U.S. Birth Centers Market Size and Trends

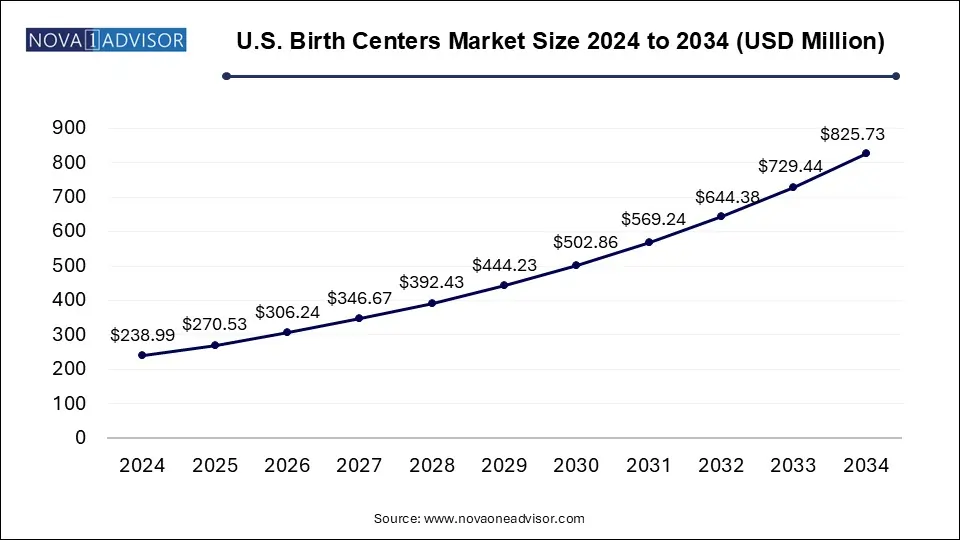

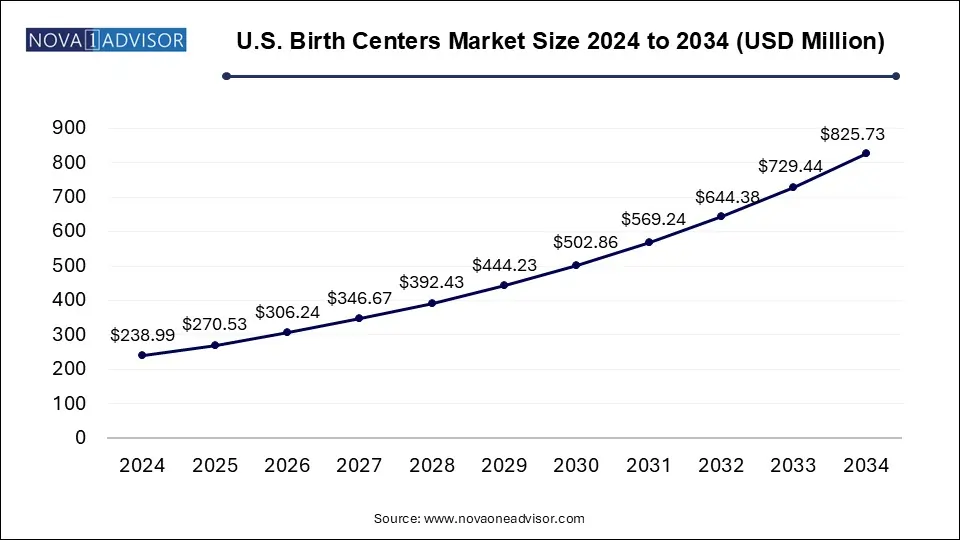

The U.S. birth centers market size was exhibited at USD 238.99 million in 2024 and is projected to hit around USD 825.73 million by 2034, growing at a CAGR of 13.2% during the forecast period 2025 to 2034.

U.S. Birth Centers Market Key Takeaways:

- In 2024, the freestanding birth centers segment accounted for the highest revenue share of 78.9% and is expected to grow at the fastest CAGR over the forecast period.

- In 2024, the obstetric care segment accounted for 35.0% of the revenue share and is expected to grow at the fastest CAGR over the forecast period.

Market Overview

The U.S. birth centers market is a vital component of the country’s maternal and neonatal healthcare system, offering expectant mothers an alternative to conventional hospital-based deliveries. Birth centers are healthcare facilities designed to provide a homelike environment with comprehensive midwifery and supportive services for low-risk pregnancies. These centers emphasize a holistic, low-intervention model of childbirth that prioritizes personalized care, family involvement, and cost-efficiency.

As maternal preferences shift toward more natural birthing experiences and dissatisfaction with highly medicalized hospital births grows, birth centers have steadily gained traction across the United States. With lower rates of cesarean sections, fewer medical interventions, and a greater focus on maternal autonomy, these centers appeal to a diverse demographic that includes health-conscious individuals, those seeking cost-effective care, and women in underserved communities.

