Tangential Flow Filtration Market Size and Growth

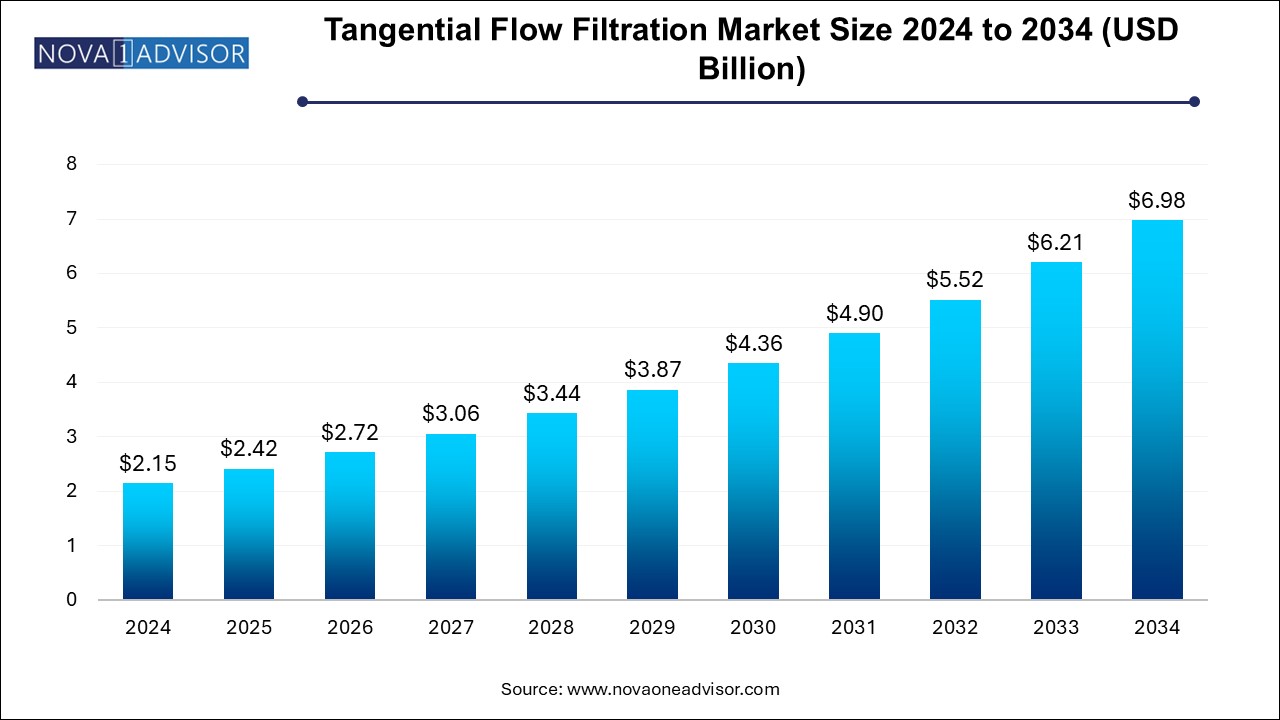

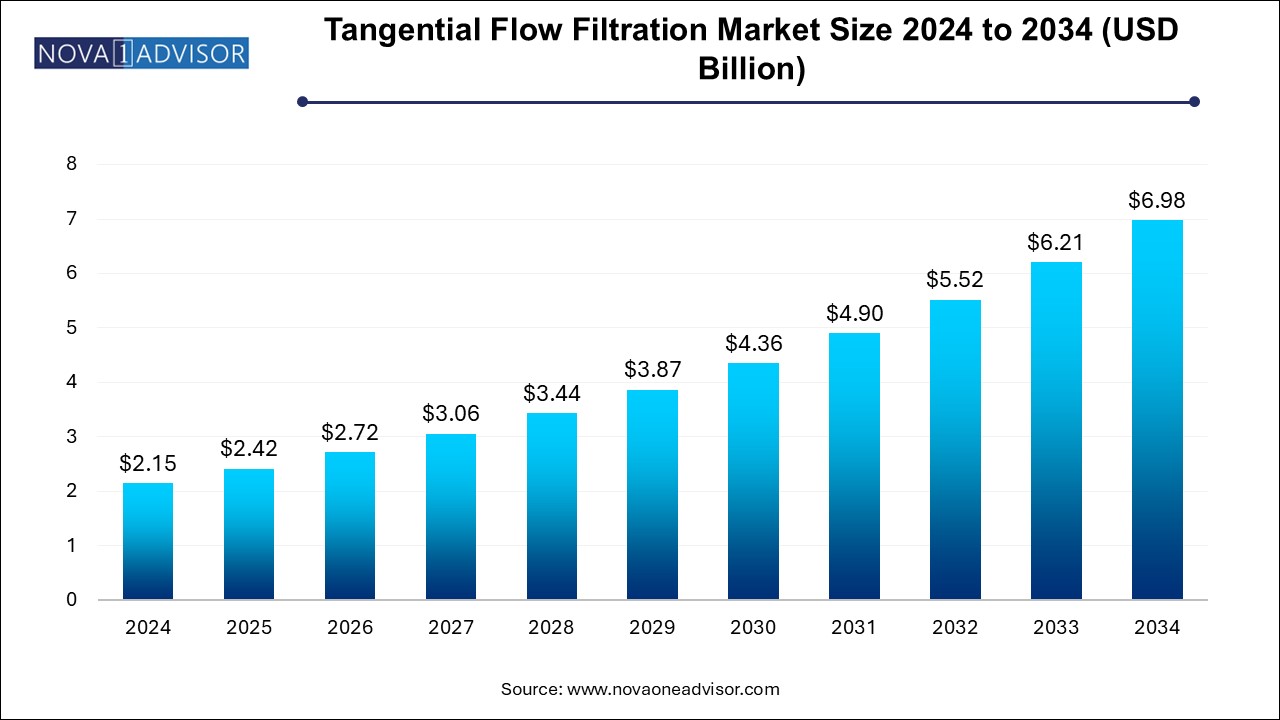

The tangential flow filtration market size was exhibited at USD 2.42 billion in 2024 and is projected to hit around USD 6.98 billion by 2034, growing at a CAGR of 12.5% during the forecast period 2024 to 2034.

Tangential Flow Filtration Market Key Takeaways:

- Single-use tangential flow filtration (TFF) systems led the market and accounted for the largest revenue share of 42.0% in 2024.

- Filtration accessories are expected to grow at a CAGR of 14.9% over the forecast period.

- Ultrafiltration technology dominated the market and accounted for the largest revenue share, 55.8%, in 2024.

- Microfiltration technology is expected to grow at a CAGR of 12.4% over the forecast period.

- Raw material filtration led the market and accounted for the largest revenue share in 2024.

- Antibody purification applications are expected to grow at the fastest CAGR of 15.2% from 2024 to 2034.

