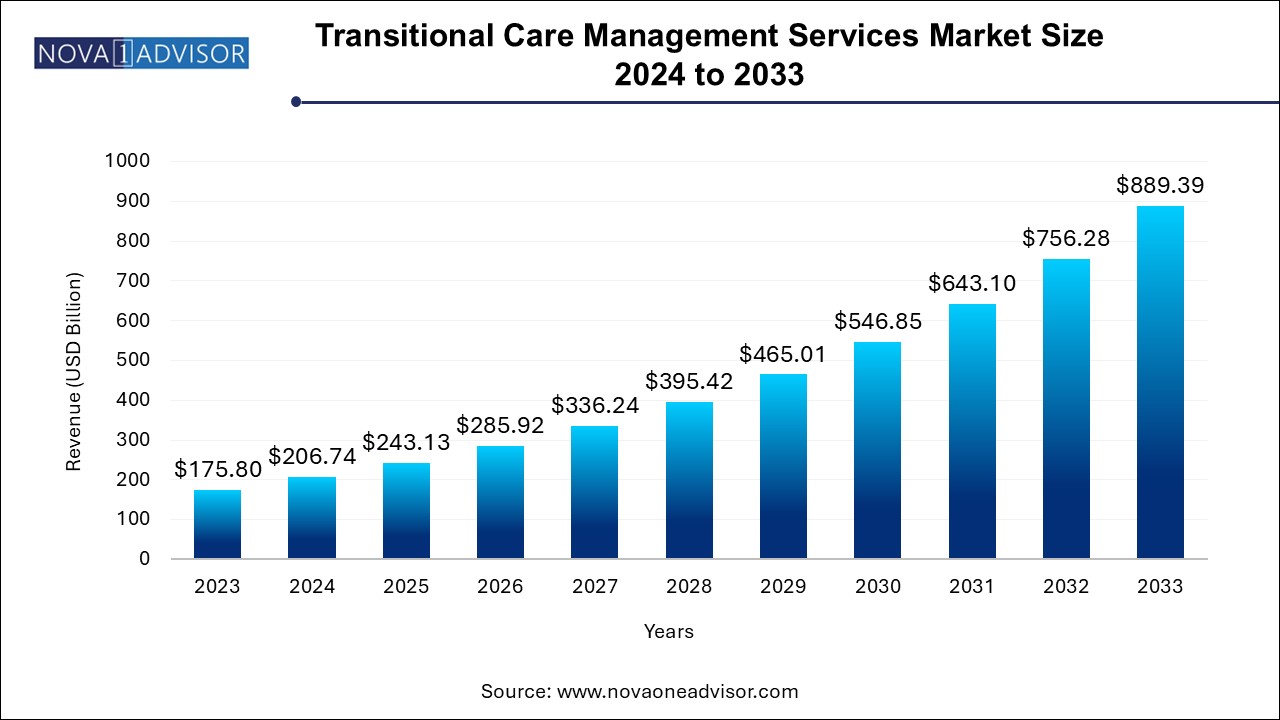

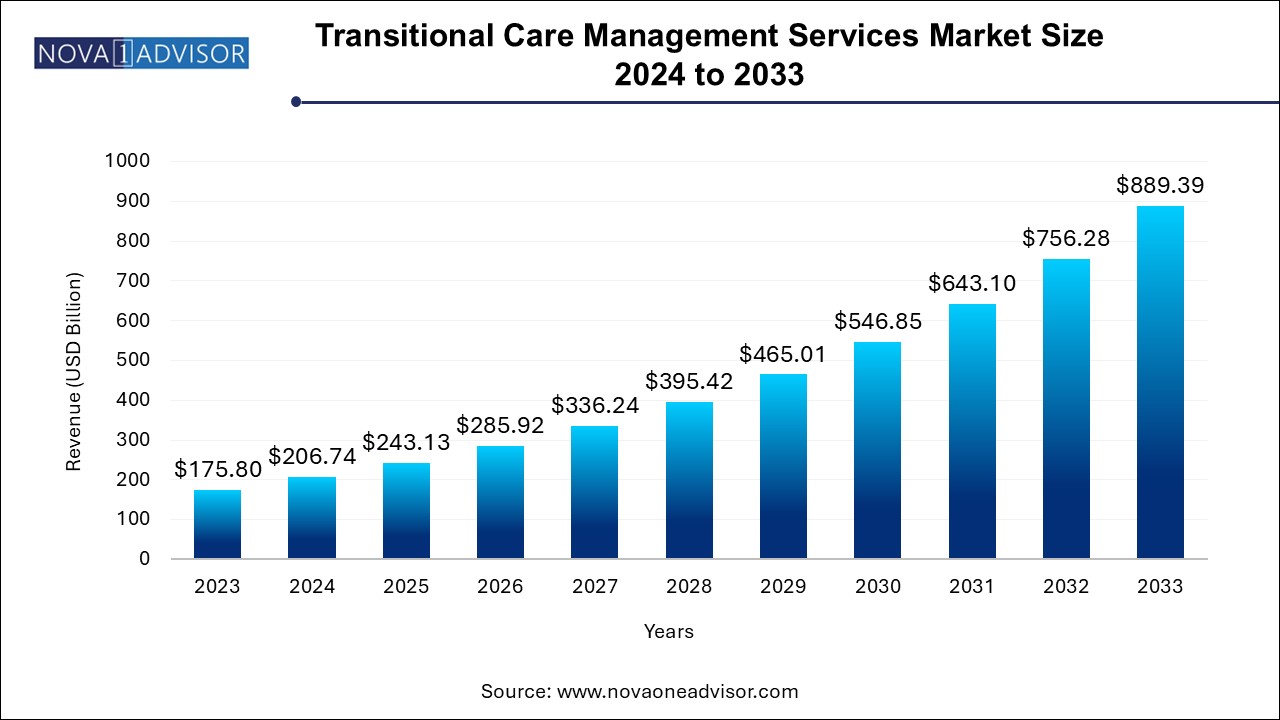

The global transitional care management services market size was exhibited at USD 175.80 billion in 2023 and is projected to hit around USD 889.39 billion by 2033, growing at a CAGR of 17.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, North America dominated the market with a share of over 47.0%.

- In 2023, the patient TCM services segment dominated the market with a share of over 30.0% owing to the reduced costs in the months after the services are provided.

- In 2023, the community settings segment accounted for the largest share of over 57.0%.

Market Overview

The Transitional Care Management (TCM) services market has emerged as a critical segment in the continuum of healthcare, playing a pivotal role in reducing hospital readmissions, improving patient outcomes, and ensuring seamless transitions from one care setting to another. TCM services refer to the comprehensive management of patients who are transitioning from an inpatient setting such as a hospital or skilled nursing facility to a community or outpatient setting. These services are especially vital for individuals with chronic conditions, multiple comorbidities, or those at high risk for rehospitalization.

As healthcare systems across the globe shift from fee-for-service models to value-based care, TCM services offer a solution that aligns both with clinical efficacy and economic efficiency. By offering structured follow-up, medication reconciliation, care coordination, and patient education, these services minimize complications and enhance recovery. The Centers for Medicare & Medicaid Services (CMS) in the United States, for example, supports TCM through specific CPT codes (99495 and 99496), which reimburse providers for performing these vital services.

