U.S. Astaxanthin Market Size and Trends

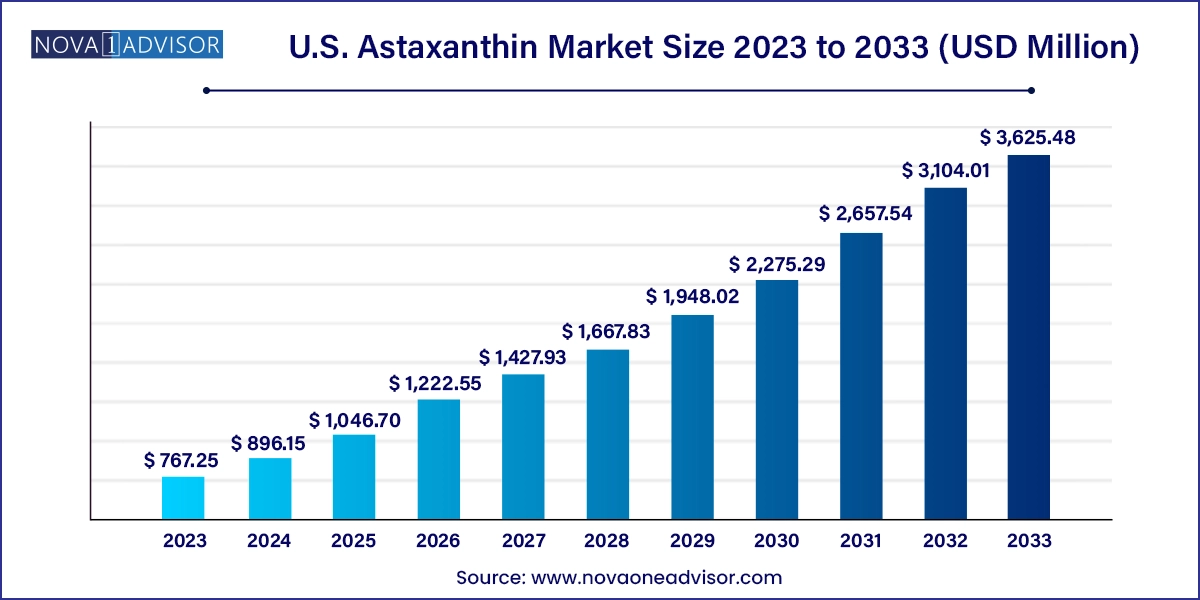

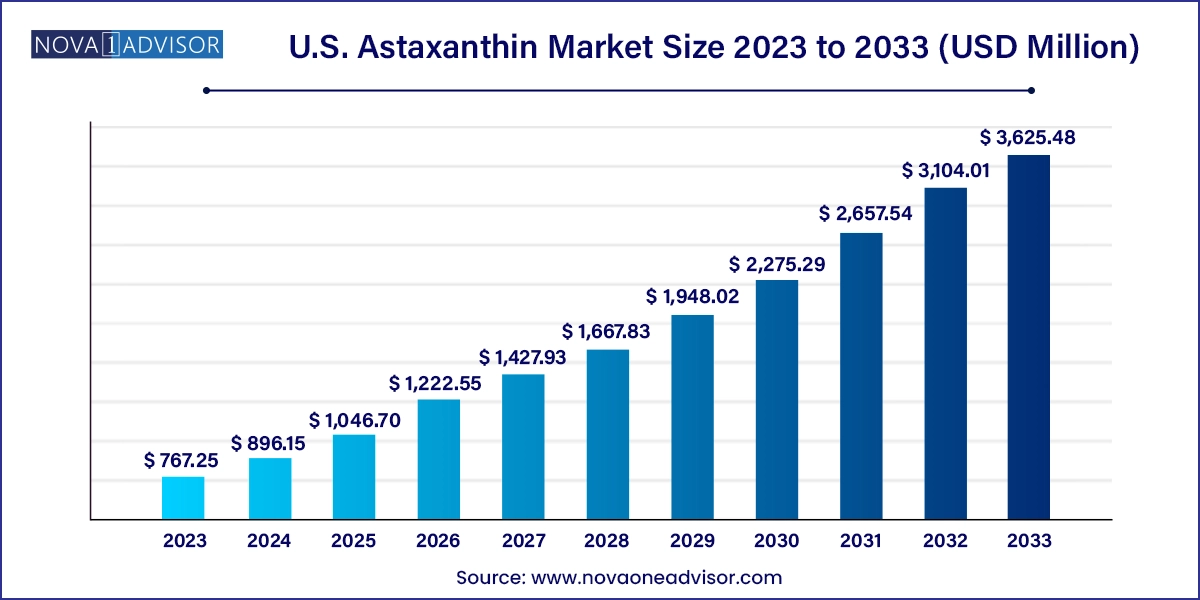

The U.S. astaxanthin market size was exhibited at USD 767.25 million in 2023 and is projected to hit around USD 3,625.48 million by 2033, growing at a CAGR of 16.8% during the forecast period 2024 to 2033.

U.S. Astaxanthin Market By Key Takeaways:

- The natural astaxanthin segment dominated the market and held a revenue share of 58.0% in 2023.

- It is expected to experience the fastest CAGR of 20.2% from 2024 to 2033.

