U.S. 3D Medical Imaging Devices Market Size and Trends

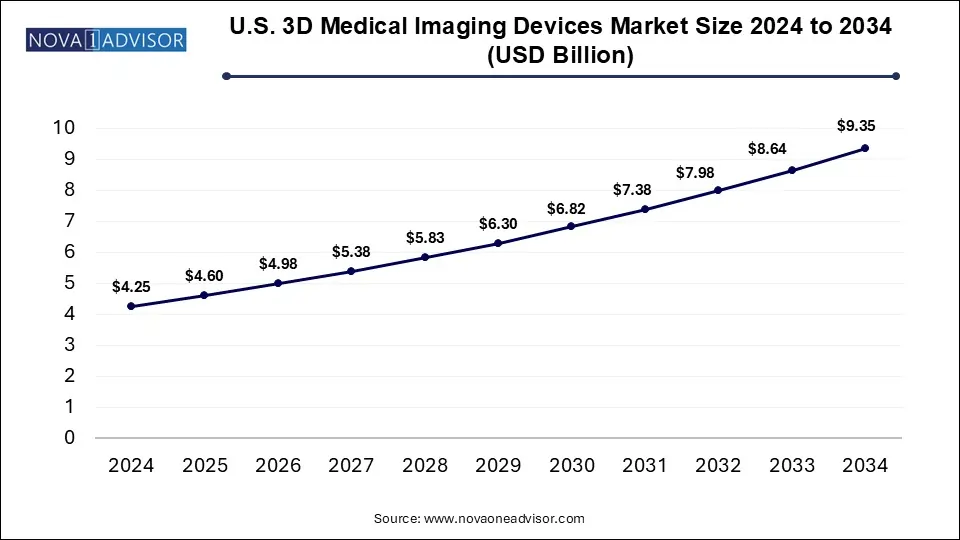

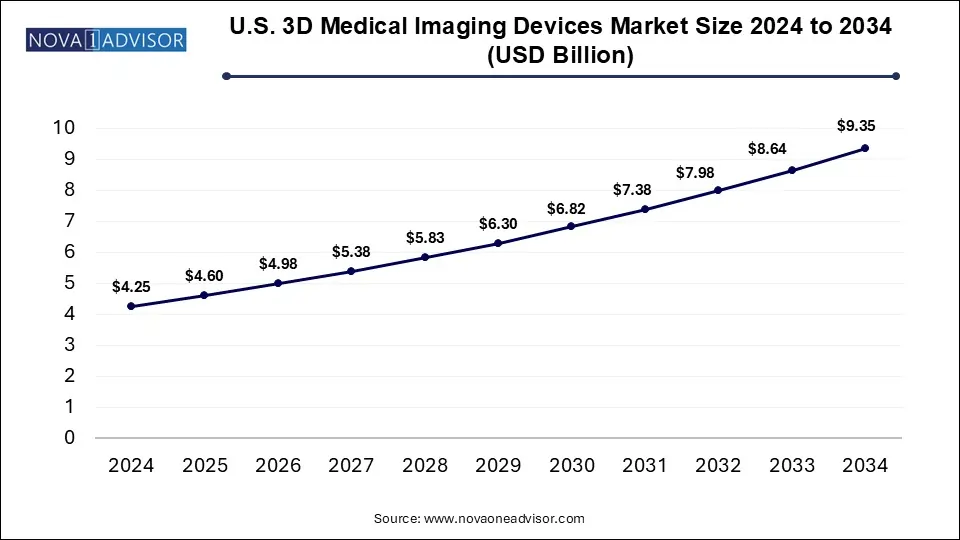

The U.S. 3D Medical Imaging Devices Market size was exhibited at USD 4.25 billion in 2024 and is projected to hit around USD 9.35 billion by 2034, growing at a CAGR of 8.2% during the forecast period 2025 to 2034.

