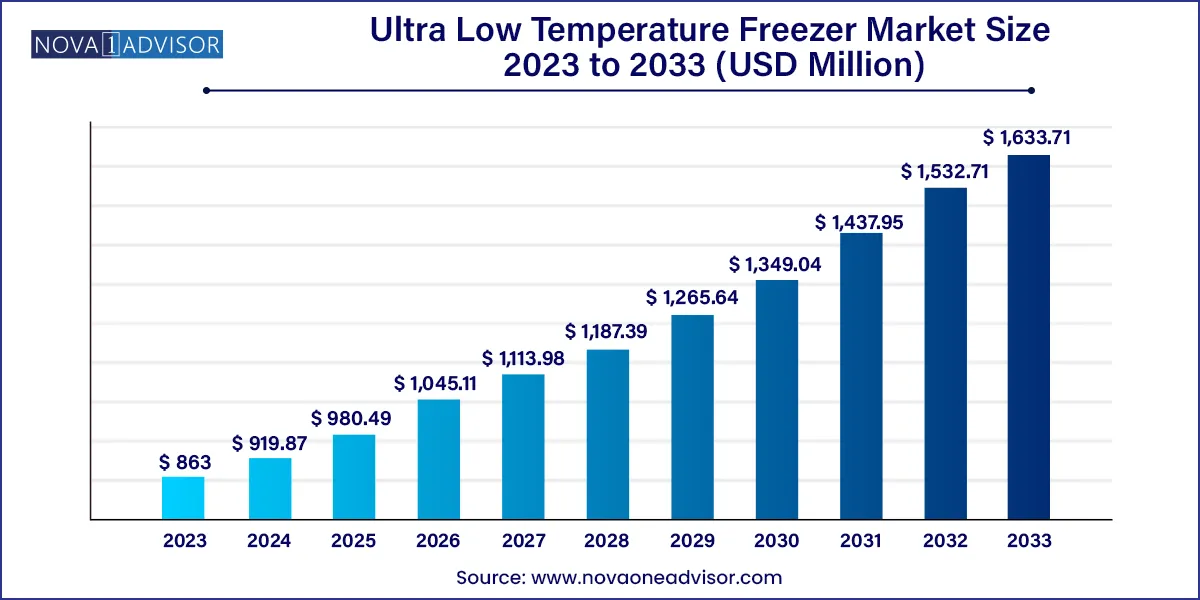

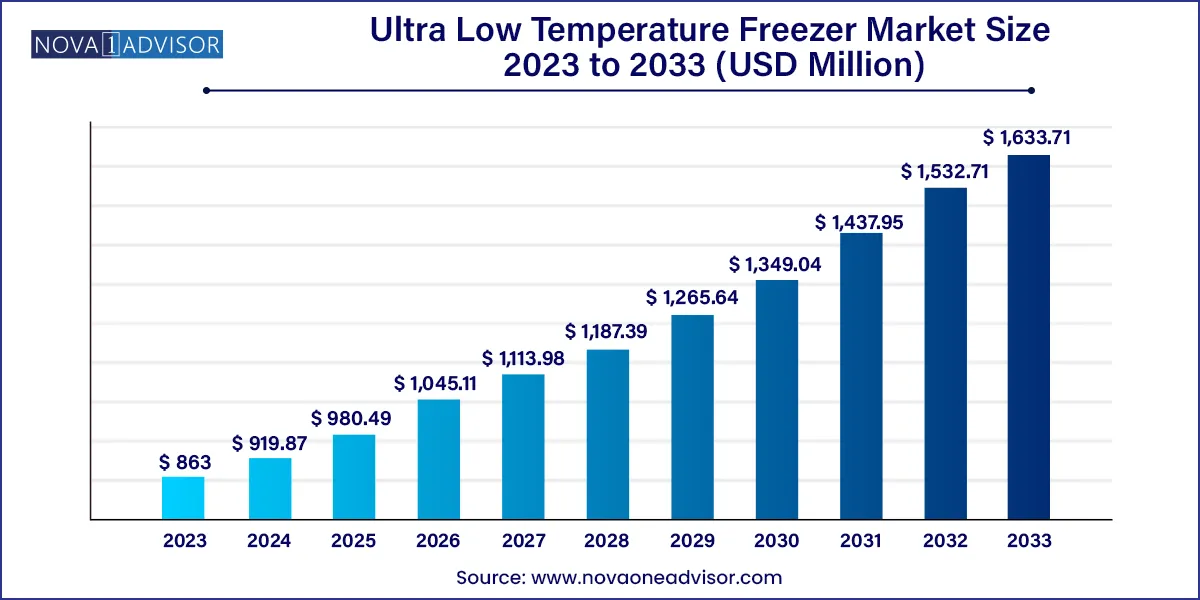

The global ultra low temperature freezer market size was exhibited at USD 863.00 million in 2023 and is projected to hit around USD 1,633.71 million by 2033, growing at a CAGR of 6.59% during the forecast period 2024 to 2033.

