Surgical Simulation Market Size and Research

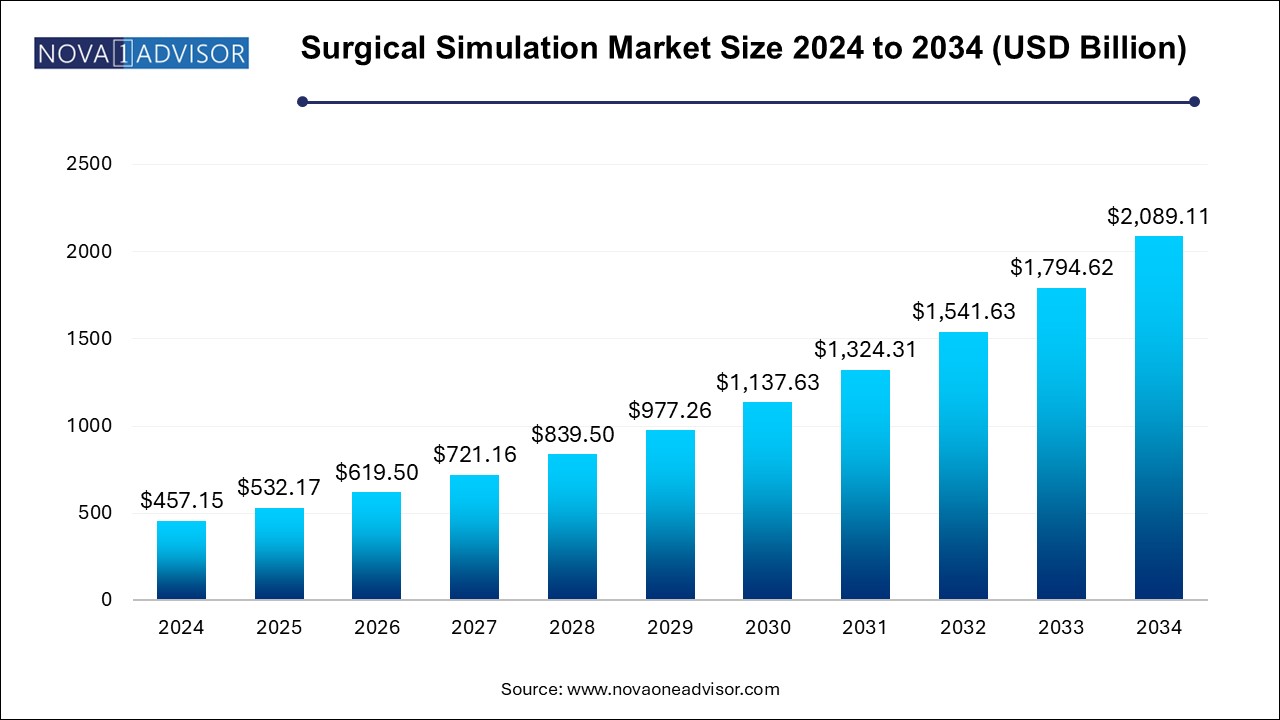

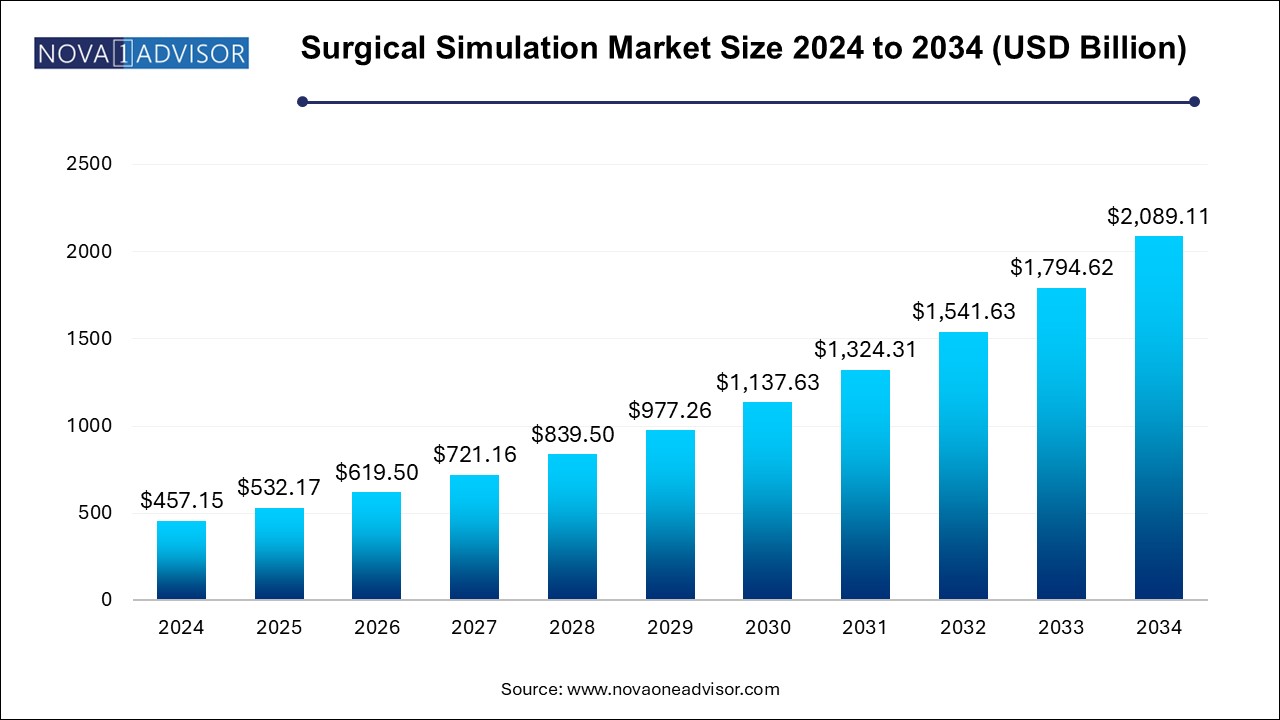

The surgical simulation market size was exhibited at USD 457.15 million in 2024 and is projected to hit around USD 2,089.11 million by 2034, growing at a CAGR of 16.41% during the forecast period 2024 to 2034.

Surgical Simulation Market Key Takeaways:

- The orthopedic surgery segment dominated the market with a revenue share of 31.75% in 2024.

- However, the reconstructive surgery segment is anticipated to witness the fastest CAGR of 17.20% over the forecast period.

