UK Pet Grooming Products Market Size and Research

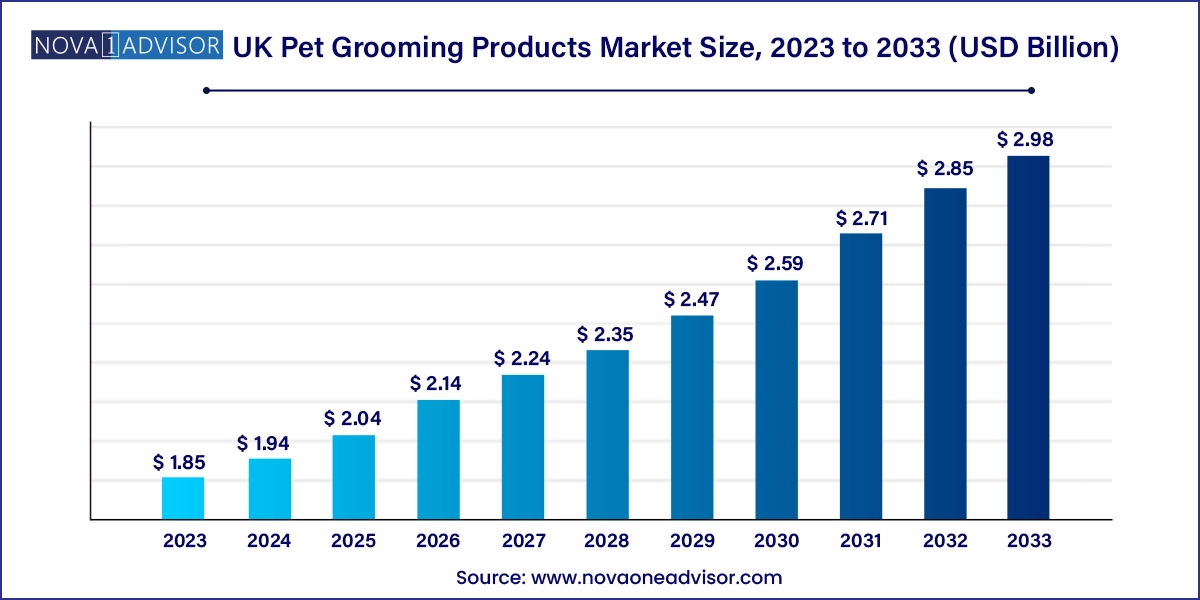

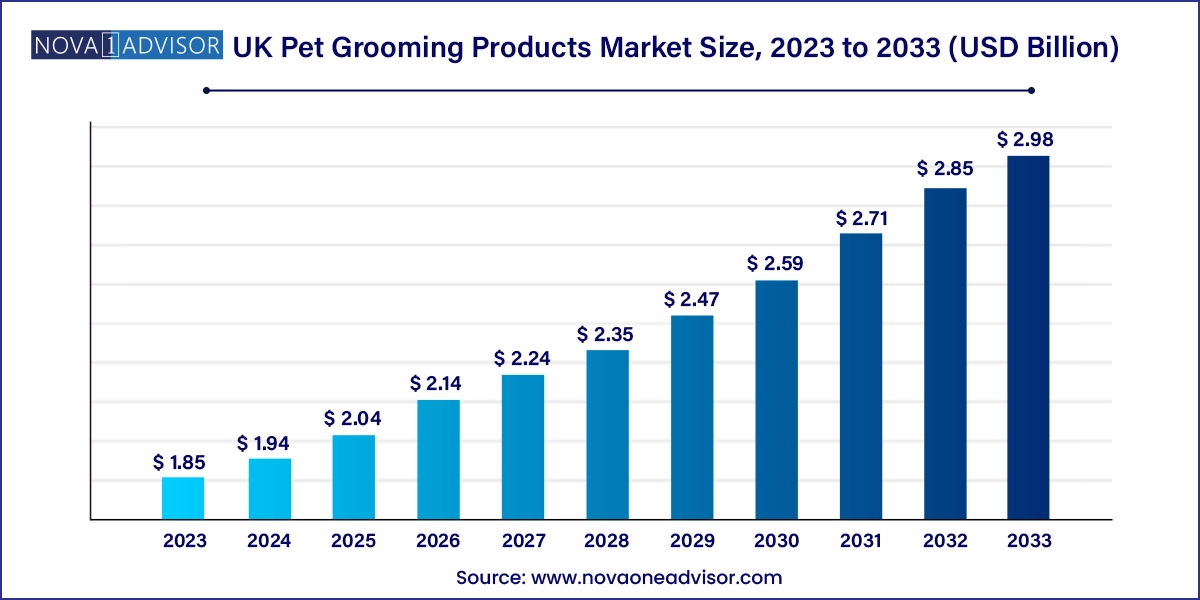

The UK pet grooming products market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 2.98 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

UK Pet Grooming Products Market Key Takeaways:

- The UK pet shampoo and conditioner market accounted for a share of 56.0% in 2023.

- The demand for pet shear & trimming tools in the UK is expected to grow at a CAGR of 4.8% from 2024 to 2033.

- The offline sales of pet grooming products in the UK accounted for a revenue share of 72.8% in 2023.

- The online sales of pet grooming products in the UK is expected to grow at a CAGR of 6.3% from 2024 to 2033.

Market Overview

The UK pet grooming products market has matured into a thriving sector driven by increasing pet ownership, heightened awareness of pet wellness, and the expanding role of pets as integral family members. As of the early 2020s, the UK had one of the highest rates of pet ownership in Europe, with approximately 57% of households owning at least one pet—mostly dogs and cats. This demographic shift is being accompanied by evolving lifestyle choices where aesthetics, hygiene, and health converge, driving the demand for professional-grade grooming products within both household and commercial contexts.

The pet grooming category in the UK is no longer limited to shampoos and brushes—it has expanded into an extensive portfolio including conditioners, detanglers, paw balms, grooming wipes, trimmers, and specialty tools for de-shedding, flea removal, and fur polishing. British pet owners are showing an increasing preference for premium and tailored grooming solutions. This includes hypoallergenic shampoos for sensitive skin, pH-balanced conditioners, breed-specific grooming kits, and ergonomic brushes suited for various coat types. Importantly, grooming is also closely associated with preventative health, as regular maintenance can identify skin issues, pests, or abnormalities early.