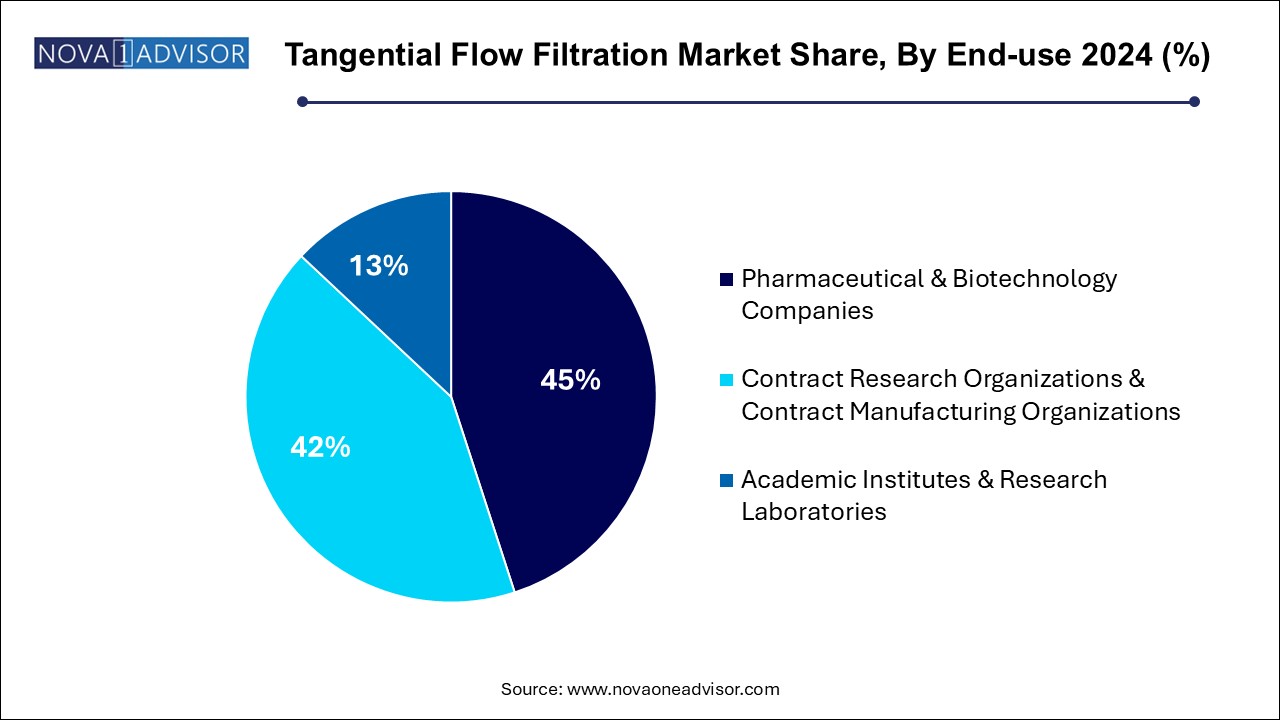

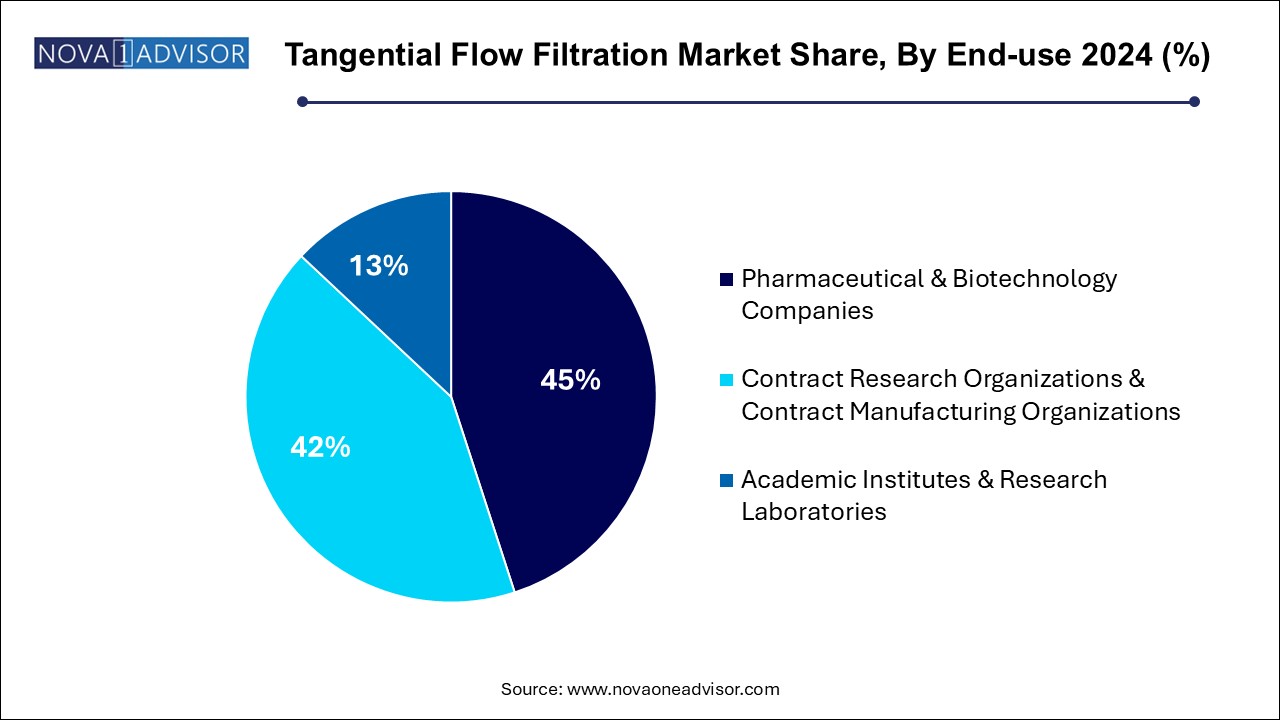

- Pharmaceutical and biotechnology companies dominated the market and accounted for the largest revenue share of 45.0% in 2024.

- Academic institutes and research laboratories are expected to grow at the fastest CAGR over the forecast period

- The North America tangential flow filtration market dominated the global market and accounted for the largest revenue share of 36.7% in 2024.

Market Overview

The tangential flow filtration (TFF) market is rapidly expanding as one of the core technologies supporting modern bioprocessing, biopharmaceutical production, and high-purity separations. Unlike conventional filtration, TFF or crossflow filtration allows a fluid to flow tangentially across the surface of the membrane, preventing build-up and enabling continuous, efficient separation of particles based on size.

This method is integral in processes such as protein purification, cell harvesting, vaccine manufacturing, and the production of viral vectors, all of which are critical components of the booming biologics and cell and gene therapy industries. TFF systems are highly scalable, from lab-scale to full commercial production, making them versatile solutions across the biotechnology, pharmaceutical, academic, and research sectors.

Recent years have seen a marked shift toward single-use TFF systems, improved membrane technologies, and automation integration, responding to the industry's need for flexibility, efficiency, and contamination control. Innovations like high-performance regenerated cellulose membranes and customized TFF modules are streamlining workflows while maintaining high yield and product quality.

The COVID-19 pandemic underscored the strategic value of TFF in vaccine and therapeutic production, catalyzing investments across the board. Moving forward, the focus on biologics, biosimilars, and emerging modalities like mRNA vaccines and cell-based therapies will ensure that TFF remains a vital component of the global bioprocessing toolkit.

Major Trends in the Market

-

Shift Toward Single-use Technologies: Demand for disposable TFF systems for contamination control and operational flexibility.

-

Membrane Material Innovations: Development of membranes with higher chemical resistance, throughput, and selectivity.

-

Integration of Automation and Digital Monitoring: Smart TFF systems with real-time analytics and predictive maintenance capabilities.

-

Expansion of Biologics and Cell Therapy Pipelines: Driving increased application of TFF in purification and formulation processes.

-

Customized TFF Solutions for Specific Applications: Tailored membrane pore sizes and formats for specialized bioprocess needs.

-

Sustainability Initiatives in Filtration Products: Focus on recyclable, energy-efficient, and lower-footprint TFF components.

-

Increased Outsourcing to CDMOs and CROs: Boosting TFF system demand among contract services providers.

-

Geographic Diversification of Biomanufacturing: Expansion of production facilities across Asia-Pacific and Latin America, spurring local TFF market growth.

