U.S. BDSM Sex Toys Market Size and Research 2026 to 2035

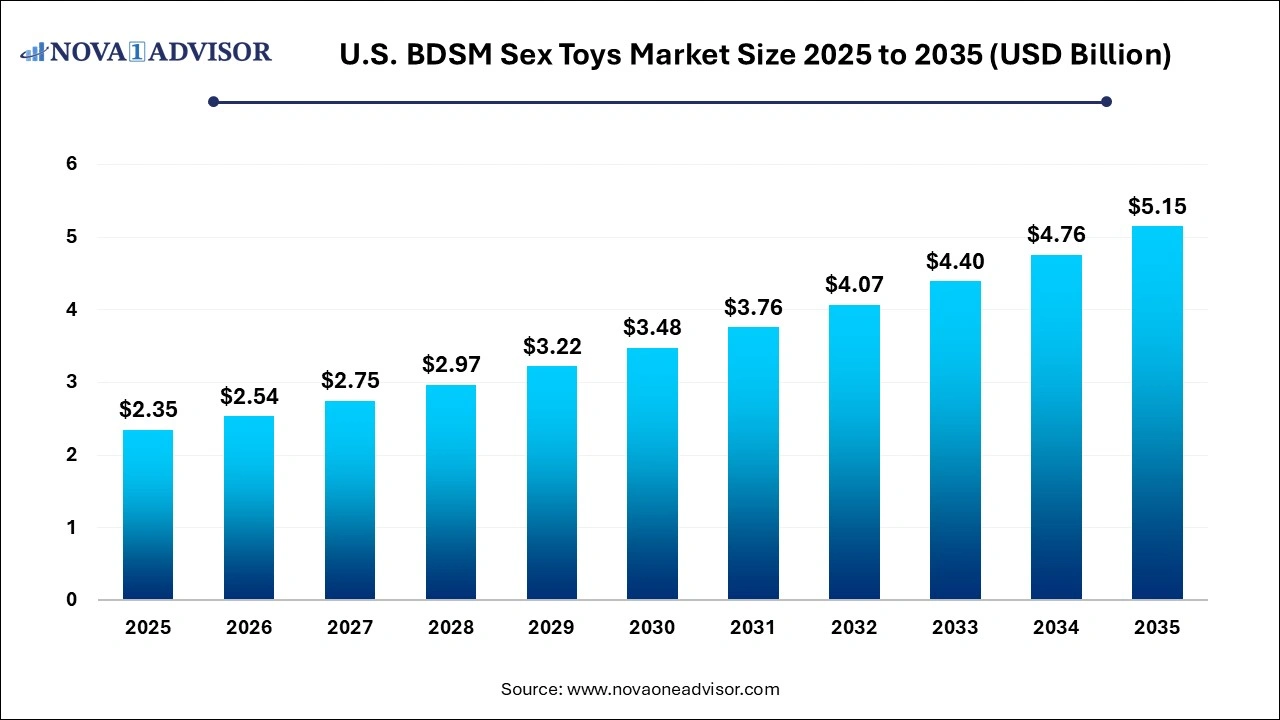

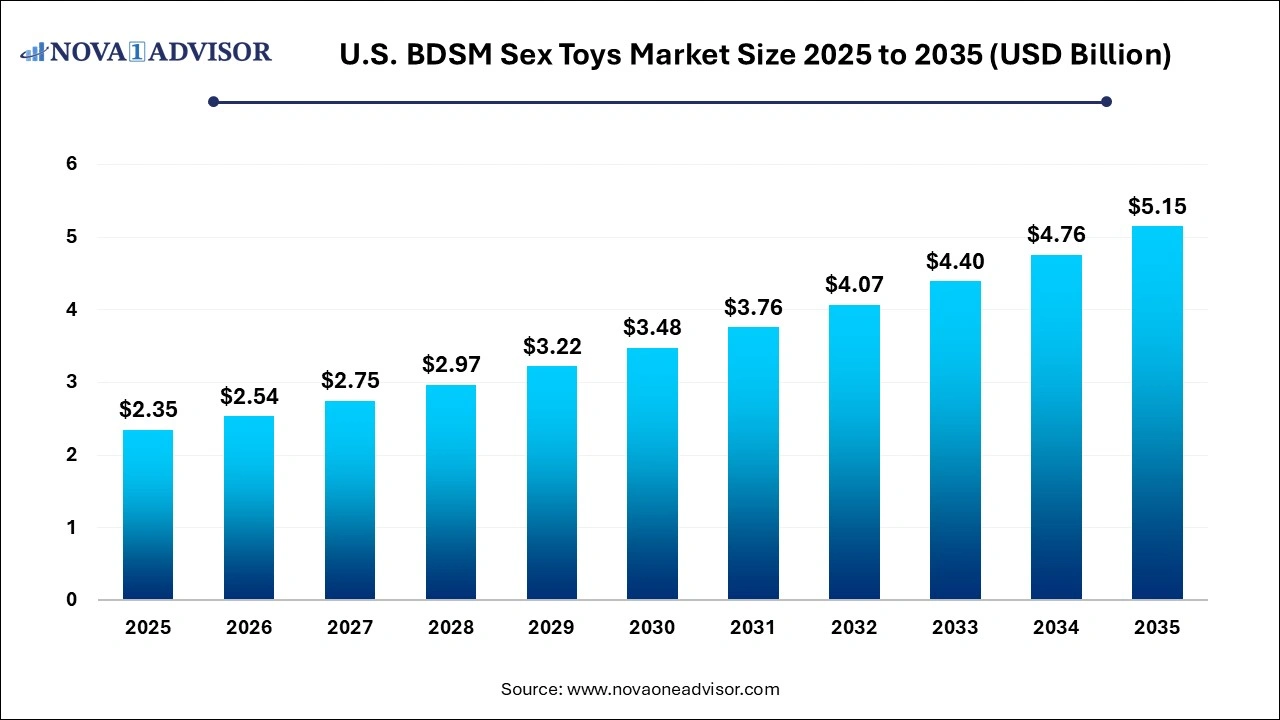

The U.S. BDSM sex toys market size was exhibited at USD 2.35 billion in 2025 and is projected to hit around USD 5.15 billion by 2035, growing at a CAGR of 8.16% during the forecast period 2026 to 2035.

Key Takeaways:

- Restraints dominated in 2025 with the largest revenue share of 30.86% and is expected to witness the fastest CAGR from 2026 to 2035.