Key Takeaways:

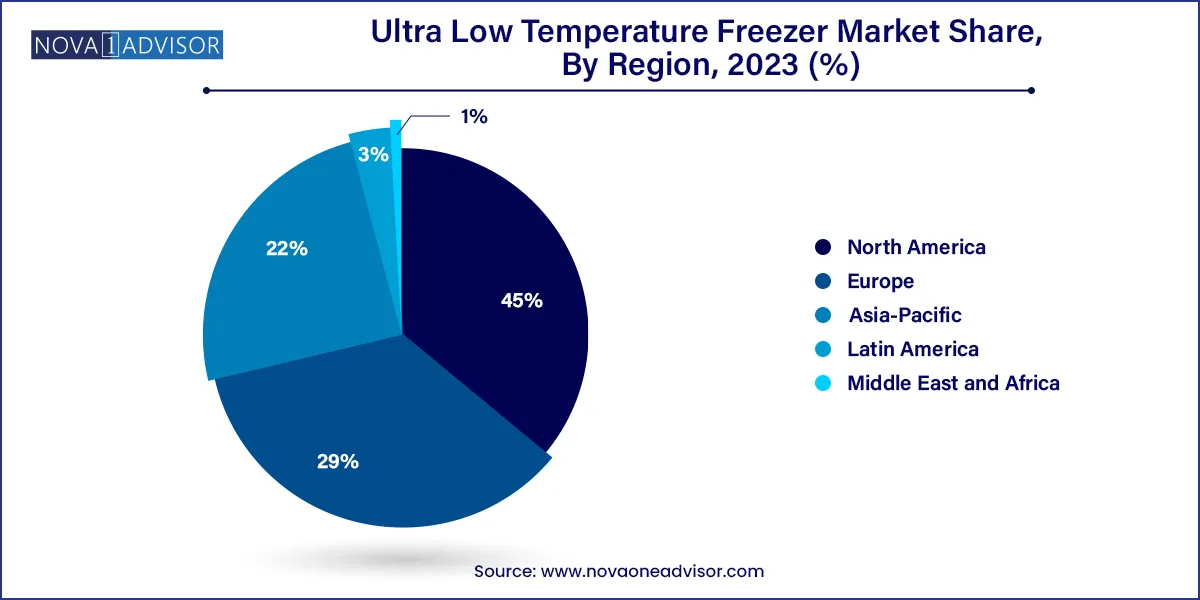

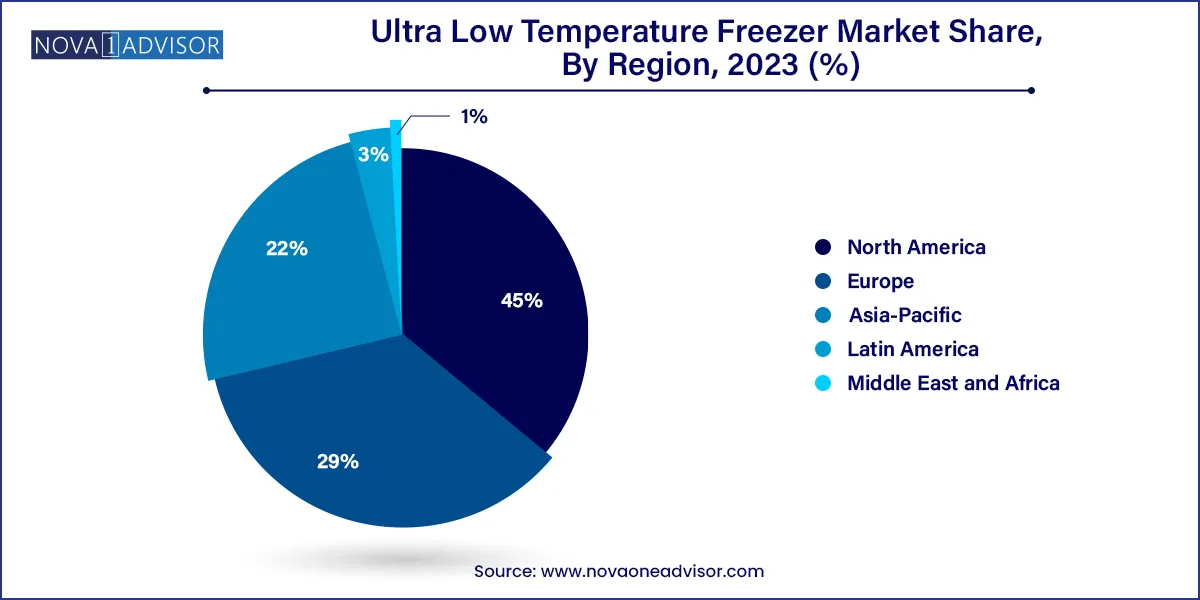

- North America contributed 45% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

