U.S. Aseptic Connectors And Welders Market Size and Trends

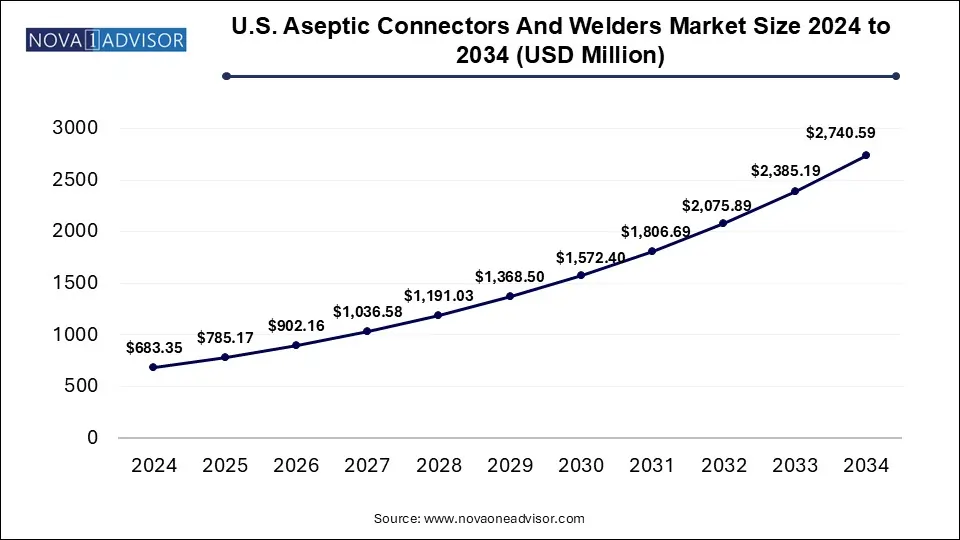

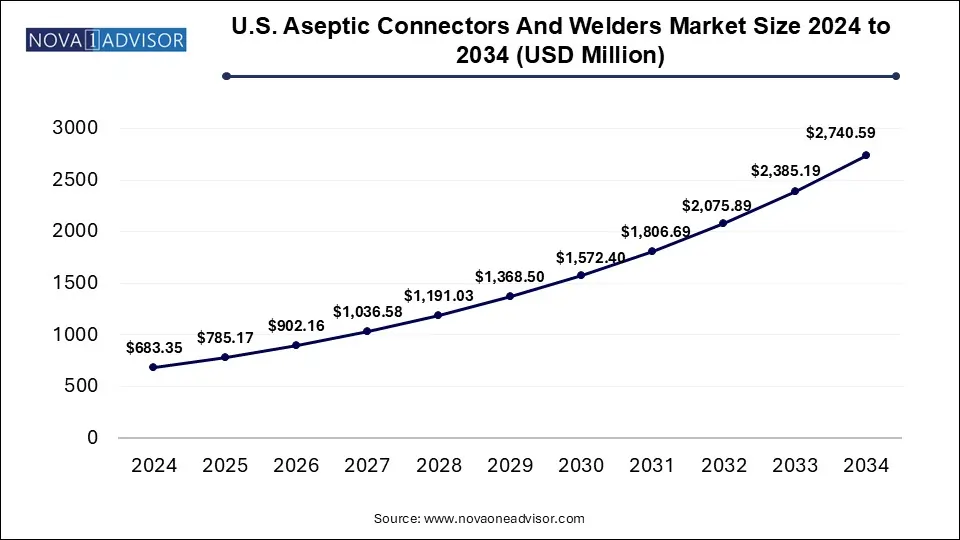

The U.S. Aseptic Connectors And Welders Market size was exhibited at USD 683.35 million in 2024 and is projected to hit around USD 2,740.59 million by 2034, growing at a CAGR of 14.9% during the forecast period 2025 to 2034.

Key Takeaways:

- The aseptic connectors segment dominates the U.S. aseptic connectors and welders industry, holding the largest market share in 2024.

- The aseptic welders segment is expected to register a significant CAGR over the forecast period.

- The upstream bioprocessing segment held the largest revenue market share at 45% in 2024.

- The downstream bioprocessing segment is expected to expand at the fastest CAGR during the forecast period

- The OEMs segment dominated the U.S. aseptic connectors and welders industry in 2024, accounting for the highest revenue share of 47%.

- The CROs (Contract Research Organizations) and CMOs (Contract Manufacturing Organizations) segment is anticipated to grow at the fastest CAGR of 14.95% throughout the forecast period.

