Tumor Ablation Market Size and Research

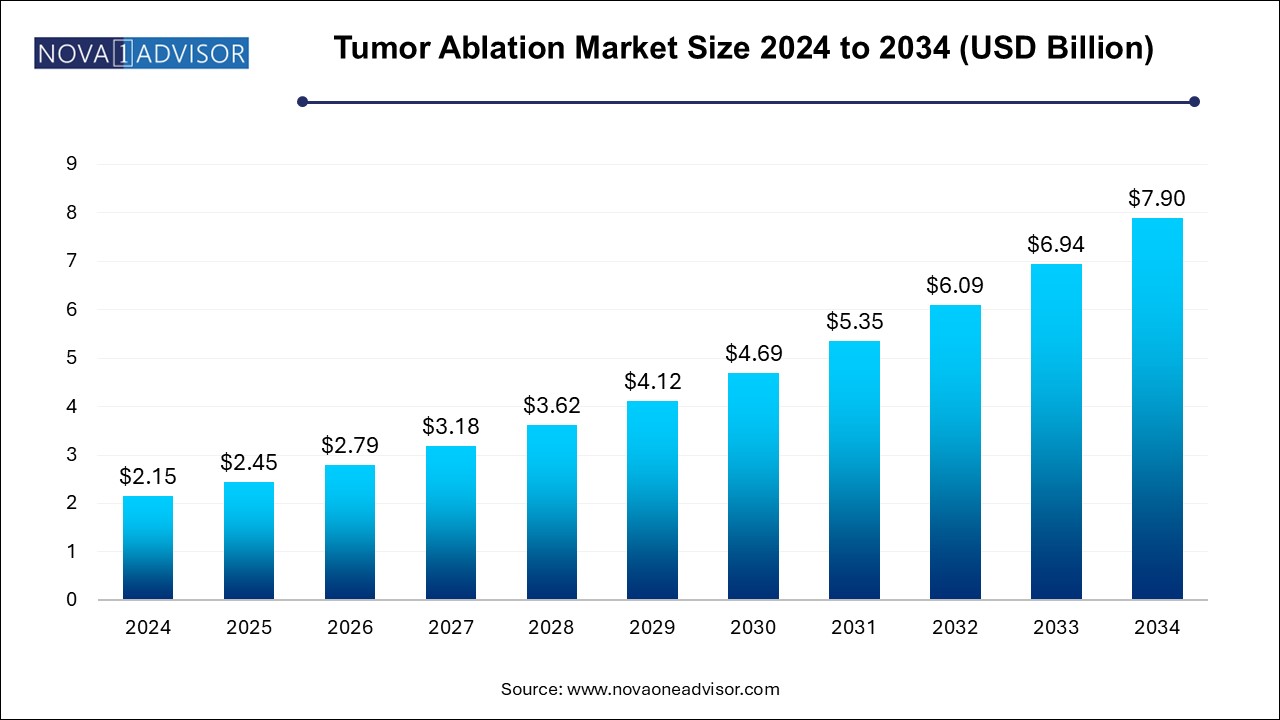

The tumor ablation market size was exhibited at USD 2.15 billion in 2024 and is projected to hit around USD 7.90 billion by 2034, growing at a CAGR of 13.9% during the forecast period 2025 to 2034.

Tumor Ablation Market Key Takeaways:

- Based on technology, the radiofrequency tumor ablation segment led the market with the largest revenue share of 33% in 2024.

- The microwave ablation technology segment is anticipated to witness at the fastest CAGR over the forecast period.

- Based on technology, the percutaneous ablation segment accounted for the largest revenue share in 2024.

- The laparoscopic ablation segment is estimated to register at the fastest CAGR over the forecast period.

- Based on application, the other segments accounted for the largest market share in 2024.

- The lung cancer segment is anticipated to grow at the fastest CAGR during the forecast period

- The kidney cancer segment is anticipated to grow at a rapid CAGR during the forecast period.

- North America dominated the tumor ablation market with the largest revenue share of 35.0% in 2024.