Increasing rates of chronic diseases, aging populations, and the financial burden of unnecessary readmissions have significantly heightened demand for transitional care services. At the same time, advancements in telehealth and digital care coordination tools are enabling more effective delivery and monitoring, even in remote or underserved areas. In this dynamic landscape, hospitals, physician groups, home care providers, and third-party service vendors are collaborating to expand and optimize TCM offerings.

Major Trends in the Market

-

Expansion of Telehealth-Driven TCM Models: Virtual follow-ups and electronic care planning are increasingly replacing traditional in-person visits.

-

Adoption of AI and Predictive Analytics: Healthcare providers are using AI tools to identify high-risk patients likely to benefit from TCM interventions.

-

Increased Focus on Post-Acute Patient Monitoring: Providers are integrating wearable technology and remote monitoring into TCM programs.

-

Rising Role of Non-Physician Practitioners: Nurse practitioners and physician assistants are becoming primary TCM providers due to staff shortages.

-

Integration with Population Health Programs: TCM is increasingly embedded into broader chronic care and disease management strategies.

-

Value-Based Incentives and CMS Support: Governmental bodies are offering financial incentives to reduce readmissions through efficient TCM delivery.

-

Cross-Industry Collaborations and Partnerships: Health tech startups, insurers, and provider networks are joining forces to build robust TCM ecosystems.