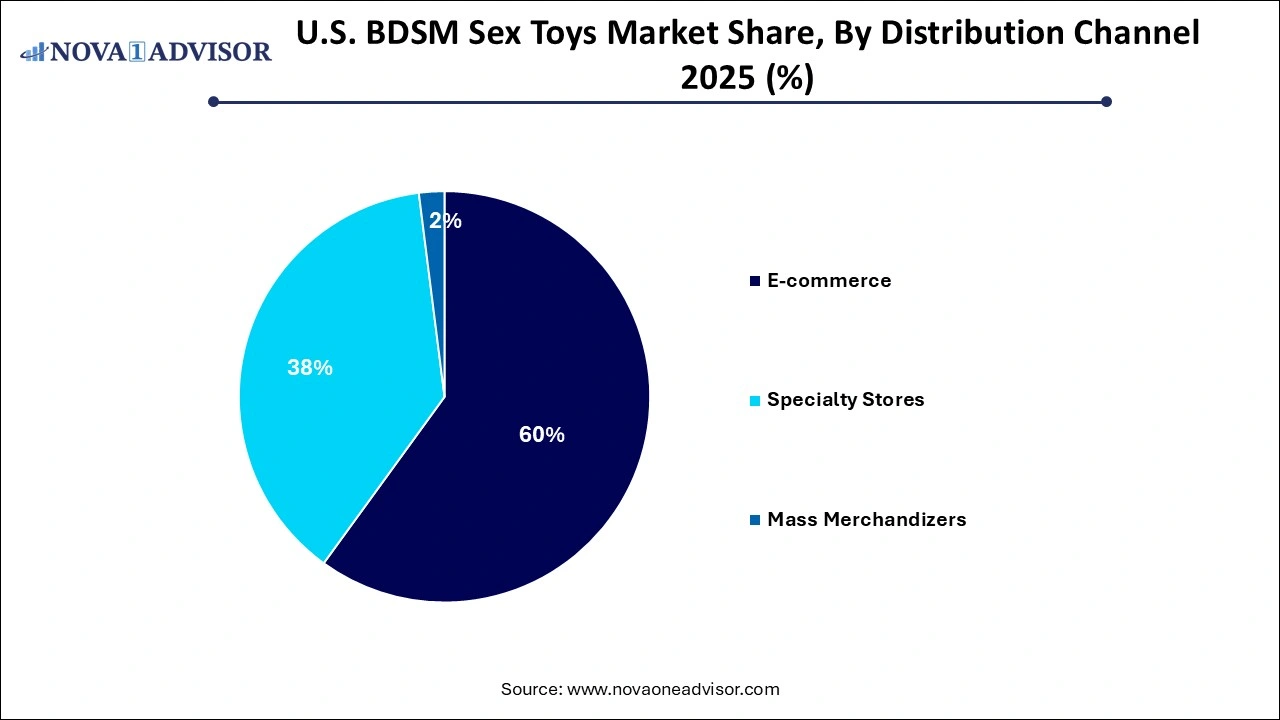

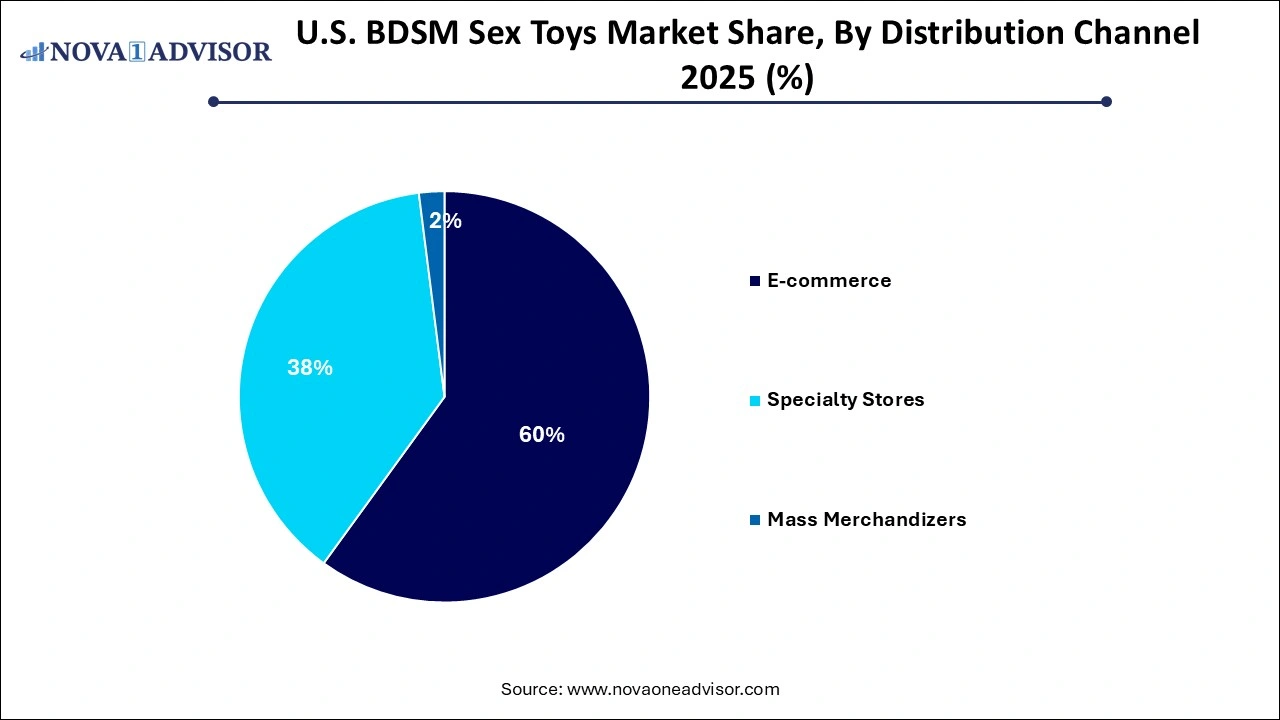

- E-commerce dominated with the largest revenue share of 60% in 2025.

- Specialty stores held a significant revenue share in 2025.

U.S. BDSM Sex Toys Market Overview

The U.S. BDSM sex toys market has transitioned from a niche domain to a flourishing segment of the broader sexual wellness industry. Driven by increasing sexual openness, rising interest in kink-positive lifestyles, and a cultural shift toward the destigmatization of BDSM (Bondage, Discipline, Dominance, Submission, Sadism, and Masochism), this market is experiencing robust expansion. From leather restraints and electrostimulation devices to advanced sex machines and bondage furniture, the U.S. consumer base is now more diverse, curious, and empowered than ever before.

Once confined to underground communities, BDSM has entered mainstream consciousness through media, literature (notably the "Fifty Shades of Grey" phenomenon), and social advocacy. Its visibility has cultivated an inclusive marketplace where both novice users and seasoned practitioners seek tools that enhance pleasure, safety, and intimacy. Moreover, consumers now prioritize high-quality, body-safe, and customizable products, signaling a demand shift from novelty to function-driven sophistication.

The intersection of e-commerce, influencer culture, and educational resources has allowed manufacturers and retailers to connect with previously untapped demographics. Online reviews, social media demonstrations, and workshops have demystified BDSM play, making it more accessible to the average consumer. Simultaneously, the U.S. market is being shaped by factors like product innovation, gender-neutral design, and ethical marketing approaches focused on consent and safety.