U.S. Tumor Ablation Market Size and Growth 2025 to 2034

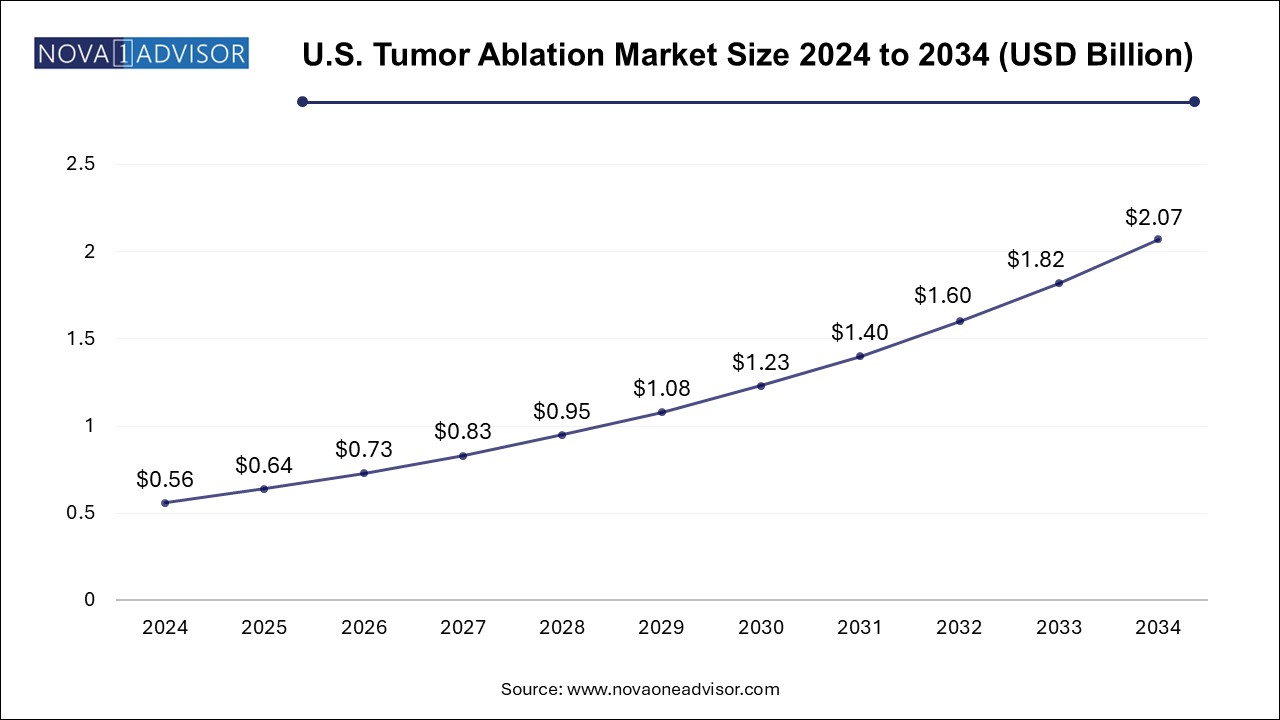

The U.S. tumor ablation market size is evaluated at USD 0.56 billion in 2024 and is projected to be worth around USD 2.07 billion by 2034, growing at a CAGR of 12.62% from 2025 to 2034.

North America, particularly the United States, leads the global tumor ablation market due to its advanced healthcare infrastructure, early adoption of novel medical technologies, and high prevalence of cancer. The U.S. benefits from strong support from organizations like the National Cancer Institute (NCI), favorable reimbursement policies for outpatient ablation procedures, and widespread availability of interventional radiologists. Additionally, leading companies like Medtronic, Boston Scientific, and AngioDynamics are headquartered in the region, fueling innovation and clinical trials.

Academic centers and specialized cancer institutes in North America are increasingly integrating ablation into multimodal cancer treatment strategies, often in combination with immunotherapies and systemic treatments. The region’s robust clinical research pipeline and FDA’s expedited regulatory pathways further bolster market momentum.

Asia Pacific is the fastest-growing region, fueled by a rising cancer burden, increasing awareness of minimally invasive therapies, and improving healthcare access. Countries such as China, India, Japan, and South Korea are investing heavily in oncology infrastructure and adopting advanced interventional radiology techniques. The high prevalence of liver cancer in China and Southeast Asia, in particular, is a major driver of ablation procedures.

Government initiatives to modernize cancer care, rising middle-class healthcare spending, and the presence of domestic ablation equipment manufacturers are creating a favorable ecosystem for market growth. Additionally, training programs and international collaborations are expanding the skill base for image-guided tumor ablation in the region, accelerating adoption.