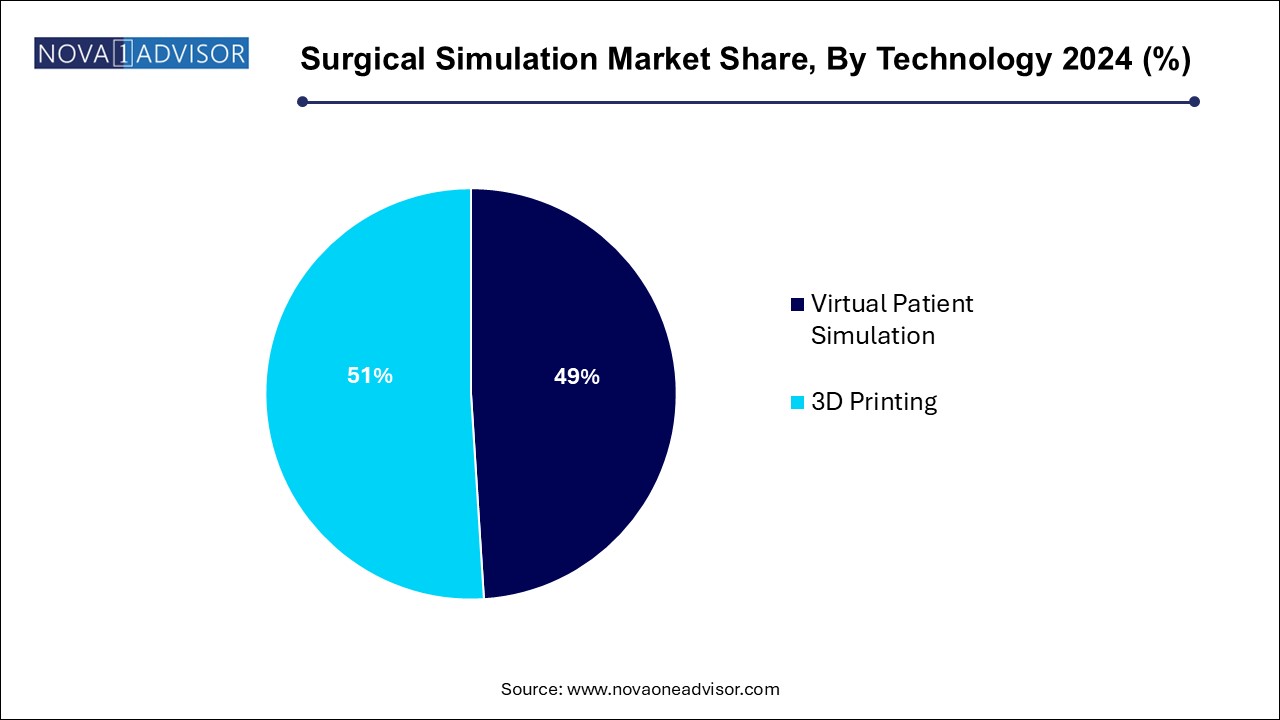

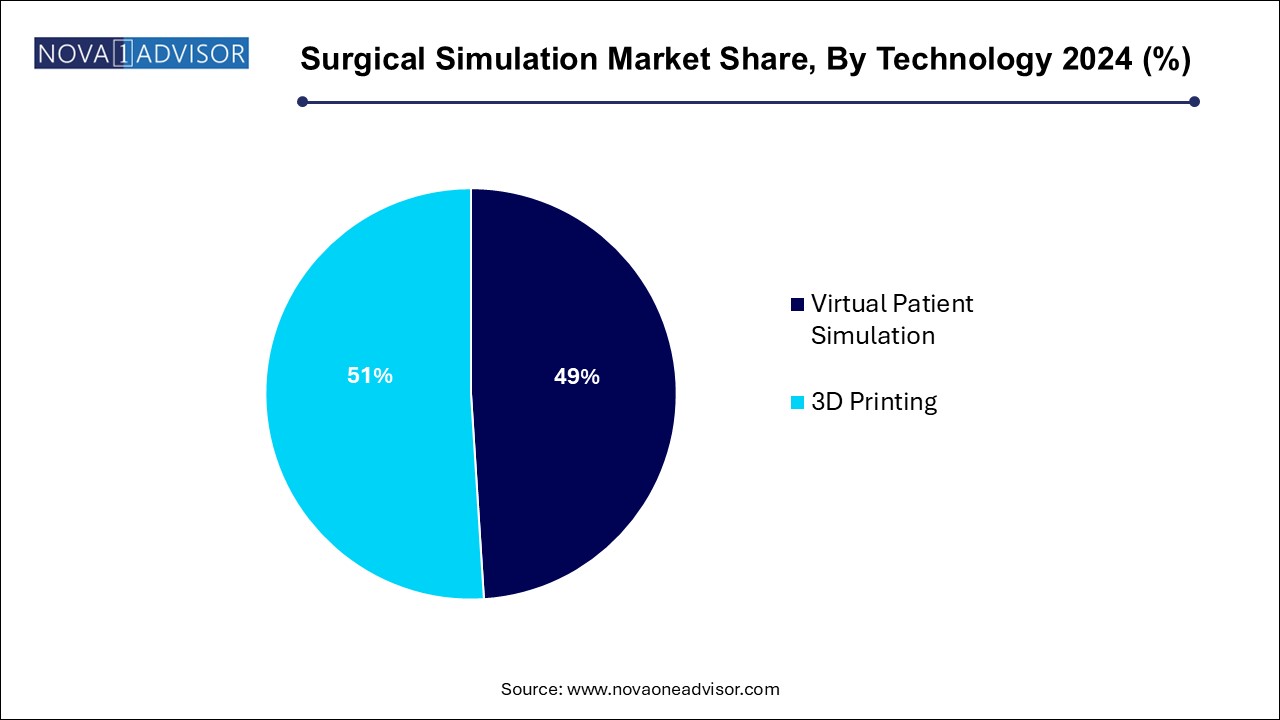

- The 3D printing segment dominated the market with the largest share of over 51% in 2024.

- The research organizations segment dominated the market with the largest revenue share in 2024.

- The hospitals segment is expected to witness the fastest CAGR over the forecast period.

- North America surgical simulation market held the largest global revenue share of 35.88% in 2024.

Market Overview

The Surgical Simulation Market has rapidly emerged as a critical facet of healthcare education and clinical training. By integrating advanced technologies like virtual reality (VR), augmented reality (AR), and 3D printing, surgical simulation allows healthcare professionals to enhance their surgical competencies, improve hand-eye coordination, and rehearse complex procedures without risking patient safety.

The need for surgical simulation is largely driven by global concerns regarding patient outcomes, surgical errors, and the evolving nature of surgical interventions. Traditional surgical training, which relied heavily on observation and cadaver dissection, has been increasingly supplemented and in some cases, replaced by immersive, repeatable simulation-based models. These platforms provide high-fidelity anatomical realism, immediate performance feedback, and the ability to tailor practice scenarios according to a trainee’s skill level.

In light of growing healthcare digitization and the increasing emphasis on competency-based education, academic institutions, hospitals, and military organizations are adopting surgical simulators to bolster training. Moreover, the ongoing global shortage of surgical professionals has made it imperative to deploy efficient and scalable training platforms. With rising technological investments and supportive regulatory environments, the surgical simulation market is poised for strong, sustained growth in the years ahead.

