U.S. Active Pharmaceutical Ingredients CDMO Market Size and Trends

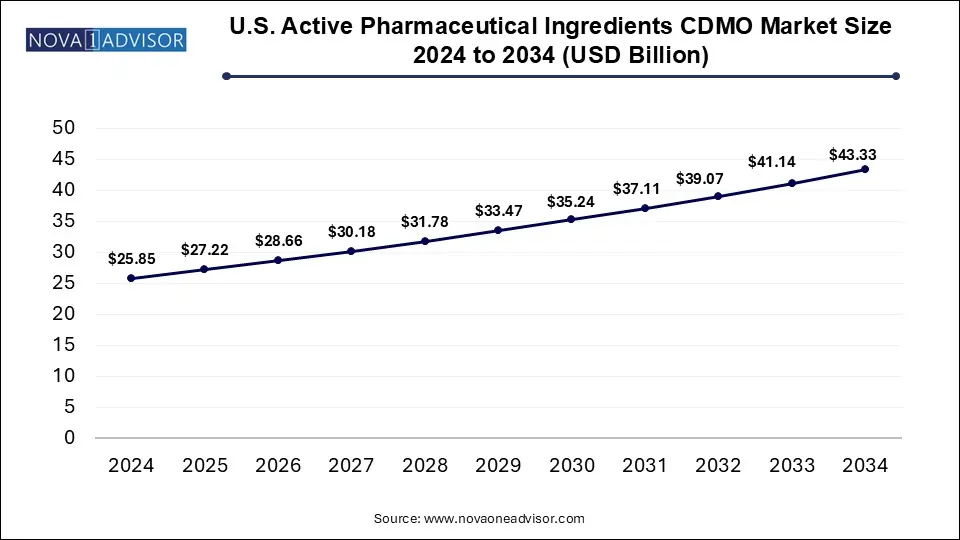

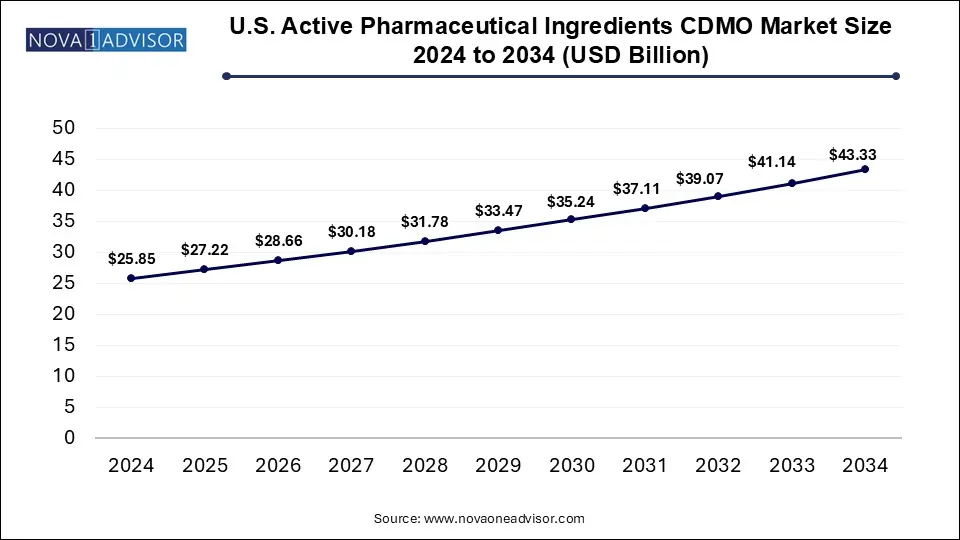

The U.S. active pharmaceutical ingredients CDMO market size is calculated at USD 25.85 billion in 2024, grows to USD 27.22 billion in 2025, and is projected to reach around USD 43.33 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034. The U.S. active pharmaceutical ingredients CDMO market expansion is driven by rising demand for biologics and generics, increased collaboration and acquisition activities, and growing preference towards outsourcing API production.

