T-cell Therapy Market Size and Growth 2026 to 2035

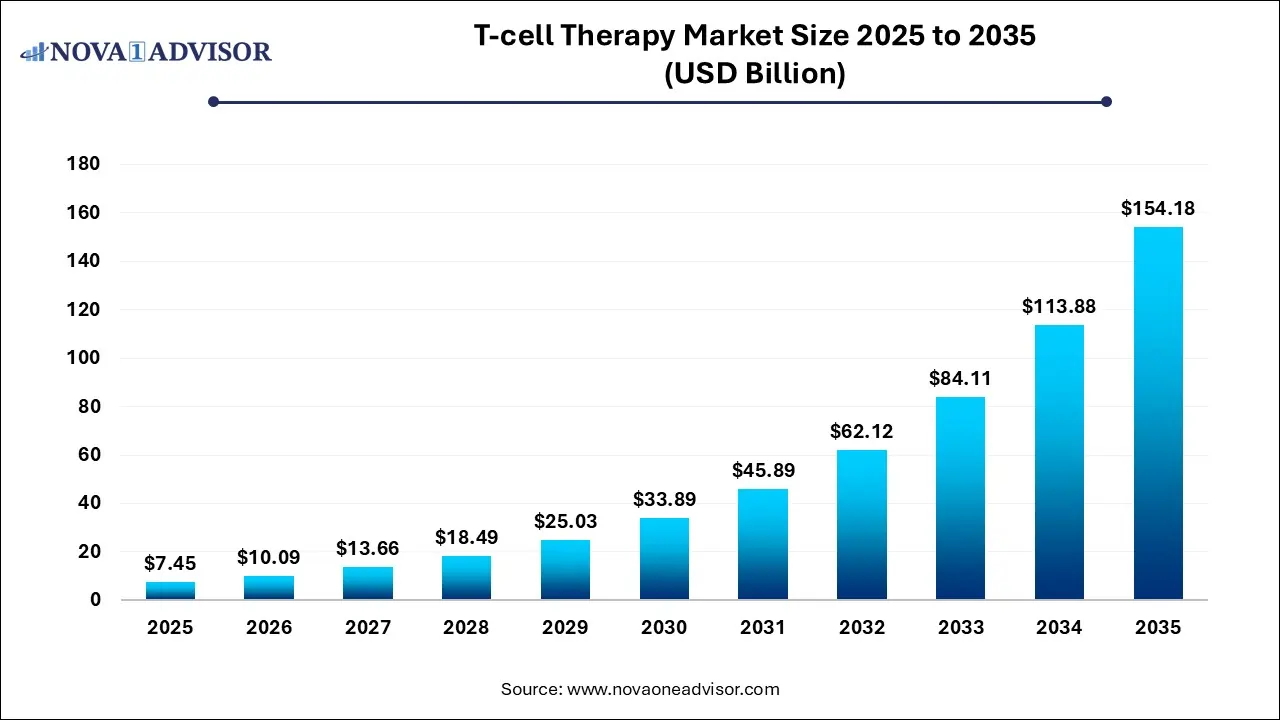

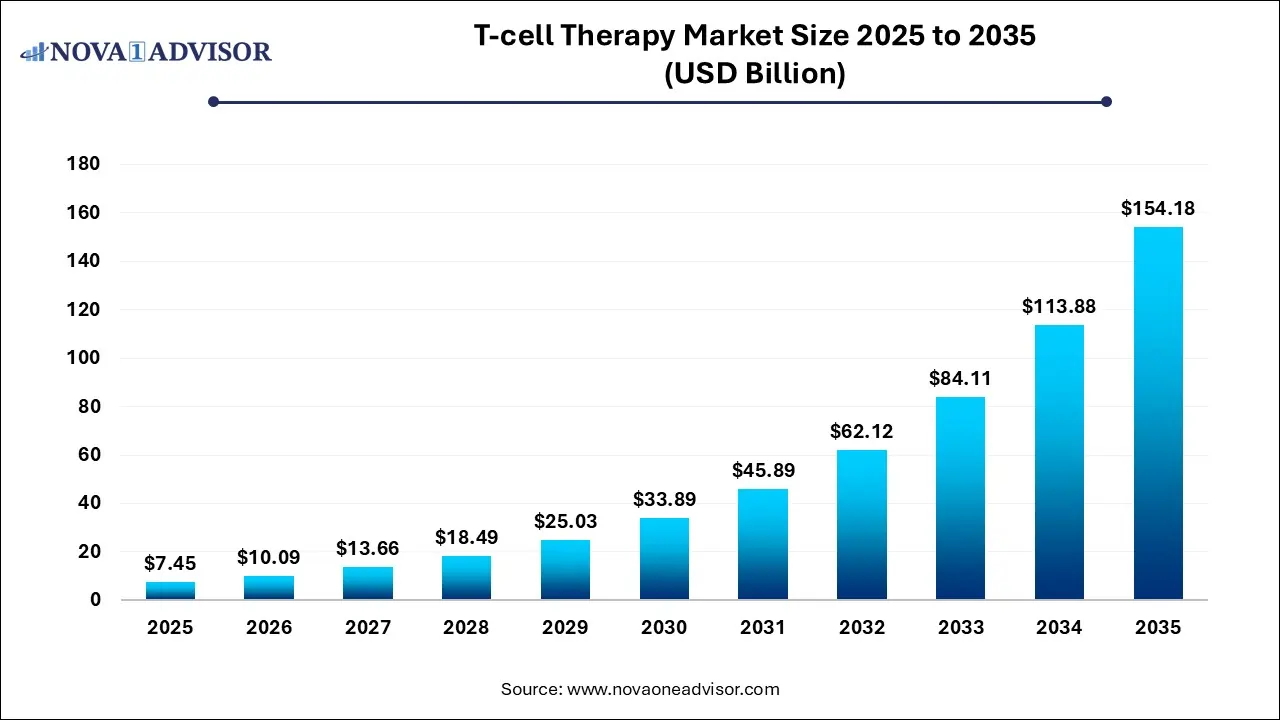

The global T-Cell therapy market size was exhibited at USD 7.45 billion in 2025 and is projected to hit around USD 154.18 billion by 2035, growing at a CAGR of 35.39% during the forecast period 2026 to 2035.

Key Takeaways:

