U.S. AAV Contract Development And Manufacturing Organization Market Size and Trends

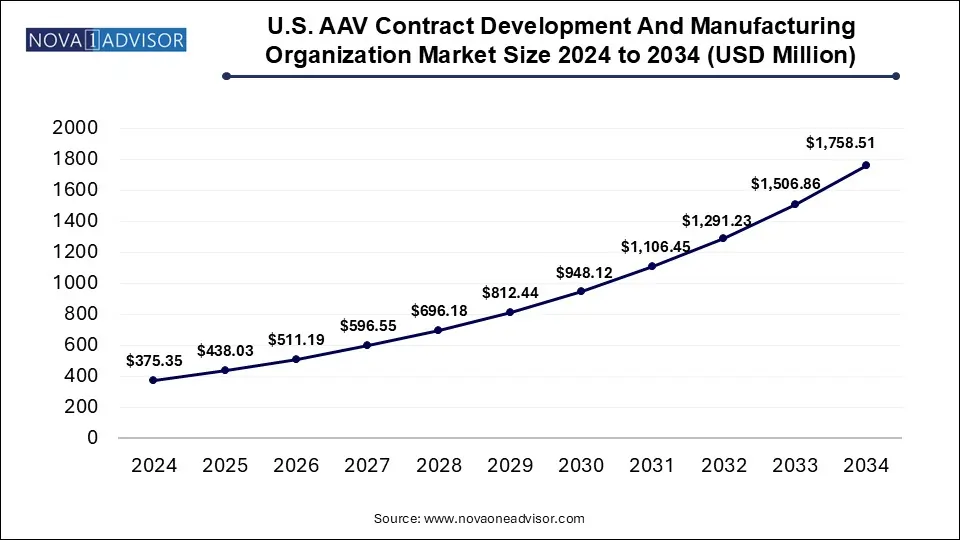

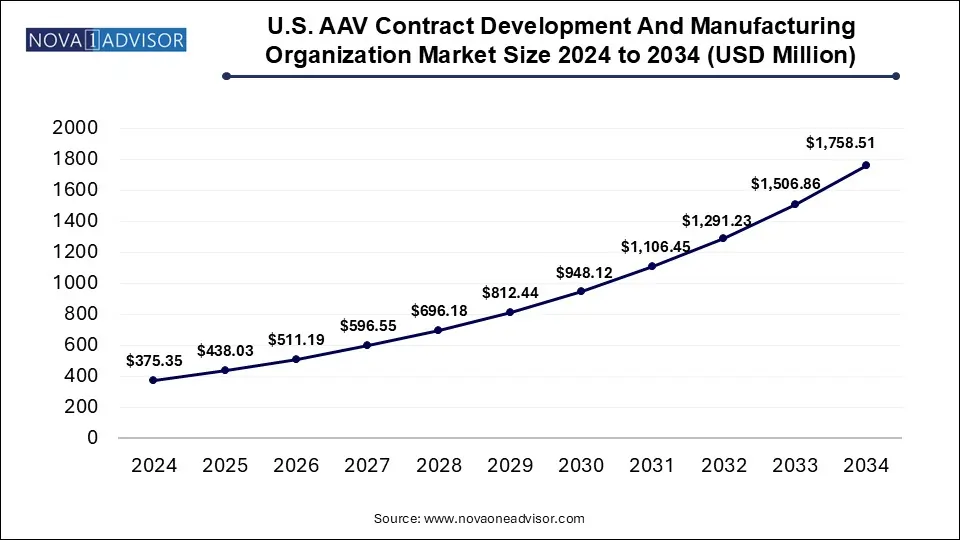

The U.S. AAV Contract Development And Manufacturing Organization Market size was exhibited at USD 375.35 million in 2024 and is projected to hit around USD 1,758.51 million by 2034, growing at a CAGR of 16.7% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the downstream processing category accounted for the largest portion of industry revenue, capturing a 51.0% share.

- The adherent culture category led the market in 2024, contributing the highest proportion of total revenue.

