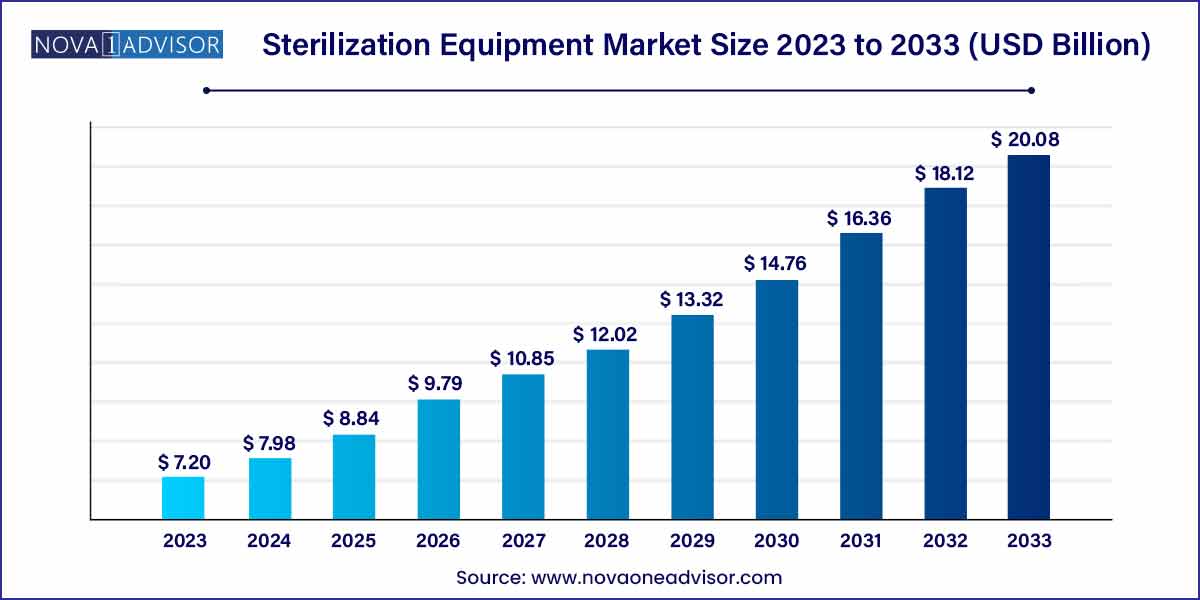

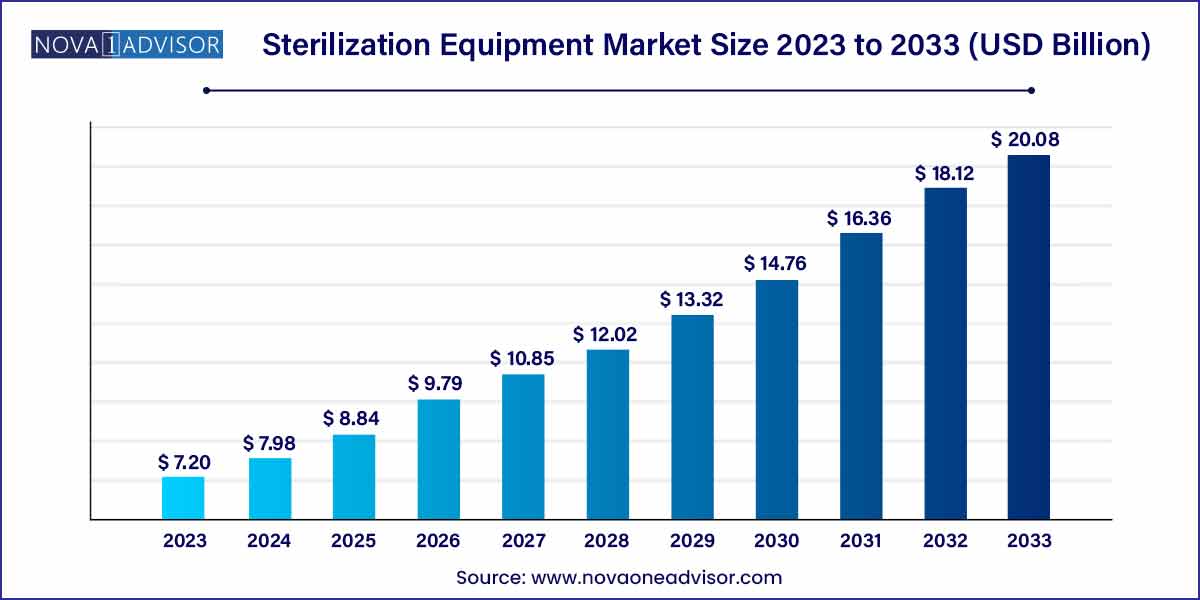

The global sterilization equipment market size was exhibited at USD 7.20 billion in 2023 and is projected to hit around USD 20.08 billion by 2033, growing at a CAGR of 10.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- Low-temperature sterilizers held the largest share of 35.0% in 2023.