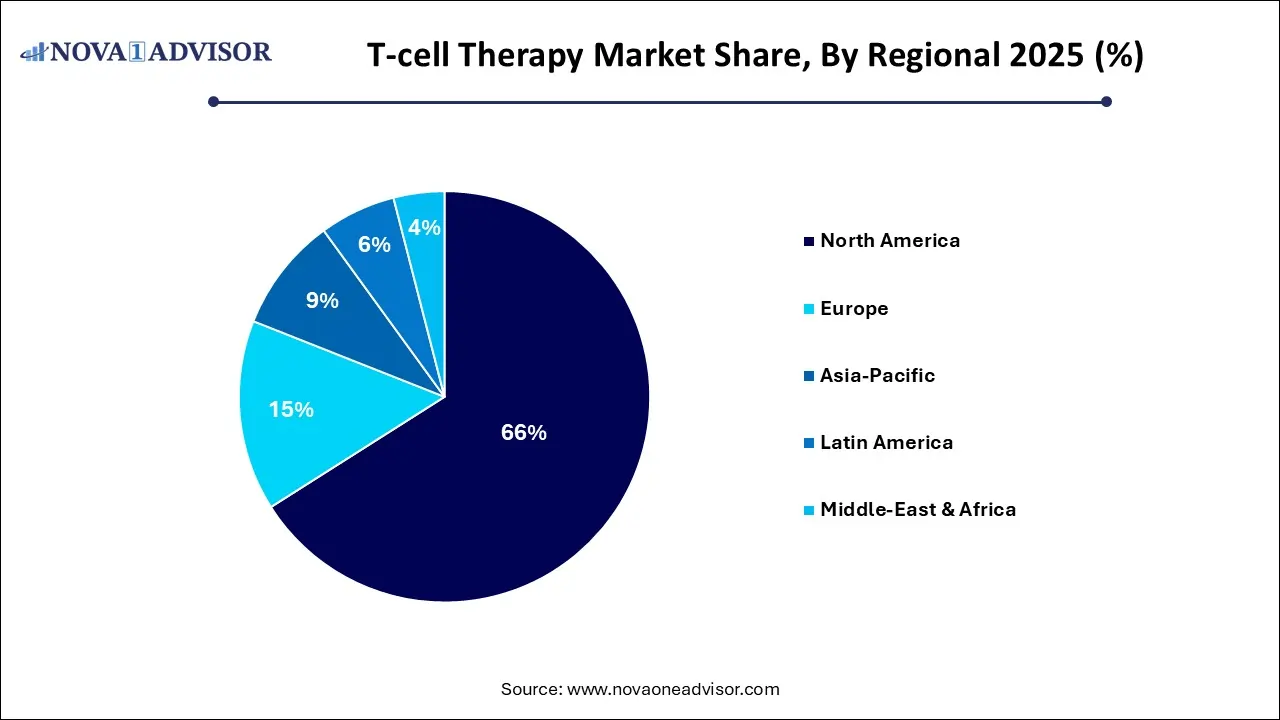

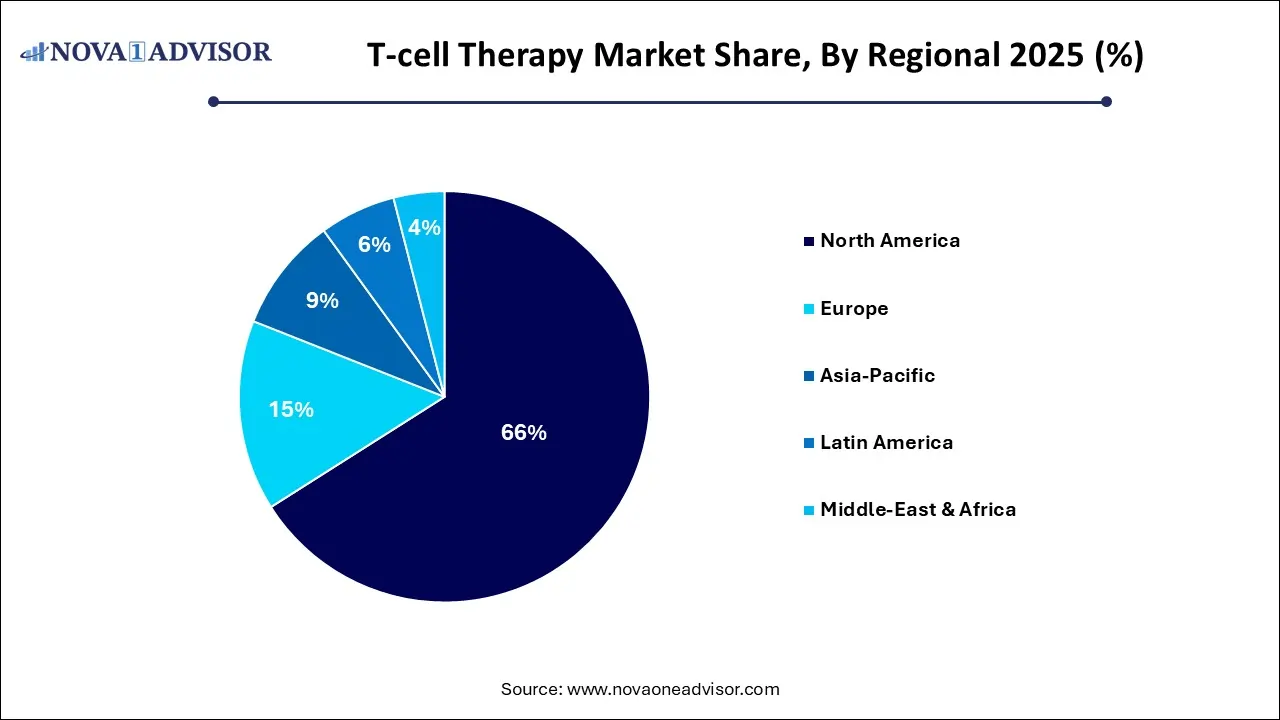

- North America held around 66.0% revenue share of the T-Cell therapy market in 2025.

- The CAR-T therapies held the highest share of 95.66% in 2025.