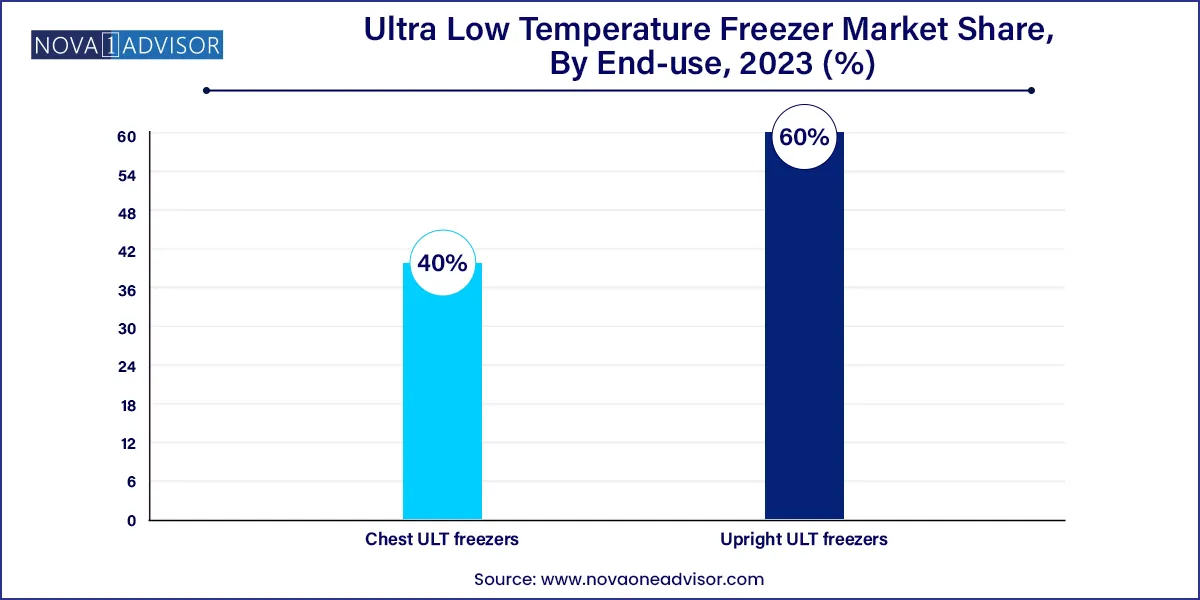

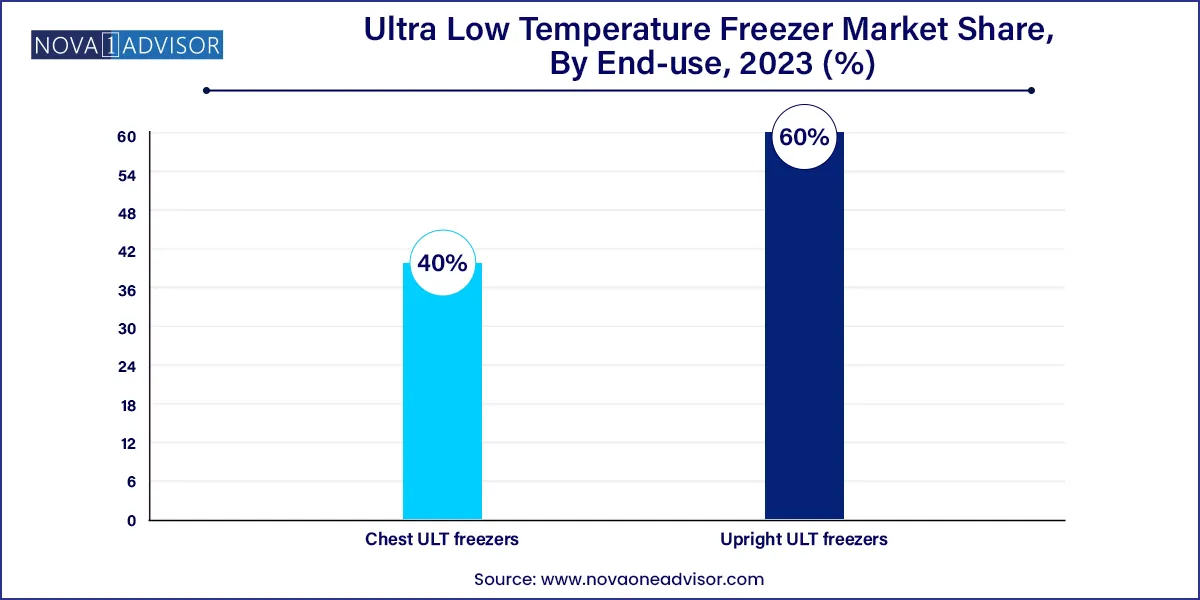

- By product type, the upright ULT freezers segment has held the largest market share of 60.0% in 2023.

- By product type, the chest ULT freezers segment is anticipated to grow at a remarkable CAGR of 7.9% between 2024 and 2033.

- By end-user, the academic and research laboratories segment generated 35% of the market share in 2023.

- By end-user, the bio-banks segment is expected to expand at the fastest CAGR over the projected period.

Ultra Low Temperature Freezer Market Overview

The ultra low temperature freezer market offers specialized devices designed to maintain extremely low temperatures, typically ranging from -40°C to -86°C or even lower. It is widely used in various scientific and medical settings to store sensitive biological materials such as vaccines, enzymes, and genetic samples. These freezers play a crucial role in preserving the integrity of these substances by preventing any degradation or loss of activity. The ultra-low temperatures slow down molecular and chemical processes, ensuring the long-term stability of stored samples. Researchers, healthcare professionals, and laboratories rely on these freezers to safeguard valuable specimens, allowing for extended storage durations without compromising the quality of the materials. The precise temperature control and reliable performance of ultra low temperature freezers make them indispensable tools in industries where maintaining the viability and functionality of biological samples is of utmost importance.

Ultra Low Temperature Freezer Market Data and Statistics

- The Pfizer-BioNTech mRNA COVID-19 vaccine, BNT162b2, as per guidelines from the Food and Drug Administration (FDA), necessitates storage in ultra-low temperature freezers, ranging from -80°C to -60°C, for a maximum of six months post-receipt.

