U.S. Automated and Closed Cell Therapy Processing Systems Market Size and Research 2026 to 2035

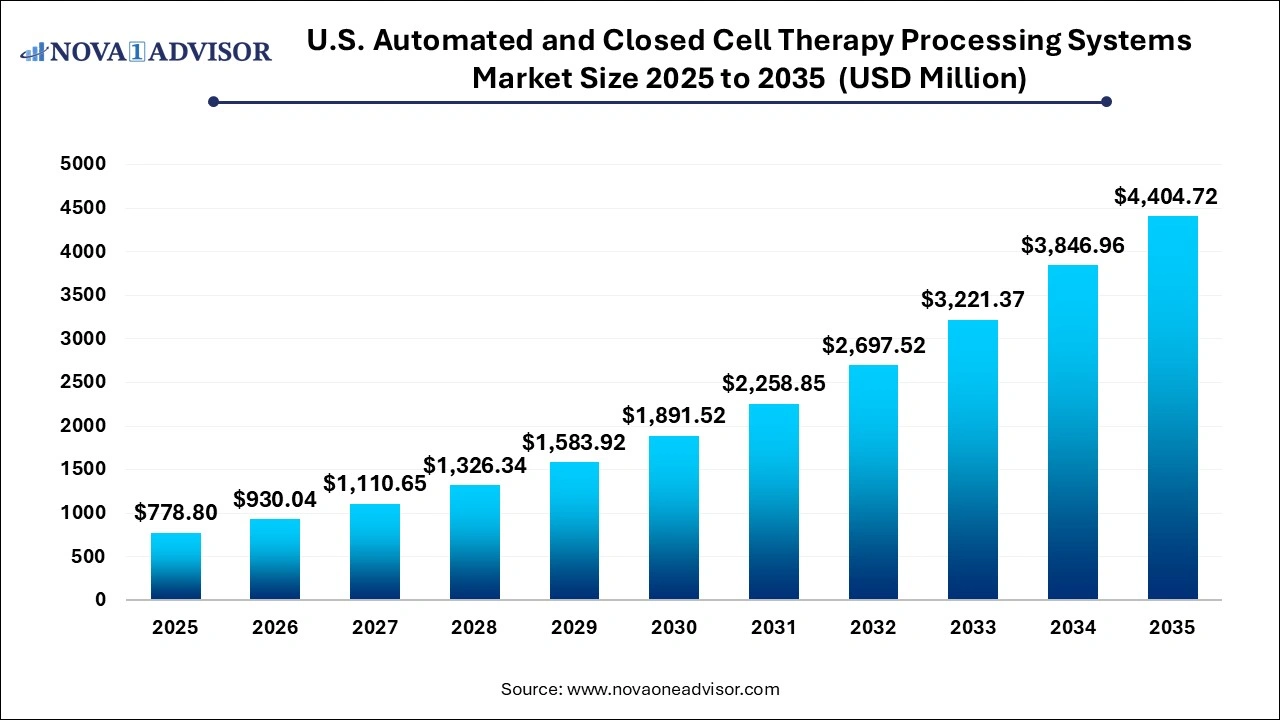

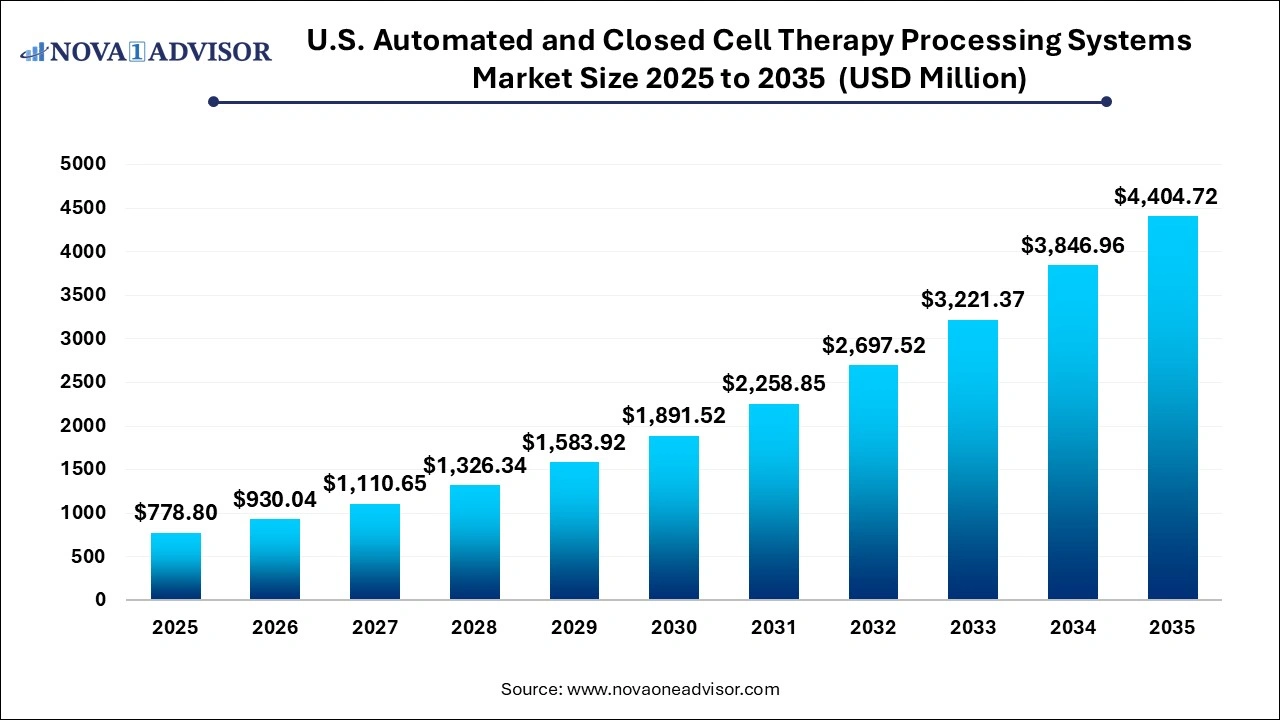

The U.S. automated and closed cell therapy processing systems market size was exhibited at USD 778.8 million in 2025 and is projected to hit around USD 4,404.72 million by 2035, growing at a CAGR of 18.92% during the forecast period 2026 to 2035. The expansion of the U.S. automated and closed cell therapy processing systems market is driven by increasing number of cell therapy-based clinical trials, rising adoption of regenerative medicine and continuous advancements in scalable biomanufacturing solutions.

U.S. Automated and Closed Cell Therapy Processing Systems Market Key Takeaways:

- Based on workflow, the separation segment dominated the market in 2025 with a market share of 31.10% and is anticipated to grow at the fastest CAGR over the forecast period.

- Based on type, the non-stem cell therapy segment dominated the market in 2025 with a share of 61.84% and is anticipated to grow at the fastest CAGR over the forecast period.

