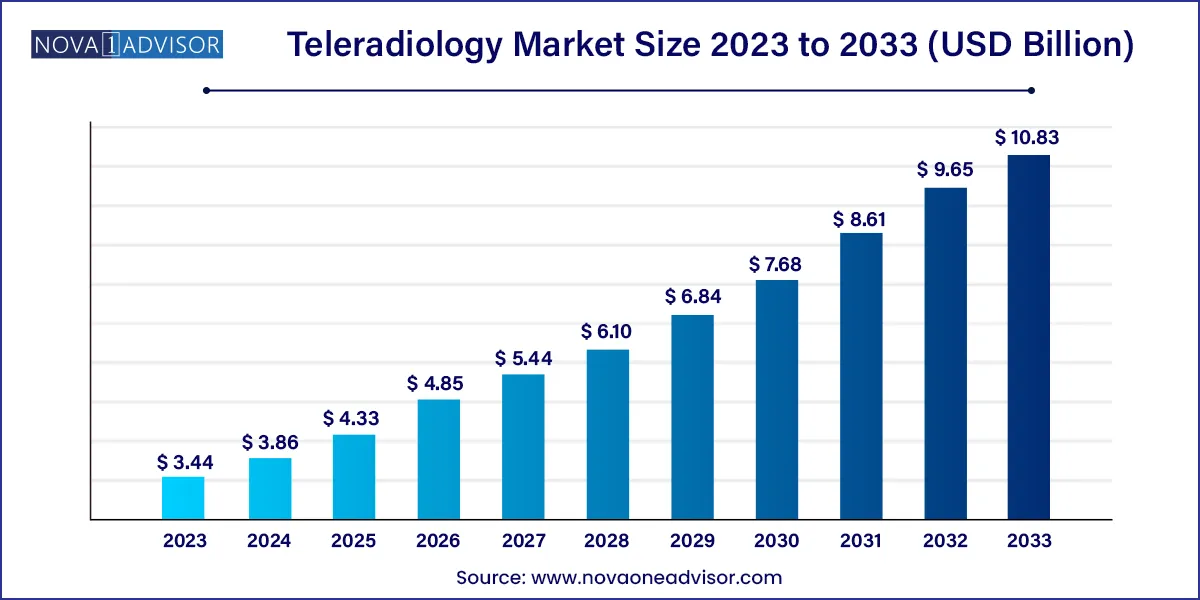

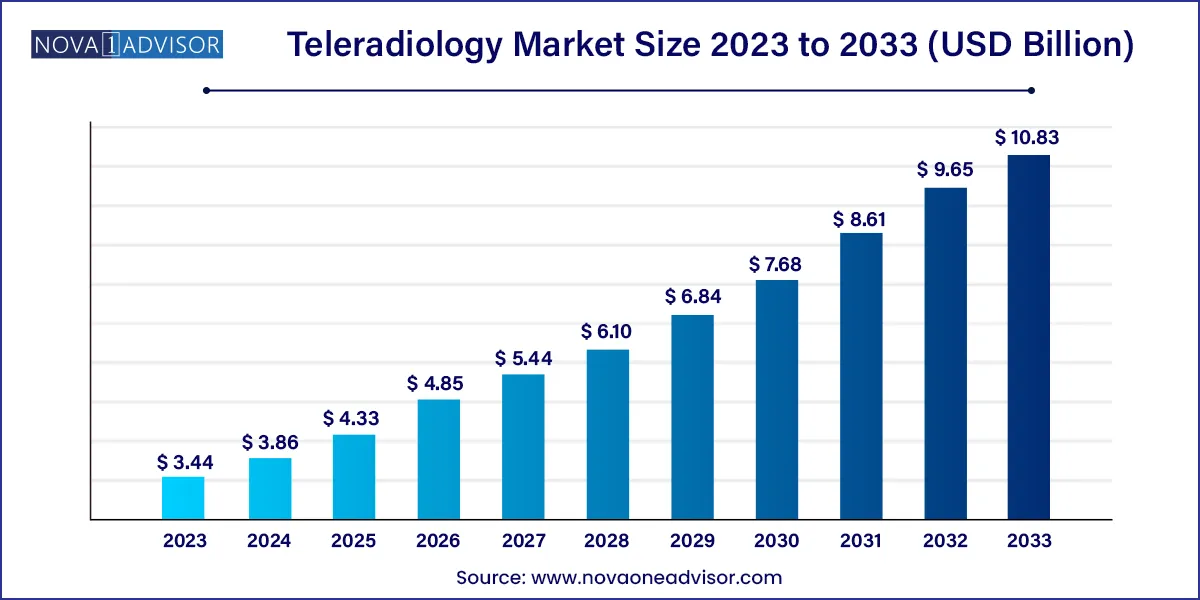

The global teleradiology market size was exhibited at USD 3.44 billion in 2023 and is projected to hit around USD 10.83 billion by 2033, growing at a CAGR of 12.15% during the forecast period of 2024 to 2033.