- Cell and gene therapy development emerged as the leading segment in 2024, generating the most significant share of market revenue.

- In 2024, pharmaceutical and biopharmaceutical companies were the top contributors to market revenue, securing the dominant share.

Market Overview

The U.S. AAV (Adeno-Associated Virus) Contract Development and Manufacturing Organization (CDMO) market is experiencing transformative growth, propelled by the increasing demand for advanced gene therapies and the rising number of rare genetic disorders requiring novel treatment approaches. Adeno-associated viruses are critical vectors used in gene therapy owing to their safety profile, stable gene expression, and ability to infect both dividing and non-dividing cells. These features have led to widespread adoption in gene therapy applications, pushing pharmaceutical and biotechnology companies to outsource AAV development and production to CDMOs for scale, speed, and regulatory expertise.

The U.S. stands as the epicenter of AAV-based innovation, home to a rich ecosystem of gene therapy companies, research institutions, and CDMOs with robust manufacturing capabilities. A significant number of investigational new drug (IND) applications and FDA approvals for gene therapy treatments in recent years have further driven the demand for scalable and compliant AAV manufacturing solutions. The CDMO model offers a cost-efficient and specialized path for emerging biopharma players to bring their therapies to market, minimizing infrastructure investment while ensuring regulatory compliance and manufacturing agility.

Major players are investing in advanced bioreactors, high-yield purification systems, and flexible manufacturing platforms to meet the surging demand. Furthermore, partnerships between academia and industry, such as those seen with the University of Pennsylvania’s Gene Therapy Program and private CDMOs, illustrate the collaborative landscape. With a growing pipeline of gene therapies targeting hemophilia, retinal diseases, and neurological disorders, the AAV CDMO market in the U.S. is poised for sustained expansion through 2034.

Major Trends in the Market

-

Expansion of capacity through acquisitions and infrastructure investments by CDMOs.

-

Transition from adherent to suspension culture systems for scalable AAV production.

-

Increased partnerships between biotech startups and CDMOs for expedited clinical timelines.

-

Adoption of automated and closed-system bioprocessing to ensure contamination-free AAV manufacturing.

-

Rising number of FDA-approved AAV-based therapies prompting clinical trial growth.

-

Growing demand for fill-finish services amid regulatory emphasis on final product sterility.

-

Use of single-use technologies in upstream processing for cost-effective manufacturing.

-

Emphasis on quality assurance and GMP-compliance in vector purification protocols.

Report Scope of U.S. AAV Contract Development And Manufacturing Organization Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 438.03 Million |

| Market Size by 2034 |

USD 1,758.51 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 16.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Workflow, Culture Type, Application, and End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Forge Biologics ; Andelyn Biosciences; National Resilience, Inc.; Akron Biotech; ViroCell Biologics, Ltd.; ElevateBio.; VintaBio LLC.; Clover Biopharmaceuticals; iVexSol |

Key Market Driver

Rising Demand for Gene Therapy Accelerates AAV Manufacturing Needs

One of the most significant drivers of the U.S. AAV CDMO market is the increasing number of gene therapies entering clinical development and seeking regulatory approval. AAV vectors are the most widely used delivery vehicles in gene therapy due to their safety and long-term transgene expression. With over 150 AAV-based therapies currently in the development pipeline in the U.S., including treatments for hemophilia, Duchenne muscular dystrophy, and Leber congenital amaurosis, the pressure on manufacturing infrastructure has intensified.

Companies with limited in-house production capacity are outsourcing to CDMOs that offer expertise in upstream vector production and downstream purification. For instance, Sarepta Therapeutics’ collaboration with Catalent exemplifies how gene therapy developers are relying on CDMOs for large-scale production in preparation for commercial launches. As regulatory authorities like the FDA continue to approve gene therapies (e.g., Elevidys in June 2023), the demand for reliable AAV CDMOs will only increase, establishing this driver as a fundamental growth pillar.