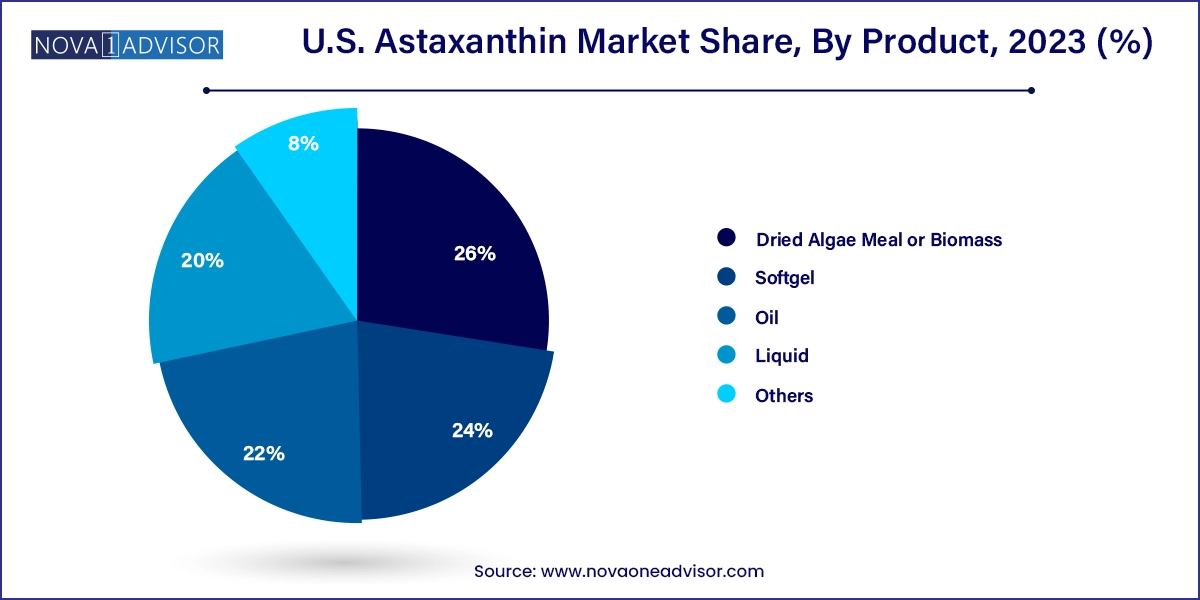

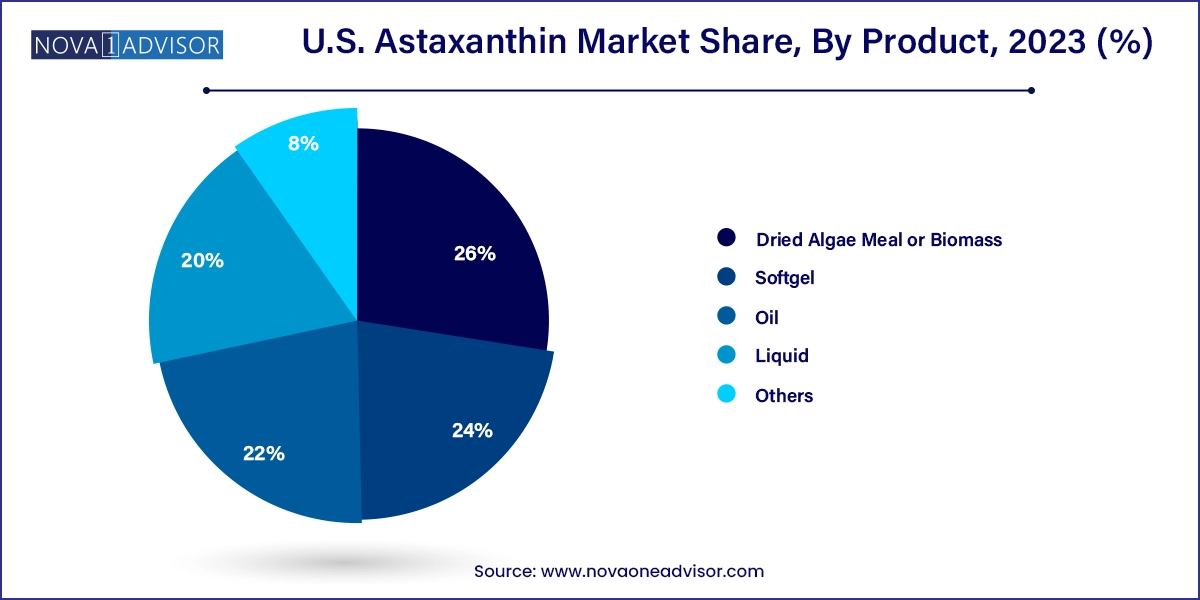

- Based on products, the dried algae meal or biomass segment held the largest revenue share of 26.0% from 2024 to 2033.

- The softgel segment is expected to witness a significant CAGR of 17.2% from 2024 to 2033.

- The aquaculture and animal feed segment accounted for the highest revenue share of 47.0% in 2023.

- The nutraceuticals segment is expected to experience a noteworthy CAGR of 17.6% from 2024 to 2033.

Market Overview

The U.S. astaxanthin market is witnessing accelerated growth, underpinned by a rising consumer inclination toward natural antioxidants, the expansion of the nutraceuticals industry, and increasing interest in algae-based health solutions. Astaxanthin, a red-orange carotenoid pigment primarily found in marine organisms such as microalgae, krill, and shrimp, has become a sought-after bioactive compound for its potent antioxidant, anti-inflammatory, and anti-aging properties. Recognized as one of the most powerful natural antioxidants up to 6,000 times more potent than vitamin C astaxanthin is increasingly integrated into a range of products, from dietary supplements to functional beverages and even anti-aging skincare formulations.

In the United States, heightened awareness about chronic inflammation, oxidative stress, and lifestyle-related diseases is driving consumer demand for health-promoting supplements. This trend, along with the clean-label movement and the desire for natural alternatives to synthetic additives, is fueling astaxanthin's popularity. The compound's ability to neutralize free radicals, support cardiovascular health, protect eye function, and enhance athletic performance is well documented in scientific literature, further boosting its credibility among U.S. consumers and health practitioners.