Key Takeaways:

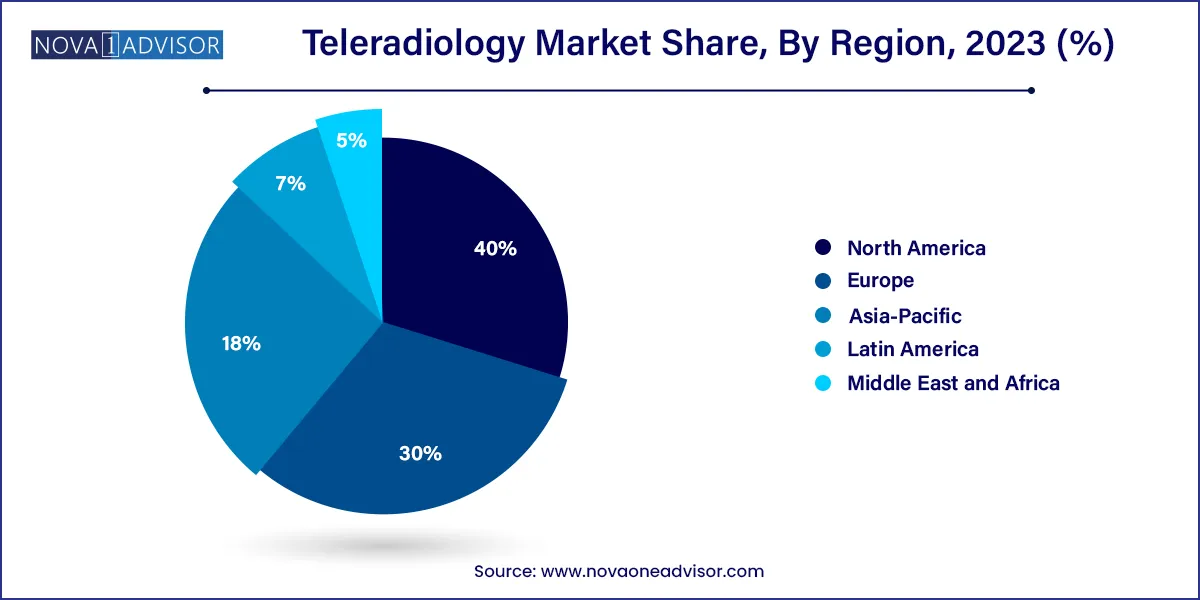

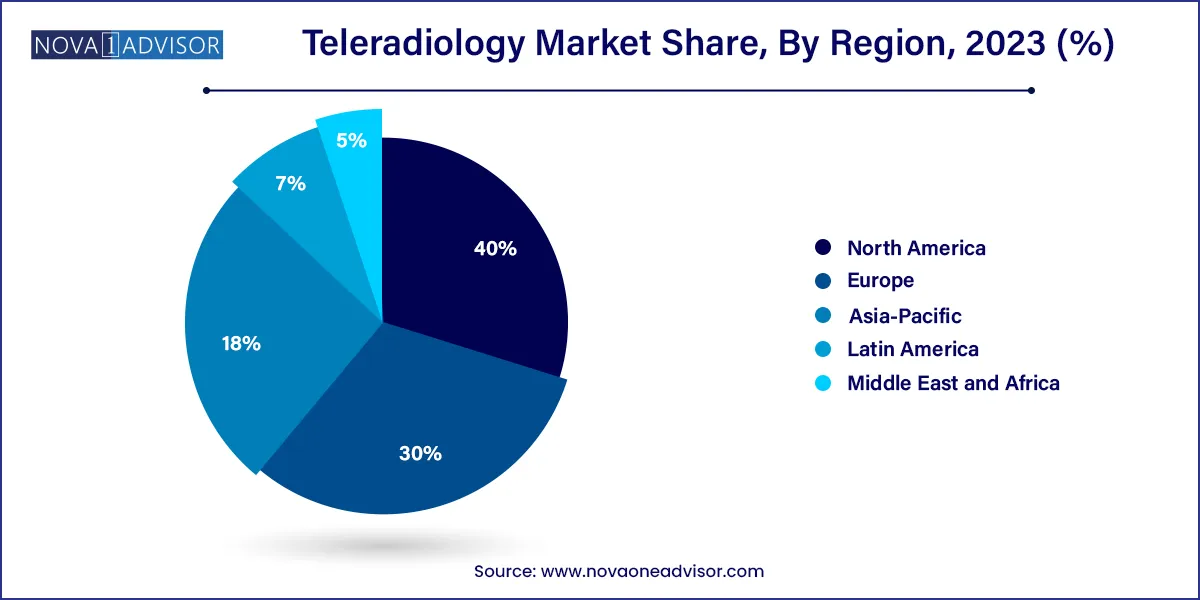

- North America held the largest market share of 40.0% in 2023 and is projected to maintain its dominance over the forecast period.

- The X-ray segment dominated the market in 2023 with a market share of around 30.2% and is expected to grow at a fastest CAGR over the forecast period.

- The preliminary report segment held the largest market share of 64.7% in 2023 and is expected to continue its dominance over the forecast period.