Major Trends in the Market

-

Integration of Artificial Intelligence in Surgical Simulators: AI enhances learning pathways, provides adaptive feedback, and identifies individual training gaps.

-

Growth of Virtual Reality and Augmented Reality Platforms: Fully immersive VR-based simulators are becoming the standard for neurosurgery and orthopedic training.

-

Expansion of Simulation in Robotic Surgery: With robotic-assisted surgery becoming more prevalent, simulators are being developed to train surgeons on robotic interfaces like the Da Vinci system.

-

Cloud-based Simulation Platforms: Cloud connectivity allows for remote access, real-time performance analytics, and peer collaboration across geographies.

-

Use of 3D Printing for Anatomical Models: Surgeons can now train on patient-specific models generated from imaging data for preoperative planning.

-

Adoption in Continuing Medical Education (CME): Surgical simulation is increasingly being recognized for re-certification and continuous skill enhancement.

-

Public-Private Partnerships in Simulation Training: Governments are collaborating with tech firms to integrate simulation in public medical curricula.

-

Rise in Gamification Techniques: Simulation vendors are incorporating game mechanics to enhance engagement and learning retention.

-

Integration of Haptics for Enhanced Tactile Feedback: Tactile realism is improving with sophisticated force-feedback devices.

-

Multi-specialty Simulators Gaining Popularity: Simulators covering a broad range of surgical domains are replacing single-specialty systems.