Simultaneously, the UK’s retail environment is fostering an ideal market for grooming products. From supermarkets and pet specialty stores to vet clinics and online platforms, consumers enjoy access to a wide variety of grooming options spanning both affordable and luxury segments. While traditional offline sales remain strong, the rise of digital pet care brands, influencer marketing, and e-commerce growth is shifting consumer behavior toward convenient online purchases, especially in urban and suburban regions.

The COVID-19 pandemic further reshaped consumer grooming habits. Lockdowns forced many pet parents to groom their pets at home, which resulted in increased demand for DIY grooming kits, shears, and digital tutorials. Even as professional grooming salons recover, the trend of home grooming persists, indicating a lasting behavioral shift. Moreover, the market has seen growing demand for eco-conscious, organic, and cruelty-free grooming solutions in alignment with broader sustainability trends.

Overall, the UK pet grooming products market is poised for sustained growth through 2033, underpinned by innovation, rising pet expenditure, digital adoption, and changing social attitudes toward pets.

Major Trends in the Market

-

Premiumization of Grooming Products: Consumers are willing to pay more for high-quality, vet-approved, and breed-specific grooming products.

-

Rise of Eco-Friendly and Organic Grooming Solutions: Shampoos and grooming tools that are biodegradable, sulfate-free, and cruelty-free are gaining traction.

-

DIY Grooming Boom: The post-pandemic era has seen a significant rise in at-home grooming supported by toolkits, online tutorials, and influencer-led content.

-

Grooming Tools with Ergonomic and Smart Features: Electric trimmers, anti-slip handles, self-cleaning brushes, and quiet grooming tools are now widely available.

-

Humanization of Pets: Grooming products are often modeled after human cosmetics in branding, scent, and quality—appealing to emotional consumer buying.

