U.S. Ball Sports Goods Market Size and Growth

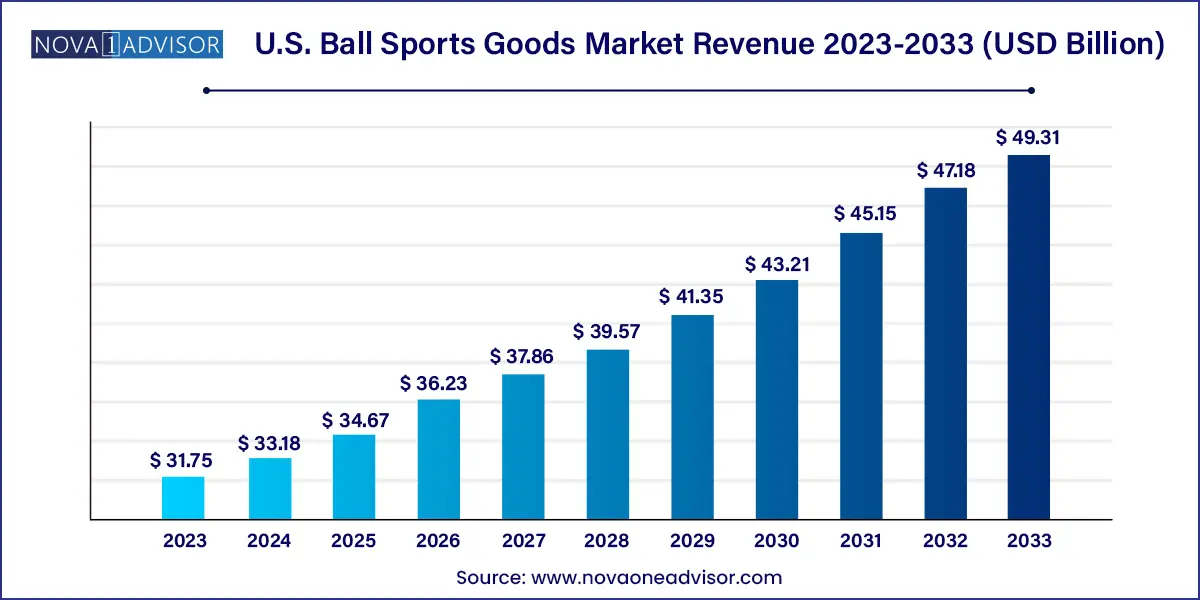

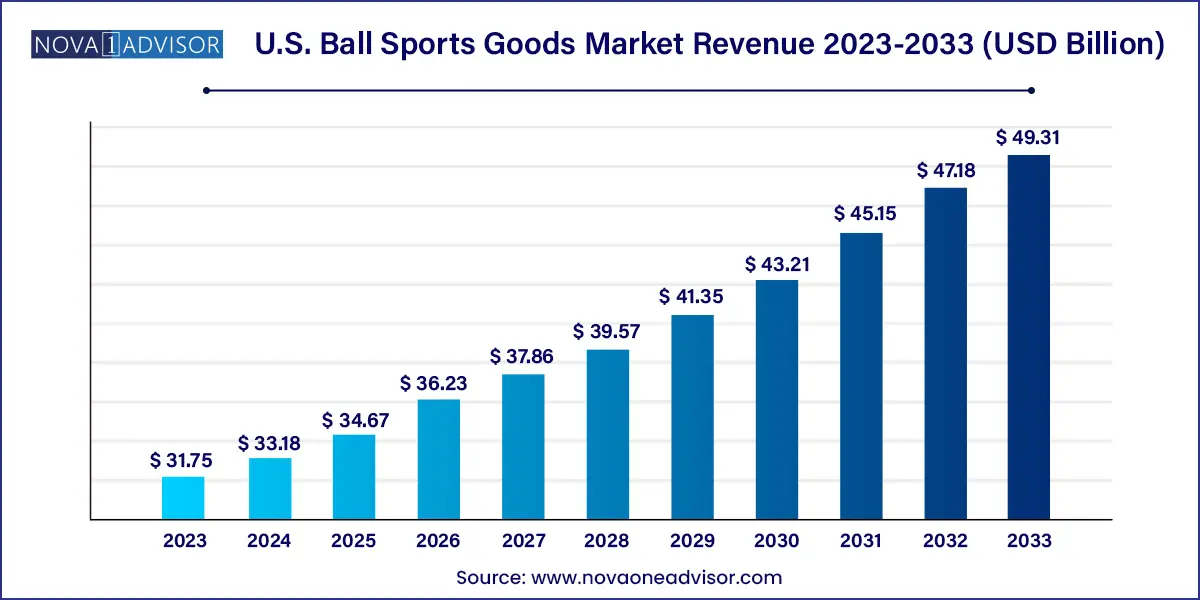

The U.S. ball sports goods market size was exhibited at USD 31.75 billion in 2023 and is projected to hit around USD 49.31 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

U.S. Ball Sports Goods Market Key Takeaways:

- The football/soccer goods segment accounted for a revenue share of 30.04% in 2023.