Key Market Restraint

High Cost and Complexity of AAV Vector Manufacturing

Despite robust growth prospects, the high cost associated with AAV production remains a considerable restraint. Manufacturing AAV vectors requires sophisticated bioreactors, intensive purification steps, and stringent quality controls—all contributing to increased operational expenses. Small and mid-sized biopharma firms often struggle to afford large batch manufacturing and scale-up processes, which can cost several million dollars per clinical lot.

In addition, variability in vector yield, challenges in vector genome integrity, and potential for contamination pose technical risks that further inflate costs. For example, discrepancies in AAV titers between research-scale and GMP-grade production can delay timelines and add to financial burdens. Although CDMOs mitigate some of these issues by offering technical expertise, the upfront costs still limit accessibility for emerging companies.

Key Market Opportunity

Transition to Suspension Culture Systems

A major opportunity in the U.S. AAV CDMO market lies in the shift from adherent culture systems to suspension-based culture platforms. Traditionally, AAVs were produced using adherent cells like HEK293 cultured in 2D formats. While effective at small scale, adherent systems are resource-intensive and hard to scale up. In contrast, suspension culture enables the use of stirred-tank bioreactors that are more amenable to large-scale and automated production.

CDMOs are increasingly investing in suspension culture platforms that allow for higher productivity and consistency. For instance, Thermo Fisher Scientific introduced its Gibco AAV-MAX Helper-Free AAV Production System in suspension format, which has been widely adopted by CDMOs across the U.S. Adopting such technologies can significantly lower production costs and increase vector yield, offering CDMOs a competitive edge and opening the market to broader applications.

Segmental Analysis

By Workflow Outlook

Downstream processing dominated the workflow segment in 2024, accounting for the largest share of revenue. This dominance is due to the intensive purification and fill-finish requirements of AAV vectors, which demand high-precision operations to maintain product quality and regulatory compliance. Purification, involving chromatography and ultrafiltration techniques, ensures removal of host cell proteins, empty capsids, and other impurities. With increasing regulatory scrutiny from agencies like the FDA on vector purity, CDMOs are prioritizing investments in downstream processing facilities. Additionally, fill-finish operations are crucial for the final packaging and sterility of gene therapy products, making them a vital part of the commercialization process.

Upstream processing, however, is projected to witness the fastest growth during the forecast period. Vector amplification and recovery require advanced bioreactors and cell culture systems. The increasing adoption of single-use bioreactors and scalable suspension culture systems are driving growth in this segment. Startups and mid-sized gene therapy developers are particularly reliant on CDMOs with strong upstream capabilities, enabling faster transitions from preclinical to clinical phases. The rising number of AAV vector IND submissions is expected to boost demand for early-stage upstream services significantly.

By Culture Type Outlook

Adherent culture systems led the market in 2024, owing to their extensive use in early-phase AAV development. These systems are familiar to researchers and are widely used for producing small- to mid-scale batches. Their established protocols and compatibility with existing analytical tools have sustained their dominance. However, their limitations in scalability and operational efficiency have made them less suited for large-scale commercial manufacturing.

Suspension culture systems are anticipated to grow at the highest CAGR through 2030. The shift toward scalable and GMP-compliant manufacturing is pushing CDMOs and therapy developers to adopt suspension cultures. These systems support higher cell densities, allow easier scale-up in bioreactors, and reduce labor-intensive handling, ultimately improving production efficiency. Major CDMOs are optimizing protocols for suspension-based production to meet rising client demands and lower costs.

By Application Outlook

Cell and gene therapy development emerged as the dominant application in 2024. As the primary use case for AAV vectors, gene therapy products represent a substantial portion of outsourced manufacturing in the U.S. Companies like Novartis and Regenxbio continue to advance AAV-based therapies for spinal muscular atrophy and ophthalmic diseases, respectively, creating consistent demand for clinical and commercial manufacturing services. CDMOs specializing in vector design, titration, and regulatory documentation are witnessing increasing client onboarding in this domain.

