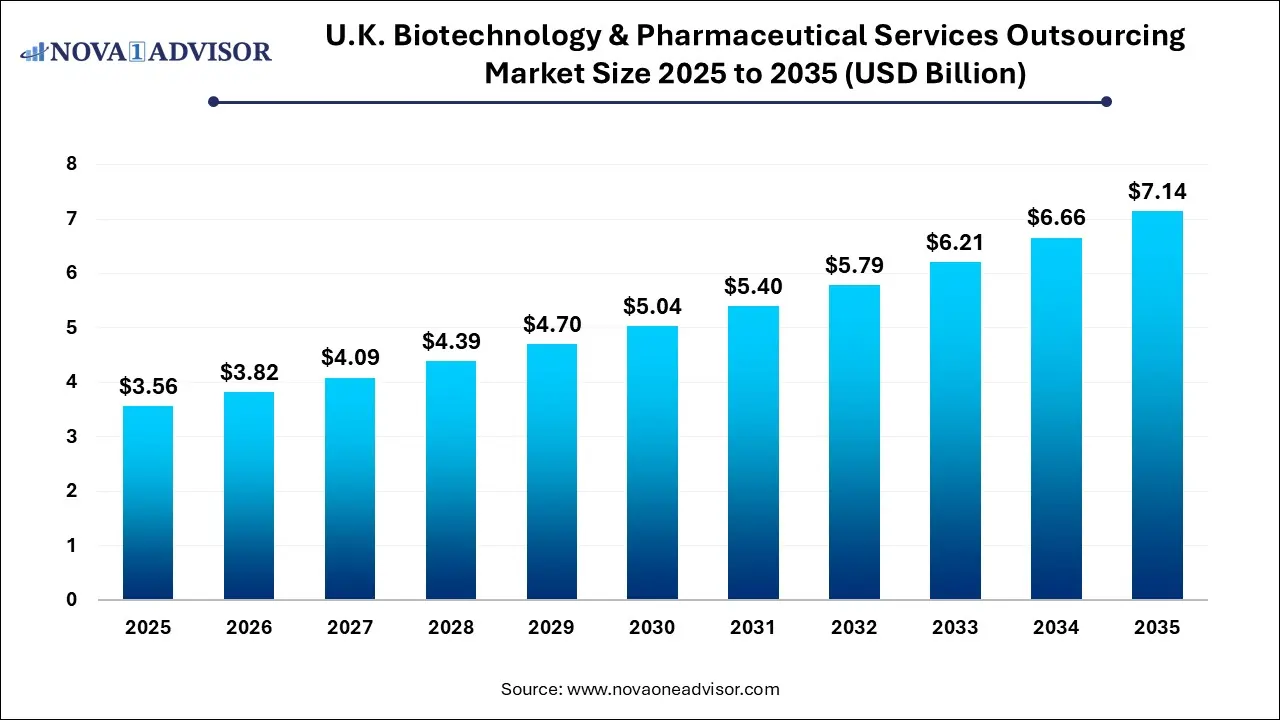

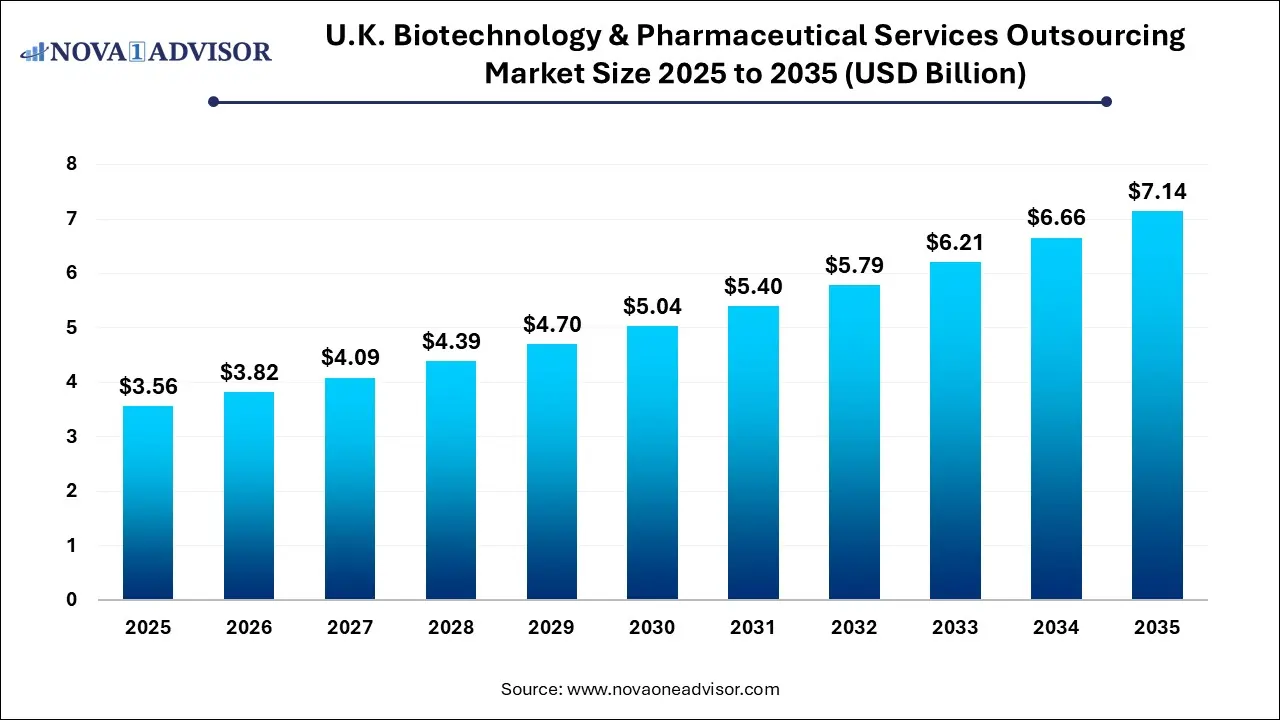

U.K. Biotechnology & Pharmaceutical Services Outsourcing Market Size and Growth

The U.K. biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 3.56 billion in 2025 and is projected to hit around USD 7.14 billion by 2035, growing at a CAGR of 7.2% during the forecast period 2026 to 2035.

U.K. Biotechnology & Pharmaceutical Services Outsourcing Market Key Takeaways:

- Based on service, the consulting service segment led the market for biotechnology and pharmaceutical services outsourcing and accounted for the largest revenue share of 22.7% in 2025.

- The pharmaceutical segment dominated the U.K. biotechnology and pharmaceutical services outsourcing market and held the largest revenue share of 56.0% in 2025.

- The biotech segment is anticipated to register significant growth over the forecast period.

Market Overview

The U.K. biotechnology and pharmaceutical services outsourcing market is experiencing a transformative phase, driven by increasing drug development complexity, cost pressures, and the strategic shift of pharmaceutical and biotech companies toward external expertise for operational efficiency. The market encompasses a wide range of services including regulatory affairs, auditing, clinical trial applications, consulting, product design and testing, and training—all pivotal in expediting drug development and ensuring regulatory compliance.

The U.K. is home to one of the most mature pharmaceutical ecosystems in Europe. With institutions like the Medicines and Healthcare products Regulatory Agency (MHRA) and a history of research excellence from academic giants like Oxford and Cambridge, the country fosters a favorable environment for both startups and multinational drug developers. This has made it an attractive location for Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and consulting firms catering to the pharma-biotech continuum.

Brexit has added an additional dimension to outsourcing demand. As companies adapt to a post-EU regulatory framework, they are increasingly relying on expert consultancies for market access, legal representation, and compliance management within the U.K. Moreover, the COVID-19 pandemic further accelerated outsourcing adoption by highlighting the agility offered by third-party providers, especially in remote audits, rapid trial setups, and decentralized study models.

Major Trends in the Market

-

Growth of Full-Service CROs and Integrated Offerings: Companies are increasingly choosing single outsourcing partners that offer end-to-end services from drug discovery to commercialization.

