U.S. Assisted Living Facility Market Size and Research

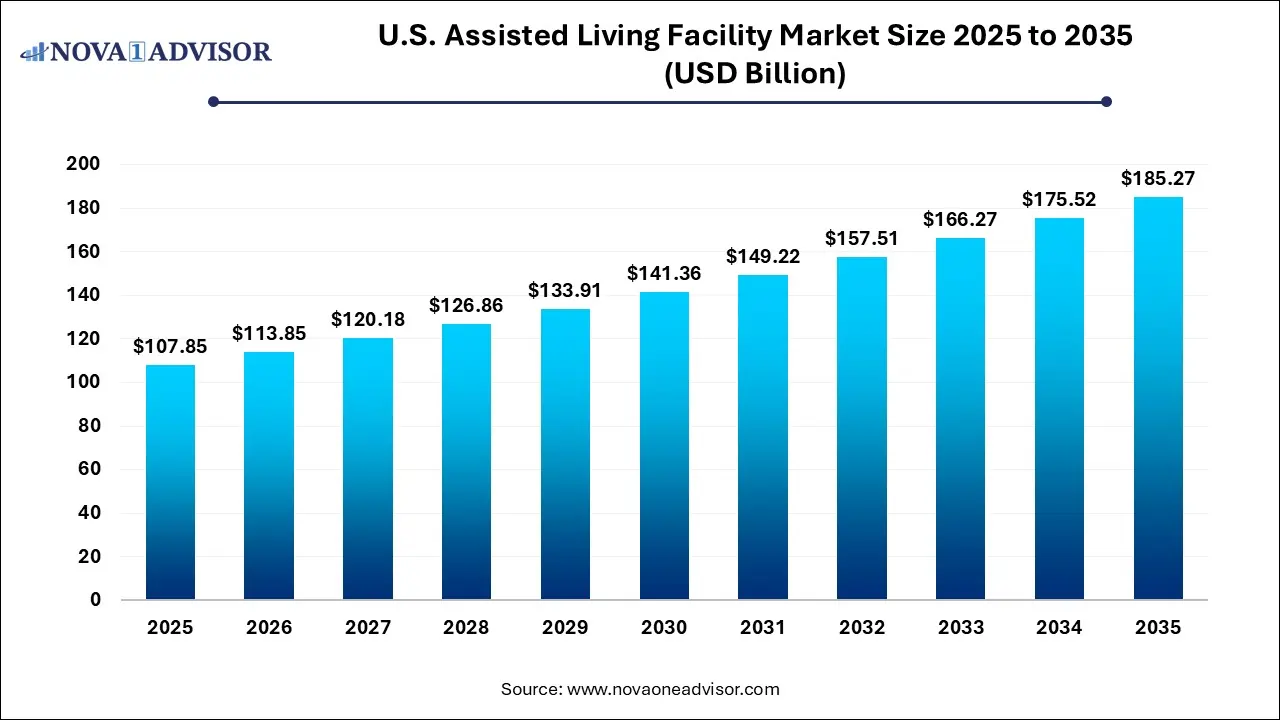

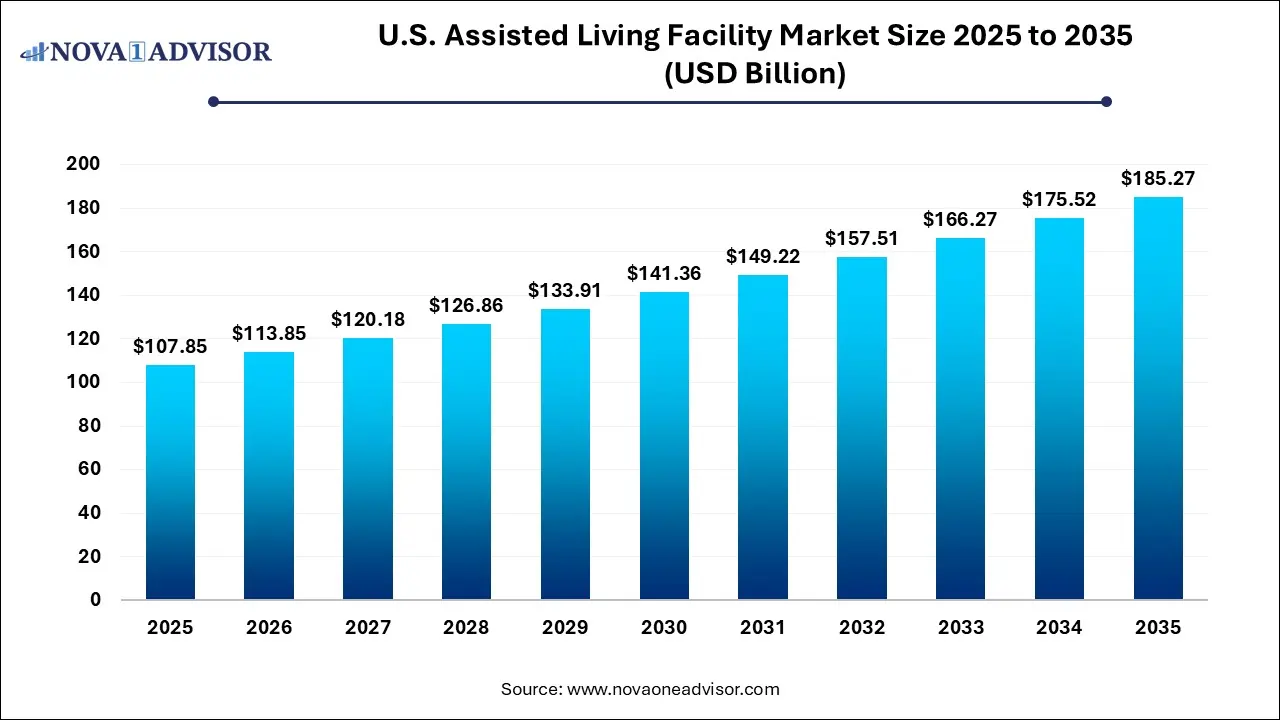

The U.S. assisted living facility market size was exhibited at USD 107.85 billion in 2025 and is projected to hit around USD 185.27 billion by 2035, growing at a CAGR of 5.56% during the forecast period 2026 to 2035.

U.S. Assisted Living Facility Market Key Takeaways:

- More than 85 years segment accounted for the largest market share of 52.35% in 2025 and is expected to register the fastest CAGR of 5.65% during the forecast period

- The west region dominated the segment with the largest market share of 43.0% in 2025

- The south region is estimated to register the fastest CAGR of 6.20% from 2026 to 2035.

Market Overview

The U.S. assisted living facility (ALF) market is a critical segment of the country’s senior care infrastructure, catering to older adults who require assistance with daily living activities but do not need intensive medical care. These facilities bridge the gap between independent living and skilled nursing homes by offering services such as meal preparation, medication management, housekeeping, and personal care, within a community-oriented setting that prioritizes autonomy and social engagement.

As of 2025, the ALF market in the United States is experiencing robust growth driven by the aging baby boomer generation, rising life expectancy, and shifting cultural attitudes toward eldercare. Families increasingly prefer assisted living over traditional nursing homes for its emphasis on quality of life, independence, and personalized care. In addition, advances in technology—such as remote monitoring, digital health records, and AI-powered emergency response systems—are improving the safety and efficiency of ALFs, allowing residents to age in place with dignity.

The COVID-19 pandemic brought challenges to the sector, including infection control and staffing constraints, but also catalyzed transformation by reinforcing the importance of resilience, staffing quality, and facility design. Providers are now investing in wellness-centered, hospitality-style communities that cater not only to physical health but also to emotional and social well-being. From boutique luxury settings to specialized memory care wings, the U.S. ALF market is evolving to meet a wide range of resident expectations and clinical profiles.

Major Trends in the Market

-

Personalized and Luxury-Oriented Care Models: Upscale ALFs offering gourmet meals, concierge services, and wellness spas are attracting affluent aging populations seeking resort-style retirement.

