U.K. Ambulatory Services Market Size and Research

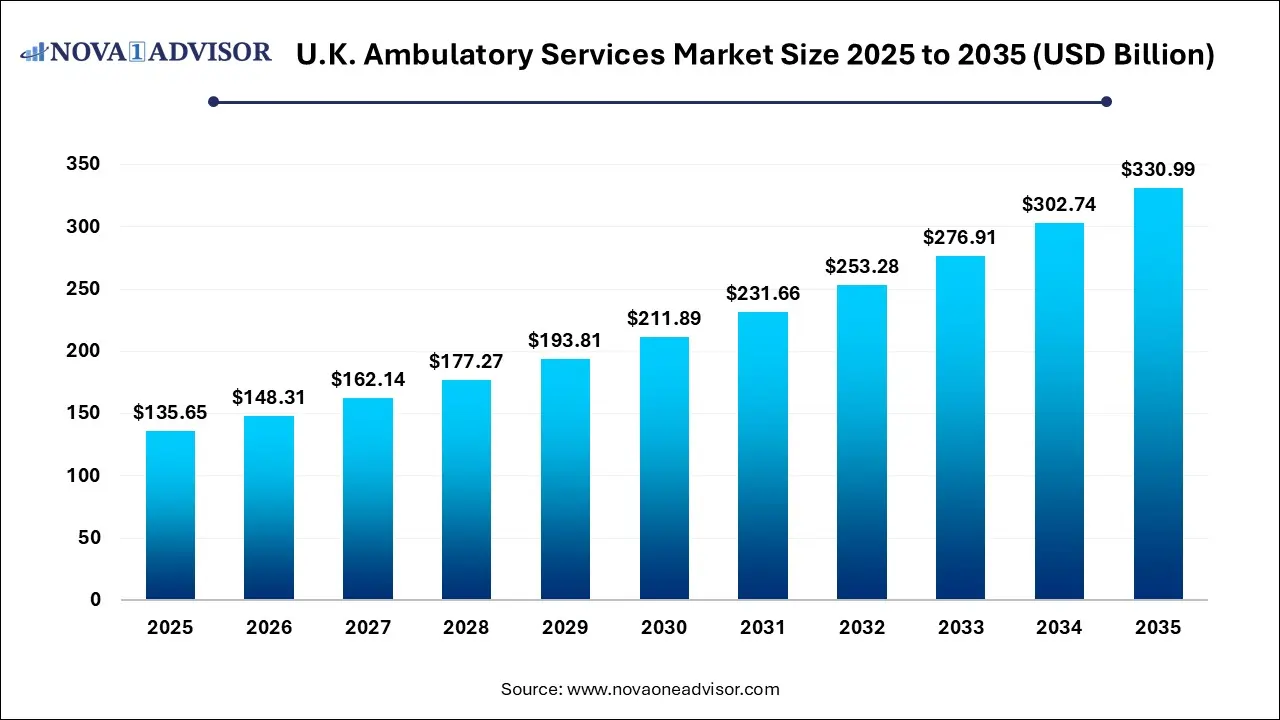

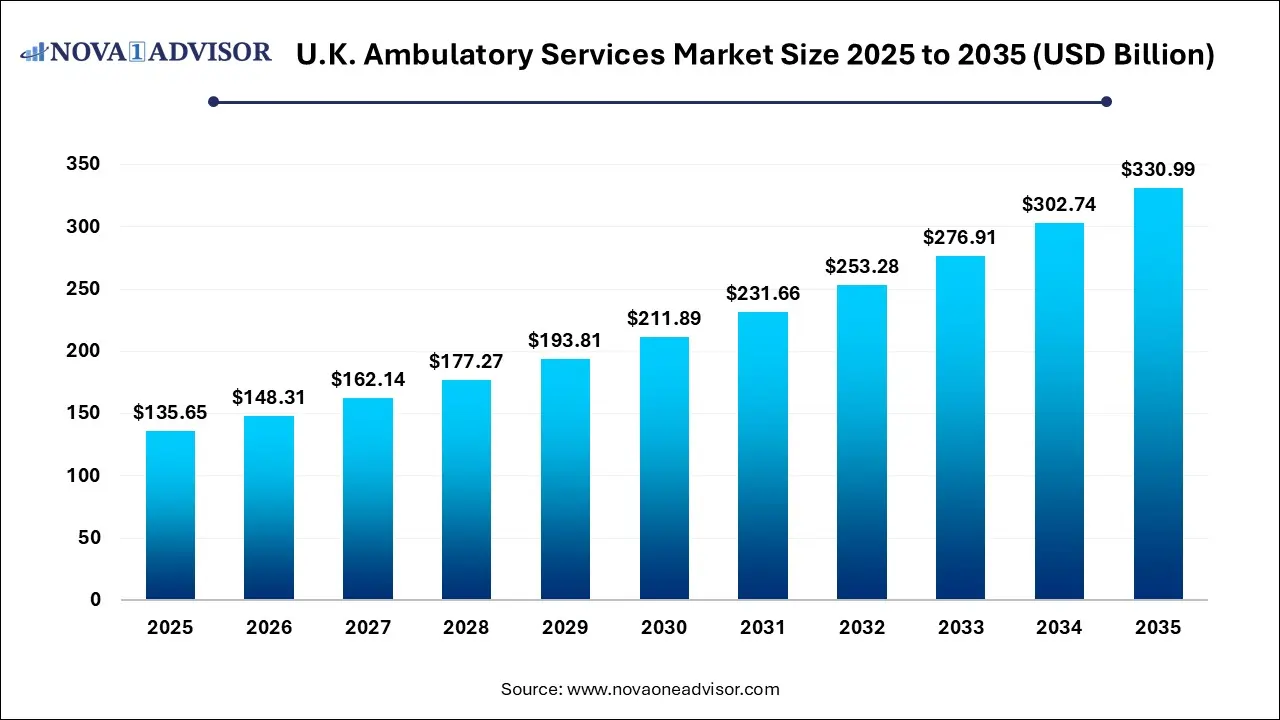

The U.K. ambulatory services market size was exhibited at USD 135.65 billion in 2025 and is projected to hit around USD 330.99 billion by 2035, growing at a CAGR of 9.333% during the forecast period 2026 to 2035.

Key Takeaways:

- The primary care office held the largest share of the market in 2025.

- The surgical specialty segment is expected to be the fastest-growing segment in the market during the forecast period.

Market Overview

The U.K. Ambulatory Services Market represents a critical and rapidly evolving component of the broader healthcare infrastructure. Ambulatory services, also known as outpatient care services, refer to medical services performed without hospital admission. These include diagnostics, minor surgical procedures, emergency care, chronic disease management, preventive screening, and rehabilitation delivered through primary care offices, outpatient departments, specialty clinics, and day-care surgical centers.

In recent years, the National Health Service (NHS) has increasingly prioritized ambulatory care as a means to alleviate pressure on overburdened hospitals and emergency departments. With rising healthcare costs and an aging population, the U.K. government and private sector stakeholders have both recognized that moving care outside of hospitals—when safe and feasible—is key to sustainability and efficiency. This shift is further supported by technological advancements, including digital diagnostics, telemedicine, and minimally invasive surgical techniques that make same-day discharge a reality for many procedures.