Astaxanthin is extracted either naturally (mainly from microalgae like Haematococcus pluvialis) or synthesized chemically. The natural form, particularly algal-derived astaxanthin, is gaining ground due to its higher bioavailability and consumer preference for plant-based sources. Technological advancements in algal cultivation, drying, and extraction have enabled the production of high-quality astaxanthin at scale, making it commercially viable for multiple applications.

The regulatory environment in the U.S. also supports astaxanthin’s growth. The Food and Drug Administration (FDA) has categorized it as “Generally Recognized As Safe” (GRAS) for use in dietary supplements and certain food applications. In parallel, investments from biotechnology firms and algae producers are creating a more competitive and innovative landscape. As consumer interest continues to shift toward preventive health, plant-based nutrition, and performance enhancement, astaxanthin is emerging as a cornerstone ingredient in the American wellness economy.

Major Trends in the Market

-

Rise in Demand for Natural Antioxidants in Preventive Health: Consumers are increasingly turning to astaxanthin to address chronic health concerns and promote longevity.

-

Microalgae as a Preferred Source: Algae-derived astaxanthin is gaining popularity due to its superior bioavailability and alignment with vegan/vegetarian product labeling.

-

Incorporation into Sports Nutrition: Astaxanthin is being marketed for its ability to improve endurance, muscle recovery, and physical performance.

-

Expansion of Cosmeceuticals: Skincare products featuring astaxanthin claim benefits such as improved elasticity, reduced wrinkles, and protection against UV-induced damage.

