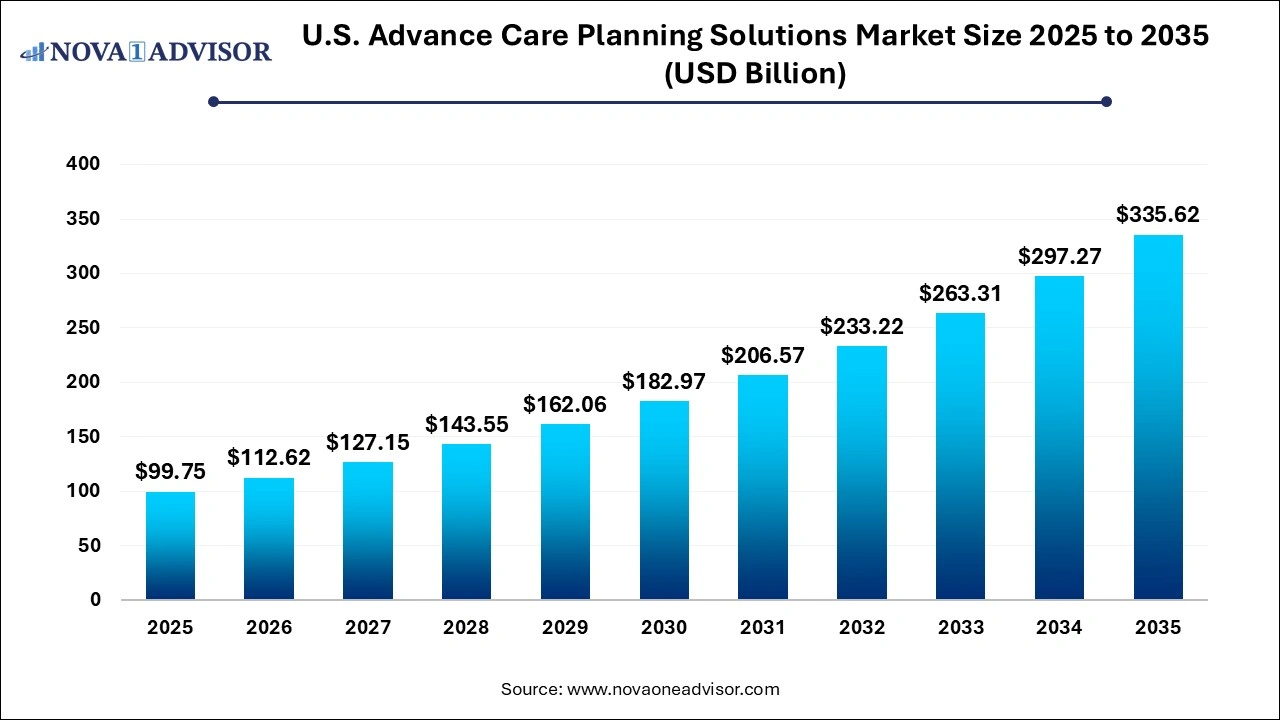

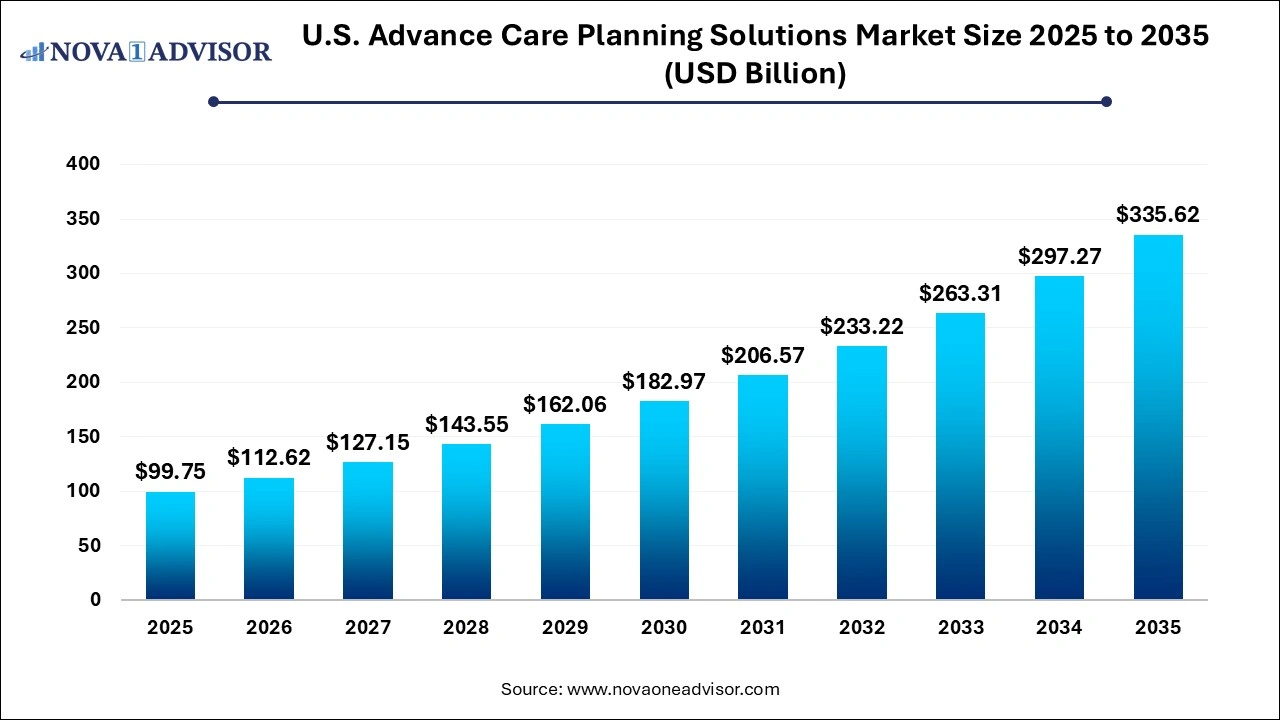

U.S. Advance Care Planning Solutions Market Size and Trends 2026 to 2035

The U.S. advance care planning solutions market size was exhibited at USD 99.75 billion in 2025 and is projected to hit around USD 335.62 billion by 2035, growing at a CAGR of 12.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The services segment dominated the market with a market share of 68.0% in 2025.

- The software segment is expected to grow at a CAGR of 13.5% over the forecast period.

- The medical power of attorney segment dominated the market with a market share of 33.3% in 2025.

- The living will segment is expected to grow at a CAGR of 13.2% over the forecast period.

- The healthcare providers segment dominated the market with a market share of 80.0% in 2025.

- The healthcare providers segment is expected to grow at a CAGR of 14.2% over the forecast period.

U.S. Advance Care Planning Solutions Market Overview

The U.S. Advance Care Planning (ACP) Solutions Market is gaining considerable momentum, driven by an aging population, evolving patient-centric care models, and increasing emphasis on value-based healthcare. Advance Care Planning encompasses a series of services and tools that allow individuals to define and document their preferences for future medical treatment in the event they are unable to communicate their decisions. These preferences are often captured in various ACP documents like living wills, medical powers of attorney, and Physician Orders for Life-Sustaining Treatment (POLST). The rising demand for these solutions stems from the growing recognition of their importance in improving the quality of care, reducing unnecessary interventions, and aligning treatments with patient goals.

