Transplant Diagnostics Market Size and Trends 2026 to 2035

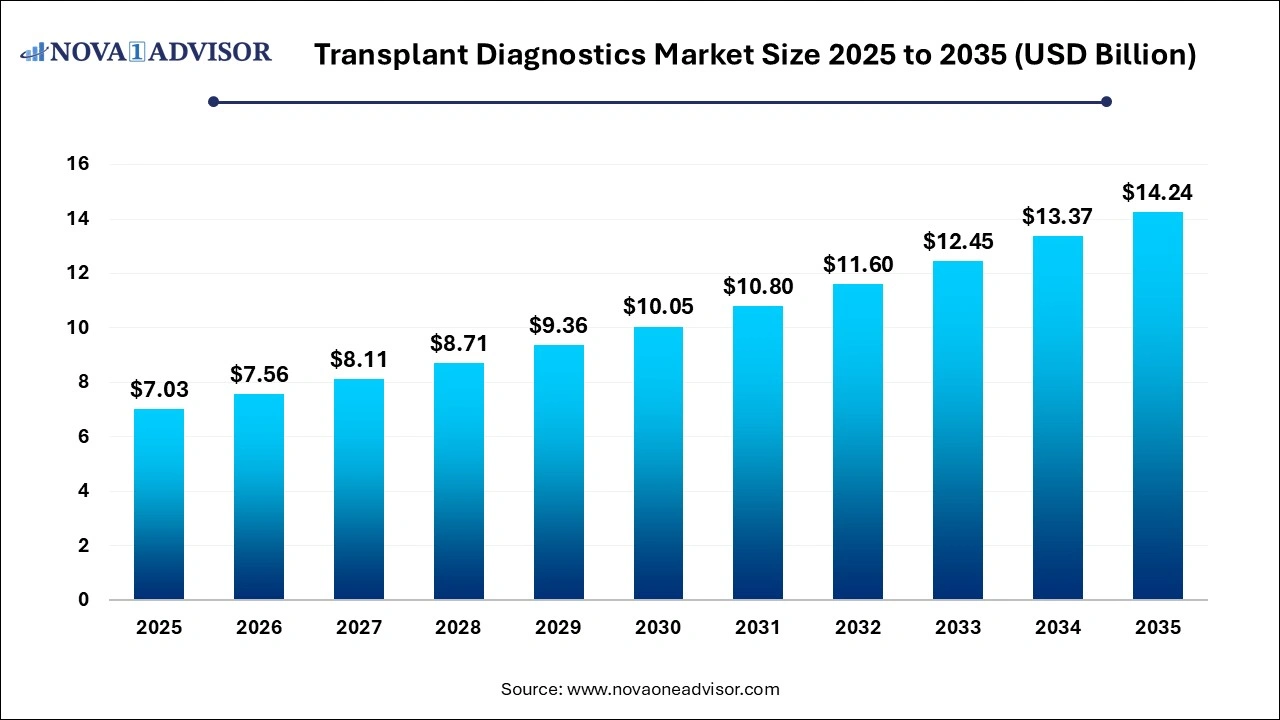

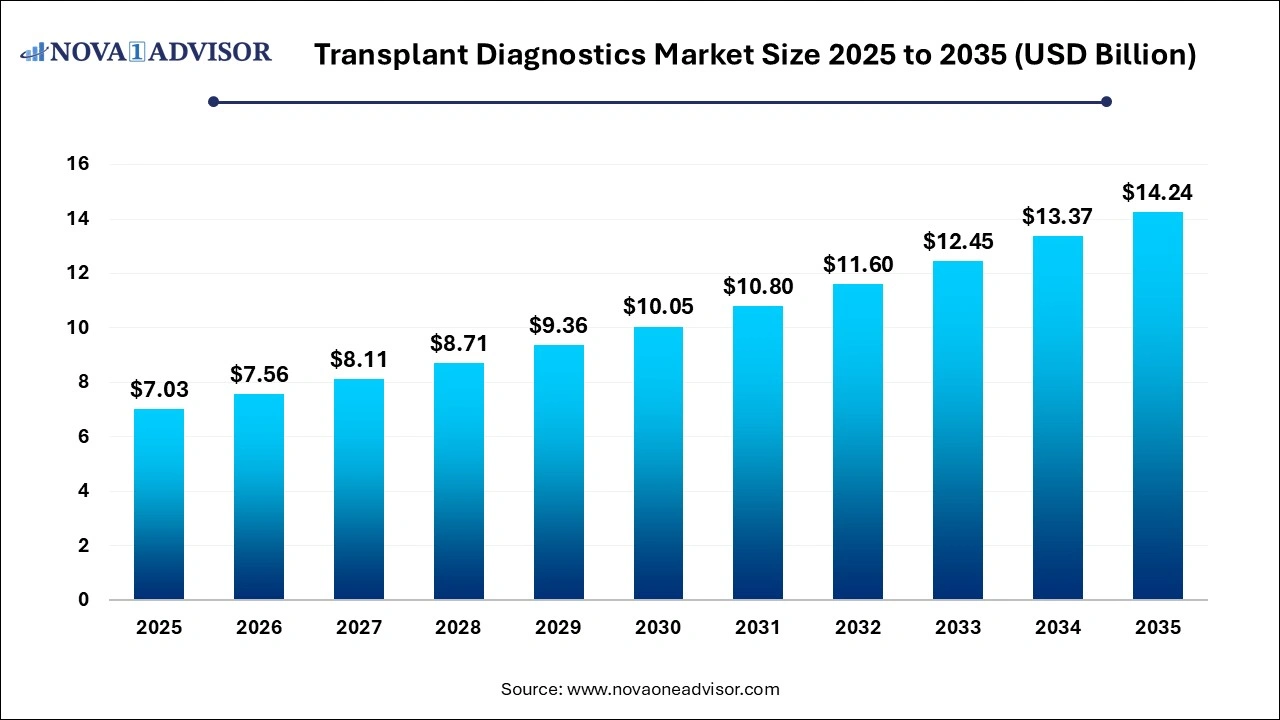

The transplant diagnostics market size was exhibited at USD 7.03 billion in 2025 and is projected to hit around USD 14.24 billion by 2035, growing at a CAGR of 7.31% during the forecast period 2026 to 2035.

Transplant Diagnostics Market Key Takeaways:

- In 2025, the molecular assays segment dominated the market and accounted for largest revenue share of 41.5%.

- The sequencing-based molecular assays are expected to witness the fastest CAGR of 8.3% during the forecast period.

- In 2025, the reagents and consumables segment dominated the market and accounted for largest revenue share in 2025

- Diagnostics dominated the market and accounted for the largest market revenue share of 71.1% in 2025.

- The solid organ transplantation segment dominated the market in 2025 and accounted for a revenue share of 45.5% in 2025.