-

Influencer-Driven Marketing on Social Media: Grooming routines shared by pet influencers on platforms like TikTok and Instagram are influencing product preferences.

-

Subscription-Based Grooming Product Delivery Models: Recurring product delivery models offer pet owners convenience and ensure grooming consistency.

-

Vet Collaboration and Professional Groomer-Endorsed Products: Vet-backed grooming lines are expanding their reach by promoting safety and dermatological integrity.

Report Scope of UK Pet Grooming Products Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.94 Billion |

| Market Size by 2033 |

USD 2.98 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

UK |

| Key Companies Profiled |

Groomer's Choice; Himalaya Herbal Healthcare; Spectrum Brands; Earthbath; Resco; SynergyLabs; Petco Animal Supplies, Inc.; Coastal Pet Products; Vet's Best; 4-Legger; World For Pets |

Key Market Driver

Surging Pet Humanization and Expenditure on Premium Care

The most powerful force driving the UK pet grooming products market is the growing humanization of pets and the corresponding willingness of consumers to spend more on pet wellness. Today’s pet parents see their animals not merely as companions but as emotional extensions of their family units. This cultural shift is translating into higher per-pet spending across categories including food, fashion, healthcare, and particularly grooming.

UK pet owners now seek the same level of care and quality in pet products as they do for themselves. This includes grooming products that are organic, hypoallergenic, pH-balanced, or dermatologically tested. Luxury grooming kits, designer pet shampoos, and breed-specific trimmers are being adopted by households who associate grooming with health and aesthetics. The availability of salon-quality products for home use has widened access and driven demand, especially among urban pet owners. This shift not only increases average order value but also fosters recurring purchases, subscription adoption, and brand loyalty.

Key Market Restraint

Price Sensitivity in Mass-Market Segments

Despite the growing appeal of premium grooming products, a significant portion of UK consumers remains price-sensitive, especially in rural areas or among older demographics. While high-income urban pet owners may seek boutique shampoos and high-tech trimmers, mass-market consumers often opt for basic grooming tools that meet essential hygiene requirements at lower prices. This bifurcation poses a challenge for manufacturers aiming to capture the entire market.

Additionally, economic fluctuations, inflationary pressures, and changes in discretionary income influence pet care spending habits. Consumers may substitute expensive grooming products for lower-cost alternatives or reduce grooming frequency during economic downturns. The competitive pricing environment, dominated by private label brands from supermarkets and online marketplaces, adds further pricing pressure on premium and mid-tier grooming product brands.

Key Market Opportunity

Expansion of Eco-Friendly and Functional Grooming Product Lines

An exciting opportunity lies in the expansion of eco-conscious and functionally enhanced grooming product lines. British consumers are increasingly attentive to environmental and ethical considerations. This is reflected in growing demand for plastic-free packaging, refillable grooming bottles, cruelty-free certifications, and plant-based ingredients. Brands that incorporate sustainable materials in brushes or biodegradable formulas in shampoos are gaining a competitive edge.

Moreover, multifunctional grooming products are carving out a strong niche. These include 2-in-1 shampoo-conditioners, anti-parasitic shampoos, and grooming sprays that double as deodorizers or detanglers. British consumers, particularly millennials, appreciate convenience and innovation—characteristics well-reflected in product lines that combine functionality with clean ingredients. Pet brands that combine environmental responsibility with dermatological effectiveness stand to grow significantly in the evolving UK market.

UK Pet Grooming Products Market By Type Insights

The UK pet shampoo and conditioner market accounted for a share of 56.0% in 2023. owing to its essential role in hygiene maintenance and skin care. With a wide array of offerings—ranging from basic cleansing shampoos to medicated, moisturizing, deodorizing, and flea-control variants—this segment remains the go-to choice for both amateur and professional groomers. The growing frequency of at-home pet bathing, combined with innovation in natural ingredients and fragrance formulations, has propelled the growth of this segment. Leading brands like Animology, Johnson's Veterinary, and Pet Head dominate store shelves and online platforms alike with diverse product portfolios.

