U.S. Biopharmaceutical CMO and CRO Market Size, Growth, Trends 2026 to 2035

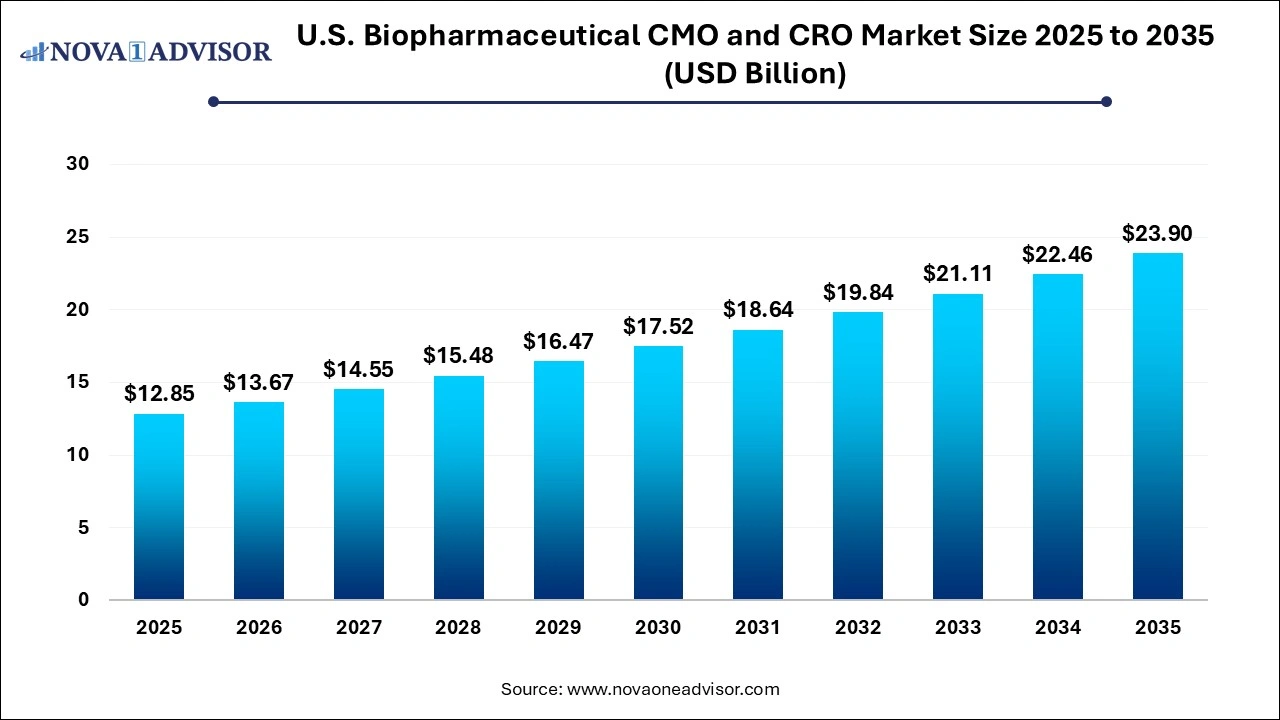

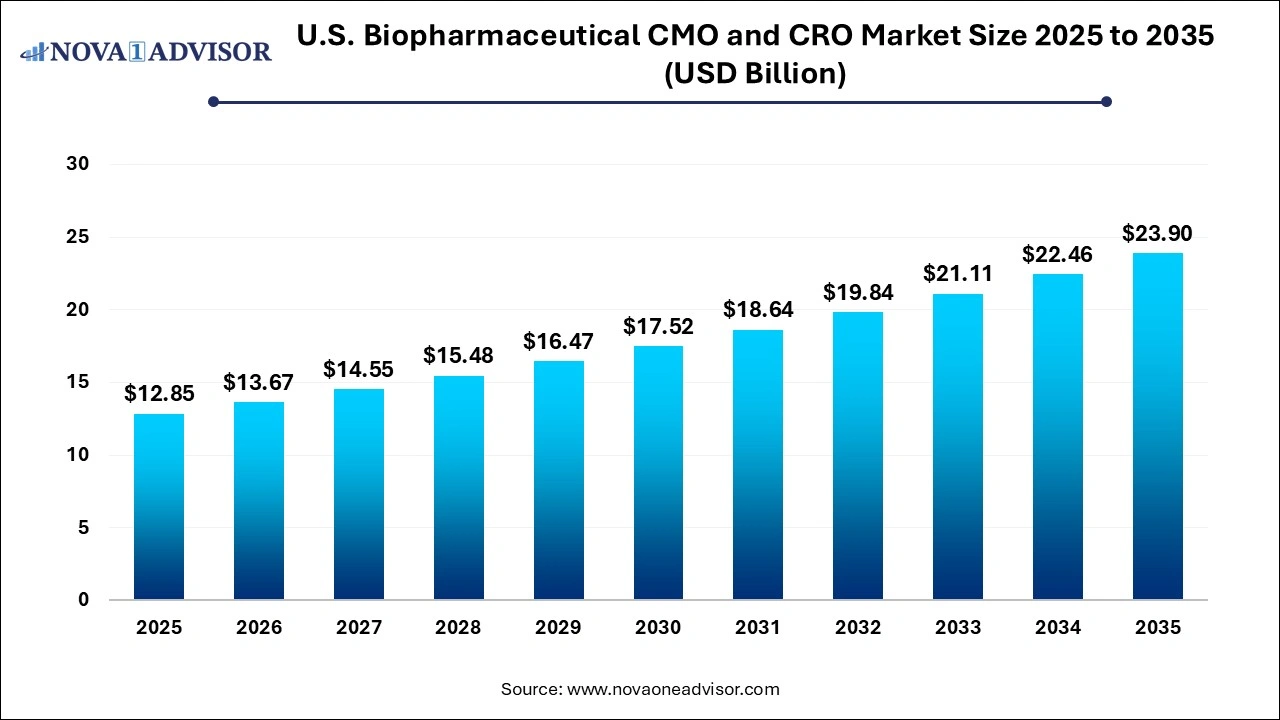

The U.S. biopharmaceutical CMO and CRO market size was estimated at USD 12.85 billion in 2025 and is projected to hit around USD 23.90 billion by 2035, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

Key Takeaways:

- In 2025, the mammalian segment of the biopharmaceutical manufacturing market held the highest market share at 69.14%. and is expected to grow at a CAGR of 6.3% during the forecast period.

- The contract research service types segment is expected to register the fastest CAGR of 6.9% over the forecast period

