U.S. Analytical Instrumentation Market Size and Research

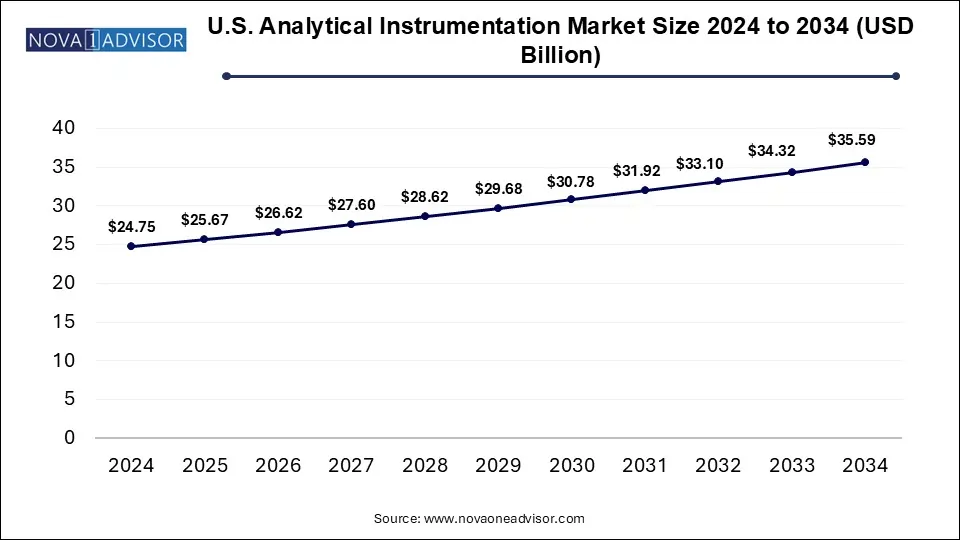

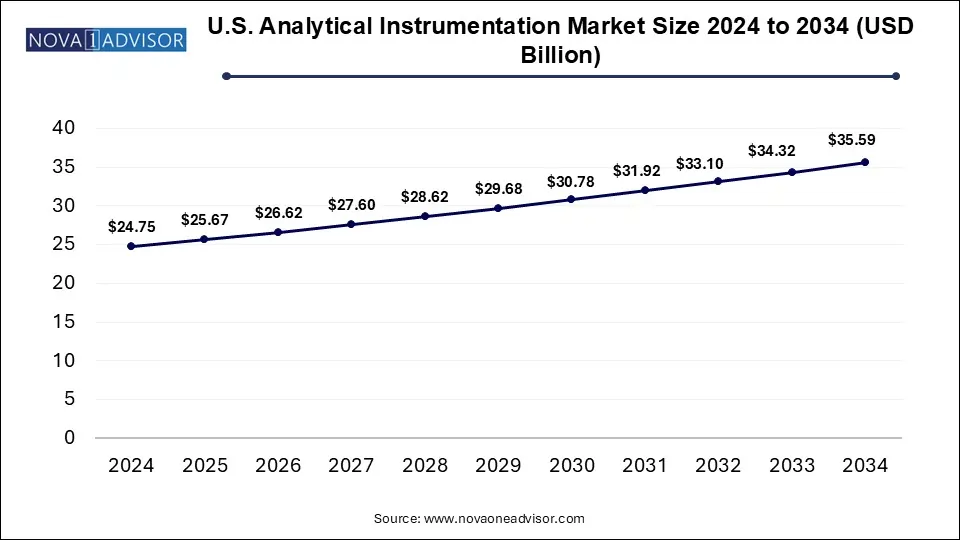

The U.S. Analytical Instrumentation Market size was exhibited at USD 24.75 billion in 2024 and is projected to hit around USD 35.59 billion by 2034, growing at a CAGR of 3.7% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the instruments category accounted for the highest portion of market revenue, representing 55% of the total share.

- The software category is projected to experience the most rapid growth, with a compound annual growth rate (CAGR) of 5.1% over the forecast period.

- The PCR technology segment led the market in 2024, securing the largest revenue share among all technologies.

- Sequencing technology is expected to register the fastest CAGR during the forecast timeframe, indicating its rising adoption.

- Life sciences R&D emerged as the leading application area in 2024, capturing the greatest share of overall market revenue.

- Clinical and diagnostic analysis is forecasted to expand at the highest CAGR throughout the analysis period, driven by increasing healthcare demands.

Market Overview

The U.S. analytical instrumentation market stands as a cornerstone of scientific research, industrial development, and clinical diagnostics. Analytical instruments are essential tools for identifying, characterizing, and quantifying materials in a wide range of sectors including life sciences, pharmaceuticals, environmental monitoring, food and beverage safety, forensics, and more. In the United States, this market has flourished due to robust investments in R&D, stringent regulatory frameworks, and the presence of world-leading institutions and multinational corporations that rely on high-precision analytical solutions.

