Thyroid Gland Disorder Treatment Market Size and Trends

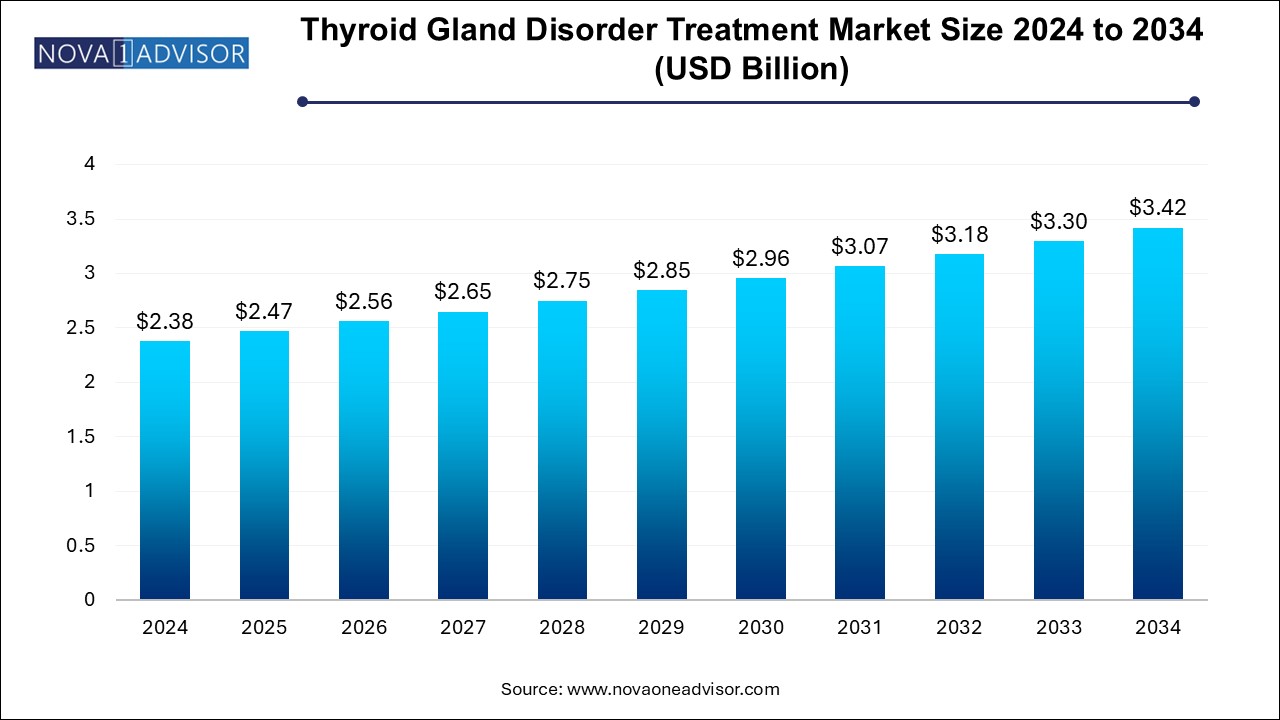

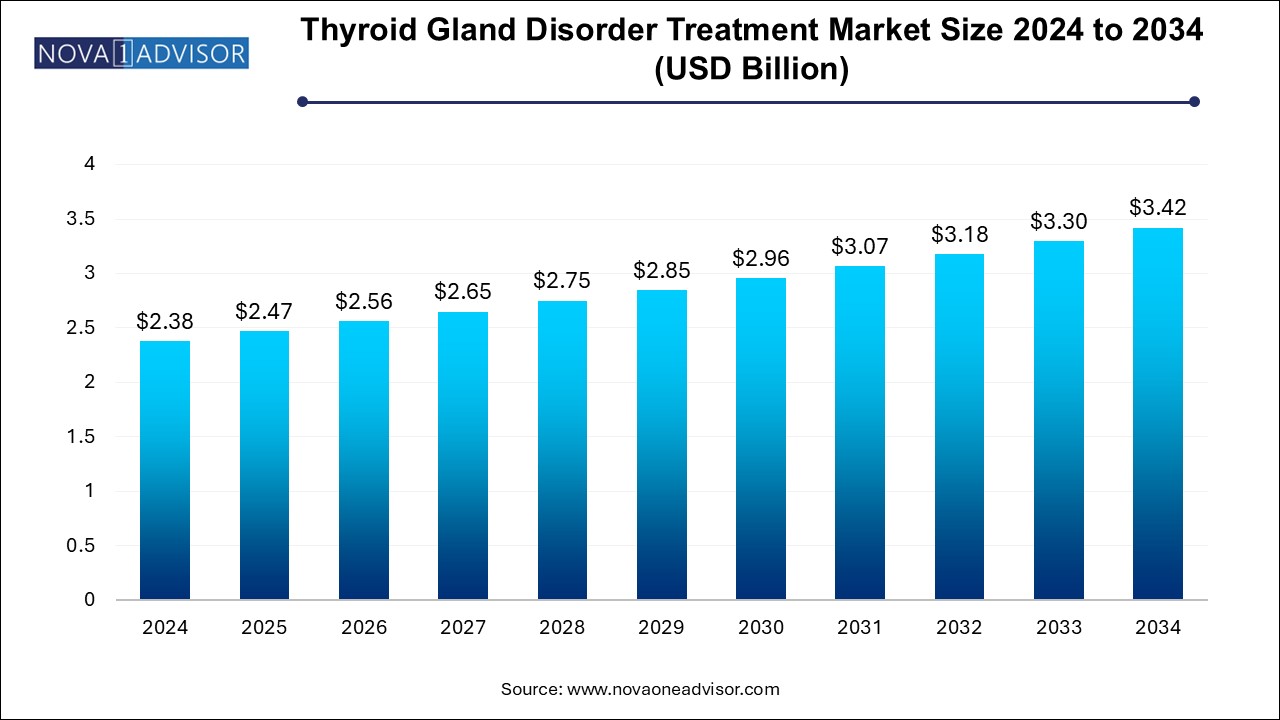

The thyroid gland disorder treatment market size was exhibited at USD 2.38 billion in 2024 and is projected to hit around USD 3.42 billion by 2034, growing at a CAGR of 3.7% during the forecast period 2024 to 2034. The growth of the thyroid gland disorder treatment market can be attributed to rising cases of thyroid disorders, continuous advancements in diagnostic techniques, development of combination therapies and increased awareness programs.

Thyroid Gland Disorder Treatment Market Key Takeaways:

- Hypothyroidism dominated the market and accounted for a market share of 68.7% in 2024.

- The hyperthyroidism segment is expected to grow significantly during the forecast period.

- Levothyroxine accounted for the largest market revenue share of 50.5% in 2024.

- The liothyronine segment is expected to grow significantly during the forecast period.