The growing BDSM segment is an integral component of the $10+ billion U.S. sex toys market and is forecasted to exhibit steady growth through the decade, supported by evolving consumer values, increasing online penetration, and an expanding ecosystem of specialized products.

Major Trends in the U.S. BDSM Sex Toys Market

-

Mainstream Normalization of Kink Culture: Social media, television, and literature continue to normalize BDSM practices, fueling interest in bondage products.

-

E-commerce Dominance: Online platforms now account for the majority of BDSM toy sales, offering discreet delivery, user reviews, and diverse inventories.

-

Gender-Inclusive and LGBTQ+ Friendly Design: Brands are focusing on inclusive designs that appeal across genders, orientations, and relationship types.

-

Premiumization of BDSM Products: Consumers are moving away from cheap novelty items toward premium, long-lasting, and luxury-grade toys.

-

Consent-Driven Marketing: Brands emphasize safety, education, and communication, embedding consent principles into packaging and promotions.

-

Rise in “Beginner Kits”: To attract first-time users, companies are launching curated starter kits featuring blindfolds, cuffs, and floggers.

-

Tech-Infused BDSM Devices: App-controlled electrostimulation tools and programmable sex machines are gaining traction among tech-savvy users.

-

Retail Collaborations with Sex Educators: Brands increasingly partner with sex therapists and kink influencers for product development and marketing outreach.