Market Overview

The tumor ablation market is gaining traction globally as a minimally invasive treatment modality for various types of solid tumors. Tumor ablation refers to the targeted destruction of cancerous cells using localized energy-based methods such as heat, cold, or electrical pulses. These techniques are increasingly being adopted as alternatives or complements to traditional treatments like surgery, chemotherapy, and radiation therapy, particularly in patients who are inoperable or unresponsive to systemic therapies.

The rise in cancer incidence—especially among aging populations—coupled with growing preference for less invasive treatment options, has created favorable conditions for market expansion. Tumor ablation procedures are valued for their lower complication rates, reduced hospitalization, faster recovery, and cost-effectiveness. Furthermore, technological advancements in imaging modalities such as CT, MRI, and ultrasound have significantly improved the precision and success rate of ablation techniques.

As oncology practices shift toward personalized and precision-based care, tumor ablation is carving a prominent role in the multidisciplinary treatment landscape. The technology has gained momentum in treating liver, lung, kidney, and prostate cancers, with emerging research expanding its use in breast and bone metastases. With robust R&D investment, increasing FDA approvals, and growing physician acceptance, the tumor ablation market is set for strong growth through 2034.

Major Trends in the Market

-

Integration of Real-Time Imaging with Ablation Systems for Precision Targeting

-

Increased Use of Combination Therapies (Ablation + Immunotherapy/Chemotherapy)

-

Shift Toward Outpatient and Ambulatory Settings for Ablation Procedures

-

Rise in Demand for Percutaneous Ablation Over Surgical Methods

-

Adoption of Microwave Ablation as a Faster and More Effective Alternative to Radiofrequency Ablation

-

Emergence of Irreversible Electroporation (IRE) for Non-Thermal Tumor Disruption

-

Growing Interest in AI-Assisted Planning and Robotic-Guided Ablation Devices

-

Expansion of Clinical Trials Evaluating Ablation in Early-Stage and Recurrent Tumors

-

Development of Hybrid Systems Integrating Multiple Ablation Modalities

-

Focus on Reimbursement Reforms to Promote Wider Adoption

Report Scope of Tumor Ablation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.45 Billion |

| Market Size by 2034 |

USD 7.90 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Treatment, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Boston Scientific Corporation; Johnson & Johnson Service Inc. (Ethicon, Inc.);AngioDynamics; Bioventus Inc. (Misonix Inc.); EDAP TMS; Chongqing Haifu Medical Technology Co., Ltd; Mermaid Medical; HealthTronics, Inc.; H.S. Hospital Service S.p.A. |

Market Driver

One of the most powerful drivers of the tumor ablation market is the increasing global burden of cancer, coupled with the rising demand for minimally invasive treatment alternatives. According to the World Health Organization, cancer is one of the leading causes of death worldwide, with over 19 million new cases and nearly 10 million deaths annually. Many patients are diagnosed at stages where surgery is either not feasible or carries significant risk due to comorbidities, age, or tumor location.

In such scenarios, tumor ablation offers a targeted and tissue-sparing option that can be performed under image guidance with minimal disruption to surrounding organs. The technique has proven particularly useful in liver cancer, where it is used both as a primary treatment and a bridge to transplantation. Its use in lung, kidney, and prostate cancers is also growing, especially for patients ineligible for curative surgery. As healthcare systems worldwide push for value-based care and better patient outcomes, the market for tumor ablation continues to expand.

Market Restraint

Despite its growing adoption in developed countries, the tumor ablation market faces challenges in underpenetrated and low-resource regions, where access to advanced imaging equipment and trained specialists is limited. Many rural or low-income hospitals lack the infrastructure necessary for ablation procedures, including high-resolution ultrasound or CT scanners, sterile settings, and specialized probes or generators.

Moreover, a significant proportion of oncologists and surgeons in these settings may be unfamiliar with the latest ablation technologies, relying instead on conventional treatments. The upfront capital cost of ablation systems—especially for newer modalities like microwave ablation or IRE—can be a deterrent for small and mid-tier hospitals. Additionally, reimbursement limitations and lack of procedure standardization can impede broader market adoption. Addressing this gap requires targeted education, training programs, and cost-effective equipment solutions.

Market Opportunity

A major opportunity lies in the expansion of tumor ablation applications beyond palliation into curative intent for early-stage and recurrent tumors. Traditionally, ablation has been used in patients unfit for surgery or as a salvage therapy. However, with improvements in ablation precision, thermal control, and real-time monitoring, many healthcare providers are now using these techniques as first-line options for selected small tumors.