Report Scope of Surgical Simulation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 532.17 Million |

| Market Size by 2034 |

USD 2,089.11 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 16.41% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Specialty, Technology, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Materialise, Stratasys, CAE Inc., Surgical Science, Mentice, Gaumard Scientific, Simulab Corporation, VirtaMed AG, 3-Dmed Learning Through Simulation, Laerdal Medical, 3D Systems, Inc., Osteo3d, AXIAL3D, Formlabs, Kyoto Kagaku Co., Ltd. |

Key Market Driver: Rising Demand for Minimally Invasive and Robotic Surgeries

One of the most powerful drivers of the surgical simulation market is the rising demand for minimally invasive and robotic surgeries, which require exceptional precision and hand-eye coordination. Minimally invasive procedures reduce recovery time, pain, and hospital stays but also present steep learning curves for surgeons due to the limited tactile feedback and visualization compared to open surgery.

Simulation tools enable trainees to master these complex techniques in a risk-free environment. For instance, robotic simulators such as Mimic dV-Trainer offer surgeons the ability to train on robotic platforms similar to those used in actual surgeries. This reduces onboarding time, enhances confidence, and improves procedural efficiency. As global hospitals increasingly adopt robotic systems like Da Vinci and Versius, the demand for compatible training simulators is accelerating, directly boosting the growth of the surgical simulation market.

Key Market Restraint: High Cost of Simulator Installation and Maintenance

Despite their benefits, high acquisition and maintenance costs of surgical simulators remain a significant barrier to adoption, especially in low- and middle-income countries. Sophisticated simulators incorporating VR/AR, haptics, and AI-driven feedback loops can cost upwards of $100,000 per unit, excluding additional expenses for software licenses, infrastructure, and instructor training.

Moreover, frequent software updates, calibration, and hardware maintenance demand ongoing investment. These costs make it challenging for smaller academic institutions or rural hospitals to integrate simulation into their training workflows. Although cloud-based solutions and open-source platforms are emerging to address affordability, pricing remains a major limiting factor for market expansion.

Key Market Opportunity: Expansion of Simulation in Global Medical Education

An emerging opportunity lies in the integration of surgical simulation into global medical and residency training curricula. The shift from knowledge-based to competency-based education is gaining global traction, prompting institutions to adopt tools that can objectively measure surgical proficiency.

Accreditation bodies and licensing authorities are increasingly endorsing simulation-based assessment. For example, the American Board of Surgery and the Royal College of Surgeons in the UK have recognized simulation as part of core surgical training. As this trend gains ground, especially in Asia, Africa, and Latin America, there is significant potential for market expansion.

Vendors who can offer modular, multilingual, and cloud-based simulation solutions are well positioned to capitalize on this opportunity by enabling large-scale, standardized training programs across diverse educational environments.

Surgical Simulation Market By Specialty Insights

Orthopedic Surgery dominated the surgical simulation market in 2024. This specialty involves high-risk, high-precision procedures where simulation-based skill enhancement is critical. Orthopedic simulators, particularly for joint replacement, arthroscopy, and spinal surgeries, have become mainstream due to the demand for minimally invasive interventions and the growing popularity of robotic orthopedic systems. Companies like VirtaMed and OSSimTech offer platforms that replicate complex bone structures and biomechanical feedback, allowing for highly realistic orthopedic training.

Neurosurgery is projected to be the fastest-growing specialty segment. Given the delicate nature of brain and spine surgeries, any error can result in severe, irreversible outcomes. Neurosurgical simulators utilizing high-resolution VR environments, real-time tactile feedback, and patient-specific imaging integration are enabling surgeons to plan and rehearse critical procedures before entering the OR. As neurosurgery techniques evolve, especially in tumor resection and endoscopic interventions, demand for next-gen simulators is increasing rapidly.

Surgical Simulation Market By Technology Insights

Virtual Patient Simulation led the technology segment in 2024. Virtual patient simulations offer lifelike environments where students and professionals can interact with dynamic 3D avatars that mimic real patient responses. These platforms are integral to both preclinical learning and surgical practice, facilitating diagnostic reasoning, communication skills, and procedural decision-making. VR simulators such as those offered by Surgical Science and CAE Healthcare are in high demand due to their versatility across multiple specialties.

