Tissue Sectioning Market Size and Research

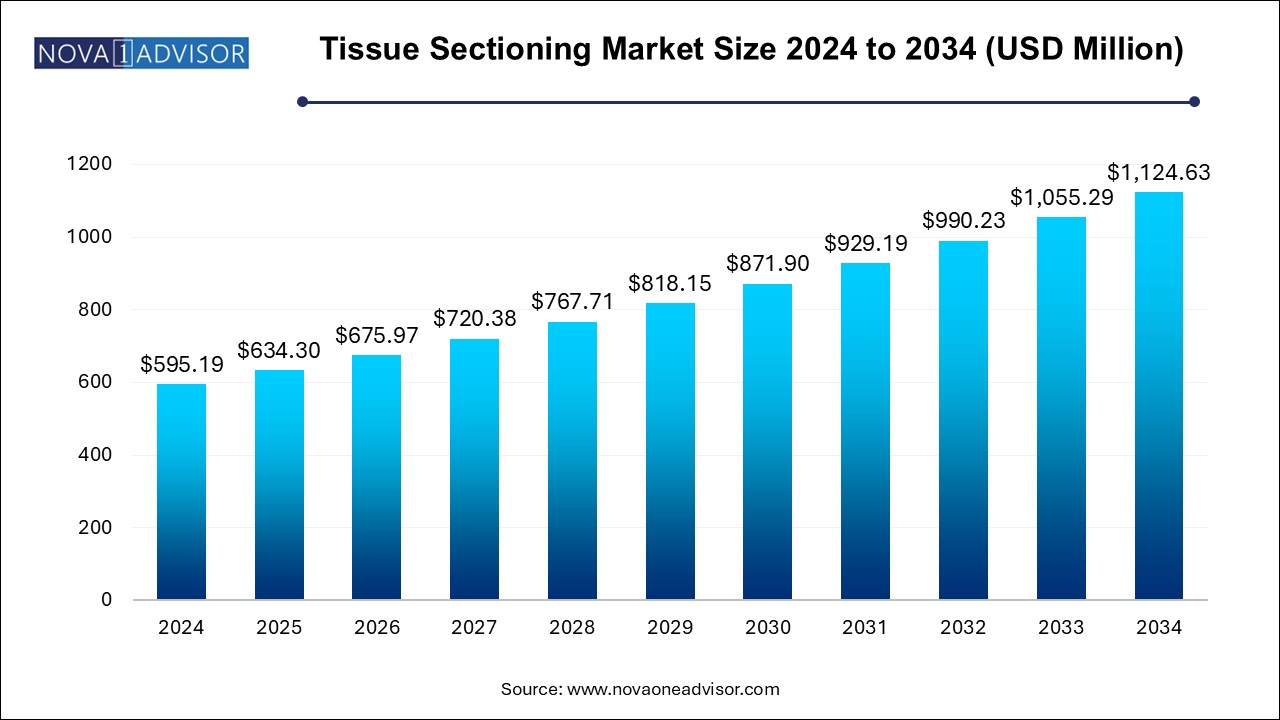

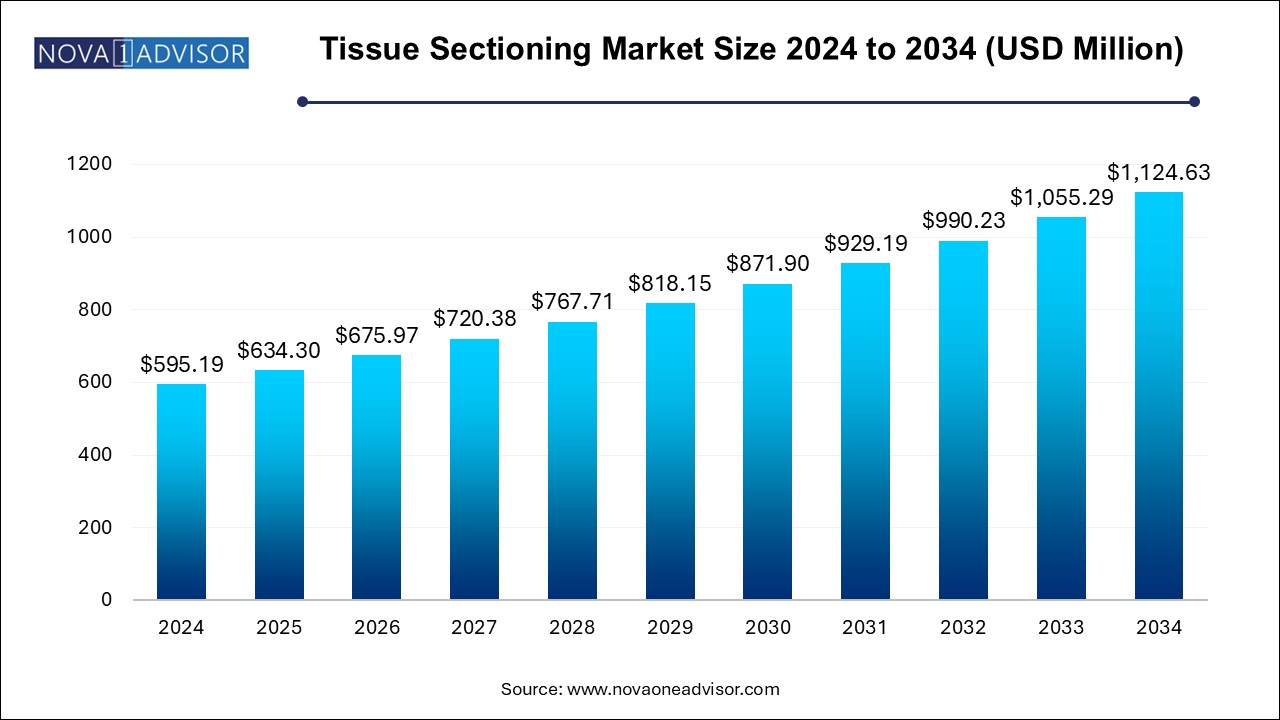

The tissue sectioning market size was exhibited at USD 595.19 million in 2024 and is projected to hit around USD 1,124.63 million by 2034, growing at a CAGR of 6.57% during the forecast period 2024 to 2034.

Tissue Sectioning Market Key Takeaways:

- In 2024, the instruments segment accounted for over 50% revenue share of the tissue sectioning market.

- The automatic technology segment accounted for the largest market share in 2024

- Disease diagnosis segment dominated the market in 2024.

