U.S. Anti-snoring Devices And Snoring Surgery Market Size and Growth

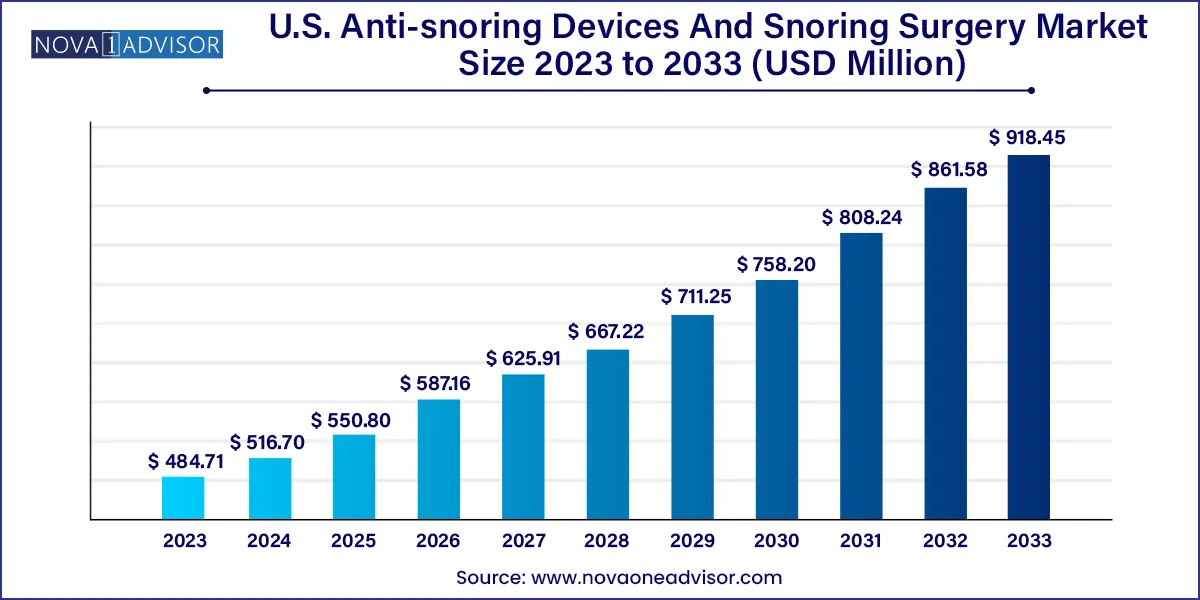

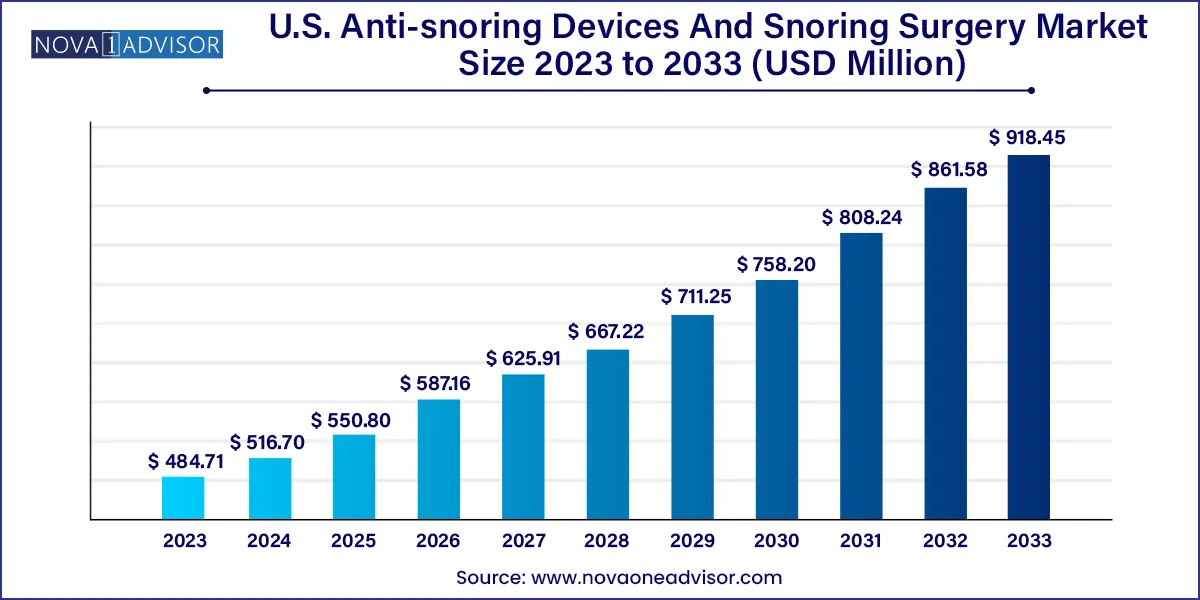

The U.S. anti-snoring devices and snoring surgery market size was exhibited at USD 484.71 million in 2023 and is projected to hit around USD 918.45 million by 2033, growing at a CAGR of 6.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- Based on type, oral appliances/mouthpieces dominated the market, with the highest market share in 2023.