-

Functional Food and Beverage Innovation: Manufacturers are adding astaxanthin to juices, energy bars, and dairy alternatives to meet demand for health-focused food options.

-

Sustainability and Clean Label Trends: Producers are emphasizing environmentally responsible cultivation methods, particularly in microalgae farming.

-

Rising R&D in Astaxanthin-Based Therapeutics: Scientific studies are exploring its applications in neuroprotection, cardiovascular therapy, and diabetes management.

Report Scope of U.S. Astaxanthin Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 896.15 Million |

| Market Size by 2033 |

USD 3,625.48 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 16.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Source, Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Kuehnle AgroSystems Inc.; Cardax, Inc.; Cyanotech Corporation; NOAH Inc.; BGG WORLD |

Key Market Driver: Increasing Popularity of Nutraceuticals and Functional Ingredients

The primary driver of the U.S. astaxanthin market is the surging popularity of nutraceuticals and functional ingredients, fueled by a wellness-oriented consumer base seeking alternatives to pharmaceutical interventions. Astaxanthin, being a naturally derived compound with broad-spectrum health benefits, is increasingly used as a central ingredient in dietary supplements targeting immunity, skin health, joint support, and cognitive performance.

The U.S. nutraceuticals industry is expanding rapidly, with consumers willing to invest in preventive health strategies rather than reactive treatments. Astaxanthin’s multifunctionality its ability to cross the blood-brain barrier, protect mitochondria, and reduce systemic inflammation makes it especially attractive in a crowded supplements market. Brands offering astaxanthin in softgel, oil, or capsule form often highlight its scientific backing and powerful antioxidant status, creating a strong value proposition for health-conscious American consumers. As wellness culture evolves, so too does astaxanthin’s centrality in supplement formulations.

Key Market Restraint: High Production Cost of Natural Astaxanthin

Despite its benefits, the high cost of producing natural astaxanthin remains a major constraint in the U.S. market. Natural astaxanthin, particularly when derived from Haematococcus pluvialis, requires carefully controlled environmental conditions, specialized photobioreactors or open ponds, and energy-intensive drying and extraction processes. Compared to synthetic variants, which can be mass-produced at a lower cost, the production of microalgae-based astaxanthin is labor-intensive and capital-heavy.

This cost burden translates into premium pricing for finished products, potentially limiting mass-market penetration. Although high-income and health-focused consumers may tolerate the price differential, mainstream adoption especially in food applications and animal feed may be hampered. As a result, brands using natural astaxanthin face pricing pressure while attempting to maintain margins. Scaling production and improving extraction efficiencies are necessary to enhance affordability and sustain long-term competitiveness against synthetic alternatives.

Key Market Opportunity: Expanding Use in Functional Foods and Beverages

A promising opportunity in the U.S. astaxanthin market lies in its growing incorporation into functional foods and beverages. With consumers increasingly seeking health-enhancing ingredients in their everyday diets, manufacturers are exploring ways to infuse astaxanthin into products like smoothies, sports drinks, protein bars, dairy alternatives, and even ready-to-drink coffee.

Astaxanthin offers both nutritional and marketing appeal it can be positioned as a natural energy booster, anti-aging molecule, and brain protector, making it ideal for health-centric food brands. Its vibrant reddish hue also adds visual appeal to natural formulations. The challenge of solubility and stability in beverages is being addressed by novel encapsulation technologies and oil-in-water emulsion techniques, opening new frontiers for astaxanthin in the functional foods space.

Startups and established players alike are capitalizing on this potential. As more clinical evidence supports the benefits of oral astaxanthin, particularly in gut health and systemic inflammation, its use in consumable wellness products is expected to surge.

U.S. Astaxanthin Market By Source Insights

Natural astaxanthin dominates the U.S. market by source, reflecting consumer preference for plant-based, high-bioavailability antioxidants. Among natural sources, microalgae (especially Haematococcus pluvialis) is the most prevalent, favored for its high astaxanthin content and compatibility with vegan lifestyles. Producers such as AstaReal and Cyanotech have invested heavily in photobioreactor and closed-loop pond systems to ensure consistent and clean production. Natural astaxanthin is widely used in premium supplements, skincare products, and performance nutrition, where synthetic versions are less accepted.