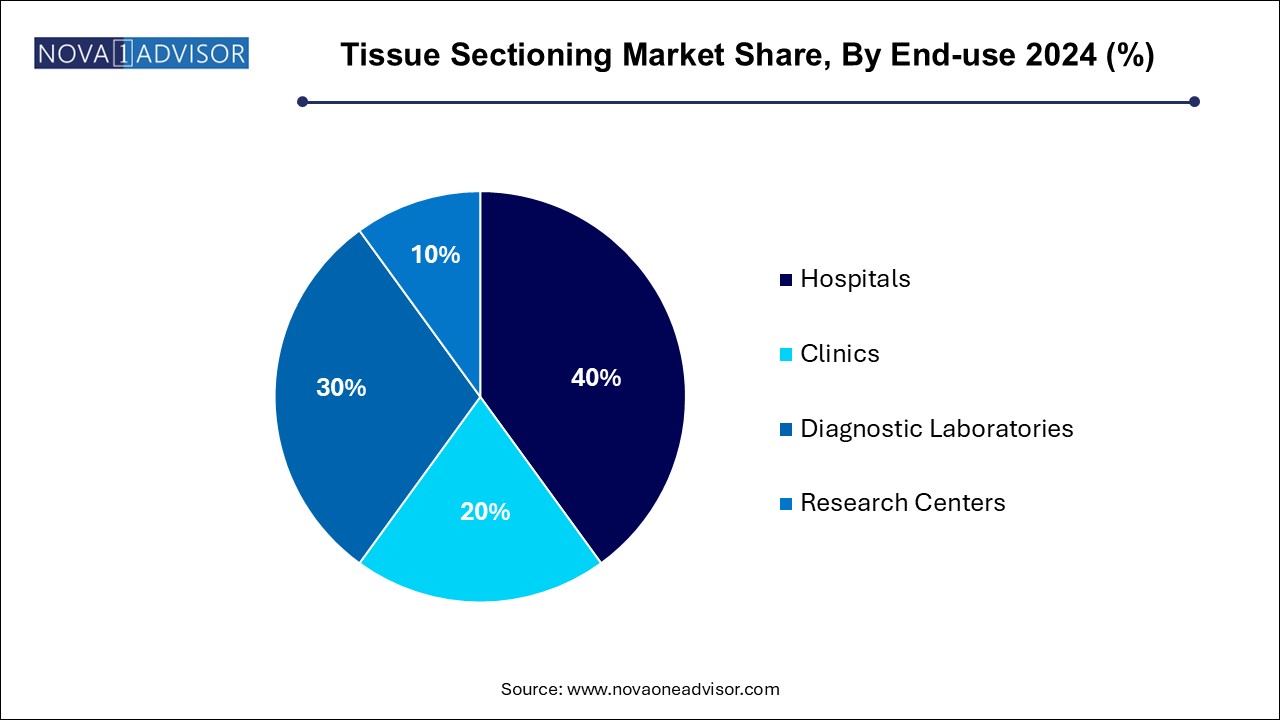

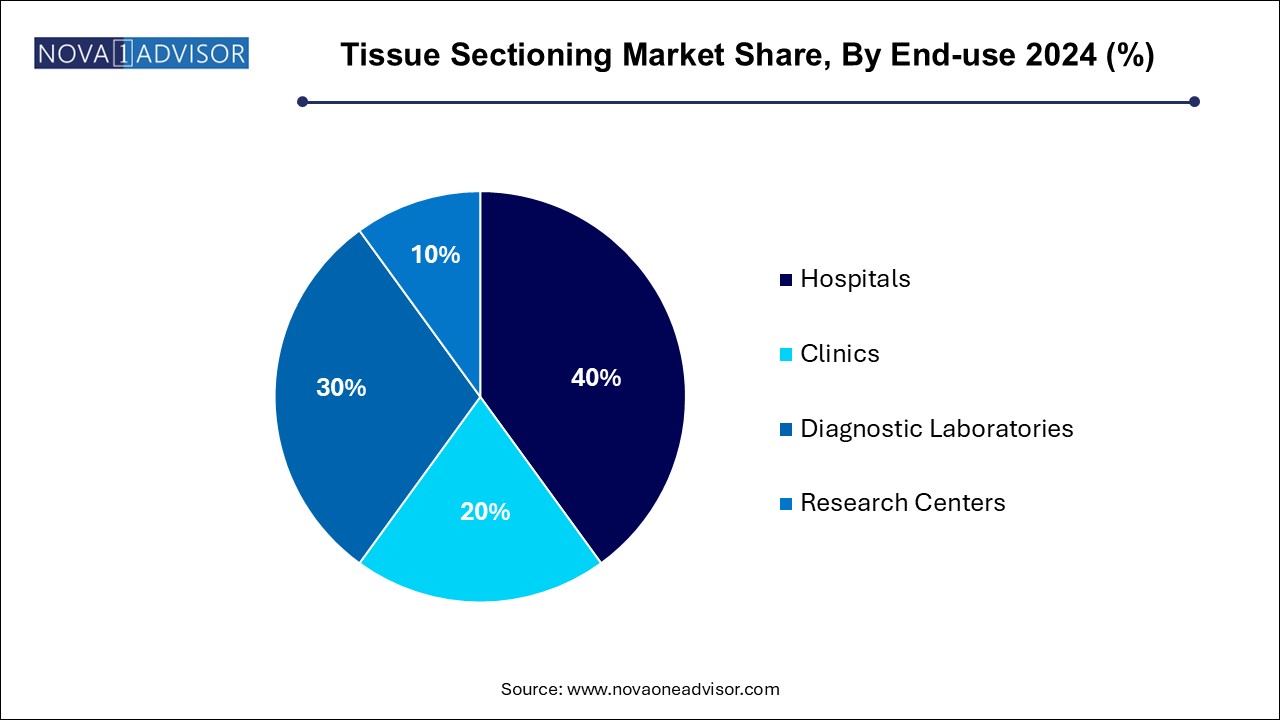

- Hospitals segment accounted for the largest market share Of 40.0% in 2024.

- North America held the dominant revenue share of the market for tissue sectioning in 2024

- Asia Pacific is expected to witness the fastest CAGR during the forecast period.

Market Overview

The tissue sectioning market forms a foundational component of histopathology, research, and clinical diagnostics, enabling the precise slicing of biological tissues for microscopic analysis. Tissue sectioning, typically achieved through the use of microtomes and cryostats, is essential for identifying morphological structures, cellular patterns, and pathological changes in tissues.

The field has gained immense relevance across diverse sectors including oncology diagnostics, neuroscientific research, infectious disease studies, and pharmaceutical drug development. Modern advancements are driving the transition from traditional manual microtomy to semi-automatic and fully automatic systems, enhancing the precision, reproducibility, and throughput of tissue sectioning processes.

