Ultrasonic Skincare Devices Market Size and Research

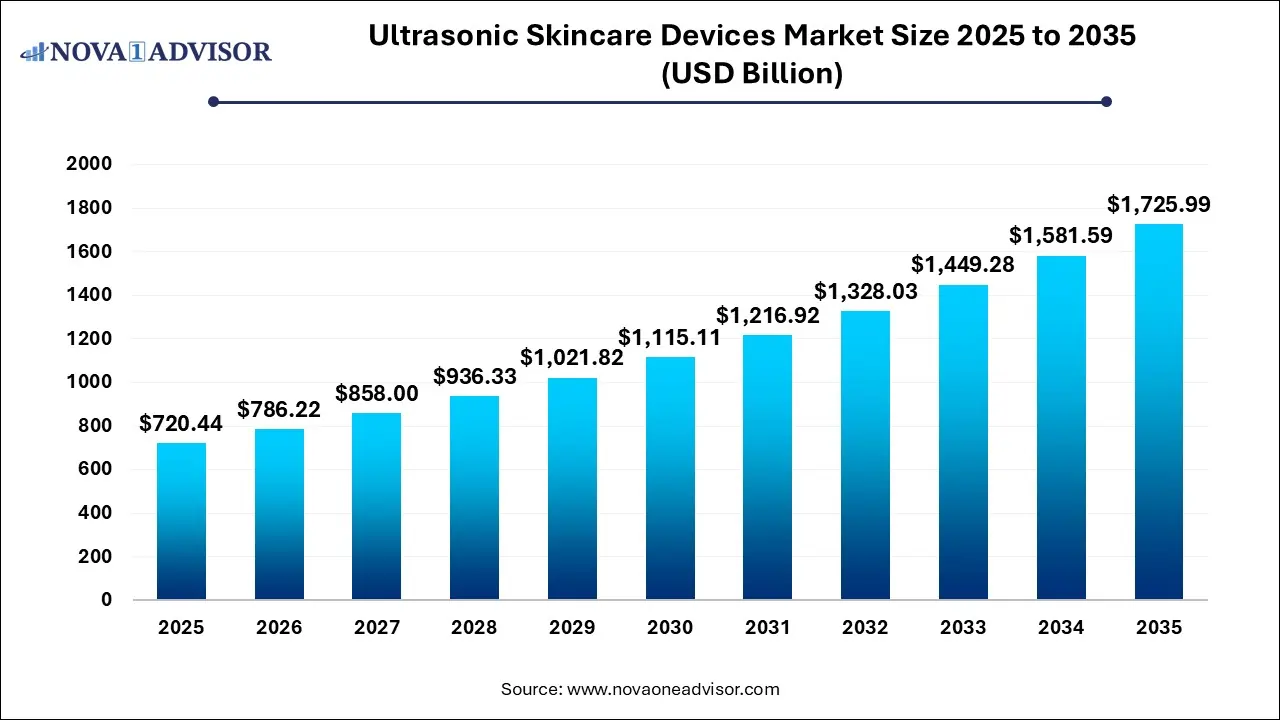

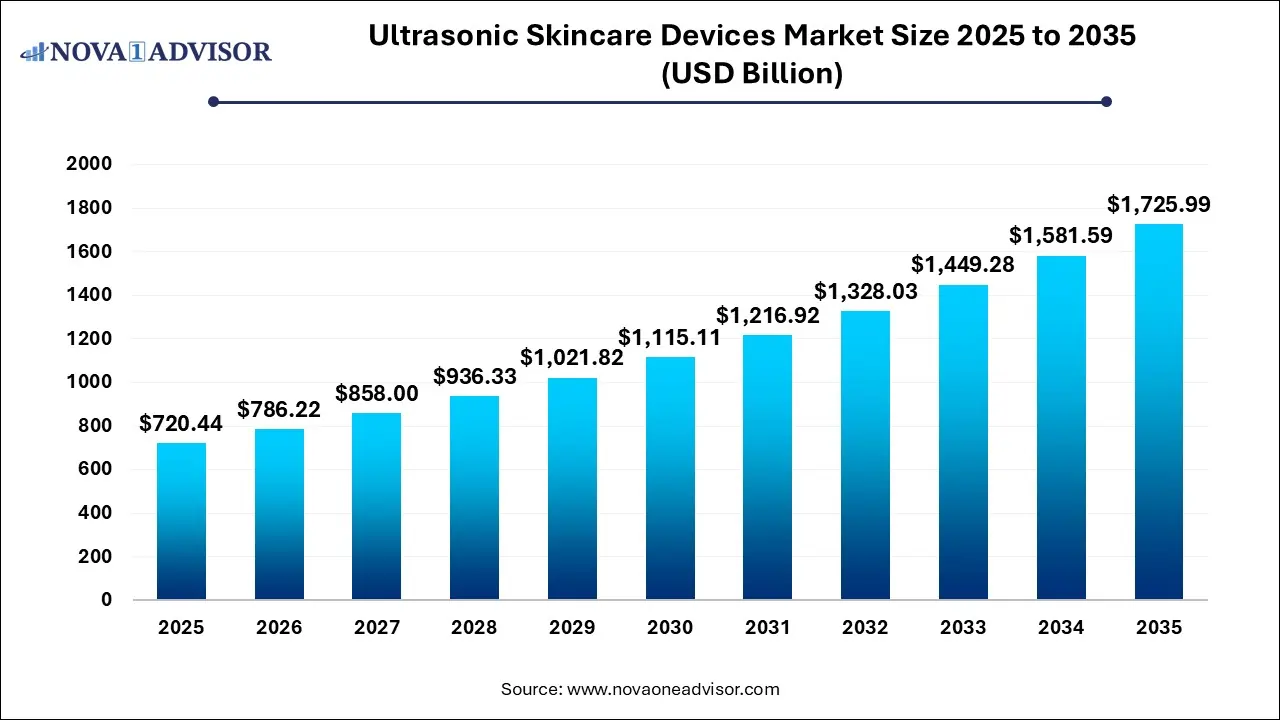

The Ultrasonic skincare devices market size was exhibited at USD 720.44 billion in 2025 and is projected to hit around USD 1,725.99 billion by 2035, growing at a CAGR of 9.13% during the forecast period 2026 to 2035.

Key Takeaways:

- The handheld ultrasonic skincare segment held the largest market share of 72% in 2025.

- Homecare dominated the ultrasonic skincare devices industry in 2025.

- The North America market accounted for a 41% share in 2025.

Market Overview

The ultrasonic skincare devices market is gaining robust momentum, shaped by the convergence of technological innovation, rising consumer interest in advanced skincare routines, and expanding accessibility to aesthetic treatments. Ultrasonic skincare devices employ high-frequency sound waves, typically in the 20,000 Hz to 2 MHz range, to cleanse, exfoliate, and enhance the absorption of skincare products. The mechanism improves blood circulation, stimulates collagen production, and assists in non-invasive skin rejuvenation.

With the growing global consciousness around personal grooming, anti-aging, and wellness, the demand for at-home and professional-grade skincare tools has significantly increased. A notable shift toward non-surgical aesthetic solutions has further accelerated the popularity of ultrasonic facial and skincare devices. The market includes a wide range of products catering to professional settings such as dermatology clinics and medspas, as well as homecare segments that have witnessed substantial growth due to the COVID-19 pandemic-induced surge in DIY skincare.

Manufacturers are introducing multi-functional devices combining ultrasonic technology with features like LED therapy, galvanic iontophoresis, and microcurrent therapy. Such innovations have expanded the consumer base, drawing interest from both tech-savvy millennials and older adults seeking effective anti-aging regimens. As clinical evidence supporting the efficacy of ultrasonic treatments continues to grow, the market is poised for steady expansion across developed and emerging economies.

Major Trends in the Market

-

Rising Popularity of At-Home Skincare Tools: Consumer preferences are shifting toward portable, user-friendly ultrasonic skincare devices that offer professional-grade results at home.

-

Technological Advancements and Device Miniaturization: Integration of features such as touch screens, wireless charging, and app connectivity has made devices more sophisticated and user-friendly.