Report Scope of Tangential Flow Filtration Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.42 Billion |

| Market Size by 2034 |

USD 6.98 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 12.5% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Technology, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Danaher Corporation; Sartorius AG; Parker-Hannifin Corporation; Alfa Laval AG; Merck KGaA; Repligen Corporation; FUJIFILM Wako Pure Chemical Corporation; ABEC, Inc.; Sterlitech Corporation; Synder Filtration, Inc.; Meissner Filtration Products, Inc. |

Key Market Driver: Rising Demand for Biologics and Advanced Therapies

The major driver accelerating the tangential flow filtration market is the surging demand for biologics, biosimilars, and advanced therapies. Biologic drugs including monoclonal antibodies, vaccines, recombinant proteins, and gene therapies require highly specialized purification processes during manufacturing.

TFF is ideal for such bioprocessing needs, offering high selectivity, scalability, and consistent product recovery while minimizing process time and contamination risks. The continuous expansion of the global biologics pipeline, with hundreds of new candidates under development, ensures a rising need for robust, efficient filtration systems like TFF at every production stage.

Furthermore, the proliferation of cell and gene therapies, which demand careful handling and high-yield concentration of viral vectors, exosomes, and nucleic acids, is driving adoption of advanced TFF technologies tailored for these sensitive products.

Key Market Restraint: High Initial Investment Costs

Despite its growing importance, the TFF market faces a significant constraint: high initial investment costs associated with system installation, customization, and maintenance.

While TFF systems are cost-effective over the long term, especially for large-scale manufacturing, the upfront capital required for acquiring state-of-the-art TFF equipment, integrating it into existing bioprocess platforms, and training staff can be prohibitive, particularly for small biotech firms and academic labs.

Moreover, regulatory scrutiny around membrane validation, cleaning protocols, and performance documentation adds to the complexity and cost of implementing TFF solutions, sometimes delaying or deterring adoption among resource-limited organizations.

Key Market Opportunity: Technological Innovation in Single-use and Automated TFF Systems

An emerging opportunity in the TFF market is the technological innovation in single-use and automated systems. Single-use TFF modules eliminate the need for extensive cleaning and validation, significantly reducing downtime, labor costs, and contamination risks.

Simultaneously, the rise of Industry 4.0 principles in biomanufacturing is driving demand for smart, automated TFF systems that can monitor parameters like pressure, flow rate, and membrane integrity in real-time. These advances enable predictive maintenance, process optimization, and greater batch-to-batch consistency critical attributes for high-value biologics production.

Manufacturers who invest in developing modular, plug-and-play, digitally enabled TFF solutions tailored for flexible and continuous processing will be well-positioned to capture a rapidly expanding market niche.

Tangential Flow Filtration Market By Product Insights

Single-use tangential flow filtration systems dominate the product segment, owing to their operational advantages in speed, flexibility, and contamination control. Single-use systems have become indispensable in clinical-stage biomanufacturing and multi-product facilities, where cleaning validation and turnaround times are critical constraints. Their pre-sterilized, ready-to-use formats enable rapid deployment and reduce regulatory complexity, aligning with the industry's push toward agile manufacturing.

Membrane filters are growing fastest, driven by technological improvements in membrane materials and customization for specific bioprocess needs. The development of high-flux, low-fouling membranes made from materials such as polyethersulfone (PES) and regenerated cellulose is expanding applications from vaccine production to mRNA purification, fueling rapid segment growth.

Tangential Flow Filtration Market By Technology Insights

Ultrafiltration dominates the technology segment, reflecting its broad use in concentrating and diafiltering proteins, viruses, nucleic acids, and other biomolecules. Ultrafiltration membranes with pore sizes ranging from 1 to 100 nanometers are the workhorses of biologics manufacturing, enabling separation based on molecular weight cut-offs and ensuring high recovery rates without damaging sensitive biomolecules.

Nanofiltration is expanding rapidly, particularly for applications requiring finer separation between small molecules, peptides, and solvents. With growing focus on vaccine purification, viral vector processing, and contaminant removal, nanofiltration membranes are gaining prominence for providing enhanced selectivity and process efficiency, especially in downstream processing of novel therapeutics.

Tangential Flow Filtration Market By Applications Insights

Protein purification dominates the application segment, given the central role of monoclonal antibodies, therapeutic proteins, and recombinant enzymes in modern healthcare. TFF is essential in various stages of protein production, including clarification, concentration, diafiltration, and formulation, ensuring high yield and product integrity.