Market Overview

The U.S. aseptic connectors and welders market has emerged as a critical segment in the biopharmaceutical and pharmaceutical manufacturing ecosystem. The need for sterile, contamination-free fluid transfer systems is growing rapidly, driven by the increasing adoption of single-use technologies and the demand for scalable production processes. Aseptic connectors and welders play a pivotal role in ensuring sterility during upstream and downstream bioprocessing as well as harvest and fill-finish operations.

In recent years, biopharmaceutical companies in the U.S. have significantly ramped up investments in biologics, vaccines, and cell & gene therapy production. This trend has necessitated more advanced fluid management systems that minimize cross-contamination risk. Aseptic connectors, including genderless variants, barbed fittings, and luer locks, are being widely adopted due to their ease of use and compatibility with various tubing sizes such as 1/16 inch, 1/4 inch, and 3/8 inch. Similarly, aseptic welders have become indispensable in sterile welding operations, allowing closed-system transfers that maintain process integrity.

The market is characterized by technological innovations, strategic partnerships between OEMs and contract manufacturers (CMOs), and a growing preference for modular bioprocessing facilities. These factors combined are propelling the market toward robust growth through 2034.

Major Trends in the Market

-

Increased Adoption of Genderless Connectors: Manufacturers are focusing on genderless aseptic connectors to simplify connections and reduce training requirements.

-

Shift Toward Single-use Systems: The rise of single-use technologies in biomanufacturing drives demand for aseptic connectors and welders.

-

Integration of Automation in Welding Systems: Automated aseptic welders are gaining popularity for their precision and consistency.

-

Focus on Large-scale Biologics Production: The U.S. market is experiencing heightened demand due to increasing biologics and biosimilars manufacturing.

-

Regulatory Push for Enhanced Sterility Assurance: Stricter FDA guidelines encourage the adoption of closed-system fluid transfer technologies.

Report Scope of U.S. Aseptic Connectors And Welders Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 785.17 Million |

| Market Size by 2034 |

USD 2,740.59 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 14.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., Pall Corporation (part of Danaher Corporation), Merck Millipore (MilliporeSigma in the U.S.), Sartorius Stedim Biotech, Saint-Gobain Life Sciences, CPC (Colder Products Company), GE Healthcare Life Sciences, Parker Hannifin Corporation, Entegris Inc., Watson-Marlow Fluid Technology Solutions |

Key Market Driver

Growing Demand for Biopharmaceutical Production

The single most significant driver for the U.S. aseptic connectors and welders market is the escalating demand for biopharmaceutical production, particularly for complex biologics and personalized therapies. As biologics become a dominant segment of new drug approvals, manufacturers face heightened challenges to maintain sterility across all stages of production. The production of monoclonal antibodies, vaccines, and cell & gene therapies requires highly controlled environments where any contamination can lead to batch failures costing millions.

This demand has resulted in widespread implementation of closed-system aseptic transfer solutions, such as genderless connectors and automated welders, to mitigate contamination risks. Companies like Thermo Fisher Scientific and Pall Corporation are leading this shift by introducing products designed for seamless integration into single-use bioreactor systems. For instance, the increased focus on CAR-T cell therapies necessitates sterile fluid transfer between culture and storage systems, making aseptic connectors and welders indispensable.

Key Market Restraint

High Initial Costs and Validation Requirements

A significant restraint facing the market is the high initial cost associated with aseptic connectors and welders. Although these systems reduce long-term contamination risks and operational costs, their upfront investment remains a hurdle, particularly for small-scale manufacturers and academic research facilities. Furthermore, integrating these systems into existing manufacturing lines requires extensive validation processes to meet FDA and cGMP (current Good Manufacturing Practices) requirements.

This validation can be both time-consuming and resource-intensive, often delaying deployment timelines. Smaller companies or start-ups in the U.S. bioprocessing sector may hesitate to adopt these solutions due to the perceived financial and operational burdens, despite their long-term benefits.

Key Market Opportunity

Expansion of Cell and Gene Therapy Manufacturing

One of the most promising opportunities for market growth lies in the rapid expansion of cell and gene therapy manufacturing facilities across the U.S. These advanced therapies demand highly sterile environments and flexible manufacturing solutions. Aseptic connectors and welders are well-positioned to meet these requirements by enabling closed-system transfers and reducing manual intervention.

Recent investments by companies such as Lonza and WuXi AppTec into U.S.-based cell therapy production facilities highlight this trend. These facilities often rely on modular, single-use bioprocessing systems that require aseptic connection and welding solutions for scalability and sterility. As the pipeline for advanced therapies grows, the demand for high-performance aseptic connectors and welders is expected to surge.

Segmental Analysis

By Product Outlook

Aseptic Connectors Dominate the Market

Aseptic connectors account for the largest share of the U.S. market, thanks to their widespread use across multiple stages of bioprocessing. Within this category, genderless connectors are emerging as a preferred choice due to their simplified design, which reduces operator error and training time. The luer lock sub-segment remains significant, especially in smaller-scale operations, while barbed fittings continue to find use in legacy systems. The demand for connectors compatible with various tubing sizes, including 1/16 inch and 1/4 inch, underscores the need for versatility in bioprocessing applications.