- The cricket segment is estimated to grow at a CAGR of 15.1% from 2024 to 2033.

- Apparel accounted for a revenue share of 47.86% in 2023.

- The footwear for ball sports goods market is expected to grow at a CAGR of 4.6% from 2024 to 2033.

- The mass priced ball sports goods segment accounted for a revenue share of 72.30% in 2023.

- The premium priced ball sports goods market is expected to grow at a CAGR of 5.9% from 2024 to 2033.

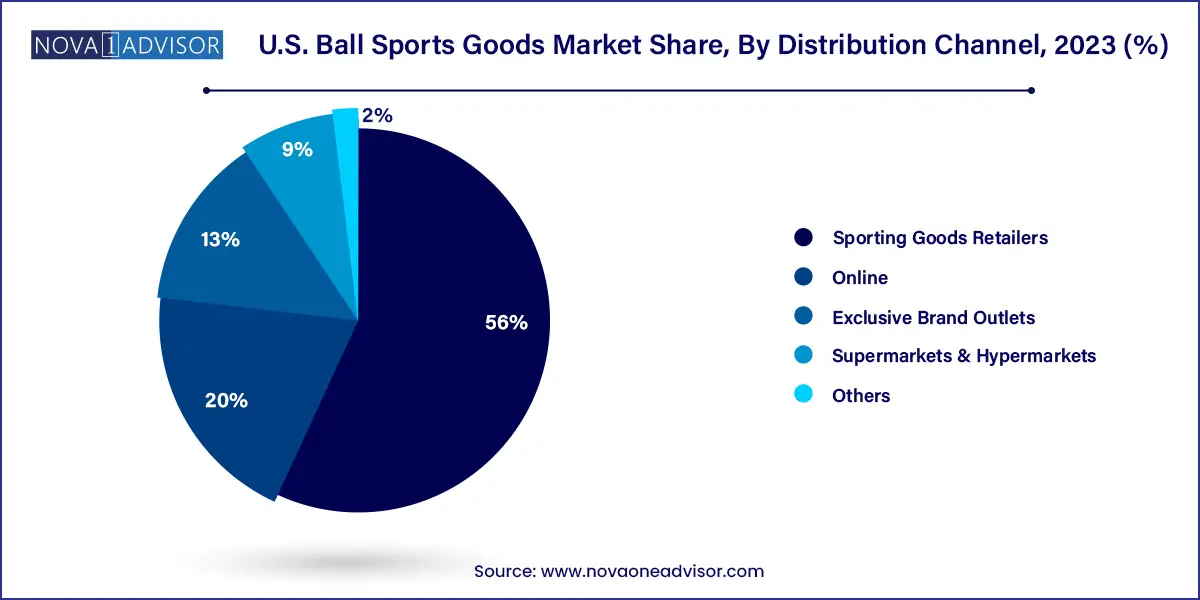

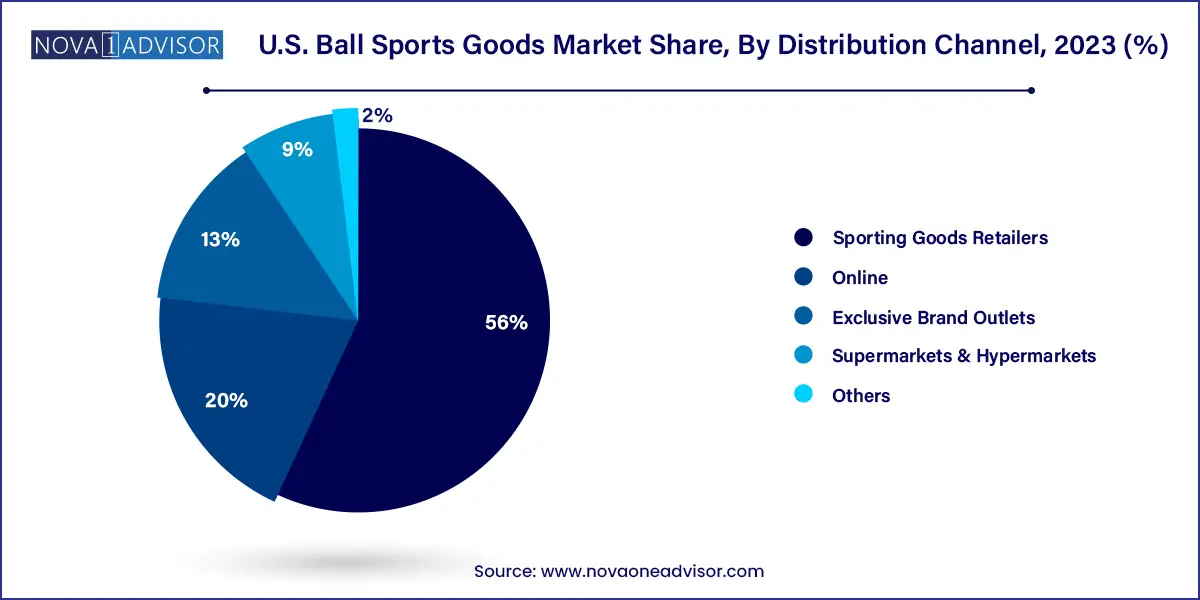

- The sales of ball sports goods through sporting goods retailers accounted for a revenue share of 56.0% in 2023.

- The sales of ball sports goods through online channels is expected to grow at a CAGR of 5.6% from 2024 to 2033.

Market Overview

The U.S. Ball Sports Goods Market represents a significant segment within the broader sporting goods industry, characterized by robust consumer interest, a culturally ingrained sports ecosystem, and consistent innovation across apparel, footwear, and equipment. Ball sports, encompassing a wide array of games such as basketball, football (soccer and American), baseball, golf, volleyball, and more, form the bedrock of American sports culture. The demand for associated sports goods is driven not only by professional leagues and collegiate athletics but also by amateur sports, community leagues, school tournaments, and recreational play.

As of 2024, the U.S. remains a global powerhouse in terms of both participation and consumption of ball sports-related products. The influence of national leagues such as the NBA, NFL, MLB, and MLS extends beyond entertainment into fashion, fitness, and youth engagement. With an increasing emphasis on health and active lifestyles, the U.S. consumer base is more inclined than ever to participate in sports—whether competitively or casually. This has led to growing demand for high-quality gear, performance-oriented apparel, and sport-specific footwear.