- In September 2022, an article published by the Journal of Rapid and Transparent Publishing highlighted the Integrated Biorepository of H3Africa Uganda (IBRH3AU) at Makerere University. This facility in Eastern Africa boasts a freezer farm equipped with 20 ultra-low temperature (ULT) freezers.

- ThermoFisher Scientific Inc. introduced the ThermoScientific TSX Series Ultra-Low Temperature (ULT) Freezers in June 2021. Additionally, in October 2022, the company launched the Thermo Scientific TDE Series -80°C Chest Freezer.

- March 2023 witnessed the launch of a central biobank network in South Africa, named Biodiversity Biobanks South Africa (BBSA). This initiative unites 7 institutions and 22 different biobanks, previously scattered, to conserve and manage biodiversity samples.

- As of May 30, 2023, ClinicalTrials.gov reported approximately 1,946 active clinical trials for vaccines. Some of these vaccines in clinical trials may require ultra-cold conditions for the storage and transportation of raw materials.

- In March 2023, Jubilant HollisterStier received a USD 23.8 million Strategic Innovation Fund from the government of Canada, aimed at enhancing its capacity for various vaccines, including mRNA, along with its annual fill and finish capacity.

Growth Factors

- The continual growth of the biopharmaceutical industry, marked by advancements in vaccine development, gene therapy, and biologics, is a significant driver for the Ultra Low Temperature Freezer market. These freezers are crucial for preserving the integrity of temperature-sensitive biological materials used in these advancements.

- The increasing establishment and expansion of biobanks, particularly for genetic and genomic research, contribute to the demand for ultra low temperature freezers. Biobanks store and manage biological samples for research, and the demand for these freezers is fueled by the growing scope of biobanking activities globally.