The COVID-19 pandemic further accelerated structural changes in the U.K.’s healthcare delivery system. To reduce infection risks and preserve inpatient resources, NHS Trusts and independent healthcare providers increased investment in outpatient care delivery. These investments have laid the groundwork for long-term growth in ambulatory services. More patients now expect, and often prefer, care that is delivered closer to home, quickly, and without the physical and psychological toll of hospital admission. Consequently, the ambulatory services sector in the U.K. is poised for continued expansion driven by convenience, clinical innovation, and strategic health policy shifts.

Major Trends in the Market

-

Shift Toward Same-Day Elective Procedures: Procedures like cataract surgery, orthopedic interventions, and gastrointestinal diagnostics are increasingly performed on a same-day basis in ambulatory settings.

-

Integration of Digital Health Tools: Use of e-consultations, remote monitoring, and AI triage tools is enhancing ambulatory care delivery.

-

Rise of Community Diagnostic Centres (CDCs): Part of NHS England’s strategy, CDCs aim to decentralize diagnostics by enabling local ambulatory testing hubs.

-

Growth in Independent Sector Partnerships: NHS is outsourcing parts of ambulatory care to independent providers to meet wait time targets and relieve capacity constraints.

-

Expansion of Ambulatory Emergency Care (AEC): AEC models are now standard in many hospitals, designed to assess and treat emergency patients without requiring overnight stays.

-

Focus on Multidisciplinary Outpatient Clinics: Specialists from different medical disciplines increasingly collaborate within outpatient environments to manage complex patients efficiently.

-

Reconfiguration of Primary Care Networks (PCNs): PCNs are investing in minor procedure clinics and community care teams to expand ambulatory services at the local level.