-

Integration of Smart Home and Health Technologies: Facilities are adopting fall detection systems, telemedicine, wearable health monitors, and voice-activated controls to enhance resident safety and independence.

-

Shift Toward Aging in Place and Continuum of Care: Many ALFs are partnering with home healthcare and hospice services to allow residents to remain in the facility as their needs evolve.

-

Growth in Specialized Memory Care Units: As Alzheimer’s and dementia cases rise, providers are segmenting communities with secure environments, sensory therapies, and cognitive programs.

-

Expansion of Public-Private Partnerships and Medicaid Waivers: States are increasing reimbursement pathways for low-income seniors to access assisted living, broadening market inclusivity.

Report Scope of U.S. Assisted Living Facility Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 113.85 Billion |

| Market Size by 2035 |

USD 185.27 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.54% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Age, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

West; South; Midwest; Northeast |

| Key Companies Profiled |

Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Atria Senior Living, Inc.; Five Star Senior Living; Capital Senior Living; Merrill Gardens; Integral Senior Living (ISL); Belmont Village, L.P.; Gardant Management Solutions |

Key Market Driver: Growing Elderly Population and Changing Family Dynamics

The most significant driver of the U.S. ALF market is the unprecedented growth in the elderly population. According to the U.S. Census Bureau, by 2030, over 70 million Americans will be aged 65 and older, representing nearly 20% of the total population. This demographic shift is accompanied by an increase in chronic conditions such as arthritis, diabetes, and cognitive impairments, which necessitate consistent personal care but not hospitalization or skilled nursing.

In parallel, modern family dynamics are evolving. With more dual-income households and geographically dispersed families, there is limited capacity for traditional at-home caregiving. Assisted living offers a viable solution that ensures safety, daily support, and community engagement. Facilities have responded by developing holistic care models that combine medical oversight with autonomy and lifestyle enhancement, making ALFs not just a necessity, but a lifestyle choice for many aging adults.

Key Market Restraint: Affordability and Insurance Limitations

A key restraint for the U.S. assisted living facility market is the issue of affordability. The average monthly cost of assisted living in the U.S. ranges from $4,000 to $6,500 depending on location and amenities, placing it out of reach for many seniors on fixed incomes. Unlike skilled nursing care, assisted living is not comprehensively covered under Medicare. While Medicaid may subsidize services for low-income residents, the availability of Medicaid waiver programs and participating facilities varies widely by state.

This affordability gap poses challenges for both providers and consumers. Facilities face financial risks when balancing service quality with occupancy goals, especially in high-cost urban markets. Meanwhile, seniors and their families often experience confusion or difficulty navigating long-term care insurance, asset-based financing options, or Medicaid eligibility. Unless addressed through policy reform or innovation in pricing models, cost will remain a barrier to broad market access.

Key Market Opportunity: Expansion of Mid-Market and Modular ALFs

An emerging opportunity in the U.S. ALF market lies in developing cost-effective, mid-market solutions that cater to the "forgotten middle"—seniors who are not wealthy enough for luxury facilities but do not qualify for Medicaid support. This population is growing rapidly and is expected to constitute over 40% of senior housing demand in the next decade. Operators who can offer affordability without compromising safety, cleanliness, and a sense of community will be well-positioned for growth.

One solution is the development of modular or prefabricated assisted living units that reduce construction time and cost. These facilities can be rapidly deployed in underserved areas or adjacent to existing healthcare campuses. Partnerships with real estate investment trusts (REITs), nonprofit organizations, and municipal governments may facilitate financing and expedite project timelines. Additionally, tech-enabled staff models—such as centralized medication management or telehealth nurse monitoring—can help contain operating costs while ensuring resident well-being.

