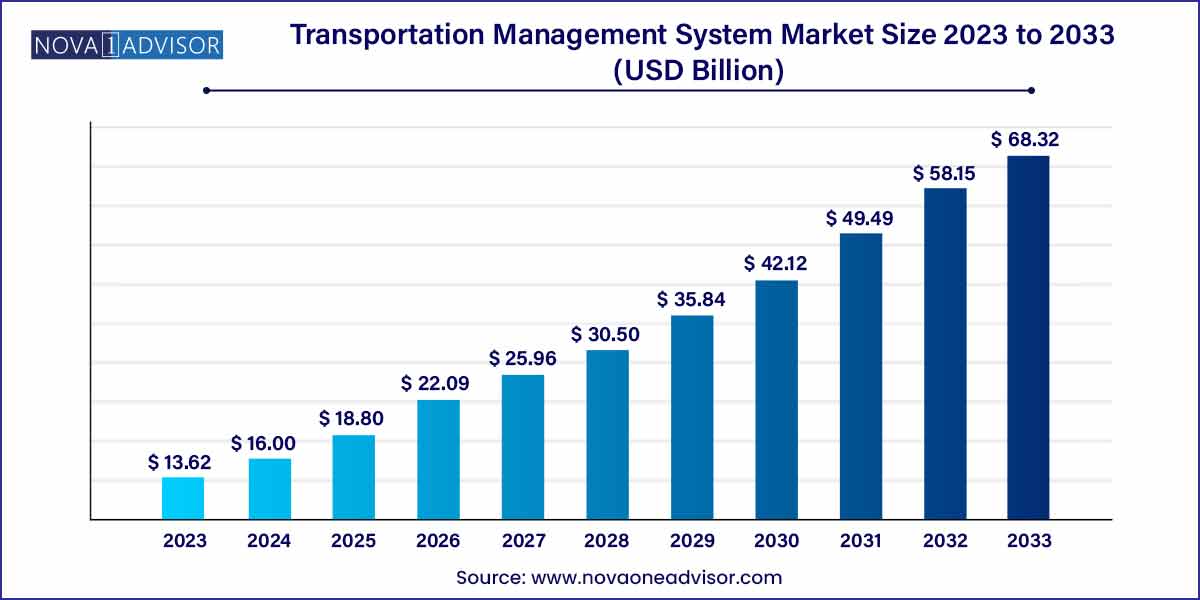

The global transportation management system market size was exhibited at USD 13.62 billion in 2023 and is projected to hit around USD 68.32 billion by 2033, growing at a CAGR of 17.5% during the forecast period of 2024 to 2033.

Key Takeaways:

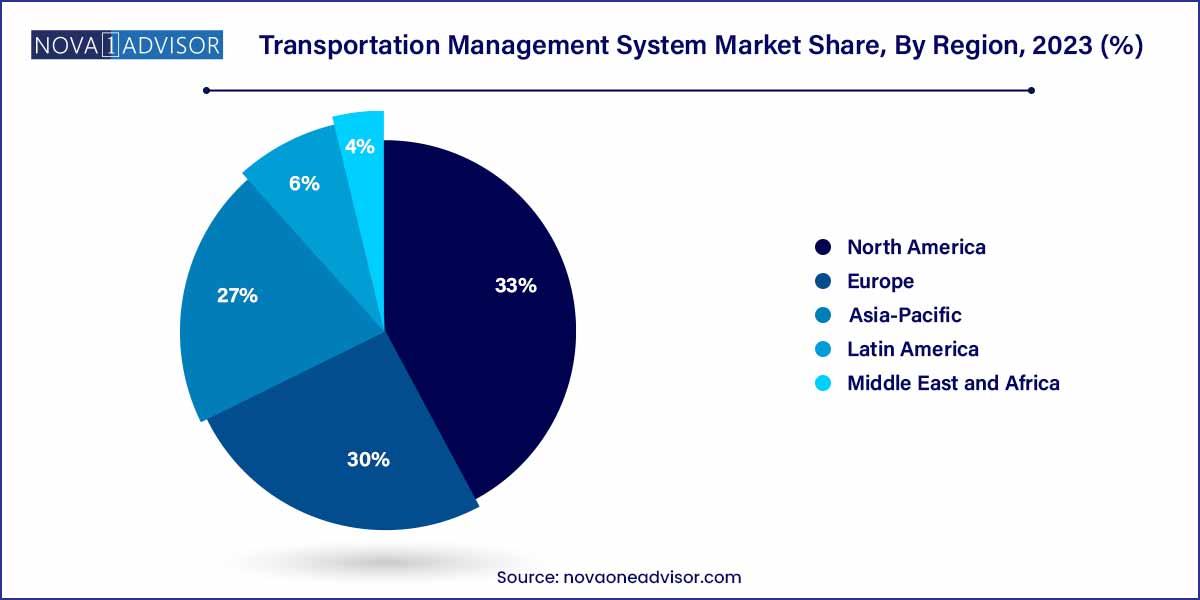

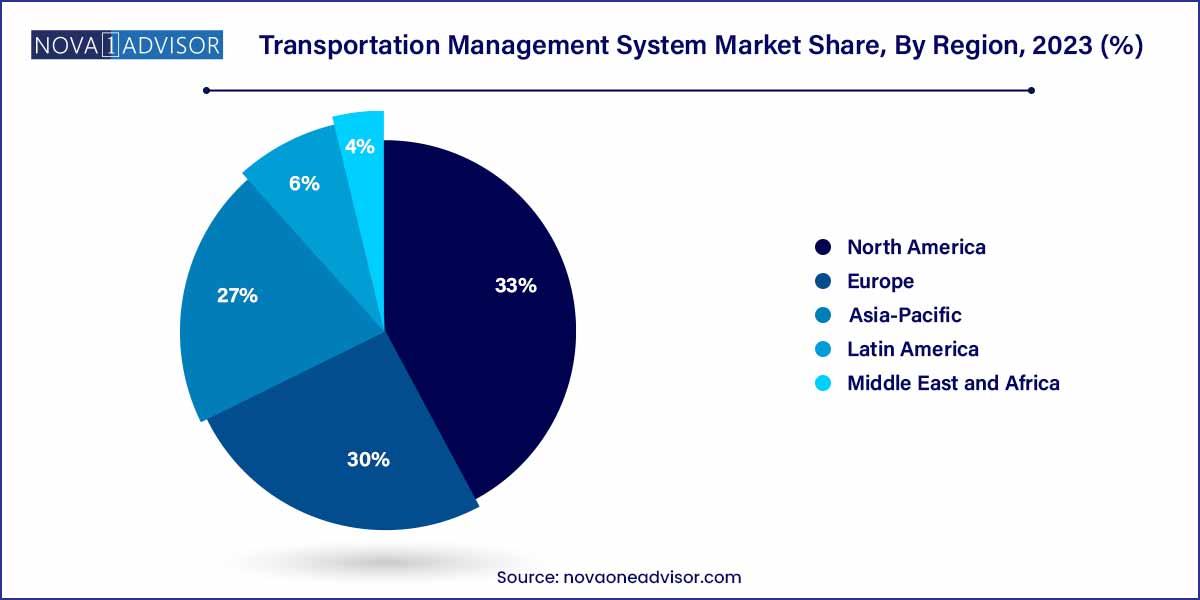

- North America dominated the global TMS market in 2023, with a revenue share of over 33.0%.

- The freight & order management segment accounted for the largest market share of 25.34% in 2023.

- The on-premise segment accounted for the largest market share of over 56.85% in 2023.