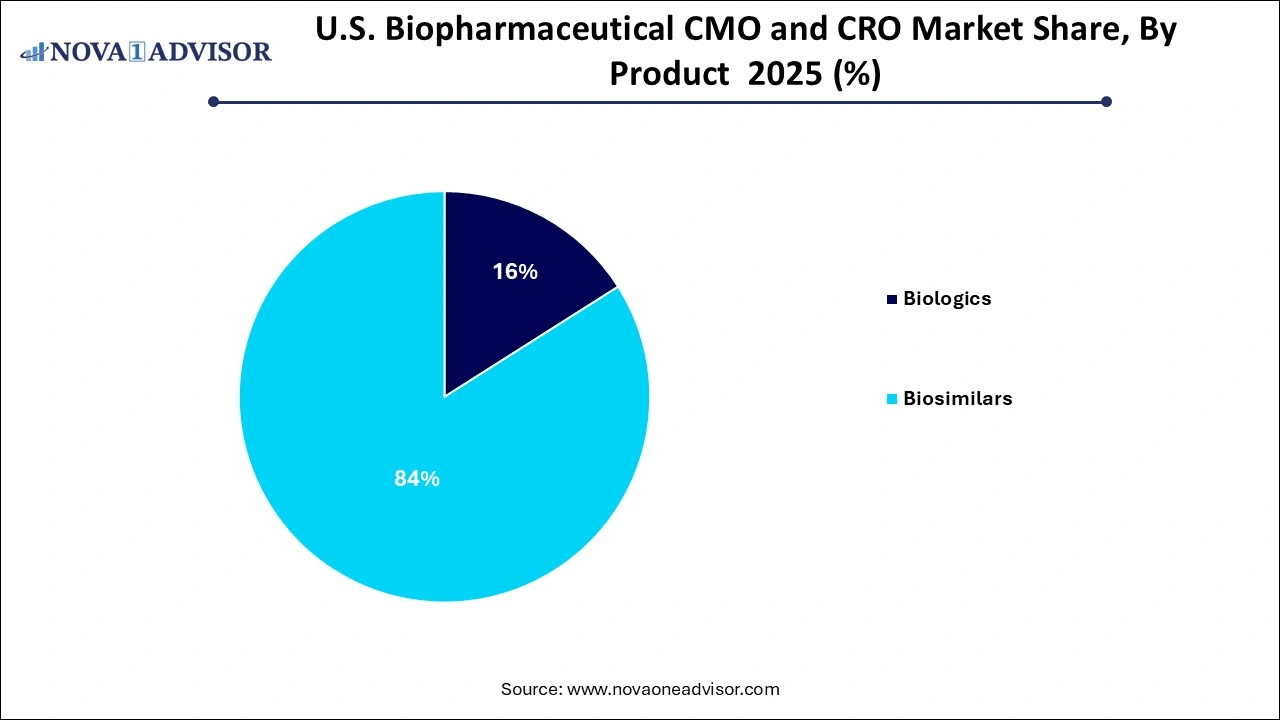

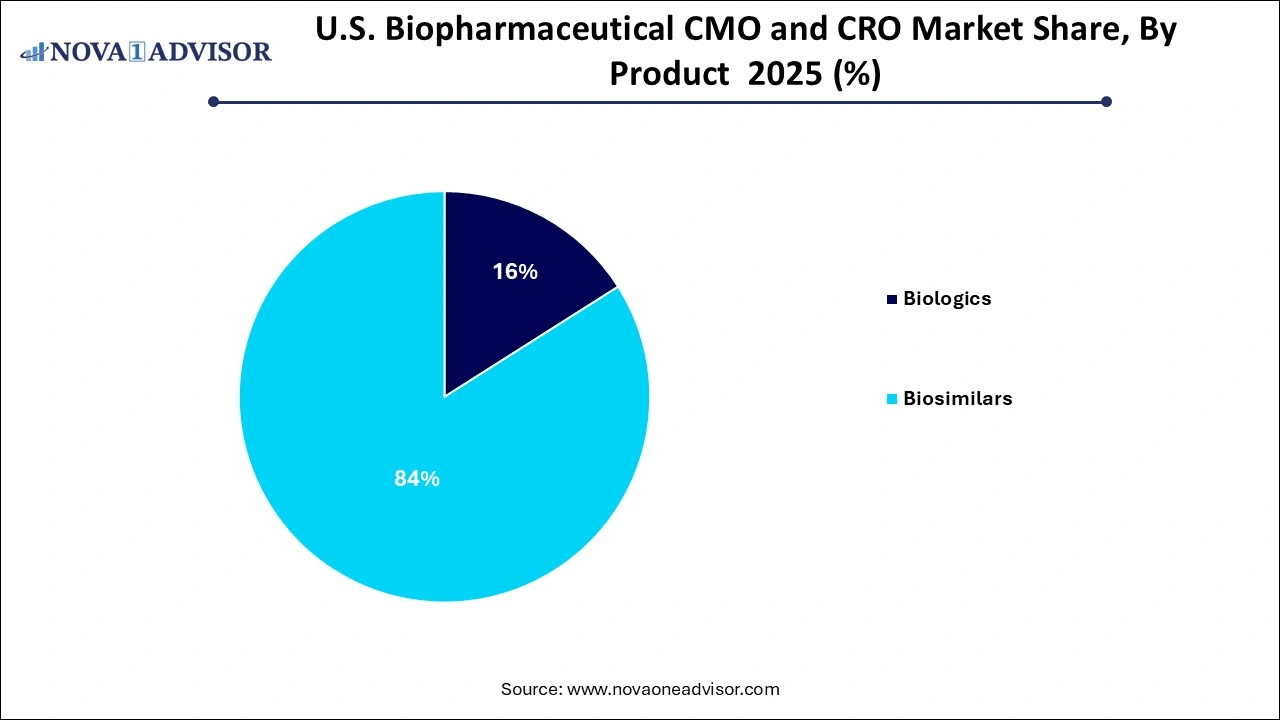

- The biologics segment is expected to dominate the market with the largest revenue share of 84% in 2025.

