U.S. & Canada Skin Cancer Dermatology Market Size and Trends

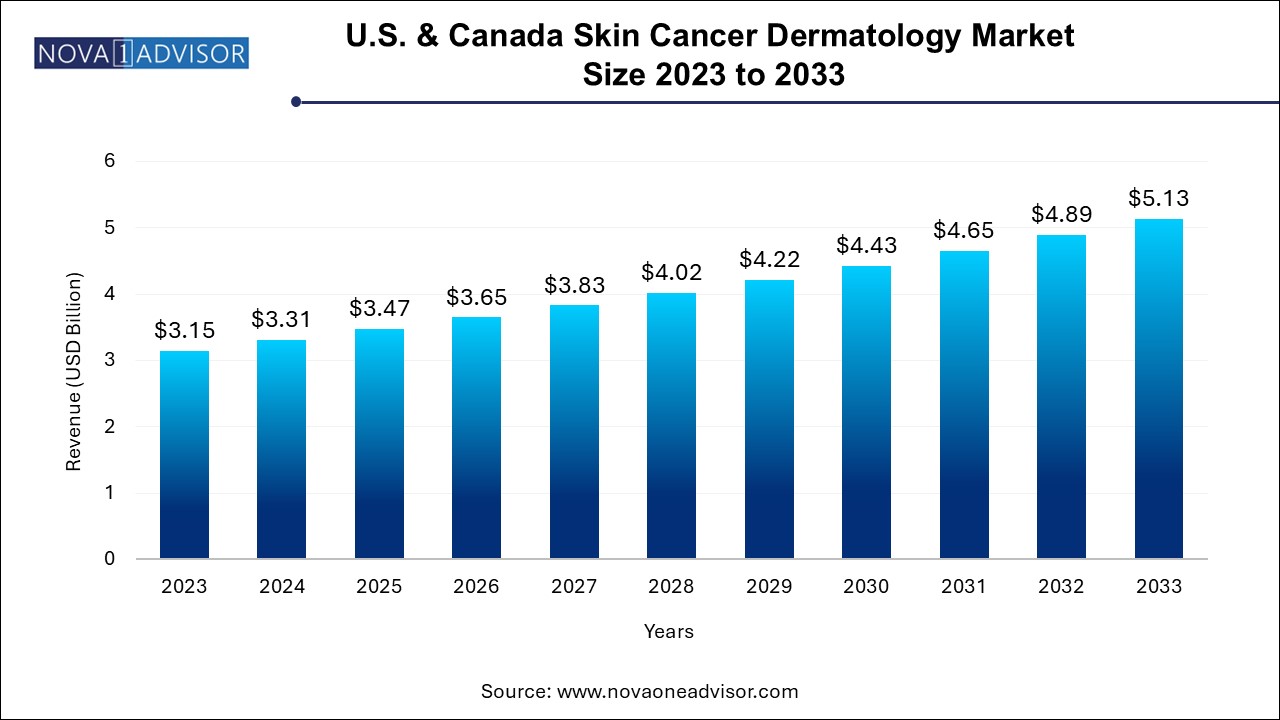

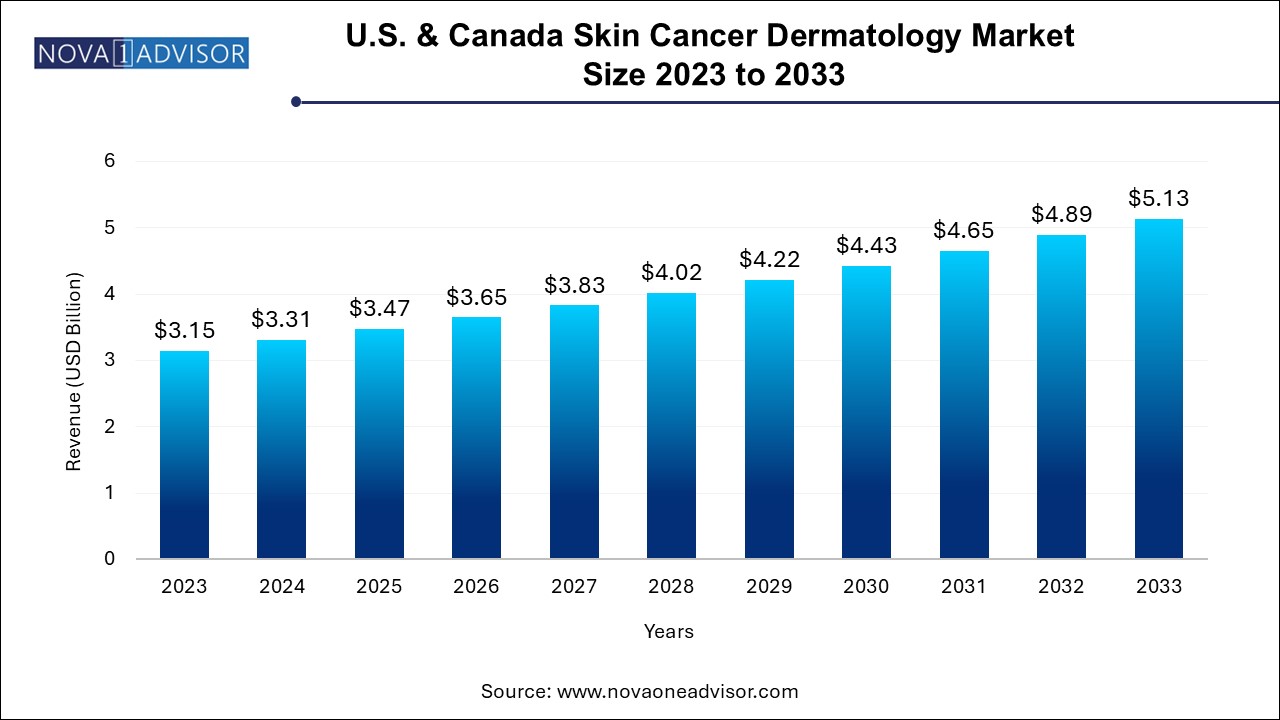

The U.S. and Canada skin cancer dermatology market size was exhibited at USD 3.15 billion in 2023 and is projected to hit around USD 5.13 billion by 2033, growing at a CAGR of 5.0% during the forecast period 2024 to 2033.

U.S. & Canada Skin Cancer Dermatology Market Key Takeaways:

- The skin biopsy test type segment held the largest market share of 32.3% in 2023.

- The diagnostic imaging segment is anticipated to grow at the fastest CAGR over the forecast period.

- The hospital OPD facility type segment held the largest market share of 40.2% in 2023 and is also expected to witness the fastest growth rate from 2024 to 2033.

- The multispecialty clinics and dermatology group segments held relatively higher market shares than the stand-alone practices segment in 2023.

- The 40-59 years age group segment held the highest market share of 26.3% in 2023.

Market Overview

The U.S. and Canada skin cancer dermatology market is a vital segment of the North American healthcare landscape, serving as the frontline in diagnosing, managing, and treating the most common form of cancer skin cancer. With millions of new skin cancer cases diagnosed annually in both countries, this market is driven by the increasing incidence of melanoma and non-melanoma skin cancers (basal and squamous cell carcinoma), rising public awareness, improved diagnostic techniques, and a strong network of dermatological specialists and advanced clinics.