In recent years, the adoption of digital solutions in advance care planning has surged, with numerous software platforms enabling patients, caregivers, and healthcare providers to collaborate seamlessly. These platforms offer secure, cloud-based environments for storing, updating, and sharing advance directives, thereby ensuring that patient preferences are accessible across different care settings. Moreover, the COVID-19 pandemic underscored the urgency for proactive care planning, as critically ill patients often faced decisions about ventilators, resuscitation, and other life-sustaining treatments without prior documentation of their wishes.

Hospitals, primary care providers, long-term care facilities, and health insurers are now actively investing in ACP tools to streamline documentation, enhance interoperability, and mitigate legal and ethical risks. Furthermore, legislative initiatives and policy support from agencies such as the Centers for Medicare & Medicaid Services (CMS) have boosted the integration of ACP discussions into routine clinical workflows, especially among older adults and individuals with chronic illnesses.

Major Trends in the U.S. Advance Care Planning Solutions Market

-

Digital Transformation in ACP Services: Emergence of cloud-based software platforms that integrate with electronic health records (EHRs) and facilitate real-time access to advance directives.

-

Increased Use of AI and Natural Language Processing: Use of AI algorithms to personalize care planning and predict patient needs based on medical history and preferences.

-

Growing Partnerships Between Payers and Providers: Health insurers are increasingly collaborating with healthcare systems to ensure ACP documentation is in place for covered members.

-

Focus on Home-Based and Telehealth Integration: ACP discussions are increasingly being conducted through virtual consultations, improving accessibility for homebound or rural patients.