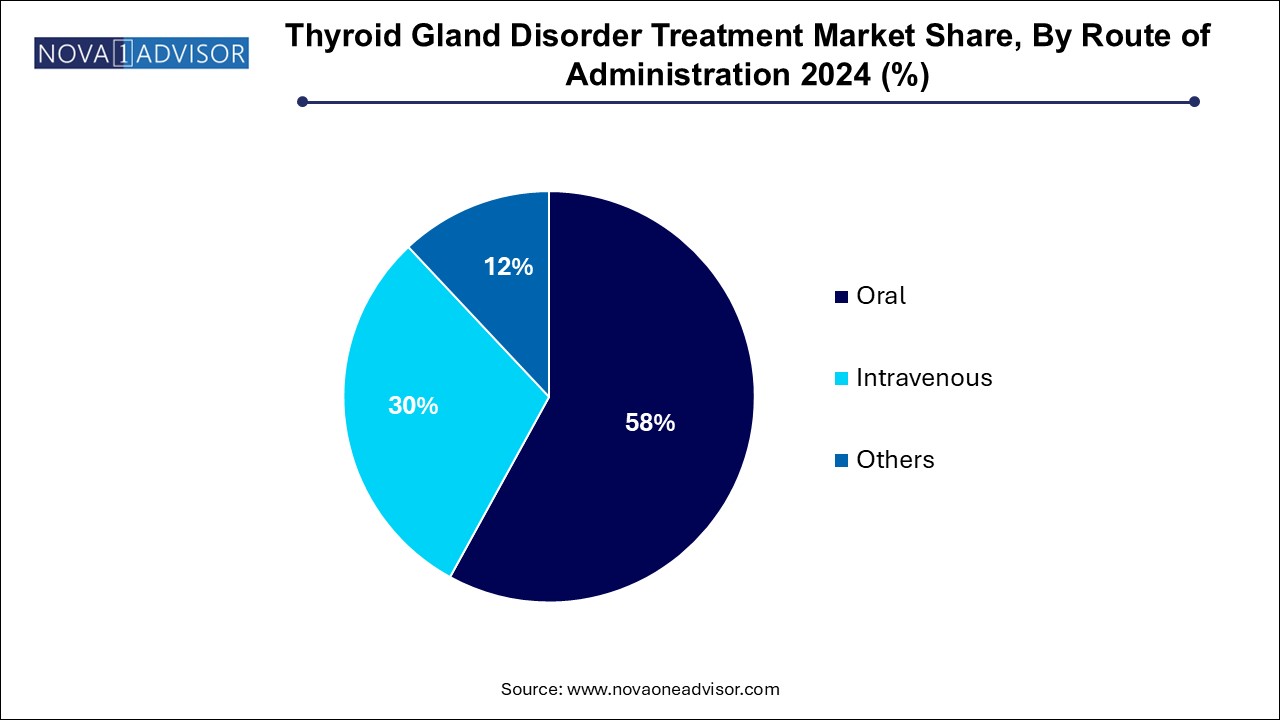

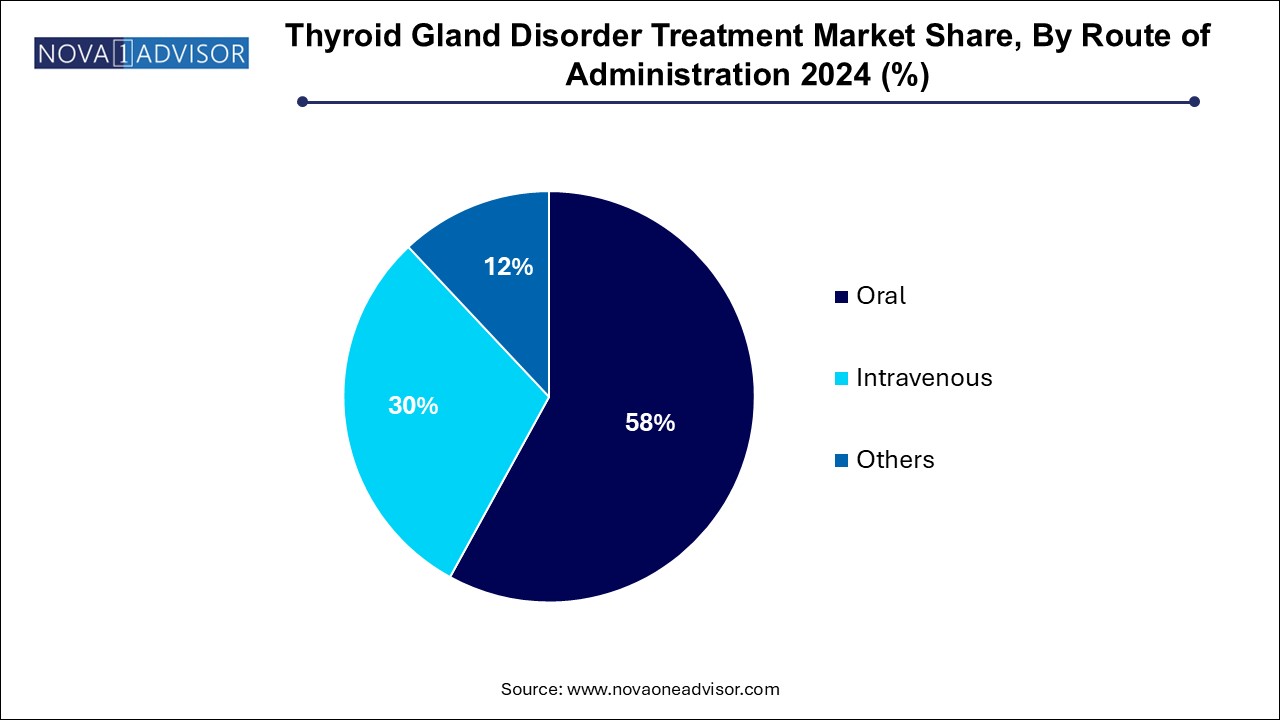

- The oral segment accounted for the largest market revenue share of 58.0% in 2024.

- The intravenous segment is expected to grow at a significant CAGR over the forecast period.

- Wholesale distribution accounted for the largest market revenue share of 46.7% in 2024.

- The online pharmacy segment is expected to grow significantly at 3.9% CAGR during the forecast period.

- North America thyroid gland disorder treatment market dominated the global industry with a revenue share of over 35.44% in 2024.

Market Overview

The thyroid gland disorder treatment market is a critical segment of the endocrine therapeutics domain, addressing a spectrum of conditions that affect thyroid hormone production and function. Thyroid disorders, such as hypothyroidism and hyperthyroidism, are among the most prevalent endocrine abnormalities worldwide. These conditions arise due to autoimmune dysfunction, iodine deficiency, genetic predispositions, and lifestyle-related factors, contributing to both underactive and overactive thyroid function. Effective treatment is crucial, as untreated thyroid dysfunction can lead to significant systemic complications, including cardiovascular diseases, infertility, metabolic imbalances, and neurocognitive deficits.

The global burden of thyroid disorders has been steadily increasing, partly due to rising awareness and better diagnostic tools. In the United States alone, the American Thyroid Association (ATA) estimates that over 20 million people suffer from some form of thyroid disorder, with a significant proportion remaining undiagnosed. Hypothyroidism is notably more common, especially among women and the elderly. Meanwhile, hyperthyroidism, although less prevalent, can lead to more acute complications and requires complex pharmacologic and surgical management.