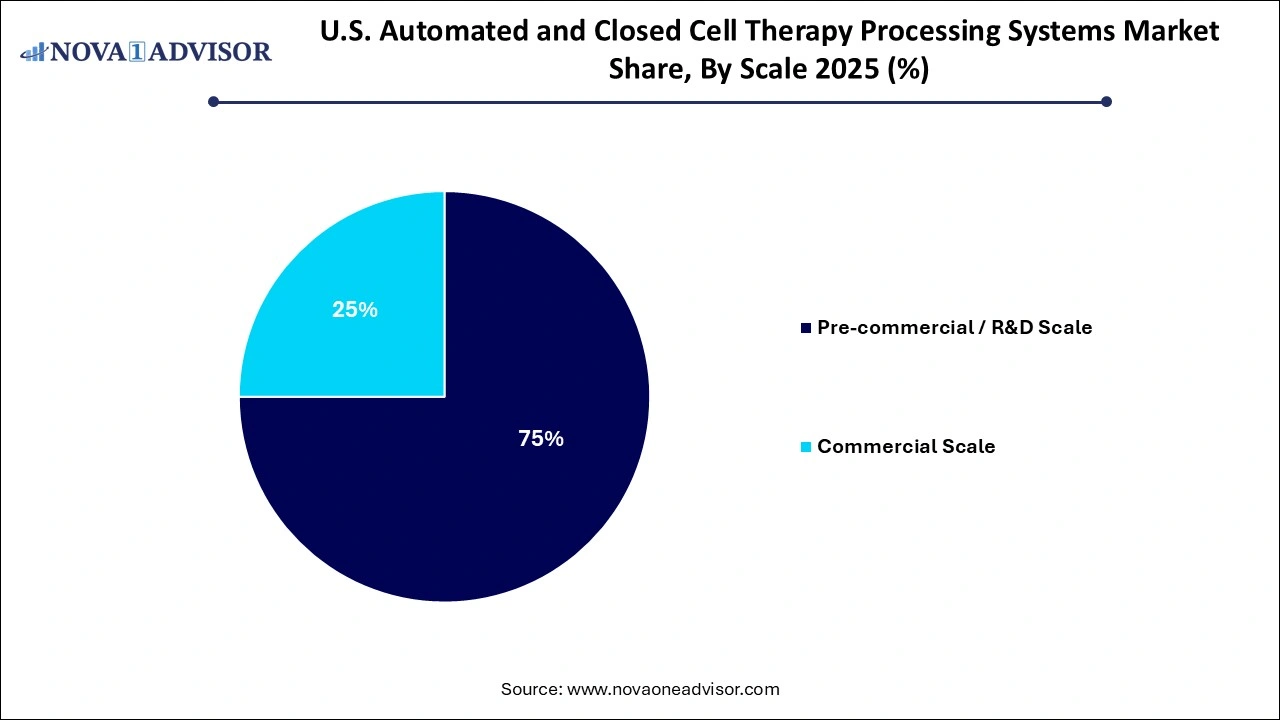

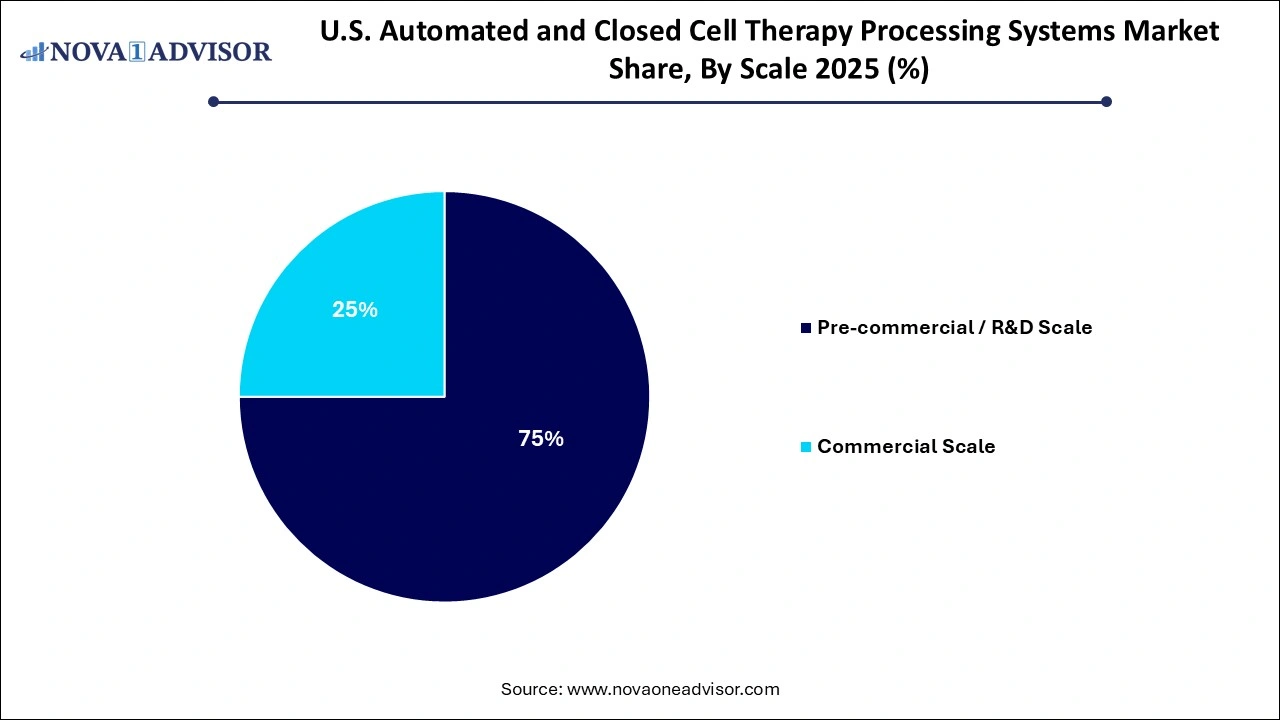

- Based on scale, the pre-commercial/R&D scale segment held the largest share of 75% in 2025.