3D Printing is emerging as the fastest-growing technology segment. The use of 3D-printed anatomical models is revolutionizing hands-on surgical training and preoperative planning. These models, derived from real patient imaging, allow for tactile practice and personalized rehearsal of complex cases such as tumor excisions, organ reconstructions, or vascular surgeries. With falling costs of 3D printing materials and enhanced anatomical accuracy, adoption is surging across academic and research institutions.

Surgical Simulation Market By End Use Insights

Academic Institutes accounted for the largest share of the end-use market in 2024. Medical schools and teaching hospitals are primary adopters of surgical simulation, integrating it into undergraduate and postgraduate training. The need to enhance student competence, reduce dependency on cadavers, and align with accreditation standards has driven high demand. Simulation labs equipped with VR stations, physical task trainers, and digital scoring systems are now essential infrastructure in top institutions globally.

Military Organizations represent the fastest-growing end-use segment. Military medical units require rapid deployment training in battlefield surgeries, trauma management, and emergency evacuations. Simulation offers mobile, on-demand, and scalable solutions for preparing medics and surgeons for high-pressure environments. Advanced haptic VR systems and manikin-based simulations are increasingly used by defense healthcare forces in the U.S., UK, Israel, and India.

Surgical Simulation Market By Regional Insights

North America continues to dominate the surgical simulation market due to a combination of advanced healthcare infrastructure, high per capita healthcare spending, and strong academic research institutions. The presence of global leaders such as CAE Healthcare, Surgical Science, and Simbionix (3D Systems) has fostered innovation and widespread adoption across universities, hospitals, and military healthcare systems.

The U.S. leads in integrating simulation into board certification processes, funded simulation research, and collaborations between tech companies and surgical societies. Government support and a robust venture capital ecosystem also contribute to North America's leadership position.

Asia Pacific is witnessing the fastest growth in the surgical simulation market, driven by a rising demand for surgical training, rapid healthcare infrastructure development, and increased investment in medical education. Countries like China, India, Japan, and South Korea are adopting simulation to address skill gaps in their large, growing healthcare workforces.

Governments and private hospitals are investing in simulation labs to improve training outcomes and meet global surgical standards. In India, initiatives such as the National Skill Development Corporation (NSDC) are promoting simulation-based training in surgical and allied healthcare domains. With the growing middle-class demand for safe surgical outcomes, APAC represents a significant long-term growth frontier.

Some of the prominent players in the surgical simulation market include:

- Materialise

- Stratasys

- CAE Inc.

- Surgical Science

- Mentice

- Gaumard Scientific

- Simulab Corporation

- VirtaMed AG

- 3-Dmed Learning Through Simulation

- Laerdal Medical

- 3D Systems, Inc.

- Osteo3d

- AXIAL3D

- Formlabs

- Kyoto Kagaku Co., Ltd.

Surgical Simulation Market By Recent Developments

-

March 2025 – CAE Healthcare announced the release of VimedixAR™, an augmented reality ultrasound and surgical training system integrated with Microsoft HoloLens 3.

-

January 2025 – Surgical Science completed the acquisition of Mimic Technologies to expand its product line for robotic surgery training simulators.

-

December 2024 – VirtaMed launched a new mixed reality simulator for knee arthroscopy, combining tactile feedback with immersive visualization.

-

September 2024 – 3D Systems (Simbionix) unveiled a next-generation cranial neurosurgery simulation suite using patient-derived imaging data.

-

July 2024 – Osso VR secured $66 million in Series C funding to develop expanded modules for orthopedic and spine surgery simulation with built-in performance analytics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the surgical simulation market

Specialty

- Cardiac Surgery

- Gastroenterology

- Neurosurgery

- Orthopedic Surgery

- Reconstructive Surgery

- Oncology Surgery

- Transplant

- Others

Technology

- Virtual Patient Simulation

- 3D Printing

End Use

- Academic Institutes

- Hospitals

- Military Organizations

- Research Organizations

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)