Transitional Care Management Services Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 175.80 Billion |

| Market Size by 2033 |

USD 889.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Humworld Inc.; Rijuven Corp.; PharMerica Corporation; CareVitality; ACT Health Solutions; Medsien; Wellsky; Nextgen Healthcare; Prohealth Select; Well Living Initiative (WLI). |

Market Driver: Surge in Hospital Readmission Penalties and Chronic Disease Prevalence

A primary driver for the TCM services market is the financial pressure healthcare institutions face due to high hospital readmission rates, coupled with a growing chronic disease burden. According to the CDC, six in ten adults in the U.S. have a chronic disease, and four in ten have two or more. These conditions often lead to hospital admissions, and poor care coordination upon discharge contributes to avoidable readmissions, often within 30 days.

To address this, regulatory agencies such as CMS have introduced penalty mechanisms through the Hospital Readmissions Reduction Program (HRRP), which financially penalizes hospitals with excessive readmission rates for certain conditions. As a result, healthcare providers are increasingly investing in transitional care management services to ensure effective discharge planning, continuity of care, and patient adherence. This has created a clear business and clinical case for expanding and optimizing TCM workflows, making it a key area of innovation and investment in modern healthcare delivery.

Market Restraint: Operational Complexity and Reimbursement Challenges

Despite its promise, a significant restraint in the transitional care management services market is the operational complexity and administrative burden associated with documenting and billing for TCM services. The requirements for TCM reimbursement such as initial contact within two business days post-discharge and face-to-face visits within specific timelines can be challenging to manage across diverse patient populations and settings.

Moreover, small practices and community health providers may lack the infrastructure or staffing required to meet these stringent requirements, particularly when services are fragmented or undocumented. In many regions, inconsistent payer policies, lack of awareness about CPT codes, and the time-intensive nature of follow-up communications create gaps in TCM execution. This makes it difficult for some healthcare organizations to justify the investment, despite potential long-term savings and better outcomes.

Market Opportunity: Integration of Telehealth and Remote Monitoring into TCM

One of the most significant opportunities in this market lies in the integration of telehealth platforms and remote patient monitoring (RPM) solutions into transitional care workflows. The COVID-19 pandemic accelerated digital transformation in healthcare, leading to broader acceptance and regulatory support for telemedicine. TCM programs are now increasingly using video conferencing, secure messaging, and AI-powered decision tools to conduct remote assessments, coordinate medications, and track symptoms post-discharge.

This is particularly beneficial for elderly patients, rural populations, and those with mobility issues who may find it challenging to attend physical follow-up visits. By embedding RPM tools—such as blood pressure monitors, glucose trackers, and wearable ECGs—healthcare teams can receive real-time data to proactively intervene when issues arise. Vendors that provide integrated platforms with built-in TCM documentation, scheduling, and billing capabilities are well-positioned to capitalize on this growth area, as healthcare moves toward connected, proactive, and patient-centered models.

By Service

Patient TCM Services dominate the market, as these represent the frontline of transitional care—directly impacting patient outcomes, satisfaction, and readmission rates. Within this category, interactive contact services (telephone, electronic communication, direct outreach) play a crucial role in initiating post-discharge care within the required two-business-day window. These early interactions are critical for reviewing discharge instructions, scheduling follow-ups, and identifying potential complications. For instance, many hospitals now use centralized call centers or digital communication platforms to manage these interactions more efficiently and at scale.

Telehealth or non-face-to-face services represent the fastest-growing segment, driven by advances in digital health and increased payer acceptance of virtual care. Many TCM programs are now incorporating scheduled virtual visits with care coordinators, case managers, or even behavioral health specialists as part of a comprehensive post-discharge plan. This modality improves accessibility, lowers overhead, and supports high-touch engagement without requiring in-person contact. Particularly in underserved or rural settings, telehealth-based TCM has proven effective in reducing rehospitalizations and supporting chronic disease self-management.

By Healthcare TCM Services

Physician-led TCM services currently dominate, largely due to historical care models that place physicians at the center of post-acute management. Hospitals and private practices typically assign TCM responsibilities to primary care physicians or specialists, who manage medication reconciliation, lab reviews, and care planning in the critical post-discharge window. The strong regulatory and reimbursement support for physician oversight ensures their continued leadership in the TCM service model.

However, non-physician practitioners (NPPs) such as nurse practitioners and physician assistants are the fastest-growing group in this segment. Amid widespread physician shortages and rising patient volumes, NPPs are increasingly stepping into TCM roles, offering cost-effective, patient-centric alternatives without compromising quality. Their holistic training in education, care navigation, and chronic disease management makes them ideal for executing transitional care tasks like check-ins, counseling, and community referrals. Regulatory changes in several countries, including expanded prescribing and care privileges, are accelerating this trend.