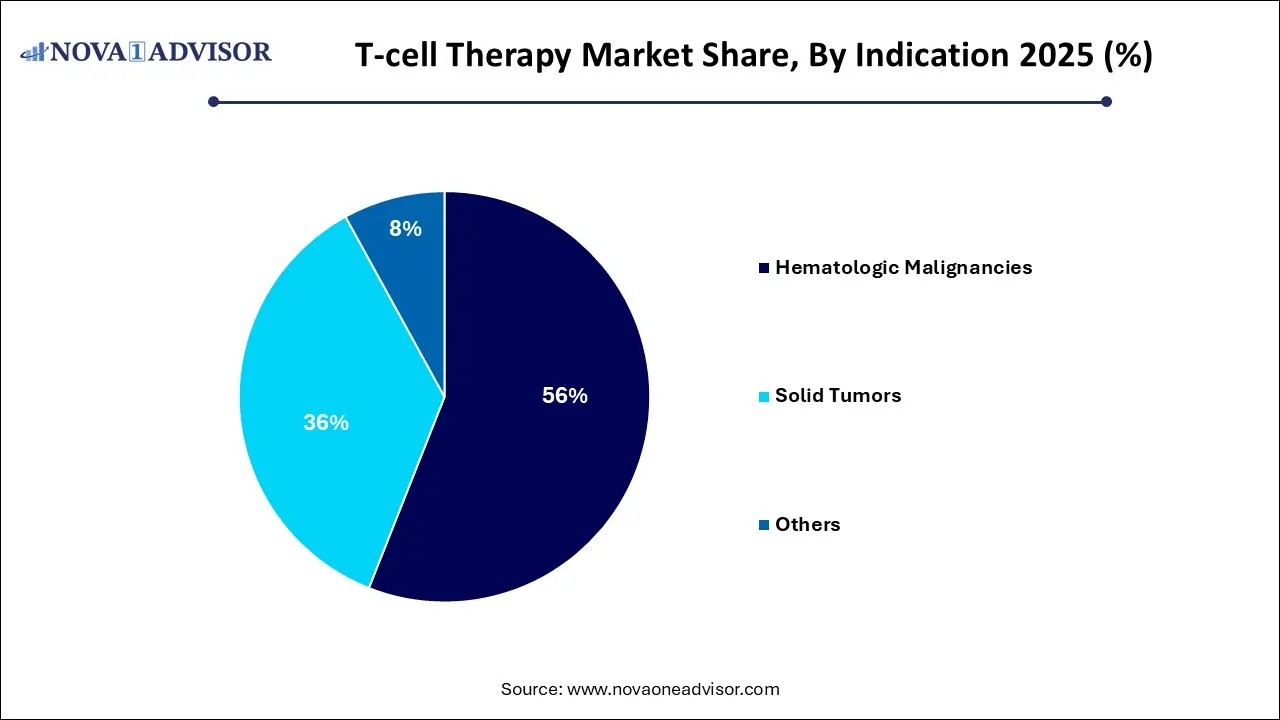

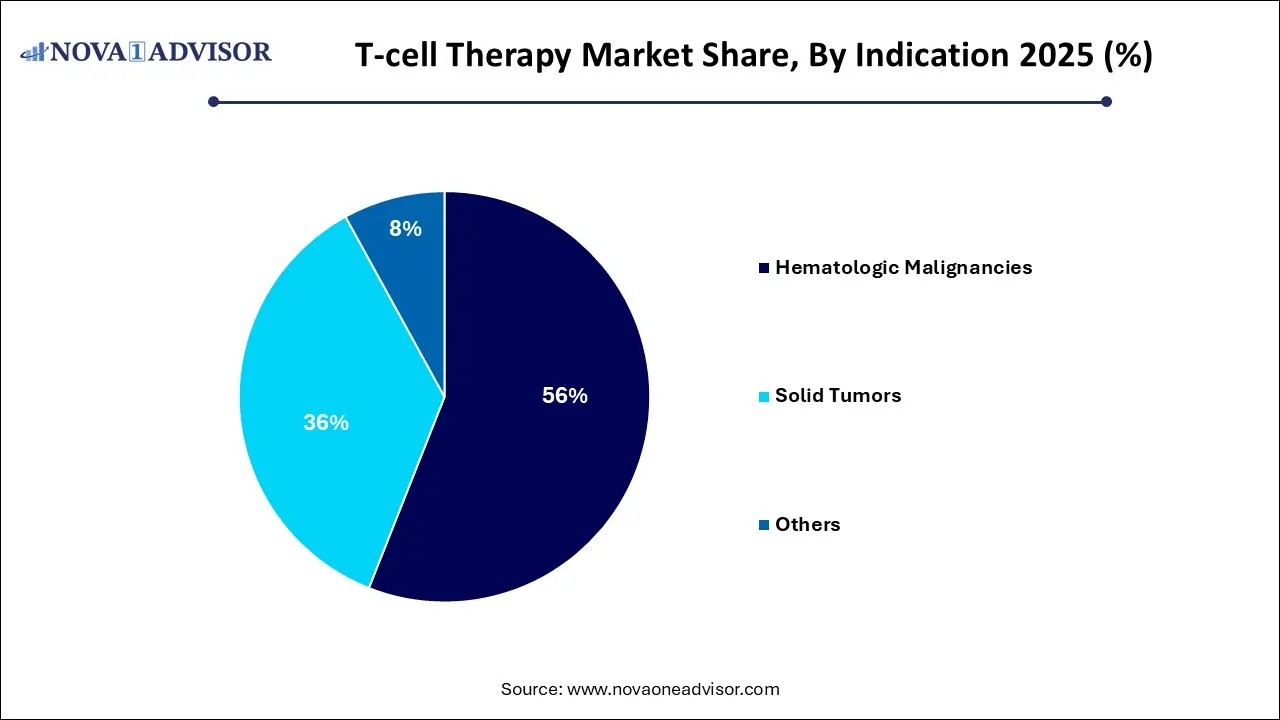

- Hematological malignancies hold a major revenue share of over 56% in 2025.