Fastest Growth in Aseptic Welders

While aseptic connectors currently dominate, aseptic welders are witnessing the fastest growth rate. This growth is fueled by the push for automation in fluid transfer processes, particularly in high-volume manufacturing settings. Automated aseptic welders provide secure, consistent welds that maintain closed-system integrity, making them essential in large-scale biopharmaceutical production. Companies are investing in advanced welding systems to support high-throughput operations, especially in facilities producing monoclonal antibodies and viral vectors.

By Application Outlook

Upstream Bioprocessing Leads the Market

Upstream bioprocessing applications, such as media preparation, cell inoculation, and cell expansion, account for the largest market share. The complexity and sterility demands of these processes make aseptic connectors and welders indispensable. Genderless connectors are often employed in media preparation, while automated welders support cell expansion by enabling sterile fluid transfers between bioreactors and storage vessels.

Harvest & Fill-finish Operations Drive Growth

Harvest and fill-finish operations are projected to grow at the fastest pace within the application segment. The need for sterility during product collection, filtration, and product filling steps drives the adoption of aseptic connectors and welders. With the rise of advanced therapies requiring small batch production, there is increased emphasis on maintaining sterility during final fill-finish processes to prevent product loss.

By End-use Outlook

Biopharmaceutical & Pharmaceutical Companies Dominate

Biopharmaceutical and pharmaceutical companies remain the dominant end-users in the U.S. aseptic connectors and welders market. These companies are heavily investing in single-use bioprocessing systems, with aseptic fluid transfer solutions forming a critical component of their manufacturing workflows. The increased production of biologics and biosimilars underscores their reliance on sterile transfer technologies.

CROs & CMOs to See Rapid Growth

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are expected to be the fastest-growing end-user segment. The outsourcing trend in biopharmaceutical manufacturing has led to the establishment of modular and flexible facilities by CROs and CMOs, which require advanced aseptic connectors and welders to accommodate a wide range of client projects.

Country-level Analysis: United States

The U.S. holds a leading position in global biopharmaceutical manufacturing, with a strong presence of both large-scale production facilities and innovative start-ups. The adoption of aseptic connectors and welders is driven by the high concentration of biologics manufacturers and an increasing focus on advanced therapies such as CAR-T and gene therapies.

Regulatory agencies like the FDA have stringent sterility requirements, further pushing manufacturers to adopt advanced aseptic technologies. States such as Massachusetts, California, and North Carolina, with dense clusters of biopharma companies, are leading in adopting these technologies. Recent investments in biomanufacturing capacity expansion across these states highlight a promising growth trajectory for the market.

Some of The Prominent Players in The U.S. Aseptic Connectors And Welders Market Include:

- Thermo Fisher Scientific Inc.

- Pall Corporation (part of Danaher Corporation)

- Merck Millipore (MilliporeSigma in the U.S.)

- Sartorius Stedim Biotech

- Saint-Gobain Life Sciences

- CPC (Colder Products Company)

- GE Healthcare Life Sciences

- Parker Hannifin Corporation

- Entegris Inc.

- Watson-Marlow Fluid Technology Solutions

Recent Developments

-

May 2025: Thermo Fisher Scientific announced the expansion of its bioprocessing capabilities in Massachusetts, including new lines of aseptic connectors and welders tailored for cell therapy applications.

-

April 2025: Pall Corporation introduced a new genderless aseptic connector designed to reduce operator error and streamline training requirements.

-

February 2025: Merck Millipore (MilliporeSigma in the U.S.) unveiled an upgraded version of its automated aseptic welding system aimed at high-throughput biologics manufacturing.

-

January 2025: Sartorius Stedim Biotech acquired a U.S.-based start-up specializing in innovative aseptic welding technologies to enhance its single-use bioprocessing portfolio.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Aseptic Connectors And Welders Market.

By Product

-

-

- Barbed fittings

- Luer locks

- Genderless

- Others

-

-

- 1/16 Inch

- 1/4 Inch

- 3/8 Inch

- Others

By Application

-

- Media Preparation

- Cell Inoculation

- Cell Expansion

- Sampling

- Other Applications

-

- Purification

- Filtration

- Sampling

- Fluid Transfer

- Other Applications

- Harvest & Fill-finish Operations

-

- Product Collection

- Filtration

- Product Filling

- Sampling

- QC Testing

By End Use

- Biopharmaceutical & Pharmaceutical Companies

- OEMs

- CROs & CMOs

- Academic & Research Institutes