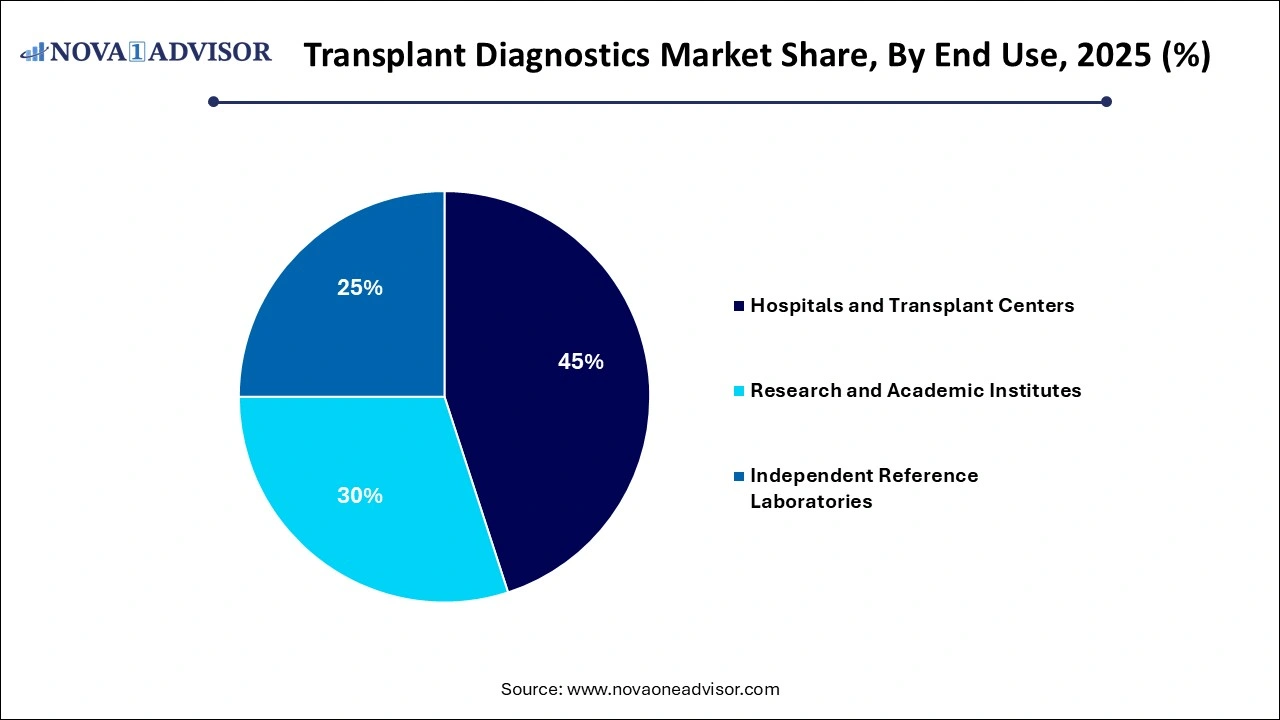

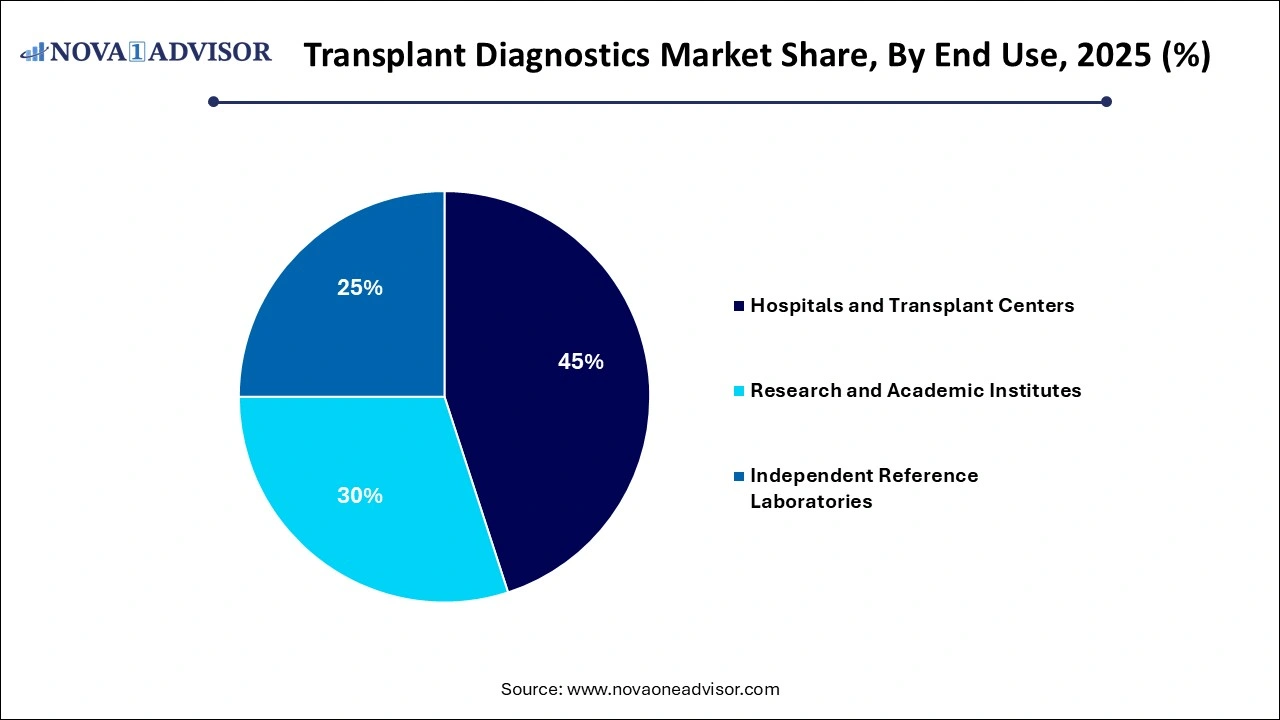

- Hospitals and transplant centers dominated the market with a revenue of 45% in 2025.

- Research and academic institutes are expected to witness the fastest CAGR during the forecast period.

- In 2025, the North America transplant diagnostics market held a considerable market share of 33.0%.

Transplant Diagnostics Market Outlook

- Market Growth Overview: The transplant diagnostics market is expected to grow significantly between 2026 and 2035, driven by the rising volume of organ tranceplants, rapid advancement in diagnostics, and high demand for better outcomes.

- Sustainability Trends: Sustainability trends involve next-generation sequencing adoption, non-invasive diagnostics and liquid biopsy, and focus on patient-centric and personalized medicine.

- Major Investors: Major investors in the market include Thermo Fisher Scientific, Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd, Abbott Laboratories, Qiagen N.V., CareDx, Inc., and Bio-Rad Laboratories, Inc.

Transplant Diagnostics Market Overview

The transplant diagnostics market is a vital component of the broader organ and tissue transplantation ecosystem. It focuses on the assessment, matching, and monitoring of donor and recipient compatibility to minimize rejection risks and improve transplantation success rates. Accurate transplant diagnostics are critical in ensuring that transplants whether solid organ, stem cell, or soft tissue are safe, effective, and long-lasting.

Transplant diagnostics encompass a range of sophisticated molecular assays, serological tests, and bioinformatics tools designed to evaluate human leukocyte antigen (HLA) typing, infectious disease status, blood group compatibility, and immune profiling. The global rise in chronic conditions like kidney failure, liver diseases, heart failure, and hematological malignancies is pushing up the demand for organ and stem cell transplantation, thus fueling the need for precise and reliable diagnostic solutions.