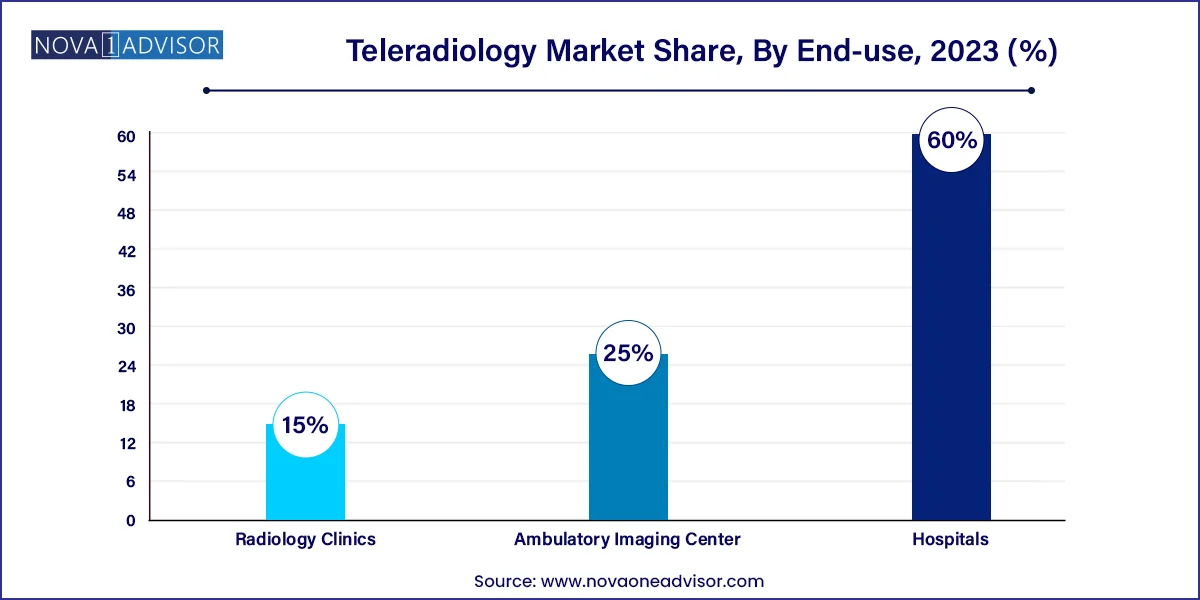

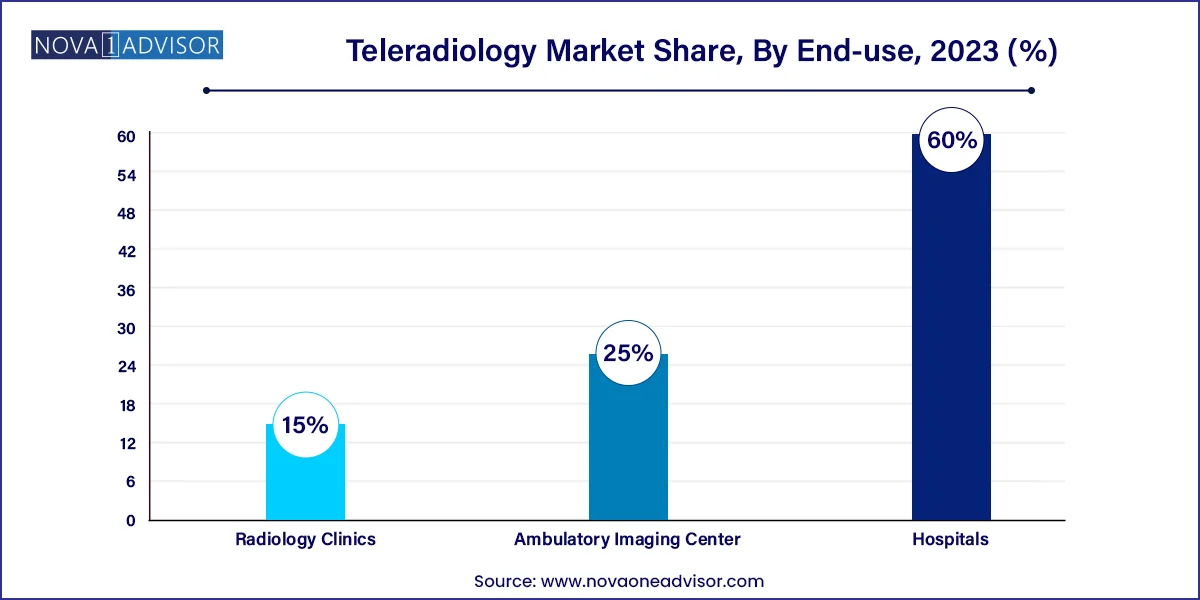

- Hospitals held the largest market share in teleradiology market in 2023, capturing more than 60.0% share.

Market Overview

The global teleradiology market is revolutionizing diagnostic imaging by enabling the remote interpretation and analysis of medical images through digital telecommunications. Teleradiology serves as a critical pillar of telemedicine, allowing radiologists to provide consultative services from any geographical location. This has drastically enhanced access to radiology expertise, especially in rural and underserved areas where qualified radiologists are scarce.

Rising demand for timely diagnosis, advancements in imaging technology, and a surge in cross-border healthcare collaborations are key drivers of the teleradiology market. Hospitals, diagnostic centers, and specialty clinics are increasingly outsourcing imaging interpretations to teleradiology providers to improve turnaround time and optimize costs. This model supports 24/7 radiology reporting, reduces the workload on in-house radiologists, and enables subspecialty consultation without needing full-time experts on-site.

Following the COVID-19 pandemic, healthcare providers rapidly adopted teleradiology as part of broader digital transformation initiatives. It not only provided continuity of imaging services but also minimized exposure risks for radiologists and patients alike. As healthcare systems globally seek scalable, cost-effective, and patient-centric diagnostic models, the teleradiology market is poised for sustained growth.

Teleradiology Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.86 Billion |

| Market Size by 2033 |

