UAE Genetic Testing Market Size, Growth and Trends 2026 to 2035

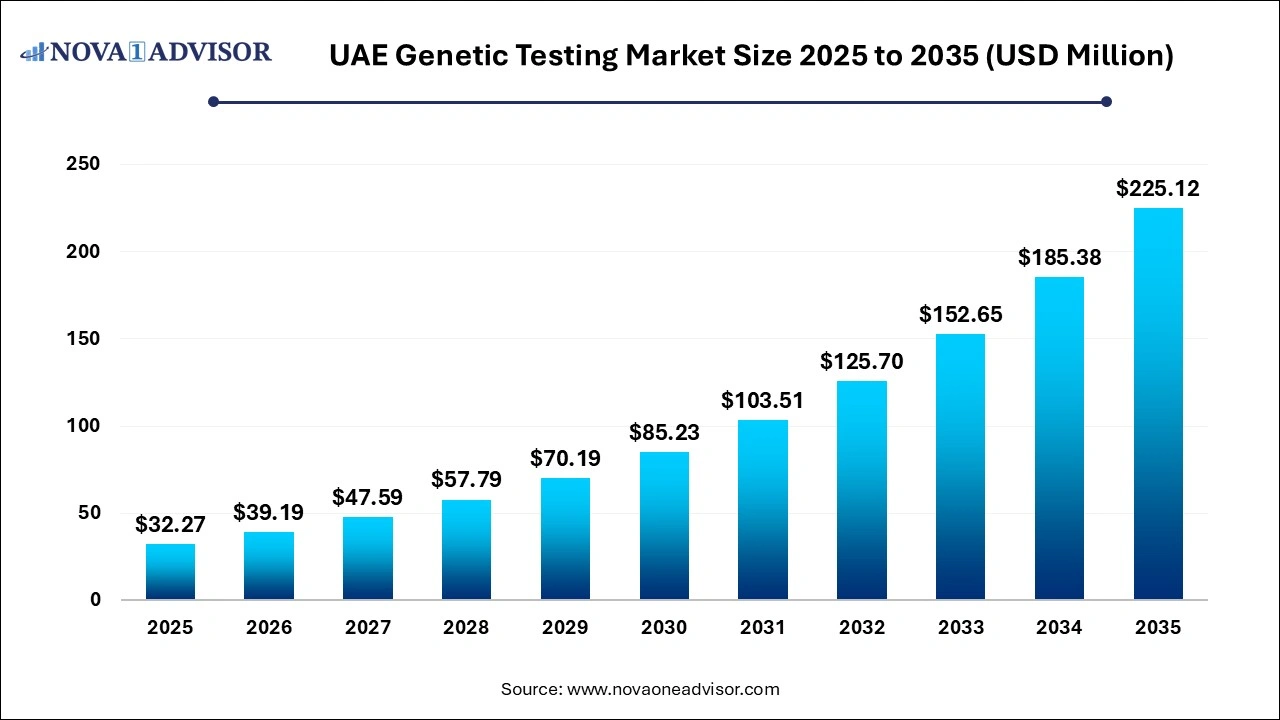

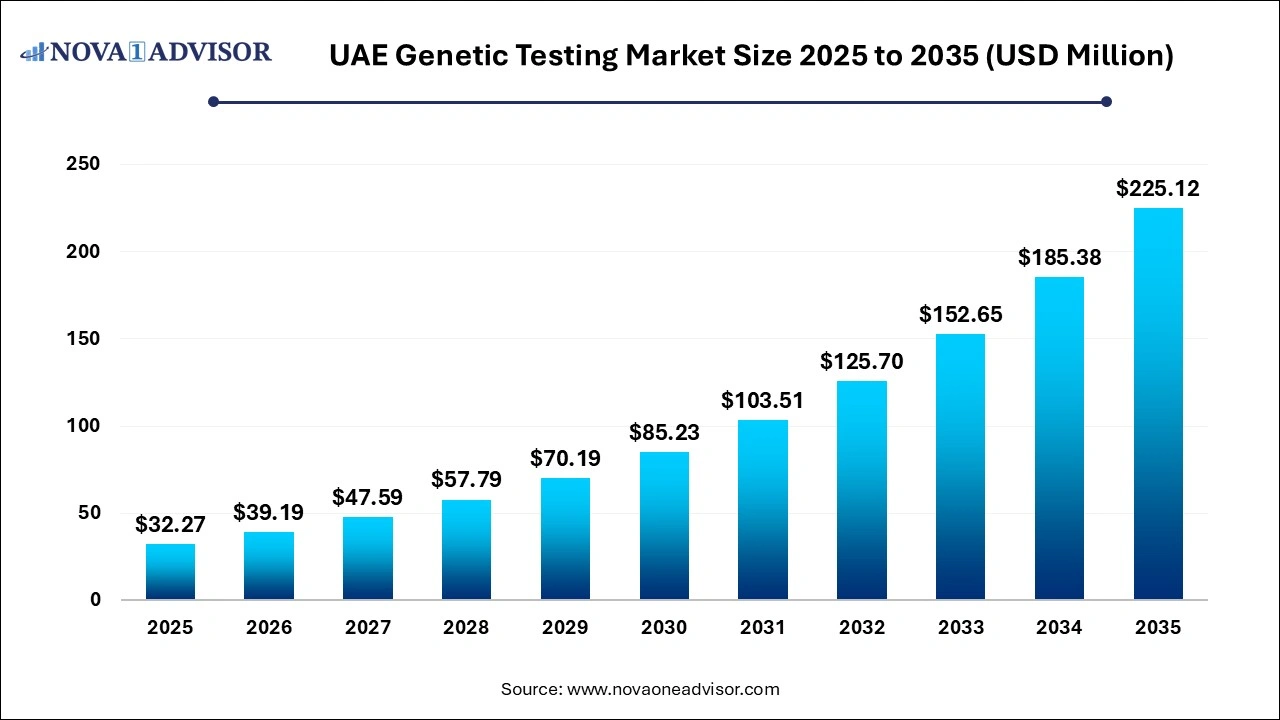

The UAE genetic testing market size was exhibited at USD 32.27 million in 2025 and is projected to hit around USD 225.12 million by 2035, growing at a CAGR of 21.42% during the forecast period of 2026 to 2035.

Key Takeaways:

- The next-generation sequencing (NGS) segment held the highest revenue share of 46.30% in 2025 and is expected to witness the highest growth during the forecast period.

- The ancestry & ethnicity application segment held the highest revenue share of 50.72%in 2025.

- The offline channel segment held the highest revenue share of 55.29% in 2025.

- The hospital end-use segment held the highest market share of 63.0% in 2025.

UAE Genetic Testing Market Overview

The UAE genetic testing market is experiencing a transformative surge, driven by a unique confluence of healthcare innovation, proactive government policy, and increasing consumer interest in personalized health and ancestry insights. As the country rapidly modernizes its healthcare infrastructure under the directives of Vision 2030 and the National Strategy for Wellbeing, genetic testing has emerged as a cornerstone of preventive medicine and precision healthcare in the Emirates. This growing market encompasses a wide range of applications from newborn screening and inherited disease risk assessment to oncology diagnostics and ancestry exploration.

Historically, genetic disorders have posed significant health challenges in the UAE due to high consanguinity rates. Studies indicate that over 50% of Emirati marriages occur between close relatives, contributing to a relatively high prevalence of inherited conditions such as thalassemia, cystic fibrosis, and metabolic disorders. Recognizing this, the government has initiated nationwide mandatory premarital screening programs and expanded access to neonatal genetic tests across public healthcare institutions. Moreover, Emiratis are increasingly aware of the potential to mitigate hereditary diseases through early risk detection, fueling demand for both clinical and direct-to-consumer genetic testing.

The private sector, too, is playing a pivotal role in market expansion. Home-grown startups, regional labs, and international genetic testing firms are investing in local partnerships, setting up testing centers, and developing Arabic-language interfaces to appeal to the culturally diverse population. With rising disposable income, a tech-savvy youth demographic, and growing acceptance of wellness-oriented diagnostics, the UAE genetic testing market is poised for sustained growth over the coming decade.