Pharmaceutical treatments remain the cornerstone of therapy. The market is dominated by synthetic thyroid hormones such as levothyroxine for hypothyroidism and antithyroid drugs like methimazole and propylthiouracil for hyperthyroidism. Over the past decade, there has been a shift toward more personalized and long-term management strategies. Emerging formulations, bioequivalence concerns among generics, and improved patient monitoring are all shaping the treatment landscape. Additionally, non-pharmacologic interventions such as radioactive iodine therapy and thyroidectomy are increasingly combined with drug therapy for comprehensive care.

With a strong presence of both branded and generic drug manufacturers, the market exhibits a balanced competitive structure. Moreover, the rise of digital health platforms and online pharmacies is enhancing drug accessibility and compliance, especially in remote and underserved areas. As public health initiatives promote early screening and intervention, and research in thyroid autoimmunity and oncology expands, the thyroid gland disorder treatment market is poised for robust long-term growth.

Major Trends in the Market

-

Rise in Autoimmune Thyroid Disorders: Increased incidence of Hashimoto’s thyroiditis and Graves’ disease is driving the demand for long-term management therapies.

-

Levothyroxine Reformulations: Innovations in bioequivalent, liquid, and soft gel levothyroxine formulations are improving absorption and patient compliance.

-

Generic Drug Penetration: Generic versions of key drugs are expanding access, particularly in cost-sensitive markets.

-

Telemedicine and Online Pharmacies: Virtual consultations and digital prescription fulfillment are enhancing treatment continuity for thyroid patients.

-

Compounded and Personalized Therapies: Tailor-made hormone therapies and compounding pharmacies are becoming a niche but growing segment.

-

Patient Education Campaigns: Public health awareness programs are boosting early diagnosis and treatment adherence.

-

Iodine Supplementation Initiatives: Government efforts to curb iodine deficiency are altering the epidemiology of thyroid disorders in developing nations.

