U.S. & Europe Ambulatory Surgery Centers Market Size and Research

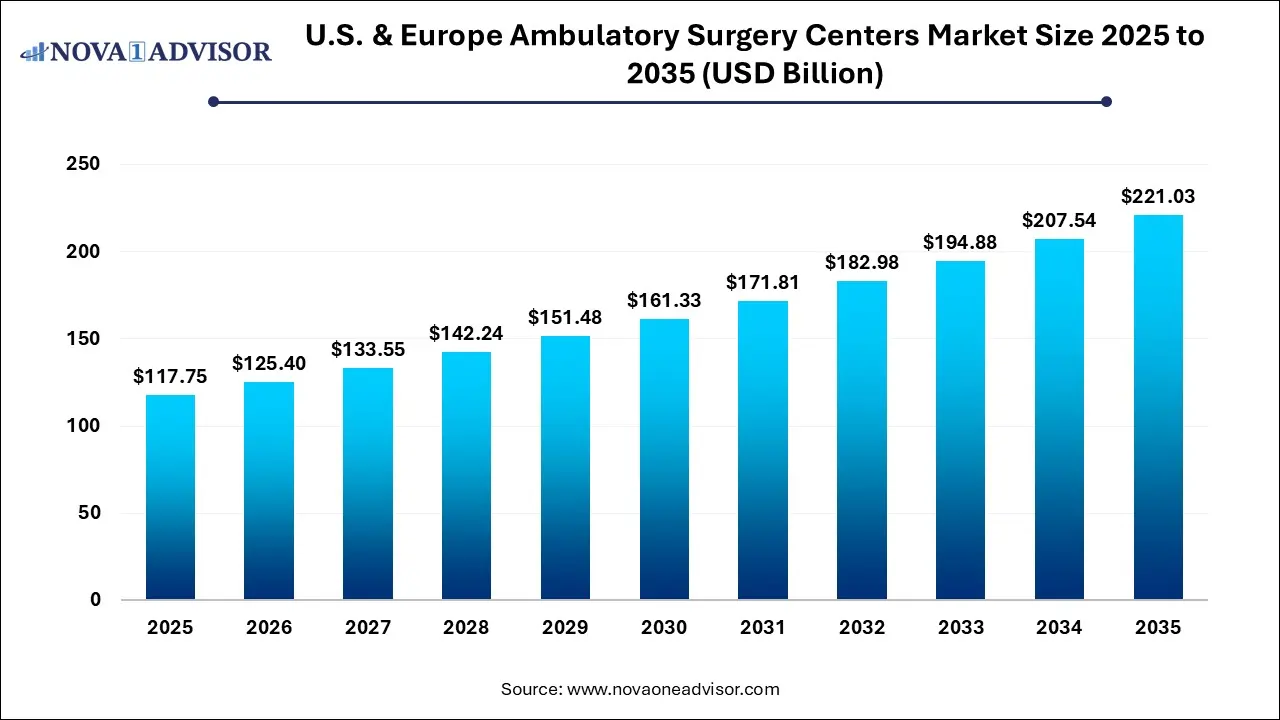

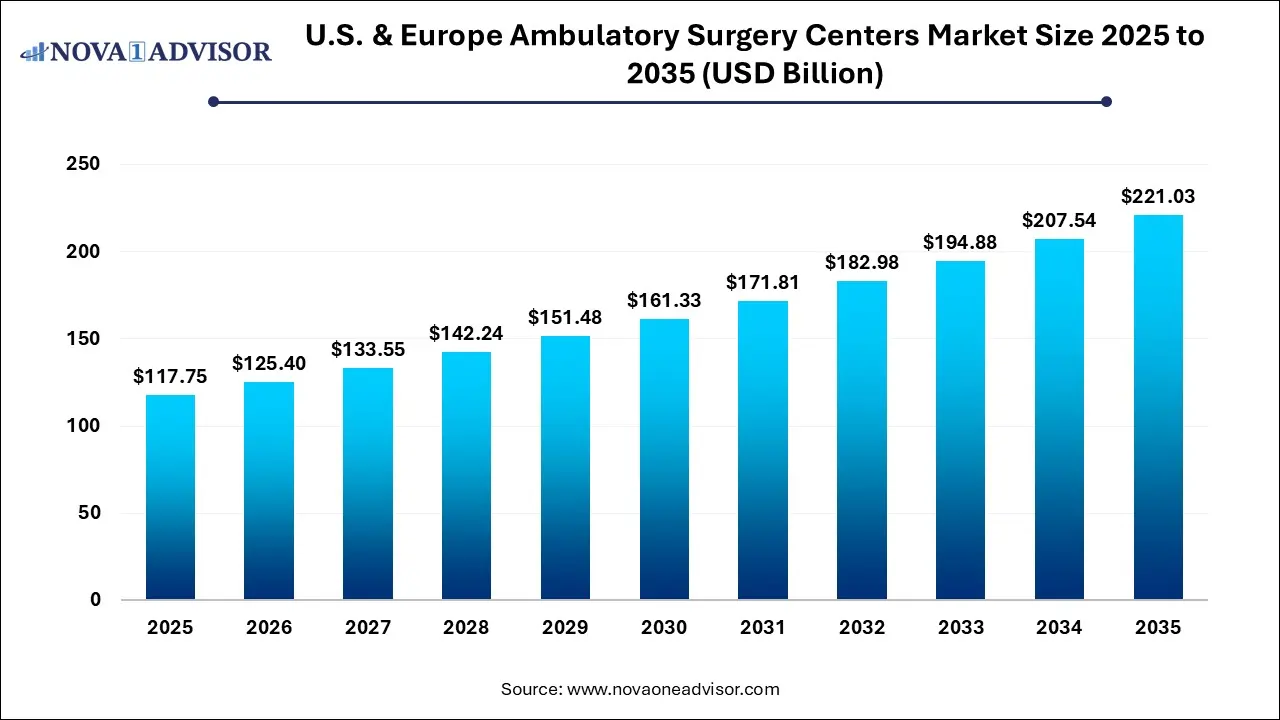

The U.S. & Europe ambulatory surgery centers market size was exhibited at USD 117.75 billion in 2025 and is projected to hit around USD 221.03 billion by 2035, growing at a CAGR of 6.5% during the forecast period 2026 to 2035.

U.S. & Europe Ambulatory Surgery Centers Market Key Takeaways:

- Orthopedics accounted for the largest share of 26.7% in 2025.

- The patch pump segment is expected to grow at the fastest CAGR of 7.9% over the forecast period

- The physician owned segment held the largest market share of 62.1% in 2025.

- The hospital owned segment is expected to grow at the fastest CAGR of 6.3% over the forecast period.

- The single-specialty segment dominated the market with share of 61.2% in 2025.

- The multi-specialty segment is expected to grow at the fastest CAGR of 6.3% over the forecast period.

- The treatment segment held the largest market share of 77.0% in 2025.

- The diagnosis segment is expected to grow at the fastest CAGR of 6.3% over the forecast period.

Market Overview

The Ambulatory Surgery Centers (ASC) market in the U.S. and Europe has undergone rapid evolution over the past decade, reshaping the traditional delivery of surgical care. ASCs are specialized healthcare facilities that provide same-day surgical care without the need for hospital admission. As patient demand for efficient, cost-effective, and minimally invasive procedures grows, ASCs have emerged as a viable and preferred alternative to inpatient hospital surgeries.

The key drivers fueling market growth include increasing outpatient procedure volumes, technological advancements in minimally invasive surgical tools, favorable reimbursement policies, and the growing preference of physicians and patients for low-cost, high-efficiency environments. ASCs enable shorter recovery times, lower infection risks, and reduced procedural costs—factors that contribute to their burgeoning popularity among payers and providers alike.