The demand for pet shear & trimming tools in the UK is expected to grow at a CAGR of 4.8% from 2024 to 2033. driven by a surge in home grooming practices post-pandemic. As many UK households adopted new pets during lockdowns, grooming became a frequent and necessary ritual. Consequently, demand for electric trimmers, nail clippers, paw shears, and fur stylers surged. Products with quiet motors, ergonomic grips, and adjustable blade lengths have seen strong uptake. Additionally, grooming tools tailored for specific breeds, fur lengths, or skin sensitivities are gaining ground. Brands are innovating with smart trimmers featuring LED lights or cordless use, catering to tech-savvy pet owners seeking salon-style precision at home.

UK Pet Grooming Products Market By Distribution Channel Insights

The offline sales of pet grooming products in the UK accounted for a revenue share of 72.8% in 2023. The strength of this channel lies in its tactile experience, in-store consultations, and the ability to physically assess product texture, scent, or suitability. Major British retail chains like Pets at Home, Tesco, and Waitrose offer both domestic and international grooming brands, often bundled with promotional discounts. Additionally, local vet clinics and grooming salons frequently stock and recommend professional-grade products, reinforcing consumer trust in offline purchases.

The online sales of pet grooming products in the UK is expected to grow at a CAGR of 6.3% from 2024 to 2033. E-commerce platforms like Amazon UK, Zooplus, and Ocado Pet Store are expanding their grooming offerings, including specialty, imported, and indie brands. Subscription models offering auto-replenishment of grooming essentials are gaining traction among busy pet parents. Online marketplaces are also leveraging user reviews, influencer promotions, and virtual grooming guides to inform and convert shoppers. With growing digital literacy and internet penetration across the UK, the online channel is projected to outpace offline growth over the forecast period.

Country-Level Analysis

The UK stands as a uniquely positioned market where traditional pet care culture intersects with modern wellness, sustainability, and digital adoption. Urban centers like London, Manchester, Birmingham, and Edinburgh are driving growth in grooming product demand due to their high concentration of pet-friendly households, mobile grooming services, and premium pet boutiques. Pet humanization trends are deeply entrenched here, leading to consistent investment in grooming routines.

British pet owners are also well-versed in animal dermatology and frequently seek products endorsed by veterinarians. Skin issues such as dermatitis, allergies, and dandruff in pets are commonly managed with medicated grooming products available both OTC and through clinics. Meanwhile, rural parts of the UK show consistent adoption of basic grooming products, often opting for affordable, multi-use items.

Moreover, the UK's cultural inclination toward sustainability is heavily influencing the grooming segment. Brands that market their environmental values, support local manufacturing, or offer plastic-free grooming kits find strong favor with conscious consumers. With a high rate of pet adoption, tech integration, and grooming awareness, the UK will continue to serve as a leading market in Europe for pet grooming innovation.

Some of the prominent players in the UK pet grooming products market include:

- Groomer's Choice

- Himalaya Herbal Healthcare

- Spectrum Brands

- Earthbath

- Resco

- SynergyLabs

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- Vet's Best

- 4-Legger

UK Pet Grooming Products Market Recent Developments

-

Animology (March 2024): The UK-based grooming brand announced the launch of its new “BotaniClean” range—a sulfate-free, vegan line of shampoos and sprays designed to cater to eco-conscious consumers.

-

Pets at Home (February 2024): Pets at Home expanded its private-label grooming toolkits, including electric shears and ergonomic brushes, catering to the growing DIY grooming segment.

-

Johnson’s Veterinary (January 2024): The company introduced a new oatmeal and chamomile-based shampoo targeted at dogs with sensitive skin and seasonal allergies. It’s being rolled out across vet clinics and independent pet retailers.

-

Wahl UK (December 2023): Wahl launched a cordless pet trimmer series in collaboration with pet grooming influencers, promoting home grooming tutorials across YouTube and TikTok.

-

Amazon UK (November 2023): Amazon launched its “Pet Essentials” category with enhanced grooming product bundles, featuring organic shampoo lines and professional-grade grooming shears.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK pet grooming products market

Type

- Shampoo & Conditioner

- Shear & Trimming Tools

- Comb & Brush

- Others

Distribution Channel