Vaccine and viral vectors are growing fastest, a trend magnified by the global COVID-19 response and the subsequent boom in mRNA and viral vector-based vaccine technologies. TFF systems are critical in concentrating, purifying, and buffer exchanging viral vectors like lentivirus, adeno-associated virus (AAV), and adenovirus, making them indispensable for emerging cell and gene therapy pipelines.

Tangential Flow Filtration Market By End-use Insights

Pharmaceutical and biotechnology companies dominate the end-use segment, driven by their substantial investments in biologics, biosimilars, and cell therapies. These companies depend on TFF for routine purification, formulation, and final fill processes, ensuring product consistency, regulatory compliance, and manufacturing efficiency.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are growing fastest, as outsourcing trends in the pharmaceutical industry accelerate. To meet client demands for flexible, rapid production of clinical and commercial biologics, CROs and CMOs are expanding their TFF capabilities, adopting single-use and modular filtration platforms to offer cost-effective, scalable solutions.

Tangential Flow Filtration Market By Regional Insights

North America dominates the global TFF market, backed by its strong biopharmaceutical industry, advanced healthcare infrastructure, and a vibrant innovation ecosystem. The United States, in particular, accounts for the largest market share, hosting leading biotechnology hubs like Boston, San Francisco, and San Diego.

The region’s dominance is further reinforced by substantial R&D investments, favorable regulatory frameworks, and robust demand for novel therapies like gene and cell therapies. Major biopharma players and TFF technology providers such as Merck Millipore, Pall Corporation, and Sartorius have their regional headquarters or significant operations here.

Asia-Pacific is the fastest-growing region, propelled by increasing biologics manufacturing capacity, rising healthcare expenditures, and favorable government initiatives to promote local biomanufacturing.

Countries such as China, India, South Korea, and Japan are investing heavily in biosimilars, vaccines, and regenerative medicine, creating strong demand for advanced bioprocessing tools like TFF. The lower manufacturing costs and improving regulatory standards in Asia-Pacific make it an attractive destination for multinational biopharma companies to establish or expand operations, further stimulating TFF market growth.

Some of the prominent players in the tangential flow filtration market include:

- Danaher Corporation

- Sartorius AG

- Parker-Hannifin Corporation

- Alfa Laval AG

- Merck KGaA

- Repligen Corporation

- FUJIFILM Wako Pure Chemical Corporation

- ABEC, Inc.

- Sterlitech Corporation

- Synder Filtration, Inc.

- Meissner Filtration Products, Inc.

Tangential Flow Filtration Market Recent Development

-

March 2025: Merck KGaA launched a new Mobius® single-use TFF system designed for flexible, mid-scale biologics manufacturing, enhancing process scalability.

-

February 2025: Pall Corporation announced the expansion of its high-performance Omega™ membrane portfolio with advanced PES membranes offering higher throughput for protein purification applications.

-

January 2025: Sartorius Stedim Biotech introduced a new line of integrated, smart TFF systems with real-time analytics and IoT connectivity.

-

December 2024: Repligen Corporation completed the acquisition of a membrane technology startup specializing in high-purity TFF membranes for viral vector processing.

-

November 2024: Parker Hannifin expanded its BioProcess Division with new TFF products targeting cell and gene therapy manufacturing markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the tangential flow filtration market

By Product

- Single-use Tangential Flow Filtration Systems

- Reusable Tangential Flow Filtration Systems

- Membrane Filters

-

- Polyethersulfone (PES)

- Polyvinylidene Difluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Mixed Cellulose Ester & Cellulose Acetate

- Polycarbonate Tracked Etched (PCTE)

- Regenerated Cellulose

- Others

By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

By Application

- Protein Purification

- Vaccine And Viral Vectors

- Antibody Purification

- Raw Material Filtration

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic Institutes & Research Laboratories

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)