-

Digital Transformation and eClinical Technologies: Integration of AI, big data analytics, and cloud-based systems in regulatory writing, clinical trials, and quality systems is gaining rapid momentum.

-

Rising Focus on Regulatory Affairs Expertise Post-Brexit: U.K.-specific compliance services and local representation are in high demand due to diverging U.K. and EU regulations.

-

Increased Biotech Startup Activity: Government support, grants, and academic spin-offs have led to a vibrant biotech scene, fueling demand for flexible outsourced services.

-

Remote and Virtual Auditing Solutions: Driven by pandemic adaptations, virtual auditing and e-learning modules for training are now common outsourcing formats.

Report Scope of U.K. Biotechnology & Pharmaceutical Services Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.82 Billion |

| Market Size by 2035 |

USD 7.14 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Quantic Group; IQVIA Holdings; Parexel International Corporation; Lachman Consultant Services; GMP Pharmaceuticals; Concept Heidelberg GMBH; Covance Inc.; PRA Health Sciences; Charles River Laboratories; Icon Plc |

Key Market Driver: Increasing Complexity of Drug Development Pipelines

A significant driver of outsourcing in the U.K. biotechnology and pharmaceutical services market is the escalating complexity and volume of drug development projects. From biologics and gene therapies to RNA-based treatments and advanced cell therapies, the modern pipeline demands specialized knowledge and advanced infrastructure often beyond the internal capabilities of even large pharma firms.

Outsourcing has become a critical tool for managing this complexity. Specialized CROs and regulatory affairs consultancies in the U.K. provide tailored expertise in protocol design, patient recruitment, data management, and submission dossiers for advanced therapy medicinal products (ATMPs). As these treatments move from concept to clinic, sponsors increasingly depend on external partners who are already well-versed in navigating U.K.-specific regulatory landscapes. This reliance is especially visible in the biotech sector, where smaller firms often lack the capital or workforce to build internal regulatory or compliance teams.

Key Market Restraint: Fragmentation of Service Providers and Variable Quality

Despite growth, the market faces a key restraint: the fragmentation of service providers and inconsistent quality of outsourcing outputs. While the U.K. boasts numerous CROs and consulting firms, not all are equipped to handle high-stakes, end-to-end support, particularly for complex therapies or first-in-human trials. The quality of deliverables ranging from clinical documentation to audit findings can vary significantly across vendors.

This variability increases risk for pharmaceutical clients, who must often invest additional time and resources in vendor assessment, training, or even rework. Additionally, the lack of standardized frameworks for performance metrics and accountability complicates contract negotiations and project management. For startups with limited experience or oversight capacity, these disparities can delay drug development timelines or impact regulatory submissions.

Key Market Opportunity: Rising Demand for U.K.-Specific Regulatory and Legal Representation Post-Brexit

A substantial opportunity in the market has emerged from the U.K.’s regulatory divergence from the EU post-Brexit. Companies that previously used an EU base for both EMA and U.K. market access now need distinct strategies for each region. This has led to an increase in demand for local regulatory affairs consulting, legal representation, and U.K.-based auditing support.

Service providers offering MHRA submission support, clinical trial application preparation, and pharmacovigilance consulting are well-positioned to capitalize on this shift. Moreover, non-U.K. firms aiming to enter the British market now require local partners for compliance and product registration. This regulatory realignment has not only expanded the scope of services required but also heightened the value of localized expertise driving growth in niche consultancies and MHRA-facing outsourcing firms.

U.K. Biotechnology & Pharmaceutical Services Outsourcing Market By Service Insights

Regulatory Affairs emerged as the dominant service segment in the U.K. biotechnology and pharmaceutical services outsourcing market. This includes critical sub-services such as clinical trial applications, legal representation, and regulatory writing particularly vital in the current regulatory climate post-Brexit. Pharmaceutical and biotech firms rely heavily on expert consultants to navigate new MHRA procedures, manage submissions, and ensure timely market access. Legal representation has become particularly essential for overseas companies needing a presence within the U.K., while regulatory writing and publishing remain fundamental to maintaining compliance across a product's lifecycle.