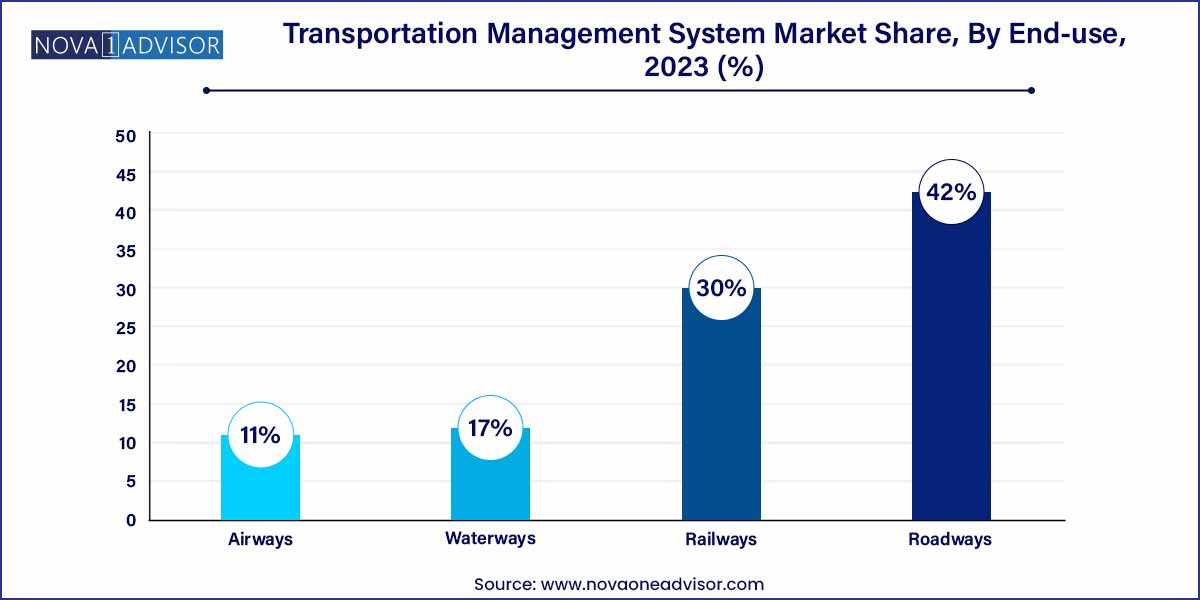

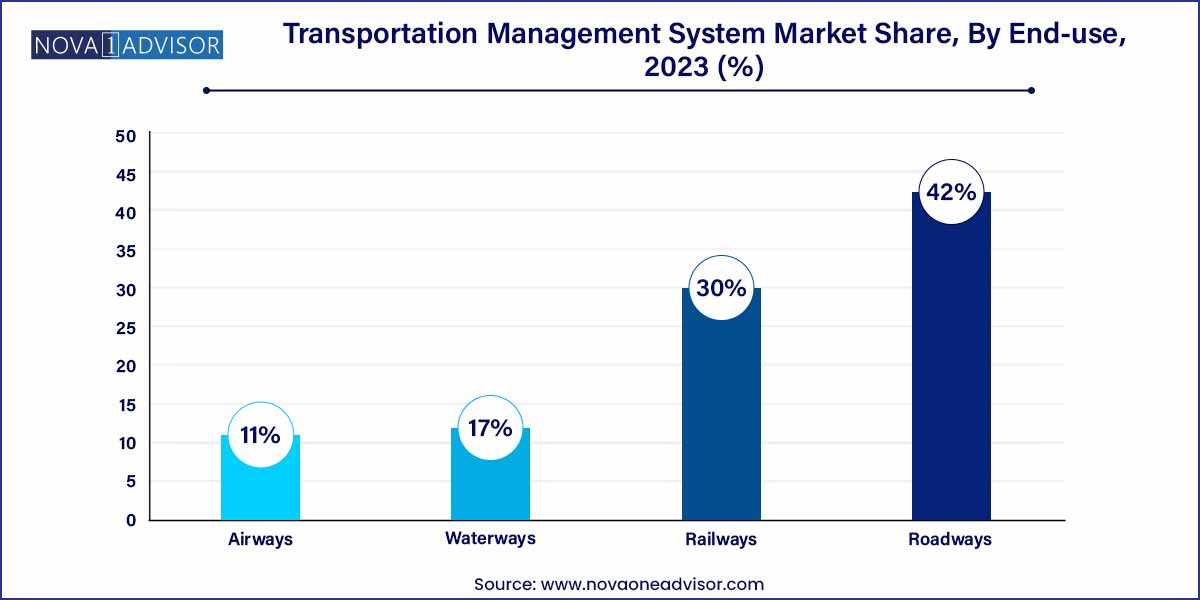

- The roadways segment accounted for the largest market share of over 42.0% in 2023.

- The manufacturing segment accounted for the largest market share of over 36.25% in 2023.

Market Overview

The Transportation Management Systems (TMS) market has evolved into a crucial backbone of modern supply chains, offering solutions that enable organizations to plan, execute, and optimize the movement of goods across various transportation modes. As global trade complexities increase and customer expectations shift toward faster, more reliable deliveries, TMS solutions have become indispensable in ensuring efficiency, visibility, and cost-effectiveness.