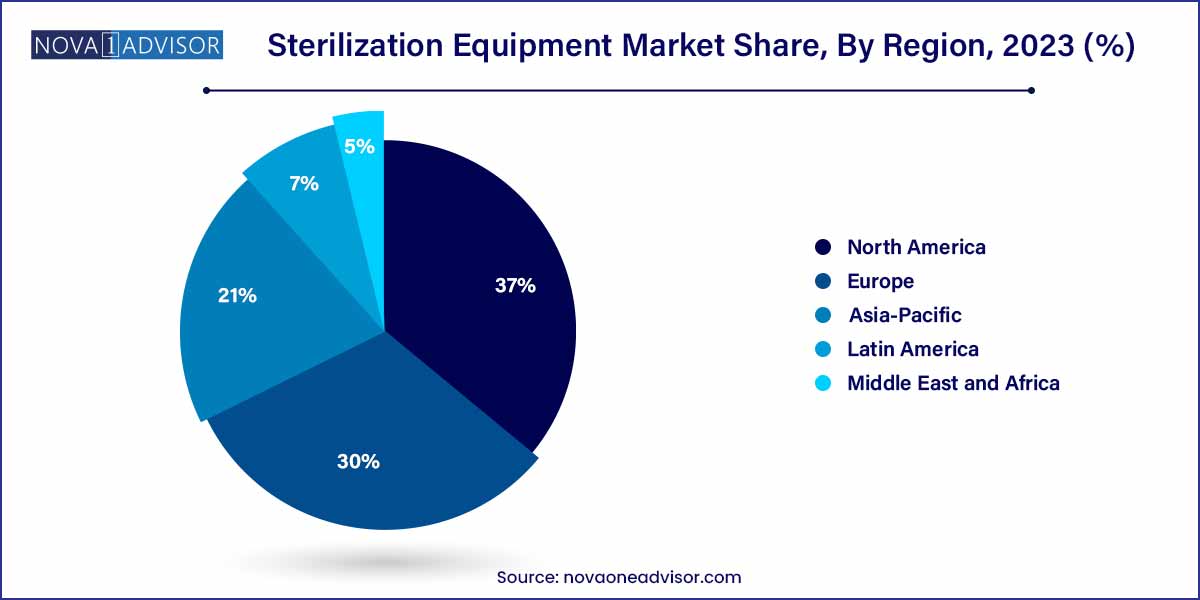

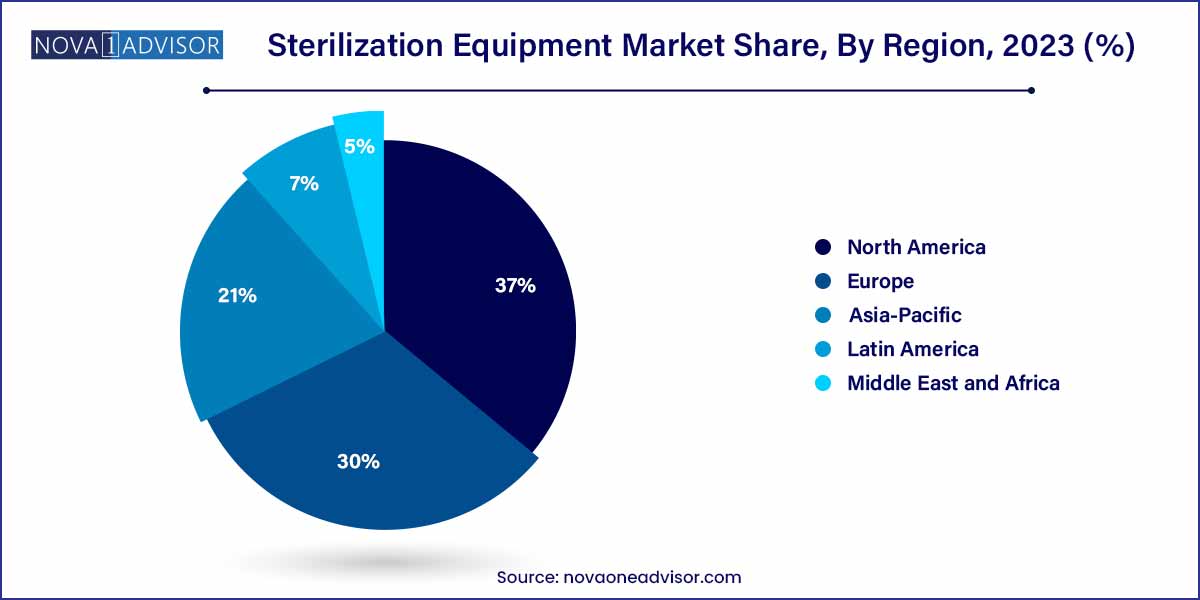

- North America dominated the market and accounted for over 37.0% of global revenue in 2023.

Market Overview

The global Sterilization Equipment Market has emerged as a critical component in ensuring patient safety, healthcare hygiene, pharmaceutical quality, and food safety. With sterilization processes forming the backbone of infection control, demand for advanced, efficient, and environmentally friendly sterilization equipment has grown substantially across hospitals, pharmaceutical companies, research laboratories, and the food & beverage industries.

The COVID-19 pandemic sharply accelerated investments in sterilization technologies as organizations worldwide prioritized disinfection and infection prevention protocols. Beyond the pandemic, rising surgical procedures, healthcare-associated infections (HAIs), increased emphasis on reusable medical devices, and stringent regulatory requirements continue to drive the market.

Innovations in low-temperature sterilization, radiation sterilization, and integration of automation and monitoring systems have transformed traditional sterilization practices. Additionally, the increasing need for cost-effective and rapid sterilization methods is prompting manufacturers to focus on versatile, user-friendly, and sustainable solutions. With healthcare systems emphasizing preventive care, the sterilization equipment market is projected to witness robust expansion in the coming years.

Major Trends in the Market

-

Shift Toward Low-temperature Sterilization: Demand for technologies like hydrogen peroxide sterilization is rising to accommodate heat-sensitive instruments.

-

Adoption of Radiation-based Sterilization Methods: Gamma rays, electron beams, and X-rays are increasingly used, especially in the pharmaceutical and medical device industries.

-

Integration of IoT and Automation: Smart sterilizers with remote monitoring and real-time tracking capabilities are gaining popularity.

-

Focus on Eco-friendly Sterilization Techniques: Manufacturers are developing devices that minimize energy consumption and chemical use.