Yeast and krill/shrimp-derived astaxanthin are also gaining visibility, especially in animal feed and aquaculture, but are limited in nutraceutical use due to allergen concerns. Despite higher production costs, the clean-label and natural positioning of microalgae-derived astaxanthin continues to drive its dominance in the U.S. market.

Synthetic astaxanthin, though more affordable, is largely limited to aquaculture and animal feed due to lower bioactivity and consumer skepticism. However, its role remains important in large-scale, cost-sensitive applications, particularly in salmon farming and poultry nutrition. Advances in biosynthetic engineering may eventually help bridge the gap between cost-efficiency and natural appeal.

U.S. Astaxanthin Market By Product Insights

Dried biomass and algae meal remain important for industrial and feed applications but are less visible in consumer-facing markets due to their bulkiness and taste considerations. Nevertheless, they play a critical role in aquaculture nutrition and pet health products.

Softgels lead the U.S. astaxanthin market by product type, owing to their convenience, bioavailability, and long shelf life. Most dietary supplement brands offer astaxanthin in softgel form, often combined with omega-3s, CoQ10, or other antioxidants to create multi-benefit formulations. Softgels are especially popular among aging consumers seeking anti-inflammatory and cognitive support. Their standardized dosing and ability to encapsulate oil-soluble compounds make them the ideal delivery system for astaxanthin.

Oil-based formulations and liquids are the fastest-growing product categories, particularly among consumers who prefer customizable dosing or plant-based formats. These forms are often used in smoothies, health shots, or direct ingestion. Oil products offer rapid absorption and can be formulated without gelatin, appealing to vegan users. In cosmetics, liquid astaxanthin is used for topical serums and creams, further expanding its application versatility.

U.S. Astaxanthin Market By Application Insights

Nutraceuticals dominate the U.S. astaxanthin market by application, driven by rising demand for functional supplements targeting aging, inflammation, and energy. The supplement market offers a diverse range of astaxanthin products, often positioned as anti-aging, eye health, or muscle recovery enhancers. Clinical studies support its efficacy in reducing fatigue, enhancing immune response, and improving skin moisture, making it a versatile ingredient for a broad demographic. Nutraceuticals also benefit from consumer trust in pill-based formats and subscription-based delivery models.

Cosmetics is the fastest-growing application, supported by the shift toward ingestible beauty and topical anti-aging formulations. Astaxanthin's role in reducing fine lines, boosting elasticity, and protecting against UV damage has led to its integration into anti-aging serums, creams, and beauty supplements. Beauty-from-within products—those that combine oral and topical solutions—are gaining momentum, with astaxanthin positioned as a star ingredient.

In aquaculture and animal feed, astaxanthin continues to play a key role in enhancing the coloration and health of farmed fish, especially salmon and trout. As the demand for natural feed additives increases, algae-derived astaxanthin is being viewed as a clean, safe alternative to synthetic versions.

Country-Level Analysis

In the United States, the astaxanthin market benefits from a mature dietary supplements industry, a proactive wellness culture, and widespread consumer acceptance of algae-based and antioxidant-rich products. The U.S. also leads in R&D investment related to natural compounds, offering an innovation-friendly environment for astaxanthin-based product development.

Health-conscious consumers, particularly millennials and boomers, are increasingly driving demand for natural anti-aging, performance, and immune-boosting products. Retailers such as Whole Foods, GNC, and Sprouts carry astaxanthin supplements, while eCommerce platforms like Amazon are enabling direct-to-consumer brands to flourish. U.S.-based companies are also at the forefront of microalgae production innovations, with production facilities in Hawaii, California, and Arizona taking advantage of sunlight and clean water for sustainable cultivation.

The U.S. regulatory climate supports astaxanthin’s use in supplements and cosmetics, with growing interest in expanding its applications into foods and beverages. Scientific partnerships between universities, biotech firms, and health organizations are also exploring astaxanthin’s therapeutic potential in cardiovascular, neurological, and metabolic health.

Some of the prominent players in the U.S. astaxanthin market include:

- Kuehnle AgroSystems Inc.

- Cardax, Inc.

- Cyanotech Corporation

- NOAH Inc.

- BGG WORLD

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. astaxanthin market

Source

-

- Yeast

- Krill/Shrimp

- Microalgae

- Others

Product

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

Application

- Nutraceuticals

- Cosmetics

- Aquaculture & Animal Feed

- Food

-

- Functional Foods & Beverages

- Other Traditional Food Manufacturing Applications