This is particularly evident in early-stage hepatocellular carcinoma (HCC), renal cell carcinoma (RCC), and lung metastases. Additionally, research is underway to evaluate ablation’s role in treating residual or recurrent tumors after initial surgery or chemotherapy. The ability to repeat ablation without cumulative toxicity, as seen with radiation, adds to its appeal. If supported by long-term survival data and insurance coverage, these expanded indications could unlock a vast new market potential.

Tumor Ablation Market By Technology Insights

Radiofrequency ablation (RFA) currently holds the largest market share among ablation technologies due to its widespread clinical adoption, strong safety record, and cost-effectiveness. RFA uses high-frequency electrical currents to generate localized heat, inducing coagulative necrosis in targeted tumor tissues. Its long-standing presence in liver and kidney cancer treatment, especially for small to medium-sized tumors, contributes significantly to its dominance.

However, microwave ablation (MWA) is emerging as the fastest-growing segment, thanks to its ability to generate higher temperatures in less time, penetrate larger tumors, and achieve greater uniformity of heat distribution. MWA has gained traction in liver, lung, and bone tumors due to its superior efficacy in challenging anatomical locations and reduced susceptibility to heat-sink effects. With new-generation systems offering precise energy control and integrated temperature monitoring, MWA is poised to surpass RFA in certain indications over the forecast period.

Tumor Ablation Market By Treatment Insights

Based on technology, the Percutaneous ablation—a minimally invasive procedure performed through the skin under imaging guidance—dominates the treatment segment. Its minimally invasive nature, shorter recovery time, and reduced procedural costs make it highly favorable for both patients and providers. It is the most commonly employed method in outpatient and interventional radiology settings, especially for liver and kidney tumors.

The segment is also the fastest growing, driven by advancements in image-guided navigation and portable ablation systems that facilitate rapid, accurate tumor targeting. As percutaneous procedures shift from inpatient to outpatient settings, demand is rising among ambulatory surgical centers and diagnostic imaging clinics. Meanwhile, laparoscopic and surgical ablation still play an important role, particularly when tumors are adjacent to critical structures or when combined with debulking procedures. However, the trend toward non-surgical tumor management ensures percutaneous ablation remains the growth leader.

Tumor Ablation Market By Application Insights

Liver cancer represents the largest share of the tumor ablation market by application. Primary liver cancers, particularly hepatocellular carcinoma (HCC), are among the most common indications for ablation due to favorable outcomes in small tumors and the frequent use of the technique in bridging patients for liver transplant. RFA and MWA are both widely used in this setting, supported by guidelines from international liver societies and transplantation protocols.

In contrast, lung cancer is emerging as the fastest-growing application, particularly for non-small cell lung cancer (NSCLC) in patients who are non-surgical candidates. With increased detection of small pulmonary nodules through lung screening programs, image-guided ablation offers a safe, repeatable alternative to surgery and stereotactic body radiation therapy (SBRT). The rise in localized recurrences and need for minimally invasive re-treatment are also boosting demand in this segment. Ablation is also gaining attention in palliative care for painful bone metastases and in select prostate and breast cancer cases, although these remain niche segments for now.

Some of the prominent players in the tumor ablation market include:

Tumor Ablation Market Recent Developments

-

March 2025: Boston Scientific launched a next-generation microwave ablation system with integrated temperature feedback, designed to improve procedural safety and ablation zone predictability for liver and lung tumors.

-

February 2025: Medtronic plc received FDA clearance for its new robotic-assisted microwave ablation catheter system, marking a significant advancement in precision tumor targeting.

-

January 2025: AngioDynamics announced a strategic collaboration with an AI imaging firm to integrate predictive thermal mapping into its Solero Microwave Ablation System, enhancing real-time ablation planning.

-

December 2024: Merit Medical Systems expanded its oncology device portfolio with the acquisition of a cryoablation technology company focusing on prostate and renal cancers.

-

November 2024: Johnson & Johnson (Ethicon) entered a co-development partnership to explore the use of HIFU (High-Intensity Focused Ultrasound) in early-stage breast cancer treatment, with pilot trials underway in North America and Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the tumor ablation market

By Technology

- Radiofrequency ablation

- Microwave ablation

- Cryoablation

- Irreversible electroporation ablation

- HIFU

- Other ablation technologies

By Treatment

- Surgical ablation

- Laparoscopic ablation

- Percutaneous ablation

By Application

- Kidney Cancer

- Liver cancer

- Breast cancer

- Lung cancer

- Prostate cancer

- Other cancer

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)