Auditing and assessment is emerging as the fastest-growing service segment, especially with the increasing emphasis on data integrity, GMP (Good Manufacturing Practices), and clinical site qualification. The shift toward remote and hybrid auditing models has reduced logistical constraints and allowed CROs and QA consulting firms to scale operations. Companies are also prioritizing mock audits and compliance readiness assessments to prevent costly delays during inspections. As the U.K. tightens its regulatory vigilance, especially in clinical and manufacturing environments, demand for third-party auditing is accelerating—especially among mid-sized pharma firms and CDMOs.

U.K. Biotechnology & Pharmaceutical Services Outsourcing Market By End-use Insights

Pharmaceutical companies were the leading end users in the market, primarily due to their expansive R&D pipelines and global commercial interests. These companies are outsourcing regulatory strategy, clinical documentation, and product lifecycle services to remain agile in an increasingly competitive and cost-intensive environment. With internal teams often focused on core development, outsourcing offers a way to maintain operational flexibility while navigating fluctuating demand and regional regulations. The U.K. hosts subsidiaries of global pharmaceutical giants that routinely partner with local CROs for market-specific submissions and compliance mandates.

Biotech companies are the fastest-growing end-use segment, driven by the proliferation of early-stage ventures and academic spin-offs in the U.K.’s biotechnology hubs such as Oxford, Cambridge, and London. These firms are typically focused on innovation—such as immunotherapies, gene editing, and rare disease treatment—but lack the regulatory and commercial infrastructure of larger players. As a result, they are increasingly dependent on outsourcing for everything from trial design and validation to MHRA interactions and quality assurance. Government incentives, research grants, and investor funding are further supporting biotech expansion and, by extension, the services outsourcing ecosystem.

Country-Level Analysis: United Kingdom

The U.K. biotechnology and pharmaceutical services outsourcing market operates in a dynamic environment shaped by its regulatory independence, research infrastructure, and innovation-centric ecosystem. London, Oxford, and Cambridge form the country's leading triad for biotech innovation, attracting both local and international startups, CROs, and support service providers. The U.K. also benefits from close collaboration between academia and industry, further enriching its service capabilities.

Since Brexit, the U.K. has undertaken a unique regulatory trajectory, with the MHRA assuming sole authority over drug approvals, clinical trial oversight, and pharmacovigilance. This transition has elevated the demand for domestic regulatory consultants and legal representatives. Furthermore, NHS collaborations and the rollout of digital health tools are opening doors for hybrid service models, including remote monitoring and teleconsulting in clinical trials. While uncertainties remain, the U.K. is establishing itself as a specialized, high-value outsourcing destination, particularly for firms seeking deep regulatory knowledge and scientific excellence.

Some of the prominent players in the U.K. biotechnology and pharmaceutical services outsourcing market include:

Recent Developments

-

Pharmalex (March 2025) expanded its regulatory services team in the U.K., launching a new London-based hub dedicated to MHRA-facing consultancy and digital document management for regulatory filings.

-

ICON plc (February 2025) opened a new facility in Manchester aimed at supporting decentralized clinical trials in the U.K., enhancing its service capabilities for biotech startups.

-

IQVIA (January 2025) launched an AI-powered regulatory writing tool designed specifically for European and U.K. compliance frameworks, improving submission turnaround time and reducing manual effort.

-

PRA Health Sciences (now part of ICON) (December 2024) began offering specialized post-Brexit auditing services to U.K.-based pharma firms, targeting GMP readiness and MHRA compliance.

-

Certara (October 2024) established a new training and simulation center in Cambridge, focusing on education programs for U.K. regulatory professionals and biotech employees.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.K. biotechnology and pharmaceutical services outsourcing market

By Service

-

- Regulatory Compliance

- Remediation

- Quality Management Systems Consulting

- Others

- Auditing And Assessment

- Regulatory Affairs

-

- Clinical Trial Applications & Product Registration

- Regulatory Writing & Publishing

- Legal Representation

- Others

- Product Maintenance

- Product Design & Development

- Product Testing & Validation

- Training & Education

- Others

By End-use