-

Customization of ACP Documents: Introduction of culturally sensitive and multilingual ACP forms like "Five Wishes" to cater to diverse patient populations.

-

Integration with Palliative and Hospice Care Services: Advance care planning is now an essential part of palliative care pathways for patients with terminal or chronic illnesses.

-

Rising Public Awareness and Legal Education Campaigns: State-level initiatives and nonprofit organizations are promoting ACP awareness through seminars, toolkits, and online portals.

Report Scope of The U.S. Advance Care Planning Solutions Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 112.62 Billion |

| Market Size by 2035 |

USD 335.62 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Component, Types of ACP Documents, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

ADVault, Inc.; Vynca, Inc.; WiserCare; Sharp HealthCare; ACP Decisions (A DBA of Nous Foundation, Inc.); Iris (Aledade); Bronson Healthcare |

Market Driver: Rising Geriatric Population and Chronic Illness Prevalence

One of the primary drivers of the U.S. Advance Care Planning Solutions Market is the steadily growing elderly population and the corresponding increase in chronic diseases. According to the U.S. Census Bureau, by 2030, all baby boomers will be age 65 or older, making up a significant portion of the population. Older adults are more likely to face complex healthcare decisions related to comorbidities such as dementia, heart disease, cancer, and respiratory illnesses. These conditions necessitate timely and documented care preferences to avoid invasive or unwanted interventions.

The prevalence of chronic illnesses often results in frequent hospitalizations, increased care costs, and complicated decision-making scenarios. In such cases, advance care planning ensures that patient autonomy is respected, and unnecessary procedures are avoided. It also provides families and caregivers with clear guidance, reducing stress and potential conflicts. Healthcare providers are increasingly incorporating ACP discussions into annual wellness visits, discharge planning, and primary care consultations, thus institutionalizing the process as a core element of personalized healthcare delivery.

Market Restraint: Legal and Regulatory Ambiguities

Despite the increasing importance of advance care planning, legal and regulatory inconsistencies across states pose a significant restraint. The recognition and enforceability of ACP documents like POLST and DNR orders vary widely across jurisdictions. For instance, a POLST form valid in California may not be honored in Texas, potentially leading to medical interventions that contradict a patient's documented wishes. This lack of uniformity creates uncertainty among providers and discourages interoperability across healthcare systems.

Moreover, concerns about liability and documentation accuracy discourage some physicians from engaging in ACP discussions. The fear of misinterpreting a directive or facing legal repercussions for acting (or not acting) on such documents adds another layer of complexity. While efforts are being made at both federal and state levels to standardize ACP protocols, these inconsistencies continue to limit seamless execution and nationwide scalability of advance care planning solutions.

Market Opportunity: Integration of ACP into Digital Health Ecosystems

A major opportunity in the U.S. market lies in integrating ACP solutions into broader digital health ecosystems. As healthcare organizations continue to invest in telemedicine, mobile health apps, and electronic health records, there is a growing demand for ACP tools that can be embedded into these platforms. Integration ensures that ACP documents are not siloed or forgotten but are easily retrievable during patient encounters, emergencies, or care transitions.

For instance, companies that offer API-based ACP modules that can plug into EHRs are witnessing significant traction. These integrations allow healthcare providers to prompt patients to complete or update ACP forms during digital check-ins, while AI-driven analytics can identify patients at high risk who should be prioritized for ACP conversations. Moreover, patient portals with ACP sections empower individuals to manage their documents, set reminders, and notify designated surrogates. This trend is paving the way for a more proactive and tech-enabled approach to end-of-life care planning.

Segmental Insights

By Component Insights

Services dominated the U.S. Advance Care Planning Solutions Market by component segment, primarily due to the intensive human engagement required in facilitating ACP discussions. Services such as ACP facilitation, consultation, legal advisory, and end-of-life counseling are essential for helping individuals articulate their values and translate them into legally binding documents. In hospitals and outpatient clinics, trained facilitators often lead ACP sessions, ensuring that the patient’s voice is clearly understood and documented. Additionally, nonprofit organizations and community-based programs are offering ACP services at the grassroots level, increasing reach and awareness. These services also address cultural sensitivities, health literacy, and family dynamics, which are vital for effective care planning.