- This can be attributed to the local presence of several contract research service providers in the country. The U.S. has a higher concentration and number of biopharmaceutical CMOs and CROs in comparison with other countries

Market U.S. Biopharmaceutical CMO and CRO Overview

The U.S. biopharmaceutical contract manufacturing organizations (CMOs) and contract research organizations (CROs) market has evolved into a cornerstone of the pharmaceutical and biotechnology industry. As the demand for biologics and biosimilars continues to surge, more pharmaceutical companies are outsourcing various segments of the drug development and production value chain to specialized third-party vendors. CMOs provide end-to-end manufacturing support including upstream/downstream processing, formulation, packaging, and fill & finish operations while CROs offer expertise in clinical research, regulatory strategy, and therapeutic area-specific trials.

With biopharmaceutical development becoming increasingly complex and capital-intensive, the CMO and CRO model offers scalability, cost-efficiency, and access to specialized talent. U.S.-based companies, many of which are globally renowned for innovation and regulatory compliance, are leading this evolution. These organizations provide state-of-the-art infrastructure, advanced biologics capabilities (like monoclonal antibody and gene therapy platforms), and deep therapeutic expertise in areas such as oncology, neuroscience, and immunology.

Additionally, the industry is seeing a convergence of CMO and CRO services into integrated CDMO (Contract Development and Manufacturing Organization) models. These hybrid firms manage the entire lifecycle of drug development—from discovery through commercialization thereby reducing hand-off risks and improving speed-to-market. As patent cliffs loom and biopharma pipelines increasingly favor biologics over small molecules, the role of U.S.-based CMOs and CROs will become even more central in the coming decade.

Major Trends in the U.S. Biopharmaceutical CMO and CRO Market

-

Rise of Integrated CDMO Models: Companies are combining manufacturing and research services under one roof to offer seamless end-to-end solutions.

-

Increased Demand for Advanced Therapy Medicinal Products (ATMPs): Gene and cell therapies are driving a shift in CMO/CRO investments and capabilities.

-

AI-Driven Clinical Trials and Data Analysis: CROs are using artificial intelligence to optimize patient recruitment, trial design, and predictive modeling.

-

Outsourcing by Emerging Biotech Startups: Early-stage companies are relying heavily on CMOs/CROs due to limited internal infrastructure.

-

FDA Fast-Track and Accelerated Approvals: Regulatory incentives are pushing sponsors to collaborate with experienced CROs to meet tight timelines.

-

Biosimilars Market Expansion: As key biologic patents expire, demand for manufacturing and clinical testing of biosimilars is on the rise.

-

U.S. Nearshoring Strategies: Companies are moving operations back to the U.S. to reduce geopolitical and supply chain risks.

-

ESG and Sustainability Requirements: There is growing pressure on CMOs/CROs to adopt greener practices and transparent ESG reporting.

U.S. Biopharmaceutical CMO & CRO Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 13.67 Billion |

| Market Size by 2035 |

USD 23.90 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Source, service, product |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Catalent; Lonza Group AG; Boehringer Ingelheim GmbH; Rentschler Biopharma SE; Thermo Fisher Scientific, Inc; AGC Biologics; Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Samsung Biologics; WuXi Biologics; AbbVie Inc.; Charles River Laboratories International, Inc.; ICON Plc; Parexel International Corporation; Labcorp, Abzena |

Market Driver: Surging Demand for Biologics and Precision Medicine

A key driver of the U.S. biopharmaceutical CMO & CRO market is the accelerated development of biologics and precision therapeutics, especially monoclonal antibodies, gene therapies, and mRNA-based drugs. As of 2024, more than 40% of all new drug approvals by the FDA fall into the biologics category, with many designed to treat oncology, autoimmune disorders, and rare diseases.

Given the complexity and regulatory sensitivity of biologic drugs, many pharmaceutical sponsors prefer to outsource production and research to experienced CMOs and CROs. These partners offer scalable GMP-compliant facilities, advanced bioprocessing capabilities (e.g., single-use bioreactors), and specialized clinical expertise. For instance, developing a monoclonal antibody may require custom upstream cell line development, strict cold chain logistics, and multi-phase clinical validation—all of which CMOs and CROs are equipped to handle. The rise in companion diagnostics and patient-specific therapies is also pushing demand for organizations that can support agile, niche development projects.

Market Restraint: Stringent Regulatory Compliance and Quality Audits

While growth prospects are strong, one of the key restraints facing the market is the high burden of regulatory compliance and quality assurance requirements imposed by the U.S. FDA and international agencies. CMOs and CROs must meet rigorous standards regarding Good Manufacturing Practice (GMP), data integrity, environmental control, and documentation. A single deviation or audit failure can lead to significant reputational damage and financial loss.