Major Trends in the UAE Genetic Testing Market

-

Government-Driven Screening Initiatives: National premarital and newborn screening programs continue to expand, particularly in Abu Dhabi and Dubai, increasing genetic test volumes and public awareness.

-

Localization of Testing Services: Global companies are localizing services through collaborations with Emirati labs and hospitals to comply with data privacy laws and cultural sensitivities.

-

Rise of Wellness and Lifestyle Genomics: The trend of using DNA testing for fitness, diet optimization, and mental health is gaining popularity, especially among urban millennials and expats.

-

Integration of AI and Cloud Platforms: Companies are integrating AI-based analytics and cloud data storage to enable faster genetic interpretation and longitudinal health tracking.

-

Public-Private Collaborations in Genomics Research: Institutions like the UAE Genomics Council are partnering with academic and corporate entities to accelerate local research capacity and indigenous test development.

-

Growing D2C Testing Platforms: Startups and healthcare innovators are launching mobile apps and e-commerce sites offering home DNA kits with courier pick-up services.

-

Focus on Emirati Genome Project: Government-led initiatives are sequencing Emirati genomes to develop population-specific reference databases, enhancing test accuracy and disease association studies.

UAE Genetic Testing Marke Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 39.19 Million |

| Market Size by 2035 |

USD 225.12 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 21.44% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, Application, End-use, Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Middle East Testing Services L.L.C; Molecular Biology & Genetics Laboratory; NSG; Freiburg Medical Laboratory Middle East; IVI MIDDLE EAST FERTILITY CLINIC; 23andMe, Inc.; Ancestry; CircleDNA; 24Genetics; MyDNA Life Australia Pty Ltd. |

Market Driver: High Prevalence of Genetic Disorders Due to Consanguinity

One of the most pressing and unique drivers of the UAE genetic testing market is the elevated prevalence of inherited genetic disorders attributed to cultural practices such as consanguineous marriages. Research from the UAE University and Department of Health–Abu Dhabi indicates that approximately 60% of marriages among nationals are between relatives, significantly raising the risk of autosomal recessive conditions. These include disorders like beta-thalassemia, G6PD deficiency, spinal muscular atrophy, and congenital hypothyroidism—conditions that, if undetected, can lead to long-term disability, high medical costs, and poor quality of life.

In response, the government has institutionalized genetic testing as part of mandatory premarital health checks, helping couples make informed reproductive choices. Additionally, newborn screening is now widely conducted in public hospitals to catch genetic conditions early, often before symptoms manifest. These practices have driven demand for advanced technologies such as PCR-based testing and next-generation sequencing (NGS), allowing both early intervention and potential cost savings. As families become increasingly aware of the health and economic benefits of early genetic screening, demand is expected to remain robust in the foreseeable future.

Market Restraint: Regulatory Gaps and Ethical Sensitivities

Despite its rapid growth, the UAE genetic testing market faces challenges stemming from regulatory ambiguity and cultural sensitivities. While initiatives like the UAE Genomics Council aim to build a national genomic infrastructure, the regulatory framework around DTC genetic tests, genetic data privacy, and cross-border data transfer is still evolving. Companies offering ancestry, lifestyle, or non-diagnostic health testing may find themselves in a gray zone with respect to approvals and consumer protections.

Furthermore, cultural and religious sensitivities can influence consumer adoption. Discussions around genetic conditions, infertility, and hereditary diseases are often viewed as private or even taboo, leading to underutilization of available services. Many individuals may avoid tests for fear of stigmatization, marital implications, or legal consequences (e.g., in cases involving non-marital paternity testing). Addressing these barriers will require not just regulatory clarity but also sustained public education and culturally competent service delivery strategies to ensure equitable and ethical access to genetic testing.

Market Opportunity: Personalized Medicine and Pharmacogenomics Integration

A major growth opportunity in the UAE lies in the integration of genetic testing with personalized medicine and pharmacogenomics. With the rise of chronic diseases like diabetes, cardiovascular disorders, and cancer in the Emirates, there is an increasing need to move from generalized treatment approaches to genetically informed, patient-specific therapies. Pharmacogenomics—the study of how genes affect an individual's response to drugs—can prevent adverse drug reactions, optimize treatment efficacy, and reduce hospitalization rates.