Report Scope of The U.K. Ambulatory Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 135.27 Billion |

| Market Size by 2035 |

USD 301.40 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.31% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.K. |

| Key Companies Profiled |

Guy's and St Thomas' NHS FT; Aspen Healthcare; BHR University Hospitals NHS Trust; Chelsea and Westminster Hospital NHS FT; Brighton and Sussex University Hospitals NHS FT; OneWelbeck; The Queen Elizabeth Hospital King's Lynn NHS FT; HCA Healthcare U.K.; Nottingham University Hospitals NHS FT; Milton Keynes NHS FT |

Market Driver: Pressure to Reduce Hospital Admissions and Wait Times

A primary driver for the expansion of ambulatory services in the U.K. is the urgent need to reduce hospital admissions and manage growing waiting lists, particularly for elective care and diagnostics. The NHS faces persistent bed shortages, especially during winter months, with emergency departments often operating at overcapacity. Simultaneously, the COVID-19 pandemic exacerbated elective surgery backlogs, highlighting the need for system-wide innovation in patient flow.

Ambulatory services offer a scalable, patient-centered solution. For example, ambulatory emergency care units can triage patients with chest pain, cellulitis, or DVT (deep vein thrombosis) without full hospital admission—freeing up inpatient beds. Similarly, outpatient surgical centers are increasingly performing procedures like hernia repair, cataract surgery, and endoscopies on a same-day basis with minimal complications and quicker recovery. This model not only cuts costs for the NHS but also improves patient satisfaction and outcomes.

According to the NHS Long Term Plan, up to one-third of hospital activity could shift to outpatient settings. As such, Trusts and Integrated Care Systems (ICSs) are prioritizing ambulatory investment, making it a long-term strategic driver of healthcare delivery transformation in the U.K.

Market Restraint: Staffing Shortages and Workforce Retention Challenges

A significant barrier to the growth of the ambulatory services market in the U.K. is the persistent shortage of trained healthcare staff, especially nurses, general practitioners (GPs), and specialist consultants. Ambulatory care models rely heavily on multidisciplinary collaboration, flexible scheduling, and efficient patient flow. These are difficult to achieve in the absence of adequate staffing or where existing staff are overextended.

Many Trusts and PCNs struggle to fill vacancies, leading to limited capacity even in newly developed outpatient units. Moreover, burnout following the pandemic has led to increased attrition rates across all levels of the workforce, including administrative and allied health professionals who play key roles in ambulatory operations. The complexity of staffing ambulatory centers—often requiring early starts, weekend availability, and cross-specialty coordination—adds further stress to the system.

Without a sustainable solution to workforce challenges, such as investment in training, international recruitment, or improved working conditions, the scalability and consistency of ambulatory services will remain constrained, especially in rural and underserved areas.

Market Opportunity: Expansion of Surgical Ambulatory Services via Independent Sector

A major growth opportunity in the U.K. ambulatory services market lies in the expansion of surgical specialty services through public-private partnerships and independent sector engagement. NHS England has increasingly turned to private providers to help address surgical backlogs, especially in high-demand areas like orthopedics, ophthalmology, and diagnostics. These private centers often operating as standalone ambulatory facilities offer high-efficiency operating lists, standardized care protocols, and faster patient turnaround.

For example, companies like Spire Healthcare, Circle Health Group, and Practice Plus Group have significantly expanded their ambulatory service offerings, often under NHS contracts. Their ability to deliver high-volume, low-complexity surgeries—such as cataract extraction or hip resurfacing on a day-case basis positions them as critical partners in reducing wait times and optimizing the use of NHS inpatient resources.

There is also growing interest in developing “surgical hubs,” where high-volume elective procedures are conducted in dedicated ambulatory facilities, thereby isolating elective pathways from emergency pressures. These hubs, whether publicly operated or privately managed, represent a key lever for scaling up ambulatory surgery across the U.K. healthcare landscape.

By Type Insights

Outpatient Departments dominated the U.K. ambulatory services market, driven by their ability to deliver a wide spectrum of care including diagnostics, chronic disease management, post-discharge follow-ups, and minor procedures. Hospitals across the U.K. have increasingly relied on their outpatient wings to reduce inpatient loads and prevent unnecessary admissions. Outpatient clinics cater to patients with conditions such as diabetes, COPD, arthritis, and hypertension, offering multidisciplinary support that minimizes hospital dependency. Innovations like electronic patient record (EPR) integration and remote consultation capabilities have further enhanced the efficiency and scope of outpatient departments, making them indispensable to modern care delivery.