Technological advancements such as next-generation sequencing (NGS), real-time polymerase chain reaction (PCR), and sequence-specific oligonucleotide probes have revolutionized the transplant diagnostics field by enabling high-resolution, rapid, and scalable compatibility assessments. Furthermore, improvements in software for data interpretation and laboratory automation have enhanced diagnostic accuracy and throughput.

With governments and healthcare providers investing in expanding transplant programs and improving patient survival outcomes, the transplant diagnostics market is poised for significant expansion globally.

How AI is Impacting on Transplant Diagnostics Market

Artificial intetelligence is transforming the transplant diagnostics industry by enhancing the precision of donor-recipient matching, reducing organ rejection rates, and enabling proactive, personalized post-transplant monitoring. Machine learning and deep learning algorithms are increasingly used to analyse complex datasets, including molecular, genetic, and imaging data, which are often too extensive for traditional methods. The shift from invasive biopsy procedures to AI-driven liquid biopsies and non-invasive monitoring allowing for early detection of complications.

Supply Chain Analysis of the Transplant Diagnostics Market

- R&D and Product Development: This foundational stage involves developing advanced molecular diagnostics, NGS (Next-Generation Sequencing) panels, and HLA typing kits to improve matching precision and reduce rejection.

Key players: Thermo Fisher Scientific, Illumina, Inc., QIAGEN N.V., and CareDx.

- Raw Material Sourcing and Component Manufacturing: This stage involves producing high-purity reagents, enzymes, antibodies, and consumables necessary for molecular testing, as well as manufacturing the actual instruments (e.g., thermal cyclers, flow cytometers).

Key Players: Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Becton, Dickinson and Company, and Roche.

- Manufacturing and Assembly of Diagnostic Systems: This step focuses on assembling the final diagnostic kits and sophisticated instruments, adhering to strict regulatory standards (e.g., FDA, CE-IVD) for safety and reliability.