U.S. 3D Medical Imaging Devices Market Key Takeaways:

- In 2024, the hardware category held the leading position in the market, accounting for 68% of the total share.

- The software category is forecasted to witness the highest compound annual growth rate (CAGR) of 8.3% throughout the projected timeframe.

- The ultrasound systems category emerged as the market leader in 2024.

- In the U.S. 3D medical imaging devices sector, the oncology application segment held the dominant share in 2024.

- The cardiology segment is projected to expand at the fastest pace, with an anticipated CAGR of 8.4% during the forecast period.

- In terms of end users, hospitals captured a 50% share of the market in 2024, making them the leading segment.

Market Overview

The U.S. 3D medical imaging devices market has seen substantial growth in recent years, driven by increasing demand for advanced diagnostic technologies across clinical and research settings. These devices are critical in producing high-resolution, three-dimensional images of internal organs, tissues, and bones, enabling healthcare professionals to diagnose, monitor, and treat diseases with greater precision. Their applications span across oncology, cardiology, orthopedics, gynecology, and other medical fields.

The U.S. remains a global leader in healthcare innovation, and the widespread adoption of 3D imaging technology is a testament to its commitment to improving diagnostic accuracy and patient outcomes. The integration of artificial intelligence (AI), machine learning, and software-based enhancements into 3D imaging platforms has further elevated their utility in healthcare delivery. Additionally, the U.S. market is fueled by robust healthcare infrastructure, the presence of major medical device manufacturers, increasing geriatric population, and the prevalence of chronic diseases.

With rapid advancements in imaging modalities like MRI, CT, and ultrasound, healthcare providers are transitioning from traditional 2D to 3D imaging systems to enable better visualization and enhanced surgical planning. Moreover, government funding, favorable reimbursement policies, and collaborations between technology providers and healthcare institutions are fostering market expansion.

Major Trends in the Market

-

Integration of AI and Machine Learning: AI algorithms are being deployed to improve image resolution, automate scan interpretation, and assist radiologists in making faster and more accurate diagnoses.

-

Shift Toward Portable and Point-of-Care Devices: Increasing demand for portable ultrasound and mobile CT/MRI devices is transforming how and where 3D imaging is used—especially in rural hospitals and ambulatory care.

-

Cloud-Based Imaging Platforms: With telehealth gaining momentum, cloud-based solutions that allow real-time sharing of 3D scans are becoming increasingly popular among hospitals and diagnostic centers.

-

Growing Use in Oncology and Cardiology: The use of 3D imaging in detecting tumors and heart conditions is expanding rapidly, thanks to its ability to deliver detailed images crucial for treatment planning.

-

Software-Driven Visualization Tools: Advanced software solutions offering 3D reconstruction and real-time navigation are becoming a core component of modern imaging devices.

Report Scope of U.S. 3D Medical Imaging Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.60 Billion |

| Market Size by 2034 |

USD 9.35 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Device Type, Hardware, Application, and End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Siemens Healthineers AG; Esaote SPA; Koninklijke Philips N.V.; GE Healthcare; CANON MEDICAL SYSTEMS CORPORATION; Hitachi High-Tech Corporation; Shimadzu Corporation; DigiRad Corporation; UMG/DEL MEDICAL. |

Market Driver: Rising Prevalence of Chronic Diseases

One of the primary drivers propelling the U.S. 3D medical imaging devices market is the rising prevalence of chronic diseases, particularly cancer and cardiovascular disorders. According to the American Cancer Society, over 1.9 million new cancer cases were estimated in the U.S. in 2024 alone. Early and accurate diagnosis is critical for effective treatment, and 3D imaging offers significant advantages over traditional methods by providing comprehensive visual data on tumor size, location, and metastasis.

Similarly, with heart disease remaining the leading cause of death in the country, 3D imaging is increasingly used in cardiology to assess coronary arteries, detect abnormalities, and plan interventions. Devices such as 3D echocardiography systems offer real-time and dynamic visualization, supporting minimally invasive surgeries and post-operative assessments. This trend is further supported by rising investments in healthcare technology and growing awareness of the importance of early diagnosis.