Surgical specialty services are the fastest-growing segment, fueled by policy incentives, public-private collaboration, and technological advances. Elective procedures that once required overnight hospitalization such as orthopedic interventions, cataract extractions, and gastrointestinal diagnostics—are now routinely conducted on a day-case basis. Among these, ophthalmology and orthopedics lead in volume and efficiency, with ambulatory surgery centers performing tens of thousands of operations annually. These facilities are being optimized for patient throughput, infection control, and enhanced recovery pathways, making them increasingly central to NHS strategies for elective recovery and waiting list reduction.

By Surgical Specialty

Ophthalmology procedures such as cataract and glaucoma surgery dominate the surgical specialty category, thanks to their minimally invasive nature, high safety profile, and short recovery periods. The U.K. performs over 400,000 cataract surgeries annually, with the majority conducted on a same-day basis in ambulatory centers. These procedures are supported by digital imaging tools and streamlined clinical workflows, ensuring rapid patient turnover. High success rates and patient satisfaction make ophthalmology a model for other surgical specialties transitioning into ambulatory care.

Orthopedics is the fastest-growing specialty, driven by increasing demand for joint replacement surgeries and sports injury treatments. Innovations in arthroscopy, local anesthesia, and enhanced recovery protocols allow for day-case procedures like knee arthroscopy, shoulder repair, and minor hip interventions. Independent sector providers have been instrumental in expanding orthopedic capacity, particularly as NHS Trusts face bed shortages and workforce bottlenecks. Additionally, private insurers and self-pay patients increasingly prefer ambulatory orthopedic procedures for their convenience and reduced cost.

Country-Level Analysis – United Kingdom

In the United Kingdom, ambulatory services are undergoing a significant reconfiguration, led by NHS England and the Department of Health and Social Care (DHSC). Major NHS Trusts across England, Scotland, Wales, and Northern Ireland have integrated ambulatory emergency care (AEC) pathways, with protocols designed to prevent unnecessary hospitalizations. This has included development of criteria-led discharge models and risk stratification algorithms for same-day emergency care.

Meanwhile, Community Diagnostic Centres (CDCs)—a key pillar of NHS England’s diagnostic transformation strategy—are being rolled out to offer MRI, CT, ultrasound, and pathology testing outside of traditional hospital sites. This decentralization of care is pivotal in reducing bottlenecks and improving patient accessibility to diagnostics and pre-operative evaluations.

Primary Care Networks (PCNs), introduced in 2019, have expanded the remit of general practices to include extended ambulatory services such as minor surgery, chronic disease clinics, and home monitoring programs. With integrated care systems (ICSs) now operational across England, cross-sector collaboration between NHS Trusts, local authorities, and independent providers is being prioritized to expand ambulatory capacity sustainably.

The U.K. government has also supported this transition through policy instruments such as the Elective Recovery Fund and the Health and Care Bill, which emphasizes outpatient transformation and virtual ward development. As a result, the ambulatory services market is gaining a central role in the future of U.K. healthcare delivery.

Some of the prominent players in the U.K. ambulatory services market include:

- Guy's and St Thomas' NHS FT

- Aspen Healthcare

- BHR University Hospitals NHS Trust

- Chelsea and Westminster Hospital NHS FT

- Brighton and Sussex University Hospitals NHS FT

- OneWelbeck

- The Queen Elizabeth Hospital King's Lynn NHS FT

- HCA Healthcare U.K.

- Nottingham University Hospitals NHS FT

- Milton Keynes NHS FT

Recent Developments

-

In March 2025, Spire Healthcare announced a £100 million expansion plan focusing on new ambulatory surgery centers in London and Birmingham to meet growing demand for elective services under NHS contracts.

-

In January 2025, NHS England reported that over 150 Community Diagnostic Centres (CDCs) had become operational, delivering 4 million tests and scans in ambulatory settings since their inception.

-

In December 2024, Circle Health Group launched a new ambulatory orthopedic hub in Manchester, capable of delivering up to 10,000 procedures annually with enhanced same-day discharge rates.

-

In November 2024, Practice Plus Group entered a new partnership with several NHS Trusts to operate cataract and endoscopy centers on a high-volume ambulatory model in underutilized estate spaces.

-

In October 2024, NHS Digital rolled out a new integrated outpatient appointment system enabling streamlined scheduling and patient reminders, significantly reducing no-show rates at ambulatory clinics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2035. For this study, Nova one advisor, Inc. has segmented the U.K. ambulatory services market

Type

- Primary Care Offices

- Outpatient Departments

- Emergency Departments

- Surgical Specialty

-

- Orthopedics

- Ophthalmology

- Gastroenterology

- Pain Management

- Plastic Surgery

- Others