Technological integration, such as smart balls and sensor-embedded equipment, as well as eco-conscious product development, is shaping the evolution of this market. Simultaneously, demographic diversification and a rise in female participation across sports have widened the market base, prompting brands to explore inclusive product design and marketing strategies. The U.S. Ball Sports Goods Market is not only flourishing through physical retail but is also witnessing significant traction via e-commerce channels, driven by digital transformation and influencer-led product promotions.

Major Trends in the Market

-

Rise in Youth and Community Sports Programs: There is an increasing number of school and community-based leagues supporting grassroots participation, thereby boosting demand for affordable equipment and apparel.

-

Integration of Smart Technology in Equipment: Smart basketballs, connected golf clubs, and wearable performance trackers are gaining popularity among amateur and professional athletes.

-

Sustainability as a Brand Differentiator: Use of recycled materials and eco-friendly packaging is becoming a norm in sports goods production, appealing to environmentally conscious consumers.

-

Women’s Participation and Gender-Inclusive Products: Rising female participation in sports such as soccer and softball is prompting brands to expand women-specific product lines.

-

Collaboration with Professional Leagues and Athletes: Co-branded merchandise and player-endorsed collections are driving aspirational purchases among fans and young athletes.

-

E-commerce and Direct-to-Consumer Surge: Online channels, especially brand-owned e-commerce platforms, are witnessing rapid growth due to convenience, customization, and promotional bundling.

-

Fitness Crossover Appeal: Ball sports apparel and footwear are increasingly being used in casual and gym settings, blurring the line between sportswear and lifestyle wear.

-

Inclusive Sizing and Adaptive Equipment: Brands are investing in inclusive sizing and adaptive designs for consumers with disabilities or specific training needs.

