U.S. And Europe Digital Pathology Market Size and Research

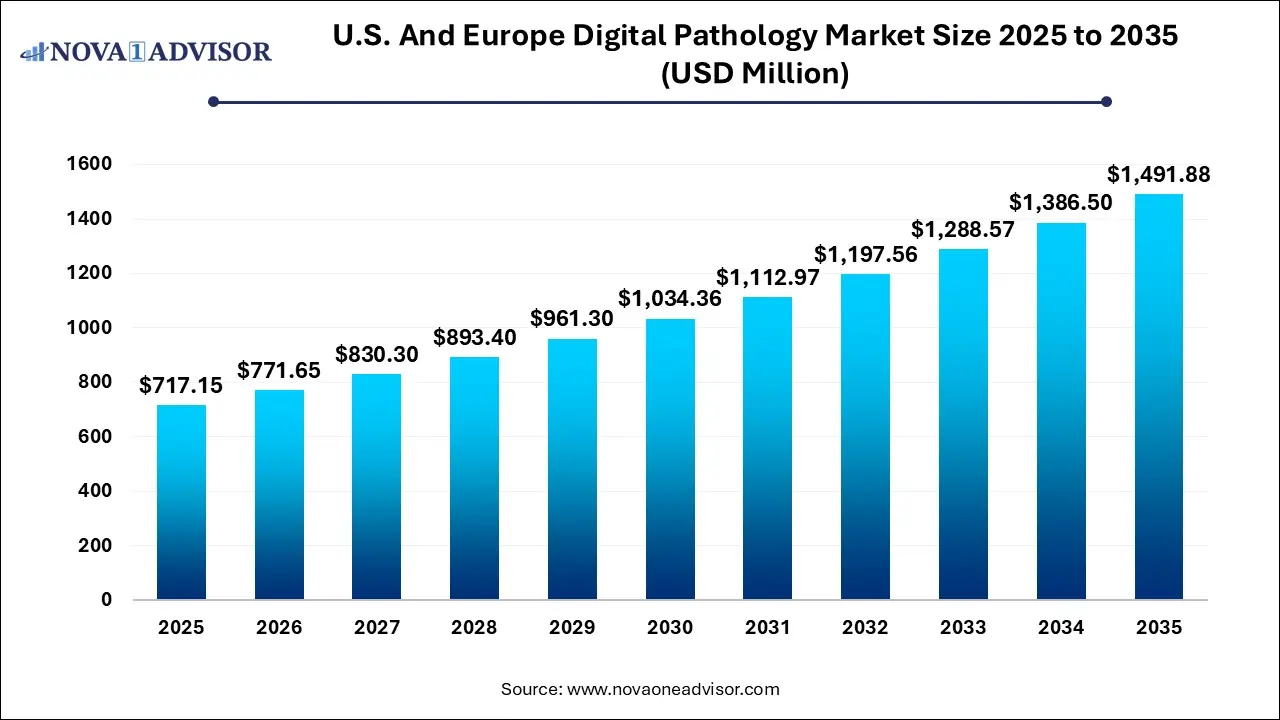

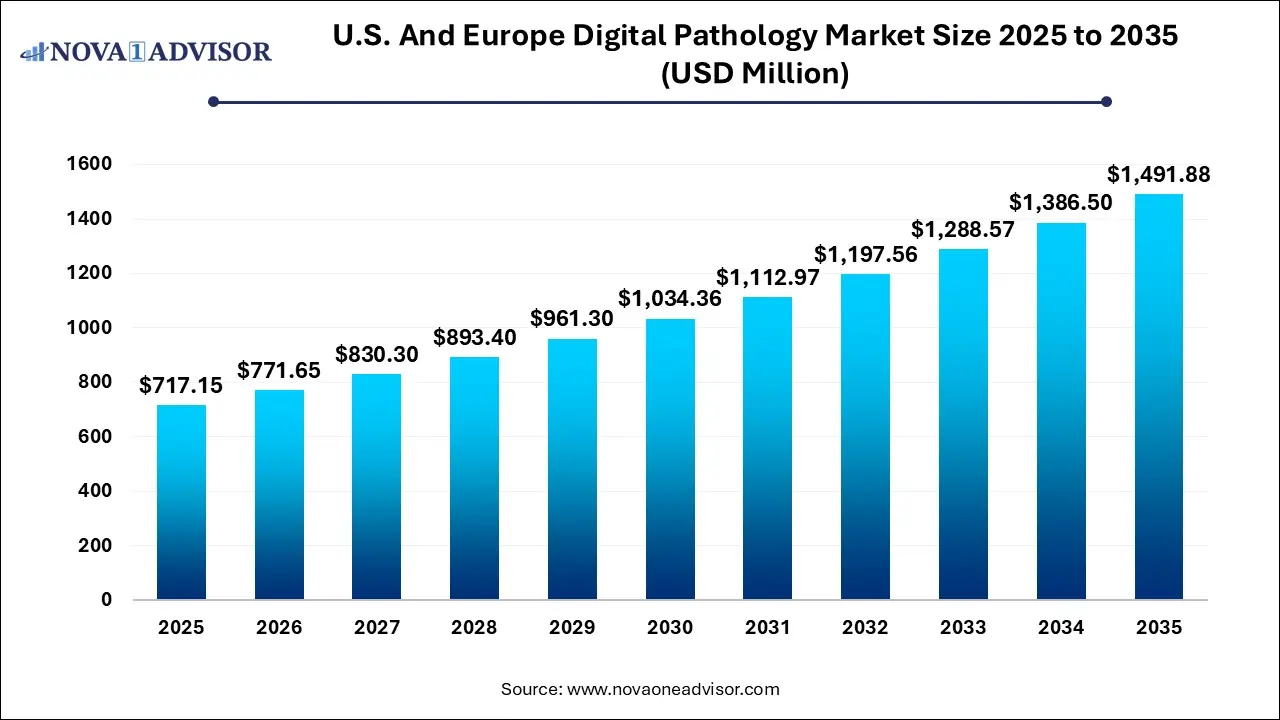

The U.S. and Europe digital pathology market size was exhibited at USD 717.15 million in 2025 and is projected to hit around USD 1,491.88 million by 2035, growing at a CAGR of 7.6% during the forecast period 2026 to 2035.

U.S. And Europe Digital Pathology Market Key Takeaways:

- In 2025, the device segment accounted for the largest market share of 53%.

- In 2025, the academic research segment accounted for the majority of the market share of 46.8%.

- The disease diagnosis segment is anticipated to grow at the fastest CAGR of 7.6% from 2026 to 2035.

- In 2025, the hospital segment accounted for the largest market share of 37.7%.

- The U.S. market held the largest share of 57.3% in 2025 and is anticipated to expand further at a considerable CAGR over the forecast period.

Market Overview

The U.S. and Europe digital pathology market represents one of the fastest-evolving segments in the healthcare diagnostics landscape. Digital pathology the process of digitizing glass slide specimens using high-resolution scanners and analyzing them using software tools is transforming the practice of pathology from a static, manual discipline into a dynamic, data-driven science.

With the growing demand for efficient diagnostics, remote access to pathology slides, AI-based interpretation, and integrated healthcare IT systems, digital pathology is rapidly gaining traction across research, clinical, and pharmaceutical applications. It enables pathologists and researchers to view, analyze, and share whole slide images (WSIs) in real time, facilitating faster and more consistent diagnostic workflows.

Both the U.S. and Europe are at the forefront of this technological revolution, with well-established healthcare infrastructure, strong academic research ecosystems, and supportive regulatory frameworks. These regions are seeing growing adoption among biotech and pharmaceutical companies for drug development, academic institutes for collaborative research, and diagnostic labs for clinical decision-making.

Factors such as the shortage of trained pathologists, growing cancer incidence, and demand for high-throughput diagnostics have accelerated the shift from analog to digital pathology. The convergence of cloud computing, artificial intelligence (AI), and machine learning (ML) has added new dimensions to pathology, enabling predictive diagnostics, image-based phenotyping, and biomarker discovery.