However, software is the fastest-growing segment as technological innovations drive automation and standardization in ACP workflows. Electronic platforms now offer templates for different ACP documents, integration with state registries, and cloud-based storage solutions accessible by multiple stakeholders. These tools are particularly valuable in large healthcare systems where digital records reduce the risks of misplaced or outdated documents. Additionally, features like electronic signatures, automated reminders, and interoperability with EHRs are transforming how ACP is approached. With increasing investments in digital health and value-based care incentives, software platforms are becoming indispensable to modern ACP programs.

By Types of ACP Documents Insights

Living wills dominated the types of ACP documents segment, given their broad acceptance and historical significance in end-of-life care planning. A living will allows individuals to specify what kind of medical treatments they want—or don’t want—if they become incapacitated. These directives are crucial in scenarios involving life-support, artificial nutrition, or palliative sedation. The familiarity and legal recognition of living wills across most states have contributed to their widespread use. Healthcare providers also find them easier to discuss with patients as they often cover common medical decisions in a clear format. Campaigns like National Healthcare Decisions Day further promote the creation and updating of living wills.

On the other hand, POLST forms are emerging as the fastest-growing document type due to their direct applicability in emergency medical situations. Unlike living wills, POLST forms are designed for individuals with serious illnesses or frailty and are signed by a healthcare provider, making them actionable immediately. These forms contain specific medical orders related to resuscitation, intubation, and hospitalization preferences. The growing awareness among emergency medical technicians (EMTs), paramedics, and acute care settings about POLST’s importance has led to increased adoption. States like Oregon and California have robust POLST registries, and initiatives are underway to promote electronic versions for real-time access.

By End-use Insights

Healthcare providers accounted for the largest market share in the end-use segment, as they are the primary initiators of ACP conversations. Hospitals, long-term care facilities, and outpatient clinics play a crucial role in identifying suitable candidates for advance care planning and ensuring that relevant documents are completed and stored. With value-based care reimbursement models gaining traction, providers are incentivized to reduce avoidable interventions and hospital readmissions, both of which ACP can help achieve. Institutional protocols now often require ACP documentation as part of admission or discharge planning. Moreover, provider training programs and clinical decision support tools are being developed to improve ACP uptake.

Healthcare payers are witnessing the fastest growth in adoption, owing to their strategic interest in reducing costs associated with end-of-life care. Insurance companies, including Medicare Advantage plans, are launching pilot programs that encourage beneficiaries to complete advance directives. Some payers are offering financial incentives or premium discounts for members who participate in ACP discussions. In addition, payer-provider collaborations are emerging to ensure that care delivery aligns with patient preferences, ultimately improving satisfaction metrics and quality ratings. These initiatives are also supported by CMS guidelines that allow billing for ACP discussions, thereby providing a financial rationale for insurers to promote such services.

Country-Level Insights United States

In the United States, the landscape of advance care planning is evolving in response to demographic, cultural, and policy changes. Federal initiatives such as Medicare reimbursement for ACP discussions have significantly increased provider engagement. Furthermore, non-profit organizations like The Conversation Project and state-run registries are enhancing public awareness about the importance of documenting healthcare wishes.

Each state maintains its own regulations governing the validity and use of ACP documents, leading to a patchwork of legal frameworks. However, efforts such as the National POLST Paradigm are promoting standardization and interstate recognition. The growing role of technology companies and startups in bridging these gaps is noteworthy. For instance, platforms that allow users to upload and update documents securely and share them across providers are gaining traction across major healthcare systems in states like California, New York, and Florida.

Some of the prominent players in the U.S. advance care planning solutions market include:

Recent Developments

-

April 2025 – ADVault Inc., a leading player in digital advance care planning, announced its collaboration with Epic Systems to integrate MyDirectives ACP platform directly into Epic’s EHR system, enhancing accessibility for clinicians during care encounters.

-

February 2025 – VyncaCare, a major ACP software provider, expanded its partnership with multiple Blue Cross Blue Shield affiliates to enable value-based ACP programs across five new states.

-

December 2024 – Respecting Choices, an established ACP service organization, launched a new certification program for ACP facilitators, with a focus on virtual delivery and culturally sensitive care.

-

November 2024 – Five Wishes introduced an AI-driven chatbot that guides users through the process of completing advance directives, targeting tech-savvy senior populations.

-

October 2024 – Cambia Health Solutions and Providence Health & Services initiated a pilot study on the impact of real-time ACP document availability on emergency care decision-making in Washington state.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. advance care planning solutions market

Component

Types of ACP Documents

- Living Will

- Medical Power of Attorney

- POLST

- DNR Orders

- Five Wishes

End-Use

- Healthcare Providers

- Healthcare Payers