U.S. Assisted Living Facility Market By Age Insights

Residents aged 85 and older dominate the U.S. assisted living facility market, accounting for the highest occupancy rates and longest stays. This demographic is most likely to require daily assistance with bathing, dressing, mobility, and medication management making assisted living an appropriate and necessary option. Facilities catering to this group often provide tiered care levels, including access to memory care, mobility aids, and full-service dining and housekeeping. The majority of new ALF developments are built with this demographic in mind, emphasizing fall prevention, wide hallways, and emergency response infrastructure.

At the same time, the 75–84 age group is the fastest-growing segment, reflecting a shift in how Americans approach retirement and long-term care. Increasingly, individuals in this age range are choosing to move into ALFs earlier to enjoy social engagement, security, and access to preventive health services. Many ALFs now market to this demographic with active living programs, fitness classes, communal dining, cultural excursions, and educational seminars. This shift toward lifestyle-oriented assisted living is not only extending the average length of stay but also redefining the consumer experience and expectations in the sector.

U.S. Assisted Living Facility Market By Regional Insights

The South holds the largest share of the U.S. assisted living facility market, largely due to its population size, aging demographics, and relatively lower construction and operating costs. States like Florida, Texas, and Georgia are major hubs for retirement communities and ALFs. Warm climates, favorable tax structures, and established senior-friendly infrastructure make the South attractive to both developers and residents. As a result, some of the largest operators in the nation maintain their densest facility portfolios in southern states.

The West is experiencing the fastest growth, especially in metropolitan areas like Phoenix, Denver, Las Vegas, and parts of California. This expansion is driven by urban migration, a proactive aging population, and progressive state-level Medicaid waiver programs. Additionally, wellness and eco-conscious living trends are strong in the western U.S., leading to the development of green-certified, wellness-focused ALFs with yoga studios, organic meal plans, and nature-based therapies. These communities are resonating with Baby Boomers who seek healthy aging in vibrant, lifestyle-rich settings.

Country-Level Analysis: United States

In the United States, the assisted living facility market is shaped by a decentralized regulatory environment and strong private sector involvement. Each state establishes its own licensing and operational standards, which results in variability in staffing ratios, medication administration rights, and allowable care services. At the federal level, oversight is limited, though regulatory discussions continue around standardizing data reporting, quality metrics, and consumer protection.

Demographic trends—particularly the doubling of the senior population between 2010 and 2040—have prompted both public and private stakeholders to reevaluate the nation’s long-term care readiness. ALFs play a strategic role in this equation, offering a scalable, less intensive alternative to nursing homes. However, ongoing challenges include addressing labor shortages, particularly among certified nursing assistants (CNAs), and investing in infection control practices in a post-COVID environment.

Urban centers offer robust facility competition and high service diversity, while rural areas face access limitations due to geographic dispersion and lower profit margins. Federal programs are beginning to target these disparities through grants and public-private partnerships. Moreover, innovations in eldercare financing—such as reverse mortgages, long-term care annuities, and hybrid insurance products—are slowly broadening consumer accessibility to ALFs across the country.

Some of the prominent players in the U.S. assisted living facility market include:

Recent Developments

-

Brookdale Senior Living (April 2025) unveiled its latest community in Scottsdale, Arizona, combining assisted living with wellness and memory care in a hybrid design inspired by hospitality standards and post-pandemic architecture.

-

Atria Senior Living (March 2025) launched its "Next Chapter" initiative in California, focusing on sustainable ALF construction, digital resident engagement platforms, and advanced fall detection systems across its communities.

-

Sunrise Senior Living (February 2025) introduced a new staff training program nationwide to upskill caregivers in mental health first aid, dementia sensitivity, and remote patient monitoring.

-

Benchmark Senior Living (January 2025) opened a new wellness-focused ALF in Massachusetts with in-house integrative medicine, meditation therapy, and chronic disease coaching for residents aged 75+.

-

Five Star Senior Living (December 2024) partnered with a regional health system in Florida to pilot a continuum-of-care model with integrated telehealth, pharmacy coordination, and post-acute transition services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. assisted living facility market

By Age

- More than 85

- 75-84

- 65-74

- Less than 65

By Region

- West

- South

- Midwest

- Northeast