U.S. Automated and Closed Cell Therapy Processing Systems Market Overview

The U.S. automated and closed cell therapy processing systems market is witnessing rapid evolution as regenerative medicine continues to redefine the future of healthcare. Cell therapy particularly involving autologous and allogeneic cell types—has gained substantial clinical relevance for treating cancer, genetic disorders, autoimmune conditions, and degenerative diseases. In this context, automated and closed system technologies play a crucial role in ensuring the scalable, reproducible, and regulatory-compliant manufacturing of therapeutic cells.

Unlike traditional manual processing methods, which are labor-intensive and susceptible to contamination, automated and closed systems minimize human intervention, reduce error margins, and maintain sterile environments throughout complex cell therapy workflows. These systems integrate advanced bioprocessing tools for cell isolation, expansion, washing, concentration, cryopreservation, and final product filling—bringing industrial-grade quality control to a domain historically dominated by artisanal practices.

The U.S. has emerged as the epicenter of innovation in this field, backed by a robust ecosystem of biopharmaceutical companies, academic research institutions, and regulatory support from agencies like the U.S. Food and Drug Administration (FDA). With over 1,000 cell and gene therapy candidates currently in various stages of clinical development, the need for scalable manufacturing platforms has never been more urgent. CAR-T cell therapies, for example, require highly personalized, complex workflows that benefit immensely from automated, closed-loop solutions to meet Good Manufacturing Practice (GMP) standards.

Companies such as Lonza, Thermo Fisher Scientific, Cytiva, and Miltenyi Biotec are investing heavily in modular, flexible platforms that support end-to-end bioprocessing for both research and commercial-scale applications. These systems not only accelerate production timelines but also reduce operational costs and risks—making them indispensable for the successful commercialization of advanced cell therapies in the U.S.

Major Trends in the U.S. Automated and Closed Cell Therapy Processing Systems Market

-

Miniaturization and Modular Platforms: Manufacturers are designing compact, modular systems that support step-wise integration across multiple workflows.

-

Single-Use and Disposable Technologies: To reduce contamination risks and cleaning validation needs, single-use bioreactor bags and tubing sets are increasingly integrated.

-

Integrated AI and Machine Learning: Smart bioprocessing platforms are employing predictive algorithms to optimize cell expansion and harvest conditions in real time.

-

Shift Toward Allogeneic Therapies: The development of “off-the-shelf” allogeneic cell therapies is driving demand for standardized, automated processing systems.

-

Cloud-Enabled Process Monitoring: Digital twin and cloud-based dashboards are allowing remote batch oversight and validation, supporting decentralized manufacturing models.

-

Collaborative Manufacturing Ecosystems: CDMOs and therapy developers are jointly developing customized processing platforms for proprietary therapies.

-

Emphasis on Regulatory Compliance: FDA cGMP guidance and the push toward harmonized quality standards are fostering automation adoption for traceability and audit-readiness.

-

Cryopreservation Innovations: Advanced closed-loop cryopreservation technologies are enabling high-viability cell storage with controlled-rate freezing.

Report Scope of U.S. Automated And Closed Cell Therapy Processing Systems Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 930.04 Million |

| Market Size by 2035 |

USD 4,404.72 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 18.92% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Workflow, By Type, By Scale |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Lonza; Miltenyi Biotec; Danaher; Sartorius AG; Fresenius Kabi, MaxCyte, Inc.; ThermoGenesis Holdings, Inc.; Terumo Corporation; and Cellares Inc. |

U.S. Automated and Closed Cell Therapy Processing Systems Market Dynamics

Driver

Rising Commercialization of Cell-Based Therapies in Oncology and Rare Diseases

The primary driver for the U.S. automated and closed cell therapy processing systems market is the commercial success and regulatory approval of personalized cellular therapies—particularly in oncology. The landmark FDA approvals of CAR-T therapies such as Novartis’ Kymriah and Gilead’s Yescarta set a precedent for cell-based treatment protocols, accelerating investments in manufacturing infrastructure.