Key Players: Thermo Fisher Scientific, Abbott Laboratories, and Bio-Rad Laboratories

- Distribution and Logistics: This stage involves the logistical handling of cold-chain-dependent products, ensuring that reagents, kits, and instruments reach hospitals, independent reference laboratories, and research centers worldwide, often requiring specialized, rapid transportation.

Key Players: Thermo Fisher Scientific, Roche.

Major Trends in the Market

-

Shift from Serological to Molecular Diagnostics: Increasing preference for high-precision molecular assays over traditional serological methods.

-

Adoption of Next-Generation Sequencing (NGS): Enabling high-resolution, comprehensive HLA typing and minimizing mismatches.

-

Integration of Artificial Intelligence (AI) and Bioinformatics: Enhancing the analysis of complex transplant data for personalized donor-recipient matching.

-

Focus on Infectious Disease Screening: Critical in ensuring safe transplantations, particularly for immunocompromised recipients.

-

Rise in Stem Cell and Bone Marrow Transplantation: Expanding the scope of transplant diagnostics beyond solid organ transplantation.

-

Development of Point-of-Care Diagnostics: Facilitating rapid crossmatching and donor screening in emergency transplant scenarios.

-

Consolidation of Diagnostic Laboratories: Mergers and partnerships leading to the creation of specialized transplant reference laboratories.

-

Growth of Cross-border Transplant Programs: International donor-recipient matching is expanding the demand for standardized, globally recognized diagnostic protocols.

Report Scope of Transplant Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 7.56 Billion |

| Market Size by 2035 |

USD 14.24 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.31% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Test, By Product, By Application, By Transplant Area, By End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Illumina, Inc.; F. Hoffmann La-Roche Ltd; Abbott; QIAGEN; Bruker; BD (Becton, Dickinson and Company); Werfen (Immucor, Inc.); Bio-Rad Laboratories, Inc.; Omixon Inc. |

Transplant Diagnostics Market Dynamics

Driver

Rising Number of Organ Transplants Worldwide

A major driver of the transplant diagnostics market is the rising number of organ transplants performed globally.

According to the Global Observatory on Donation and Transplantation (GODT), the number of organ transplants worldwide has steadily increased over the past decade, with kidney and liver transplants being the most common. This growth is fueled by rising incidences of end-stage organ failure, advancements in surgical techniques, improved post-transplant care, and expanded living donor programs.

Accurate pre-transplant diagnostics are critical for ensuring donor-recipient compatibility, predicting transplant outcomes, and avoiding complications such as graft rejection and graft-versus-host disease (GVHD). With an increasing global transplant volume, demand for sophisticated transplant diagnostics continues to surge, supporting improved patient survival and quality of life outcomes.

Restraint

High Cost of Molecular Diagnostic Technologies

A significant restraint to market growth is the high cost associated with molecular diagnostic technologies.

While molecular techniques such as NGS and real-time PCR offer unmatched precision and resolution, they require substantial investment in specialized instrumentation, reagents, skilled personnel, and data analysis infrastructure. High capital and operational costs can be prohibitive for small transplant centers, hospitals in emerging markets, and public healthcare systems with limited budgets.

Additionally, reimbursement policies for molecular transplant diagnostics vary significantly between countries, leading to out-of-pocket expenses for patients in many regions. Overcoming cost barriers through technological innovations, economies of scale, and broader insurance coverage will be crucial for expanding access to advanced transplant diagnostic solutions.

Opportunity:

Expansion of Personalized Medicine in Transplantation

An exciting opportunity for the transplant diagnostics market lies in the expansion of personalized medicine approaches in transplantation.

The future of transplantation is moving toward individualized donor-recipient matching based on comprehensive genomic, immunologic, and infectious disease profiling. High-resolution HLA typing, detection of minor histocompatibility antigens, and immune monitoring biomarkers are enabling precision matching strategies that significantly enhance graft survival and reduce rejection rates.

Moreover, personalized immunosuppressive regimens tailored to the recipient’s immune risk profile are gaining traction, creating a need for dynamic, longitudinal diagnostic monitoring. Companies investing in developing integrated diagnostic platforms offering a complete, personalized transplant profile will be well-positioned to lead the next phase of market growth.