-

Pharmacovigilance and Bioequivalence Studies: Regulatory emphasis on consistency and efficacy of generic drugs is impacting market dynamics.

Integration of artificial intelligence in thyroid gland disorder treatment is enhancing diagnosis, management of patients and development of new treatment strategies. AI-powered diagnostics tools can be embedded in hospital systems and clinical systems for early detection of thyroid disorders. Wearable devices and mobile health applications integrated with AI can assist in monitoring of symptoms, prompting early check-ups for patients and also provide personalized treatment plans based on individual patient data. Machine learning models can be applied for prediction of potential flare-ups or complications, further enabling proactive adjustments to treatment plans. AI-powered telehealth platforms are facilitating remote monitoring and consultations for thyroid patients.

Report Scope of Thyroid Gland Disorder Treatment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.47 Billion |

| Market Size by 2034 |

USD 3.42 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 3.7% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Indication, Drug, Distribution Channel, Route of Administration, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbvie Inc.; Amgen Inc.; GSK Plc; Merck KGaA; Viatris Inc.; Novartis AG; Pfizer Inc.; Takeda Pharmaceutical Company Limited; Elexis Inc.; IBSA Pharma (IBSA Group) |

Key Market Driver

Increasing Prevalence of Hypothyroidism and Growing Awareness

The steady rise in hypothyroidism cases globally especially in women over 60—remains one of the most significant drivers of the thyroid gland disorder treatment market. The condition, characterized by low production of thyroid hormones, leads to fatigue, weight gain, depression, and infertility if left untreated. This burden is further amplified by aging populations and greater incidence of autoimmune conditions such as Hashimoto’s thyroiditis.

Heightened awareness through healthcare campaigns and routine thyroid function tests has led to earlier diagnosis and treatment initiation. For instance, in the U.S., routine TSH screening is now commonly performed as part of annual health check-ups for at-risk groups. As levothyroxine continues to be the first-line therapy for hypothyroidism, the growing diagnosed population directly correlates with rising pharmaceutical demand. Educational outreach by associations such as the ATA and increased physician emphasis on thyroid health are encouraging long-term medication adherence, boosting market growth.

Key Market Restraint

Challenges with Drug Bioavailability and Treatment Compliance

Despite the widespread use of thyroid medications, achieving therapeutic efficacy can be complex due to bioavailability issues and poor patient adherence. Levothyroxine, for example, is highly sensitive to food, other medications, and gastrointestinal conditions, which can impair absorption and lead to fluctuating hormone levels. Patients often require frequent dose adjustments and TSH monitoring, leading to frustration and decreased compliance.

Inconsistent potency among different manufacturers and between branded versus generic drugs further complicates therapy. Regulatory agencies such as the FDA have responded by tightening bioequivalence standards, yet patient sensitivity to formulation changes persists. Additionally, long-term daily medication requirements for chronic conditions like hypothyroidism pose challenges for forgetful or elderly patients. As treatment efficacy relies on stringent consistency, these factors collectively limit optimal disease control and thus restrain market outcomes.

Key Market Opportunity

Growth of Online Pharmacies and Digital Health Integration

The expansion of online pharmacy platforms represents a major opportunity for thyroid treatment delivery, especially in the context of chronic disease management. Patients with hypothyroidism or hyperthyroidism often require lifelong medications, regular lab tests, and periodic physician consultations. Digital health solutions that integrate medication delivery, remote monitoring, and virtual follow-ups can streamline treatment pathways and reduce care gaps.

In the U.S., several digital platforms now offer direct-to-consumer thyroid treatment packages, including home-based blood testing kits and telehealth consultations. Companies such as Paloma Health and Everlywell are leveraging e-commerce and digital diagnostics to provide end-to-end thyroid care. These models are particularly appealing to tech-savvy younger demographics and underserved rural populations. As regulatory frameworks catch up with telemedicine and e-pharmacy models, the potential for scalable, patient-centric thyroid disorder management is substantial.