Moreover, with the increasing complexity of biologics and ATMPs, manufacturing partners must continuously invest in staff training, facility upgrades, and quality systems to remain compliant. This imposes high operational costs, especially on mid-sized players. In the CRO segment, patient data privacy under HIPAA and the use of AI/ML tools in clinical research also introduce new compliance challenges. The evolving regulatory landscape may delay time-to-market and complicate client onboarding for less mature service providers.

Market Opportunity: Expansion of Biosimilar Pipelines and Cost-effective Biomanufacturing

A substantial opportunity lies in the expansion of biosimilars pipelines in the U.S., driven by the expiration of patents for several blockbuster biologics such as Humira, Avastin, and Herceptin. The FDA’s biosimilar approval pathway though relatively recent compared to Europe is becoming more streamlined, creating favorable conditions for outsourced development and production services.

CMOs that specialize in cell line development, analytical comparability studies, and downstream purification processes are seeing increasing inquiries from biosimilar developers. CROs, in turn, are managing the comparative clinical trials required to demonstrate non-inferiority. With pricing pressures rising on payers and Medicare systems, biosimilars are expected to see greater reimbursement acceptance and physician adoption, particularly in oncology and autoimmune therapy. Companies that can offer fast, cost-effective, and regulatory-compliant services will be well-positioned to capitalize on this trend.

Segmental Analysis

By Source Analysis

Mammalian expression systems remain the dominant source in the U.S. biopharmaceutical CMO market. These systems—especially CHO (Chinese Hamster Ovary) cell lines—are critical for producing complex biologics such as monoclonal antibodies and recombinant proteins. Mammalian systems offer superior post-translational modification capabilities, making them suitable for biologics that require human-like glycosylation. Most CMO facilities in the U.S. have specialized bioreactors and purification suites designed to handle mammalian cultures, and new investments often continue to target this segment. The scalability of these systems also makes them ideal for commercial-scale production of high-volume therapeutics.

Non-mammalian systems, especially microbial and yeast-based platforms, are growing rapidly due to their cost-efficiency, speed, and utility in biosimilars and niche biologics. Escherichia coli-based expression systems, for example, are widely used in insulin and growth hormone manufacturing. Their rapid replication and lower nutrient requirements make them attractive for small to mid-sized CMOs focusing on early-phase production or research applications. Additionally, new advances in synthetic biology and cell-free expression systems are pushing the boundaries of non-mammalian manufacturing. As demand rises for biosimilar formulations and targeted peptides, this segment is poised for aggressive growth.

By Service Type Analysis

Contract manufacturing services dominate the market, with end-to-end offerings that span upstream/downstream process development, fill & finish, and packaging. The growing demand for biologics and viral vector-based therapies has led to a surge in CMO investments across the U.S., especially in Massachusetts, North Carolina, and California. For example, Curia announced in March 2024 a major expansion of its cGMP biologics manufacturing facility in New York, targeting monoclonal antibody production and viral vector packaging. Fill & finish operations, particularly aseptic filling for biologics and vaccines, are in high demand as pharmaceutical sponsors prepare for large-scale commercialization.

CRO services specializing in oncology trials are the fastest growing, reflecting the pipeline priorities of major pharma companies. With nearly 35% of global clinical trials involving oncology indications, CROs in the U.S. are building niche capabilities in immuno-oncology, CAR-T therapies, and precision diagnostics. These trials are highly complex, involving biomarkers, small patient cohorts, and adaptive designs. CROs that offer regulatory consulting, trial site management, and real-world evidence collection are experiencing rapid revenue growth. The trend is further fueled by FDA fast-track designations and breakthrough therapy approvals in oncology.

By Product Analysis

Biologics continue to dominate the product segment, representing the lion’s share of outsourced CMO/CRO activity in the U.S. This category includes monoclonal antibodies (MAbs), recombinant proteins, and therapeutic vaccines, each of which requires advanced bioprocessing infrastructure. MAbs are particularly resource-intensive, often needing extensive purification and cold-chain handling. With over 100 MAbs approved by the FDA and dozens more in clinical pipelines, CMOs and CROs supporting these products see consistent demand. Companies such as Lonza, Catalent, and WuXi Biologics are investing heavily in expanding their U.S.-based manufacturing capacity to support biologics development.

