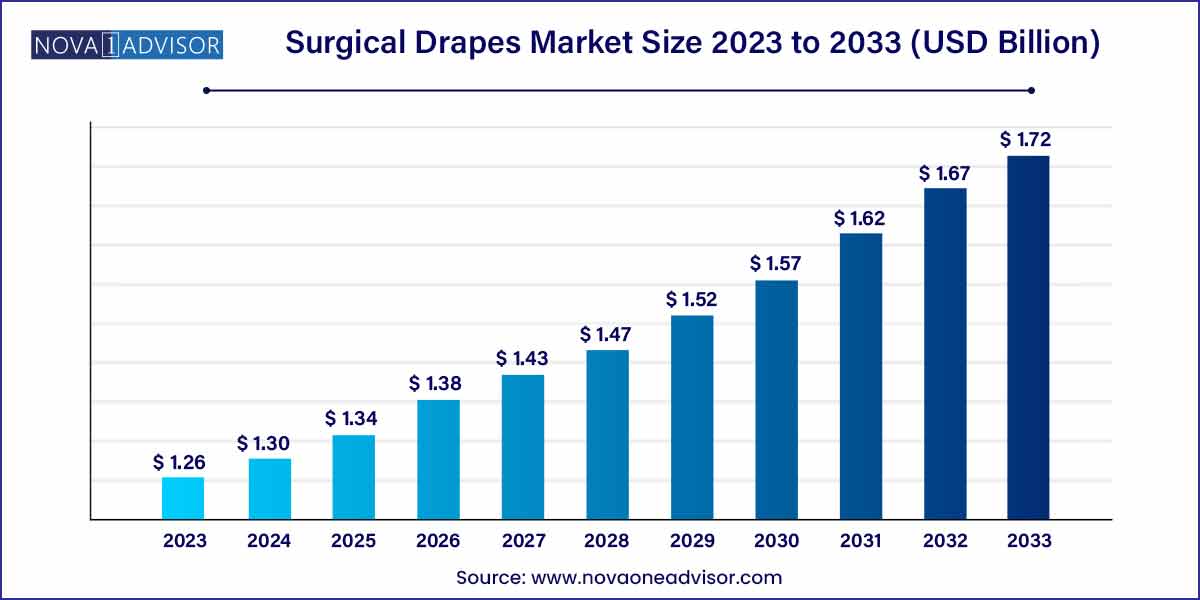

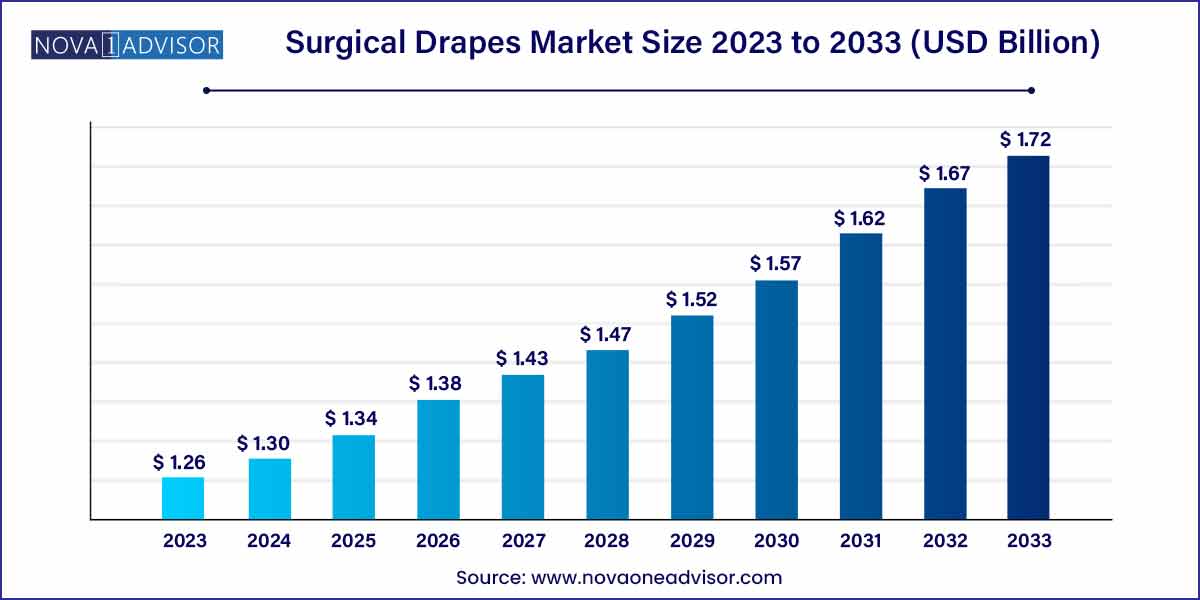

The global surgical drapes market was exhibited at USD 1.26 billion in 2023 and is projected to hit around USD 1.72 billion by 2033, growing at a CAGR of 3.19% during the forecast period of 2024 to 2033.

Key Takeaways:

- Reusable surgical drapes held the largest revenue share of over 55.0% in 2023.

- The disposable segment is anticipated to expand at the fastest growth rate of 3.4% over the forecast period.

- Moderate (AAMI Level 3) risk surgical drapes held the largest revenue share of over 30.0% in 2023 and are expected to witness the fastest growth over the forecast period.

- The hospital segment held the largest revenue share of over 41.0% in 2023.

- Asia Pacific dominated the market in 2023 with a revenue share of over 26.0%.

Market Overview

The surgical drapes market has cemented itself as a vital component of the broader surgical equipment industry. Surgical drapes are essential barriers that prevent microbial contamination during surgical procedures, safeguarding both the patient and surgical staff. Available in various materials, sizes, and levels of barrier protection, surgical drapes are used across an extensive range of surgeries, from minor outpatient procedures to complex, high-risk operations.