Transplant Diagnostics Market Segmental Insights

By Test Insights

Molecular assays dominate the test segment, capturing the largest market share due to their superior specificity, sensitivity, and ability to deliver high-resolution compatibility data. PCR-based molecular assays—including sequence-specific oligonucleotide PCR (SSO-PCR) and sequence-based primer PCR (SBP-PCR)—remain widely used for initial HLA typing and infectious disease testing.

Sequencing-based molecular assays, particularly next-generation sequencing (NGS), are growing fastest, enabling comprehensive analysis of HLA genes and minor histocompatibility antigens. NGS offers advantages like multiplexing, high throughput, and the ability to detect novel or rare alleles, significantly improving donor-recipient matching precision and long-term transplant success rates.

By Product Insights

Reagents and consumables dominate the product segment, as frequent testing for donor-recipient matching, post-transplant monitoring, and infectious disease screening necessitate a continuous supply of high-quality reagents, primers, probes, and assay kits. Single-use nature and recurring demand contribute to this segment's leading position.

Software and services are growing fastest, driven by the increasing complexity of transplant diagnostics data. Advanced software solutions for HLA typing analysis, transplant risk prediction, and bioinformatics services are becoming integral to transplant centers, supporting data-driven, evidence-based transplant decisions.

By Application Insights

Diagnostic applications dominate the application segment, reflecting the indispensable role of transplant diagnostics in clinical practice. Infectious disease testing, histocompatibility testing, and blood profiling are routine, mandatory components of pre- and post-transplant evaluations to ensure patient safety and graft viability.

Research applications are growing fastest, supported by rising R&D investments aimed at uncovering novel transplant biomarkers, improving graft tolerance strategies, and developing next-generation immunosuppressants. Research in transplant immunology, tolerance induction, and xenotransplantation requires sophisticated, high-precision diagnostic tools, fueling growth in this segment.

By Transplant Area Insights

Solid organ transplantation dominates the transplant area segment, with kidney, liver, heart, and lung transplants driving major diagnostic demand. The complexity of solid organ matching and the critical need for HLA compatibility and infectious disease screening underpin the dominance of this segment.

Stem cell transplantation is growing fastest, driven by the increasing adoption of hematopoietic stem cell transplants (HSCT) for treating leukemias, lymphomas, and genetic blood disorders. High-resolution HLA typing and immune reconstitution monitoring are critical in stem cell transplantation, creating a robust need for advanced molecular diagnostics.

By End Use Insights

Hospitals and transplant centers dominate the end-use segment, as they are the primary sites for pre-transplant assessments, organ procurement coordination, and post-transplant patient monitoring.

Independent reference laboratories are growing fastest, due to the rising trend of outsourcing complex diagnostic testing to specialized, high-throughput laboratories. Reference labs offer cost-effective, rapid, and high-quality transplant diagnostics services to hospitals and clinics lacking advanced molecular testing capabilities.

Transplant Diagnostics Market Regional Insights

North America holds the largest share of the transplant diagnostics market, fueled by a high volume of transplant procedures, advanced healthcare infrastructure, favorable reimbursement policies, and strong adoption of molecular diagnostic technologies.

The United States leads the region, supported by extensive transplant registries, public awareness programs, and leading transplant centers with cutting-edge laboratory capabilities. Additionally, the presence of major players like Thermo Fisher Scientific, Bio-Rad Laboratories, and CareDx boosts regional market strength.

Government initiatives like the Organ Procurement and Transplantation Network (OPTN) and investments in genomic transplant research further reinforce North America's leadership.

Asia-Pacific is the fastest-growing region, driven by increasing healthcare investments, growing burden of end-stage organ diseases, expanding transplant programs, and rising awareness about transplantation and related diagnostics.

Countries such as China, India, Japan, and South Korea are witnessing substantial growth in kidney, liver, and stem cell transplantations. Government support, public-private partnerships, and international collaborations are strengthening transplant infrastructure across the region.

Asia-Pacific’s improving healthcare accessibility, coupled with rising adoption of advanced molecular diagnostics and NGS technologies, ensures sustained market momentum over the coming years.