In the U.S., the Centers for Medicare & Medicaid Services (CMS) have expanded ASC-covered procedures annually, enabling broader service offerings and growing payer support. Meanwhile, European nations are increasingly adopting the ASC model, particularly in response to hospital overcrowding, the COVID-19 backlog, and strained national healthcare systems. Countries such as the UK, Germany, and Sweden are investing in outpatient infrastructure to improve elective surgery throughput and patient experience.

Despite these benefits, the ASC market faces challenges related to staffing shortages, regulatory variances across regions, and capital investment barriers. Nevertheless, strategic investments by hospital systems, private equity firms, and physician groups are consolidating the ASC landscape, creating a high-growth trajectory for the sector in both the U.S. and Europe.

Major Trends in the Market

-

Rise in Multi-Specialty ASCs: These centers are gaining prominence due to their flexibility in offering a wide range of procedures under one roof, optimizing patient flow and resource utilization.

-

Increased Physician Ownership and Integration: Physicians are increasingly participating in ASC ownership structures, enabling greater autonomy, revenue generation, and patient-centric care.

-

Technology Adoption: Use of AI, robotics, and digital surgical platforms is improving precision, reducing errors, and speeding up turnaround times in ASCs.

-

Shift Toward Value-Based Care Models: Reimbursement schemes are increasingly tied to outcomes, prompting ASCs to focus on quality benchmarks and patient satisfaction.

-

Private Equity Investments: The market is witnessing consolidation with numerous buyouts and strategic investments, particularly in the U.S., by PE firms.

-

Expansion of Covered Procedures: Regulatory bodies are approving more complex and high-acuity procedures to be performed in ASCs, such as total joint replacements and cardiovascular interventions.

-

Post-COVID Recovery Focus: Health systems are leveraging ASCs to address surgical backlogs created during the pandemic, accelerating market demand.

Report Scope of U.S. & Europe Ambulatory Surgery Centers Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 125.40 Billion |

| Market Size by 2035 |

USD 221.03 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.3% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Specialty, Ownership, Type, Services, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Envision Healthcare; TH Medical; Pediatrix Medical Group; TeamHealth; UnitedHealth Group; QHCCS, LLC; Surgery Partners; SCA Health; CHSPSC, LLC.; HCA Management Services, L.P.; SurgCenter |

Market Driver: Rising Demand for Cost-Efficient Surgical Care

One of the most powerful drivers for the U.S. & Europe ASC market is the escalating demand for affordable surgical care without compromising quality. Hospital-based surgeries are typically more expensive due to overhead costs, longer lengths of stay, and administrative complexity. ASCs, by contrast, offer a streamlined care pathway, often at a fraction of the cost. According to data from U.S. government reports, Medicare saves billions annually by directing procedures to ASCs.

Europe is also increasingly recognizing the financial benefits of the ASC model. As public healthcare systems in countries like the UK and France face growing pressure to cut costs and reduce wait times, ASCs are being integrated into national surgery networks to enhance efficiency. This cost advantage benefits patients, payers, and providers alike, particularly amid rising healthcare expenditures and aging populations in both markets.

Market Restraint: Workforce Shortages and Operational Constraints

A significant restraint on the growth of ASCs in both the U.S. and Europe is the ongoing shortage of skilled healthcare professionals, particularly surgical nurses, anesthesiologists, and surgical technologists. As demand for procedures increases, many ASCs struggle to maintain optimal staffing levels. The situation is exacerbated by burnout and post-pandemic attrition in the healthcare workforce.

Additionally, operational challenges such as regulatory approvals, reimbursement coding, accreditation compliance, and insurance contract negotiations can create barriers to entry. In Europe, the decentralization of healthcare policy means that ASCs must navigate country-specific regulatory frameworks, making scalability more complex. In the U.S., state-level Certificate of Need (CON) laws in some regions restrict new ASC development, further impeding growth.