Cell therapy products require complex, multistep workflows that are time-sensitive and subject to strict sterility and quality control standards. Automated systems ensure consistent output by eliminating manual variability and enabling real-time monitoring of cell culture conditions. In oncology, where every patient’s immune profile may demand tailored approaches, these systems play a vital role in scaling production while preserving therapeutic integrity. The successful commercialization of such therapies has signaled to the broader industry that robust automated systems are not a luxury but a necessity for regulatory approval and economic feasibility.

Restraint

High Capital Investment and Integration Complexity

Despite their long-term value, automated and closed processing systems present a significant capital burden for many small-to-mid-sized therapy developers. The upfront cost of acquiring and validating equipment that meets regulatory and process-specific requirements can be prohibitive especially in early-stage R&D companies with limited funding. Furthermore, integration across multiple platforms (e.g., cell expansion, harvest, fill-finish) often demands specialized software, bespoke hardware configurations, and rigorous validation protocols.

Additionally, transitioning from manual or semi-automated processes to fully automated systems introduces organizational and operational challenges, including staff retraining, process requalification, and data migration. The complexity of system interoperability with existing GMP suites further adds to implementation delays. While larger companies may have the capacity to absorb these costs, smaller biotechs often face delays in scale-up due to financial and technical barriers.

Opportunity

Emergence of Decentralized and Point-of-Care Manufacturing Models

The push toward decentralized and point-of-care (POC) manufacturing represents a significant opportunity for the adoption of portable, automated, and closed processing systems. Hospitals, cancer centers, and regional manufacturing hubs are increasingly exploring the feasibility of producing autologous therapies at or near the patient site. This shift is being driven by logistical complexities, cell viability concerns, and the need for rapid treatment delivery—especially in time-sensitive conditions like hematologic malignancies.

Automated systems designed for compact environments and GMP-in-a-box configurations can support the entire cell processing cycle within confined clinical spaces. These mobile or modular platforms reduce transportation requirements, improve turnaround times, and allow facilities to customize processing for individual patients. Companies offering plug-and-play systems with built-in quality assurance and remote support can cater to this emerging segment and open new commercial avenues in precision medicine infrastructure.

U.S. Automated And Closed Cell Therapy Processing Systems Market Segmental Insights

By Workflow Insights

Separation workflow systems dominate the U.S. market, as cell separation is a foundational step in nearly all cell therapy production pipelines. Whether isolating T-cells from blood, stem cells from bone marrow, or specific immune cell subtypes, the precision and sterility of the separation phase dictate the downstream success of the therapy. Automated separation systems use closed-loop magnetic or flow-based technologies to efficiently isolate high-purity cell populations while maintaining their viability. Companies like Miltenyi Biotec and Thermo Fisher have introduced benchtop magnetic separation units integrated with disposable kits for fast and sterile operation.

Fill-finish workflows are the fastest-growing segment, driven by the need to maintain sterility, integrity, and traceability at the final stage of cell therapy manufacturing. This step involves the transfer of processed cells into cryogenic storage bags, infusion bags, or vials—often under highly controlled environments. Recent regulatory scrutiny on contamination during fill-finish operations is prompting companies to invest in enclosed, automated fill systems equipped with visual inspection, volume standardization, and barcode-based traceability. These systems play a crucial role in ensuring product safety before administration to patients, especially under FDA guidelines for advanced therapy medicinal products (ATMPs).

By Type Insights

Stem cell therapy processing systems currently dominate the U.S. market, primarily due to the high clinical and commercial activity in hematopoietic and mesenchymal stem cell (MSC)-based therapies. Stem cells, especially those derived from umbilical cord blood, bone marrow, or adipose tissue, are increasingly being evaluated for applications ranging from regenerative orthopedics to cardiovascular repair. Automated systems that support the isolation, expansion, and cryopreservation of stem cells while maintaining their pluripotency and differentiation potential are in high demand.

Non-stem cell therapy processing systems are the fastest-growing, owing to the success of T-cell and dendritic cell-based immunotherapies. CAR-T and TCR-engineered therapies require precise manipulation of mature immune cells, which differ in expansion behavior and culture sensitivity from stem cells. These therapies demand customized bioreactor parameters and automated monitoring of activation markers, cell viability, and cytokine expression. As more non-stem cell therapies enter late-stage clinical trials and gain FDA approval, the need for scalable, closed-loop solutions tailored to these cell types is expected to accelerate.