Market Overview

T-cell therapy has evolved into one of the most transformative advancements in the field of cancer immunotherapy. It utilizes the patient’s own T-cells engineered or naturally reactive to detect and destroy malignant cells, offering precision treatment with the potential for long-term remission. Since the first CAR T-cell therapy received FDA approval in 2017, the T-cell therapy market has rapidly gained traction, spurred by clinical success, regulatory support, and surging investments from both public and private sectors.

Unlike traditional cancer therapies such as chemotherapy or radiation, T-cell therapies target cancer at a cellular level, minimizing collateral damage to healthy tissues. This approach holds significant promise for treating hematologic malignancies and solid tumors that have proven resistant to conventional treatment. The mechanism typically involves extracting T-cells from a patient, modifying or expanding them ex vivo (outside the body), and reinfusing them to bolster the immune response.

CAR T-cell therapy has emerged as the most well-established T-cell modality, with products like Kymriah (Novartis) and Yescarta (Kite Pharma/Gilead) revolutionizing the treatment landscape for leukemia and lymphoma. Meanwhile, therapies based on T-cell receptors (TCRs) and tumor-infiltrating lymphocytes (TILs) are undergoing intensive research and clinical trials, particularly for addressing solid tumors such as melanoma and glioblastoma.

The future of the T-cell therapy market lies in expanding indications, optimizing manufacturing, and democratizing access to these highly individualized treatments. As of 2024, hundreds of clinical trials are underway globally, promising new frontiers in autoimmune diseases, infectious diseases, and beyond.

Major Trends in the Market

-

Surge in Personalized Oncology: Increasing reliance on personalized T-cell therapies tailored to a patient’s tumor profile and immune characteristics.

-

Growth in Allogeneic (“Off-the-shelf”) T-cell Therapies: Development of donor-derived T-cell therapies to overcome manufacturing delays and reduce costs.

-

Use of Artificial Intelligence in Cell Engineering: AI-driven algorithms are optimizing TCR affinity selection, antigen targeting, and safety profiles.

-

Focus on Solid Tumors: Shift from hematologic malignancies to aggressive solid tumors like glioblastoma, pancreatic cancer, and metastatic melanoma.

-

Global Clinical Trial Expansion: Major academic and commercial trials are spreading to Asia-Pacific, Eastern Europe, and Latin America to diversify patient cohorts.

-

Integration with Gene Editing Technologies: Technologies like CRISPR-Cas9 are being applied to precisely modify T-cells to improve efficacy and reduce side effects.

-

Improved Cryopreservation and Supply Chain Management: To ensure cell viability during global transport, new standards in cold chain logistics are emerging.

T-cell Therapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 10.09 Billion |

| Market Size by 2035 |

USD 154.18 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 35.39% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Therapy Type, Indication, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Novartis AG; Merck KGaA; Gilead Sciences Inc.; TCR2 Therapeutics Inc.; Bluebird Bio Inc.; Sorrento Therapeutics; Fate Therapeutics; Pfizer Inc.; Amgen; Celgene Corporation. |

Key Market Driver: Increasing Success in Hematologic Cancer Treatment

The primary driver for the T-cell therapy market has been its unprecedented success in treating hematologic malignancies, especially relapsed or refractory cases where conventional treatments have failed. CAR T-cell therapies have demonstrated durable responses in patients with diffuse large B-cell lymphoma (DLBCL), acute lymphoblastic leukemia (ALL), and multiple myeloma.

For instance, Kymriah, the first FDA-approved CAR T therapy, achieved complete remission in a significant percentage of pediatric and young adult patients with refractory ALL. Similarly, Yescarta has shown consistent efficacy in aggressive B-cell lymphomas. These therapies provide a new lease on life for patients with limited options, validating the clinical potential of T-cell-based interventions.

The positive outcomes have catalyzed a wave of research, with over 600 T-cell therapy clinical trials currently registered globally. Payers and policymakers are beginning to view T-cell therapy as a cost-effective long-term solution, especially when compared to ongoing chemotherapy or bone marrow transplants. As these therapies continue to achieve regulatory approval and real-world success, their adoption is expected to soar.