Report Scope of The U.S. BDSM Sex Toys Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.54 Billion |

| Market Size by 2035 |

USD 5.15 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.16% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Lovehoney Group Ltd.; Doc Johnson Enterprises; Unbound; PHE, Inc. (Adam & Eve); California Exotic Novelties; Pipedream Products; Mr. S Leather; The Stockroom (JTT, Co.); Extreme Restraints (XR LLC); Kink Store |

Market Driver: Expanding Sexual Wellness Discourse and Acceptance of Kink

One of the most significant drivers propelling the U.S. BDSM sex toys market is the cultural acceptance of sexual wellness and kink exploration as components of a healthy lifestyle. The contemporary consumer especially millennials and Gen Z is increasingly open to discussing intimacy, consent, and pleasure without shame. This shift has fostered a thriving demand for sexual tools that go beyond conventional vibrators or dildos.

Media portrayals, from HBO series to wellness podcasts, have brought kink into the mainstream lexicon. According to a 2023 YouGov survey, over 45% of Americans expressed interest in experimenting with some form of BDSM. This interest translates directly into consumer demand for safe, quality-tested products ranging from light restraints to advanced bondage gear. As sex-positive therapy and education gain traction, even therapeutic uses of BDSM tools such as sensory deprivation for anxiety relief—are being explored, expanding the product’s functional appeal.

Market Restraint: Stigma and Uneven Retail Representation

Despite increased visibility, social stigma and limited representation in physical retail environments remain substantial restraints. Many mainstream brick-and-mortar retailers continue to avoid BDSM products due to concerns over conservative backlash or community standards. This results in limited offline access, particularly in suburban and rural areas where alternative lifestyle products are not widely promoted.

Moreover, while online channels mitigate some of these issues, algorithmic content restrictions and advertising bans on platforms like Facebook and Instagram create hurdles for marketers and sellers of BDSM toys. Inconsistent regulatory labeling standards for products involving electrostimulation or bondage furniture can further confuse consumers and limit entry for smaller players. The stigma associated with BDSM also deters some consumers from engaging in retail or educational opportunities, potentially slowing the conversion of curious individuals into paying customers.

Market Opportunity: Personalization and Smart Technology Integration

A compelling opportunity lies in the integration of smart technology and customizable features into BDSM products, catering to a highly experimental consumer base. Tech-enhanced toys that connect to apps for remote control, programmable intensity settings, or AI-driven feedback loops are transforming how BDSM is experienced. Consumers can now program electrostimulation patterns, sync devices with music, or even control a partner’s restraints via Bluetooth across long distances—blending intimacy with innovation.

Customization is also on the rise, allowing consumers to tailor tools based on body type, experience level, and personal limits. Adjustable cuffs, modular furniture, and ergonomic sex machines with app-controlled interfaces are increasingly popular. Companies that harness these innovations while ensuring user safety and compliance are poised to lead the next wave of growth in this highly responsive market.

Segmental Insights

By Type Insights

Restraints dominate the BDSM toy market in the U.S., primarily due to their universal appeal, affordability, and accessibility for beginners and advanced users alike. This category includes handcuffs, ankle cuffs, ropes, hog ties, harnesses, and bondage tape. These tools are often featured in beginner kits and represent a low-risk, high-intensity entry point into power play. Their flexibility allows users to experiment with dominance and submission dynamics without investing in elaborate setups. Major retailers like Lovehoney and Stockroom report that restraint kits consistently outsell other BDSM product categories, underlining their mass-market compatibility.

Electrostimulation products are the fastest growing type, propelled by consumer fascination with tech-enhanced intimacy and sensory control. E-stim devices use low-voltage currents to create tingling or pulsating sensations, and advanced models allow for precision targeting of erogenous zones. The market is seeing a rise in digital controllers, remote-operated units, and app-syncing functionalities. These tools are particularly popular among experienced users and are also being adopted in kink-focused therapy contexts. As understanding of safe usage grows and stigma around such practices lessens, this segment is expected to continue its exponential growth.

By Distribution Channel Insights

E-commerce is the dominant distribution channel in the BDSM sex toys market, owing to its anonymity, expansive product variety, and educational content. Platforms like Amazon, Lovehoney, and Adam & Eve enable discreet purchasing and offer access to reviews, how-to guides, and size charts. The online model also benefits from algorithms that suggest complementary products, increasing basket size. Sales via e-commerce surged during the COVID-19 pandemic and continue to grow as consumers become more comfortable shopping for adult products digitally.