Modern TMS platforms integrate with warehouse management systems (WMS), enterprise resource planning (ERP) systems, and customer relationship management (CRM) systems to provide end-to-end visibility into logistics operations. They support route optimization, carrier selection, freight auditing, real-time tracking, and advanced analytics. The demand for cloud-based TMS, in particular, has surged due to its scalability, lower upfront costs, and ease of integration.

With the rise of e-commerce, digital freight brokerage, and globalized supply chains, businesses across sectors such as retail, manufacturing, logistics, and government organizations are investing in sophisticated TMS solutions to gain a competitive edge. Enhanced focus on sustainability, real-time analytics, and the need for better risk management are further driving the adoption of next-generation TMS platforms.

Transportation Management System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 13.62 Billion |

| Market Size by 2033 |

USD 68.32 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Deployment, Mode Of Transportation, End user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BluJay Solutions Ltd.; Cargobase; Cerasis, Inc.; GoComet; 3GTMS; Infor Inc.; IBM Corporation; JDA Software Group, Inc.; Manhattan Associates; MercuryGate International, Inc.; Oracle Corporation; SAP SE; The Descartes System Group Inc.; The Descartes System Group Inc.; Trimble Transportation Enterprise Solutions, Inc. |

Transportation Management System: Market Dynamics

The Transportation Management System (TMS) market is propelled by several key drivers, with globalization standing out as a primary force. The interconnectedness of global markets necessitates efficient transportation solutions to facilitate the seamless movement of goods across borders. Additionally, the exponential growth of the e-commerce sector has become a pivotal driver, intensifying the demand for robust TMS solutions. As online retail continues to surge, the need for effective logistics and supply chain management becomes paramount. Another crucial driver is the relentless pursuit of cost optimization by organizations.

While the transportation management system market experiences remarkable growth, it is not without its challenges. Implementation hurdles pose a significant restraint, as integrating TMS into existing systems can be a complex process, often met with resistance from organizations. The initial investment required for TMS implementation serves as another notable restraint, particularly for small and medium-sized enterprises. The high upfront costs may deter some businesses from adopting TMS solutions, limiting the market's potential reach.

Transportation Management System Market Restraint

- Implementation Challenges:

One of the primary restraints in the Transportation Management System (TMS) market revolves around implementation challenges. Integrating TMS into existing systems requires meticulous planning and execution, often posing complexities for organizations. Resistance to change, potential disruptions in ongoing operations, and the need for extensive employee training contribute to the implementation challenges.

The high initial costs associated with implementing transportation management systems represent a substantial restraint, particularly for small and medium-sized enterprises (SMEs). The upfront investment required for software deployment, hardware acquisition, and the training of personnel can be a significant financial burden. This financial barrier may dissuade some businesses from exploring or adopting TMS solutions, hindering market growth.

Transportation Management System Market Opportunity

- Global Supply Chain Optimization:

A prominent opportunity in the Transportation Management System (TMS) market lies in its potential to contribute to global supply chain optimization. As businesses increasingly operate on a global scale, the need for seamless and efficient logistics becomes paramount. TMS offers a comprehensive solution for organizations to optimize transportation processes, streamline supply chain operations, and enhance overall efficiency. The opportunity for TMS providers lies in presenting their solutions as integral tools for achieving end-to-end visibility, reducing lead times, and improving overall supply chain responsiveness, thus positioning themselves as key partners in the ongoing evolution of global trade.

- Rising Demand for Cloud-Based Solutions:

The growing demand for cloud-based solutions presents a significant opportunity in the transportation management system market. Cloud-based TMS solutions offer scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems. With businesses increasingly adopting cloud technologies, the opportunity for TMS providers lies in catering to this shift in preference. Offering robust cloud-based TMS solutions can attract a broader spectrum of clients, including small and medium-sized enterprises seeking scalable options. As the industry continues to embrace digital transformation, TMS providers can position themselves strategically to capitalize on the rising demand for cloud-based logistics and transportation solutions.

Transportation Management System Market Challenges

- Integration with Existing Systems:

A significant challenge in the Transportation Management System (TMS) market is the integration of these systems with existing infrastructure. Many organizations already have established software and processes in place, and introducing a TMS can lead to compatibility issues. The seamless integration of TMS with ERP systems, warehouse management systems (WMS), and other enterprise software is crucial for maximizing its effectiveness. Overcoming this challenge requires careful planning, collaboration with IT teams, and the development of adaptable interfaces to ensure a smooth transition without disrupting ongoing operations.