Thyroid Gland Disorder Treatment Market By Indication Insights

Hypothyroidism dominated the thyroid gland disorder treatment market, driven by its significantly higher prevalence compared to hyperthyroidism. Most cases of hypothyroidism are chronic and require daily hormone replacement therapy, often for life. Levothyroxine, the standard of care, remains among the most prescribed drugs in the U.S. According to IQVIA data, over 100 million prescriptions for levothyroxine are written annually in the U.S. alone, underscoring the dominance of this indication. The rising aging population, autoimmune trends, and better detection of subclinical hypothyroidism are further contributing to sustained growth.

Hyperthyroidism is the fastest-growing indication, particularly with increasing incidence of Graves’ disease among younger adults and women of reproductive age. The management of hyperthyroidism is more complex, involving antithyroid drugs, radioactive iodine therapy, or surgery in certain cases. Advances in understanding thyroid autoimmunity, as well as improved diagnostic algorithms, are facilitating earlier diagnosis. The availability of targeted treatments and combination therapies is helping reduce relapse rates and hospitalizations, thus propelling market expansion in this subsegment.

Thyroid Gland Disorder Treatment Market By Drug Insights

Levothyroxine holds the largest share of the thyroid drug market, reflecting its long-standing use and clinical efficacy for hypothyroidism. Available in multiple strengths, generic and branded formulations, and even novel liquid and gel caps, levothyroxine continues to be a cornerstone of endocrine therapeutics. Despite periodic controversies over generic equivalency, its cost-effectiveness and familiarity make it the preferred first-line option globally. Innovations in dosage titration algorithms and mobile adherence reminders are improving therapeutic success rates.

Imidazole-based compounds are the fastest-growing drug category, used primarily for treating hyperthyroidism. Methimazole and its derivatives offer better tolerability profiles and longer half-lives than propylthiouracil, leading to wider physician preference. New research into improved formulations with reduced hepatotoxicity and lower relapse rates is boosting their appeal. Their adoption is also expanding in pediatric and pregnancy-related hyperthyroidism, creating new avenues for market growth.

Thyroid Gland Disorder Treatment Market By Route of Administration Insights

The oral segment accounted for the largest market revenue share of 58.0% in 2024. This route ensures ease of use, affordability, and patient compliance. Oral levothyroxine and methimazole are the primary agents across most treatment guidelines, and innovations in formulation—such as liquid forms for patients with absorption issues—are enhancing usability.

Intravenous therapies are gaining traction as the fastest-growing route, particularly in hospital settings or in severe cases such as myxedema coma or thyroid storm. While niche in terms of market volume, the critical role of IV levothyroxine and other emergency interventions contributes to their steady growth. These treatments are essential in intensive care units and during surgeries requiring hormonal stabilization. Recent advances in IV delivery protocols and product stability are aiding in wider clinical adoption.

Thyroid Gland Disorder Treatment Market By Distribution Channel Insights

Retail stores dominate the distribution landscape for thyroid disorder medications, owing to their accessibility and established trust among patients. Brick-and-mortar pharmacies often provide patient counseling, automatic refills, and insurance coordination, which are critical for chronic therapy adherence. In countries like the U.S., retail chains such as CVS and Walgreens offer loyalty programs and medication management services, strengthening their role in endocrine care.

Online pharmacies are the fastest-growing channel, fueled by the convenience of doorstep delivery, lower prices, and increasing digital literacy. The pandemic significantly accelerated online adoption, and this trend continues post-COVID. Startups and telehealth-integrated pharmacies are now offering subscription models for thyroid medications, often bundled with lab monitoring services. The ability to automate refills and integrate adherence tracking is making online platforms increasingly attractive for long-term patients.

Thyroid Gland Disorder Treatment Market By Regional Insights

North America leads the thyroid gland disorder treatment market, supported by a robust healthcare infrastructure, high awareness levels, and favorable reimbursement systems. The U.S. accounts for a significant share of global levothyroxine prescriptions and is home to several leading pharmaceutical companies producing both branded and generic versions of thyroid drugs. Regular thyroid function screening is part of preventive healthcare in many U.S. states, particularly for pregnant women and older adults. The region also hosts a thriving ecosystem of digital health startups focused on chronic disease management, boosting innovation in the treatment landscape.