The importance of surgical drapes has grown with increasing surgical volumes globally, a rising focus on hospital-acquired infection (HAI) prevention, and the emergence of stricter sterilization protocols. The healthcare industry’s shift toward minimally invasive surgeries and outpatient surgeries has further propelled demand for specialized, high-quality draping solutions that ensure sterility and efficient workflow. Innovation within the market, including the development of disposable, antimicrobial-coated, and procedure-specific drapes, continues to drive adoption. With sustainability initiatives gaining momentum, the market is also witnessing a surge in eco-friendly and biodegradable drape products.

Major Trends in the Market

-

Surge in preference for disposable drapes: Single-use drapes are favored for their sterility assurance, ease of use, and reduced infection risks.

-

Integration of antimicrobial technologies: Drapes embedded with antimicrobial agents are gaining popularity for enhanced infection control.

-

Customization and procedure-specific drapes: Tailored drapes for orthopedic, cardiac, and neurosurgical procedures are increasingly demanded.

-

Sustainability initiatives: Manufacturers are introducing biodegradable and recyclable drapes to reduce environmental impact.

-

Rising demand from ambulatory surgical centers: ASCs require compact, procedure-ready sterile draping kits for faster turnover.

-

Emergence of smart textiles: Research into intelligent drapes capable of detecting contamination or wound leakage is underway.

-

Strengthening regulatory requirements: Stricter FDA, EU-MDR, and WHO guidelines on surgical environment safety are driving demand for advanced draping solutions.

Surgical Drapes Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.26 Billion |

| Market Size by 2033 |

USD 1.72 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.19% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Risk Type, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M; Cardinal Health; Molnlycke Health Care AB; Steris; Paul Hartmann AG; Standard Textile Co.; Medline Industries, Inc.; Priontex; OneMed; Medic. |

Type Insights

Disposable surgical drapes dominated the type segment in 2024. Single-use surgical drapes provide superior sterility assurance and eliminate the logistical complexities of reprocessing. In high-volume surgical centers, disposables offer logistical convenience, time savings, and lower labor costs. Particularly during the COVID-19 pandemic, the demand for disposable barriers surged dramatically to minimize cross-contamination risks, cementing their dominant status in the market.

Reusable surgical drapes are anticipated to grow rapidly due to sustainability concerns. As environmental awareness spreads, many hospitals are reconsidering reusable drapes made of high-grade, durable fabrics. Modern reusable drapes offer excellent liquid barrier properties and withstand multiple sterilization cycles without compromising performance. The cost-effectiveness of reusables over the long term is another factor influencing their growing acceptance, especially in Europe and parts of Asia.

Risk Type Insights

Moderate Risk (AAMI Level 3) drapes dominated the risk type segment in 2024. Level 3 drapes, offering moderate fluid resistance, are widely used for surgeries involving moderate amounts of fluid exposure, such as orthopedic and cardiovascular procedures. Their versatility across multiple surgical fields ensures higher utilization rates compared to other drape types.

High Risk (AAMI Level 4) drapes are projected to be the fastest-growing segment. As surgeries become more complex and procedures such as organ transplants, trauma surgeries, and oncological resections rise, the demand for high-risk surgical drapes—offering the highest fluid resistance—is surging. Hospitals increasingly prefer AAMI Level 4 drapes for critical surgeries to maximize infection control.

End-use Insights

Hospitals dominated the end-use segment in 2024. Hospitals, especially large tertiary-care centers, handle diverse and high volumes of surgeries daily, necessitating significant quantities of surgical drapes. Their well-established sterilization infrastructure and robust infection control protocols drive consistent demand for premium quality drapes tailored to specific surgical requirements.

Ambulatory Surgical Centers (ASCs) are expected to be the fastest-growing end-use segment. The global healthcare trend toward outpatient and day-care surgeries has fueled ASC expansion. ASCs prioritize quick surgical turnovers, and thus highly value pre-packaged disposable draping systems. The growth in minimally invasive procedures aligns perfectly with ASC operational models, promoting faster adoption of lightweight, efficient draping solutions.

Regional Insights

North America dominated the surgical drapes market in 2024. The region’s leadership stems from a combination of high surgical volumes, stringent infection control regulations, and an early shift toward disposable surgical solutions. The United States alone accounts for a significant share of global surgical procedures, supported by a dense network of hospitals, surgical centers, and ambulatory care units. Major players like Cardinal Health, 3M, and Medline Industries drive constant product innovation, ensuring that the region maintains a competitive edge in surgical draping technologies. Additionally, hospital accreditation bodies such as the Joint Commission heavily emphasize sterile surgical environments, reinforcing consistent demand for premium drapes.

Asia-Pacific is projected to be the fastest-growing region. Rising healthcare investments, expanding insurance coverage, and growing medical tourism have significantly increased surgical procedure volumes across countries like India, China, and Southeast Asia. Improved access to healthcare facilities coupled with a rising awareness of infection prevention practices is boosting surgical drape adoption. Regional healthcare providers are increasingly opting for procedure-specific, cost-effective, and sustainable draping solutions to cater to burgeoning patient demands. Additionally, the rapid growth of private hospitals and specialized clinics in Asia-Pacific contributes to a robust market expansion trajectory.

Some of the prominent players in the surgical drapes market include:

- 3M

- Cardinal Health

- Mölnlycke Health Care

- Steris

- Paul Hartmann AG

- Standard Textile Co.

- Medline Industries, Inc.

- Priontex

- OneMed

- Medic

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global surgical drapes market.

Type

Risk Type

- Minimal (AAMI Level 1)

- Low (AAMI Level 2)

- Moderate (AAMI Level 3)

- High (AAMI Level 4)

End-use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)