- The urgency and scale of global COVID-19 vaccination campaigns have significantly boosted the demand for ultra low temperature freezers. Vaccines like Pfizer-BioNTech's BNT162b2, with stringent temperature requirements, have driven the adoption of these specialized freezers in healthcare settings, while promoting the growth of ultra low temperature freezer market.

- Ongoing advancements in ultra-low temperature freezer technology, such as improved energy efficiency, precise temperature control, and user-friendly features, are driving market growth. Innovations like the ThermoScientific TSX Series ultra-low temperature freezers launched by ThermoFisher Scientific Inc. contribute to market expansion.

- Government initiatives and funding for research and development, as well as healthcare infrastructure, play a vital role in the growth of the ultra low temperature freezer market. Financial support, grants, and strategic partnerships enhance the accessibility of these freezers in various research and healthcare institutions.

- The surge in global clinical trials, with a reported 1,946 active trials for vaccines as of May 30, 2023, fuels the demand for ultra low temperature freezers. These freezers are essential for maintaining the stability and viability of materials used in clinical trials, contributing to the overall expansion of the market.

Ultra Low Temperature Freezer Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 919.87 Million |

| Market Size by 2033 |

USD 1,633.71 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.59% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, End User Insights , By Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

PHC Corporation (formerly Panasonic Healthcare), Helmer Scientific, Eppendorf AG, Haier Biomedical, Stirling Ultracold (a division of Global Cooling Inc.), Arctiko A/S,Thermo Fisher Scientific Inc., Bionics Scientific Technologies (P) Ltd., Esco Micro Pte. Ltd., Labcold Ltd., Azbil Telstar, S.L., BINDER GmbH, B Medical Systems, Glen Dimplex Group (Labcold), NuAire, Inc. and Others. |

Ultra Low Temperature Freezer Market Dynamics

Driver: Expanding biobanking activities

The Integrated Biorepository of H3Africa Uganda (IBRH3AU) equipped with 20 ultra-low temperature freezers reflects the expanding biobanking infrastructure.

The surge in expanding biobanking activities significantly boosts the growth of the ultra low temperature freezer market. Biobanks, which store and manage various biological samples like tissues, blood, and DNA, play a pivotal role in advancing medical and genetic research. As biobanking activities expand globally, the need for reliable preservation of these sensitive biological materials also grows. Ultra low temperature freezers provide the necessary conditions to maintain the long-term viability and integrity of stored samples. With the increasing emphasis on genomic and personalized medicine research, biobanks require ultra-low temperature storage to ensure the stability of specimens. The heightened demand for ULT freezers is, therefore, a direct result of the expanding biobanking landscape, as researchers and healthcare professionals rely on these specialized freezers to safeguard and maintain the quality of crucial biological samples for ongoing and future studies.

Restraint: Alternative storage solutions

The ultra low temperature freezer market faces restraints due to the emergence of alternative storage solutions. Advances in cryopreservation and the use of dry ice present cost-effective alternatives for specific applications, challenging the dominance of ULT freezers. These alternatives, often considered more economical, can restrain market growth, particularly in sectors where budget constraints are a significant concern. Moreover, the adoption of alternative storage solutions is driven by environmental considerations. Cryopreservation methods, for example, may be viewed as more environmentally friendly compared to the high energy consumption associated with ULT freezers. As industries seek sustainable practices, the perceived environmental impact of ultra low temperature Freezers becomes a factor that restrains their market demand, prompting a shift towards alternative storage solutions that align with more eco-conscious practices.

Opportunity: Global health security initiatives

Global health security initiatives are creating significant opportunities for the ultra low temperature freezer market. As the world grapples with the challenges posed by pandemics and infectious diseases, governments and organizations are prioritizing the development of robust vaccine distribution networks. ultra low temperature freezers play a crucial role in this landscape by providing the necessary infrastructure for storing vaccines at extremely low temperatures, ensuring their efficacy and safety.

The demand for ultra low temperature freezers has surged as a result of these initiatives, leading to increased investments in healthcare infrastructure. Governments worldwide are focusing on enhancing their cold chain capabilities to respond effectively to health emergencies. This presents a substantial opportunity for manufacturers and suppliers in the ultra low temperature freezer market to contribute to global health security efforts by providing reliable and efficient storage solutions, fostering growth and market expansion in the process.

Segments Insights:

By Product Type Insights

Upright ULT freezers dominated the product type segment, primarily due to their higher storage capacity and space-saving vertical design, making them ideal for use in large research institutions and pharmaceutical facilities. These freezers are typically easier to access, allowing for multiple compartments and adjustable shelving for sample categorization. Their design facilitates more efficient use of lab space and integration with automated sample retrieval systems. Large biorepositories and vaccine storage hubs often prefer upright freezers for managing thousands of vials systematically.