Report Scope of U.S. Ball Sports Goods Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 33.18 Billion |

| Market Size by 2033 |

USD 49.31 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Sport, Product, Price Range, and Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Nike, Inc.; Adidas AG; PUMA SE; Under Armour, Inc.; Columbia Sportswear Company; lululemon athletica Inc.; New Balance Athletics, Inc.; Mizuno Corporation; Callaway Golf Company; ANTA Sports Products Limited |

Market Driver: Cultural Integration and National Sports Infrastructure

The dominant driver of the U.S. Ball Sports Goods Market is the nation’s deeply entrenched sports culture and institutional infrastructure. From Little League baseball to NCAA basketball, and all the way up to the NFL and MLS, ball sports are a societal staple. The structured progression from youth leagues to professional sports allows brands to engage with consumers at multiple life stages. School districts, city councils, and private clubs collectively create a massive consumer base that regularly invests in sporting goods. High school sports participation in the U.S. reached over 7 million athletes in 2023, according to NFHS data, reflecting the critical role of these systems in market development. Moreover, televised sports and merchandise licensing have turned fans into consumers, expanding revenue opportunities for apparel and branded gear.

Market Restraint: Seasonal and Weather Dependency of Certain Sports

Despite robust market dynamics, one notable restraint is the seasonal nature of several ball sports. Sports such as baseball, softball, and outdoor soccer are heavily influenced by climate conditions, especially in regions prone to extreme winters or summers. This leads to cyclical sales patterns, underutilization of inventory in off-seasons, and storage challenges for retailers. Furthermore, sports like cricket and lacrosse, while growing, still have limited participation in certain states, causing regional imbalances in demand. This seasonality also affects product development cycles, with brands having to anticipate demand several months in advance, increasing the risk of overstocking or under-delivering.

Market Opportunity: Expansion of Esports-Integrated and Training-Based Ball Sports

One of the most promising opportunities lies in merging traditional ball sports with digital training aids and esports elements. Interactive platforms that replicate real-world sports using virtual interfaces or simulate training environments are gaining attention. For instance, the rise of products like smart basketball hoops that track accuracy or golf simulators that provide in-depth swing analysis can create year-round engagement. Moreover, partnerships between video game publishers (like FIFA or NBA 2K) and sports leagues are driving cross-platform merchandise sales. Brands that tap into these hybrid spaces can appeal to both digital-native youth and competitive athletes seeking high-performance training solutions.

U.S. Ball Sports Goods Market By Sport Insights

Basketball dominated the U.S. ball sports market in 2024, owing to its widespread adoption across schools, urban centers, and professional circuits. With deep cultural relevance, particularly in inner-city communities and high schools, basketball remains the sport with the highest participation rate among youth. The influence of the NBA, frequent tournaments, and a lower entry barrier (minimal equipment needed) drive consistent consumer interest in basketball shoes, jerseys, hoops, and practice accessories. Street basketball also contributes to sustained demand outside formal settings. Moreover, player-endorsed footwear—such as signature series from LeBron James or Stephen Curry—transcends sport and blends into fashion, bolstering product sales.

Soccer is the fastest-growing sport segment, benefitting from a surge in youth participation and the increasing popularity of Major League Soccer (MLS). As soccer gains momentum, both male and female participation is rising, particularly at the school level and in suburban regions. The FIFA World Cup 2026, co-hosted by the U.S., has already begun to influence purchasing behavior, with early merchandising initiatives underway. Soccer cleats, jerseys, shin guards, and training cones are among the high-demand equipment. Additionally, women's soccer teams have gained national attention, contributing to the growth of gender-neutral and female-specific products.

U.S. Ball Sports Goods Market By Product Insights

Apparel dominated the product category, buoyed by both functional performance needs and the crossover into lifestyle wear. Sports jerseys, moisture-wicking t-shirts, compression wear, and hoodies associated with ball sports are worn both on and off the field. The influence of major sports apparel brands like Nike and Adidas, along with growing fan engagement in professional leagues, drives significant revenue from co-branded clothing. Jerseys, in particular, are collectible items that see spikes during major tournaments or player signings. Additionally, collegiate team merchandise contributes to seasonal sales peaks, especially during the March Madness and college football seasons.

Equipment is emerging as the fastest-growing product segment, with increasing innovation in smart gear and accessibility. Training equipment like automatic ball launchers, rebound nets, and simulation-based tools are popular among amateur players and schools. Personalized gear, such as custom bats or engraved golf balls, is also trending among consumers seeking unique sporting experiences. The demand for safety-certified equipment, especially in youth sports, is on the rise as well. With increased media coverage of injuries and health risks, consumers are investing more in quality helmets, padding, and sport-specific protection.