Market Restraint: High Equipment and Maintenance Costs

Despite its advantages, the high cost of 3D medical imaging devices poses a significant challenge, especially for small- to mid-sized healthcare facilities. Purchasing advanced MRI or CT equipment involves substantial capital investment, often ranging from several hundred thousand to millions of dollars. This cost burden is further amplified by expenses related to maintenance, software upgrades, and operator training.

Smaller diagnostic centers and rural hospitals may struggle to justify such expenses, particularly if patient volumes are low. Additionally, insurance reimbursement for certain imaging procedures may not always cover the total cost, thereby affecting profit margins. These financial constraints can slow the adoption rate of newer 3D imaging systems, particularly in non-urban areas.

Market Opportunity: Expansion of Tele-imaging and Remote Diagnostics

An emerging opportunity in the U.S. 3D medical imaging devices market lies in the integration of tele-imaging and remote diagnostics. As telemedicine becomes a standard mode of healthcare delivery, there is increasing demand for imaging systems that can capture, store, and transmit 3D images in real-time. This capability is especially valuable in rural and underserved regions, where access to expert radiologists is limited.

Several companies are developing imaging systems compatible with cloud platforms, allowing seamless collaboration between radiologists and clinicians located in different geographic areas. For example, a patient undergoing a scan in Idaho can have their 3D imaging results interpreted by a specialist in New York within minutes. This enhances diagnostic accuracy and enables timely interventions, improving overall healthcare delivery.

Segmental Analysis

By Device Type Outlook

Hardware dominated the U.S. 3D medical imaging devices market in 2024, capturing a 68% revenue share. This dominance can be attributed to the tangible, capital-intensive nature of imaging systems such as MRI machines, CT scanners, and ultrasound equipment. These devices form the backbone of diagnostic infrastructure in hospitals and imaging centers. The increasing installation of high-end imaging equipment in both public and private healthcare facilities, driven by demand for high-precision diagnostics, reinforces the stronghold of the hardware segment. Moreover, hardware continues to be the key revenue-generating component in new imaging system installations.

The software segment is projected to grow at the fastest CAGR of 8.3% during the forecast period. This rapid growth is driven by the increasing importance of software tools in enhancing image interpretation, 3D reconstruction, and automated reporting. With AI-driven applications gaining traction, hospitals and diagnostic centers are investing in software upgrades that improve workflow efficiency and diagnostic accuracy. Additionally, cloud-based platforms and vendor-neutral software solutions are being widely adopted, allowing compatibility across different imaging modalities and seamless integration into hospital information systems.

By Hardware Outlook

Ultrasound systems emerged as the leading sub-segment within hardware in 2024. These systems are widely used due to their safety, cost-effectiveness, and versatility. The ability of modern ultrasound machines to provide 3D and even 4D imaging has broadened their applications in obstetrics, gynecology, cardiology, and orthopedics. Ultrasound systems are increasingly preferred for bedside diagnostics, emergency medicine, and outpatient care. Their non-invasive nature and lack of ionizing radiation make them particularly suitable for pediatric and prenatal imaging.

MRI equipment is anticipated to register the fastest growth rate over the forecast period. This growth stems from increasing utilization of MRI for soft tissue analysis, neurological assessments, and musculoskeletal imaging. Advanced 3D MRI capabilities offer unparalleled detail in anatomical imaging, supporting surgical planning and cancer staging. Furthermore, innovations such as wide-bore and silent MRI systems, along with ongoing research into contrast agents and functional imaging, are expected to propel adoption across academic and clinical settings.