The growing global burden of cancer, neurodegenerative diseases, and autoimmune disorders, coupled with rapid advances in molecular pathology and personalized medicine, has expanded the applications and demand for tissue sectioning products. Laboratories and healthcare institutions increasingly require high-quality, reproducible tissue sections to support diagnosis, biomarker discovery, and translational research.

The technological evolution toward automation, enhanced ergonomics, digital integration, and user safety is redefining the market landscape, providing significant growth opportunities for key players globally.

Major Trends in the Market

-

Shift Toward Automated Tissue Sectioning Systems: Rising demand for high-throughput, consistent tissue sectioning workflows.

-

Miniaturization and Ergonomic Design Enhancements: Improving user comfort, reducing strain, and enhancing precision.

-

Integration with Digital Pathology Platforms: Seamless linkage of tissue preparation and image analysis.

-

Rising Demand for Cryosectioning: Driven by increased intraoperative diagnosis and molecular analysis needs.

-

Development of Specialized Microtomes for Advanced Research: Catering to needs like electron microscopy and neuroscientific studies.

-

Growing Focus on User Safety: Implementation of safety shields, blade guards, and contamination control systems.

-

Customized Consumables and Accessories: Focus on application-specific blades, cassettes, and anti-roll devices.

-

Expansion in Emerging Markets: Increasing lab modernization and healthcare spending in Asia-Pacific and Latin America.

Report Scope of Tissue Sectioning Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 634.30 Million |

| Market Size by 2034 |

USD 1,124.63 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 6.57% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific; Leica Biosystems Nussloch GmbH; LLS ROWIAK LaserLabSolutions GmbH; Sakura Finetek Europe B.V. |

Key Market Driver: Rising Global Burden of Cancer and Chronic Diseases

The most critical driver accelerating the tissue sectioning market is the rising global burden of cancer and other chronic diseases, which necessitates histopathological diagnosis for accurate treatment planning.

According to the World Health Organization (WHO), cancer accounts for nearly 10 million deaths annually, and early, accurate diagnosis significantly improves patient outcomes. Tissue biopsies followed by sectioning and staining remain the gold standard for confirming malignancies and grading tumors.

Additionally, the surge in neurological, autoimmune, and infectious diseases has expanded tissue analysis beyond oncology. Tissue sectioning instruments are integral for generating thin, uniform sections critical for pathology, immunohistochemistry (IHC), and molecular diagnostics, ensuring precise clinical decisions and research outcomes.

Key Market Restraint: High Costs and Maintenance Challenges of Advanced Systems

A major restraint confronting the tissue sectioning market is the high initial cost and ongoing maintenance challenges associated with advanced automated systems.

While automation enhances throughput and consistency, the price points of fully automated microtomes, cryostats, and ultramicrotomes can be prohibitively high for small and mid-sized laboratories, especially in low-resource settings. Additionally, these systems require specialized training, regular calibration, and maintenance contracts to ensure optimal performance, adding to the total cost of ownership.

The capital-intensive nature of upgrading laboratory infrastructure often leads to hesitance in technology adoption, particularly among diagnostic laboratories and research centers in emerging economies. Bridging the affordability gap remains crucial to broadening market reach.

Key Market Opportunity: Expansion of Tissue Sectioning in Molecular Pathology and Precision Medicine

A transformative opportunity lies in the expansion of tissue sectioning applications within molecular pathology and precision medicine.

Molecular diagnostics, including next-generation sequencing (NGS) and in situ hybridization, require highly consistent, thin tissue sections to maximize nucleic acid yield and ensure assay reliability. The integration of tissue sectioning with digital pathology, spatial transcriptomics, and biomarker discovery workflows is opening new frontiers in personalized cancer treatment and rare disease diagnostics.

Companies offering integrated, standardized sectioning solutions compatible with downstream molecular assays stand to capitalize significantly. Furthermore, partnerships with digital pathology firms and AI-driven diagnostic platforms can create synergistic value propositions, accelerating market growth.

Tissue Sectioning Market By Product Insights

Instruments dominate the product segment, encompassing microtomes (rotary, sliding, ultramicrotomes), cryostats, and other sectioning devices. These instruments form the core hardware enabling precise tissue slicing for histological analysis, with rotary microtomes being the most widely used across clinical and research settings due to their reliability and versatility.

Accessories and consumables are growing fastest, driven by the recurrent demand for blades, embedding cassettes, anti-roll plates, and disposable microtome knives. Customization of consumables for specific applications like soft tissue, bone, or brain slicing is gaining traction, ensuring consistent sectioning quality while enhancing operational efficiency.