Market Outlook

- Market Growth Overview: The U.S. and Europe digital pathology market is expected to grow significantly between 2025 and 2034, driven by the enhanced diagnostics, screening for drug development and cancer research, and integration of AI for automated image analysis.

- Sustainability Trends: Sustainability trends involve the reduction of physical waste and transport, improved operational efficiency and resource utilization, and adoption of cloud-based platforms.

- Major Investors: Major investors in the market include Danaher Corporation, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd., PerkinElmer Inc., and Hamamatsu Photonics K.K.

- Startup Economy: The startup economy is focused on developing sophisticated AI-powered software, integration of digital pathology solutions, and strong partnerships.

Impact of AI on the U.S. And Europe Digital Pathology Market?

AI is profoundly impacting the U.S. and European digital pathology markets by significantly enhancing diagnostic accuracy and streamlining lab workflows. Algorithms automate routine and time-consuming tasks like cell counting and preliminary case review, allowing pathologists to concentrate on complex cases and high-level decision-making.

This integration enables faster turnaround times, addresses a systemic shortage of pathologists, and facilitates remote consultations and multi-institutional collaboration via telepathology. Both regions are experiencing substantial investment and the emergence of a robust ecosystem of AI solutions, though challenges related to high implementation costs, regulatory frameworks, and data privacy must still be navigated for widespread adoption.

Major Trends in the Market

- Growing Adoption of Telepathology and Remote Solutions

The need for remote diagnostics and accelerated telepathology is a mainstream solution, especially for accessing subspecialty expertise in underserved or rural areas. This allows pathologists to review cases, consult with peers, and offer expert opinions without the physical transfer of glass slides, thereby reducing logistics and turnaround times.

- Shift Towards Cloud-Based Platforms and Interoperability

Cloud-based solutions are expanding rapidly as they offer scalable storage for massive whole-slide images (WSIs), enhance data security (adhering to regulations like HIPAA and GDPR), and facilitate seamless, cross-institutional collaboration.

- Increasing Role in Personalized Medicine and Drug Discovery

Digital pathology plays a crucial role in the development of companion diagnostics and personalized therapies, enabling quantitative tissue analysis and biomarker detection for targeted treatments.

- Supportive Regulatory Environment and Government Initiatives

Regulatory bodies in both regions are actively supporting the adoption of digital pathology. The U.S. FDA has provided multiple clearances for WSI for primary diagnosis, while European initiatives, such as the EU's BigPicture platform and national NHS programs, are funding and promoting the use of AI and digital infrastructure for cancer diagnosis and research.

Report Scope of U.S. And Europe Digital Pathology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 771.65 Million |

| Market Size by 2035 |

USD 1,491.88 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 7.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Germany; UK; France; Italy; Spain; Russia; Switzerland; The Netherlands |

| Key Companies Profiled |

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corp.; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; Owkin; Lunit; Tempus Labs; DeepBio |

Market Driver: Rising Demand for Accurate and Rapid Cancer Diagnostics

A key driver of the U.S. and European digital pathology market is the growing incidence of cancer and the need for rapid, accurate histopathological diagnosis. Cancer remains a leading cause of death in both regions, and accurate diagnosis is essential for determining effective treatment strategies.

Traditional pathology workflows rely heavily on manual slide examination, which can be time-consuming and subject to human variability. Digital pathology enables standardized image interpretation, immediate sharing with subspecialists, and AI-assisted screening, which significantly improves diagnostic speed and consistency.

In countries like the U.S., breast and prostate cancers are among the most commonly diagnosed types, requiring extensive pathology input. Europe, with aging populations in Germany, Italy, and France, also faces high oncology workloads. Digital pathology streamlines multi-disciplinary tumor boards and reduces diagnosis delays, particularly in centralized lab models or cross-border consultations.

Market Restraint: High Capital Investment and IT Integration Challenges

Despite its benefits, a prominent restraint is the high upfront cost of implementing digital pathology systems, which includes investments in high-resolution scanners, software licenses, servers, cloud storage, and training. This limits adoption in smaller hospitals, community pathology labs, and underfunded research institutions.

Additionally, successful deployment requires seamless integration with hospital electronic medical records (EMR), laboratory information systems (LIS), and PACS systems. Many legacy systems lack compatibility, and customization can be costly and time-intensive.