The UAE’s advanced healthcare infrastructure and digital health adoption make it a fertile ground for such innovation. For example, institutions like Cleveland Clinic Abu Dhabi and Dubai Health Authority are exploring the use of genetic panels in cancer treatment planning. As the Emirati Genome Program progresses, test interpretation for native populations will become more precise, boosting confidence among physicians and patients alike. For private diagnostic labs and startups, this opens the door to develop niche panels for diabetes risk profiling, cancer gene mutations (like BRCA1/2), and medication metabolism. Insurance providers are also gradually warming up to covering genetic testing as part of wellness plans, further enhancing accessibility.

Segments Insights:

By Technology Type

Next Generation Sequencing (NGS) dominated the technology segment due to its scalability, high accuracy, and ability to process large volumes of genetic data across multiple conditions. In both clinical and research settings, NGS allows for the simultaneous analysis of thousands of genes, making it indispensable in cancer genomics, carrier screening, and newborn diagnostics. Public and private labs across Abu Dhabi and Dubai are investing heavily in NGS platforms such as Illumina and Thermo Fisher systems to enhance their diagnostic capabilities. Moreover, the UAE Genome Project is heavily reliant on NGS technologies, further strengthening the segment’s dominance.

FISH (Fluorescence In Situ Hybridization) is emerging as one of the fastest-growing segments, especially in prenatal and cancer-related genetic analysis. FISH enables cytogenetic evaluation of chromosomal abnormalities such as trisomies, gene fusions, and deletions. Its application is increasingly seen in fertility centers and oncology clinics across the Emirates. The technique's precision and ability to visualize chromosomal anomalies in situ have made it a preferred tool for IVF clinics, particularly in screening embryos during preimplantation genetic testing (PGT). As reproductive health services continue to grow, FISH is expected to see wider adoption.

By Application Type

Cancer screening dominated the application segment, owing to a growing incidence of cancers such as breast, colorectal, and prostate cancer in the UAE population. Genetic testing for BRCA mutations, Lynch syndrome, and other hereditary cancers is now integrated into the care protocols at leading institutions like Cleveland Clinic Abu Dhabi and Mediclinic Middle East. Genetic profiling is increasingly used not only for diagnostics but also for treatment selection and recurrence risk assessment, particularly in high-risk families. With government-led cancer prevention programs gaining traction, demand for oncology-related testing remains on a steep upward curve.

Health and wellness predisposition testing is the fastest-growing application, reflecting a broader consumer interest in preventive healthcare. Urban populations, especially younger demographics, are using DNA testing services to assess risks related to obesity, diabetes, mental health, and heart conditions. Wellness-focused startups like LifeXDNA and international platforms like 23andMe are tapping into this opportunity with curated lifestyle recommendations based on individual genetic makeup. Gyms, nutritionists, and corporate wellness programs are increasingly bundling genetic tests with health services, creating a parallel, non-clinical demand stream in the market.

By Channel

Offline channels dominated the distribution landscape, primarily through hospitals, clinics, and pharmacies where most clinical genetic tests are prescribed, administered, or referred. Traditional healthcare providers remain the most trusted source of genetic tests, particularly when it comes to hereditary disease screening, cancer diagnostics, or prenatal care. Moreover, physical presence is often required for sample collection such as blood draws or buccal swabs, making offline channels essential for most high-complexity tests.

Online channels are emerging as the fastest-growing segment, reflecting a digital shift in healthcare service delivery. Consumers are increasingly using apps and websites to order genetic testing kits, review reports, and schedule virtual consultations with genetic counselors. Platforms like Geneblitz, DNAFit, and Dante Labs now offer Arabic interfaces and local courier support to serve the UAE market efficiently. Online aggregators and marketplaces are also listing test kits alongside wellness products, leveraging cross-selling and bundled discounting. As digital trust deepens, the convenience and accessibility of online genetic testing will continue to attract younger, tech-oriented consumers.