U.S. Active Pharmaceutical Ingredients Market Key Takeaways

- By product, the traditional active pharmaceutical ingredients segment dominated the market with the largest share in 2024.

- By product, the antibody drug conjugates (ADCs) segment is expected to show the fastest growth over the forecast period.

- By synthesis, the synthetic segment held the largest market share in 2024.

- By synthesis, the biotech segment is expected to register fastest growth during the forecast period.

- By drug, the innovative segment captured the largest market share in 2024.

- By drug, the generic segment is expected to show the fastest growth during the forecast period.

- By workflow, the clinical segment generated the highest market revenue in 2024.

- By workflow, the commercial segment is expected register the fastest CAGR over the forecast period.

- By application, the oncology segment accounted for the highest market share in 2024.

- By application, the glaucoma segment is expected to grow significantly during the predicted timeframe.

What Drives the U.S. Active Pharmaceutical Ingredients CDMO Market?

Active pharmaceutical ingredients CDMO (Contract Development and Manufacturing Organization) refers to a company providing comprehensive services and specialized expertise to pharmaceutical and biotechnology companies for the development and manufacturing of active pharmaceutical ingredients (APIs). Broad range of services offered by CDMOs such as development and optimization of chemical processes, validation of analytical methods, implementation of Current Good Manufacturing Practices (cGMP) to ensure compliance, scale-up and technology transfer as well as assistance with regulatory filings are driving the outsourcing trend for API production in the pharmaceutical industry in U.S.

What are the Key Trends in the U.S. Active Pharmaceutical Ingredients CDMO Market in 2025?

In May 2025, Benuvia Operations LLC, signed a multi-year commercial supply agreement for providing its Dronabinol API with a leading U.S. pharmaceutical company for accelerating the development of a cannabinoid-based drug product.

In February 2025, SK pharmateco, an international contract development and manufacturing organization (CDMO), launched a state-of-the-art High Potency Active Pharmaceutical Ingredients (HPAPIs) at its Rancho Cordova, California site.

How is AI Influencing the U.S. Active Pharmaceutical Ingredients CDMO Market?

Artificial intelligence (AI) and machine learning is being integrated across various stages such as from drug discovery to production processes in the U.S. active pharmaceutical ingredients CDMO market. AI algorithms can be applied for analyzing large datasets of molecular structures and protein databases to identify potential new drug molecules, further enhancing drug discovery processes. Automation driven by AI can assist in optimizing manufacturing processes, prediction of potential issues and for making real-time adjustments during production, leading to increased yields with consistent quality. Leveraging AI-powered tools and data analytics can help manufacturers in ensuring compliance with the regulatory guidelines set by the U.S. Food and Drug Administration (FDA).

Report Scope of U.S. Active Pharmaceutical Ingredients CDMO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 27.22 Billion |

| Market Size by 2034 |

USD 43.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Synthesis, Drug, Workflow, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

BSP Pharmaceuticals, Cambrex Corporation, Corden Pharma, Noramco, Novo Group (Catalent, Inc.), Piramal Pharma Limited, Siegfried Holding AG, Seqens North America, SK pharmteco Inc., Thermo Fisher Scientific Inc. |

Market Dynamics

Drivers

Rising Outsourcing Trend

Strategic approach by various pharmaceutical and biotechnology companies in the U.S. for outsourcing development and manufacturing of API is the major driver for market growth. Outsourcing services offer several benefits to pharmaceutical companies such as access to state-of-the-art facilities, cost effective manufacturing, reduced capital expenditure, specialized expertise, enhanced scalability and flexibility, regulatory compliance and accelerated time to market. Economies of scale are benefitting the CDMOs which serve multiple clients leading to reduced costs for their partners.

Restraints

High Capital Investment

Setting up a cutting-edge API manufacturing facility with capacity for handling complex or highly potent APIs requires large capital expenditure. Wide range of specialized and sometimes custom-made equipment as well as expertise required for process validation and scale-up can be quite expensive creating the need for considerable financial responsibility. Furthermore, ongoing operational costs for maintenance and upgrades, energy costs, effective waste management, and ensuring adherence to stringent and evolving regulatory guidelines can potentially increase the financial burden and may impact profitability.