Vaccine development is expected to grow at the fastest rate during the forecast period. The success of AAV-based platforms in addressing infectious diseases like Zika and HIV has expanded research interest in viral vector vaccines. While mRNA technologies took the spotlight during COVID-19, AAV-based vaccines are being developed for long-term immunity in chronic infectious diseases. Government funding and public-private partnerships will accelerate this trend, further enhancing demand for AAV CDMO services.

By End Use Outlook

Pharmaceutical and biopharmaceutical companies dominated the end-use segment in 2024. These companies are at the forefront of commercializing gene therapies and rely heavily on CDMOs for scale-up, regulatory compliance, and manufacturing infrastructure. With increasing FDA approvals and clinical trial initiations, outsourcing to specialized CDMOs has become a strategic imperative. The trend is reinforced by major collaborations such as Sarepta Therapeutics’ alliance with Lonza for AAV vector supply.

Academic and research institutes are expected to show significant growth through 2030. These institutions are central to discovery-phase research and preclinical studies, particularly in orphan diseases. Many leading universities, including Harvard and Stanford, are running gene therapy labs that partner with CDMOs for pilot-scale production. As translational research expands, these institutes will play a critical role in the innovation pipeline, driving demand for development-stage manufacturing services.

Country-Level Analysis (United States)

The United States continues to be a global leader in gene therapy research and AAV vector development. With strong support from regulatory bodies like the FDA and funding from the NIH and venture capital firms, the U.S. offers a fertile ecosystem for innovation. The presence of major CDMOs such as Thermo Fisher Scientific, Catalent, and Lonza in the country gives therapy developers a strategic advantage in scaling their products.

Moreover, the country’s biomanufacturing hubs Boston, San Diego, Philadelphia, and the San Francisco Bay Area are witnessing infrastructure expansion with new GMP-compliant AAV manufacturing facilities. In 2023, Thermo Fisher opened a new viral vector manufacturing site in Plainville, MA, doubling its production capacity. This reflects the national emphasis on domestic vector production to support an expanding therapeutic pipeline and ensure pandemic preparedness.

Some of The Prominent Players in The U.S. AAV Contract Development And Manufacturing Organization Market Include:

- Thermo Fisher Scientific Inc.

- Forge Biologics

- Andelyn Biosciences

- National Resilience, Inc.

- Akron Biotech

- ViroCell Biologics, Ltd.

- ElevateBio.

- VintaBio LLC.

- Clover Biopharmaceuticals

- iVexSol

Recent Developments

-

March 2024 – Catalent announced the expansion of its gene therapy manufacturing facility in Maryland, including dedicated upstream and downstream AAV production suites to enhance capacity for Phase III and commercial batches.

-

January 2024 – Thermo Fisher Scientific unveiled its new Gibco AAV-MAX Production System in suspension format, aimed at accelerating scalable and GMP-compliant AAV manufacturing.

-

November 2023 – Regenxbio Inc. partnered with the University of Pennsylvania’s Gene Therapy Program to license novel AAV capsids, aimed at improving tissue targeting for CNS disorders.

-

October 2023 – Charles River Laboratories acquired Vigene Biosciences’ AAV manufacturing assets, strengthening its CDMO offerings across the U.S. and expanding its gene therapy client base.

-

July 2023 – Andelyn Biosciences opened a new 180,000-square-foot GMP manufacturing facility in Ohio, with dedicated AAV vector production capabilities for late-stage and commercial gene therapies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. AAV Contract Development And Manufacturing Organization Market.

By Workflow

-

- Vector Amplification & Expansion

- Vector Recovery & Harvesting

By Culture Type

- Adherent Culture

- Suspension Culture

By Application

- Cell & Gene Therapy Development

- Vaccine Development

- Biopharmaceutical and Pharmaceutical Discovery

- Biomedical Research

By End Use

- Pharmaceutical and Biopharmaceutical Companies

- Academic & Research Institutes

-

- Drug Discovery

- Preclinical

- Clinical