By End-use

Hospitals and clinics dominated the end-use segment, driven by their integrated healthcare delivery models, established trust, and comprehensive diagnostic infrastructure. Major public hospitals in Abu Dhabi and Dubai now include genetic testing as part of maternity, oncology, and neurology care. Hospitals also act as testing centers for government-mandated programs such as newborn screening and premarital checks. With medical tourism on the rise, hospitals are also catering to international patients seeking genetic testing as part of their treatment plans.

Diagnostic laboratories are the fastest-growing segment, fueled by the rise in outpatient services, direct-to-consumer testing, and increased competition among private labs. Leading laboratories like Al Borg, National Reference Laboratory, and Biogenix Lab have expanded their testing panels and adopted high-throughput platforms to reduce turnaround times. Many labs are also entering strategic partnerships with e-commerce and health tech firms to offer home collection kits and personalized reports. As patient autonomy and digital health literacy improve, diagnostic labs are expected to take a larger share of the genetic testing ecosystem.

Country-Level Analysis: United Arab Emirates (UAE)

The UAE has positioned itself as a regional leader in genomics and personalized healthcare. With a population exceeding 10 million and a strong commitment to medical innovation, the country is fostering a robust regulatory and technological foundation for genetic testing. The Emirati Genome Program, launched in 2021, aims to sequence the entire genomes of one million citizens, marking a major milestone in building a comprehensive, ancestry-specific genomic reference for future diagnostics and treatments.

Cities like Abu Dhabi and Dubai have become epicenters of genetic innovation, hosting regional headquarters for international biotech firms and state-of-the-art laboratories. Public entities like the Department of Health – Abu Dhabi and the Dubai Health Authority are actively integrating genetic testing into public health protocols, ensuring high coverage and accessibility. Moreover, Emirati culture places a premium on family health, enabling wider acceptance of reproductive and carrier screening initiatives.

The UAE's commitment to data sovereignty has also led to increased investment in local genomic data centers, ensuring that sensitive health data is stored securely within national borders. This regulatory framework creates an attractive environment for international genetic testing firms looking to localize and scale operations in the GCC region. In sum, the UAE’s centralized governance, financial muscle, and tech-forward mindset make it a unique and rapidly advancing market for genetic testing services.

Some of the prominent players in the UAE genetic testing market include:

- Middle East Testing Services L.L.C

- Molecular Biology & Genetics Laboratory

- NSG

- Freiburg Medical Laboratory Middle East

- IVI MIDDLE EAST FERTILITY CLINIC

- 23andMe, Inc

- Ancestry

- CircleDNA

- 24Genetics

- MyDNA Life Australia Pty Ltd.

Recent Developments

-

March 2025 – M42, the health-tech giant formed by the merger of G42 Healthcare and Mubadala Health, launched the first AI-powered clinical genomic platform in the UAE for population-scale analysis.

-

January 2025 – LifeXDNA, a Dubai-based wellness genomics startup, expanded its offerings by launching an ancestry and trait-based DNA test tailored to the Arab population.

-

October 2024 – National Reference Laboratory (NRL) entered into a strategic partnership with Illumina to expand NGS-based testing capacity for hereditary cancers and cardiovascular conditions.

-

August 2024 – Biogenix Labs, based in Abu Dhabi, announced the successful sequencing of 250,000 genomes under the Emirati Genome Program, aiming to enhance local diagnostic accuracy.

-

June 2024 – DHA introduced subsidized BRCA testing in Dubai public hospitals, aimed at improving early breast cancer detection in high-risk families

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global UAE genetic testing market.

Technology Type

- Next Generation Sequencing

- Array Technology - Specific to Microarray Only

- PCR-based Testing

- FISH

- Others

Application Type

- Ancestry & Ethnicity

- Cancer Screening

- Genetic Disease Carrier Status

- New Baby Screening

- Traits

- Health and Wellness - Predisposition/ Risk / Tendency

End-use

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

Channel

- Online (Own Website/ App, Aggregators, Marketplace)

- Offline (Pharmacy, Own Clinics, Partner Clinics, Lab, Hospitals)

- Others