Market Opportunity: Expansion of High-Acuity Procedures in ASCs

As surgical technology and post-operative care protocols advance, ASCs are being cleared to perform more complex procedures traditionally reserved for hospitals. These include orthopedic joint replacements, spine surgeries, and even select cardiovascular interventions. The growing success of Enhanced Recovery After Surgery (ERAS) protocols has enabled same-day discharges for what were once inpatient-only procedures.

In the U.S., CMS continues to expand the ASC Covered Procedures List, including high-acuity surgeries such as total shoulder replacements and complex endoscopies. Similarly, countries like Germany and the Netherlands are investing in outpatient surgical programs as part of their long-term healthcare strategy. This trend opens vast opportunities for ASC operators, equipment manufacturers, and surgical technology providers to scale their offerings.

U.S. & Europe Ambulatory Surgery Centers Market By Specialty Insights

Orthopedics emerged as the dominant specialty segment in the ASC market across both the U.S. and Europe. Procedures such as arthroscopic repairs, joint replacements, and fracture fixations have transitioned from inpatient to outpatient settings due to minimally invasive techniques and improved anesthesia protocols. The orthopedic ASC model is particularly attractive due to high procedural volumes, significant cost savings, and predictable patient recovery timelines. In the U.S., the popularity of bundled payment models for joint replacements has further accelerated this shift. Europe is following suit, especially in Germany and the UK, where musculoskeletal surgeries account for a substantial share of elective procedures.

On the other hand, pain management and spinal injections are the fastest growing segment. The surge in chronic pain diagnoses, coupled with the opioid crisis, has led to increased demand for interventional pain therapies. ASCs provide an ideal setting for procedures like nerve blocks, epidural injections, and radiofrequency ablation, which are typically low-risk and require minimal recovery time. These services are being expanded not only by pain specialists but also by orthopedic and neurology practices collaborating with ASCs. Reimbursement support and a strong focus on non-pharmacological pain control have contributed to the rapid growth of this segment.

U.S. & Europe Ambulatory Surgery Centers Market By Ownership Insights

Physician-owned ASCs continue to dominate the market, particularly in the U.S. Physicians find ownership models appealing due to greater control over scheduling, staffing, and clinical decisions. These models also provide income diversification for surgeons and help improve care continuity. In Europe, countries like Spain and Italy are increasingly adopting this model as physicians seek alternatives to overburdened public systems. Physician-led ASCs tend to focus on high-efficiency, high-volume specialties like orthopedics, gastroenterology, and ophthalmology.

However, corporate-owned ASCs are growing at the fastest rate, largely due to private equity investment and hospital partnerships. Large U.S.-based healthcare groups like United Surgical Partners International (USPI), SCA Health, and HCA Healthcare are aggressively acquiring or establishing new ASCs. These entities benefit from economies of scale, centralized billing, and payer contracting leverage. In Europe, hospital networks and private investors are creating ASC chains to standardize quality and streamline operations. This trend signals increasing consolidation in the market, potentially reshaping the ownership dynamics.

U.S. & Europe Ambulatory Surgery Centers Market By Type Insights

Multi-specialty ASCs hold the largest market share due to their ability to serve diverse patient populations under one roof. These centers are designed to perform a wide range of procedures—from gastroenterology and ENT to ophthalmology and orthopedics. The versatility of multi-specialty ASCs enables better resource utilization, more efficient staffing, and higher patient throughput. They are particularly prevalent in metropolitan areas where patient volumes and physician group networks support broader service lines.

Nonetheless, single-specialty ASCs are gaining traction, especially in niche markets and high-demand areas. Ophthalmology and GI-focused centers, for example, offer specialized workflows, reduced overhead, and greater procedural efficiency. In the U.S., retina and cataract centers dominate the single-specialty landscape, while Europe is seeing an uptick in ENT and dermatologic surgical centers. These facilities can offer faster turnaround and patient-specific care models, contributing to their rapid growth.