Opportunities

Demand for Complex and Highly Potent APIs

Increased emphasis on development of highly potent and complex APIs for various therapeutic applications such as oncology, autoimmune disorders and other diseases as well as specialized expertise provided by CDMOs in the U.S. is creating opportunities for market growth. CDMOs invest heavily in infrastructure development, and for offering scientific expertise and end-to-end services which makes them preferred choice of innovator companies for developing advanced therapies.

Segmental Insights

Why Did the Traditional Active Pharmaceutical Ingredients Segment Dominate in 2024?

By product, the traditional active pharmaceutical ingredients (APIs) segment captured the largest market share in 2024. Traditional APIs play an important role in manufacturing of various small molecule drugs as well as in the development of innovative and complex drugs which drives their demand in the market. Rising trend of outsourcing API production to CDMOs by pharmaceutical companies is leading to reduced costs and streamlined operations, further allowing them to focus on core competencies. Furthermore, increased demand for personalized medicine, rising focus on developing innovative therapies and regulatory support are driving the market dominance of this segment.

By product, the antibody drug conjugates (ADCs) segment is expected to register the fastest CAGR over the forecast period. Rising cancer disease burden, growing demand for targeted therapies, increased clinical trial activities and surging investments in R&D activities are the factors fuelling the market expansion of this segment. Continuous advancements in ADC technologies such as development of site-specific conjugation, optimization of payload and linker chemistry are enhancing the safety and efficacy of ADCs

What Made Synthetic APIs the Dominant Segment in 2024?

By synthesis, the synthetic segment dominated the market with the largest share in 2024. Synthetic APIs are widely used for large-scale manufacturing of branded and generic drugs for various therapeutic applications such as analgesic anti-infective, cardiovascular and central nervous system (CNS) drugs. Rising prevalence of chronic diseases, increased demand for effective drugs, irregularities in global supply chains, government initiatives supporting domestic manufacturing, and strategic collaboration and merger initiatives among CDMOs and biopharmaceutical companies are the factors driving the market growth.

By synthesis, the biotech segment is expected to show the fastest growth during the predicted timeframe. Increased emphasis on development of complex molecules such as biologics, high potency APIs and small molecule drugs as well as advanced therapies like cell and gene therapies requiring specialized manufacturing equipment and processes is driving the shift towards outsourcing through CDMOs offering specialized expertise and necessary facilities.

How Innovative Drugs Segment Dominated the Market in 2024?

By drug, the innovative segment accounted for the largest market share in 2024. CDMOs are equipped with advanced manufacturing technologies and offer specialized capabilities with a strong focus on quality control, speed, efficiency and better adaptability, further driving their adoption by innovator companies for development of APIs. Implementation of Pharma 4.0 principles by CDMOs with the integration of advanced digital technologies such as AI, Internet of Things (IoT), cloud computing, big data analytics, robotics and automated systems is enhancing manufacturing processes, improving drug development and streamline workflows. Furthermore, rising demand for targeted therapies, increased emphasis on accelerating drug development process and expanding capabilities of CDMOs are boosting the market growth of this segment.

By drug, the generic segment is expected to expand rapidly over the forecast period. The market growth of this segment can be linked to the rising patent expirations, increased demand for generic APIs, evolving regulatory landscape, and expanding capabilities of CDMOs focused on cost-effective and large volume of API production. Strategic collaborations and mergers of CDMOs with generic drug manufacturers as well as innovator companies for expanding geographical reach, development and manufacturing of APIs for generic and innovator drugs, and for providing customized solutions are creating opportunities for market growth.

How Did Clinical Manufacturing Segment Generate Highest Revenue in 2024?

By workflow, the clinical segment held the highest market share in 2024. Rise in clinical trial activity with increasing R&D investments, accelerated regulatory approvals, and focus of companies on development of strong product pipeline of novel drug products, especially small molecules are driving the market growth of this segment. Evolving regulatory landscape, rising chronic disease prevalence and demand for effective therapies to address unmet medical needs is leading to increased adoption of CDMO services in the clinical phase, further allowing the pharmaceutical companies to focus on core competencies.