By Billing and Documenting Services

Billing TCM services dominate this backend function, as accurate and timely reimbursement hinges on proper documentation of services rendered. Healthcare organizations, especially large systems, increasingly rely on third-party billing firms and revenue cycle management (RCM) platforms to navigate the complex requirements associated with CPT codes, TCM billing timelines, and payer-specific rules. These services ensure financial viability and compliance in a domain where underbilling or coding errors can result in significant losses.

Documenting TCM services is the fastest-growing sub-segment, with a rising number of electronic health record (EHR) systems now integrating automated documentation tools, care templates, and voice-enabled transcription features specifically for TCM. Platforms that enable seamless, end-to-end documentation capturing patient interactions, medication changes, and appointment history are being rapidly adopted to support audits and optimize reimbursements. Startups offering TCM-specific documentation SaaS (Software as a Service) tools are gaining popularity among small clinics and home health agencies.

By End-use

Inpatient settings currently dominate, as hospitals are the origin point for most care transitions. Discharge planners, case managers, and attending physicians collaborate to initiate TCM protocols before patients leave the facility. Academic medical centers, tertiary hospitals, and integrated delivery networks (IDNs) often have structured TCM pathways to reduce their readmission penalties and improve care quality scores. These institutions invest in dedicated staff and IT systems to ensure TCM execution within regulatory guidelines.

Community settings are the fastest-growing end-use category, as healthcare shifts from institution-based to community-centered models. Home health agencies, independent physician associations (IPAs), accountable care organizations (ACOs), and even retail clinics are adopting TCM frameworks to bridge care gaps post-discharge. The flexibility of community settings—combined with mobile health technology and visiting providers—enables patient-centric care that addresses social determinants, enhances engagement, and supports medication adherence. This shift also reflects a broader industry trend toward decentralizing healthcare delivery.

Regional Analysis

North America dominates the global TCM services market, led by the United States’ robust policy and reimbursement framework that incentivizes post-discharge care coordination. The U.S. healthcare system, through CMS and private insurers, has standardized TCM billing codes and quality metrics, making TCM a strategic and financially supported initiative. Leading hospital networks, such as Kaiser Permanente and Cleveland Clinic, operate advanced TCM programs that integrate virtual care, data analytics, and interdisciplinary teams. Canada, too, has made strides in post-acute care transitions, especially for elderly populations and indigenous communities.

Asia-Pacific is the fastest-growing regional market, driven by aging populations, increasing healthcare access, and national health reforms in countries like Japan, China, South Korea, and India. Governments are beginning to recognize the role of care transitions in managing chronic disease and healthcare costs, especially as these countries face demographic shifts and rural-urban health disparities. Pilot programs involving telehealth-driven TCM in India and elderly care models in Japan are paving the way for more structured implementations. The APAC region’s appetite for digital innovation and scalable health delivery models positions it as a key growth hub for TCM services.

Some of the prominent players in the transitional care management services market include:

- Humworld Inc.

- Rijuven Corp

- PharMerica Corporation

- CareVitality

- ACT Health Solutions

- Medsien

- Wellsky

- Nextgen Healthcare

- Prohealth Select

- Well Living Initiative (WLI)

Recent Developments

-

CareBridge (April 2025): Announced a partnership with several Medicaid MCOs to deliver transitional care services to high-risk patients with disabilities using nurse-led telehealth.

-

Signify Health (March 2025): Launched a new AI-powered platform for predictive TCM planning, helping providers identify patients most likely to require post-acute intervention.

-

Epic Systems (February 2025): Released a TCM-specific module within its EHR platform to automate documentation, patient communication, and billing workflows for hospital networks.

-

Teladoc Health (January 2025): Expanded its virtual care offerings with a TCM-focused service line targeting recently discharged patients with chronic diseases.

-

Humana (December 2024): Partnered with a network of community clinics to roll out coordinated TCM programs integrated with social services for Medicare Advantage enrollees.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global transitional care management services market.

Service

-

- Interactive Contact (Direct Contact, Telephone, Electronic)

- Face-to-face Visit

- Non-face-to-face (Telehealth)

-

- Physicians

- Non-Physician Practitioners

- Billing TCM Services

- Documenting TCM Services

- Others

End-use

- Inpatient Settings

- Community Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)