- EPAP therapy devices will be the second leading segment in terms of revenue in 2023.

Market Overview

Snoring is often dismissed as a mere nuisance, but in reality, it represents a widespread and medically significant concern for millions across the United States. It not only disrupts the sleep of individuals but also impacts partners, leading to decreased sleep quality and increased health risks. At its core, snoring is a symptom of obstructed airflow during sleep, often indicative of underlying conditions such as Obstructive Sleep Apnea (OSA). The rise in lifestyle-related health issues, growing awareness about sleep health, and the increasing demand for non-invasive treatment alternatives have together fueled the expansion of the U.S. anti-snoring devices and snoring surgery market.

This market consists of a wide range of solutions—ranging from simple, over-the-counter nasal strips to custom-fitted oral appliances and advanced surgical procedures. With modern consumers taking a more proactive stance on wellness, the preference for home-based, tech-integrated solutions is rising. Simultaneously, for severe or chronic snoring—often resistant to conservative approaches—surgical interventions remain a critical recourse. These include uvulopalatopharyngoplasty (UPPP), radiofrequency ablation, and other minimally invasive surgeries aimed at correcting anatomical blockages in the airway.

Increasing acceptance of medical-grade sleep solutions by consumers and improved accessibility through online platforms and retail stores have collectively transformed the market. What was once a niche segment limited to medical sleep clinics has now evolved into a hybrid consumer-medical model, paving the way for innovation, affordability, and mass adoption.

Major Trends in the Market

-

Miniaturization and Design Innovation: Anti-snoring devices are becoming smaller, more comfortable, and discreet, enabling all-night wear with minimal discomfort.

-

Rise of Over-the-Counter (OTC) Sleep Aids: Devices such as nasal dilators, chin straps, and position-control pillows are increasingly available without prescription, appealing to price-sensitive consumers.

-

AI-Enabled Smart Devices: Integration of artificial intelligence and sensors in wearable devices that detect snoring patterns and autonomously adjust to prevent them.

-

Digital Health Integration: Apps and cloud-connected platforms that provide feedback on sleep quality and snoring frequency are gaining popularity, especially among millennials and Gen Z.

-

Shift Toward Customization: Bespoke oral appliances that are 3D printed and custom-fitted based on digital mouth scans are replacing traditional one-size-fits-all models.

-

Surgical Advancements: Minimally invasive surgical techniques with quicker recovery and higher success rates are becoming more acceptable among patients with chronic snoring or sleep apnea.

-

Increased Male Participation: Historically underreported, more men are now seeking snoring treatments, encouraged by workplace wellness programs and family health awareness.

-

Direct-to-Consumer (DTC) Marketing: Brands are investing in influencer partnerships and social media campaigns to educate consumers and reduce stigma around snoring.

Report Scope of The U.S. Anti-snoring Devices And Snoring Surgery Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 516.70 Million |

| Market Size by 2033 |

USD 918.45 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Ocular Therapeutix Inc.; SomnoMed Ltd.; Airway Management, Inc.; Resmed Inc.; Fisher & Paykel Healthcare Corp. Ltd.; Koninklijke Philips NV; Sleep Well Enjoy Life, Ltd.; Tomed Dr. Toussaint GmbH; MEDiTAS Ltd. |

Key Market Driver: Increased Focus on Sleep Health and Quality of Life

One of the foremost drivers of this market is the growing public consciousness about sleep as a foundational pillar of health. Sleep is no longer viewed as a passive state but as an active contributor to physical and mental well-being. The increasing popularity of sleep tracking devices, wellness content on social media, and corporate wellness initiatives has made the average consumer far more aware of the dangers of poor sleep snoring being a leading cause.

People experiencing chronic snoring are often unaware of the serious implications, including cardiovascular risks, fatigue-related accidents, impaired concentration, and depression. As consumer health education improves through campaigns, medical endorsements, and even television advertising, individuals are more likely to seek both diagnosis and treatment. This cultural shift is compelling even insurance providers and employers to include sleep-related services in their wellness coverage. Consequently, the demand for non-invasive devices as well as surgical correction procedures is steadily rising.

Despite increasing awareness, one of the critical barriers in this market remains the underdiagnosis of sleep disorders. A significant number of individuals suffering from habitual snoring or mild sleep apnea do not seek medical consultation, either due to embarrassment, lack of awareness, or the misconception that snoring is harmless. This leads to self-diagnosis and reliance on generic, often ineffective, solutions.

Moreover, navigating the healthcare system for snoring-related complaints can be complex. Patients must often consult multiple specialists ENT doctors, sleep therapists, and dentists for a proper diagnosis and treatment plan. This fragmented care pathway acts as a deterrent for patients, especially when treatment options require follow-ups, fittings, or long-term commitment. In addition, affordability and perceived inconvenience continue to delay early intervention, particularly in underserved and rural communities.