-

Expansion of Central Sterile Services Departments (CSSDs): Hospitals are investing in centralized sterilization units to streamline operations.

-

Growing Demand in Emerging Markets: Rapid healthcare infrastructure development in Asia-Pacific and Latin America is creating new opportunities.

-

Stringent Regulatory Standards: Compliance with infection control standards from agencies like FDA, CDC, and WHO is boosting equipment upgrades.

-

Increased Outsourcing of Sterilization Services: Many pharmaceutical and medical device companies are outsourcing sterilization to specialized service providers.

Sterilization Equipment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.20 Billion |

| Market Size by 2033 |

USD 20.08 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

STERIS PLC; Sterigenics U.S. LLC; Cantel Medical; E-BEAM Services, Inc.; Fortive. |

Driver: Rising Incidence of Healthcare-associated Infections (HAIs)

One of the most significant drivers of the sterilization equipment market is the global rise in healthcare-associated infections (HAIs). HAIs affect millions of patients annually, leading to extended hospital stays, higher medical costs, and increased mortality rates.

Effective sterilization of surgical instruments, patient care devices, and hospital environments is crucial to preventing HAIs. Governments and healthcare organizations worldwide are enforcing strict guidelines for sterilization practices, propelling investments in advanced equipment. Moreover, public awareness about hospital-acquired infections and demand for high standards of care are further strengthening the market for sterilization solutions.

Restraint: High Capital and Operational Costs

Despite the growing need for sterilization equipment, high initial capital investment and ongoing operational costs act as significant barriers, particularly for small and medium-sized healthcare facilities. Advanced sterilization devices, including ethylene oxide sterilizers, gamma radiation chambers, and hydrogen peroxide systems, entail substantial purchase and maintenance expenses.