-

Growing Demand in Men’s Grooming Segment: Men are increasingly investing in skincare routines, particularly for exfoliation and acne control, contributing to broader market growth.

-

Fusion of Aesthetic Treatments with Wellness: The boundary between cosmetic and wellness treatments is blurring, driving demand for devices that promise both beauty and therapeutic benefits.

-

Expansion of E-commerce and D2C Channels: Online platforms have become a key distribution channel, offering consumers access to premium brands and personalized skincare devices.

-

Adoption by Medspas and Dermatology Clinics: Clinics are expanding ultrasonic services for non-invasive procedures such as anti-aging, acne treatment, and skin tightening.

-

Sustainability Focus in Product Development: Brands are emphasizing sustainable packaging, rechargeable batteries, and long-life devices to appeal to eco-conscious consumers.

Report Scope of Ultrasonic Skincare Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 786.22 Billion |

| Market Size by 2035 |

USD 1,725.99 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.13% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Canfield Scientific, Inc.; 3Gen; Aesthetic Group; Ambicare Health; Image Derm, Inc.; Fotona |

Key Market Driver

Escalating Demand for Non-Invasive and Anti-Aging Treatments

One of the most powerful drivers of the ultrasonic skincare devices market is the growing demand for non-invasive aesthetic treatments particularly in the anti-aging domain. With an increasing number of individuals seeking to maintain youthful skin without undergoing surgery or laser-based procedures, ultrasonic skincare tools have emerged as a safe, effective, and convenient alternative.

Ultrasonic devices stimulate fibroblasts to produce collagen and elastin, which are critical for maintaining skin elasticity. This function makes them especially appealing for users experiencing early signs of aging, such as fine lines, sagging, or uneven texture. Furthermore, the rising consumer demographic in the 30+ and 50+ age groups is willing to invest in high-end personal care tools to preserve skin health. This shift toward prevention rather than correction is significantly fueling the adoption of ultrasonic skincare devices both at home and in professional settings.

Key Market Restraint

Limited Consumer Awareness in Emerging Markets

While the market is thriving in North America, parts of Europe, and developed areas of Asia, there remains a significant gap in consumer awareness and accessibility in several emerging regions. Factors such as low skincare education, economic constraints, and limited retail presence of advanced devices restrict market penetration in countries across Latin America, Africa, and parts of Southeast Asia.

Additionally, many potential users are unaware of how ultrasonic skincare differs from other beauty tools like microdermabrasion or LED therapy. The lack of standardized clinical information, certification, and after-sale support from local retailers creates hesitation among consumers. Bridging this knowledge and trust gap requires targeted marketing, dermatological endorsements, and strategic partnerships with local distributors to effectively address these challenges.

Key Market Opportunity

Boom in the Personalized and Smart Skincare Segment

An emerging and exciting opportunity lies in the integration of AI and IoT with ultrasonic skincare devices to offer personalized skincare solutions. Smart ultrasonic tools that sync with mobile applications are able to analyze skin type, hydration levels, and temperature to tailor treatment settings accordingly. This level of customization enhances user experience and ensures optimized outcomes.

Companies that harness data analytics and AI to provide real-time skin diagnostics and usage recommendations are likely to capture significant market share, particularly among tech-forward consumers. As skincare becomes more individualized, consumers increasingly expect products that adapt to their changing skin conditions, thereby boosting the relevance and appeal of intelligent ultrasonic devices. Collaborations between skincare brands and technology firms are expected to drive further innovation in this area.

Segmental Analysis

Product Outlook

Handheld devices dominated the product segment in 2024 and are projected to maintain their lead through 2030. Their portability, ease of use, and affordability have made them the preferred choice among individual consumers. The rise in do-it-yourself (DIY) beauty routines, especially during and post-COVID-19 lockdowns, has cemented their place in modern skincare regimes. Handheld devices are widely available in beauty retail stores and online platforms and often include dual or triple-mode functionalities such as ultrasound, LED light, and galvanic ion therapies. Their ergonomic designs and rechargeable features make them ideal for daily or weekly usage at home.