Key Market Restraint: Manufacturing Complexity and Cost

While the therapeutic outcomes are promising, the manufacturing and scalability challenges of T-cell therapy present a significant hurdle. Unlike mass-produced pharmaceuticals, T-cell therapies are personalized, requiring the extraction, modification, and expansion of a patient’s own immune cells. This process is time-consuming, labor-intensive, and highly sensitive to variables such as cell viability and contamination.

Moreover, the infrastructure needed for cell processing clean rooms, bioreactors, cryogenic storage, and quality control systems is capital-intensive. Delays in manufacturing can lead to treatment postponement, which is critical in aggressive cancers. Additionally, the cost of therapy often exceeds $350,000 per treatment, excluding hospital costs, limiting accessibility in lower-income markets.

Efforts are underway to automate cell processing, develop universal donor platforms, and standardize regulatory frameworks. Until these innovations become mainstream, production bottlenecks and affordability will continue to restrain market growth, especially in developing economies.

Key Market Opportunity: Expanding into Solid Tumor Indications

A promising frontier for T-cell therapies is their application in solid tumors, which currently represent over 90% of all cancers but remain underserved by CAR-T and TCR-based therapies. Challenges such as tumor microenvironment, antigen heterogeneity, and immune suppression have historically limited efficacy in solid tumors.

However, emerging technologies are addressing these barriers. For example, TIL therapies derived from a patient’s tumor have shown encouraging results in metastatic melanoma. TCR-T therapies, which recognize intracellular antigens presented on MHC molecules, are also advancing into clinical trials for hepatocellular carcinoma, pancreatic cancer, and glioblastoma.

Companies like Immatics, Adaptimmune, and Instil Bio are pioneering trials targeting solid tumor-specific antigens such as NY-ESO-1 and MAGE-A4. Successful breakthroughs in this area would unlock a multi-billion-dollar opportunity and redefine cancer immunotherapy paradigms. Coupled with biomarker-driven patient selection, the future holds immense potential for solid tumor-focused T-cell therapies.

Segments Insights:

By Therapy Type Insights

CAR T-cell Therapy currently dominates the market due to its early regulatory approvals, commercial success, and strong evidence in treating hematologic cancers. Products like Kymriah, Yescarta, and Breyanzi have reshaped treatment algorithms for refractory blood cancers. CAR T-cells are genetically engineered to express synthetic receptors that specifically target cancer antigens like CD19 and BCMA, making them highly effective in leukemia, lymphoma, and multiple myeloma. The rapid adoption in tertiary care centers across North America and Europe has propelled CAR T-cell therapy to the forefront.

Tumor Infiltrating Lymphocyte (TIL)-based therapy is expected to be the fastest-growing therapy type over the next decade. TIL therapy extracts naturally occurring T-cells from a patient's tumor, expands them ex vivo, and reinfuses them to attack cancer cells. This approach has demonstrated efficacy in metastatic melanoma and is undergoing trials in head and neck, lung, and cervical cancers. With fewer genetic modifications required, TILs offer a more “natural” immunotherapy route. As more biotech firms enter the space and clinical data accumulates, TILs are poised to revolutionize solid tumor treatment.

By Indication Insights

Hematologic Malignancies dominate the indication segment, especially due to the established use of CAR T-cell therapy in treating aggressive blood cancers. Within this category, Lymphoma and Leukemia have seen the highest uptake. Lymphomas like DLBCL and follicular lymphoma respond favorably to CD19-directed CAR T-cells. Multiple myeloma, though traditionally difficult to treat, has found promise through BCMA-targeting therapies like ide-cel and cilta-cel. The depth of response and remission rates in hematologic indications continue to validate T-cell therapy’s effectiveness and justify its high cost.

Solid Tumors are projected to be the fastest-growing segment over the forecast period. Despite current challenges, solid tumors such as melanoma, glioblastoma, and hepatocellular carcinoma are witnessing increased clinical trial activity. TCR and TIL therapies are gaining momentum due to their capacity to target intracellular and tumor-specific antigens. The potential to treat large patient populations and unlock new markets—especially in Asia-Pacific and Latin America—positions this segment for exponential growth pending regulatory success and clinical efficacy.