Additionally, specialized infrastructure requirements, such as ventilation systems and trained personnel for handling complex sterilization processes, further elevate costs. For emerging economies and smaller hospitals, cost remains a crucial limiting factor, hindering broader adoption of state-of-the-art sterilization technologies.

Opportunity: Technological Advancements in Portable and Automated Sterilizers

An exciting opportunity lies in the development of portable, compact, and automated sterilization solutions. Portable autoclaves, table-top sterilizers, and mobile radiation units are addressing the need for flexible and decentralized sterilization, particularly in ambulatory surgical centers, dental clinics, military field hospitals, and remote healthcare facilities.

Automated sterilizers integrated with IoT platforms enable real-time monitoring, predictive maintenance, and compliance reporting, reducing human error and operational inefficiencies. Companies that invest in lightweight, rapid-cycle, user-friendly sterilization devices with automated controls and remote accessibility are well-positioned to capitalize on the evolving market needs.

Product Insights

Heat sterilizers dominated the sterilization equipment market in 2023. Instruments like steam autoclaves and depyrogenation ovens are widely used due to their proven efficacy, reliability, and cost-effectiveness. Steam autoclaves, particularly, are considered the gold standard for sterilizing surgical instruments and hospital materials, offering broad-spectrum microbial kill at high efficiency.

However, low-temperature sterilizers are projected to experience the fastest growth. As modern medical devices become more complex and sensitive to heat and moisture, demand for low-temperature sterilization technologies such as ethylene oxide (EtO) sterilizers and hydrogen peroxide plasma systems is rising. These methods are crucial for ensuring the sterility of delicate instruments like endoscopes, robotic surgery devices, and electronics.

Additional Product Insights

Among radiation sterilization devices, gamma ray technology held a significant share due to its deep penetration capability and effectiveness for bulk sterilization. However, electron beam sterilization is gaining popularity for its rapid processing times and minimal material degradation, particularly in the pharmaceutical and medical device sectors.

Sterile membrane filters also represent a key growth area, driven by applications in pharmaceutical manufacturing, laboratory settings, and food & beverage processing industries where sterile filtration is critical.

Regional Insights

North America led the sterilization equipment market in 2023, accounting for the largest revenue share. Factors such as the presence of advanced healthcare infrastructure, stringent infection control standards, a high number of surgical procedures, and strong regulatory oversight by the FDA and CDC contribute to regional dominance.

The United States has witnessed significant investments in hospital CSSDs, pharmaceutical manufacturing facilities, and medical device sterilization units. Major players like STERIS Corporation, Getinge AB, and ASP (Advanced Sterilization Products) are headquartered in North America, driving continual innovation and market leadership.

Asia-Pacific is expected to record the fastest growth rate during the forecast period. Rapid healthcare infrastructure development, rising surgical volumes, increasing incidence of HAIs, and improving regulatory frameworks are fueling demand for sterilization equipment in countries like China, India, and Japan.

Additionally, expanding pharmaceutical production, government initiatives to upgrade public health systems, and growing medical tourism are creating lucrative opportunities for sterilization equipment manufacturers. Strategic partnerships between local distributors and multinational companies are further enhancing market penetration in the region.

Some of the prominent players in the sterilization equipment market include:

- STERIS PLC.

- Sterigenics U.S., LLC

- Cantel Medical

- E-BEAM Services, Inc.

- Fortive

Recent Developments

-

March 2025: STERIS plc announced the launch of its new "V-PRO® maX 2 Low-Temperature Sterilization System," offering improved throughput and sustainability features.

-

January 2025: Getinge AB introduced "GSS67H" Series steam sterilizers, featuring enhanced energy efficiency and digital connectivity for hospital CSSDs.

-

December 2024: 3M Company expanded its "Attest Rapid Readout" line of biological indicators, designed to shorten sterilization cycle monitoring times.

-

November 2024: Sotera Health’s Nordion division initiated the construction of a new gamma irradiation facility in North America to meet rising sterilization demands.

-

September 2024: Belimed AG partnered with Microsoft Azure to develop cloud-based sterilization tracking and predictive maintenance solutions.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global sterilization equipment market.

Product

-

- Depyrogenation Oven

- Steam Autoclaves

- Low-temperature Sterilizers

-

- Ethylene Oxide Sterilizers

- Hydrogen Peroxide Sterilizers

- Others

- Sterile Membrane Filters

- Radiation Sterilization Devices

-

- Electron Beams

- Gamma Rays

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)