Biosimilars are emerging as the fastest growing product segment, driven by patent expirations and policy support. As of 2025, more than 45 biosimilars have been approved in the U.S., covering therapeutic areas such as oncology, endocrinology, and rheumatology. The need for efficient scale-up, analytical comparability studies, and abbreviated clinical trials makes outsourcing particularly attractive for biosimilar developers. Smaller biotech firms entering the biosimilars space are increasingly seeking turnkey CDMO solutions that allow them to navigate regulatory complexities while optimizing cost.

Biosimilars are emerging as the fastest growing product segment, driven by patent expirations and policy support. As of 2025, more than 45 biosimilars have been approved in the U.S., covering therapeutic areas such as oncology, endocrinology, and rheumatology. The need for efficient scale-up, analytical comparability studies, and abbreviated clinical trials makes outsourcing particularly attractive for biosimilar developers. Smaller biotech firms entering the biosimilars space are increasingly seeking turnkey CDMO solutions that allow them to navigate regulatory complexities while optimizing cost.

Country-Level Analysis – United States

The United States continues to be the epicenter of global biopharmaceutical innovation and outsourcing, hosting some of the world’s leading CMOs and CROs. The FDA’s rigorous standards make U.S.-based providers highly trusted by multinational sponsors. Innovation clusters like Boston-Cambridge, the San Francisco Bay Area, and the Research Triangle in North Carolina house a high concentration of CDMO/CRO facilities supported by academic partnerships, skilled labor, and strong capital flows.

Recent policy initiatives, such as the Biologics Control Act modernization and funding under the Infrastructure Investment and Jobs Act, are improving supply chain resilience and incentivizing domestic manufacturing. There is also growing federal focus on pandemic preparedness, gene therapy regulation, and biosimilar adoption, all of which directly benefit the CMO/CRO landscape.

Workforce training programs in biomanufacturing are also expanding through universities and technical schools, addressing the talent bottleneck. As the U.S. continues to prioritize reshoring of pharma manufacturing and investment in public-private R&D initiatives, the domestic CMO & CRO market is expected to maintain its leadership role globally.

Key Companies & Market Share Insights

Recent Developments

-

February 2024 – Samsung Biologics announced the acquisition of a U.S.-based CRO, enhancing its presence in North America and integrating late-phase clinical trial capabilities.

-

March 2024 – Curia revealed an expansion of its cGMP facility in Rensselaer, New York, focused on biologics process development and aseptic fill/finish services.

-

January 2024 – Catalent partnered with a Boston biotech firm to develop and manufacture an mRNA-based rare disease therapy, using its Maryland site for lipid nanoparticle formulation.

-

October 2023 – Lonza inaugurated a new early-phase development center in San Diego, California, to support preclinical biopharmaceutical clients with integrated services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Biopharmaceutical CMO & CRO market.

By Source

By Service Type

- Contract Manufacturing

- Process Development

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

- Contract Research

- Oncology

- Inflammation & Immunology

- Cardiology

- Neuroscience

- Others

By Product

- Biologics

- Monoclonal antibodies (MAbs)

- Recombinant Proteins

- Vaccines

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilars

Biosimilars are emerging as the fastest growing product segment, driven by patent expirations and policy support. As of 2025, more than 45 biosimilars have been approved in the U.S., covering therapeutic areas such as oncology, endocrinology, and rheumatology. The need for efficient scale-up, analytical comparability studies, and abbreviated clinical trials makes outsourcing particularly attractive for biosimilar developers. Smaller biotech firms entering the biosimilars space are increasingly seeking turnkey CDMO solutions that allow them to navigate regulatory complexities while optimizing cost.

Biosimilars are emerging as the fastest growing product segment, driven by patent expirations and policy support. As of 2025, more than 45 biosimilars have been approved in the U.S., covering therapeutic areas such as oncology, endocrinology, and rheumatology. The need for efficient scale-up, analytical comparability studies, and abbreviated clinical trials makes outsourcing particularly attractive for biosimilar developers. Smaller biotech firms entering the biosimilars space are increasingly seeking turnkey CDMO solutions that allow them to navigate regulatory complexities while optimizing cost.