Freestanding birth centers and hospital-affiliated birth centers coexist in this space, with some operating independently and others under hospital umbrellas to ensure continuity of care in emergency scenarios. The market is supported by rising awareness, favorable outcomes documented in clinical studies, and increasing endorsements from public health authorities. According to the American Association of Birth Centers (AABC), there are over 400 active birth centers in the U.S., with continued expansion anticipated in response to growing demand.

Policy support, such as Medicaid reimbursement and state-led maternal health initiatives, plays a significant role in shaping the market. Furthermore, a rise in private and nonprofit investments in women's health, midwifery education, and telehealth integration have paved the way for broader adoption of birth center services nationwide.

Major Trends in the Market

-

Rising Preference for Midwifery-Led Care: Consumers are increasingly opting for midwife-supported deliveries due to personalized, low-intervention care and high satisfaction rates.

-

Growth in Freestanding Birth Centers: Independent birth centers are expanding rapidly in both urban and rural settings, offering services outside of traditional hospital infrastructure.

-

Integration of Telehealth and Prenatal Education: Many birth centers are offering remote consultations, virtual prenatal classes, and lactation support through telemedicine platforms.

-

Supportive Policy Landscape: State and federal initiatives are encouraging alternative maternal care models, especially in addressing racial disparities in birth outcomes.

-

Collaborative Care Models: Birth centers are strengthening referral relationships with OB/GYNs and hospitals to ensure seamless transfers in high-risk cases.

-

Expansion of Insurance Reimbursement: Public and private insurers are gradually including birth center services under maternity benefits, improving affordability.

-

Increased Emphasis on Postpartum and Lactation Support: Birth centers are expanding their service offerings to include extended postpartum care, mental health screening, and lactation counseling.

Report Scope of U.S. Birth Centers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 270.53 Million |

| Market Size by 2034 |

USD 825.73 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 13.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Service |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Ronald Reagan UCLA Medical Center (UCLA Health); Barnes-Jewish Hospital; Rose Medical Center; Cedars-Sinai Medical Center (Cedars-Sinai); Cleveland Clinic; Prisma Health Baptist Parkridge Hospital; The Mount Sinai Hospital; TriStar Centennial Women's and Children’s Hospital; Lenox Hill Hospital (Northwell Health); The Mother Baby Center; St. David's Women's Center of Texas; Norton Women's and Children's Hospital; NewYork-Presbyterian Hospital; The BirthPlace Santa Monica (UCLA Health); Hospital of the University of Pennsylvania; Houston Methodist Hospital; The Johns Hopkins Hospital; Massachusetts General Hospital; Mayo Clinic; Northwestern Memorial Hospital; NYU Langone Hospitals; Rush University Medical Center; Stanford Health Care’s Lucile Packard Children’s Hospital Stanford; University of Michigan Hospitals-Michigan Medicine; UCSF Medical Center; UCLA Medical Center |

Market Driver – Shift Toward Personalized, Low-Intervention Maternity Care

The primary driver propelling the U.S. birth centers market is the growing shift in consumer preferences toward personalized, low-intervention maternity care. In contrast to hospital births that often involve routine interventions such as epidurals, inductions, and cesarean sections, birth centers prioritize natural childbirth, empowering expectant mothers to lead their birthing experience with fewer medical procedures and more autonomy.

Clinical studies have consistently shown that for low-risk pregnancies, birth centers deliver outcomes comparable to hospitals—often with lower complication rates and significantly reduced costs. The AABC’s Strong Start initiative, which tracked over 15,000 births, reported reduced cesarean rates and fewer preterm births among birth center clients. This model resonates with individuals who seek a more holistic approach to childbirth, including continuous midwifery support, mobility during labor, and inclusion of family members in the birthing process.

As consumers increasingly advocate for dignified, culturally competent, and patient-centered care, the demand for birth centers is rising especially among millennials and Gen Z parents who value empowerment, education, and control over their healthcare experiences.

Market Restraint – Limited Geographic Availability and Workforce Challenges

Despite their benefits, birth centers face key challenges foremost among them being limited geographic accessibility and workforce constraints. Many parts of the U.S., especially rural and underserved inner-city areas, lack accessible birth centers due to regulatory hurdles, operational costs, and limited trained staff. Establishing a freestanding birth center requires navigating state-specific licensing laws, building appropriate infrastructure, and maintaining transfer agreements with hospitals—obstacles that deter new entrants.

Furthermore, the shortage of licensed midwives and birth center-trained nurses restricts scalability. The U.S. has a lower midwife-to-birth ratio compared to other high-income countries, making workforce development a critical bottleneck. Educational barriers, lack of public funding for midwifery training, and a limited number of accredited programs slow the pipeline of qualified professionals. These constraints not only impact capacity but also limit the expansion of comprehensive services, particularly in regions with high maternal mortality rates and racial disparities.