Data storage is another challenge, as WSIs are massive in size (hundreds of MB per slide), requiring scalable storage and data security solutions. Compliance with HIPAA in the U.S. and GDPR in Europe also requires advanced data protection infrastructure, which not all facilities are equipped to handle.

A compelling opportunity lies in the integration of AI algorithms and companion diagnostics within digital pathology platforms. Machine learning models can detect patterns, quantify biomarkers, and assist in grading tumors or identifying mitotic figures with higher accuracy than the human eye in certain tasks.

Pharmaceutical companies and academic researchers are increasingly using digital pathology to support drug response prediction, patient stratification, and translational research. The FDA and European Medicines Agency (EMA) are now approving AI-assisted platforms for clinical use, broadening the scope of AI-driven pathology.

Moreover, as personalized medicine and targeted therapies become mainstream, digital pathology plays a critical role in companion diagnostics, linking histopathological features to genomic or proteomic profiles. This trend is encouraging partnerships between pathology AI firms, pharma companies, and diagnostic labs, creating a robust ecosystem for innovation.

U.S. And Europe Digital Pathology Market By Product Insights

Software led the market due to its central role in managing, analyzing, and sharing digital pathology images. This segment includes image management systems (IMS), image analysis software, AI-based diagnostic tools, and cloud-based pathology platforms. The versatility and scalability of software solutions make them indispensable across academic, clinical, and industrial use cases.

Modern software platforms are often equipped with AI algorithms, case management workflows, annotation tools, and decision support systems, making them powerful tools for diagnostic pathologists and researchers alike. Moreover, software’s subscription-based models allow labs to scale usage based on demand, further expanding market accessibility.

Storage systems are experiencing rapid growth, driven by the surge in whole slide image acquisition and the need for compliant data archiving. Digital pathology generates terabytes of data per lab annually, especially in large-scale research trials or when implementing AI training datasets.

Hospitals and research labs increasingly prefer cloud-based or hybrid storage solutions that offer data redundancy, fast retrieval, and secure access. Additionally, compliance with regulations like GDPR and HIPAA makes data encryption and traceability crucial, increasing the demand for advanced medical-grade storage infrastructure.

U.S. And Europe Digital Pathology Market By Application Insights

Disease diagnosis was the leading application in the U.S. and Europe, driven by the integration of digital pathology into routine clinical workflows. With cancer, autoimmune disorders, and infectious diseases requiring biopsy-based confirmation, digital slide review offers time-saving and diagnostic consistency advantages.

In clinical labs and hospitals, digital pathology supports faster turnaround times, second opinions, subspecialty reviews, and integration into multi-disciplinary teams (MDTs). It is especially beneficial for cases requiring urgent review or geographical flexibility, allowing expert consultation across institutions.

Drug discovery and development is the fastest-growing application, largely due to the pharmaceutical industry’s increasing reliance on pathology biomarkers in preclinical and clinical research. Digital pathology supports quantitative tissue analysis, spatial biomarker detection, and standardized scoring for histopathological endpoints.

CROs and pharma companies use these tools to evaluate drug efficacy, identify target expression, and correlate histology with omics data, often across multi-site trials. The ability to analyze slides remotely and archive them digitally significantly enhances trial efficiency and reproducibility.

U.S. And Europe Digital Pathology Market By End-use Insights

Diagnostic labs are the largest users of digital pathology solutions in both regions. National reference labs, cancer centers, and private pathology groups deploy digital pathology to reduce diagnostic bottlenecks, enable telepathology, and centralize workflows.

High sample throughput, need for remote collaboration, and value-based care mandates are pushing these labs to digitize operations. Additionally, many labs are expanding into AI-guided diagnostics and quality control systems to maintain consistency across pathologists and improve outcome reliability.

Academic and research institutes are the fastest-growing user group, driven by investments in digital transformation and translational research. Digital pathology enables collaborative, multi-center studies, global data sharing, and AI model development.