Specialty stores are experiencing steady growth, especially in urban centers and progressive regions. These outlets provide hands-on demonstrations, expert staff, and community engagement opportunities. Retailers like Pleasure Chest and Babeland are embracing educational retail, hosting workshops on kink safety and communication. The in-store experience allows consumers to explore tactile elements and ensures proper sizing for complex products like harnesses or furniture. As destigmatization continues, specialty stores are becoming community hubs for empowerment and exploration.

Specialty stores are experiencing steady growth, especially in urban centers and progressive regions. These outlets provide hands-on demonstrations, expert staff, and community engagement opportunities. Retailers like Pleasure Chest and Babeland are embracing educational retail, hosting workshops on kink safety and communication. The in-store experience allows consumers to explore tactile elements and ensures proper sizing for complex products like harnesses or furniture. As destigmatization continues, specialty stores are becoming community hubs for empowerment and exploration.

Country-Level Insights – United States

The U.S. BDSM sex toys market is distinguished by its rapid cultural evolution, expansive e-commerce infrastructure, and a large base of sexually active, open-minded consumers. With over 70 million adults aged 25–45 an age group most likely to purchase BDSM-related products the market benefits from a robust demographic foundation. Progressive regions such as California, New York, and Washington show the highest per capita BDSM product sales, driven by high urbanization, LGBTQ+ inclusivity, and strong retail presence.

At the same time, suburban and conservative markets are showing increased curiosity and penetration via digital channels. Federal law permits the sale of adult toys, but individual state interpretations and zoning restrictions can still limit offline expansion. However, rising acceptance of kink in therapy, media, and health education is creating a favorable environment nationwide. Moreover, growing representation of non-heteronormative relationships is reshaping consumer expectations and product design, turning the U.S. into both a consumer and innovation hub for the BDSM toy segment.

Some of the prominent players in the U.S. BDSM sex toys market include:

Recent Developments

-

February 2024 – Lovehoney Group announced the expansion of its BDSM line in the U.S., featuring eco-conscious materials, adjustable sizing, and gender-inclusive packaging. The launch included a line of app-controlled electrostim devices and a collaboration with a popular TikTok sex educator.

-

January 2024 – Sportsheets International launched a customizable bondage furniture collection targeting luxury consumers, featuring modular components and smart lock mechanisms.

-

November 2023 – Doc Johnson, a major U.S. manufacturer, introduced a new “Beginner’s BDSM” collection in partnership with therapists to offer psychologically safe tools for couples new to kink.

-

September 2023 – Stockroom Inc. partnered with sexual health clinics in California to promote safe BDSM practices and demonstrate their impact on communication and trust in intimate relationships.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. BDSM sex toys market

Type

- Restraints

- Bondage Furniture

- Sex Machines

- Electrostimulation Products

- Sensory Deprivation

- Physical Stimulation

Distribution Channel

- E-commerce

- Specialty Stores

- Mass Merchandizers

Specialty stores are experiencing steady growth, especially in urban centers and progressive regions. These outlets provide hands-on demonstrations, expert staff, and community engagement opportunities. Retailers like Pleasure Chest and Babeland are embracing educational retail, hosting workshops on kink safety and communication. The in-store experience allows consumers to explore tactile elements and ensures proper sizing for complex products like harnesses or furniture. As destigmatization continues, specialty stores are becoming community hubs for empowerment and exploration.

Specialty stores are experiencing steady growth, especially in urban centers and progressive regions. These outlets provide hands-on demonstrations, expert staff, and community engagement opportunities. Retailers like Pleasure Chest and Babeland are embracing educational retail, hosting workshops on kink safety and communication. The in-store experience allows consumers to explore tactile elements and ensures proper sizing for complex products like harnesses or furniture. As destigmatization continues, specialty stores are becoming community hubs for empowerment and exploration.