By workflow, the commercial segment is expected to show the fastest growth during the forecast period. Increased drug approvals by FDA through expedited pathways such as Breakthrough Therapy, Fast Track and Orphan Drug designations is shortening drug development times and accelerating their market reach which drives various pharmaceutical and biotechnology companies to develop robust product pipelines and launching innovative drug products. Focus of pharmaceutical companies on core competencies such as R&D and marketing is leading to increased outsourcing investments and complex manufacturing to CDMOs. U.S. government initiatives for nearshoring and reshoring API production for enhancing national health security and supply chain resilience are fuelling the market growth of this segment.

What Drives Dominance of the Oncology Segment in the Market in 2024?

By application, the oncology segment generated the highest market revenue in 2024. According to the National Cancer Institute (NCI), approximately 2,041,910 new cases of cancer will be diagnosed and 618,120 people will die from cancer in U.S. in 2025. Continuous advancements in development of novel cancer therapies and innovative treatment approaches requires specialized APIs and manufacturing processes to cater the rising cancer disease burden in the U.S. Growing emphasis of pharmaceutical manufacturers on strengthening product pipeline with the development of new oncology drugs is boosting the demand for CDMO services to manufacture API. Moreover, supportive government policies, demand for personalized treatments and rising investments in R&D activities are fuelling the market expansion.

By application, the glaucoma segment is expected to grow significantly over the forecast period. Rising prevalence of glaucoma in the aging population as well as increased awareness regarding the chronic nature of the disease in the public is leading to early diagnosis, creating a growing demand for ophthalmic APIs. Need for long-acting and effective treatments with improved tolerance are driving R&D activities for development of novel ophthalmic therapies for glaucoma. Highly specialized manufacturing processes in accordance with stringent regulatory guidelines required for production of ophthalmic APIs is increasing outsourcing by ophthalmic pharmaceutical companies to CDMOs. Patent expiration of blockbuster glaucoma drugs is driving the demand for genetic APIs of established glaucoma medications, further significantly contributing to the market growth.

Country-Level Analysis

The U.S. active pharmaceutical ingredients CDMO market is witnessing strong growth, owing to the factors such as increased complexity of drug development processes, focus on optimizing costs and increasing yield of API production, rising prevalence of chronic diseases, and continuous progress in therapeutics areas such as cardiovascular diseases and oncology. Various government programs such as funding and incentives for pharmaceutical companies, reshoring initiatives and promotional activities for collaboration of public private entities is significantly contributing to the market growth. Strict regulations set by the FDA for maintaining adherence to regulatory requirements and quality standards for API manufacturing are streamlining operational workflows for CDMOs.

Some of The Prominent Players in The U.S. Active Pharmaceutical Ingredients CDMO Market Include:

- BSP Pharmaceuticals

- Cambrex Corporation

- Corden Pharma

- Noramco

- Novo Group (Catalent, Inc.)

- Piramal Pharma Limited

- Siegfried Holding AG

- Seqens North America

- SK pharmteco Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In May 2025, to meet the rising demand for drug substance (DS) and drug product (DP) stability studies, SK pharmteco declared the expansion of its stability storage capacity at its El Dorado Hills, California facility.

- In July 2024, Agilent Technologies Inc. signed a deal of $925 million for acquiring a leading specialized contract development and manufacturing organization, BIOVECTRA which focuses on production of highly potent active pharmaceutical ingredients, biologics and other molecules for targeted therapeutics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Active Pharmaceutical Ingredients CDMO Market.

By Product

- Traditional Active Pharmaceutical Ingredient

- Highly Potent Active Pharmaceutical Ingredient

- Antibody Drug Conjugate (ADC)

- Other

By Synthesis

By Drug

By Workflow

By Application

- Oncology

- Hormonal

- Glaucoma

- Cardiovascular disease

- Diabetes

- Others