Data security represents a persistent challenge in the TMS market, given the sensitive nature of transportation and logistics data. As TMS solutions involve the handling of vast amounts of information, including shipment details, customer data, and supply chain analytics, ensuring the security and integrity of this data is paramount. Concerns about potential data breaches, unauthorized access, or cyber threats can impede the adoption of TMS, particularly among organizations handling confidential or regulated information. TMS providers must prioritize robust cybersecurity measures, encryption protocols, and compliance with industry standards to address these concerns and instill confidence in their solutions.

Segments Insights:

Solution Insights

Operational planning solutions dominate the TMS market, as companies prioritize route optimization, load planning, carrier selection, and shipment scheduling to reduce costs and improve efficiency. Effective operational planning ensures timely deliveries and better asset utilization, making it a cornerstone of any TMS deployment.

Monitoring and tracking solutions are the fastest-growing, driven by the need for real-time visibility into freight movement. As customers demand live updates and businesses seek to pre-emptively manage risks, GPS tracking, telematics integration, and IoT-enabled monitoring tools are becoming essential features in TMS platforms.

Deployment Insights

Cloud deployment dominates the market, largely due to its scalability, cost-effectiveness, and ease of access. Cloud-based TMS platforms allow businesses to deploy quickly, receive automatic updates, and integrate easily with other cloud-based systems such as ERP and WMS.

On-premise deployment is still relevant in highly regulated industries, such as defense and pharmaceuticals, where data security and compliance requirements necessitate tighter control over IT infrastructure. However, its market share is declining as cloud security improves and businesses favor agile, flexible solutions.

Mode Of Transportation Insights

Roadways dominate the TMS market by mode of transportation, as road freight continues to account for the majority of domestic and regional cargo movement globally. TMS solutions focused on road logistics offer functionalities like driver assignment, route optimization, and real-time tracking that are critical for last-mile delivery success.

Airways represent the fastest-growing segment, fueled by the boom in cross-border e-commerce and high-value cargo shipments. Speed is paramount for air freight, and TMS platforms that offer air cargo scheduling, customs documentation management, and compliance tracking are seeing rising demand.

End User Insights

Retail and e-commerce dominate TMS end-user segments, leveraging transportation management systems to manage the complexity of omnichannel fulfillment, reverse logistics, and last-mile delivery. Retailers rely on TMS solutions to maintain service levels while optimizing transportation costs in highly competitive markets.

Manufacturing is a fast-growing segment, particularly as manufacturers seek greater control over their global supply chains. TMS platforms are used to manage inbound raw materials, inter-facility movements, and outbound finished goods distribution. Visibility and predictive analytics are critical for minimizing production delays and inventory costs.

Regional Insights

North America dominates the global TMS market, driven by the presence of major players, advanced IT infrastructure, high e-commerce penetration, and strong focus on supply chain optimization. The U.S. market, in particular, is characterized by widespread TMS adoption among retail, manufacturing, and logistics companies. Furthermore, regulatory frameworks such as the Electronic Logging Device (ELD) mandate have accelerated digitalization efforts in transportation management.

Asia-Pacific is the fastest-growing region, propelled by rapid industrialization, booming e-commerce activity, and government initiatives to modernize logistics infrastructure. China, India, Japan, and Southeast Asian countries are witnessing increasing investments in smart logistics and supply chain technologies. As SMEs and large enterprises alike recognize the benefits of TMS in managing complex regional and cross-border logistics, Asia-Pacific is expected to lead future market growth.

Some of the prominent players in the transportation management system market include:

- BluJay Solutions Ltd.

- Cargobase

- Cerasis, Inc.

- GoComet

- 3GTMS

- Infor Inc.

- IBM Corporation

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate International, Inc.

- Oracle Corporation

- SAP SE

- The Descartes System Group Inc.

- Trimble Transportation Enterprise Solutions, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global transportation management system market.

Solution

- Operational Planning

- Fright & Order Management

- Payment & Claims Management

- Monitoring & Tracking

- Reporting & Analytics

- Others

Deployment

Mode of Transportation

- Roadways

- Railways

- Waterways

- Airways

End User

- Retail & Ecommerce

- Manufacturing

- Logistics

- Government Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)