Skin cancer accounts for the majority of all cancer diagnoses in the U.S. and is a leading health concern in Canada. According to the American Academy of Dermatology, it is estimated that 1 in 5 Americans will develop skin cancer by the age of 70. Canada reflects a similar trend, with rising cases among younger populations as well as the elderly. The market comprises a combination of public and private healthcare services, with dermatology clinics playing a pivotal role in routine screenings, early detection, and outpatient management.

Rapid advancements in diagnostic imaging, artificial intelligence integration for lesion analysis, and the increasing popularity of full-body scanning are improving accuracy and reducing diagnostic errors. Moreover, the growth in multispecialty clinics and dermatology-focused health chains, coupled with cross-border collaboration between institutions, is transforming the market. From biopsies to lymph node mapping and dermatoscopy, the U.S. and Canada are investing in early detection strategies to reduce morbidity and long-term healthcare costs.

Major Trends in the Market

-

AI-Driven Diagnostic Tools: Artificial intelligence is being used for image analysis and risk scoring, increasing early detection accuracy and reducing unnecessary biopsies.

-

Rise of Full-Body Skin Imaging: High-resolution dermatoscopy and 3D imaging devices are becoming common in large clinics, enabling comprehensive skin mapping and tracking of lesion changes over time.

-

Growth in Preventive Dermatology: Skin cancer awareness campaigns are boosting preventive check-ups and mole screening services across both countries.

-

Teledermatology Expansion: Virtual consultations and asynchronous image-sharing for suspected skin lesions are growing, especially in rural and underserved areas.

-

Precision Dermatology Approaches: Genomic and molecular profiling of skin lesions is guiding targeted therapies and follow-up strategies.