USD 10.83 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.15% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Report, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Virtual Radiologic (vRad); Agfa-Gevaert Group; ONRAD, Inc.; Everlight Radiology; 4ways Healthcare Ltd.; RamSoft, Inc.; USARAD Holdings, Inc.;.Koninklijke Philips N.V., Matrix (Teleradiology Division of Radiology Partners), Medica Group PLC., 5C Network. |

Key Market Driver: Radiologist Shortage and Global Demand for Imaging Services

One of the most significant drivers of the teleradiology market is the global shortage of radiologists, especially in low- and middle-income countries and rural regions of high-income nations. With the growing incidence of chronic diseases and the aging global population, the volume of diagnostic imaging procedures has surged dramatically. However, the supply of trained radiologists has not kept pace, resulting in delayed diagnoses and increased patient risks.

Teleradiology addresses this gap by enabling radiologists to serve multiple hospitals and diagnostic centers remotely. For instance, a U.S.-based radiologist can interpret scans for a rural Indian or African clinic within minutes, offering time-sensitive insights for stroke, trauma, or cancer cases. This model improves healthcare delivery and allows resource optimization across borders.

Key Market Restraint: Data Security and Regulatory Compliance

Despite its benefits, teleradiology presents significant challenges related to data privacy, cybersecurity, and regulatory compliance. The transmission of sensitive patient images and clinical data across networks makes the system vulnerable to breaches, unauthorized access, and ransomware attacks. Healthcare data is a prime target for cybercriminals due to its high black-market value.