Asia Pacific is the fastest-growing region, driven by increasing awareness, expanding healthcare access, and a growing middle-class population. Countries such as India and China are witnessing a surge in diagnosed cases of both hypothyroidism and hyperthyroidism, partly due to public health campaigns and urban lifestyle shifts. The rising burden of iodine deficiency disorders in rural regions is also contributing to greater treatment demand. Pharmaceutical companies are responding by offering affordable generics and localized formulations, while e-pharmacy platforms are making medications more accessible. Government initiatives for thyroid screening, especially in prenatal care, are further supporting regional market expansion.

Why is the Thyroid Gland Disorder Treatment Market Expanding in the U.S.?

U.S. dominates the market in North America, owing to the factors such as growing prevalence of thyroid disorders, increased screening and diagnosis rates, advanced healthcare infrastructure, rise of telemedicine platforms and rising disposable incomes. Continuous advancements in treatments such as improved diagnostic techniques, development of replacement therapies for thyroid hormone, minimally invasive procedures with techniques like radiofrequency ablation (RFA) for benign thyroid nodules and recurrent thyroid cancers, targeted therapies for thyroid cancers and innovations in thyroid surgery like continuous intraoperative nerve monitoring and minimally invasive video-assisted thyroidectomy (MIVAT) are significantly contributing to the market growth.

Various government bodies like the National Institutes of Health (NIH) via the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) and the National Cancer Institute (NCI) funds research on various aspects of thyroid-related disorders such as causes, diagnosis and treatment of hypothyroidism, hyperthyroidism and thyroid cancer. The Centers for Medicare & Medicaid Services (CMS) provides insurance coverage for thyroid treatments.

What Factors are Fuelling the Growth of Thyroid Gland Disorder Treatment Market in China?

China is anticipated to witness fastest growth in the Asia Pacific region. The market expansion is driven by increased burden of thyroid disorders, increasing public and clinical awareness regarding thyroid health issues, expanding healthcare infrastructure, rising disposable incomes, surge in drug clinical trials and favourable health coverage policies to cater the large population. Access to advanced treatment options with adoption of modern Western medicine and sophisticated surgical techniques as well as growing emphasis on traditional Chinese medicine approaches like herbal medicine and acupuncture is expected to boost the market growth in the upcoming years.

Some of the prominent players in the thyroid gland disorder treatment market include:

- Abbvie Inc.

- Amgen Inc.

- GSK Plc

- Merck KGaA

- Viatris Inc.

- Novartis AG

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Elexis Inc.

- IBSA Pharma (IBSA Group)

Thyroid Gland Disorder Treatment Market Recent Developments

- In April 2025, Merida Biosciences, launched with a Series A financing round securing $121 million. The company aims at using its novel platform designed precisely for targeting pathogenic antibodies for a broad range of autoimmune and allergic diseases which includes lead candidate targeting Graves’ disease autoantibodies.

- In April 2025, Merck, a global pharmaceutical company, launched a thyroid awareness program, ThyroAfrica in Kenya for raising awareness of thyroid disorders in Africa.

- In February 2025, Egetis Therapeutics, a Swedish pharmaceutical company, received approval for its ultra-rare disease drug Emcitate (tiratricol) for treating patients with monocarboxylate transporter 8 (MCT8) deficiency which is also known as Allan-Herndon-Dudley syndrome, a rare congenital disorder characterized by increased serum levels of thyroid hormone with no current therapies available.

- In August 2024, Ascendis Pharma received the FDA approval for palopegteriparatide hormone replacement therapy developed as TransCon PTH. The drug marketed under the brand name Yorvipath will be used for treatment of rare endocrine disorder hypoparathyroidism in adults.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the thyroid gland disorder treatment market

By Indication

- Hypothyroidism

- Hyperthyroidism

By Drug

- Levothyroxine

- Liothyronine

- Propylthiouracil

- Imidazole-based compounds

- Others

By Distribution Channel

- Wholesale Distribution

- Retail Stores

- Online Pharmacy

By Route of Administration Channel

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)