Key Market Opportunity: Consumer Shift Toward Home-Based, Connected Devices

A golden opportunity lies in the continued development of smart, user-friendly, home-based anti-snoring devices. As remote care becomes a central tenet of modern healthcare, the ability to offer accurate, comfortable, and effective solutions that don’t require clinical oversight is invaluable. Devices integrated with mobile applications that track snoring frequency, intensity, and sleep quality provide real-time feedback, motivating users to adhere to treatment.

The appeal of home-based interventions is highest among working professionals and caregivers demographics seeking minimal disruption to their daily lives. Furthermore, with an aging population increasingly seeking non-surgical options, manufacturers have a clear opportunity to innovate in this direction. Whether through wearable oral devices, positional therapy belts, or nasal valves equipped with monitoring sensors, this trend is poised to lead the market over the next decade.

U.S. Anti-snoring Devices And Snoring Surgery Market By Type Insights

Oral Appliances/Mouthpieces Dominated the Market

Oral appliances, particularly mandibular advancement devices (MADs), currently hold the lion’s share in the U.S. anti-snoring devices market. These devices are widely used to reposition the lower jaw forward, thereby increasing airway space and reducing tissue vibration responsible for snoring. Many of these devices are dentist-prescribed, custom-fitted for comfort, and have demonstrated effectiveness in both primary snoring and mild obstructive sleep apnea cases. Consumers appreciate the balance they offer between comfort, affordability, and clinical efficacy.

Moreover, oral appliances are often preferred by patients who cannot tolerate CPAP machines due to noise, discomfort, or mobility issues. With increasing dental collaborations and technological enhancements in dental imaging and 3D printing, custom oral appliance production has become faster and more precise. This segment continues to expand in urban and suburban areas where access to dental sleep specialists is readily available.

EPAP Therapy Devices Are the Fastest-Growing Segment

Expiratory Positive Airway Pressure (EPAP) therapy devices represent a newer and rapidly growing segment of the market. Unlike traditional devices, EPAP devices are small, single-use valves placed over the nostrils that create back pressure during exhalation. This keeps the airway open and prevents snoring without the need for mechanical power or bulk.

These devices appeal especially to frequent travelers, athletes, and patients with mild to moderate snoring issues who seek a discreet and portable solution. Innovations in adhesive technology and airflow resistance calibration have improved comfort and consistency. Additionally, this segment benefits from strong word-of-mouth promotion due to its simplicity and relatively low cost. As manufacturers expand product trials and optimize designs, EPAP therapy devices are expected to register the highest compound annual growth rate in the forecast period.

Country-Level Analysis: United States

The U.S. market for anti-snoring devices and surgical procedures is both mature and highly segmented. Urban areas like New York, Los Angeles, and Chicago show higher penetration of premium and customized anti-snoring devices, especially among tech-savvy professionals and health-conscious millennials. These regions benefit from the availability of sleep clinics, dental sleep medicine practices, and cosmetic surgical centers.

Meanwhile, suburban and semi-rural regions demonstrate increasing adoption of over-the-counter devices sold through retail chains and online platforms. The ease of access, combined with direct-to-consumer marketing campaigns, has driven growth in these zones, especially for nasal dilators, chin straps, and mouthguards.

The Southern states, with higher obesity rates and related respiratory complications, are witnessing an uptick in surgical interventions and physician-supervised treatments. Telemedicine, driven by regulatory relaxation post-pandemic, is helping bridge the gap in specialist access, thereby improving rural market engagement. Furthermore, employer-sponsored wellness programs in corporate hubs are encouraging routine sleep assessments, leading to higher diagnosis rates and device prescriptions.

Some of the prominent players in the U.S. anti-snoring devices and snoring surgery market include:

- Ocular Therapeutix Inc.

- SomnoMed Ltd.

- Airway Management, Inc.

- Resmed In

- Fisher & Paykel Healthcare Corp. Ltd.

- Koninklijke Philips NV

- Sleep Well Enjoy Life, Ltd.

- Tomed Dr. Toussaint GmbH

- MEDiTAS Ltd.

Recent Developments

-

January 2025 – SomnoMed Inc., a leading manufacturer of oral appliances, announced the launch of a fully digital workflow for sleep dentists, integrating 3D scanning, cloud-based case submissions, and AI-powered design to reduce production times for custom-fitted devices.

-

March 2025 – SnoreLab, a mobile app specializing in sleep and snore tracking, partnered with a U.S.-based medical device firm to launch a hybrid solution that combines smartphone analytics with nasal valve therapy.

-

February 2025 – SilentNite Solutions, a growing player in chin strap design, released its “GenX Strap,” made from ultra-light, hypoallergenic materials, targeting young adults and travelers with mild snoring.

-

April 2025 – A group of sleep surgeons in California, operating under the SleepAir Network, reported a 40% increase in demand for radiofrequency-assisted uvula reduction procedures among men aged 35–50, citing improved patient outcomes and low recovery times.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. anti-snoring devices and snoring surgery market

Type

- Oral appliances/Mouthpieces

- Nasal Devices

- Position Control Devices

- Chin Straps

- Tongue Stabilizing Devices

- EPAP Therapy Devices