U.S. & Europe Ambulatory Surgery Centers Market By Services Insights

Treatment services constitute the bulk of ASC operations, driven by the delivery of same-day surgical interventions such as cataract removal, hernia repairs, and orthopedic reconstructions. These services generate the majority of revenue due to procedural billing, high patient volume, and payer alignment. Both U.S. and European ASCs are structured primarily around surgical throughput, making treatment the dominant revenue contributor. Improvements in anesthesia, pain control, and recovery protocols have further enabled safe outpatient treatment of increasingly complex cases.

Diagnosis services, while traditionally limited, are gaining importance as ASCs expand their capabilities. Many ASCs now offer pre-surgical diagnostics such as endoscopy, colonoscopy, ultrasound, and imaging to streamline the patient journey. The integration of diagnostic labs and advanced imaging units within ASC facilities is being observed particularly in high-volume centers. This trend is likely to accelerate as value-based models incentivize early diagnosis and care coordination, especially for chronic and oncologic conditions.

Country Insights

United States

The U.S. is the global leader in ASC infrastructure, with over 5,000 operating facilities. CMS policies and commercial payer support have enabled the transition of multiple surgical procedures from inpatient settings to ASCs. Medicare’s ASC Payment System and annual updates to the Covered Procedures List have spurred volume growth. States such as Florida, Texas, and California lead in ASC density, while regulatory hurdles like CON laws affect penetration in others.

United Kingdom

The UK is investing heavily in outpatient surgery to reduce hospital burden. NHS England’s Elective Recovery Plan emphasizes same-day surgeries, with funding allocated for new surgical hubs and community diagnostic centers.

Germany

Germany’s ASC sector is expanding as part of broader healthcare reforms. The G-BA has allowed additional procedures to shift to outpatient settings, especially in orthopedics and ophthalmology.

France

France is cautiously adopting ASCs, primarily via public-private partnerships. Reimbursement reforms and surgical backlogs post-pandemic have created momentum for outpatient expansion.

Italy and Spain

Both countries are witnessing ASC growth in private healthcare networks. Orthopedic and ENT procedures are increasingly being outsourced to standalone centers.

Scandinavia (Sweden, Denmark, Norway)

These countries lead in innovation, leveraging ASCs within their publicly funded systems. Digital surgery suites, telemonitoring, and integrated care pathways are enhancing efficiency and outcomes.

Some of the prominent players in the U.S. & Europe ambulatory surgery centers market include:

- Envision Healthcare

- TH Medical

- Pediatrix Medical Group

- TeamHealth

- UnitedHealth Group

- QHCCS, LLC

- Surgery Partners

- SCA Health

- CHSPSC, LLC.

- HCA Management Services, L.P.

- SurgCenter

U.S. & Europe Ambulatory Surgery Centers Market Recent Developments

-

April 2025: United Surgical Partners International (USPI) announced the opening of four new multi-specialty ASCs in Texas and Ohio as part of its $300 million expansion plan.

-

March 2025: UK’s NHS launched a new partnership with private outpatient surgery providers to reduce wait times, particularly for cataract and hip replacement procedures.

-

February 2025: SCA Health entered a joint venture with a major orthopedic group in California to develop three single-specialty ASCs focusing on spine and joint surgeries.

-

January 2025: Germany's Helios Kliniken Group acquired two regional ambulatory surgical centers to expand its outpatient portfolio.

-

December 2024: France-based Ramsay Santé launched its pilot ASC project in Paris to trial outpatient ENT and gynecology surgeries with full digital pre-op tracking.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. & Europe ambulatory surgery centers market

By Specialty

- Orthopedics

- Pain Management/Spinal Injections

- Gastroenterology

- Ophthalmology

- Plastic Surgery

- Otolaryngology

- Obstetrics/Gynecology

- Dental

- Podiatry

- Others

By Ownership

- Physician Owned

- Hospital Owned

- Corporate Owned

By Type

- Single-Specialty

- Multi-Specialty

By Services

By Country

-

- UK

- Germany

- France

- Italy

- Spain

- Norway

- Sweden

- Denmark