Furthermore, teleradiology services must comply with complex legal frameworks such as HIPAA (U.S.), GDPR (Europe), and local healthcare data protection laws. Inconsistencies across jurisdictions can complicate international service delivery. Failure to meet regulatory standards can result in severe penalties and damage institutional credibility, thereby limiting adoption in highly regulated markets.

Key Market Opportunity: AI-Enhanced Teleradiology Solutions

An exciting opportunity in the market lies in the integration of artificial intelligence (AI) with teleradiology workflows. AI algorithms can pre-screen scans to detect abnormalities, prioritize urgent cases, and even generate preliminary diagnostic suggestions. This significantly improves efficiency, reduces diagnostic errors, and shortens report turnaround times.

Companies are increasingly developing AI-powered solutions that support radiologists in interpreting complex cases such as brain hemorrhages, pulmonary embolisms, or breast cancer. The use of natural language processing (NLP) for automated report generation further accelerates productivity. As AI algorithms are trained on large, diverse datasets, they are becoming more accurate and contextually aware, enhancing the value proposition of teleradiology services.

Segments Insights:

By Product

Computed Tomography (CT) dominates the teleradiology market, due to its widespread use in emergency diagnostics, oncology, and trauma care. CT scans generate high-resolution images that require timely interpretation, especially in stroke and head injury cases. Teleradiology platforms facilitate the rapid sharing of CT images with expert radiologists, ensuring timely intervention and improved patient outcomes. Hospitals and trauma centers globally rely on remote CT interpretations to maintain 24/7 service availability.

Magnetic Resonance Imaging (MRI) is the fastest-growing product segment, attributed to its growing use in neurology, musculoskeletal, and oncology imaging. MRI produces complex data that requires specialized interpretation. With increasing adoption of advanced MRI protocols, teleradiology services offering subspecialty reads in neuro-MRI or spine imaging are in high demand. Additionally, MRI studies are often outsourced by mid-size facilities lacking on-site MRI-trained radiologists.

By Report Type

Final reports dominate the teleradiology report segment, as they represent the official, signed-off interpretations that are stored in patient records and used for clinical decision-making. These are typically provided by board-certified radiologists and are critical in elective and routine care environments where accuracy and completeness are paramount.

Preliminary reports are the fastest-growing segment, particularly in emergency and night-time teleradiology services. These reports offer immediate interpretations that guide urgent treatment decisions while final reviews are pending. Hospitals with limited overnight radiology staffing rely on preliminary reports for continuity of care, making them essential in emergency departments and rural settings.

By End-use Insights

Hospitals remain the largest end users of teleradiology services, given their high imaging volumes, need for 24/7 reporting, and multispecialty service offerings. Teleradiology enables hospitals to optimize staffing, manage peak workloads, and access subspecialty expertise. Large health systems often establish centralized command centers for remote imaging services across affiliated facilities.

Radiology clinics are the fastest-growing end-use segment, as outpatient imaging centers expand across urban and semi-urban geographies. These centers often lack in-house radiologists or require flexible staffing models. Teleradiology allows clinics to offer same-day reporting, second opinions, and consultation from internationally certified radiologists, enhancing their competitiveness and service portfolio.

By Regional Analysis

North America dominates the teleradiology market, supported by advanced digital infrastructure, high imaging volumes, and a well-established network of radiology professionals. The U.S. leads the region with its early adoption of telehealth and strong regulatory frameworks such as HIPAA that guide secure data transmission. Additionally, North American hospitals are increasingly using teleradiology for night coverage, subspecialty interpretations, and rural healthcare delivery.

Asia-Pacific is the fastest-growing region, driven by the dual factors of increasing healthcare digitization and chronic radiologist shortages. Countries like India, China, and Indonesia are rapidly adopting teleradiology to bridge the urban-rural diagnostic gap. Public health investments and private diagnostic chains are accelerating infrastructure development, while international teleradiology partnerships are expanding the regional service footprint.

Some of the prominent players in the Teleradiology market include:

- Virtual Radiologic (vRad)

- Agfa-Gevaert Group

- ONRAD, Inc.

- Everlight Radiology;

- 4ways Healthcare Ltd.

- RamSoft, Inc.

- USARAD Holdings, Inc.

- Koninklijke Philips N.V.

- Matrix (Teleradiology Division of Radiology Partners)

- Medica Group PLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global teleradiology market.

Product

- X-ray

- Ultrasound

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Nuclear Imaging

Report

- Preliminary reports

- Final reports

End-use

- Hospitals

- Ambulatory Imaging Center

- Radiology Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)