Conversely, tabletop devices are experiencing the fastest growth, especially in clinical and medspa settings. These professional-grade machines offer higher power output, broader treatment settings, and additional features suitable for advanced procedures like ultrasonic lipolysis, deep pore cleansing, and serum infusion. They are often used by dermatologists and aestheticians to treat conditions like rosacea, hyperpigmentation, and acne scarring. As more dermatology clinics expand their non-invasive treatment offerings, and as medspas invest in premium devices to differentiate their services, the demand for tabletop units is expected to see robust growth in the forecast period.

End Use Outlook

Homecare segment dominated the market in 2024, driven by the surge in at-home wellness and beauty devices. A growing number of consumers are investing in their own skincare tools for convenience, cost-effectiveness, and hygiene. Influencer marketing, online tutorials, and tele-dermatology services have all contributed to the rise in consumer confidence regarding home-use ultrasonic devices. Brands like Foreo, Trophy Skin, and PMD have successfully tapped into this demand with compact, user-friendly offerings that align with modern aesthetics and lifestyle needs.

Meanwhile, dermatology clinics are anticipated to be the fastest-growing segment, benefiting from the rising popularity of in-office, non-invasive aesthetic procedures. These clinics offer professional guidance, advanced diagnostic tools, and FDA-cleared devices, which appeal to clients seeking safe and effective solutions for complex skin concerns. Dermatologists increasingly recommend ultrasonic therapies for conditions such as post-inflammatory hyperpigmentation, sebaceous hyperplasia, and photoaging. The credibility and customization provided in these clinical settings attract a clientele willing to pay premium prices for superior outcomes.

Regional Analysis

North America Dominates the Global Market

North America accounted for the largest revenue share in the ultrasonic skincare devices market in 2024, and it continues to be the dominant region due to high consumer awareness, established beauty infrastructure, and widespread access to dermatological care. The United States leads the region, bolstered by a large base of early adopters and beauty enthusiasts. The presence of key market players, ongoing product innovations, and supportive regulatory frameworks have contributed to strong market performance. Leading retail chains like Sephora, Ulta Beauty, and Amazon have also enhanced product availability and visibility. Additionally, the region has seen a rise in male skincare adoption, expanding the customer base.

Asia Pacific Emerges as the Fastest-Growing Region

Asia Pacific is poised to be the fastest-growing region, with countries like China, Japan, South Korea, and India playing pivotal roles. South Korea, known for its global influence in beauty and skincare innovation, is a key hub for product development and consumer experimentation. Japan has a strong tradition of integrating technology with personal care, while China’s growing middle-class population is fueling premium beauty spending. Increasing digital engagement, beauty influencer culture, and availability of advanced cosmetic treatments are contributing to regional growth. Local and international brands are launching country-specific campaigns to capture the unique preferences of Asian consumers, further accelerating market expansion.

Some of The Prominent Players in The Ultrasonic skincare devices market Include:

- Alma Lasers GmbH

- Cynosure, Inc.

- Solta Medical, Inc.

- Cutera, Inc.

- Syneron Medical Ltd.

- Canfield Scientific, Inc.

- 3Gen

- Aesthetic Group

- Ambicare Health

- Image Derm, Inc.

- Fotona

Recent Developments

-

April 2025 – Foreo introduced the LUNA Ultra line in the U.S., featuring ultrasonic technology combined with biometric sensors to personalize facial treatments based on user skin profiles.

-

February 2025 – Trophy Skin launched its “BrightenMD Pro” device with dual-mode ultrasound and LED features, aiming to capture the growing medspa demand across North America.

-

January 2025 – L&L Skin, a Japan-based brand, expanded into the U.S. and UK through exclusive partnerships with dermatology clinics, introducing their ultrasonic line for anti-aging and acne-prone skin.

-

November 2024 – PMD Beauty rolled out its “Wave Pro” line with smart sensors and app-guided skincare regimens in major online stores like Amazon and Nordstrom.

-

August 2024 – Ya-Man, a Japanese beauty tech firm, opened a new R&D center in South Korea, focusing on multi-functional ultrasonic devices for Asia Pacific markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Handheld Devices

- Tabletop Devices

By End Use

- Dermatology Clinics

- Medspas

- Homecare

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)