U.S. Ball Sports Goods Market By Price Range Insights

Mass-priced products dominate the market by volume, serving the needs of school programs, recreational players, and budget-conscious consumers. Affordable yet durable options available through large-scale retailers such as Walmart, Dick’s Sporting Goods, and Amazon are particularly popular. This segment is essential for public sports programs and youth clubs operating with limited budgets. Mass-priced goods ensure wider access to essential sporting goods, contributing to the social inclusivity of sports.

Premium products are the fastest-growing price category, driven by aspirational consumption and the demand for professional-grade gear. Whether it's NBA-style jerseys made with advanced fabrics, or golf clubs designed with aerodynamic materials, high-income households are increasingly investing in quality and performance. Custom-fit footwear, tech-integrated gear, and collector-edition merchandise are also key components of this segment. Athletes and serious hobbyists are willing to pay a premium for tools that enhance their game, improve safety, or add prestige to their sports involvement.

U.S. Ball Sports Goods Market By Distribution Channel Insights

Sporting goods retailers dominate the U.S. market in terms of sales volume and consumer trust. Chains like Academy Sports + Outdoors, Dick’s Sporting Goods, and Modell’s provide a comprehensive assortment of brands and cater to both novice and experienced players. These outlets offer the advantage of product trials, expert guidance, and immediate availability, especially for equipment that needs fitting or customization. Their partnerships with schools and clubs further reinforce bulk purchasing.

Online distribution is the fastest-growing channel, significantly boosted by digital transformation and mobile-first consumer behavior. Brand websites, e-commerce platforms, and marketplaces provide consumers with detailed product information, peer reviews, and delivery convenience. Online-exclusive drops, influencer marketing, and virtual try-ons have enhanced user engagement. Particularly in categories like apparel and footwear, online sales outperform physical stores in terms of frequency and ease of purchase. Additionally, subscription-based equipment rental and delivery models are also gaining traction, especially for sports like golf and baseball.

Country-Level Analysis

In the United States, ball sports enjoy a unique status, heavily integrated into the cultural, educational, and entertainment fabric of society. Professional leagues like the NFL, NBA, and MLB are not only massive business empires but also cultural institutions that influence youth aspirations, local economies, and consumer behavior. Ball sports participation begins early in childhood, often through school or club-based programs, and is supported by a vast network of facilities, coaches, and government-backed initiatives.

Urban centers like New York, Los Angeles, and Chicago serve as epicenters for basketball and baseball, while cities like Dallas and Boston excel in football. Meanwhile, suburban regions are driving growth in soccer and softball. States with milder climates, such as California and Florida, benefit from year-round sports activities, leading to higher per capita spending on sports goods. In recent years, digital-first regions like Seattle and Austin have emerged as hotspots for smart fitness adoption, reflecting an evolving consumer mindset.

U.S. Ball Sports Goods Market Recent Developments

-

January 2025: Nike launched its Elite Performance Basketball Shoe, co-designed with top NBA stars, incorporating enhanced shock absorption and customizable traction for indoor and outdoor courts.

-

February 2025: Adidas announced a new line of climate-positive soccer balls, manufactured using bio-based polymers and recyclable cores, aligning with the brand’s sustainability goals.

-

March 2025: Wilson Sporting Goods introduced the Connected Baseball Series, embedded with motion sensors to help coaches analyze pitching and swing data in real-time.

-

January 2025: Under Armour unveiled Project GameDay, an apparel collection tailored for female athletes in rugby and softball, designed using feedback from collegiate players.

-

February 2025: Puma entered into a multi-year partnership with MLS, becoming the official equipment and apparel sponsor for several major teams, expanding their footprint in American soccer.

Some of the prominent players in the U.S. ball sports goods market include:

- Nike, Inc.

- Adidas AG

- Callaway Golf Company

- New Balance Athletics, Inc

- Under Armour, Inc.

- PUMA SE

- lululemon athletica Inc.

- ANTA Sports Products Limited

- Columbia Sportswear Company

- Mizuno Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ball sports goods market

Sport

- Basketball

- Football/ Soccer

- Volleyball

- Baseball

- Ice Hockey

- Cricket

- Golf

- Lacrosse

- Rugby

- Softball

Product

- Apparel

- Footwear

- Equipment

Price Range

Distribution Channel

- Online

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others