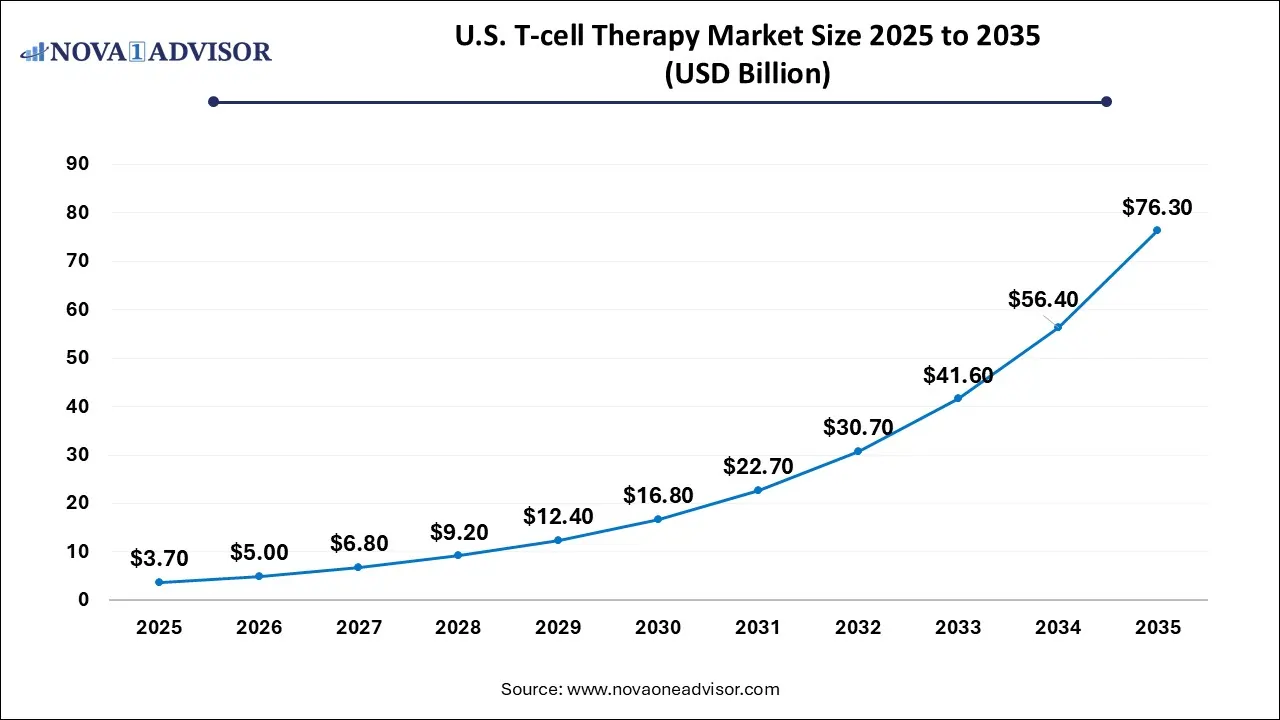

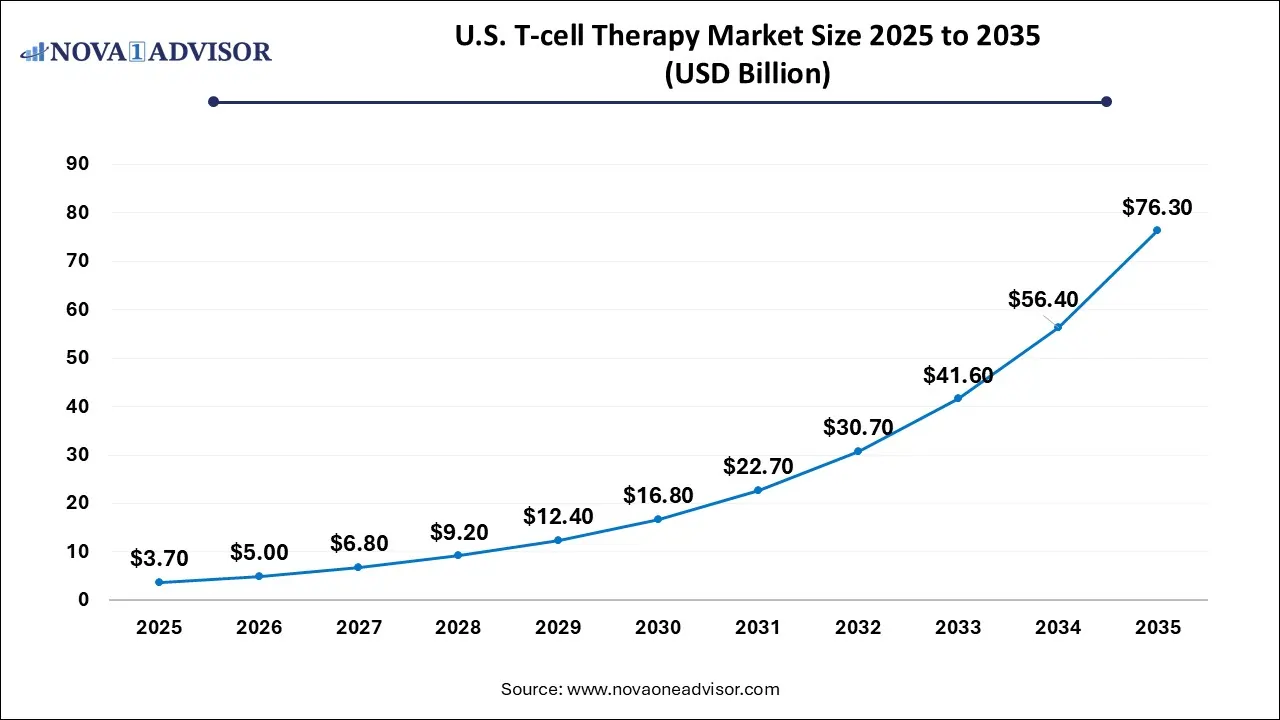

U.S. T-cell Therapy Market Size and Growth 2026 to 2035

The U.S. T-Cell therapy market size is calculated at USD 3.7 billion in 2025 and is expected to reach nearly USD 76.3 billion in 2035, accelerating at a strong CAGR of 31.61% between 2026 and 2035.

By Regional Insights

North America leads the global T-cell therapy market, fueled by pioneering R&D, advanced healthcare infrastructure, and favorable regulatory frameworks. The FDA has been instrumental in accelerating therapy approval through pathways like Breakthrough Therapy and RMAT (Regenerative Medicine Advanced Therapy) designations. The region also hosts the highest number of clinical trials, academic collaborations, and biotech ventures focused on immunotherapy.

Companies like Gilead (Kite Pharma), Bristol Myers Squibb (Breyanzi), and Novartis (Kymriah) have extensive manufacturing and commercialization operations in the U.S. Additionally, the presence of elite cancer centers such as MD Anderson, Dana-Farber, and Memorial Sloan Kettering facilitates high patient enrollment and real-world adoption. Government initiatives like the Cancer Moonshot 2.0 are also driving innovation and funding for next-generation T-cell therapies.

Asia-Pacific is emerging as the fastest-growing T-cell therapy market, propelled by increasing cancer prevalence, rising investments in biotech infrastructure, and evolving regulatory pathways. China, in particular, is a hotspot for CAR T-cell development, with over 200 ongoing clinical trials and growing manufacturing capacity. Companies like JW Therapeutics and Legend Biotech have successfully launched domestic CAR T therapies.