Chest ULT freezers are projected to be the fastest-growing segment, particularly in niche applications that require ultra-consistent temperature performance and minimal air exchange. Chest models have fewer air exchanges and better cold retention during power failures or door openings. They are also more thermally stable, making them ideal for storing highly sensitive samples such as cryogenic embryos, stem cells, and RNA materials. Smaller labs and mobile cold storage units increasingly prefer chest freezers due to their simplicity, lower cost, and excellent insulation.

By End-user

Bio-banks emerged as the leading end-user segment, driven by massive investments in global genetic research initiatives and personalized medicine. Institutions like UK Biobank and China Kadoorie Biobank house millions of samples, including blood, urine, and DNA, all stored at ultra-low temperatures for decades. These repositories serve as backbones for long-term clinical studies and vaccine development, driving consistent demand for high-capacity, redundant ULT systems with robust temperature monitoring capabilities.

Pharmaceutical and biotechnology companies represent the fastest-growing end-user segment, propelled by increasing drug discovery pipelines, vaccine R&D, and clinical trials. The post-pandemic era has seen a surge in mRNA therapies and biologics, many of which require stringent storage conditions. Leading companies such as Moderna and BioNTech have significantly expanded their cold-chain capabilities, contributing to this growth. ULT freezers are vital not only for R&D but also for storing batch samples during regulatory reviews and post-market surveillance.

By Regional Analysis

North America is the largest market for ULT freezers, underpinned by its well-established biotechnology and pharmaceutical sectors. The U.S. alone accounts for the majority of installed ULT freezer units globally, with extensive infrastructure across universities, biopharma companies, and federal research labs. The region benefits from strong funding support, favorable reimbursement structures, and government initiatives like the NIH’s All of Us Research Program, which stores millions of samples. Major players such as Thermo Fisher Scientific, Helmer Scientific, and PHC Corporation of North America are headquartered or heavily active in this region, reinforcing its dominance through frequent product innovation and strategic acquisitions.

Asia-Pacific is projected to be the fastest-growing region, thanks to expanding life sciences research and healthcare infrastructure in emerging economies like China, India, and South Korea. Governments are increasingly investing in genomic research, biopharma innovation, and academic collaborations. China, for instance, has seen exponential growth in biobank development, supported by its national precision medicine strategy. Meanwhile, India is witnessing rising clinical trial activity, especially in oncology and infectious diseases, which necessitates advanced storage technologies. Asia-Pacific’s rapid urbanization, growing middle-class population, and increased focus on pandemic preparedness are key catalysts for future growth.

Recent Developments

-

In February 2025, Thermo Fisher Scientific unveiled its next-generation TSX Series ULT Freezers featuring V-drive technology and hydrocarbon refrigerants for enhanced energy efficiency and sustainability compliance.

-

PHCbi (a division of PHC Holdings Corporation) expanded its product portfolio in November 2024 by launching the VIP ECO ULT Freezer in Europe, combining vacuum insulation panels with natural refrigerants.

-

Eppendorf AG, a German-based life sciences company, announced in October 2024 its strategic partnership with smart laboratory software providers to enable real-time IoT monitoring in ULT units.

-

In August 2024, Haier Biomedical introduced its –86°C Cold Chain Vehicle Solutions for transporting ULT materials across rural and remote areas in China and Southeast Asia.

-

Helmer Scientific in January 2025 launched the GX Solutions ULT freezer series, focusing on healthcare facilities with energy-efficient design and optional connectivity features for HL7 integration.

Some of the prominent players in the Ultra low temperature freezer market include:

- Thermo Fisher Scientific Inc.

- PHC Corporation (formerly Panasonic Healthcare)

- Helmer Scientific

- Eppendorf AG

- Haier Biomedical

- Stirling Ultracold (a division of Global Cooling Inc.)

- Arctiko A/S

- Bionics Scientific Technologies (P) Ltd.

- Esco Micro Pte. Ltd.

- Labcold Ltd.

- Azbil Telstar, S.L.

- BINDER GmbH

- B Medical Systems

- Glen Dimplex Group (Labcold)

- NuAire, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ultra low temperature freezer market.

By Product Type

- Upright ULT freezers

- Chest ULT freezers

By End-user

- Bio-Banks

- Pharmaceutical and Biotechnology Companies

- Academic and Research Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)