Driven by both innovation and necessity, the U.S. market is at the forefront of integrating digital technologies with analytical devices. Automation, artificial intelligence (AI), and cloud connectivity have become integral to modern instrumentation platforms, enabling real-time data analysis, remote diagnostics, and enhanced process control. This integration is particularly beneficial in high-throughput laboratories where productivity and reproducibility are paramount.

The role of analytical instrumentation became even more pronounced during the COVID-19 pandemic, which revealed the need for rapid, accurate, and scalable diagnostic solutions. From PCR thermocyclers used in molecular testing to chromatography systems applied in vaccine development and quality control, analytical devices proved indispensable across the healthcare landscape. Beyond the pandemic, the ongoing boom in biopharmaceuticals, precision medicine, environmental regulation, and clean energy initiatives continues to shape the demand profile in this sector.

Major Trends in the Market

-

Integration of AI and machine learning in analytical software for predictive diagnostics and anomaly detection.

-

Rising adoption of cloud-based laboratory information management systems (LIMS).

-

Increased use of portable and handheld analytical devices for on-site environmental and food safety testing.

-

Strong emphasis on sustainability, leading to the development of energy-efficient and low-waste instrumentation.

-

Miniaturization of instruments without compromising analytical performance, enabling point-of-care applications.

-

Growing reliance on contract analytical service providers, especially among biotech startups.

-

Transition toward multi-modal platforms combining techniques such as spectroscopy and microscopy.

-

Emergence of single-cell analysis tools driven by oncology and neuroscience research.

Report Scope of U.S. Analytical Instrumentation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 25.67 Billion |

| Market Size by 2034 |

USD 35.59 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technology, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Danaher; Agilent Technologies, Inc.; Bruker Corp.; PerkinElmer, Inc.; Mettler Toledo; Bio-Rad Laboratories, Inc.; Illumina, Inc.; F. Hoffmann-La Roche AG; Avantor, Inc. |

Key Market Driver

Growing Biopharmaceutical and Life Sciences Research Activity

The most significant driver for the U.S. analytical instrumentation market is the accelerated growth in biopharmaceutical R&D and life sciences research. The country leads globally in the number of ongoing clinical trials, with over 130,000 active studies as of 2024. Each of these stages discovery, preclinical validation, and manufacturing—requires rigorous analytical validation.

For example, mass spectrometry and chromatography systems are critical in identifying impurities in biologics, while PCR and flow cytometry are used extensively in genetic analysis and cell line characterization. The National Institutes of Health (NIH) alone allocated over $47 billion for medical research in FY 2023, much of which fuels demand for high-end analytical equipment and services. Furthermore, the increasing complexity of biologics, gene therapies, and cell therapies necessitates cutting-edge instrumentation capable of providing both sensitivity and specificity at molecular and atomic levels.

Key Market Restraint

High Capital Investment and Operational Costs

While analytical instrumentation is indispensable, the market faces a significant restraint in the form of high capital and maintenance costs. Advanced systems such as high-resolution electron microscopes or next-generation sequencing (NGS) platforms can cost hundreds of thousands to millions of dollars, making them inaccessible for smaller research entities or universities operating under tight budgets.

Additionally, maintaining these instruments requires specialized staff, routine calibration, and periodic software updates, all of which add to operational overhead. For example, chromatography instruments may require costly consumables like columns and solvents, and mass spectrometers may involve vacuum system upkeep and ion source replacements. These recurring expenses can significantly deter new installations, particularly in cost-sensitive settings such as public health labs or educational institutions.

Key Market Opportunity

Expansion of Analytical Services and Outsourcing

An emerging opportunity within the U.S. analytical instrumentation landscape is the growing market for outsourced analytical services. As biopharmaceutical and food safety companies focus more on core competencies like product development and regulatory strategy, they increasingly turn to specialized service providers for testing and validation work. This is especially attractive for small- to mid-sized firms lacking in-house infrastructure.

For instance, companies like Eurofins Scientific and Intertek offer advanced analytical capabilities including high-performance liquid chromatography (HPLC), spectroscopy, elemental analysis, and microbial testing. Outsourcing not only reduces the financial burden of acquiring and maintaining analytical hardware but also grants access to industry-certified experts and faster turnaround times. This shift toward outsourcing is driving secondary demand for instruments among service providers, creating a self-sustaining growth loop in the sector.