By Application Outlook

The oncology segment held the largest market share in 2024. The growing burden of cancer cases in the U.S. has led to an increased reliance on advanced imaging technologies for early detection, staging, and monitoring of treatment response. 3D imaging provides critical information on tumor size, shape, and vascularization, which is essential for personalized treatment planning. CT and PET-CT systems with 3D imaging are widely used in oncology to evaluate disease progression and recurrence. The adoption of AI-assisted tools for lesion detection and tumor tracking further enhances the utility of 3D imaging in cancer care.

Cardiology is expected to experience the fastest CAGR of 8.4% throughout the forecast period. This growth is largely attributed to advancements in cardiac imaging technologies such as 3D echocardiography, cardiac MRI, and CT angiography. These tools provide high-resolution, dynamic images of heart structures and blood flow, aiding in the diagnosis of arrhythmias, coronary artery disease, and congenital heart defects. The use of 3D imaging in pre-surgical planning and post-intervention follow-up is gaining momentum, particularly as minimally invasive procedures like TAVR and ablations become more common.

By End Use Outlook

Hospitals dominated the market with a 50% share in 2024. This dominance is due to the comprehensive nature of services provided in hospital settings, which include emergency, inpatient, surgical, and specialized diagnostics. Hospitals have the financial and infrastructural capacity to invest in high-end imaging equipment and employ trained radiologists and technicians. The centralization of patient data and integration with electronic medical records (EMRs) further supports the use of advanced imaging technologies.

Diagnostic imaging centers are anticipated to register the fastest growth over the coming years. These standalone facilities offer cost-effective and rapid imaging services, making them attractive for outpatient diagnostics. As healthcare shifts toward decentralized models, these centers are expanding in suburban and rural areas. Technological advancements in compact 3D imaging devices and increasing collaboration between imaging providers and insurers are expected to drive this segment forward.

Country-Level Analysis: United States

The United States represents the largest market for 3D medical imaging devices globally, driven by strong healthcare expenditure, technological innovation, and high demand for advanced diagnostics. Urban centers across the country are witnessing a surge in demand for AI-enhanced imaging solutions, while rural areas are seeing increased deployment of portable devices to improve access to care.

Public-private partnerships and government initiatives, such as funding from the National Institutes of Health (NIH) and healthcare grants for technology adoption, are playing a pivotal role in fostering innovation. States like California, Texas, New York, and Florida are leading in terms of market adoption due to the presence of large healthcare systems and research institutions. Additionally, trends such as outpatient imaging services, tele-radiology, and cloud-based PACS are gaining momentum nationwide.

Some of The Prominent Players in The U.S. 3D Medical Imaging Devices Market Include:

- Siemens Healthineers AG

- Esaote SPA

- Koninklijke Philips N.V.

- GE Healthcare

- CANON MEDICAL SYSTEMS CORPORATION

- Hitachi High-Tech Corporation

- Shimadzu Corporation

- DigiRad Corporation

- UMG/DEL MEDICAL

Recent Developments

-

GE HealthCare (May 2025) announced a collaboration with Mayo Clinic to integrate AI capabilities into its Revolution CT platform, enabling enhanced cardiac 3D imaging capabilities and real-time decision support tools.

-

Siemens Healthineers (April 2025) launched its new Acuson Origin 3D Ultrasound System, targeting advanced obstetric and cardiovascular imaging applications, with real-time 3D rendering and AI-enabled workflow automation.

-

Canon Medical Systems USA (March 2025) introduced an upgraded version of its Vantage Galan 3T MRI scanner with improved deep learning reconstruction algorithms, reducing scan time and improving 3D resolution.

-

Philips (February 2025) revealed a strategic partnership with Nuance Communications to integrate 3D imaging data with voice-enabled radiology reporting solutions, streamlining reporting workflows and reducing turnaround time.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. 3D Medical Imaging Devices Market.

By Device Type

By Hardware

- X-ray Devices

- CT Devices

- Ultrasound Systems

- MRI Equipment

By Application

- Oncology

- Cardiology

- Orthopedic

- Gynaecology

- Others

By End Use

- Hospitals

- Diagnostic Imaging Centers

- Others