Japan's regenerative medicine framework allows conditional approval for novel cell therapies, accelerating time-to-market. South Korea and Singapore are also investing in local manufacturing hubs and R&D centers to attract global biotech collaborations. With a large unmet medical need, increasing public funding, and a proactive regulatory stance, the Asia-Pacific region is on a trajectory to become a global immunotherapy hub.

Some of the prominent players in the T-Cell therapy market include:

- Novartis AG

- Merck KGaA

- Gilead Sciences Inc.

- TCR2 Therapeutics Inc

- Bluebird Bio Inc.

- Sorrento Therapeutics

- Fate Therapeutics

- Pfizer Inc.

- Amgen

- Celgene Corporation

Recent Developments

-

In April 2024, Kite Pharma received expanded FDA approval for Yescarta to include earlier lines of therapy in relapsed large B-cell lymphoma, increasing its market reach.

-

In March 2024, Immatics N.V. initiated a Phase II trial for its TCR-T therapy targeting MAGE-A4 in patients with advanced head and neck cancers.

-

In February 2024, Instil Bio secured $110 million in Series C funding to advance its TIL therapies for solid tumors, with upcoming trials in melanoma and cervical cancer.

-

In January 2024, Poseida Therapeutics announced a strategic partnership with Roche to co-develop allogeneic T-cell therapies using non-viral gene editing platforms.

-

In December 2023, Legend Biotech and Janssen reported new data from CARTITUDE-4, showing superior outcomes in multiple myeloma patients treated with cilta-cel compared to standard of care.

-

In November 2023, Adaptimmune Therapeutics submitted a BLA to the FDA for its SPEAR T-cell therapy targeting NY-ESO-1 in synovial sarcoma, marking a potential milestone in TCR therapy.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global T-Cell therapy market.

Therapy Type

- CAR T-cell Therapy

- T Cell Receptor (TCR)-based

- Tumor Infiltrating Lymphocytes (TIL)-based

Indication

-

- Lymphoma

- Leukemia

- Myeloma

-

- Melanoma

- Brain & Central Nervous System

- Liver Cancer

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)