-

Age-Specific Screening Programs: Demographic-specific dermatology services—targeted at high-risk groups like older men and younger females—are becoming prevalent.

-

Clinic Consolidations and Acquisitions: Large dermatology networks are acquiring standalone practices to expand regional reach, as seen in recent Canadian and U.S. deals.

Report Scope of U.S. & Canada Skin Cancer Dermatology Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.31 Billion |

| Market Size by 2033 |

USD 5.13 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, Facility Type, Age Group |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

U.S.; Canada |

| Key Companies Profiled |

Firefly; SkinIO; Canfield Scientific, Inc.; FotoFinder Systems, Inc.; 3Gen; MetaOptima; Agilent Technologies; SkinVision; Speclipse, Inc.; Skin Analytics |

Market Driver: Increasing Incidence of Skin Cancer Across Age Groups

One of the most significant drivers of the U.S. and Canada skin cancer dermatology market is the increasing incidence of skin cancer across all age groups. With the depletion of the ozone layer, increased exposure to UV radiation, and changing outdoor lifestyle habits, cases of both melanoma and non-melanoma cancers have surged. In the U.S. alone, more than 5 million cases are treated annually, while Canada reports increasing melanoma rates, particularly among younger women.

This growing incidence has prompted regular dermatological screening to become a part of primary care recommendations. Moreover, public awareness campaigns such as “Melanoma Monday” in the U.S. and “Sun Awareness Week” in Canada have led to increased patient-initiated consultations. Dermatology providers are responding with faster triage models, dedicated lesion clinics, and full-body scanning services. As patients demand proactive care, dermatologists are expanding both capacity and services—leading to sustained market expansion.

Market Restraint: Limited Access and Wait Times in Public Systems

While demand for dermatology services continues to rise, one key market restraint is the limited access and long wait times in public health systems, particularly in Canada. Due to shortages in dermatologists and concentration of services in urban areas, patients often experience delays in receiving diagnostic imaging or skin biopsies. In Canada’s publicly funded healthcare system, wait times for specialist consultations can extend to several months, which can be critical in skin cancer progression.

Similarly, underserved rural and indigenous communities in both Canada and remote U.S. regions face limited access to trained dermatologists. The scarcity of pathology services for rapid biopsy review further delays care. While private dermatology clinics help bridge the gap, affordability and insurance coverage create access disparities. These systemic issues necessitate investment in training, telehealth infrastructure, and mobile diagnostic services to ensure equitable access to skin cancer screening and management.

Market Opportunity: Technological Integration in Dermatological Diagnostics

A significant opportunity in the U.S. and Canada skin cancer dermatology market lies in the integration of technology, particularly AI and advanced imaging systems. AI-enabled dermatoscopy, pattern recognition algorithms, and cloud-based lesion databases are revolutionizing diagnosis. These tools assist dermatologists in risk assessment, mole tracking, and identification of suspicious lesions, especially in high-volume practices.

Companies are developing handheld devices for remote dermatoscopy, portable skin scanners, and smartphone-compatible diagnostic aids. These innovations enable point-of-care diagnostics in primary care offices and remote health centers. Additionally, real-time patient portals allow individuals to upload images of lesions for triage by dermatologists, improving early detection and reducing patient anxiety. The combination of consumer-facing tools and professional diagnostic platforms offers a powerful pathway to expand market reach and optimize clinical workflows.

U.S. & Canada Skin Cancer Dermatology Market By Test Type Insights

Skin biopsy remains the dominant test type in the market. As the gold standard for confirming skin cancer, it is essential for diagnosing both melanoma and non-melanoma types. Biopsies provide histopathological analysis necessary for staging, treatment planning, and determining surgical margins. In both U.S. and Canadian clinical practices, excisional and punch biopsies are routinely conducted in outpatient dermatology clinics and hospital outpatient departments. The reliability and criticality of biopsy confirm its primacy in clinical workflows.

However, dermatoscopy is emerging as the fastest-growing test segment. Non-invasive, rapid, and increasingly aided by AI, dermatoscopy enables early assessment of pigmented and non-pigmented lesions, reducing unnecessary biopsies. It is particularly popular in screening scenarios and is frequently used in routine checkups for patients with multiple nevi. With innovations such as polarized light dermoscopy, multispectral imaging, and handheld dermatoscopes, its accuracy is improving, leading to higher adoption among general practitioners and nurse practitioners trained in skin cancer detection.