Institutes such as Dana-Farber Cancer Institute (U.S.), Charité University Hospital (Germany), and Institut Curie (France) are partnering with tech companies to develop AI-enabled teaching libraries, digital slide atlases, and training datasets for pathology residents and AI algorithm development.

Country-Level Analysis

United States

The U.S. leads the digital pathology market globally, backed by early FDA approvals, a large network of academic medical centers, and significant venture capital investment in digital health. U.S.-based institutions are integrating digital pathology in tumor boards, precision medicine programs, and AI-powered diagnostics.

The pandemic accelerated regulatory acceptance, with the FDA granting multiple Emergency Use Authorizations (EUAs) for remote pathology systems. Leading labs like Mayo Clinic, Cleveland Clinic, and Memorial Sloan Kettering have adopted whole slide imaging at scale.

Germany

Germany is a key player in the European market, supported by advanced hospital networks, pathology digitization mandates, and robust funding for AI research. The government-backed Digital Healthcare Act (DVG) has accelerated investments in medical digitization, including pathology labs.

Institutions such as Heidelberg University Hospital and Charité Berlin are pioneers in digital pathology and are often involved in multi-country AI pathology consortia such as EUCAIM and BigPicture.

U.S. And Europe Digital Pathology Market Companies

- Leica Biosystems (Danaher): Offers comprehensive solutions from scanners to software, driving integrated digital pathology workflows in labs and research.

- Hamamatsu Photonics: Provides high-quality digital slide scanners and imaging tech, crucial for capturing accurate whole slide images (WSIs).

- Koninklijke Philips N.V.: A major player in digital pathology platforms, offering scanners and enterprise software for clinical and research use.

- Olympus Corporation: Contributes microscopes and digital imaging systems, expanding access to digital workflows in traditional microscopy.

- F. Hoffmann-La Roche Ltd.: Develops software (like uPath) and integrates AI, streamlining workflows and enhancing diagnostics in clinical settings.

- Mikroscan Technologies, Inc.: Focuses on digital slide scanners and image management, providing essential hardware for digital labs.

- Inspirata, Inc.: Offers digital pathology solutions, including image management and AI-driven tools for cancer diagnostics.

- Epredia (3DHISTECH Ltd.): Provides scanners, software, and integrated systems, particularly strong in Europe with its 3DHISTECH acquisition.

- Visiopharm A/S: A leading AI & image analysis software company, enabling automated quantitative pathology for research and clinical trials.

- Huron Technologies International Inc.: Focuses on AI-powered analysis, enhancing research and drug development with advanced computational pathology.

- ContextVision AB: Develops AI software, especially for real-time image analysis, improving diagnostic accuracy.

- Owkin: A federated learning AI company, enabling collaborative research on large datasets without sharing sensitive patient data.

- Lunit: An AI company providing deep learning solutions for cancer detection and prediction, driving AI adoption in pathology.

- Tempus Labs: Integrates clinical and molecular data with AI, offering comprehensive oncology insights through digital pathology.

- DeepBio: An AI company offering solutions for cancer pathology, enhancing diagnostic efficiency and precision.

Recent Developments

-

April 2025 – Philips launched its next-generation IntelliSite Pathology Solution with enhanced AI analytics, focusing on breast and prostate cancer grading.

-

March 2025 – Paige.AI announced a partnership with Dana-Farber Cancer Institute to develop an AI platform for lymphoma pathology diagnosis using WSIs.

-

February 2025 – Roche expanded its cloud-based uPath image management system in Europe, enabling cross-institutional pathology data sharing.

-

January 2025 – Proscia partnered with the Netherlands Cancer Institute to deploy AI pathology tools in clinical workflows under a new pilot program.

-

December 2024 – Visiopharm announced CE-mark approval for its AI-based lung cancer diagnostic module, integrated with several European labs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. and Europe digital pathology market

By Product

- Software

- Device

- Storage System

By Application

- Drug Discovery & Development

- Academic Research

- Disease Diagnosis

By End-use

- Software

- Biotech & Pharma Companies

- Diagnostic Labs

- Academic & Research Institutes

By Regional

-

- UK

- Germany

- France

- Italy

- Russia

- Spain

- The Netherlands

- Switzerland

- Sweden