Segmental Analysis

By Product Outlook

Instruments held the largest revenue share in 2024, dominating the product outlook due to their foundational role across every application vertical from laboratory testing to industrial process monitoring. Whether it is gas chromatographs in environmental labs or fluorescence microscopes in oncology research, instruments remain irreplaceable. Technological advancements in resolution, throughput, and user interface design have further enhanced their value proposition. Furthermore, the rapid development of compact and modular instruments allows laboratories to integrate analytical tools seamlessly into workflows, enhancing efficiency and output quality.

Software is expected to witness the fastest growth rate over the forecast period. As laboratories increasingly adopt digitalization strategies, software tools that support data acquisition, instrument control, analytics, and compliance management are in high demand. Features such as 21 CFR Part 11 compliance, data integrity assurance, and remote monitoring are becoming standard expectations. The rise of AI-powered analytics, predictive maintenance, and cloud integration is transforming software from a supportive utility into a key enabler of laboratory productivity and compliance.

By Technology Outlook

Spectroscopy dominated the technology segment in 2024, supported by its versatility and adoption in pharmaceuticals, environmental monitoring, and food safety. Techniques such as UV-Vis, IR, and atomic absorption spectroscopy are widely employed for quantitative and qualitative analysis of materials. Their non-destructive nature, rapid analysis times, and relatively low cost make them ideal for high-throughput labs and regulatory testing environments.

Flow cytometry is projected to grow at the fastest pace through 2030, driven by its critical applications in immunology, oncology, and stem cell research. The increasing demand for cell-based assays, single-cell analytics, and biomarker discovery is fueling adoption of advanced flow cytometry platforms. Innovations in microfluidics and multi-parametric analysis, including the ability to analyze up to 50 parameters simultaneously, are expanding its use in both research and clinical diagnostics.

By Application Outlook

Life sciences research and development held the largest share in 2024, buoyed by a surge in molecular biology, genomics, and regenerative medicine research. Analytical instruments are integral at every stage of drug discovery—from target identification to lead optimization. Chromatography, mass spectrometry, NGS, and thermal cyclers (for PCR) are commonly used in biopharma R&D pipelines. Moreover, the use of bioinformatics platforms integrated with analytical systems has amplified data-driven research efforts in genomics and proteomics.

Environmental testing is anticipated to grow at the fastest CAGR during the forecast period. With growing concern about pollution, climate change, and water safety, regulatory bodies like the Environmental Protection Agency (EPA) and Centers for Disease Control and Prevention (CDC) are enforcing stringent guidelines. Analytical instruments are used to monitor heavy metals, pesticides, and microbial contaminants in air, soil, and water. Portable analyzers, coupled with IoT sensors, are enabling real-time environmental data collection and response strategies.

Country-Level Analysis: United States

The United States, as the largest and most technologically advanced analytical instrumentation market globally, benefits from a confluence of factors: mature research infrastructure, strong academic-industrial partnerships, and regulatory-driven demand. The FDA, NIH, EPA, and USDA are not only end users of analytical technology but also key drivers of innovation through funding and regulation.

Biotech hubs such as Boston, San Diego, and the San Francisco Bay Area host leading research institutions and pharmaceutical giants that continuously invest in analytical capabilities. Additionally, government initiatives like the Cancer Moonshot and the Precision Medicine Initiative continue to infuse billions into biomedical research, stimulating equipment demand. In industrial domains, companies in oil & gas, food processing, and semiconductor manufacturing rely heavily on spectrometry, chromatography, and particle size analysis to ensure quality, safety, and compliance.

Some of The Prominent Players in The U.S. Analytical Instrumentation Market Include:

- Thermo Fisher Scientific, Inc.

- Danaher

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche AG

- Avantor, Inc.

Recent Developments

-

June 2024 – Agilent Technologies launched its new InfinityLab LC/MSD iQ system, designed for labs seeking compact, high-sensitivity mass detection integrated into liquid chromatography workflows.

-

April 2024 – Thermo Fisher Scientific acquired MarqMetrix Inc., a U.S.-based company specializing in Raman spectroscopy, expanding its portfolio of real-time process analytical technologies.

-

February 2024 – Waters Corporation introduced its Xevo TQ Absolute mass spectrometer, promising industry-leading sensitivity in a compact footprint for clinical and food safety applications.

-

December 2023 – PerkinElmer completed its acquisition of Nexcelom Bioscience, enhancing its position in cell counting and analysis tools used in drug development.

-

November 2023 – Bruker Corporation unveiled a new generation of FTIR spectrometers, optimized for faster material identification in pharmaceutical QA/QC environments.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Analytical Instrumentation Market.

By Product

- Instruments

- Services

- Software

By Technology

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

- Sequencing

- Microarray

- Others

By Application

- Life Sciences Research & Development

- Clinical & Diagnostic Analysis

- Food & Beverage Analysis

- Forensic Analysis

- Environmental Testing

- Others