U.S. Transplant Diagnostics Market Trends

U.S.’s transition toward non-invasive molecular monitoring, allowing for earlier detection of rejection through genomic and proteomic biomarkers. The high-volume demand for reagents and consumables, necessitated by the rising global burden of end-stage renal and cardiovascular diseases. The favorable regulatory frameworks and expanded reimbursement models are accelerating patient access, positioning advanced diagnostics as the critical bridge between organ availability and long-term transplant success.

China Transplant Diagnostics Market Trends

China’s integration of AI-driven predictive analytics and machine learning, which optimize donor-recipient matching and allow for the real-time monitoring of graft health through liquid biopsies (cfDNA). In high-growth regions, significant infrastructure investment and a surging voluntary donor pool, reaching over 120,000 organs, are driving the demand for scalable, cost-effective molecular assays. The shift from reactive to predictive post-transplant care ensures superior long-term survival rates and reduced hospital readmissions, positioning advanced diagnostics as the primary engine for global transplant market expansion.

Key Players in the Transplant Diagnostics Market

- Thermo Fisher Scientific, Inc.: Provides a comprehensive portfolio, including One Lambda HLA typing assays, molecular diagnostics (PCR/NGS), and antibody detection tools for pre- and post-transplant monitoring.

- Illumina, Inc.: Enables high-resolution, deep HLA genotyping and comprehensive genomic profiling through their next-generation sequencing (NGS) platforms. Their technologies are crucial for precise, fast, and accurate donor-recipient matching to reduce the risk of transplant rejection.

- F. Hoffmann-La Roche Ltd: Focuses on molecular and immunodiagnostic solutions, specifically targeting transplant-related infectious disease screening and HLA typing.

- Abbott: Leverages expertise in immunoassay and molecular testing to provide crucial screening for pathogens in transplant recipients and donors. Their high-throughput Alinity s and other automated platforms ensure safety and efficiency in HLA compatibility testing.

- QIAGEN: Offers a wide range of sample preparation and molecular detection kits designed for high-sensitivity qPCR and digital PCR applications. Their solutions allow for rapid detection of pathogens and early identification of rejection markers.

Transplant Diagnostics Market Recent Developments

-

March 2025: CareDx announced the launch of KidneyCare, a comprehensive multimodal diagnostic solution integrating gene expression profiling and cell-free DNA monitoring for kidney transplant recipients.

-

February 2025: Thermo Fisher Scientific introduced the Ion Torrent Genexus System for fully automated NGS-based HLA typing, aiming to reduce turnaround times in transplant labs.

-

January 2025: Illumina and Eurofins Genomics announced a collaboration to develop a new suite of NGS-based transplant diagnostic panels for global markets.

-

December 2024: Bio-Rad Laboratories launched its new multiplex real-time PCR assay for simultaneous detection of key infectious agents in transplant donors.

-

November 2024: GenDx, a leading HLA typing company, expanded its NGSgo product line with high-resolution HLA typing kits optimized for bone marrow transplantation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the transplant diagnostics market

By Test

-

- PCR-based Molecular Assays

- Real-time PCR

- Sequence-based Primer-PCR

- Sequence-specific Oligonucleotide-PCR

- Other PCR-based Molecular Assays

- Sequencing-based Molecular Assays

-

- Sanger Sequencing

- Next Generation Sequencing

- Other Sequencing-based Molecular Assays

-

- Serological Assays

- Mixed Lymphocyte Culture Assays

By Product

- Reagents & Consumables

- Instruments

- Software and Services

By Application

-

- Infectious Disease Testing

- Histocompatibility Testing

- Blood Profiling

By Transplant Area

- Solid Area Transplantation

-

- Kidney Transplantation

- Liver Transplantation

- Heart Transplantation

- Lung Transplantation

- Pancreas Transplantation

- Other Organs Transplantation

- Stem Cell Transplantation

- Soft Tissue Transplantation

- Bone Marrow Transplantation

By End Use

- Hospitals and Transplant Centers

- Research and Academic Institutes

- Independent Reference Laboratories

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)