Tissue Sectioning Market By Technology Insights

Manual systems dominate the technology segment, historically forming the backbone of histopathology labs, particularly in regions where budget constraints persist. Manual rotary microtomes and cryostats are valued for their simplicity, cost-effectiveness, and reliability.

Automatic systems are growing fastest, offering precise motorized control of section thickness, speed, and force, drastically reducing user fatigue and improving reproducibility. Automated systems also facilitate high-throughput sectioning essential for large-scale clinical diagnostics and research applications, aligning with the growing global emphasis on laboratory efficiency.

Tissue Sectioning Market By Application Insights

Diagnosis dominates the application segment, reflecting the critical role of tissue sectioning in routine pathological examinations, cancer diagnostics, infectious disease identification, and autoimmune disorder analysis. High demand from hospitals, clinics, and diagnostic labs underscores the dominance of clinical diagnostics.

Research applications are growing fastest, driven by expanding use of tissue sectioning in academic studies, drug development, neuroscience, regenerative medicine, and translational research. Increasing R&D funding and initiatives focused on biomarker discovery and personalized therapeutics further amplify the demand for advanced tissue sectioning instruments in research settings

Tissue Sectioning Market By End-use Insights

Hospitals dominate the end-use segment, owing to the volume of biopsies and surgical specimens requiring pathological examination daily. Comprehensive healthcare facilities house histopathology departments equipped with full tissue processing and sectioning capabilities.

Research centers are growing fastest, supported by increasing investments in biomedical research, government funding programs, and collaborations between academia and industry. Research institutions demand cutting-edge sectioning technologies, such as ultramicrotomes for electron microscopy or cryostats for frozen tissue studies, further boosting segment growth.

Tissue Sectioning Market By Regional Insights

North America holds the largest market share, driven by a strong healthcare infrastructure, robust research ecosystem, and early adoption of innovative technologies.

The United States accounts for the majority of North America's revenue, fueled by the high incidence of cancer, well-established histopathology networks, and substantial investment in biomedical research. Additionally, the presence of leading companies like Leica Biosystems (Danaher), Thermo Fisher Scientific, and Sakura Finetek supports the regional market's leadership.

Furthermore, favorable reimbursement structures for cancer diagnostics and a rising trend toward personalized medicine further consolidate North America's dominance in the tissue sectioning industry.

Asia-Pacific is the fastest-growing region, propelled by rising healthcare expenditure, increasing cancer burden, and expanding healthcare infrastructure in countries such as China, India, Japan, and South Korea.

Governments across the region are investing heavily in healthcare modernization, pathology infrastructure, and research funding, creating fertile ground for tissue sectioning technology adoption. Additionally, growing collaborations between Asian academic institutions and global biopharma companies are driving demand for high-precision histological tools.

Affordable, locally manufactured sectioning equipment, combined with rapid urbanization and rising awareness about early disease diagnosis, ensures Asia-Pacific's continued outperformance in market growth rates.

Some of the prominent players in the tissue sectioning market include:

- Thermo Fisher Scientific

- Leica Biosystems Nussloch GmbH

- LLS ROWIAK LaserLabSolutions GmbH

- Sakura Finetek Europe B.V.

Recent Developments

-

March 2025: Leica Biosystems launched the HistoCore Arcadia 2 automated embedding and sectioning system, featuring AI-assisted tissue orientation for improved pathology lab productivity.

-

February 2025: Sakura Finetek introduced the Tissue-Tek SmartCut automated rotary microtome designed to integrate seamlessly with digital pathology systems.

-

January 2025: Thermo Fisher Scientific expanded its cryostat product line with the CryoStar NX75 Plus, offering faster sectioning speeds and improved safety features for intraoperative pathology.

-

December 2024: Slee Medical GmbH announced a strategic partnership with a leading AI diagnostics firm to integrate smart automation into their tissue sectioning instruments.

-

November 2024: SM Scientific Instruments unveiled its new range of ergonomic microtomes tailored for high-throughput clinical laboratories across Asia-Pacific markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the tissue sectioning market

Product

-

- Rotary Microtome

- Sliding Microtome

- Ultramicrotome

- Cryostat

- Others

- Accessories & Consumables

- Services

By Technology

- Automatic

- Semiautomatic

- Manual

By Application

By End-use

- Hospitals

- Clinics

- Diagnostic Laboratories

- Research Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)