By Scale Insights

Based on scale, the pre-commercial/R&D scale segment held the largest share of 75% in 2025. As the majority of cell therapies remain in preclinical or early-phase clinical trials. Research organizations and emerging biotechs use these systems for process development, optimization, and proof-of-concept studies. Modular R&D platforms offer flexibility to adapt protocols for various cell types and culture conditions, making them ideal for laboratories engaged in exploratory regenerative medicine projects. Moreover, academic GMP facilities and translational research centers are key users of small-scale systems for investigator-initiated trials.

Commercial scale systems are the fastest-growing, driven by the growing number of FDA-approved therapies and late-phase clinical candidates nearing commercialization. These platforms are designed for high-throughput processing, long-duration cultures, and stringent compliance with cGMP guidelines. Automation is critical at this scale to ensure batch-to-batch consistency and reduce the risk of cross-contamination. Recent expansions in commercial cell therapy manufacturing capacity such as Lonza’s facility in Houston and Bristol Myers Squibb’s cell therapy plant in Devens, Massachusetts—underscore the increasing demand for commercial-scale systems.

Country-Level Insights

The U.S. stands at the forefront of the automated and closed cell therapy processing systems market due to a mature biotech ecosystem, progressive regulatory frameworks, and significant investment inflows into advanced therapies. The presence of the FDA’s accelerated approval pathways and the Regenerative Medicine Advanced Therapy (RMAT) designation has galvanized innovation in this sector. Major hubs such as Boston, San Francisco, and San Diego host a dense concentration of therapy developers, CDMOs, and equipment manufacturers, fostering collaborative growth.

Furthermore, U.S. federal initiatives such as the NIH’s Somatic Cell Genome Editing (SCGE) program and the Cancer Moonshot initiative have infused both funding and focus into regenerative medicine and cell-based treatments. The U.S. Department of Defense has also invested in cellular therapeutics for trauma and wound healing, stimulating cross-sector partnerships. These factors, combined with venture capital enthusiasm and public-private partnerships, solidify the country’s leadership in this transformative healthcare domain.

Some of the prominent players in the U.S. automated and closed cell therapy processing systems market include:

U.S. Automated And Closed Cell Therapy Processing Systems Market Recent Development

- In May 2025, Thermo Fisher Scientific Inc., a provider of scientific instrumentation and laboratory solutions based in U.S., launched its innovative 1500 Series Class II, Type A2 Biological Safety Cabinet (BSC). The cabinet designed specifically for academic, pharmaceutical, biotechnology, and routine laboratory environments can be applied in cell culture and molecular biology workflows.

- In April 2025, Thermo Fisher Scientific Inc., introduced its 5L DynaDrive Single-Use Bioreactor (S.U.B.) which is first-of-its-kind bench scale bioreactor designed for meeting the evolving needs of modern bioprocessing. The new bioreactor offers efficient development and commercialization of life-saving therapies by maximizing productivity and accelerating time to market reach while reducing environmental impact.

- In March 2025, Cytiva announced expansion of its Xcellerex X-platform portfolio with the inclusion of 500L and 2,000L bioreactors offering additional features to enhance scalability of operations for its customers.

In December 2024, Thermo Fisher Scientific Inc., launched the the Gibco CTS Detachable Dynabeads CD4 and CTS Detachable Dynabeads CD8 (CTS Detachable Dynabeads) for enhancing workflows in cell therapy development and production.

- In September 2024, Multiply Labs, a leading robotics technology company, entered into a partnership with Legend Biotech Corporation for automating cell therapy manufacturing with advanced robotic systems.

- In June 2024, Cytiva launched its next-generation manufacturing platform, Sefia. The platform enables accelerated production of chimeric antigen receptor T-cell (CAR T) therapies and other cell-based treatments with automated technologies for drug developers and larger healthcare providers at low costs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. automated and closed cell therapy processing systems market

By Workflow

- Separation

- Expansion

- Apheresis

- Fill- Finish

- Cryopreservation

- Others

By Type

- Stem Cell Therapy

- Non Stem Cell Therapy

By Scale

- Pre-commercial/ R&D Scale

- Commercial Scale