U.S. & Canada Skin Cancer Dermatology Market By Facility Type Insights

Dermatology group practices dominate the facility type segment due to their specialization, infrastructure, and availability of advanced diagnostic tools. These facilities attract a high volume of patients seeking routine checks, mole mapping, and specialist consultations. Group practices benefit from economies of scale and often participate in clinical trials, technological pilots, and education initiatives. U.S.-based networks like Schweiger Dermatology Group and U.S. Dermatology Partners have expanded aggressively, offering services across urban and suburban regions.

Multispecialty clinics are emerging as the fastest growing facility type. These centers integrate dermatology with oncology, internal medicine, and radiology, offering one-stop solutions for complex skin cancer cases. For example, multispecialty centers in Toronto and New York now house dermatopathology, surgery, and imaging under one roof, streamlining patient care. Insurance companies increasingly favor such integrated care settings for better coordination and cost savings, thus driving patient flow and investment into this facility segment.

U.S. & Canada Skin Cancer Dermatology Market By Age Group Insights

The 65–74 age group dominates the market owing to cumulative UV exposure over a lifetime, which significantly increases the risk of both melanoma and non-melanoma skin cancers. This demographic represents a high-volume user base for dermatological services, particularly in retirement communities and assisted living facilities. Clinics are tailoring screening protocols for this group, focusing on full-body scans and preventive education. In both countries, national guidelines recommend annual skin checks for this high-risk category, ensuring continued market demand.

In contrast, the 40–59 female subgroup is the fastest growing segment, driven by heightened awareness, proactive health behavior, and aesthetic consciousness. Women in this age group are more likely to seek early consultations for suspicious moles or lesions, particularly in sun-exposed areas. Many dermatology clinics offer combined skin screening and cosmetic dermatology packages for this demographic. Additionally, the growing influence of social media and skincare awareness campaigns is pushing middle-aged women to prioritize skin cancer screenings, contributing to growth in this subsegment.

Country-Level Analysis

United States

The U.S. skin cancer dermatology market is highly advanced, with a broad network of dermatologists, cutting-edge diagnostic tools, and strong public awareness. Skin cancer is the most diagnosed form of cancer in the U.S., with more than 9,500 people diagnosed daily. The American Academy of Dermatology (AAD) leads efforts in awareness, while insurance coverage for dermatological exams supports access. Urban centers boast specialized skin cancer centers with AI-powered imaging and pathology labs.

Nevertheless, disparities exist rural areas and certain ethnic populations still face barriers to care. The rise of freestanding dermatology chains and increased use of teledermatology are helping bridge these gaps. Investment in training and digital outreach is ongoing, ensuring continuous market growth and innovation.

Canada

Canada faces a unique dual challenge of high skin cancer incidence and access limitations within the public health system. While metropolitan regions like Toronto, Vancouver, and Montreal offer specialized care, smaller provinces and remote communities often face long wait times for dermatology services. The Canadian Dermatology Association (CDA) is actively promoting sun safety and mole screening initiatives, while provincial governments are funding mobile skin clinics to improve rural outreach.

Private dermatology clinics are growing to meet demand, especially in provinces like Alberta and British Columbia. These clinics often offer faster services and adopt cutting-edge technologies. AI-powered dermatoscopy and full-body scanning systems are gaining traction, particularly in private settings, indicating a future where innovation and private-public partnerships could define access and outcomes.

Some of the prominent players in the U.S. and Canada skin cancer dermatology market include:

Recent Developments

-

April 2024 – Epiphany Dermatology announced the acquisition of a major skin care group in Ontario, Canada, marking its first foray into the Canadian market. The move expands its footprint to over 75 clinics across North America.

-

February 2024 – Canfield Scientific, a U.S.-based imaging leader, launched its new full-body skin mapping platform for dermatologists in both the U.S. and Canada, aiming to support early melanoma detection with AI-enhanced analytics.

-

January 2024 – DermTech, a pioneer in non-invasive genomic testing, expanded its test availability across Canada through a partnership with dermatology clinics in Toronto and Calgary.

-

November 2023 – University of British Columbia researchers developed a smartphone-based AI tool capable of early melanoma detection using patient-uploaded lesion photos. Pilot testing began in Vancouver clinics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. and Canada skin cancer dermatology market

Test Type

- Skin Biopsy

- Dermatoscopy

- Diagnostic Imaging

- Lymph Node Biopsy

Age Group

Facility Type

- Stand Alone Practices

- Multispecialty Clinics

- Dermatology Group

- Hospital OPD

- Others

Country