Market Opportunity – Addressing Racial and Socioeconomic Disparities in Maternal Care

A profound opportunity in the U.S. birth centers market lies in addressing racial and socioeconomic disparities in maternal and neonatal outcomes. Black and Indigenous women in the U.S. face significantly higher maternal mortality and morbidity rates, often stemming from systemic bias, inadequate prenatal care, and restricted access to high-quality healthcare.

Birth centers offer a culturally competent, community-based model that can help close these gaps. They emphasize continuous support, trust-building, and individualized care plans key components in improving outcomes among marginalized groups. Initiatives such as the Birth Center Equity Fund are working to establish and sustain BIPOC-led birth centers across the country, aiming to make equitable maternal care more accessible.

Federal and state agencies are increasingly recognizing this potential. The 2023 “Improving Maternal Health Outcomes Act” allocated grants to develop alternative maternity care models, including birth centers. By expanding these facilities in medically underserved areas and integrating doulas, lactation consultants, and behavioral health professionals, stakeholders can build a more inclusive and effective maternal care system.

U.S. Birth Centers Market By Type Insights

Freestanding birth centers dominated the market, representing a growing trend in independent maternity care delivery outside hospital systems. These centers, typically staffed by certified nurse-midwives or direct-entry midwives, operate independently with defined emergency transfer protocols. The appeal of freestanding centers lies in their non-institutional environment, affordability, and flexible care models. They cater to patients seeking an intimate, low-intervention birth experience, and are often located in suburban or rural areas where hospital maternity wards are limited or overburdened. Their autonomy enables swift adaptation to patient needs, community engagement, and innovative programming, including prenatal yoga, nutrition counseling, and family-centered education.

Hospital-affiliated birth centers are the fastest-growing type, particularly in urban and semi-urban settings. These centers are located either within or adjacent to hospitals and offer the comfort and autonomy of a birth center with the safety net of rapid access to obstetric intervention if complications arise. Increasingly, hospitals are establishing birth center arms to retain maternity patients seeking natural births while reducing cesarean rates and improving patient satisfaction. This hybrid model enables collaborative care between midwives and OB/GYNs, strengthening maternal care delivery and appealing to a broader demographic—including first-time mothers and those with slightly elevated risk profiles.

U.S. Birth Centers Market By Service Insights

Obstetric care remains the largest service segment, as the primary function of birth centers is to support healthy labor and delivery for low-risk pregnancies. This includes prenatal screenings, labor support, water births, and postpartum monitoring. Birth centers emphasize continuity of care, with the same midwife or team supporting the patient throughout pregnancy, birth, and recovery. This model improves trust, reduces anxiety, and often leads to better clinical outcomes and fewer interventions compared to fragmented hospital care. The demand for obstetric services at birth centers has grown alongside consumer dissatisfaction with high-intervention hospital births.

Lactation support is the fastest-growing service, reflecting rising awareness about the benefits of breastfeeding and the need for expert guidance postpartum. Birth centers are increasingly integrating International Board-Certified Lactation Consultants (IBCLCs) into their teams, offering lactation counseling during both prenatal and postpartum visits. With national breastfeeding initiation rates climbing, there is heightened demand for accessible and personalized breastfeeding support. Birth centers offer a unique advantage by providing immediate skin-to-skin contact, delayed cord clamping, and early breastfeeding initiation—practices that support long-term lactation success. Many centers also host lactation clinics, support groups, and virtual counseling sessions to expand reach.

Some of the prominent players in the U.S. birth centers market include:

- Ronald Reagan UCLA Medical Center (UCLA Health)

- Barnes-Jewish Hospital

- Rose Medical Center

- Cedars-Sinai Medical Center (Cedars-Sinai)

- Cleveland Clinic

- Prisma Health Baptist Parkridge Hospital

- The Mount Sinai Hospital

- TriStar Centennial Women's and Children’s Hospital

- Lenox Hill Hospital (Northwell Health)

- The Mother Baby Center

- St. David's Women's Center of Texas

- Norton Women's and Children's Hospital

- NewYork-Presbyterian Hospital

- The BirthPlace Santa Monica (UCLA Health)

- Hospital of the University of Pennsylvania

- Houston Methodist Hospital

- The Johns Hopkins Hospital

- Massachusetts General Hospital

- Mayo Clinic

- Northwestern Memorial Hospital

- NYU Langone Hospitals

- Rush University Medical Center

- Stanford Health Care’s Lucile Packard Children’s Hospital Stanford

- University of Michigan Hospitals-Michigan Medicine

- UCSF Medical Center

- UCLA Medical Center

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. birth centers market

By Type

- Freestanding Birth Centers

- Hospital-affiliated Birth Centers

By Service

- Obstetric Care

- Neonatal Care

- Gynecological Care

- Lactation Support